Best New York, NY Car Insurance Insurance (2026)

Discover the Best Auto Insurance Providers and Coverage in New York, NY: Compare Rates, Policies, Customer Reviews, and Save Money. Finding the right auto insurance in the bustling city of New York can be a daunting task. Our comprehensive guide helps you navigate through the options by providing an in-depth comparison of rates, policies, and customer reviews.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2025

Welcome to our comprehensive guide on New York, NY Auto Insurance. Our extensive guide is designed to help you navigate the complexities of auto insurance providers and coverage options in the vibrant city of New York. We cover crucial topics such as rate comparisons, policy options, coverage levels, and finding the best insurance providers tailored to your needs.

- JP Morgan Chase

- American Express

- Morgan Stanley

- Citigroup

- Goldman Sachs

- The Bank of New York Mellon

- Merrill Lynch

- Thomson Reuters

- Bloomberg

Take control of your coverage by entering your ZIP code now and comparing rates from top insurance providers. Don’t miss out on securing the best protection and peace of mind for your New York driving experience.

Read more: JP Morgan Car Insurance Discount

The Cost of Car Insurance in New York

It’s certainly true: New York, New York is a great place to live. That’s in large part why it’s one of America’s most desirable metro areas.

Now let’s learn more about buying car insurance in the Big Apple.

Male Versus Female Versus Age

Do men and women pay different amounts for car insurance? Often, they do.

In most places, men will pay more than women, especially teenage men, who may pay substantially more than their female peers.

Unfortunately, New York is not yet one of the six states — California, Hawaii, Massachusetts, Montana, North Carolina, and Pennsylvania — to ban gender discrimination in car insurance premiums. The short video below offers a look at California’s ban on gender discrimination in car insurance.

Read more: Pennsylvania Car Insurance Discounts

https://www.youtube.com/watch?v=bZj2y4W-xNg&feature=youtu.be

But you should know: your age and marital status have a far larger effect on your car insurance premiums than your gender.

DataUSA reports that the average age of New Yorkers is 36.6 years old.

The table below provides the average car insurance premiums for New York City residents based on gender, age, and marital status.

NYC Demographics

| Demographic | Average Annual Rate |

|---|---|

| Single 17-year-old Male | $16,247.58 |

| Single 17-year-old Female | $12,988.41 |

| Single 25-year-old Male | $5,699.13 |

| Single 25-year-old Female | $5,384.78 |

| Married 35-year-old Male | $4,988.73 |

| Married 35-year-old Female | $5,144.36 |

| Married 60-year-old Male | $4,722.65 |

| Married 60-year-old Female | $4,681.38 |

As you can see, teen drivers pay a lot more than drivers in their 20s or older. (But good news: student drivers often get substantial discounts. Check out our guide to Affordable Car Insurance for Students to learn more.)

You might be surprised to learn that where you live within the City That Doesn’t Sleep can have an effect on the cost of your insurance.

Cheapest ZIP Codes in New York

Our research shows that your car insurance premium can vary not only by what city you call home, but also by what neighborhood you live in within that city.

New York City proper has a whopping 170 unique ZIP codes representing distinct parts of the city.

Interested in obtaining the most affordable coverage with the lowest average premiums? Then you should look for a home in ZIP code 10023, an area on the Upper East Side that has average yearly premiums of $5,780.61.

But be forewarned, bordered by Central Park to the east and the Hudson River to the west, this tiny neighborhood has an average home value of $872,500. But hey, living here also makes it easy to walk to the Lincoln Center for the Performing Arts.

The table below shows you the average car insurance premiums for New York by ZIP code.

NYC by ZIP Code

| ZIP Code | Average Annual Rate |

|---|---|

| 10001 | $6,187.75 |

| 10002 | $6,283.05 |

| 10003 | $6,103.20 |

| 10004 | $6,132.00 |

| 10005 | $6,150.55 |

| 10006 | $6,150.55 |

| 10007 | $6,152.52 |

| 10009 | $6,283.29 |

| 10010 | $5,847.38 |

| 10011 | $6,060.67 |

| 10012 | $6,105.24 |

| 10013 | $6,073.95 |

| 10014 | $6,075.96 |

| 10016 | $5,842.83 |

| 10017 | $5,830.45 |

| 10018 | $6,187.75 |

| 10019 | $5,827.81 |

| 10020 | $5,857.14 |

| 10021 | $5,783.72 |

| 10022 | $5,828.18 |

| 10023 | $5,780.61 |

| 10024 | $5,793.64 |

| 10025 | $6,473.98 |

| 10026 | $6,864.98 |

| 10027 | $6,868.58 |

| 10028 | $5,819.47 |

| 10029 | $6,446.14 |

| 10030 | $7,277.72 |

| 10031 | $7,277.72 |

| 10032 | $7,308.31 |

| 10033 | $7,308.65 |

| 10034 | $7,408.79 |

| 10035 | $7,184.24 |

| 10036 | $5,828.18 |

| 10037 | $7,283.01 |

| 10038 | $6,196.78 |

| 10039 | $7,305.06 |

| 10040 | $7,300.81 |

| 10041 | $7,094.01 |

| 10044 | $6,480.45 |

| 10045 | $6,466.81 |

| 10055 | $6,361.03 |

| 10060 | $7,241.16 |

| 10065 | $6,286.05 |

| 10069 | $6,500.22 |

| 10075 | $5,926.57 |

| 10090 | $7,241.16 |

| 10095 | $7,241.16 |

| 10103 | $6,361.03 |

| 10104 | $6,361.03 |

| 10105 | $6,361.03 |

| 10106 | $6,361.03 |

| 10107 | $6,361.03 |

| 10110 | $6,466.71 |

| 10111 | $6,361.03 |

| 10112 | $6,361.03 |

| 10115 | $6,527.29 |

| 10118 | $6,584.61 |

| 10119 | $6,682.43 |

| 10120 | $6,682.43 |

| 10121 | $6,682.43 |

| 10122 | $6,682.43 |

| 10123 | $6,682.43 |

| 10128 | $5,924.72 |

| 10151 | $6,444.14 |

| 10152 | $6,444.14 |

| 10153 | $6,437.36 |

| 10154 | $6,437.36 |

| 10155 | $6,437.36 |

| 10158 | $6,445.22 |

| 10161 | $6,411.66 |

| 10162 | $6,002.91 |

| 10165 | $6,437.36 |

| 10166 | $6,437.36 |

| 10167 | $6,437.36 |

| 10168 | $6,221.63 |

| 10169 | $6,221.63 |

| 10170 | $6,221.63 |

| 10171 | $6,221.63 |

| 10172 | $6,229.49 |

| 10173 | $6,221.63 |

| 10174 | $6,221.63 |

| 10175 | $6,221.63 |

| 10176 | $6,221.63 |

| 10177 | $6,221.63 |

| 10178 | $6,229.49 |

| 10199 | $6,305.14 |

| 10270 | $6,503.26 |

| 10271 | $6,503.26 |

| 10278 | $6,503.26 |

| 10279 | $6,503.26 |

| 10280 | $6,146.59 |

| 10281 | $6,524.40 |

| 10282 | $6,455.53 |

| 10301 | $6,855.12 |

| 10302 | $6,897.81 |

| 10303 | $6,894.63 |

| 10304 | $6,911.15 |

| 10305 | $6,911.15 |

| 10306 | $6,919.58 |

| 10307 | $6,853.41 |

| 10308 | $6,875.88 |

| 10309 | $6,854.28 |

| 10310 | $6,857.21 |

| 10312 | $6,857.96 |

| 10314 | $6,849.70 |

| 10451 | $9,062.76 |

| 10452 | $9,097.53 |

| 10453 | $8,812.75 |

| 10454 | $9,116.81 |

| 10455 | $9,158.51 |

| 10456 | $9,211.85 |

| 10457 | $9,076.75 |

| 10458 | $8,211.09 |

| 10459 | $8,874.35 |

| 10460 | $8,559.68 |

| 10461 | $7,919.58 |

| 10462 | $8,074.44 |

| 10463 | $7,921.45 |

| 10464 | $7,290.57 |

| 10465 | $7,634.29 |

| 10466 | $8,166.42 |

| 10467 | $8,147.36 |

| 10468 | $8,243.53 |

| 10469 | $8,113.87 |

| 10470 | $7,318.04 |

| 10471 | $7,157.51 |

| 10472 | $8,362.38 |

| 10473 | $8,001.24 |

| 10474 | $9,115.00 |

| 10475 | $7,970.78 |

| 11005 | $7,733.02 |

| 11201 | $8,502.16 |

| 11203 | $10,096.41 |

| 11204 | $9,108.90 |

| 11205 | $9,308.70 |

| 11206 | $9,874.39 |

| 11207 | $10,476.23 |

| 11208 | $10,055.22 |

| 11209 | $8,556.92 |

| 11210 | $9,541.90 |

| 11211 | $9,245.06 |

| 11212 | $10,576.93 |

| 11213 | $10,499.21 |

| 11214 | $9,154.70 |

| 11215 | $8,721.63 |

| 11216 | $10,296.06 |

| 11217 | $8,619.43 |

| 11218 | $9,063.14 |

| 11219 | $9,087.62 |

| 11220 | $8,604.58 |

| 11221 | $10,297.30 |

| 11222 | $8,971.90 |

| 11223 | $9,358.44 |

| 11224 | $9,252.85 |

| 11225 | $10,297.86 |

| 11226 | $9,746.91 |

| 11228 | $8,659.25 |

| 11229 | $9,291.58 |

| 11230 | $9,337.21 |

| 11231 | $8,495.83 |

| 11232 | $8,910.23 |

| 11233 | $10,545.72 |

| 11234 | $9,632.57 |

| 11235 | $9,567.09 |

| 11236 | $10,080.76 |

| 11237 | $9,531.70 |

| 11238 | $9,442.09 |

| 11239 | $10,214.05 |

| 11426 | $7,743.58 |

Now that you know that where you live within New York can make a difference in what you pay for car insurance, let’s take a look at what car insurance companies are best in the Capital of the World.

What’s the best car insurance company in New York?

New Yorkers love their major league baseball team, the New York Yankees. (Okay, and some New Yorkers love the Mets, too.)

The Yankees have won more World Series Championship — with a total of 27 series wins! — than any other team in Major League Baseball. And despite a lot of America hating the Yankees, they’re a team with a lot of historical heart.

Just check out this video of some of Yankee’s star players Whitey Ford, Yogi Berra, Mickey Mantle and Bill Skowron on The Ed Sullivan Show on April 13, 1958.

So they may claim the Yankees are the best baseball franchise, but who do New Yorkers say is the best car insurance company in their city?

Well, the best car insurance company for you depends on what you want and need from your insurer, and what kind of company you want to do business with.

When shopping for car insurance, the key issues you need to prioritize include:

- The level of insurance coverage you need

- The amount of money you can afford to pay for your car insurance premium

- The type of insurance company you want to do business with

Let’s cover some of the factors that can help you figure out the best New York City car insurance provider for you and your family. You can also check out our guide to the nation’s best insurance companies.

Cheapest Car Insurance Rates by Company

You probably won’t be surprised to hear that the cheapest car insurance company isn’t always the best car insurance company.

But that doesn’t mean an affordable provider is a bad provider, either. Again, it depends on several factors.

In New York, Geico is likely to be your cheapest car insurance provider by far considering average rates for all demographics.

The table below offers the average premiums for New York’s eight biggest car insurance companies.

NYC Average Rates by Company

| Company | Average Annual Rate |

|---|---|

| $8,460.05 | |

| $3,743.10 | |

| $12,619.18 |

| $7,277.47 |

| $6,056.87 | |

| $6,911.58 | |

| $8,299.58 | |

| $6,489.18 |

When researching car insurance providers, make sure to ask about discounts, incentives, and promotions the company may offer to save you money on your policy.

Read more: New York Car Insurance Discounts

Let’s take a look at how your commute can affect your car insurance rates in New York City.

Best Car Insurance for Commute Rates

New Yorkers have an average one-way commute of 40 minutes, which is well above the national average of just 25.5 minutes.

So it’s worth asking: how far do you drive to work each day? Your car insurance company will want to know.

The length of your daily commute can affect your car insurance premium.

But no matter your commute, Geico will probably be the most affordable car insurance provider for you in Gotham.

The table below provides average premiums for New York City’s top insurers based on both a 10- and 25-mile average commute.

| Company | 10-Mile Commute. 6000 Annual Mileage. | 25-Mile Commute. 12000 Annual Mileage. | Average Annual Rage |

|---|---|---|---|

| $8,337.62 | $8,582.49 | $8,460.06 | |

| $3,645.84 | $3,840.37 | $3,743.11 | |

| $12,252.01 | $12,986.35 | $12,619.18 |

| $7,277.47 | $7,277.47 | $7,277.47 |

| $6,056.87 | $6,056.87 | $6,056.87 | |

| $6,649.67 | $7,173.50 | $6,911.59 | |

| $8,299.58 | $8,299.58 | $8,299.58 | |

| $6,422.01 | $6,556.34 | $6,489.18 |

But you might be wondering: how much car insurance do I need, anyway? It’s a good question. Do you need a little or a lot?

This is something you’ll need to think about as you begin your car insurance research.

Best Car Insurance for Coverage Level Rates

Perhaps it’s obvious, but the more car insurance you need, the higher your premium will be. Or at least, that’s obvious if you’re used to living under capitalism.

Whether you need a low, medium or high level of insurance, Geico is still likely to be your most affordable car insurance provider in The Big Apple.

You might also be wise to check out our Car Insurance Basics guide to learn more about coverage levels and your car insurance needs.

The table below provides average rates for New York’s biggest car insurers by coverage level, including high, medium, and low coverage.

NYC Coverage Levels

| Company | Low Coverage | Medium Coverage | High Coverage | Average Coverage |

|---|---|---|---|---|

| $7,334.68 | $8,379.06 | $9,666.43 | $8,460.06 | |

| $3,473.17 | $3,706.95 | $4,049.19 | $3,743.10 | |

| $11,975.93 | $12,584.89 | $13,296.72 | $12,619.18 |

| $6,693.37 | $7,185.35 | $7,953.69 | $7,277.47 |

| $5,636.33 | $5,995.63 | $6,538.66 | $6,056.87 | |

| $6,473.21 | $6,957.54 | $7,304.00 | $6,911.58 | |

| $7,668.66 | $8,153.39 | $9,076.69 | $8,299.58 | |

| $6,267.22 | $6,447.19 | $6,753.12 | $6,489.18 |

So now we’ve got to ask: What’s your credit score?

Your credit history is one of the key factors car insurance companies will use to determine your car insurance premium.

Best Car Insurance for Credit History Rates

Our credit history affects so many parts of our lives, from buying a home, to even, in some cases, getting a job. Our car insurance premiums are also affected.

This short video offers a great explanation as to how and why credit scores help determine car insurance premiums.

According to financial experts LendEDU, New York City residents, by and large, have credit scores well above the national average of 673.

Given the cost of living in New York City, this is not surprising. They offer a look at New Yorkers’ average credit scores neighborhood by neighborhood, which we share in the table below.

NYC Credit Scores

| Rank | ZIP Code | Neighborhood | Borough | Average Credit Score |

|---|---|---|---|---|

| 1 | 11697 | Breezy Point | Queens | 736 |

| 2 | 11362 | Douglaston | Queens | 735 |

| 3 | 11360 | Clearview | Queens | 733 |

| 4 | 10075 | Yorkville | Manhattan | 732 |

| 5 | 11363 | Douglaston | Queens | 732 |

| 6 | 10021 | Lenox Hill | Manhattan | 732 |

| 7 | 10023 | Upper West Side | Manhattan | 730 |

| 8 | 10282 | Battery Park | Manhattan | 729 |

| 9 | 10069 | Upper West Side | Manhattan | 729 |

| 10 | 10028 | Yorkville | Manhattan | 728 |

| 11 | 11364 | Oakland Gardens | Queens | 728 |

| 12 | 10024 | Upper West Side | Manhattan | 727 |

| 13 | 10065 | Upper East Side | Manhattan | 726 |

| 14 | 11109 | Hunters Point | Queens | 725 |

| 15 | 10022 | Turtle Bay | Manhattan | 725 |

| 16 | 10280 | Battery Park | Manhattan | 724 |

| 17 | 11357 | Whitestone | Queens | 723 |

| 18 | 10128 | Yorkville | Manhattan | 722 |

| 19 | 10010 | Stuyvesant Park | Manhattan | 722 |

| 20 | 11215 | South Slope | Brooklyn | 722 |

| 21 | 11004 | Glen Oaks | Queens | 721 |

| 22 | 10003 | East Village | Manhattan | 721 |

| 23 | 10014 | Meatpacking District | Manhattan | 720 |

| 24 | 11366 | Utopia | Queens | 720 |

| 25 | 10011 | Chelsea | Manhattan | 720 |

| 26 | 11001 | Floral Park | Queens | 719 |

| 27 | 10007 | Tribeca | Manhattan | 718 |

| 28 | 10016 | Murray Hill | Manhattan | 718 |

| 29 | 10013 | Tribeca | Manhattan | 717 |

| 30 | 10012 | NoHo | Manhattan | 714 |

| 31 | 11361 | Bayside | Queens | 714 |

| 32 | 10471 | Fieldston | Bronx | 714 |

| 33 | 11228 | Dyker Heights | Brooklyn | 714 |

| 34 | 10312 | Great Kills | Staten Island | 712 |

| 35 | 11426 | Bellerose | Queens | 712 |

| 36 | 10308 | Great Kills | Staten Island | 712 |

| 37 | 10017 | Murray Hill | Manhattan | 712 |

| 38 | 11358 | Murray Hill | Queens | 711 |

| 39 | 10019 | Upper West Side | Manhattan | 709 |

| 40 | 11229 | Homecrest | Brooklyn | 708 |

| 41 | 11204 | Bensonhurst | Brooklyn | 707 |

| 42 | 10006 | Wall Street | Manhattan | 707 |

| 43 | 10005 | Wall Street | Manhattan | 707 |

| 44 | 10025 | Upper West Side | Manhattan | 706 |

| 45 | 11365 | Auburndale | Queens | 705 |

| 46 | 11367 | Kew Gardens Hill | Queens | 705 |

| 47 | 10309 | Rossville | Staten Island | 705 |

| 48 | 11214 | Brooklyn | Brooklyn | 705 |

| 49 | 11355 | Queensboro Hill | Queens | 704 |

| 50 | 11209 | Bayridge | Brooklyn | 704 |

| 51 | 11414 | Howard Beach | Queens | 704 |

| 52 | 11235 | Sheepshead Bay | Brooklyn | 704 |

| 53 | 10306 | Great Kills | Staten Island | 704 |

| 54 | 10038 | City Hall | Manhattan | 703 |

| 55 | 10464 | The Bronx | Bronx | 703 |

| 56 | 11219 | Borough Park | Brooklyn | 703 |

| 57 | 11354 | Flushing | Queens | 703 |

| 58 | 10044 | Roosevelt Island | Manhattan | 703 |

| 59 | 10314 | Bull's Head | Staten Island | 703 |

| 60 | 11415 | Kew Gardens | Queens | 701 |

| 61 | 10307 | Tottenville | Staten Island | 701 |

| 62 | 11222 | Little Poland | Brooklyn | 701 |

| 63 | 11230 | Bensonhurst | Brooklyn | 700 |

| 64 | 10036 | Clinton | Manhattan | 699 |

| 65 | 10004 | Lower Manhattan | Manhattan | 699 |

| 66 | 11223 | Bensonhurst | Brooklyn | 699 |

| 67 | 11217 | Boerum Hill | Brooklyn | 698 |

| 68 | 11104 | Sunnyside | Queens | 698 |

| 69 | 11218 | Brooklyn | Brooklyn | 698 |

| 70 | 10001 | Chelsea | Manhattan | 698 |

| 71 | 11694 | Belle | Queens | 697 |

| 72 | 11105 | Steinway | Queens | 697 |

| 73 | 11427 | Queens Village | Queens | 696 |

| 74 | 11231 | Red Hook | Brooklyn | 695 |

| 75 | 10018 | Clinton | Manhattan | 695 |

| 76 | 10002 | LoDel | Manhattan | 695 |

| 77 | 10305 | Rosebank | Staten Island | 695 |

| 78 | 11378 | Maspeth | Queens | 694 |

| 79 | 10009 | East Village | Manhattan | 692 |

| 80 | 11373 | Elmhurst | Queens | 691 |

| 81 | 11211 | Williamsburg | Brooklyn | 690 |

| 82 | 11220 | Sunset Park | Brooklyn | 690 |

| 83 | 11372 | Jackson Heights | Queens | 690 |

| 84 | 11377 | Woodside | Queens | 689 |

| 85 | 11103 | Long Island City | Queens | 689 |

| 86 | 11238 | Prospect Heights | Brooklyn | 687 |

| 87 | 11106 | Long Island City | Queens | 686 |

| 88 | 11356 | College Point | Queens | 685 |

| 89 | 11370 | Steinway | Queens | 683 |

| 90 | 10463 | Riverdale | Bronx | 682 |

| 91 | 11101 | Sunnyside | Queens | 682 |

| 92 | 11234 | Bergen Beach | Brooklyn | 682 |

| 93 | 11102 | Long Island City | Queens | 680 |

| 94 | 11428 | Queens Village | Queens | 679 |

| 95 | 11432 | Jamaica Hills | Queens | 678 |

| 96 | 11224 | Coney Island | Brooklyn | 678 |

| 97 | 11385 | Glendale | Queens | 678 |

| 98 | 11232 | Sunset Park | Brooklyn | 678 |

| 99 | 10475 | Coop City | Bronx | 677 |

| 100 | 11417 | Ozone Park | Queens | 677 |

| 101 | 10465 | Eastchester Bay | Bronx | 675 |

| 102 | 10461 | Westchester Square | Bronx | 673 |

| 103 | 11418 | Richmond Hill | Queens | 672 |

| 104 | 11421 | Woodhaven | Queens | 671 |

| 105 | 11419 | Richmond Hill | Queens | 671 |

| 106 | 11210 | Marine Park | Brooklyn | 670 |

| 107 | 11435 | Jamaica | Queens | 668 |

| 108 | 11205 | Navy Hill | Brooklyn | 667 |

| 109 | 11423 | Jamaica Estates | Queens | 666 |

| 110 | 11420 | South Ozone Park | Queens | 666 |

| 111 | 10301 | Silver Lake | Staten Island | 665 |

| 112 | 10470 | Wakefield | Bronx | 665 |

| 113 | 10310 | West Brighton | Staten Island | 665 |

| 114 | 10040 | Washington Heights | Manhattan | 662 |

| 115 | 11416 | Woodhaven | Queens | 661 |

| 116 | 10304 | Grymes Hill | Staten Island | 661 |

| 117 | 10033 | Washington Heights | Manhattan | 661 |

| 118 | 11369 | East Elmhurst | Queens | 661 |

| 119 | 10034 | Inwood | Manhattan | 658 |

| 120 | 11225 | Prospect Leffert | Brooklyn | 657 |

| 121 | 10027 | Morningside Heights | Manhattan | 656 |

| 122 | 11239 | Spring Creek | Brooklyn | 655 |

| 123 | 11693 | Far Rockaway | Queens | 654 |

| 124 | 11237 | Ridgewood | Brooklyn | 654 |

| 125 | 10462 | Van Nest | Bronx | 653 |

| 126 | 10302 | West Brighton | Staten Island | 653 |

| 127 | 11206 | Williamsburg | Brooklyn | 653 |

| 128 | 10026 | Harlem | Manhattan | 652 |

| 129 | 11411 | Laurelton | Queens | 652 |

| 130 | 11368 | Corona | Queens | 651 |

| 131 | 11216 | Bedford Stuyvesant | Brooklyn | 650 |

| 132 | 10032 | Washington Heights | Manhattan | 648 |

| 133 | 10469 | Pelham Gardens | Bronx | 646 |

| 134 | 10031 | Hamilton Heights | Manhattan | 645 |

| 135 | 11213 | Crown Heights | Brooklyn | 644 |

| 136 | 11203 | East Flatbush | Brooklyn | 643 |

| 137 | 11226 | Flatbush | Brooklyn | 643 |

| 138 | 11422 | Rosedale | Queens | 642 |

| 139 | 10029 | East Harlem | Manhattan | 641 |

| 140 | 11429 | Cambria Heights | Queens | 641 |

| 141 | 11413 | Brookville | Queens | 641 |

| 142 | 11236 | Canarsie | Brooklyn | 639 |

| 143 | 11434 | Springfield Garden | Queens | 636 |

| 144 | 11436 | South Jamaica | Queens | 634 |

| 145 | 10037 | Harlem | Manhattan | 634 |

| 146 | 10473 | Soundview | Bronx | 634 |

| 147 | 11221 | Bushwick | Brooklyn | 634 |

| 148 | 10303 | Mariners Park | Staten Island | 633 |

| 149 | 10467 | Van Cortlandt Park | Bronx | 633 |

| 150 | 11412 | Saint Albans | Queens | 632 |

| 151 | 10468 | Jerome Park | Bronx | 631 |

| 152 | 10451 | Melrose | Bronx | 630 |

| 153 | 10035 | East Harlem | Manhattan | 630 |

| 154 | 10466 | North Baychester | Bronx | 630 |

| 155 | 10472 | Soundview Bruckner | Bronx | 630 |

| 156 | 11208 | City Line | Brooklyn | 630 |

| 157 | 11691 | Bayswater | Queens | 629 |

| 158 | 10458 | Belmont | Bronx | 625 |

| 159 | 11433 | Saint Albans | Queens | 624 |

| 160 | 10039 | Washington Heights | Manhattan | 624 |

| 161 | 11233 | Ocean Hill | Brooklyn | 623 |

| 162 | 10452 | Highbridge | Bronx | 622 |

| 163 | 11207 | East New York | Brooklyn | 621 |

| 164 | 10030 | Harlem | Manhattan | 620 |

| 165 | 10455 | Mott Haven | Bronx | 618 |

| 166 | 10459 | Longwood | Bronx | 618 |

| 167 | 10453 | Morris Heights | Bronx | 617 |

| 168 | 10460 | Bronx Park South | Bronx | 615 |

| 169 | 11212 | Brownsville | Brooklyn | 615 |

| 170 | 10454 | Mott Haven | Bronx | 615 |

| 171 | 10457 | Bathgate | Bronx | 614 |

| 172 | 11692 | Arverne-Edgemere | Queens | 614 |

| 173 | 10456 | Melrose | Bronx | 613 |

| 174 | 10474 | Hunt's Point | Bronx | 611 |

But what if you don’t have a great credit score? What will be the most affordable car insurance company for you in New York City?

Our research shows that across all credit types — good, fair, average and poor — Geico is still likely to be the cheapest car insurance provider for New Yorkers.

The table below provides average rates for each credit type in New York City.

| Company | Good Credit | Fair Credit | Average Credit | Poor Credit |

|---|---|---|---|---|

| $5,853.98 | $6,976.23 | $8,460.05 | $12,549.95 | |

| $3,093.37 | $3,446.50 | $3,743.10 | $4,689.44 | |

| $8,605.28 | $11,537.19 | $12,619.18 | $17,715.08 |

| $7,277.47 | $7,277.47 | $7,277.47 | $7,277.47 |

| $3,398.72 | $4,764.69 | $6,056.87 | $10,007.20 | |

| $4,862.01 | $6,121.40 | $6,911.58 | $9,751.34 | |

| $5,929.64 | $7,025.44 | $8,299.58 | $11,943.65 | |

| $4,404.27 | $5,017.27 | $6,489.18 | $10,045.99 |

We think it’s always a great idea to keep your eye on your credit report to make sure it’s up to date and free from errors. This can save you money on other large purchases.

You can get your credit report — usually for free — from respected companies such as Equifax, TransUnion, and Experian.

But no matter where you live, one thing will affect your car insurance premiums even more than your credit history.

It’s a factor that worries a lot of folks: your driving record.

Best Car Insurance for Driving Record Rates

Most of us don’t have spotless driving records. Just ask Seinfeld’s resident cranky New Yorker, Newman.

So if you’re like most folks, there might be a speeding ticket, an accident, or even a DUI in your past.

But did you know that not all violations affect your car insurance premium in the same way?

For New Yorkers with all types of driving histories, Geico is still likely to be the cheapest car insurance provider.

The following table provides the average rates for drivers of various histories — those with a clean record or a speeding ticket, accident or DUI in their past — in the City That Doesn’t Sleep.

NYC Rates by Driving History

| Company | Clean Record | With One Accident | With One DUI | With One Speeding Violation | Average Annual Rate |

|---|---|---|---|---|---|

| $7,089.19 | $7,089.19 | $10,588.15 | $9,073.68 | $8,255.51 | |

| $2,883.95 | $3,146.78 | $6,057.73 | $2,883.95 | $4,029.49 | |

| $9,912.48 | $9,912.48 | $20,739.30 | $9,912.48 | $13,521.42 |

| $5,462.37 | $5,462.37 | $12,589.36 | $5,595.77 | $7,838.03 |

| $5,875.96 | $5,875.96 | $6,554.29 | $5,921.27 | $6,102.07 | |

| $6,564.81 | $6,564.81 | $7,258.36 | $7,258.36 | $6,795.99 | |

| $7,045.87 | $8,900.58 | $9,008.64 | $8,243.22 | $8,318.36 | |

| $5,809.04 | $5,901.27 | $8,345.12 | $5,901.27 | $6,685.14 |

Did you know that even if you’ve had a speeding ticket, accident, or DUI, taking a driving course can often help negate increases in your car insurance premiums?

Make sure to look for defensive driving, advanced driving, and DUI awareness courses. Check with your insurance company to see what they consider to be important in a driving course.

But what if your driving record makes it impossible for you to find car insurance you can afford?

Please know: You’re not alone.

The Insurance Information Institute provides this helpful guide to help you explore your options, many of which are public and backed by the state.

Regional factors such as a city’s growth, prosperity, and poverty rates can also affect your car insurance premiums.

Let’s take a look at some of these specific factors and how they can affect what you end up paying for car insurance in the Capital of the World.

Car Insurance Factors in New York

As you know, New York is The City That Never Sleeps, and that constant state of movement also means a lot of growth. As New York continues to grow, the city is forging forward into the future.

In the sections below, we’ll cover some of the factors of this growth.

These factors can affect your car insurance premiums in surprising ways, so it’s important to know about changing demographics in good ol’ New York.

Metro Report — Growth and Prosperity

The Brookings Institute reports that New York City is seeing a steady, sustainable rate of financial growth.

The figures below reflect Brookings’ most recent findings on issues of both growth and prosperity in the New York-Newark-Jersey City metropolitan statistical area.

And by the way, that metropolitan statistical area is home to over 20 million people, the largest metropolitan statistical area in the United States.

Growth

- Jobs – +1.6 percent (38th of 100)

- Gross metropolitan product (GMP) – +3.4 percent (21st of 100)

- Jobs at young firms – +3.3 percent (51st of 100)

Prosperity

- Productivity – +1.7 percent (20th of 100)

- Standard of living – +3.2 percent (7th of 100)

- Average annual wage – +1.7 percent (16th of 100)

With especially strong increases in average annual wages and standard of living, we think New York City’s brightest days are still yet to come.

Median Household Income

Not surprisingly, New York has a strong median household income.

According to DataUSA, “households in New York, N.Y. have a median annual income of $60,879, which is more than the median annual income of $60,336 across the entire United States. This is in comparison to a median income of $58,856 in 2016, which represents a 3.44 percent annual growth.”

But given the high cost of living in Gotham, this above-average annual income may be deceiving.

With an average annual car insurance premium of $5,780.61, New Yorkers spend a whopping 9.49 percent of their annual income on car insurance.

Use the handy calculator below to see what percentage of your income could go to car insurance.

CalculatorPro

Homeownership in New York

Property values in New York are very high compared to the national average.

DataUSA reports that the “median property value in New York, N.Y. was $609,500 in 2017, which is 2.8 times larger than the national average of $217,600. Between 2016 and 2017 the median property value increased from $569,700 to $609,500, a 6.99 percent increase. ”

Not surprisingly, this means relatively few New Yorkers own their homes, and more are opting to rent. For 2017, only 32.7 percent of homes were owner-occupied, well below the national average of 63.9 percent.

As you can see in the video below, you can buy or rent properties with some amazing views in New York, N.Y.

Education in New York

There’s no doubt about it: New York is absolutely a hub for world-class educational institutions.

According to DataUSA, “in 2016, universities in New York, N.Y. awarded 147,960 degrees.”

New York is certainly home to some great universities, colleges, and community colleges. These include:

- New York University

- Columbia University in the City of New York

- Pace University-New York

- Touro College

- The New School

- Fashion Institute of Technology

- Berkeley College-New York

- Technical Career Institutes

- School of Visual Arts

- Yeshiva University

- Teachers College at Columbia University

- DeVry College of New York

- Marymount Manhattan College

Check out the video below for a tour of Columbia University, New York’s Ivy League institution located in the Morningside Heights neighborhood of Manhattan.

Wage by Race and Ethnicity in Common Jobs

Unfortunately, wages by race and ethnicity are not tracked on the city level for New York.

However, DataUSA explains that “in 2017 the highest paid race/ethnicity of New York workers was white. These workers were paid 1.07 times more than Native Hawaiian and Other Pacific Islander workers, who made the second highest salary of any race/ethnicity.”

The most common job types in New York, they also report, are miscellaneous managers; elementary and middle school teachers; secretaries and administrative assistants; retail salespersons; and nursing, psychiatric and home health aides.

Read more: Nurse Car Insurance Discount

Wage by Gender in Common Jobs

Though wages by gender are not tracked on the city level for New York, DataUSA explains that, frustratingly, “in 2017, full-time male employees in New York made 1.29 times more than female employees.”

We hope this is a trend that will soon be reversed through public action.

Poverty by Age and Gender

Whereas the national average of people living in poverty is 13.4 percent, New York has a much higher poverty rate of 19.6 percent.

Women ages 25–34 make up a disproportionate number of the people living below the poverty line in the city, DataUSA explains.

Poverty by Race and Ethnicity

According to DataUSA, “the most common racial or ethnic group living below the poverty line in New York, N.Y. is Hispanic, followed by white and black.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving in New York

Did you know that a city’s road conditions, level of traffic congestion and unique driving laws can all affect your car insurance premiums?

In the sections below, we’ll provide you with some of the best information about driving safely in New York.

You can start your search for car insurance in the City That Doesn’t Sleep today just by entering your ZIP code below.

Roads in New York

What kind of roads do New Yorkers have to work with?

Major Highways

Given the number of people trying to get into the city, the amount of commercial shipping traffic that converges here, and the limitations of a city that is ultimately a series of islands, it’s no surprise that several major roadways serve the New York City metropolitan area.

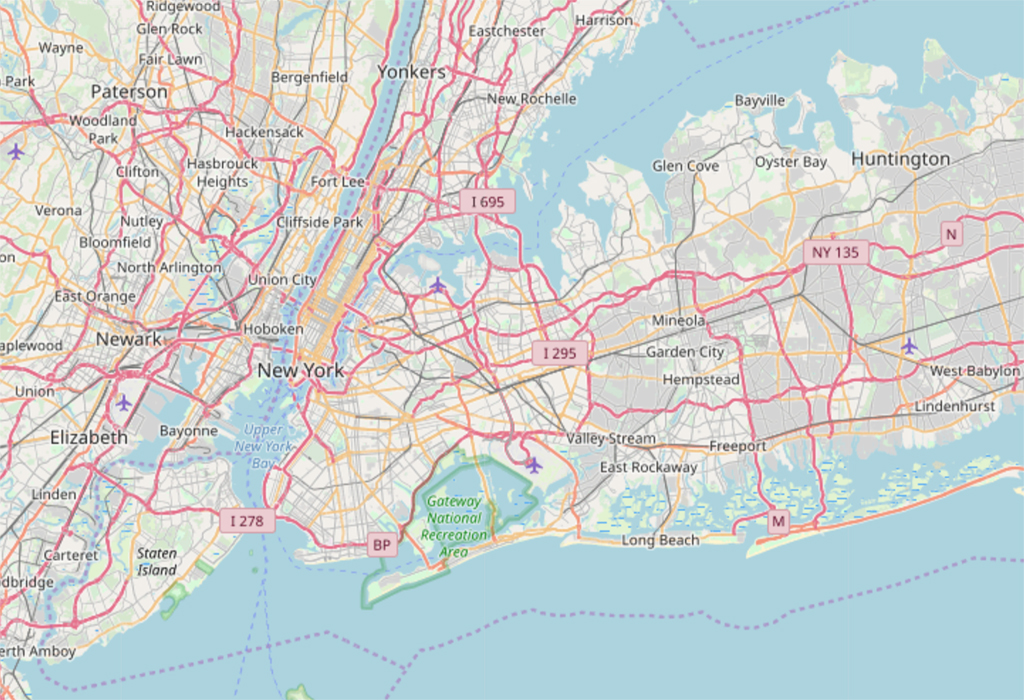

Check out the map below to get a bird’s eye view of New York’s roadways.

The major interstates that feed into Gotham include:

- Interstate 78

- Interstate 87

- Interstate 278

- Interstate 478

- Interstate 678

- Interstate 95

- Interstate 295

- Interstate 495

- Interstate 695

- New York State Route 440

- New York State Route 495

- New York State Route 895

For savvy drivers, expressways can often help you avoid bumper-to-bumper congestion. New York City has several expressways that help commuters make their way into and out of the city on a daily basis. These include:

- The Brooklyn-Queens Expressway

- The George Washington Bridge Expressway

- The JFK Expressway

- The Lincoln Tunnel

- The Long Island Expressway

- The Staten Island Expressway

- The Trans-Manhattan Expressway

What about tollways?

It’s true: many of the tunnels and bridges leading into and out New York City have a toll attached to them. Here are some examples:

- George Washington Bridge – $15 eastbound only

- Lincoln Tunnel – $15 inbound to NYC only

- Queens Midtown Tunnel – $9.50 each way

- Hugh L. Carey Tunnel – $9.50 each way

- Goethals Bridge – $15 inbound to Staten Island only

- Bayonne Bridge – $15 inbound to Staten Island only

Paying for tolls can add money to your vehicle operating costs. But it’s important to know that the New York State Thruway Authority does offer an EZPass discount to help save you a few bucks.

With so many major roadways, both accidents and car breakdowns are bound to happen. Most car insurance companies offer some sort of towing coverage, which can come in handy if you find yourself in such a situation.

Various car insurance companies handle towing coverage differently, however, so you should always check with your insurer to confirm that they offer this service.

Popular Road Trips/Sites

You might be wondering: What is there to do in New York, N.Y.?

The short answer: a lot. (There’s a reason they named the city twice.)

Check out Lost LeBlanc’s video of 30 great things to do in New York to keep you and your family from sleeping.

From Broadway and the Theater District to the Central Park Zoo, there is a seemingly infinite number of things to see and do in the New York City area.

Does New York use speeding or red-light cameras?

For a long time, New York state law allowed for speeding or red-light cameras to be operative only in school zones during school hours. Recently, however, this law has changed.

According to the New York Times, this recent change at the state level has led the city of New York to expand its traffic camera system rapidly.

They report that “now the city is sharply expanding the use of such cameras to nearly every neighborhood. It’s part of a far-reaching effort to enforce speed limits, including on busy streets with no schools and at times when classes are out — at night, on holidays and during summer vacation.

“The result will be the nation’s largest urban network of automated speed cameras, with a nearly 10-fold increase to more than 2,000 cameras deployed in 750 areas within a quarter-mile radius of a school, effectively blanketing the city.”

So drive safely throughout the city. You just don’t know who might be watching. And remember: Traffic violations are one of the easiest and quickest ways to increase your car insurance premiums.

You might be wondering what the driving culture is like in Gotham.

Read on to find out.

Vehicles in New York

If you call New York City home, chances are you live in a no-car household, have a commute of 40 minutes each way, and take public transportation to work.

In the sections below, we’ll look at the particulars of the City That Doesn’t Sleep’s car culture.

How Many Cars per Household

According to YourMechanic, BMW 328i’s are New York’s most popular vehicle.

Read more: BMW Car Insurance Discount

Around 45.6 percent of New York’s households own no vehicles, according to DataUSA. Only 33.9 percent of the city’s households own one vehicle, and 14.3 percent own two. Both figures are well below the national average.

Households Without a Car

As we’ve seen above, nearly half — or 45.6 percent — of New York City households have no vehicle at all, which is not surprising given the city’s extensive public transportation network.

Speed Traps in New York

Given New York City’s densely populated demographics, the city doesn’t lend itself well to speed traps. That’s not to say that there aren’t any in the Big Apple, however, as you can see in the video below.

Be aware that if you’re caught speeding, you can be fined at least $50, usually more, in addition to getting points added to your license, which leads to increases in car insurance premiums.

But what is a speed trap in the first place? Check out the short video below to find out.

Speed trap or no speed trap, it’s always important to drive at a safe and legal speed. Follow posted speed limits to keep you and your family safe and your car insurance premiums affordable.

Vehicle Theft in New York

The Federal Bureau of Investigation reported that in 2017, 5,735 vehicles were stolen in the city of New York.

According to NeighborhoodScout, crime is relatively low in New York City, especially given its size and density.

New York is safer than 23 percent of other cities in the United States. And the Big Apple has a low violent crime rate of 4.78 incidents per 1,000 residents.

In New York, you want to find a safe neighborhood, but also a neighborhood that fits your personality and lifestyle. Check out the video below for a guide to seven of the most unique neighborhoods in NYC.

But what’s the traffic situation like in New York?

Traffic

New York is part of a densely populated — and thus, often congested — region that stretches from the Boston metro area to the north to the Washington, D.C., metro area to the south.

And as we’ve talked about above, the New York-Newark-Jersey City metropolitan statistical area alone is home to more than 20 million people. That can mean a lot of cars on the road.

Traffic Congestion in New York

New York is the fourth-most congested city in the United States, which is not bad, all things considered.

Traffic monitoring agency INRIX reports that folks in this region spend an average of 133 hours or more in congestion per year, with an average financial cost of $1,859 to each commuter because of traffic congestion.

TomTom reports that New York drivers face an average congestion level of 36 percent.

This means residents spend an extra 17 minutes in congestion during the peak morning commute period, and an extra 21 minutes during the peak evening commute hours.

According to Numbeo, those living in the City That Doesn’t Sleep face a traffic index of 161.41, a time index of 43.01 minutes, and an inefficiency index of 190.97. Numbeo offers the following definitions for these factors:

- Traffic Index – A composite index of time consumed in traffic due to job commute, estimation of time consumption dissatisfaction, CO2 consumption estimation in traffic and overall inefficiencies in the traffic system.

- Time Index – An average one-way time needed to transport, in minutes.

- Inefficiency Index – An estimation of inefficiencies in the traffic. High inefficiencies are usually caused by the fact that people drive a car instead of using a public transport or long commute times. It can be used as a traffic component measurement in economies of scale.

Transportation

As DataUSA explains, New Yorkers face a 40-minute one-way commute on average, well above the national average of 25.5 minutes.

“Additionally,” they explain, “7.71 percent of the workforce in New York, N.Y. have ‘super commutes’ in excess of 90 minutes.”

They also report that “in 2017, the most common method of travel for workers in New York, N.Y. was Public Transit (55.8 percent), followed by those who Drove Alone (22.3 percent) and those who Walked (10.1 percent).”

Busiest Highways

Topping the list of the busiest highways in the New York City metro area are Interstate 95 and US-9. Additionally, Interstates 78, 95 and 278 also have the most lanes in the metro area of New York.

Sure, more lanes can help alleviate some of the congestion that New York faces, but it also means a higher chance of traffic incidents and other roadway obstructions.

If you become involved in a traffic accident, it’ll be comforting to know that you did your homework and have the best car insurance provider available in your corner.

How safe are New York’s streets and roads?

Though the National Highway Traffic Safety Administration (NHSTA) doesn’t track city-specific roadway safety statistics, they do provide countywide statistics.

New York City is the county seat of five counties, areas which mostly represent the city’s five boroughs. These counties include:

- New York County (Manhattan)

- Kings County (Brooklyn)

- Bronx County (The Bronx)

- Richmond County (Staten Island)

- Queens County (Queens)

The table below provides the number of traffic fatalities in the Big Apple’s roadways from 2013 to 2017.

NYC Fatalities

| County | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Bronx | 52 | 35 | 40 | 49 | 40 |

| Kings | 87 | 78 | 69 | 53 | 56 |

| New York | 45 | 39 | 28 | 48 | 38 |

| Queens | 99 | 86 | 78 | 61 | 59 |

| Richmond | 12 | 12 | 26 | 19 | 14 |

How safe are New Yorkers as drivers on the road?

Allstate America’s Best Drivers Report

When it comes to best drivers, New York residents could be doing a bit better.

According to Allstate America’s Best Drivers Report for 2019, Gotham ranked 111th out of the 200 safest driving cities in the United States.

On average, residents of the city also went around 8.8 years between filing a car insurance claim. Check out our complete guide to car insurance claims.

Ridesharing

According to RideGuru, the following rideshare services are available in the city of New York:

- Arro

- Blacklane

- Carmel

- Curb

- Jayride

- Kid Car

- Limos.com

- Lyft

- SuperShuttle

- Talixo

- Traditional taxis

- Uber

- Via

Read more: Uber Driver Car Insurance Discount

Weather

New York has a distinct atmosphere in each of the four seasons. In winter, it can be a beautiful, if not also inconvenient, wonderland.

But it’s not all doom and gloom weather-wise for the City That Doesn’t Sleep. New York City gets 2,677 hours of sunshine a year.

The table below offers some of the city’s annual atmospheric averages.

NYC Weather

| Weather Condition | Average |

|---|---|

| Annual high temperature | 62.3°F |

| Annual low temperature | 48°F |

| Average temperature | 55.15°F |

| Average annual rainfall | 46.23 inches |

| Days per year with rainfall | 121 days |

| Annual hours of sunshine | 2677 hours |

You might be wondering: Does New York have viable public transportation? Absolutely. Read on to find out more.

Public Transit

New York is a city that depends on its public transportation system, the Metro Transit Authority, or MTA.

As DataUSA reports, 55.9 percent of New Yorkers use public transportation to commute to work.

And when snow, rain, or other bad weather hit New York City, disruptions are more likely to make commute times longer because New Yorkers are so heavily reliant on the MTA to get them around.

In the video above, a local explains that the MTA has several ways to pay the fares and tolls around the city, including:

The reduced-fare MetroCard is designed for New Yorkers who are 65 years or older.

Because the fares and tolls can vary so widely depending on how you choose to use the MTA, it’s always a good idea to visit their Fares and Tolls page to find out what the prices and schedules for your route will be.

Parking in Metro Areas

As you can probably imagine, parking in the New York area can be costly. You can expect to pay anywhere from $16 to $50 depending on where you park and the time of day that you’re looking for a spot.

Luckily, there is no shortage of spots in Gotham according to Parkopedia.

But with such costly prices for parking, no wonder so many New Yorkers rely on public transportation to get around.

No matter how you intend to travel around New York, however, the best thing to do is to plan ahead, especially if you’re thinking about taking your car into the city.

Air Quality in New York

The Environmental Protection Agency (EPA) provides air quality reports for all cities and counties across the nation. The agency designates an area’s air quality as good, moderate, unhealthy for certain groups, unhealthy, and very unhealthy, for every day of the year.

Air quality in New York is pretty good, we’re happy to report, despite the city’s density and penchant for industry.

For the last three years, the EPA has designated the majority of New York days as having good or moderate air quality.

The table below shows the number of days in New York with each EPA designation for the years 2016 to 2018.

NYC Air

| New York-Newark-Jersey City, NY-NJ-PA | 2016 | 2017 | 2018 |

|---|---|---|---|

| Good Days | 155 | 154 | 156 |

| Moderate Days | 281 | 192 | 182 |

| Days Unhealthy for Sensitive Groups | 28 | 17 | 24 |

| Days Unhealthy | 2 | 2 | 2 |

| Days Very Unhealthy | 0 | 0 | 0 |

Though conditions could certainly be worse, the New York metro area spent more days in the moderate range than in any other category. If more people cut back on the things that contribute to global warming, air quality could continue to improve in the Big Apple.

Some steps we can all take to help the environment include:

- Using energy-efficient light bulbs

- Recycling more

- Maintaining proper tire pressure

- Driving less

- Planting a tree

- Pumping gas during a cooler part of the day

You may not be able to do all of these things, but every little bit helps.

Speaking of helping, how many veterans call NYC home?

Military/Veterans

You might not think of New York City as a center of military life, but it might be wise to think again. After all, Syracuse.com asserts that New York County, home to Manhattan, is home to 33 vets for every 1,000 people.

All told, according to the City of New York:

New York State is home to nearly 900,000 veterans, 225,000 of whom call New York City home, and nearly 30,000 active duty military personnel and 30,000 National Guard and Reserve personnel statewide.

Several military installations are in the New York City metro area, including:

- The U.S. Army Department

- The Military and Naval Affairs Office

- The 369th Regiment Armory

- The New York Air National Guard

- The U.S. Army Reserve

- Thakur Naval Base

- The Kaplan Foundation

- The U.S. Navy Department

As you can see, New York is perhaps more of a military town than people realize.

Also, keep in mind that our research shows that many car insurance companies offer discounts to either active or retired military personnel.

These companies include Allstate, Esurance, Farmers, Geico, Liberty Mutual, MetLife, Safe Auto, Safeco, State Farm, and The General.

Read more: Metlife Car Insurance Discounts

USAA is consistently ranked as one of the best auto insurance companies, and they insure only military personnel, active or retired, and their immediate family members. Check out our comprehensive review of USAA car insurance today.

Unique City Laws

Given that it’s truly the Capital of the World, there are a lot of unique things involved in living in or visiting New York City. And it’s true: Sometimes the things that happen in the Big Apple lead to some pretty unique laws.

Some of the strangest laws unique to Gotham include:

- It is illegal to sell cat or dog hair.

- Flirting could result in a $25 fine.

- It’s against the law to put on a puppet show from a window.

So you might not have to worry about breaking those esoteric laws, but you should know that New York City also has some pretty unique driving laws.

One of the most surprising for most people is the fact that sanitation vehicles have now been included in the “Move Over” law. This means that you must slow down or move over when you see sanitation trucks working alongside the roadways.

A key to driving in the city, too: New York City doesn’t allow rights on red unless there is a sign stating that it is allowed in that specific spot.

Just check out the video below for some of the hotspots — particularly restaurants — not to be missed.

Now that you understand the basics of driving, living, and working in the Big Apple, it’s time to put your knowledge to work by getting the best deal on your car insurance.

We know researching and buying car insurance is no simple task, but if you have a working knowledge of the basics, you are better equipped to handle the challenges it brings.

And that’s why we created this guide: to help you obtain that basic knowledge for the city of New York.

What part of this New York City car insurance guide was the most helpful?

Was there something we could explain better? Please, let us know.

Ready to compare rates now? Enter your zip code above for FREE.

Frequently Asked Questions

What are the state minimums for car insurance in New York?

The minimum coverage amounts for car insurance in New York State are:

- $10,000 for property damage for a single accident

- $25,000 for bodily injury and $50,000 for death for a person involved in an accident

- $50,000 for bodily injury and

- $100,000 for death for two or more people in an accident

Should I purchase extra coverage for my car given where I live?

Car insurance coverage types and amounts vary based on your necessity and your location within the city.

How can I get a Metro Card?

You can buy a Metro Card at any subway station or at the station booths and MetroCard vending machines throughout the city.

Where is the nearest MTA stop?

The Metro Transit Authority has provided some helpful tools on their website that can help you figure out where all of the trains, subways, and buses go and where all of their stops are.

What’s the best way to hail a cab?

Hailing a cab in NYC is one of those things that makes you feel like you’re an active part of the city. A few tips for successfully hailing a cab include:

- Stand on the side of the street that has traffic heading the direction that you want to travel.

- Step off the sidewalk a bit to get the attention of a passing cab.

Don’t bother to shout for a taxi or try to whistle unless you want to announce that you’re a newbie or out-of-towner. - Look the driver in the eyes as they approach you.

And stick your arm out — not up in the air like you want the teacher to call on you.

What police precinct or fire district do I live in?

The NYPD has provided a Find Your Precinct and Sector page that’s interactive and available to all residents of the Big Apple with just one click. The New York City Fire Department also has an interactive page that can help you find out which firehouse serves your community.

What school district do I live in?

Like the MTA, the New York City Department of Education has a great district locator tool on its website. Just enter some information and hit the search button.

How do I get my utilities turned on?

Getting your water, power, or gas turned on in the Big Apple is just a click away. All you have to do is visit their customer service pages online and follow a few simple steps.

How do I get to the airport?

There are three major airports in the New York metro area and these include:

- John F. Kennedy International Airport (JFK)

- LaGuardia Airport (LGA)

- Newark International Airport (EWR)

Where’s the nearest library?

The New York Public Library system has locations all over the city to serve you. They also provide an easy-to-use library locator tool on their website as well as a list of the addresses for all of their branches in the five boroughs.

Is there anything to do in New York?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.