Best Life Insurance Companies in Washington

Looking for the best life insurance companies in Washington? This article provides an in-depth analysis of top insurers, helping you make an informed decision to protect your loved ones' future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

Are you a resident of Washington and in need of a reliable life insurance company? Look no further! In this article, we will guide you through the best life insurance companies in Washington. Understanding life insurance is crucial before making any decisions, so let’s start by exploring what life insurance entails.

Understanding Life Insurance

Life insurance is a contract between you and an insurance provider. It ensures that your loved ones are financially protected in the event of your passing. In exchange for regular premium payments, the insurance company will provide a death benefit to your beneficiaries.

But let’s dive deeper into the world of life insurance and explore the different types available to you.

Types of Life Insurance

There are different types of life insurance, each with its own unique features and benefits.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically 10-30 years. It offers a death benefit to your beneficiaries if you pass away during the term of the policy. This type of insurance is often chosen by individuals who want coverage for a specific period, such as until their mortgage is paid off or their children are financially independent.

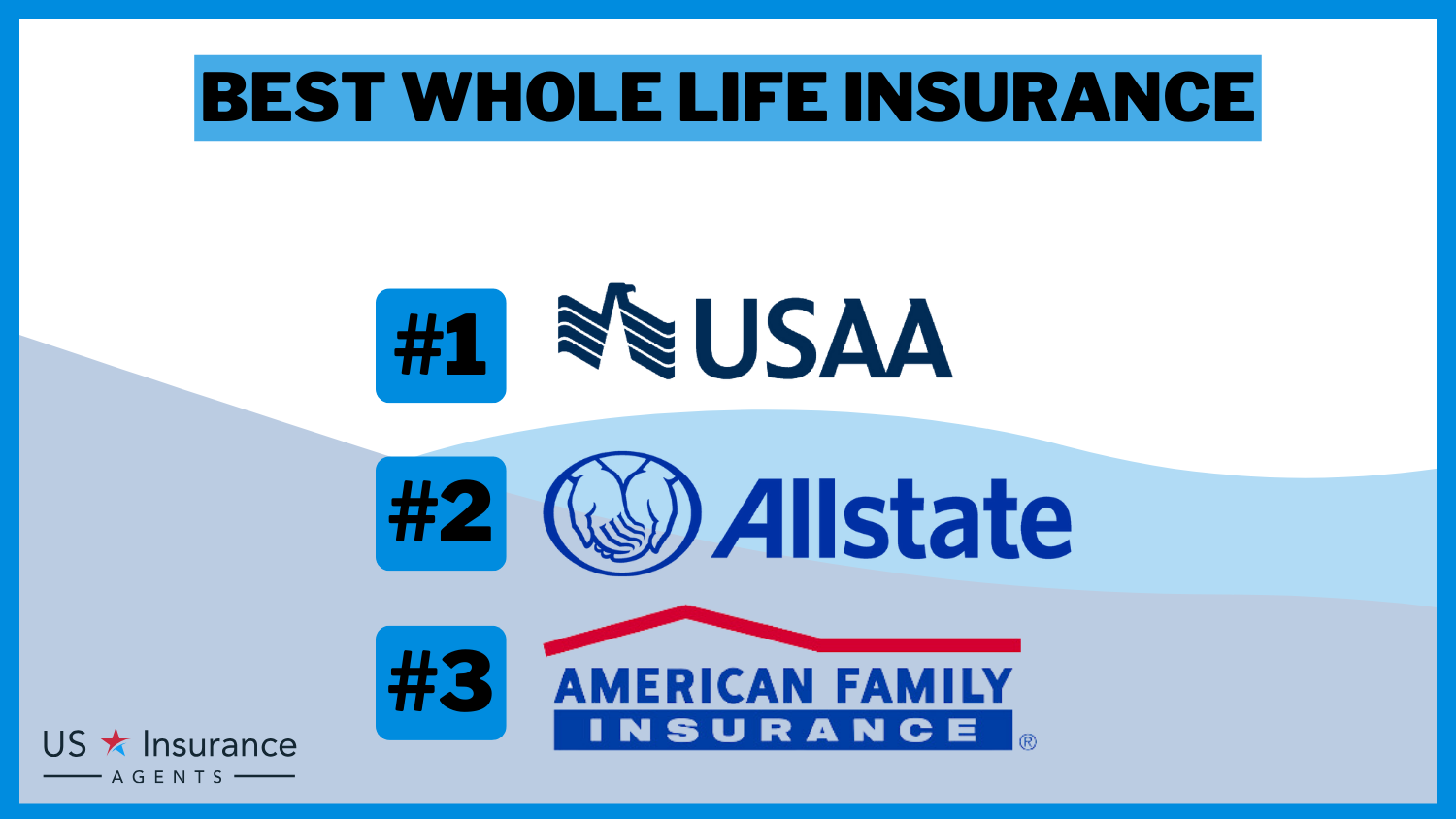

Whole Life Insurance

On the other hand, whole life insurance is permanent coverage that lasts your entire life. It not only offers a death benefit but also includes a cash value component. The cash value grows over time and can be accessed by the policyholder through loans or withdrawals. Whole life insurance provides lifelong protection and can be a valuable tool for estate planning or leaving a legacy to your loved ones.

The Importance of Life Insurance

Life insurance plays a vital role in securing your family’s financial future. In the event of your untimely death, life insurance ensures that your loved ones won’t be burdened with financial hardships.

Imagine this scenario: You are the primary breadwinner of your family, and your sudden passing leaves your spouse and children without your income. Without life insurance, they may struggle to make ends meet, pay for daily living expenses, or even keep up with mortgage payments. However, with the right life insurance policy in place, your family can continue to maintain their standard of living and meet their financial obligations.

Life insurance can also be utilized to cover funeral expenses and any outstanding medical bills. The cost of funerals can be significant, and the last thing you want is for your loved ones to worry about how to afford a proper farewell. With life insurance, you can ensure that your final expenses are taken care of, allowing your family to focus on grieving and healing.

Furthermore, life insurance provides peace of mind knowing that your family will have the necessary financial means to carry on even without your presence. It can provide a sense of security, knowing that your loved ones will be protected and supported in the face of unexpected circumstances.

So, whether you choose term life insurance or whole life insurance, it’s important to consider the benefits it can offer to you and your family. Life insurance is not just a financial product; it’s a way to safeguard your loved ones’ future and provide them with the stability they deserve.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors To Consider When Choosing A Life Insurance Company

When selecting a life insurance company, it is essential to assess several factors to ensure you make the best choice for your specific needs. Let’s delve into these considerations:

Financial Stability

One crucial aspect is the financial stability of the company. You want to choose a provider with a strong financial standing, as they will be responsible for fulfilling the claims. Look for companies with high credit ratings issued by rating agencies like A.M. Best or Standard & Poor’s.

Financial stability is vital because it ensures that the life insurance company has the necessary resources to meet its policyholders’ claims obligations. A financially stable company will have a robust investment portfolio, a solid track record of profitability, and a healthy reserve fund. These factors indicate that the company can honor its commitments and provide the financial security you seek.

Policy Options

Another crucial factor is the availability of policy options that align with your requirements. Different life insurance companies provide a variety of policy types, coverage amounts, and add-on features. It’s vital to choose a company that offers the specific coverage and flexibility you are looking for.

Consider the various types of life insurance policies available, such as term life, whole life, universal life, and variable life. Each policy type has its own features and benefits, and the right choice depends on your individual circumstances and financial goals. Additionally, assess the coverage amounts offered by different companies to ensure they meet your needs, both in terms of immediate financial protection and long-term financial planning.

Furthermore, some life insurance companies provide additional features or riders that can enhance your policy’s value. These may include options like accelerated death benefits, which allow you to access a portion of your policy’s death benefit if you are diagnosed with a terminal illness. Other riders may offer benefits such as coverage for critical illnesses or the ability to increase your coverage in the future without undergoing additional medical exams.

Customer Service

Excellent customer service can make a significant difference in the overall experience with a life insurance company. Look for reviews and ratings regarding a company’s customer service department. A responsive and helpful customer support team can assist you throughout the policy buying process and address any concerns or inquiries you may have.

Consider the accessibility and responsiveness of the company’s customer service channels, such as phone, email, or live chat. A prompt and knowledgeable customer support team can provide guidance when selecting a policy, help you understand the terms and conditions, and assist with any necessary paperwork or claims processes. Additionally, a reputable company will have a dedicated claims department that can efficiently handle any claims that arise, ensuring a smooth and hassle-free experience during difficult times.

Furthermore, it is beneficial to research the company’s reputation for customer satisfaction. Look for testimonials or feedback from policyholders who have had interactions with the company’s customer service team. Positive reviews and a strong reputation for excellent customer service indicate that the company values its policyholders and is committed to providing a positive experience throughout the policy’s duration.

Top Life Insurance Companies In Washington

When it comes to choosing a life insurance company, there are several important aspects to consider. Factors such as financial stability, policy options, customer service, and claims processing can greatly influence your decision. In Washington, there are a number of top-notch life insurance companies that excel in these areas. Let’s dive into the details of the top life insurance companies in Washington:

Company 1 Overview And Offerings

Company 1 is a standout in the industry, known for its exceptional financial stability and diverse policy options. They understand that every individual’s insurance needs are unique, which is why they provide customizable coverage plans that cater to various budgets and specific requirements. Whether you’re looking for term life insurance or whole life insurance, Company 1 has got you covered. Their policies are designed to provide comprehensive protection and peace of mind for you and your loved ones.

One of the key reasons why Company 1 has gained a positive reputation is their attentive customer service. They believe in putting their customers first and strive to provide personalized assistance every step of the way. From helping you understand the different policy options to guiding you through the application process, their dedicated team is there to ensure that you make an informed decision.

Additionally, Company 1 is known for their timely claims processing. Dealing with the loss of a loved one is already emotionally challenging, and the last thing you need is a complicated claims process. With Company 1, you can have peace of mind knowing that they are committed to handling claims efficiently and with compassion.

Company 2 Overview And Offerings

Company 2 has made a name for itself in Washington with its competitive rates and comprehensive coverage options. They understand that affordability is a key factor for many individuals when it comes to life insurance, which is why they offer policies at rates that won’t break the bank. Whether you’re looking for a term life insurance policy to cover a specific period or a whole life insurance policy that provides lifelong coverage, Company 2 has options to suit your needs.

One of the standout features of Company 2 is their user-friendly online platform. They believe in making the purchasing process as seamless and convenient as possible. With their intuitive website, you can easily compare different policy options, get instant quotes, and even complete the application process online. This not only saves you time but also ensures a smooth customer experience from start to finish.

Company 2 also understands the importance of transparency and clarity when it comes to life insurance. They provide detailed information about their policies, including coverage limits, exclusions, and additional benefits. This allows you to make an informed decision based on your specific needs and preferences.

Company 3 Overview And Offerings

Company 3 has earned a highly regarded reputation in Washington for its excellent track record and long-standing presence in the insurance industry. With a wide range of policy options and flexible terms, they have gained the trust of many customers over the years. Whether you’re looking for a basic term life insurance policy or a more comprehensive whole life insurance policy, Company 3 has options to suit your needs.

One of the key factors that sets Company 3 apart is their robust financial stability. When it comes to life insurance, it’s crucial to choose a company that can fulfill its promises when the time comes. With Company 3, you can have peace of mind knowing that they have a strong financial foundation, ensuring the reliability of their claims payout.

Company 3 also understands that life is unpredictable, and your insurance needs may change over time. That’s why they offer flexibility in their policy terms, allowing you to make adjustments as your circumstances evolve. Whether you need to increase your coverage or make changes to your beneficiaries, Company 3 is there to accommodate your needs.

Choosing the right life insurance company is a crucial decision that requires careful consideration. By exploring the top life insurance companies in Washington, you can find a company that not only meets your needs but also provides the peace of mind you deserve.

Comparing Life Insurance Policies

Now that we have explored some of the top life insurance companies in Washington, let’s delve deeper into the world of life insurance policies to help you make an informed decision.

Life insurance is a crucial financial tool that provides protection and peace of mind for you and your loved ones. It is designed to provide a financial safety net in the event of your untimely demise, ensuring that your family’s financial needs are taken care of.

Term Life Insurance Vs. Whole Life Insurance

When considering life insurance options, two primary types come into play: term life insurance and whole life insurance.

Term life insurance offers temporary coverage for a specified term, typically ranging from 10 to 30 years. It tends to be more affordable, making it an attractive option for those on a budget. With term life insurance, you pay a fixed premium for the duration of the term, and if you pass away during that time, the policy pays out a death benefit to your beneficiaries.

On the other hand, whole life insurance provides lifelong coverage with a cash value component that can grow over time. It offers more financial benefits but comes at a higher cost. Whole life insurance policies combine a death benefit with a savings component, allowing you to accumulate cash value over the life of the policy. This cash value can be accessed during your lifetime through policy loans or withdrawals.

Choosing between term life insurance and whole life insurance depends on your specific needs and financial goals. If you are looking for temporary coverage to protect your family during a specific period, such as when you have dependents or outstanding debts, term life insurance may be the right choice. On the other hand, if you want lifelong coverage with potential financial benefits and the ability to build cash value, whole life insurance could be a better fit.

Cost Comparison

One of the essential factors to consider when comparing life insurance policies is the cost. The cost of life insurance varies depending on factors such as age, health, coverage amount, and the insurance company itself.

It is crucial to obtain quotes from multiple providers and compare the premiums and benefits offered. While affordability is often a significant consideration, it is equally important to evaluate the overall value and coverage provided by each policy.

When comparing the cost of life insurance, consider your budget and long-term financial goals. While term life insurance may offer lower premiums initially, whole life insurance’s higher cost can be justified by the potential for accumulating cash value and lifelong coverage.

Coverage Comparison

When comparing coverage, it is essential to evaluate the specific terms and conditions of each policy. Each life insurance policy comes with its own set of benefits, limitations, and exclusions.

Look closely at what circumstances are covered and any exclusions or limitations that may apply. Some policies may have waiting periods before certain benefits are available, while others may exclude coverage for specific causes of death.

Consider your personal circumstances and the needs of your beneficiaries when choosing the most suitable coverage. If you have dependents who rely on your income, it is vital to ensure that the policy provides adequate coverage to meet their financial needs in your absence.

Furthermore, consider any additional riders or options that may be available to enhance your coverage. Riders such as accidental death benefit riders or disability income riders can provide added protection and peace of mind.

Remember, life insurance is not a one-size-fits-all solution. Your coverage needs may differ from others based on factors such as age, health, financial obligations, and long-term goals. Take the time to assess your unique situation and consult with a qualified insurance professional to determine the most appropriate coverage for you.

In conclusion, choosing the right life insurance policy requires careful consideration of various factors, including financial stability, policy options, and customer service. By evaluating the top companies in Washington and comparing different policies, you can make an informed decision that provides financial security for yourself and your loved ones.

Frequently Asked Questions

What are the best life insurance companies in Washington?

According to the article in cell E45, some of the best life insurance companies in Washington are State Farm, Mutual of Omaha, Pacific Life, Prudential, and Northwestern Mutual.

What factors should I consider when choosing a life insurance company in Washington?

When selecting a life insurance company in Washington, it is essential to consider factors such as financial stability, customer reviews and ratings, coverage options, premium costs, and the company’s reputation for customer service.

Are there any specific requirements for obtaining life insurance in Washington?

While specific requirements may vary between insurance companies, generally, individuals applying for life insurance in Washington will need to provide information about their age, health condition, lifestyle habits, and may need to undergo a medical examination.

Can I purchase life insurance online in Washington?

Yes, many life insurance companies in Washington offer the option to purchase life insurance online. It allows for a convenient and streamlined process, but it’s important to thoroughly research the company and policy before making a purchase online.

What types of life insurance policies are available in Washington?

According to the article in cell E45, common types of life insurance policies available in Washington include term life insurance, whole life insurance, and universal life insurance. Each type has its own features and benefits, so it’s important to understand the differences before choosing a policy.

Can I switch life insurance companies in Washington?

Yes, it is possible to switch life insurance companies in Washington. However, before making a switch, it is crucial to consider factors such as any penalties or fees associated with canceling the current policy, the financial stability and reputation of the new company, and whether the new policy meets your coverage needs and goals.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.