Best Life Insurance Companies in New Jersey

Looking for the best life insurance companies in New Jersey? This article provides a comprehensive list of top-rated insurers, ensuring you make an informed decision to protect your loved ones' future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated January 2025

Life insurance is an essential financial planning tool that provides financial protection to your loved ones in the event of your death. However, with so many options available, it can be overwhelming to choose the best life insurance company in New Jersey. This article will guide you through the process by explaining what life insurance is, why it’s important, factors to consider when choosing a life insurance company, and highlighting the top insurance providers in New Jersey. We will also compare different types of life insurance policies and discuss how to apply for life insurance in New Jersey.

Understanding Life Insurance

Before diving into the details, let’s first understand what life insurance is all about. Life insurance is a contract between you and an insurance company, where you pay regular premiums, and in return, the insurance company pays a death benefit to your beneficiaries upon your passing. It provides financial security and peace of mind during challenging times.

Life insurance is not just a simple financial product; it is a tool that can help protect your loved ones and provide them with a safety net when they need it the most. By taking out a life insurance policy, you are taking a proactive step towards ensuring the financial well-being of your family and loved ones.

What Is Life Insurance?

Life insurance is designed to protect your loved ones financially after you’re gone. It can help cover funeral expenses, outstanding debts, mortgage payments, and provide income replacement for your dependents. Life insurance policies can be customized according to your specific needs and budget.

Life insurance policies come in various forms, such as term life insurance, whole life insurance, and universal life insurance. Each type of policy offers different benefits and features, allowing you to choose the one that best suits your individual circumstances.

Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. It offers a death benefit if you pass away during the term of the policy. This type of insurance is often more affordable, making it a popular choice for young families or individuals with temporary financial obligations.

On the other hand, whole life insurance provides coverage for your entire lifetime. It not only offers a death benefit but also accumulates a cash value over time. This cash value can be used for various purposes, such as supplementing retirement income or funding educational expenses.

Universal life insurance combines the benefits of both term and whole life insurance. It provides flexibility in terms of premium payments and death benefit amounts. With universal life insurance, you have the ability to adjust your coverage and premiums as your financial situation changes.

Why Is Life Insurance Important?

Life insurance is important because it ensures the financial stability of your family when you are no longer around to provide for them. It helps your loved ones maintain their current lifestyle, pay for children’s education, and cover any outstanding debts or medical expenses.

Imagine the peace of mind knowing that your family will be taken care of financially, even if you’re not there to support them. Life insurance provides a safety net that can help your loved ones navigate through difficult times and maintain their financial independence.

Life insurance also plays a crucial role in estate planning. It can help cover estate taxes, ensuring that your assets are passed on to your beneficiaries without them having to bear a significant financial burden. By including life insurance in your estate planning, you can leave a lasting legacy for future generations.

Furthermore, life insurance can be a valuable tool for business owners. It can help protect your business from financial hardships in the event of the death of a key employee or business partner. With the right life insurance policy, you can ensure the continuity and success of your business even after you’re gone.

In conclusion, life insurance is not just a financial product; it is a means of safeguarding the financial well-being of your loved ones and protecting your legacy. By understanding the different types of life insurance and their benefits, you can make an informed decision that suits your specific needs and provides you with peace of mind.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors To Consider When Choosing A Life Insurance Company

When selecting a life insurance company, it’s essential to consider the following factors:

Financial Stability

A financially stable insurance company is crucial to ensure that they can fulfill their obligations when the time comes. Check the company’s credit ratings from reputable rating agencies to ensure their long-term financial stability.

Financial stability is not just about the present; it’s about the future. A financially stable life insurance company has a solid foundation that allows them to withstand economic downturns and continue to provide the coverage and benefits they promise to policyholders. It means they have the resources to pay out claims, invest in growth, and adapt to changing market conditions.

One way to assess a company’s financial stability is by looking at their financial strength ratings. These ratings are given by independent agencies that evaluate insurers based on their ability to meet their financial obligations. The higher the rating, the more secure the company’s financial position.

Another factor to consider is the company’s history of financial performance. Look for a company that has a track record of consistent profitability and growth. This indicates that they have a sound business model and are well-managed.

Coverage Options

Consider the different types of life insurance policies offered by the company. They may include term life insurance, whole life insurance, universal life insurance, or variable life insurance. Determine which type of policy best suits your needs and provides comprehensive coverage.

Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. It is a popular choice for those who want coverage for a specific period, such as until their children graduate from college or their mortgage is paid off.

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured. It also includes a cash value component that grows over time, providing a savings element in addition to the death benefit.

Universal life insurance offers flexibility in premium payments and death benefit amounts. It allows policyholders to adjust their coverage and premiums as their needs change.

Variable life insurance combines a death benefit with investment options. Policyholders can choose from a variety of investment options, such as stocks, bonds, and mutual funds, to potentially grow the cash value of their policy.

When considering coverage options, it’s important to assess your financial goals, risk tolerance, and long-term needs. A comprehensive policy should provide adequate coverage for your loved ones, while also aligning with your financial objectives.

Customer Service

Customer service is another crucial aspect to consider when choosing a life insurance company. Look for a company that is known for its excellent customer service, quick claims processing, and responsive representatives who can address your concerns promptly.

Good customer service goes beyond just being polite and friendly. It involves being knowledgeable, efficient, and proactive in assisting policyholders. A reputable life insurance company will have a dedicated customer service team that is available to answer questions, provide guidance, and help with claims.

When researching a company’s customer service reputation, consider reading reviews and testimonials from current and former policyholders. Look for feedback on their responsiveness, accessibility, and overall satisfaction with the company’s service.

Additionally, consider the company’s claims process. A smooth and efficient claims process is essential during a difficult time. Look for a company that has a streamlined claims process, with clear instructions and minimal paperwork.

Lastly, consider the company’s communication channels. Are they easily accessible through phone, email, or online chat? Do they have a user-friendly website where you can access policy information and make changes? These factors can contribute to a positive customer experience.

Top Life Insurance Companies In New Jersey

When it comes to protecting your loved ones and ensuring their financial stability, choosing the right life insurance company is crucial. In New Jersey, there are several top-notch companies that have gained a reputation for their quality services and competitive offerings. Let’s take a closer look at three of these companies:

Company 1 Overview And Benefits

Company 1 stands out among the top life insurance companies in New Jersey for its commitment to meeting individual needs. They offer a diverse range of life insurance policies that can be tailored to your specific requirements. Whether you’re looking for term life insurance, whole life insurance, or universal life insurance, Company 1 has you covered. Their policies not only provide financial protection for your loved ones but also offer peace of mind at affordable premiums.

What sets Company 1 apart is its strong track record of customer satisfaction. With excellent financial ratings, you can trust that they have the stability and reliability to fulfill their promises. Their team of dedicated professionals is always ready to assist you and answer any questions you may have, ensuring a smooth and hassle-free experience throughout your policy journey.

Company 2 Overview And Benefits

Company 2 is another top life insurance provider in New Jersey that has gained recognition for its diverse portfolio of options. They understand that everyone’s life insurance needs are unique, and that’s why they offer a wide range of policies with flexible terms and customization options. Whether you’re a young professional just starting a family or a retiree looking to leave a legacy, Company 2 has the right solution for you.

But it’s not just their extensive selection of policies that makes Company 2 stand out. Their commitment to superior customer service is unparalleled. From the moment you inquire about their offerings to the day you make a claim, you can expect a seamless and personalized experience. Their knowledgeable agents are always available to guide you through the process and ensure that you make an informed decision.

Company 3 Overview And Benefits

Company 3 is a reputable life insurance provider that has made a name for itself in New Jersey by offering comprehensive coverage and competitive rates. They understand that protecting your loved ones’ future is a top priority, and they have designed their policies accordingly. Whether you’re looking for short-term coverage with term life insurance or a lifelong plan with whole life insurance, Company 3 has the options to meet your needs.

What sets Company 3 apart is its commitment to exceptional customer support. Their highly trained professionals are dedicated to providing you with the guidance and assistance you need to make the right decisions. They understand that navigating the world of life insurance can be overwhelming, and they are there to simplify the process for you. With Company 3, you can expect a hassle-free experience from start to finish.

So, when it comes to choosing a life insurance company in New Jersey, you can’t go wrong with any of these top providers. Whether you prioritize customization options, superior customer service, or comprehensive coverage, there’s a company that will meet your unique requirements. Take the time to research and compare their offerings to find the perfect life insurance policy that will provide you and your loved ones with the financial security and peace of mind you deserve.

Comparing Life Insurance Policies

Term Life Insurance Vs. Whole Life Insurance

Two commonly compared types of life insurance policies are term life insurance and whole life insurance. Term life insurance provides coverage for a specified period, usually 10, 20, or 30 years, while whole life insurance provides lifelong coverage. Term life insurance is generally more affordable, making it suitable for individuals looking for temporary coverage, whereas whole life insurance offers lifelong protection along with a cash value component.

Cost Comparison

The cost of life insurance varies depending on factors such as age, health, coverage amount, and the type of policy chosen. It’s important to compare quotes from different insurance companies to ensure you get the best value for your money. Additionally, consider any discounts or benefits offered by the insurance company that can further reduce your premiums.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How To Apply For Life Insurance In New Jersey

Application Process

Applying for life insurance in New Jersey is a relatively straightforward process. Begin by researching and selecting a reputable life insurance company that meets your needs. Once you’ve chosen a company, reach out to them or visit their website to begin the application process. You will need to provide personal information, undergo a medical examination, and consent to a background check. Following the completion of these steps, the insurance company will review your application and determine the final premium rates.

Required Documentation

When applying for life insurance, you will typically need the following documents:

- Proof of identification (driver’s license, passport, etc.)

- Proof of residency in New Jersey

- Financial information (income, assets, liabilities)

- Medical history and current health condition

- Family medical history

It’s important to be honest and accurate when providing information during the application process, as any misrepresentation can lead to denial of benefits. After successfully completing the application process, you will receive your life insurance policy, and your coverage will begin.

In conclusion, choosing the best life insurance company in New Jersey requires careful consideration of factors such as financial stability, coverage options, and customer service. It’s important to compare different insurance policies and understand the types of life insurance available. By following the application process and providing the required documentation, you can secure the financial future of your loved ones. Get started today by researching top life insurance companies, comparing policies, and taking the necessary steps to protect what matters most.

Frequently Asked Questions

What factors should I consider when choosing a life insurance company in New Jersey?

When choosing a life insurance company in New Jersey, it’s important to consider factors such as financial stability, customer reviews and ratings, policy options and coverage, premium rates, and the company’s reputation and customer service.

Which are some of the best life insurance companies in New Jersey?

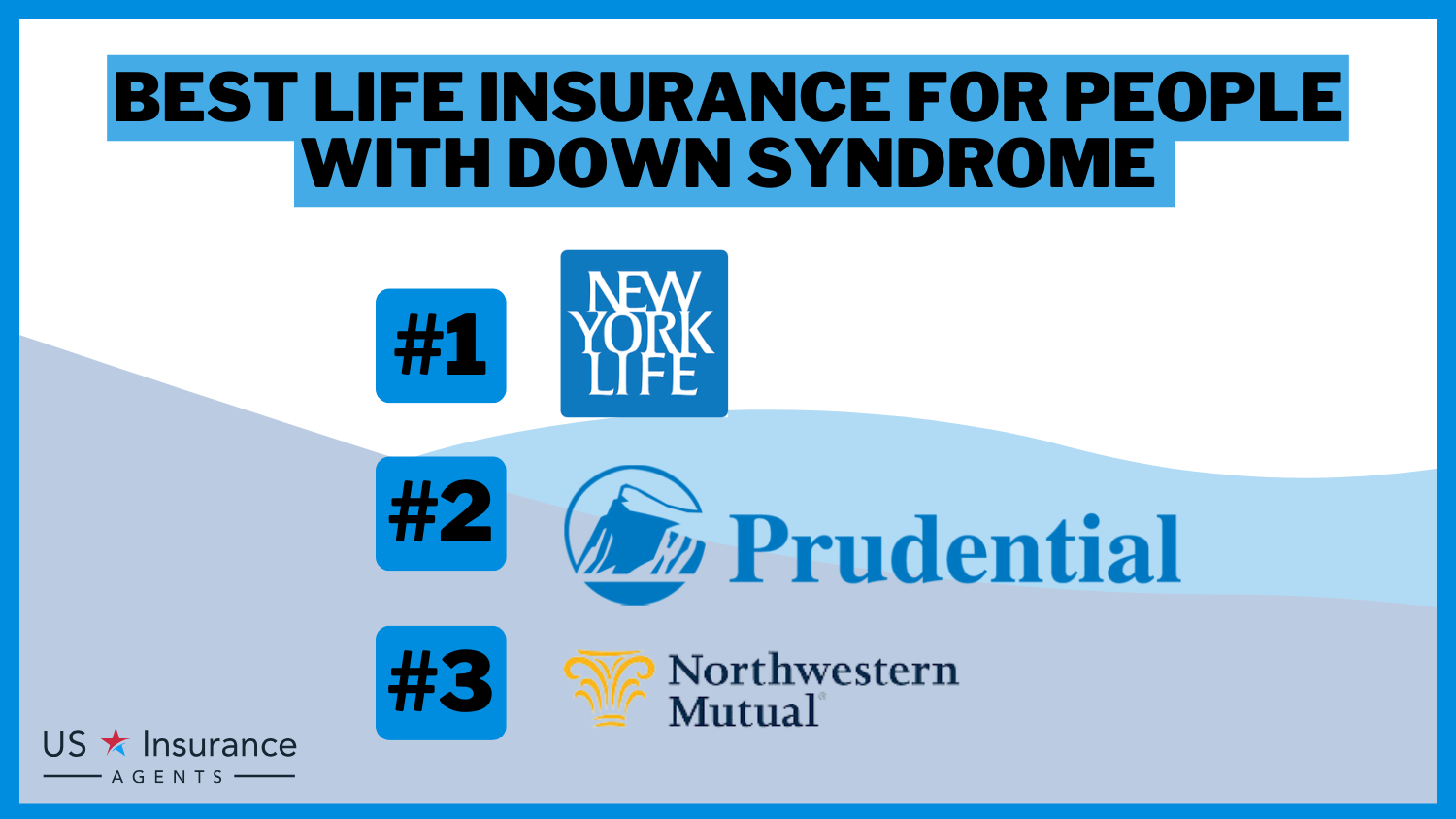

Some of the best life insurance companies in New Jersey include Prudential Financial, New York Life Insurance, MetLife, Northwestern Mutual, and MassMutual.

What types of life insurance policies are available in New Jersey?

New Jersey offers various types of life insurance policies, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type has its own features and benefits, so it’s important to explore them and choose the one that suits your needs.

How can I determine the financial stability of a life insurance company in New Jersey?

You can determine the financial stability of a life insurance company in New Jersey by checking their ratings from independent rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s. These agencies assess the financial strength and creditworthiness of insurance companies.

What should I consider when comparing premium rates for life insurance in New Jersey?

When comparing premium rates for life insurance in New Jersey, it’s important to consider factors such as your age, health condition, coverage amount, policy type, and any additional riders or benefits you may require. Additionally, obtaining quotes from multiple insurance companies can help you find the most competitive rates.

Can I purchase life insurance online in New Jersey?

Yes, many life insurance companies in New Jersey offer the option to purchase life insurance online. This allows you to conveniently compare policies, get quotes, and complete the application process from the comfort of your own home.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.