Best Life Insurance Policies for Test Pilots

Are you a test pilot looking for the perfect life insurance policy? Discover the top options available for test pilots and ensure your future with the best life insurance policies tailored to your unique needs. Find peace of mind while soaring through the skies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

Test pilots play a crucial role in the development and testing of new aircraft. With their knowledge and expertise, they put themselves at risk to ensure the safety and reliability of these machines. As test flying involves inherent dangers, it is essential for test pilots to have adequate life insurance coverage to protect themselves and their loved ones in case of emergencies or unfortunate accidents.

Understanding the Risks of Being a Test Pilot

Being a test pilot is no ordinary profession. Their job involves pushing the limits of aviation technology and exploring uncharted territories in the sky. However, with these adventures come risks, and it is vital to comprehend the potential hazards and challenges faced by test pilots.

The Role of a Test Pilot

A test pilot is responsible for evaluating the performance and capabilities of new aircraft. They conduct rigorous flight tests, both in simulated environments and real-world conditions, to identify potential flaws and ensure the aircraft’s compliance with safety standards.

During these flight tests, test pilots collect vast amounts of data on the aircraft’s behavior, including its handling characteristics, stability, and overall performance. They meticulously analyze this data to provide valuable insights to engineers and developers, enabling them to make necessary improvements and modifications.

Common Risks and Hazards in Test Flying

Test flying often involves flying prototypes or modified aircraft that may have unknown or unforeseen issues. These challenges can range from flight instability to mechanical failures, which pose a significant risk to the pilot’s safety.

One of the most critical risks in test flying is the possibility of encountering an aerodynamic stall. An aerodynamic stall occurs when the airflow over the wings becomes disrupted, resulting in a loss of lift and control. Test pilots must be highly trained to recognize and recover from stalls promptly.

Another hazard test pilots face is the potential for structural failure during extreme maneuvers. The forces exerted on the aircraft during high-speed dives, sharp turns, and other demanding flight profiles can put immense stress on the airframe. Test pilots must carefully assess the structural limits of the aircraft to prevent catastrophic failures.

Safety Measures for Test Pilots

Despite the dangers, test pilots take extensive safety precautions to mitigate risks. They undergo rigorous training to hone their skills and learn emergency procedures.

Test pilots also rely on advanced technology to enhance safety. Modern aircraft are equipped with sophisticated flight control systems that provide real-time feedback and warnings to pilots, helping them make informed decisions during critical moments. Additionally, state-of-the-art simulators allow test pilots to practice complex flight scenarios and emergency procedures in a controlled environment before executing them in actual flight tests.

Furthermore, constant communication and collaboration with engineers, developers, and other stakeholders allow test pilots to address potential concerns before conducting test flights. By actively participating in the design and development process, test pilots can provide valuable input that improves the overall safety and performance of the aircraft.

In conclusion, being a test pilot is a high-stakes profession that requires exceptional skill, knowledge, and courage. The risks and hazards associated with test flying are significant, but through meticulous preparation, advanced technology, and collaboration, test pilots continue to push the boundaries of aviation and contribute to the advancement of aerospace engineering.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Life Insurance for Test Pilots

Given the unique nature of their profession, test pilots need to prioritize obtaining the right life insurance policy. It not only provides financial security for their families but also ensures coverage for medical expenses and offers peace of mind in a high-risk profession.

Test pilots, with their daring and adventurous spirit, take on a profession that demands immense skill and courage. They are the ones who push the limits of aviation technology, putting their lives at risk to ensure the safety of future pilots and passengers. In such a high-stakes environment, it becomes crucial for test pilots to plan for the unexpected and secure their loved ones’ future.

Financial Security for Your Family

A comprehensive life insurance policy guarantees that your loved ones are protected financially in the event of your demise. It provides them with a financial cushion to cover living expenses, education costs, and other necessary expenditures during difficult times.

Imagine the relief it brings to the family of a test pilot knowing that they will be taken care of, even in the face of tragedy. With life insurance, the burden of financial responsibilities is lifted, allowing the family to focus on healing and rebuilding their lives.

Coverage for Medical Expenses

Test flying can involve accidents or injuries that may require extensive medical treatment. A suitable life insurance policy includes provisions for medical expenses, ensuring that you receive the necessary care and support without overwhelming financial burdens.

When it comes to test pilots, the risks they face are not limited to their lives alone. In the event of an accident, medical expenses can quickly pile up, adding to the stress and uncertainty. However, with a well-structured life insurance policy, these concerns can be alleviated. The financial coverage provided can help ease the financial strain on the pilot and their family, ensuring that they receive the best medical care available.

Peace of Mind in a High-Risk Profession

Life insurance not only offers financial benefits but also provides emotional reassurance. Knowing that you have a safety net in place, allowing you to focus on your job without constant worry, can significantly reduce stress and promote a healthier work-life balance.

For test pilots, the mental and emotional toll of their profession can be overwhelming. The constant pressure to perform at their best, combined with the inherent risks involved, can take a toll on their well-being. However, having a comprehensive life insurance policy can provide them with the peace of mind they need to focus on their work. It allows them to approach each flight with a clear mind, knowing that their loved ones are protected and their future secure.

Evaluating Different Life Insurance Policies

When selecting a life insurance policy as a test pilot, it is important to consider various factors such as coverage, cost, and flexibility. Here are different types of life insurance policies commonly available:

Term Life Insurance

Term life insurance provides coverage for a specific period. It offers a death benefit to your beneficiaries if you pass away during the policy term. This type of insurance is often the most affordable option for test pilots, with premiums based on factors such as age, health, and term length.

For test pilots, term life insurance can be particularly advantageous. As a test pilot, you face unique risks in your profession, and having adequate coverage during active flight periods is crucial. Term life insurance allows you to tailor your coverage to coincide with your flying career, providing the necessary protection for your loved ones in case of an unfortunate event.

Additionally, term life insurance offers flexibility when it comes to policy length. As a test pilot, you may have a clear understanding of the duration of your career or specific milestones you wish to secure financially. With term life insurance, you can choose a policy term that aligns with your goals, ensuring that you have coverage when you need it the most.

Whole Life Insurance

Whole life insurance is a permanent policy that provides protection for your entire life. It offers a death benefit and accumulates cash value over time, which you can borrow against or use for future financial needs. While whole life insurance generally has higher premiums, it provides lifelong coverage and financial benefits.

As a test pilot, whole life insurance can be an attractive option due to its long-term coverage. The nature of your profession involves inherent risks, and having a policy that covers you throughout your entire life can bring peace of mind to both you and your loved ones. This type of insurance ensures that your beneficiaries will receive a death benefit regardless of when you pass away, providing a sense of security and financial stability.

Furthermore, the cash value accumulation feature of whole life insurance can be beneficial for test pilots. The ability to borrow against the cash value or use it for future financial needs can provide a safety net during uncertain times. Whether it’s for emergency expenses or supplementing retirement income, the accumulated cash value can serve as a valuable asset for test pilots looking for financial flexibility.

Universal Life Insurance

Universal life insurance blends life insurance coverage with an investment component. It allows flexibility in premium payments and death benefit amounts, making it suitable for individuals seeking more control over their policy. However, it is essential to weigh the potential risks and rewards associated with the investment aspect.

For test pilots who desire more control over their life insurance policy, universal life insurance can be an intriguing option. The flexibility in premium payments and death benefit amounts allows you to adjust your coverage as your circumstances change. This can be particularly beneficial for test pilots who experience fluctuations in income or have evolving financial goals.

However, it is important to carefully consider the investment component of universal life insurance. While the potential for growth and accumulation of cash value can be appealing, it also introduces investment risks. As a test pilot, you may already be exposed to a certain level of risk in your profession, and it is crucial to assess whether taking on additional investment risks aligns with your overall financial strategy.

Variable Life Insurance

Variable life insurance combines life insurance coverage with investment opportunities. Policyholders have the option to allocate premiums into various investment accounts, typically consisting of stocks and bonds. While this type of policy offers potential growth, it also carries investment risks, and returns are not guaranteed.

For test pilots with a higher risk tolerance and a desire for potential growth, variable life insurance can be an appealing choice. The ability to allocate premiums to different investment accounts allows you to participate in the market’s potential upside. This can be particularly attractive for test pilots who have a strong understanding of investments and are comfortable with assuming the associated risks.

However, it is important to note that variable life insurance is subject to market fluctuations, and returns are not guaranteed. As a test pilot, you may already be exposed to a certain level of volatility in your profession, and it is crucial to assess whether the potential growth from variable life insurance aligns with your overall financial goals and risk tolerance.

In conclusion, when evaluating different life insurance policies as a test pilot, it is crucial to consider factors such as coverage, cost, and flexibility. Whether you opt for term life insurance, whole life insurance, universal life insurance, or variable life insurance, each type has its own advantages and considerations. By carefully assessing your needs and consulting with a financial professional, you can make an informed decision that provides the necessary protection and financial benefits for you and your loved ones.

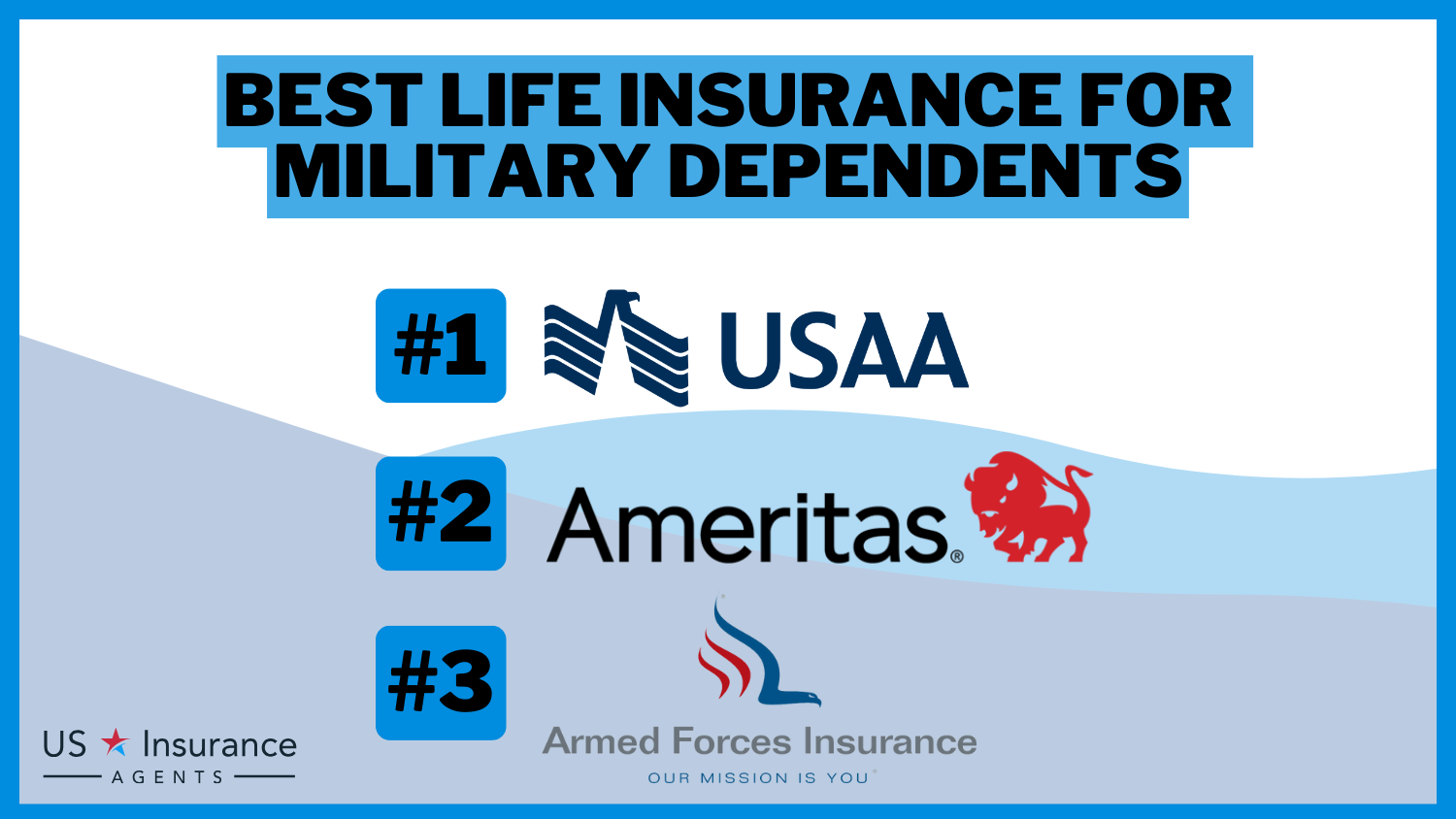

Top Life Insurance Providers for Test Pilots

When choosing a life insurance provider, it is crucial to consider their reputation, financial stability, and customer service. Here are three top-rated life insurance providers well-suited for test pilots:

Provider 1 Review

Provider 1 is known for its extensive coverage options and competitive premiums. They have a strong financial rating and a history of excellent customer service, making them a reliable choice for test pilots seeking comprehensive life insurance policies.

Provider 2 Review

Provider 2 specializes in offering customized life insurance solutions to meet the unique needs of different professions. Their policies include features specifically designed for high-risk occupations, making them an ideal choice for test pilots.

Provider 3 Review

Provider 3 has a long-standing reputation in the insurance industry and offers a range of life insurance products to fit various budgets and coverage requirements. Their commitment to customer satisfaction and prompt claim processing sets them apart as a reliable choice for test pilots.

In conclusion, as test pilots embark on their courageous journey to ensure aviation safety, obtaining the best life insurance policy should be a top priority. Understanding the risks associated with their profession and evaluating different policies can help them find the most suitable coverage. By choosing a reputable insurance provider and investing in comprehensive life insurance, test pilots can obtain the financial security, medical support, and peace of mind they need to excel in their high-risk profession.

Frequently Asked Questions

What are the key factors to consider when choosing a life insurance policy for test pilots?

When selecting a life insurance policy for test pilots, it is important to consider factors such as coverage amount, premium costs, policy exclusions related to high-risk activities, and the financial stability of the insurance provider.

What types of life insurance policies are suitable for test pilots?

Test pilots may find term life insurance or accidental death and dismemberment (AD&D) insurance policies to be suitable. Term life insurance provides coverage for a specified period, while AD&D insurance specifically covers accidents resulting in death or severe injuries.

Can test pilots obtain life insurance coverage despite their high-risk profession?

Yes, test pilots can still obtain life insurance coverage despite their high-risk profession. However, they may face higher premiums due to the increased likelihood of accidents or injuries associated with their job. Insurance providers may also impose certain exclusions or limitations related to aviation activities.

Are there any specific policy exclusions that test pilots should be aware of?

Test pilots should be aware of policy exclusions related to aviation activities, which may vary depending on the insurance provider. These exclusions can include limitations on coverage during test flights, experimental aircraft, or specific types of maneuvers. It is crucial to thoroughly review the policy terms and conditions to understand the extent of coverage.

How can test pilots ensure they get the best life insurance rates?

To secure the best life insurance rates as a test pilot, it is recommended to compare quotes from multiple insurance providers. Working with an independent insurance agent who specializes in high-risk professions can also be beneficial. Additionally, maintaining a good health record and demonstrating a commitment to safety can help in negotiating more favorable rates.

Can test pilots modify their life insurance policies if their job responsibilities change?

Yes, test pilots can modify their life insurance policies if their job responsibilities change. It is advisable to inform the insurance provider about any changes in occupation and discuss potential adjustments to the policy to ensure continued coverage that aligns with the new job requirements.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.