Best Veteran Car Insurance Discounts in 2026 (Save 15% With These 10 Companies)

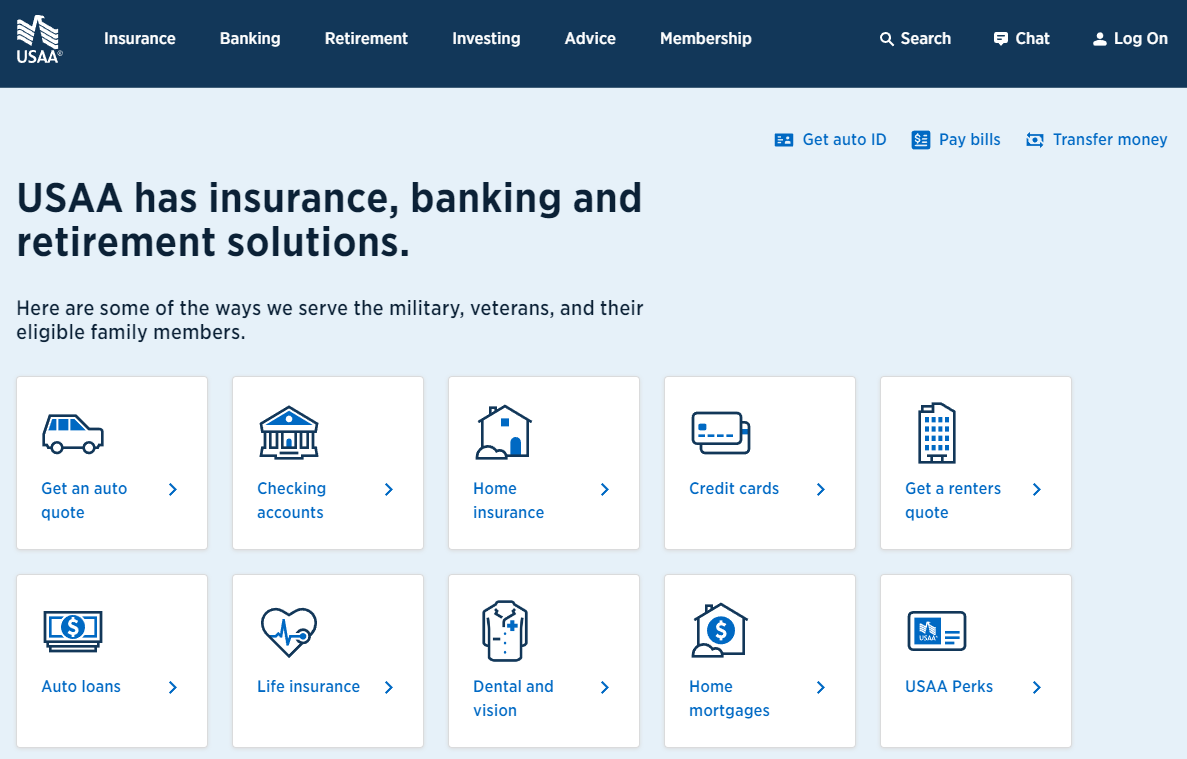

The best veteran car insurance discounts can save you up to 15% on premiums with top providers like USAA, Geico, and Navy Federal Credit Union. USAA offers military benefits, Geico provides competitive veteran rates, and Navy Federal tailors discounts for service members.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated October 2024

The best veteran car insurance discounts come from USAA, Geico, and Navy Federal, with USAA leading the pack for its exclusive military benefits.

This article explores why these top providers stand out, offering savings of up to 15% while meeting the unique needs of veterans and their families.

Our Top 10 Company Picks: Best Veteran Car Insurance Discounts

Company Rank Savings Potential Description

#1 15% Exclusive military discount available

#2 15% Great discounts and competitive pricing

#3 15% Special focus on military members

#4 10% Discount available for military members

#5 10% Discount for active and retired military

#6 10% Military discount available

#7 8%

Discount for veterans and active-duty

#8 8% Military discount available

#9 5% Discount available for veterans

#10 5% Discount for active military and veterans

Discover how each company delivers tailored coverage and competitive rates. Learn about the additional perks that make them stand out.

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Your Guide to Qualifying for Veteran Car Insurance Discounts

Securing the best car insurance discounts as a veteran can significantly reduce your premiums and reward your service. To maximize these benefits, follow these essential steps to ensure you qualify for the best possible discounts.

Provide Proof of Military Service

To qualify for veteran car insurance discounts, you’ll need to provide documentation that verifies your military service. Acceptable documents typically include a DD-214 form, military ID, or other official records that confirm your status as a veteran. Expand your knowledge with our comprehensive guide titled “Military Car Insurance Discount.”

This proof helps insurance companies confirm your eligibility for veteran-specific discounts and ensures they apply the correct rate reductions.

Verify Active Duty or Retiree Status

Some insurance providers offer discounts not only to veterans but also to active-duty military personnel and retirees. Make sure to clarify your current status with your insurer—whether you’re a recent veteran, an active-duty member, or a retired service member—to ensure you receive the appropriate discount.

Depending on your status, you may need different forms of proof, such as a military service record or retirement documents. For a comprehensive analysis, refer to our detailed guide titled “What is pension (retirement benefit)?“

Meet Specific Insurer Requirements

Different insurance companies may have unique criteria for qualifying for discounts. This could include a minimum number of years of service, specific branches of the military, or other conditions.

Be sure to check with your insurance provider to understand their specific requirements and confirm that you meet them.

Contact your insurer directly to get detailed information on their discount eligibility criteria and provide any required additional information. For detailed information, refer to our comprehensive report titled “What is eligibility assessment?“

Submit Accurate and Up-to-Date Documentation

Make sure your documentation is accurate and up-to-date. Outdated or incorrect papers can cause delays or denial of your discount. Verify requirements with your insurer and update any necessary documents to reflect your current status.

By following these steps, you can effectively navigate the process of qualifying for veteran car insurance discounts and make the most of the savings available to you. Explore our insurance guide, “Best Car Insurance Discounts to Ask for” to learn more.

Jeff Root Licensed Life Insurance Agent

Always stay in touch with your insurer to ensure your information is current and to take full advantage of the benefits offered.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Car Insurance Companies Offering Veteran Discounts

When it comes to car insurance, veterans deserve the best. Fortunately, there are several car insurance companies known for their commitment to serving veterans and providing them with exclusive discounts.

This table provides a comparison of full coverage car insurance monthly rates by age and gender across various insurance companies. The rates are listed for males and females at ages 16, 25, 45, and 60, highlighting the variations in premiums based on both age and gender.

Full Coverage Car Insurance Monthly Rates by Age and Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 25 Female | Age: 25 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $608 | $638 | $181 | $190 | $162 | $160 | $150 | $154 | |

| $414 | $509 | $124 | $147 | $115 | $117 | $104 | $105 | |

| $695 | $735 | $182 | $190 | $153 | $151 | $136 | $140 | |

| $810 | $773 | $172 | $180 | $139 | $139 | $120 | $128 | |

| $298 | $312 | $97 | $93 | $80 | $80 | $73 | $74 | |

| $723 | $785 | $187 | $215 | $171 | $174 | $148 | $159 |

| $801 | $814 | $141 | $146 | $112 | $105 | $92 | $95 | |

| $311 | $349 | $101 | $111 | $86 | $86 | $76 | $76 | |

| $552 | $577 | $135 | $143 | $115 | $113 | $101 | $103 |

| $245 | $249 | $80 | $85 | $59 | $59 | $53 | $53 |

Companies included are Allstate, American Family, Amica, Farmers, Geico, Liberty Mutual, Progressive, State Farm, The Hartford, and USAA. Generally, younger drivers, particularly males, face higher premiums, while rates tend to decrease with age for both genders.

Minimum Coverage Car Insurance Monthly Rates by Age and Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 25 Female | Age: 25 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $237 | $260 | $69 | $72 | $62 | $61 | $59 | $60 | |

| $161 | $207 | $46 | $55 | $43 | $44 | $40 | $40 | |

| $215 | $238 | $55 | $57 | $46 | $46 | $42 | $44 | |

| $317 | $317 | $66 | $68 | $53 | $53 | $47 | $50 | |

| $114 | $125 | $36 | $35 | $30 | $30 | $28 | $29 | |

| $283 | $325 | $72 | $83 | $66 | $68 | $60 | $64 |

| $308 | $327 | $52 | $54 | $41 | $39 | $35 | $36 | |

| $124 | $146 | $39 | $42 | $33 | $33 | $30 | $30 | |

| $215 | $235 | $51 | $54 | $44 | $43 | $39 | $40 |

| $96 | $102 | $30 | $32 | $22 | $22 | $21 | $21 |

This table presents the monthly rates for minimum coverage car insurance across different age groups and genders from various insurance companies. It compares costs for 16-year-olds, 25-year-olds, 45-year-olds, and 60-year-olds, showing that rates generally decrease with age.

Female and male rates are compared within each age group, highlighting how insurance premiums vary not only by age but also by gender across different providers. Companies like Geico and USAA offer some of the lowest rates, especially for older drivers, while Liberty Mutual and Farmers tend to have higher premiums, particularly for younger drivers.

Other Financial Benefits for Veterans

As a veteran, your dedication and sacrifice can open doors to various financial benefits beyond discounted car insurance. These benefits are designed to support you in protecting your home, managing healthcare costs, and more. To delve deeper, refer to our in-depth report titled “Car Owners Car Insurance Discounts.”

Home Insurance Discounts for Veterans

Home insurance providers often offer special rates and discounts to veterans, making it more affordable to protect your home and assets. These discounts can significantly reduce your car insurance premium, and some providers also offer additional perks like coverage for military memorabilia and repair assistance.

Taking advantage of these benefits can provide both financial savings and peace of mind. Check out our ranking of the top providers: Best Homeowners Insurance

Health Insurance Benefits for Veterans

Veterans can access discounted health insurance through the Department of Veterans Affairs (VA) and other veteran-focused programs. These options offer comprehensive coverage, from routine check-ups to specialized treatments, helping veterans manage their healthcare needs affordably.

Utilizing these financial perks helps veterans save money and secure comprehensive car insurance coverage. Leveraging home and health insurance discounts allows veterans to protect their assets and enjoy greater financial relief. For a complete overview, check out our detailed guide titled “What is comprehensive coverage?”

These benefits offer valuable peace of mind and can significantly ease financial burdens. By taking advantage of all available discounts, veterans can enhance their overall financial well-being.

Maximizing Your Veteran Car Insurance Discounts

Maximize your veteran car insurance discounts for big savings and better coverage by exploring extra strategies to lower premiums and simplify management. To gain profound insights, consult our extensive guide titled “How does the insurance company determine my premium?“

Combining Discounts for Greater Savings

Bundling your car insurance with homeowners or renters insurance can lead to significant savings through multi-policy ca insurance discounts. It also simplifies coverage by dealing with a single insurer, making claims easier and potentially offering added benefits like roadside assistance or identity theft protection.

Regularly Reviewing Your Policy for Additional Discounts

Insurance discounts change often, so review your policy regularly. Compare quotes and update your policy with life changes to maximize savings and coverage. For more details, see our handbook “How much is car insurance?”

By bundling policies and regularly reviewing your coverage, you can take full advantage of available discounts and ensure you receive the best possible rates. Staying informed about updates and changes will help you maximize savings and maintain optimal insurance coverage as your needs evolve.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unlocking Car Insurance Savings for Veterans: Top Discounts and Benefits

Veterans can enjoy significant savings on car insurance through specialized discounts from top insurers like USAA, Geico, and Navy Federal Credit Union. By providing the right documentation and regularly reviewing policies, veterans can maximize these benefits. For a thorough understanding, refer to our detailed analysis titled “Can I bundle my car insurance with other policies?“

Additionally, discounts on home and health insurance further enhance their financial well-being, recognizing their service while ensuring comprehensive coverage. Avoid overpaying for your car insurance by entering your ZIP code below in our free comparison tool to find which company has the lowest rates.

Frequently Asked Questions

What are veteran car insurance discounts?

Veteran car insurance discounts are special savings offered by insurance companies to military veterans as a token of appreciation for their service. These discounts can reduce premiums and provide additional benefits for qualifying veterans.

How can I qualify for veteran car insurance discounts?

To qualify for veteran car insurance discounts, you generally need to provide proof of your military service. This can include documents such as a DD-214 form, military ID, or discharge papers. Specific requirements can vary by insurer, so it’s best to check with your provider.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Which insurance companies offer the best veteran car insurance discounts?

Top insurance companies known for offering significant veteran car insurance discounts include USAA, Geico, and Navy Federal Credit Union. Each company has its own set of benefits and discount options tailored for veterans.

To gain further insights, consult our comprehensive guide titled “How To Get Discounts on Car Insurance.”

Do I need to be an active-duty service member to get a veteran car insurance discount?

No, veteran car insurance discounts are available not only to retired service members but also to active-duty personnel. Ensure you provide the correct documentation of your current status to qualify for the appropriate discount.

Can I combine veteran car insurance discounts with other types of discounts?

Yes, many insurance companies allow you to combine veteran discounts with other discounts, such as those for bundling policies or maintaining a good driving record. This can maximize your savings on car insurance.

What types of discounts are available for veterans?

Common types of veteran car insurance discounts include reduced premiums, discounts for safe driving, savings for multiple vehicles, and special rates for bundling policies. Each insurance company may offer unique discounts tailored to veterans.

To learn more, explore our comprehensive resource on insurance titled “Best Safe Driver Car Insurance Discounts.”

How often should I review my car insurance policy to ensure I’m getting the best veteran discount?

It’s a good idea to review your car insurance policy annually or whenever significant life changes occur. Insurance companies may update their discount offerings, and comparing quotes regularly can help you find the best rates.

How can I compare car insurance quotes to find the best veteran discount?

You can use online comparison tools to compare car insurance quotes from multiple companies. Enter your ZIP code into a comparison tool to get quotes and see which insurer offers the best rates and discounts for veterans.

Are there additional benefits that come with veteran car insurance policies?

In addition to discounts, some car insurance policies for veterans include benefits such as roadside assistance, accident forgiveness, and flexible payment options. Check with your insurer to learn about any extra perks that may be included.

For additional details, explore our comprehensive resource titled “Roadside Assistance Coverage: A Complete Guide.”

What documentation do I need to provide to qualify for veteran car insurance discounts?

Typically, you need to provide documentation such as a DD-214 form, military ID, or discharge papers to verify your military service. Make sure your documents are accurate and up-to-date to ensure you receive the correct discount.

Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.