Best Life Insurance Companies in North Dakota

Are you a North Dakotan looking for the best life insurance company? Look no further! This article reveals the top life insurance companies in North Dakota, providing you with valuable insights to make an informed decision and secure the best coverage for your future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated August 2025

Life insurance is an essential financial tool that provides protection and peace of mind for you and your loved ones. In North Dakota, there are several reputable insurance companies offering a wide range of policies to meet your needs. In this article, we will explore the best life insurance companies in North Dakota and discuss the factors you should consider when choosing the right company for you.

Understanding Life Insurance

Before diving into the details of the top life insurance companies in North Dakota, it is important to understand what life insurance is and why it is crucial to have.

Life insurance is a contract between you and an insurance company, where you pay regular premiums in exchange for a lump-sum payment, also known as a death benefit, to your beneficiaries upon your death.

But what exactly does life insurance entail? Let’s take a closer look.

Life insurance is a way to protect your loved ones financially in the event of your death. It ensures that your beneficiaries have the financial resources to cover expenses such as funeral costs, outstanding debts, mortgage payments, and other financial responsibilities.

What Is Life Insurance?

Life insurance acts as a safety net for your loved ones, providing them with financial support during a difficult time. It serves as a means to replace your income and alleviate any financial burdens that may arise after your passing.

When you purchase a life insurance policy, you are essentially entering into a contract with an insurance company. In exchange for regular premium payments, the insurance company promises to pay a predetermined amount, known as the death benefit, to your chosen beneficiaries upon your death.

The death benefit can be used in a variety of ways to support your loved ones. It can help cover funeral expenses, which can often be a significant financial burden for grieving families. Additionally, life insurance can provide funds to pay off outstanding debts, such as credit card balances, student loans, or a mortgage.

Furthermore, life insurance can help ensure that your family can maintain their current lifestyle without any financial hardships. It can replace the income you would have provided, allowing your loved ones to continue paying for everyday expenses, such as groceries, utilities, and education.

Why Is Life Insurance Important?

Life insurance is not just a financial product; it is a vital tool for providing security and peace of mind to your loved ones. Here are a few reasons why life insurance is important:

1. Financial Stability: In the unfortunate event of your passing, life insurance can help provide the necessary financial stability for your family. It can help cover immediate expenses, such as funeral costs, and provide a source of income to replace your lost earnings.

2. Debt Repayment: Life insurance can be used to pay off any outstanding debts you may have, preventing your loved ones from shouldering the burden. Whether it’s a mortgage, car loan, or credit card debt, life insurance ensures that your family won’t be left struggling to make ends meet.

3. Future Planning: Life insurance can also serve as a means of future planning. It can help fund your children’s education or provide for your spouse’s retirement. By securing life insurance, you are taking proactive steps to protect your family’s financial future.

4. Peace of Mind: Knowing that your loved ones will be taken care of financially can bring immense peace of mind. Life insurance provides a sense of security, allowing you to focus on enjoying your time with family and loved ones without worrying about their financial well-being.

In conclusion, life insurance is a crucial component of financial planning. It offers protection and support to your loved ones, ensuring that they are not burdened with financial hardships in the event of your passing. By understanding the importance of life insurance, you can make informed decisions when choosing the right policy for you and your family.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors To Consider When Choosing A Life Insurance Company

When selecting a life insurance company in North Dakota, it is important to evaluate several key factors to ensure that you are choosing the right company for your needs.

Life insurance is a crucial financial decision that provides protection and peace of mind for you and your loved ones. With so many options available, it can be overwhelming to determine which life insurance company is the best fit for your specific requirements. To simplify the decision-making process, consider the following factors:

Financial Stability

One of the most critical factors to consider when choosing a life insurance company is its financial stability. You want to ensure that the company has a strong financial foundation and is capable of fulfilling its obligations to policyholders. A financially stable company will have a solid track record of meeting its financial commitments, even during challenging economic times. Look for companies with high ratings from reputable credit rating agencies, such as Standard & Poor’s or Moody’s. These ratings indicate the company’s ability to meet its financial obligations and provide a strong indication of its long-term stability.

Additionally, it is essential to consider the company’s financial reserves. A company with substantial reserves demonstrates its ability to pay out claims promptly and efficiently, giving you peace of mind that your loved ones will be taken care of when the time comes.

Policy Options

Another important consideration is the range of policy options offered by the insurance company. Different individuals have distinct needs and circumstances, so it is crucial to choose a company that offers a variety of policies to cater to your specific requirements.

Term life insurance is a popular choice for individuals looking for affordable coverage for a specific period, such as during the years when dependents are financially dependent on the policyholder. Whole life insurance, on the other hand, provides lifelong coverage and often includes a cash value component that grows over time. Universal life insurance offers flexibility in premium payments and death benefit amounts, while variable life insurance allows policyholders to invest a portion of their premiums in various investment options.

By selecting a company that offers a wide range of policy options, you can customize your coverage to align with your financial goals and ensure that your loved ones are protected in the best possible way.

Customer Service

Good customer service is essential when dealing with any insurance company. Look for companies with a reputation for excellent customer service, as this ensures that you will receive the support and assistance you need throughout the life of your policy.

When considering the customer service aspect, pay attention to factors such as responsiveness, accessibility, and transparency. A company with a responsive customer service team will promptly address any inquiries or concerns you may have, providing peace of mind and a sense of security. Accessibility is also crucial, as you want to be able to reach out to the company easily whenever you need assistance or have questions about your policy.

Transparency is another vital aspect of good customer service. A reputable life insurance company will provide clear and concise information about its policies, coverage options, and premium rates. They will also be transparent about any changes or updates to your policy and will communicate them to you in a timely manner.

Remember, excellent customer service can make all the difference when it comes to addressing any concerns or making changes to your policy. Choose a company that values its customers and is committed to providing exceptional support throughout your life insurance journey.

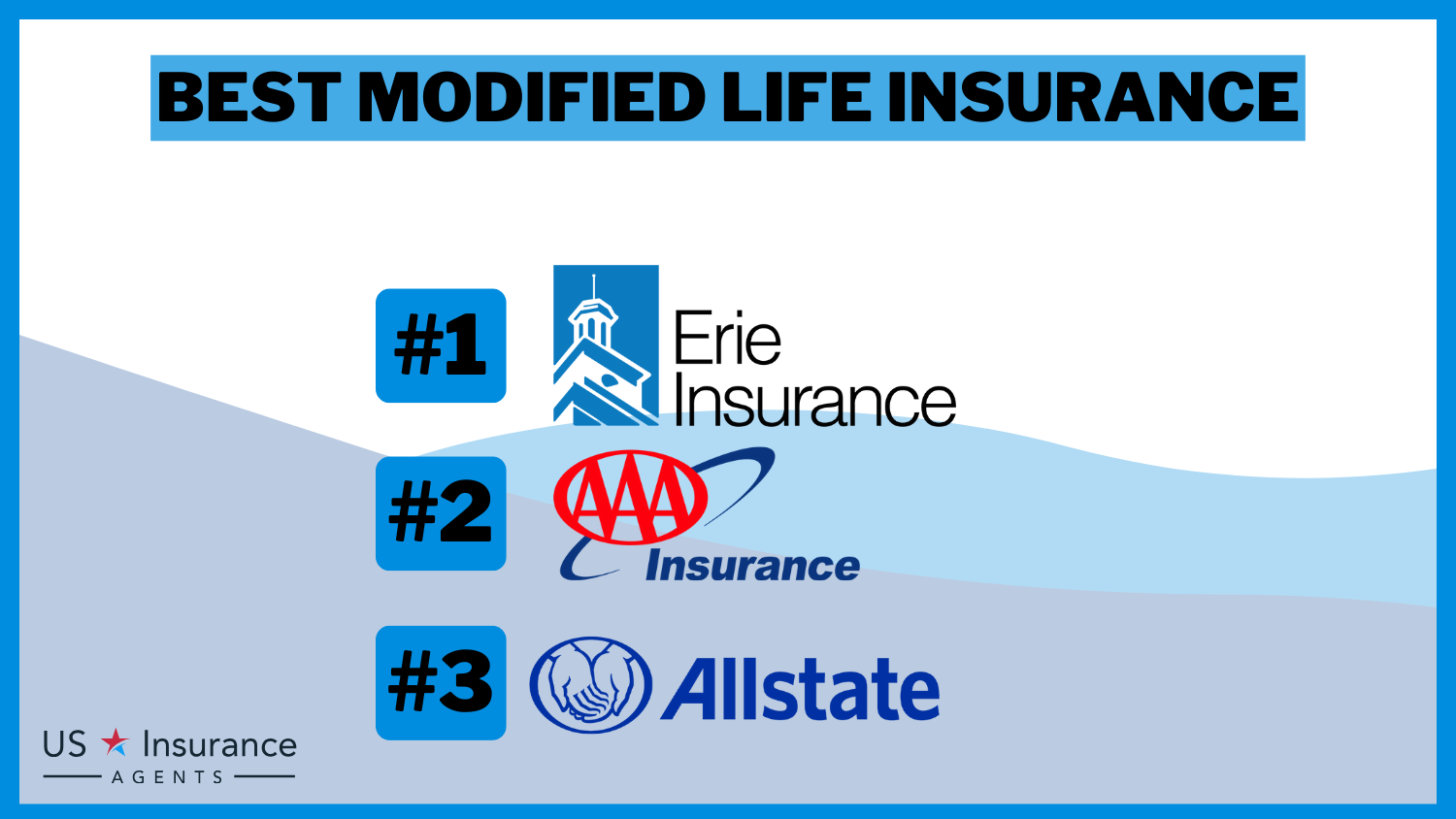

Top Life Insurance Companies In North Dakota

Now that we’ve covered the factors to consider when selecting a life insurance company, let’s delve into the top life insurance companies in North Dakota.

When it comes to protecting your loved ones and securing their financial future, it’s crucial to choose a life insurance company that you can trust. In North Dakota, there are several outstanding insurers that have proven their reliability and commitment to their policyholders. These companies offer a wide range of policies with competitive rates and exceptional benefits, ensuring that you find the coverage that suits your needs.

Company 1 Overview And Benefits

Company 1 is a highly regarded insurer in North Dakota, offering a wide range of life insurance policies. Whether you’re looking for term life insurance, whole life insurance, or universal life insurance, Company 1 has you covered. With their strong financial stability rating, you can have peace of mind knowing that your policy is backed by a financially secure company. Moreover, Company 1 is known for its outstanding customer service, ensuring that you receive personalized attention and support throughout your policy journey.

One of the standout features of Company 1 is their customizable coverage options. They understand that every individual’s needs are unique, and they strive to provide policies that cater to those specific requirements. Whether you’re a young professional just starting a family or a retiree looking to leave a legacy, Company 1 has the right policy for you.

Company 2 Overview And Benefits

Company 2 is another reputable life insurance company in North Dakota. With their diverse portfolio of policies, they cater to different needs and budgets. Whether you’re looking for a basic term life insurance policy or a comprehensive whole life insurance policy, Company 2 has options that will meet your requirements.

One of the aspects that sets Company 2 apart is their exceptional customer service. They understand that purchasing life insurance can be a complex process, and they are committed to guiding you every step of the way. From answering your initial questions to assisting you with claims, Company 2 ensures that you receive the personalized attention you deserve.

In addition to their outstanding customer service, Company 2 is known for their prompt claim processing. In times of tragedy, you can rely on Company 2 to handle your claims efficiently and compassionately, providing you with the financial support you need during difficult times.

Company 3 Overview And Benefits

Lastly, Company 3 is a top player in the North Dakota life insurance market. With their comprehensive range of policies, including term life insurance, whole life insurance, and universal life insurance, Company 3 offers options for every individual’s needs.

One of the reasons why Company 3 stands out is their competitive rates. They understand that affordability is a key factor when it comes to choosing life insurance, and they strive to provide policies that offer excellent value for your money. With Company 3, you can protect your loved ones without breaking the bank.

Furthermore, Company 3 is known for its flexibility in policy options. They understand that life is unpredictable, and your insurance needs may change over time. With Company 3, you have the flexibility to adjust your policy to accommodate those changes, ensuring that your coverage always aligns with your current circumstances.

When it comes to customer satisfaction, Company 3 has an excellent reputation. They prioritize their policyholders and go above and beyond to ensure that their needs are met. From providing clear and transparent policy information to offering prompt and efficient customer support, Company 3 has earned the trust and loyalty of their customers.

Comparing Life Insurance Policies

When considering life insurance, you may come across various policy options, including term life insurance and whole life insurance. It is crucial to understand the differences between these types to make an informed decision.

Term Life Insurance Vs. Whole Life Insurance

Term life insurance provides coverage for a specified term, typically 10, 20, or 30 years. It offers a death benefit if you pass away during that term but does not build cash value. On the other hand, whole life insurance provides coverage for your entire life and includes an investment component that accumulates cash value over time. Both types have their advantages and considerations, so it’s essential to assess your needs and financial goals before making a decision.

Cost Comparison

Cost is a crucial factor when comparing life insurance policies. The premium for a life insurance policy typically depends on various factors, including your age, health, and coverage amount. It is advisable to obtain quotes from multiple insurance companies and compare the costs against the coverage and benefits they offer. This will help you identify the most cost-effective option.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How To Apply For Life Insurance In North Dakota

If you are ready to secure life insurance coverage in North Dakota, here are the steps to follow:

Application Process

- Research and compare insurance companies – Consider the factors mentioned earlier and research various insurance companies to find the one that meets your needs.

- Consult with an insurance agent – Reach out to an insurance agent who can guide you through the application process and provide expert advice.

- Gather necessary documents – Collect all relevant documents, such as identification, medical records, and financial information required for the application.

- Complete the application – Fill out the application form provided by the insurance company, providing all necessary information accurately and truthfully.

- Undergo medical examination – Depending on the policy and insurer, you may need to undergo a medical examination to assess your health condition.

- Review and sign the policy – Once your application is processed and approved, carefully review the policy terms and conditions. If satisfied, sign the policy and make the initial premium payment.

Required Documents

When applying for life insurance, you will typically need the following documents:

- Proof of identity – Passport, driver’s license, or other government-issued identification.

- Proof of residence – Utility bills, lease agreements, or other documents that verify your residential address.

- Medical records – Any relevant medical reports, prescriptions, or healthcare information.

- Financial information – Income statements, tax returns, or other financial documents that demonstrate your financial stability.

In conclusion, choosing the right life insurance company in North Dakota is a decision that requires careful consideration. Take the time to evaluate factors such as financial stability, policy options, and customer service before making your final choice. Remember to compare life insurance policies and make sure they align with your needs and budget. By following the application process and providing the necessary documents, you can successfully secure the life insurance coverage that will protect your loved ones and provide peace of mind.

Frequently Asked Questions

What are the top life insurance companies in North Dakota?

According to the article, some of the best life insurance companies in North Dakota include State Farm, Northwestern Mutual, New York Life, Mutual of Omaha, and Principal Financial Group.

How can I choose the best life insurance company in North Dakota?

The article suggests considering factors such as financial strength, customer service, policy options, and pricing when choosing the best life insurance company in North Dakota. It is recommended to research and compare multiple companies before making a decision.

What is the importance of financial strength when selecting a life insurance company?

Financial strength is crucial when selecting a life insurance company as it indicates the company’s ability to fulfill its financial obligations, such as paying out claims. It is advisable to choose a company with a strong financial rating to ensure stability and reliability.

What factors should I consider when evaluating customer service in life insurance companies?

When evaluating customer service in life insurance companies, it is important to consider factors such as responsiveness, accessibility, communication, and the overall customer experience. Reading reviews and seeking recommendations can also provide insights into the quality of customer service offered by different companies.

What are some common policy options offered by life insurance companies in North Dakota?

Life insurance companies in North Dakota typically offer policy options such as term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each option has its own features and benefits, so it is essential to understand the differences and choose the one that aligns with your needs and goals.

How can I get a life insurance quote from the mentioned companies?

To obtain a life insurance quote from the mentioned companies or any other life insurance company, you can visit their official websites or contact their agents directly. Most companies provide online quote forms or have toll-free numbers to assist you in getting a personalized quote based on your specific requirements.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.