Best Life Insurance Policies for Veterans

Are you a veteran looking for the best life insurance policies? Look no further! Discover our comprehensive guide on the top life insurance options tailored specifically for veterans, ensuring peace of mind and financial security.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

As a veteran, it is crucial to secure the best life insurance policy to protect yourself and your loved ones. Life insurance provides financial security and peace of mind in case of the unexpected. However, choosing the right policy can be challenging, given the myriad of options available. In this article, we will discuss the various factors to consider when selecting a life insurance policy and highlight some of the top providers that cater specifically to veterans.

Understanding Life Insurance for Veterans

Before delving into the different policies available, it is essential to have a clear understanding of what life insurance is and how it works. Life insurance is a contract between an individual and an insurance company. In exchange for regular premium payments, the insurance company guarantees a sum of money, known as the death benefit, to the designated beneficiaries upon the insured’s death.

Life insurance serves as a financial safety net, allowing your loved ones to cover expenses such as funeral costs, outstanding debts, mortgage payments, and everyday living expenses in the event of your passing. It offers peace of mind, knowing that your family will be financially protected during a difficult time.

What is Life Insurance?

Life insurance is a contract between an individual and an insurance company to provide financial protection to the individual’s beneficiaries in the event of their death. In exchange for regular premium payments, the insurance company guarantees a sum of money, known as the death benefit. This benefit is paid to the designated beneficiaries.

Life insurance policies come in various types, including term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured, as long as premiums are paid. Universal life insurance offers flexibility in premium payments and death benefits.

When considering life insurance, it is important to assess your financial needs, such as outstanding debts, mortgage, education expenses, and income replacement for your loved ones. This will help determine the appropriate amount of coverage and the type of policy that best suits your needs.

Why Veterans Need Specific Life Insurance Policies

While veterans can typically obtain life insurance from traditional providers, there are certain circumstances unique to veterans that necessitate specialized life insurance policies. Veterans may have unique health conditions resulting from their service or they may require coverage for disabilities incurred during their time in the military.

Furthermore, veterans may have certain preferences when it comes to customer service and support. Given these specific needs, it is important for veterans to explore life insurance policies tailored to their unique circumstances.

Specialized life insurance policies for veterans often take into account their military service, providing coverage for service-related disabilities and health conditions. These policies may also offer additional benefits, such as accelerated death benefits, which allow veterans to access a portion of their death benefit while still living if they are diagnosed with a terminal illness.

Additionally, some life insurance policies for veterans may offer options for coverage even if they have pre-existing health conditions. These policies may have underwriting requirements specific to veterans, taking into consideration their military service and the associated risks.

When considering life insurance options as a veteran, it is important to research and compare policies from different providers. Look for policies that offer competitive premiums, comprehensive coverage, and excellent customer service. It is also advisable to consult with a financial advisor or insurance specialist who can guide you through the process and help you make an informed decision based on your unique circumstances.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Providers for Veterans

Now that we understand the importance of selecting a life insurance policy suited to veterans, let’s explore some of the top providers in the industry.

USAA Life Insurance for Veterans

USAA is a well-known provider of insurance products for military members and their families. They have been serving the military community for decades and have a deep understanding of the unique needs of veterans. USAA offers a range of life insurance policies specifically designed for veterans.

One of the key benefits of USAA’s life insurance policies for veterans is the coverage for post-military health conditions. As veterans transition to civilian life, they may face various health challenges that are a result of their service. USAA recognizes this and provides comprehensive coverage to ensure veterans receive the necessary support.

Additionally, USAA has a seamless claims process, which is particularly important for veterans who may have experienced trauma or other challenges during their service. The last thing veterans need is a complicated claims process when they or their loved ones are already dealing with a difficult situation. USAA’s commitment to a smooth and efficient claims process provides peace of mind to veterans and their families.

Navy Mutual Aid Association

Another reputable provider catering to veterans is the Navy Mutual Aid Association. As the name suggests, this association was founded by Navy veterans with the mission to provide financial security to the military community, including veterans.

Navy Mutual Aid Association offers a variety of life insurance options, including coverage for veterans with service-connected disabilities. This is a crucial benefit as veterans with disabilities may face unique challenges when it comes to obtaining life insurance coverage. The association recognizes these challenges and ensures that veterans with service-connected disabilities have access to the protection they need.

Moreover, Navy Mutual Aid Association’s policies often provide lower premiums and higher coverage amounts compared to traditional providers. This can be particularly advantageous for veterans who may be on a tight budget or have specific financial goals they want to achieve with their life insurance policy.

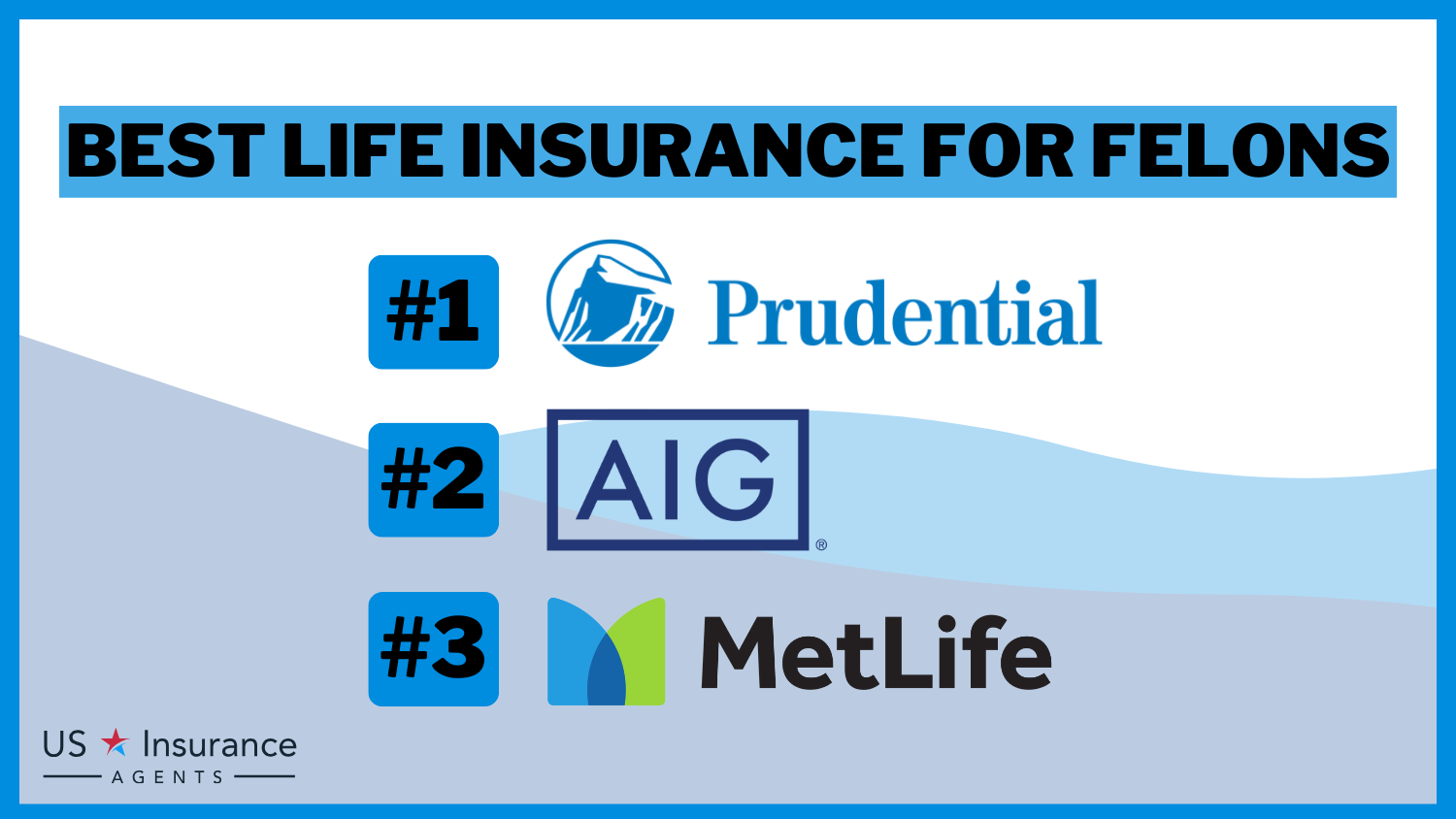

Prudential Life Insurance for Veterans

Prudential is a well-established provider with a strong reputation in the industry. They have been serving customers for over 140 years and have a long history of providing quality life insurance products.

Prudential offers life insurance policies specifically tailored to veterans, understanding the unique needs and circumstances they may face. Their policies include coverage options for service-related disabilities, ensuring that veterans receive the necessary financial protection in case of disability resulting from their service.

One of the standout features of Prudential’s life insurance policies for veterans is the flexibility they offer. Veterans can customize their premiums and benefits to suit their individual needs and financial situation. This level of customization allows veterans to have a life insurance policy that aligns with their specific goals and priorities.

In conclusion, when it comes to life insurance for veterans, these top providers – USAA, Navy Mutual Aid Association, and Prudential – offer comprehensive coverage, tailored benefits, and a deep understanding of the unique needs of veterans. By choosing one of these providers, veterans can ensure that their financial future and the well-being of their loved ones are protected.

Comparing Life Insurance Policies for Veterans

When evaluating life insurance policies, it is important to consider factors such as policy coverage, cost, and benefits. Let’s explore each of these aspects in detail.

Policy Coverage Comparison

One of the first things to consider when comparing life insurance policies is the coverage they provide. Look for policies that offer comprehensive coverage, including coverage for specific health conditions or disabilities that may be relevant to veterans. For example, some policies may provide coverage for service-related injuries or illnesses, ensuring that veterans are adequately protected.

Additionally, it is important to consider the maximum coverage amount available and any restrictions or exclusions. Some policies may have limitations on coverage for certain conditions or activities. Understanding these details can help veterans make an informed decision about the policy that best suits their needs.

Cost Comparison

Cost is another critical factor to consider when comparing life insurance policies. Evaluate the premium payments and ensure they align with your budget. It is crucial to strike a balance between affordability and the coverage amount provided.

When it comes to cost, veterans may have access to special discounts or benefits. Some insurance companies offer discounted rates for veterans or specific military organizations. Exploring these options can help veterans find a policy that fits their financial situation while still providing adequate coverage.

Benefit Comparison

The benefits offered by each policy can vary significantly. Some policies may include additional benefits, such as accelerated death benefits that allow access to funds in case of terminal illness or disability. These benefits can provide financial support during challenging times and ensure that veterans and their families are taken care of.

Furthermore, some policies may offer additional features like cash value accumulation, which allows policyholders to build up savings over time. This can be particularly beneficial for veterans who may have specific financial goals or plans for the future.

When comparing benefits, it is essential to consider personal needs and priorities. For example, if a veteran has a pre-existing medical condition, they may want to prioritize policies that offer coverage for that specific condition.

In conclusion, comparing life insurance policies for veterans involves carefully evaluating policy coverage, cost, and benefits. By considering these factors and understanding the specific needs and circumstances of veterans, it becomes easier to make an informed decision and choose a policy that provides the necessary protection and peace of mind.

How to Choose the Best Life Insurance Policy as a Veteran

Now that we have explored the various aspects of life insurance policies for veterans, let’s delve deeper into the process of choosing the best one for you. Selecting the right life insurance policy is crucial, as it ensures that your loved ones are protected financially in the event of your passing. Here are some key steps to consider:

Assessing Your Financial Needs

Begin by conducting a comprehensive assessment of your financial needs. Take into account various factors such as outstanding debts, mortgage payments, and future education expenses for your children. By evaluating your financial situation thoroughly, you can determine the appropriate coverage amount required to adequately protect your loved ones.

Consider the potential financial burden your family may face if you were no longer there to provide for them. This includes not only immediate expenses but also long-term financial obligations. By taking the time to assess your financial needs, you can ensure that the life insurance policy you choose offers sufficient coverage.

Understanding Policy Terms and Conditions

When choosing a life insurance policy, it is crucial to read and understand the terms and conditions of each option thoroughly. Pay close attention to details such as policy exclusions, riders, and renewal provisions. These factors can significantly impact the coverage and benefits provided by the policy.

Policy exclusions refer to specific situations or conditions that are not covered by the insurance policy. It is important to be aware of any limitations or restrictions that may affect your coverage, such as pre-existing medical conditions or certain high-risk activities.

Riders, on the other hand, are additional provisions that can be added to your life insurance policy to enhance its coverage. Common riders include accidental death benefit riders, waiver of premium riders, and accelerated death benefit riders. Understanding these additional options can help you tailor your policy to meet your specific needs.

Lastly, pay attention to the renewal provisions of the policy. Some policies may require periodic medical examinations or premium adjustments upon renewal. Being aware of these provisions ensures that you are prepared for any changes that may occur in the future.

Evaluating Customer Service and Company Reputation

When selecting a life insurance provider, it is essential to evaluate their customer service and reputation in the industry. A reputable company with excellent customer service will provide you with peace of mind throughout your life insurance journey.

Start by researching customer reviews and ratings of different insurance providers. This will give you insights into the experiences of other policyholders and help you gauge the level of satisfaction you can expect. Look for companies that have a track record of efficiently processing claims and providing prompt customer support.

Additionally, consider reaching out to the insurance companies directly to ask any questions or concerns you may have. Assess their responsiveness and willingness to assist you. A company that values its customers and prioritizes their needs will be more likely to provide a smooth and hassle-free experience.

Remember that choosing the best life insurance policy as a veteran requires careful consideration of your unique circumstances and needs. By thoroughly understanding what life insurance entails, exploring specialized providers that cater to veterans, and comparing policies, you can make an informed decision that provides financial security and peace of mind for both you and your loved ones.

Frequently Asked Questions

What are the key factors to consider when choosing the best life insurance policy for veterans?

When selecting a life insurance policy for veterans, it is important to consider factors such as the coverage amount, premium cost, policy duration, beneficiary designations, and any specific benefits or riders tailored for veterans.

What types of life insurance policies are available for veterans?

Veterans have various options for life insurance policies, including term life insurance, whole life insurance, and universal life insurance. Each type has its own features and benefits, so it’s essential to understand the differences before making a decision.

Are there any life insurance policies specifically designed for veterans?

Yes, there are life insurance policies specifically designed for veterans. These policies often offer additional benefits such as accelerated death benefits for terminal illness, waiver of premium for disability, and coverage for service-related injuries or deaths.

Can veterans with pre-existing conditions still get life insurance?

Yes, veterans with pre-existing conditions can still obtain life insurance. While some conditions may affect the premium or coverage options, there are insurance companies that specialize in providing coverage for individuals with pre-existing conditions, including veterans.

What documents are typically required to apply for life insurance as a veteran?

The documents required to apply for life insurance as a veteran may vary depending on the insurance company. However, common documents often include proof of military service (such as DD Form 214), medical records, and any relevant discharge paperwork.

Can veterans convert their SGLI (Servicemembers’ Group Life Insurance) to a civilian policy?

Yes, veterans can convert their SGLI to a civilian policy within a certain timeframe after leaving the military. This conversion option allows veterans to continue their life insurance coverage without undergoing a new medical exam or providing proof of insurability.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.