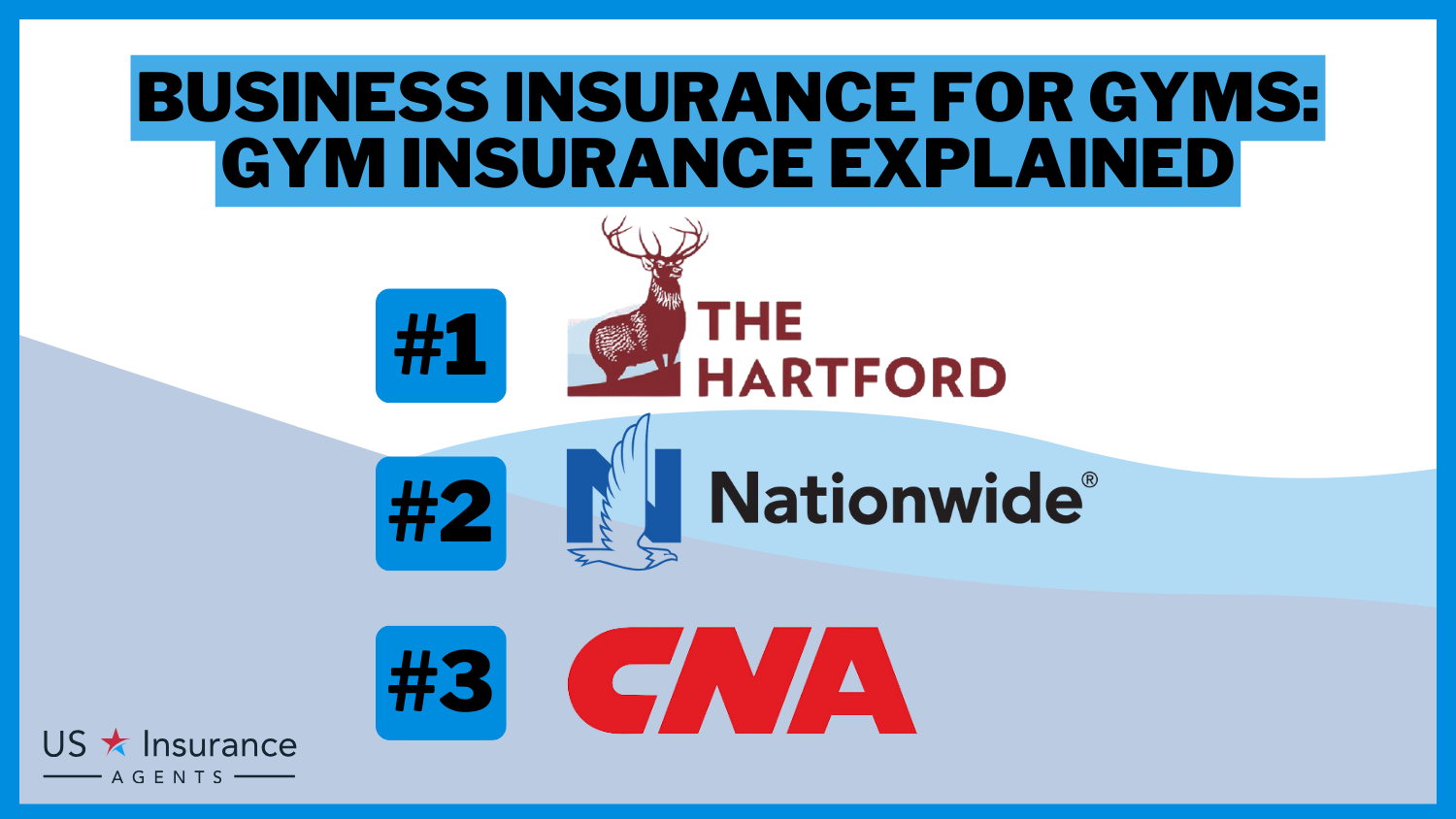

Best Business Insurance for Gyms in 2026 (Top 10 Companies Ranked)

The best business insurance for gyms are offered by The Hartford, Nationwide, and CNA Insurance providing extensive coverage, with enjoyable discounts of up to 20%. Gym owners can safeguard their fitness centers against various hazards with tailored protection from these top insurers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristine Lee is a licensed insurance agent and one of The Zebra’s in-house content strategists. With a background in copywriting, she covers the ins and outs of the home and car insurance industries. She has been a contributor to numerous publications focused on the nuances of insurance, including on The Points Guy.

Kristine Lee

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2025

765 reviews

765 reviewsCompany Facts

Full Coverage for Gyms

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Gyms

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 0 reviews

0 reviewsCompany Facts

Full Coverage for Gyms

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviewsWith extensive coverage options, including general liability, professional liability, and property insurance, The Hartford ensures comprehensive protection tailored to the needs of gym owners. In this comprehensive guide, we’ll explore the top insurance providers for gyms, including The Hartford, Nationwide, and CNA Insurance, and explain why they’re the best choices for gym owners.

Our Top 10 Company Picks: Best Business Insurance for Gyms

| Company | Rank | Fitness Liability Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 25% | Specialized Coverage | The Hartford |

| #2 | 17% | 17% | Gym Equipment Coverage | Nationwide | |

| #3 | 12% | 22% | Comprehensive Coverage | CNA | |

| #4 | 10% | 22% | Gym Liability Coverage | Markel | |

| #5 | 19% | 23% | Risk Management Services | Philadelphia Insurance Co. | |

| #6 | 15% | 20% | Online Convenience | Hiscox | |

| #7 | 15% | 21% | Global Presence | AIG |

| #8 | 10% | 19% | High-Value Property Coverage | Chubb | |

| #9 | 14% | 24% | Business Income Coverage | Travelers | |

| #10 | 17% | 22% | Industry Expertise | ProSight |

Explore our guide to find the perfect insurance coverage for your gym today. Enter your ZIP code above to get started on comparing business insurance quotes.

#1 – The Hartford: Top Overall Pick

Pros

- Specialized Coverage: The Hartford offers specialized coverage tailored specifically for gym owners, ensuring comprehensive protection for their unique needs.

- Multi-Policy Discount: With a multi-policy discount of up to 5%, clients can save on premiums by bundling multiple insurance policies with The Hartford.

- Reputable Company: The Hartford insurance review & ratings are excellent, as they are a well-established and reputable insurance company recognized for their reliability and exceptional customer service.

Cons

- Limited Online Convenience: While The Hartford excels in coverage, its online convenience may be limited compared to some competitors.

- Slightly Lower Multi-Policy Discount: The maximum multi-policy discount of 5% may be lower than what some other gym insurance companies offer.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Gym Equipment Coverage

Pros

- Gym Equipment Coverage: Nationwide insurance review & ratings highlight the company’s comprehensive coverage for gym equipment, safeguarding owners from potential damages.

- High Multi-Policy Discount: With a generous multi-policy discount of up to 7%, Nationwide offers substantial savings for clients bundling their insurance needs.

- Trusted Brand: Nationwide is a well-known and trusted brand, providing a sense of security for gym owners seeking insurance.

Cons

- Limited Industry Expertise: While excelling in equipment coverage, Nationwide may lack some industry-specific expertise compared to other competitors.

- Moderate Low-Mileage Discount: The low-mileage discount of up to 3% may not be as competitive as some other companies in the market.

#3 – CNA Insurance: Best for All-Inclusive Gym Shield

Pros

- Comprehensive Coverage: CNA Insurance offers comprehensive coverage, ensuring that gym owners have protection across various aspects of their business.

- Competitive Multi-Policy Discount: With a multi-policy discount of up to 6%, clients can benefit from significant savings when combining different insurance policies.

- Strong Financial Stability: CNA Insurance review & ratings is known for its financial stability, providing assurance to policyholders that claims will be handled efficiently.

Cons

- Limited Online Presence: CNA Insurance may have a less robust online presence compared to some competitors, potentially affecting the ease of policy management.

- Moderate Low-Mileage Discount: The low-mileage discount of up to 2% may be considered moderate compared to other companies in the industry.

#4 – Markel Corporation: Best for Legal Safeguard

Pros

- Gym Liability Coverage: Markel Corporation specializes in gym liability coverage with reasonable gym liability insurance cost, ensuring that owners are protected against potential legal issues and claims.

- Solid Multi-Policy Discount: With a multi-policy discount of up to 4%, clients can enjoy cost savings by bundling different insurance needs with Markel Corporation.

- Experience in the Industry: Markel Corporation brings industry expertise, understanding the unique risks and challenges faced by gym owners.

Cons

- Limited Global Presence: Markel Corporation may have a limited global presence compared to some competitors, potentially impacting coverage for international gym operations.

- Slightly Lower Multi-Policy Discount: The maximum multi-policy discount of 4% may be lower than what some other companies offer.

Discover more information on our “Markel American Review & Ratings“.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Philadelphia Insurance Co.: Best for Proactive Risk Management

Pros

- Risk Management Services: Philadelphia Insurance Co. goes beyond standard coverage by providing risk management services, assisting gym owners in proactively minimizing potential risks.

- Competitive Multi-Policy Discount: With a multi-policy discount of up to 6%, clients can benefit from substantial savings when combining various insurance policies.

- Customized Solutions: Philadelphia insurance review & ratings provides customized solutions to ensure that gym owners receive coverage that meets their specific requirements.

Cons

- Moderate Online Convenience: While offering comprehensive services, Philadelphia Insurance Co. may provide slightly less online convenience compared to some competitors.

- Limited Global Presence: The global presence of Philadelphia Insurance Co. might be more restricted compared to certain multinational insurers.

#6 – Hiscox: Best for Convenient Online Gym Protection

Pros

- Online Convenience: Hiscox stands out for its online convenience, providing gym owners with a user-friendly platform for policy management and claims.

- Industry Expertise: Hiscox offers industry expertise, understanding the unique requirements of gym owners and tailoring coverage accordingly.

- Flexible Coverage Options: Gym owners can benefit from flexible coverage options with Hiscox, allowing them to customize their insurance plans.

Cons

- Moderate Multi-Policy Discount: The multi-policy discount of up to 3% offered by Hiscox may be considered moderate compared to some competitors.

- Slightly Limited Global Presence: Hiscox’s global presence may be slightly more restricted compared to larger multinational insurers.

#7 – AIG: Best for Global Assurance

Pros

- Global Presence: AIG boasts a strong global presence, making it an ideal choice for gym owners with international operations.

- Multi-Policy Discount: With a multi-policy discount of up to 5%, AIG offers clients significant savings when bundling various insurance policies.

- Innovative Solutions: AIG insurance review & ratings highlight innovative insurance solutions, ensuring that gym owners have access to cutting-edge coverage options.

Cons

- Higher Premiums: AIG’s comprehensive coverage and global presence may come at a slightly higher premium compared to some other insurers.

- Complex Application Process: The application process with AIG may be more complex compared to some competitors, potentially requiring more detailed information.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Chubb: Best for Safeguarding Valuable Gym Assets

Pros

- High-Value Property Coverage: Chubb specializes in high-value property coverage, making it an excellent choice for gym owners with valuable equipment and facilities.

- Generous Multi-Policy Discount: With a multi-policy discount of up to 7%, Chubb offers substantial savings for clients bundling different insurance needs.

- Financial Strength: Chubb insurance review & ratings is known for its financial strength, assuring policyholders that claims will be handled with stability and efficiency.

Cons

- Higher Premiums: Chubb’s focus on high-value coverage may result in slightly higher premiums compared to some other insurers.

- Limited Online Convenience: While providing comprehensive coverage, Chubb may offer slightly less online convenience compared to some competitors.

#9 – Travelers: Best for Safeguarding Gym Income Streams

Pros

- Business Income Coverage: Travelers specializes in business income coverage, ensuring that gym owners are protected against potential income loss due to unforeseen events.

- Competitive Multi-Policy Discount: With a multi-policy discount of up to 6%, clients can benefit from significant savings when bundling different insurance needs.

- Wide Range of Coverage Options: Travelers insurance review & ratings underscore offering diverse range of coverage options, allowing gym owners to tailor their insurance plans to their specific requirements.

Cons

- Moderate Online Convenience: Travelers may provide slightly less online convenience compared to some competitors, impacting the ease of policy management.

- Slightly Lower Low-Mileage Discount: The low-mileage discount of up to 2.5% may be considered slightly lower than what some other companies offer.

#10 – ProSight Specialty Insurance: Best for Tailored Expert Solutions

Pros

- Industry Expertise: ProSight Specialty Insurance brings industry expertise, understanding the unique risks and challenges faced by gym owners.

- Solid Multi-Policy Discount: With a multi-policy discount of up to 4%, clients can enjoy cost savings by bundling different insurance needs with ProSight Specialty Insurance.

- Customized Solutions: ProSight Specialty Insurance offers tailored solutions, ensuring that gym owners get coverage that aligns with their specific needs.

Cons

- Limited Global Presence: ProSight Specialty Insurance may have a limited global presence compared to other insurance companies, potentially impacting coverage for international gym operations.

- Slightly Lower Low-Mileage Discount: The maximum low-mileage discount of 1.5% may be considered slightly lower than what some other companies offer.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safeguarding Your Gym: Understanding Business Insurance Needs

Is owning a gym a good business? Is a gym a good business investment? Operating a gym or fitness center comes with numerous responsibilities. Beyond the task of managing staff, memberships, and facilities, there is an inherent responsibility to ensure the safety and well-being of all who frequent the establishment. This is where business insurance steps in.

- Understanding Insurance Needs: Business insurance for gyms is crucial to protect your investment, members, staff, and the future of your business. The types of coverage needed can vary based on your specific gym, including services offered and potential risks involved.

- Types of Gym Insurance: Key types of gym insurance include general liability insurance, professional liability insurance, workers’ compensation insurance, property insurance, and business interruption insurance. Each offers unique protections, from covering member injuries and professional advice claims to property damage and business interruptions.

- Gym Management Software: In addition to insurance, leveraging the best gym management software can streamline administrative tasks, enhance member engagement, and assist with risk management, such as equipment maintenance tracking and managing insurance policies.

- Getting Insurance Quotes: Using a free online tool to compare business gym insurance quotes can help you find the best coverage for your gym at the most competitive price. The tool allows you to see various options side by side, aiding in understanding what each policy offers. Discover how to get free insurance quotes online.

- Insurance as an Investment: The goal is not just to find the cheapest insurance but the best insurance for gyms that offers comprehensive coverage for all the unique risks associated with running a fitness center. Proper insurance is an investment in the longevity and success of your business.

Business insurance for gym owners is an essential component of risk management, protecting your business from unforeseen circumstances that could otherwise lead to financial ruin.

Types of Business Insurance for Gyms

The various options for business insurance for gyms include general liability insurance, professional liability insurance, workers’ compensation insurance, property insurance, and business interruption insurance. Each type of coverage offers its own unique protection. Learn which type of coverage required will vary based on your specific gym, the services offered, and the risks involved.

General liability insurance is the most basic type of coverage that every gym should have. What is the liability of a gym? It protects against claims of bodily injury or property damage. In a gym setting, this could cover accidents such as a member slipping on a wet floor or a piece of equipment malfunctioning and causing injury.

Delve deeper into our “Liability Insurance: A Complete Guide” for more insights.

In addition, general liability insurance also covers legal defenses and court costs, which can be significant even in seemingly minor cases. Gym general liability insurance can protect your business against claims of non-physical harm, such as libel, slander, or violation of privacy, which can arise from marketing or other business activities.

It’s advisable to conduct a thorough risk assessment to determine the adequate amount of general liability coverage needed, considering factors like the size of your gym, the number of members, and the types of activities conducted.

Chris Abrams Licensed Insurance Agent

Next is gym professional liability insurance, also known as Errors and Omissions Insurance, professional liability insurance is especially important for gyms that offer personal training, fitness classes, or other professional services. It covers claims related to the professional advice or services provided by the staff at your gym.

For example, if a client gets injured due to a workout plan suggested by a personal trainer, professional liability insurance would cover the legal costs and any settlement or judgment. This is critical if your gym offers personalized fitness programs or advice, which can have varying effects on different individuals, potentially leading to injuries.

For more details, explore our “Personal Injury Protection (PIP) Insurance: A Complete Guide” page.

Even with well-trained staff, there’s always a risk of misunderstanding or incorrect application of advice by clients, making this coverage essential. It’s crucial to ensure that all professionals providing advice or services at your gym are adequately covered by insurance.

Another is Gym workers’ compensation insurance. If you employ staff at your gym, whether trainers, front desk staff, or cleaning crew, workers’ compensation insurance is mandatory in most states. This policy covers medical costs and a portion of lost wages if an employee gets injured or falls ill due to their job.

Gym worker’s compensation insurance is not only a legal requirement but also a way to protect your business from lawsuits by injured employees. It’s also beneficial for employees as it provides assurance of coverage for work-related injuries or illnesses, encouraging a safer working environment. The cost of workers’ compensation insurance can vary depending on several factors.

Is gym equipment insured? How do I protect my gym equipment? Property Insurance is necessary for gyms to cover physical assets like buildings, gym equipment, computers, and furniture in case of damage from incidents like fire, theft, or natural disasters. Property insurance for gyms is crucial even if you lease your gym space, as it can cover improvements or modifications you’ve made to the leased property.

Business Insurance for Gyms: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $54 | $159 |

| Chubb | $56 | $161 |

| CNA | $52 | $155 |

| Hiscox | $51 | $152 |

| Markel | $48 | $145 |

| Nationwide | $55 | $160 |

| Philadelphia Insurance Co. | $53 | $157 |

| ProSight | $49 | $147 |

| The Hartford | $50 | $150 |

| Travelers | $57 | $163 |

It’s advisable to consider a policy that includes coverage for equipment breakdown, as gym equipment can be expensive to repair or replace. The cost of property insurance can depend on factors like the location of your gym, the type of building, and the value of your equipment and other property.

Gym owners must understand the specifics of their policy, including the waiting period before the coverage kicks in and the maximum period that the policy will cover. It’s also worthwhile to consider coverage for extra expenses that can help minimize downtime, such as the cost of moving to and operating from a temporary location.

Importance of Gym Business Insurance

The importance of good business insurance for a gym cannot be understated. Running a gym or fitness center involves risks that are unique to the industry. From potential injuries on the gym floor to property damage, many unforeseen situations can jeopardize your business.

By investing in comprehensive coverage business insurance, you protect not only your financial assets but also the longevity of your business and the well-being of your members and employees. Read these case studies and see why going without business insurance for a fitness center or gym business can land you in a world of hurt.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Obtain an Online Quote for Gym Business Insurance

Getting an insurance quote online for your gym’s business insurance is quick and easy. Follow these simple steps to find the right coverage for your fitness center:

- Visit the insurance provider’s website. Go to the website of the insurance provider you’re interested in.

- Navigate to the business insurance section. Look for the section related to business insurance or commercial insurance.

- Fill out the quote form. Locate the online quote form for business insurance and fill it out. You’ll need to provide information about your gym, such as its location, size, number of employees, and the types of coverage you’re interested in.

- Review your quote. Once you’ve filled out the form, you’ll receive a quote based on the information you provided. Review the quote carefully to ensure it meets your needs.

- Compare quotes. Consider getting quotes from multiple insurance providers to compare gym insurance coverage options and rates.

- Finalize your coverage. Once you’ve found the right insurance policy for your gym, you can finalize your coverage and purchase the policy online.

Obtaining an online quote is the first step towards protecting your gym against various risks and ensuring its long-term success.

Don’t wait until it’s too late. Get an online quote for your gym’s business insurance today and enjoy peace of mind knowing your fitness center is protected against unforeseen circumstances.

Case Studies: Best Business Insurance for Gyms

Business insurance is vital for gym centers. Explore these case studies to see how gym insurance can protect your business from unexpected challenges.

- Case Study #1 – Injury Liability Coverage: A gym member slipped on a wet floor and suffered a serious injury. Thanks to the gym’s general liability insurance, the medical expenses and legal fees were covered, preventing a significant financial burden on the business.

- Case Study #2 – Property Damage Protection: During a high-intensity workout class, a weight machine malfunctioned and caused damage to the gym floor. The gym’s property insurance covered the cost of repairs, ensuring minimal disruption to daily operations.

- Case Study #3 – Professional Liability Claim: A client sued the gym for injuries sustained during a personal training session, claiming negligence. The gym’s professional liability insurance covered the legal fees and settlement costs, protecting the business’s reputation and financial stability.

These case studies highlight the importance of having comprehensive insurance coverage for your gym. By investing in the right insurance policies and best business insurance, you can safeguard your gym against unexpected events and ensure its long-term success and stability.

Optimizing Gym Operations With the Best Gym Management Software

In the modern fitness industry, managing a gym involves more than just maintaining equipment and managing memberships. It’s also about leveraging technology to streamline operations, enhance customer experience, and, ultimately, drive business growth. This is where the best gym management software comes into play.

The best gym management software automates administrative tasks like membership, scheduling, payments, and reporting, while also providing tools for member engagement. This allows owners and managers to focus on improving services, while reducing the risk of injuries by tracking equipment maintenance.

Check out our “Access Insurance Review & Ratings” for more details.

Some software even integrates with insurance providers, offering an easy way to manage and access insurance policies. The top gym management software even offers gym check-in software that will integrate with your gym security system to handle door access control and other facility management features.

In essence, investing in the best gym management software is not just about efficiency. It also contributes to providing a safer, more enjoyable environment for your members, reinforcing your gym’s commitment to their well-being. An investment in gym management software coupled with comprehensive business insurance, forms a robust strategy for managing and mitigating risks in your gym.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Insurance for Your Gym

While it’s clear that business insurance is critical for gyms, not all policies are created equal. The specific needs of your business depend on various factors, including the size of your gym, the services you offer, and the types of risks you’re most likely to encounter.

It’s crucial to work with an experienced insurance agent who understands the fitness industry’s nuances. They can help you assess your risk exposure and tailor an insurance package that addresses your gym’s specific needs. Get a few quotes from the best insurance companies to find affordable rates and adequate coverage for your business.

Tim Bain Licensed Insurance Agent

Business insurance is not just an afterthought; it’s an essential part of your gym’s risk management strategy. It ensures that your business can withstand the trials of unforeseen events. Having adequate best gym insurance is fundamental to your success. Gym business insurance will be the safety net that protects your business from unforeseen circumstances and potential financial ruin.

Whether it’s a member’s injury, damage to your property, or an interruption to your operations, having the right gym insurance coverage can mean the difference between a minor hiccup and a crippling setback.

Visit our “How does the insurance company determine my premium?” to discover more.

We recommend using our free online tool to compare gym business insurance quotes. This tool allows you to see a variety of options side by side, making it easier to understand what each policy offers and how they stack up against each other in terms of price and coverage. It’s a simple, quick, and efficient way to ensure you’re securing the best insurance for your gym.

Stay safe, stay covered, and let’s continue to promote a healthier world. Our free quote tool below makes it easy to compare affordable coverage options for your business — simply enter your ZIP code to find the best commercial insurance company for you.

Frequently Asked Questions

What insurance do I need for a gym?

Running a gym requires diverse insurance coverage. This includes General and Professional Liability Insurance for injuries and professional services, Workers’ Compensation for employee health, Property Insurance for physical assets, and Business Interruption Insurance for financial protection during closures.

What is the best way to get cheap gym insurance?

To secure affordable gym insurance, manage risks by maintaining equipment, training staff, and enforcing safety rules. Compare quotes from different providers using a free tool, ensuring the coverage not only fits your budget but also meets your specific needs. Keep in mind that the cheapest option may not provide adequate protection for your business.

What is the most important type of insurance for a gym?

No single insurance type is deemed most crucial for a gym; it depends on the specific risks. General liability insurance is a fundamental necessity, covering bodily injury and property damage claims. Additional types such as professional liability, workers’ compensation, property, and business interruption insurance are vital based on your business specifics.

Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

Is professional liability insurance necessary if I don’t offer personal training services?

Even if your gym doesn’t offer personal training, professional liability insurance can still be beneficial. This type of insurance covers claims related to the professional advice or services provided by your business. So, if your gym offers fitness classes or any type of guidance to members, professional liability insurance could protect you from potential lawsuits related to these services.

Are gym members covered by my business insurance if they get injured at my gym?

General liability insurance can cover gym members if they get injured at your gym due to a covered risk such as a slip-and-fall accident or equipment malfunction. It can cover their medical costs and your legal defense if they decide to sue. However, members’ personal belongings usually aren’t covered, and they would need personal insurance for that.

Find out more on our “What is medical discount plan?“.

How much does gym business insurance cost?

The gym insurance costs for business setting varies widely based on a range of factors, including the size of your gym, the number of employees, the types of services you offer, and your location. An insurance agent who specializes in gym insurance can provide a more accurate quote based on your specific situation.

Can gym management software help with insurance?

Yes, some of the best gym management software can assist with insurance. For instance, they can help you keep track of equipment maintenance schedules, which is important for reducing the risk of injuries and potential insurance claims. Some software even integrates with insurance providers, making it easier to manage your policies.

Can business interruption insurance cover closures due to a pandemic?

Business interruption insurance typically covers closures due to physical damage to your property, like a fire or natural disaster. However, whether it covers closures due to a pandemic can depend on the specific terms of your policy. It’s important to review your policy details and consult with your insurance provider or insurance agent for clarification.

Can I bundle different types of business insurance for my gym?

Yes, insurance providers often offer business owner’s policies (BOPs) that bundle various types of insurance into one package. A typical BOP might include general liability, property, and business interruption insurance. Bundling policies can be a cost-effective way to get the coverage you need.

Is workers’ compensation insurance mandatory for all gyms?

The requirement for workers’ compensation insurance depends on the laws in your state and the number of employees you have. However, most states require businesses with employees to carry workers’ compensation insurance. It’s essential to check your state’s laws to ensure you’re in compliance.

Explore more insights on our “Commercial Insurance: A Complete Guide“.

Is there a specific insurance for fitness equipment?

Can I adjust my gym’s insurance coverage as my business grows?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.