Best Renters Insurance in 2026 (Your Guide to the Top 10 Companies)

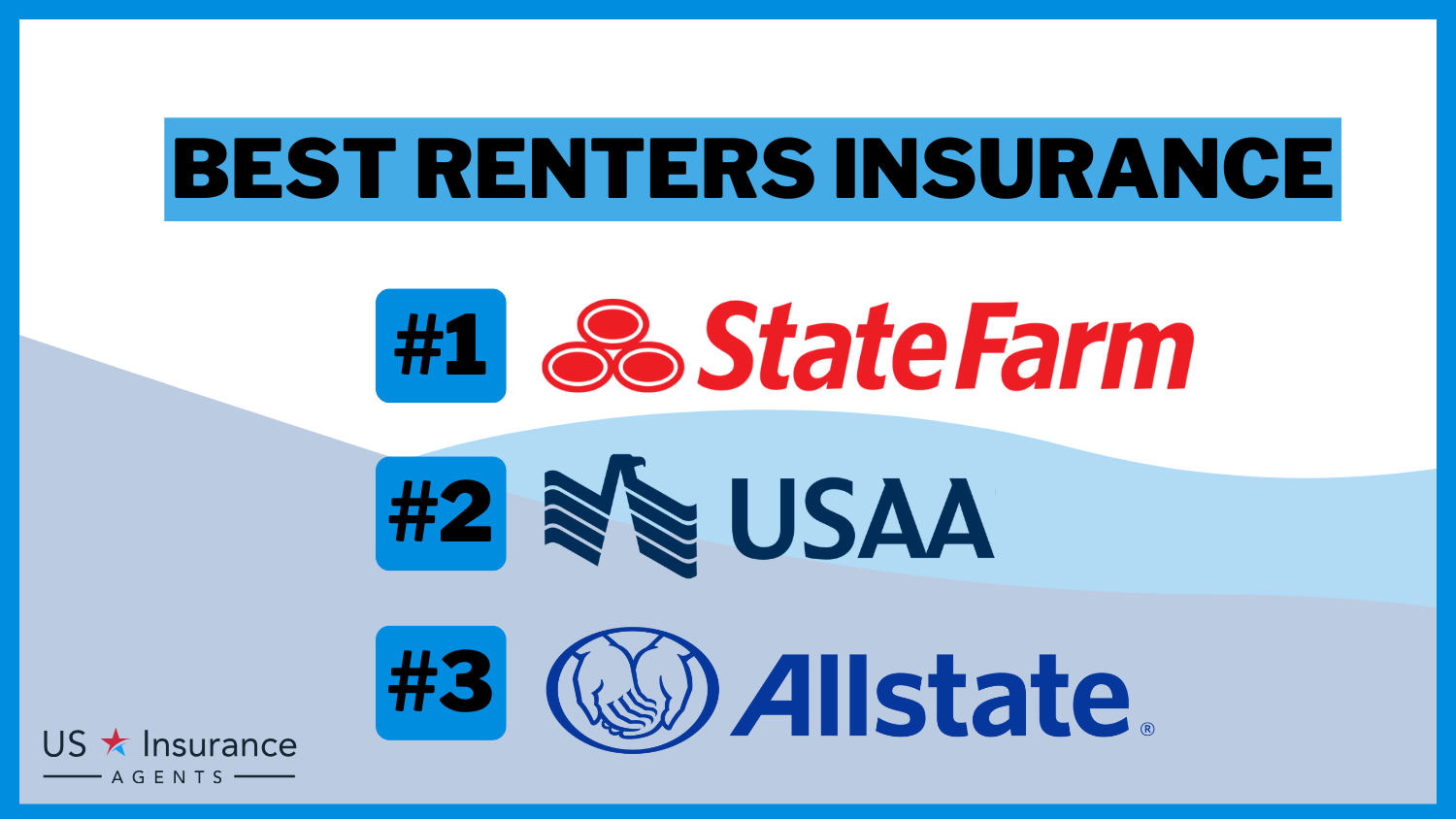

State Farm, USAA, and Allstate lead as the best renters insurance providers, offering comprehensive coverage starting at just $33 monthly. These companies excel in customer service and also provide excellent car insurance options, ensuring reliable and affordable insurance solutions for renters.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Mortgage Loan Originator

Steve Crowell is a New Hampshire based mortgage loan originator with Luminate Home Loans, Inc. After graduating from the University of New Hampshire in 2003 with a BS in Business and Economics and a BA in History, he went on to get his broker license in 2005. In 2021, he was recognized as a Luminate Home Loans “Circle of Excellence” top agent. Steve works as a trusted resource for clients w...

Steve Crowell

Updated November 2024

Company Facts

Full Coverage for Renters

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Renters

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Renters

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best renters insurance are State Farm, USAA, and Allstate, known for their exceptional coverage and customer satisfaction.

These companies not only excel in offering extensive protection for renters but also provide top-tier car insurance, making them ideal for comprehensive insurance needs. With their robust customer service and reliable claims processing, they stand out in the insurance market.

Our Top 10 Company Picks: Best Renters Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 20% B Broad Coverage State Farm

![]()

#2 10% A++ Exceptional Service USAA

![]()

#3 25% A+ Multiple Discounts Allstate

#4 25% A Flexible Policies Liberty Mutual

#5 20% A High Satisfaction American Family

#6 20% A+ Comprehensive Options Nationwide

#7 8% A++ Competitive Rates Travelers

#8 20% A Bundling Discounts Farmers

#9 10% A+ Financial Stability Erie

#10 25% A Solid Service MetLife

Renters seeking reliable insurance for personal belongings and liability should consider these top providers.

Renters insurance is typically affordable, but it’s important to compare policies as coverage and costs can differ significantly between companies.

Researching renters insurance can help you find the best coverage easily. Learn about your options and explore companies that meet your needs.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- State Farm tops the list as the best choice for renters insurance

- Renters insurance covers personal property and liability risks

- Policies vary, emphasizing the need to compare coverage options

#1 – State Farm: Top Overall Picks

Pros

- Bundling Discounts: Significant savings available for customers who bundle multiple policies. Discover more about offerings in our “State Farm Insurance Review & Complaints: Car Insurance.”

- High Coverage Flexibility: State Farm offers a wide range of coverage options to meet diverse insurance needs.

- Excellent Financial Rating: Holds an A++ rating from A.M. Best, indicating superior financial stability.

Cons

- Higher Premium Costs: Premiums may be relatively higher than competitors for certain coverage levels.

- Limited Multi-Policy Discount: Multi-policy discounts are not as competitive as those offered by other insurers.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Exceptional Service Provider

Pros

- Dedicated to Military and Families: Exclusively serves members of the military and their families, providing tailored services.

- Strong Financial Health: Rated A++ by A.M. Best, ensuring reliability and trust. If you want to learn more about the company, head to our “USAA Insurance Review & Ratings.”

- Customer Satisfaction: Known for high levels of customer satisfaction and support.

Cons

- Limited Availability: Services are only available to military personnel, veterans, and their families.

- Fewer Physical Locations: Limited physical presence, which might affect customers preferring face-to-face interaction.

#3 – Allstate: Best for Multiple Discounts Champion

Pros

- Wide Range of Discounts: Offers a variety of discounts including a substantial 25% for multi-vehicle policies.

- Robust Policy Options: Provides a comprehensive suite of insurance options and add-ons.

- High Customer Interaction: Notable for active and accessible customer service. Check out insurance savings in our complete “Allstate Auto Insurance Review & Complaints: Auto Insurance.”

Cons

- Variable Premium Rates: Premium costs can be inconsistent, often depending on location and other factors.

- Mixed Reviews on Claim Resolution: Some customers report issues with the speed and efficiency of claim processing.

#4 – Liberty Mutual: Best for Flexible Policies Expert

Pros

- Customizable Coverage: Offers highly flexible policies that can be tailored to specific needs.

- Good Discount Options: Competitive discounts, especially for safe drivers and multi-policy bundling.

- Solid Financial Standing: Rated A by A.M. Best, indicating good financial health. More information is available about this provider in our “Liberty Mutual Review & Ratings.”

Cons

- Higher Pricing Tiers: Can be more expensive than competitors, especially for basic coverage levels.

- Customer Service Variability: Some customers experience variability in service quality.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for High Satisfaction Leader

Pros

- Customer-Centric: Known for high customer satisfaction rates. Read up on the “American Family Insurance Review & Ratings” for more information.”

- Broad Insurance Offerings: Provides a wide array of insurance products beyond vehicles.

- Strong Agent Network: Extensive network of agents provides personalized service.

Cons

- Availability Limitations: Not available in all states, which could limit potential customers.

- Pricing Inconsistencies: Some customers might find pricing to be higher compared to other insurers with similar offerings.

#6 – Nationwide: Best for Comprehensive Options Innovator

Pros

- Extensive Coverage Options: Nationwide offers a broad range of coverage, including rare and unique options.

- Positive Customer Feedback: Generally receives positive reviews for customer service.

- Strong Financial Rating: Maintains an A+ rating from A.M. Best. Access comprehensive insights into our “Nationwide Insurance Review & Complaints: Auto, Home, Health & Pet Insurance.”

Cons

- Complex Policy Structures: Some customers find their policy options complex and difficult to understand.

- Higher Cost for Additional Features: Premiums can escalate quickly with added features and coverage.

#7 – Travelers: Best for Competitive Rates Specialist

Pros

- Competitive Pricing: Offers some of the most competitive rates in the industry.

- Wide Acceptance: Available widely across many states. Discover insights in our “Travelers Insurance Review & Complaints: Home, Auto & Boat Insurance.”

- High Financial Stability: Holds an A++ rating from A.M. Best.

Cons

- Limited Personalized Interaction: Some customers feel the company lacks personalized customer service.

- Conservative Discount Policies: Fewer discount opportunities compared to other major insurers.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Bundling Discounts Master

Pros

- Strong Bundling Options: Excellent discounts for customers who bundle multiple types of insurance.

- Diverse Coverage Offerings: Provides a wide variety of coverage options to suit different needs.

- Good Customer Support: Known for accessible and supportive customer service. Unlock details in our “Farmers Insurance Review & Complaints: Home, Business & Auto Insurance.”

Cons

- Inconsistent Agent Experience: Customer experiences can vary significantly depending on the individual agent.

- Premium Costs: Some policies may come at a higher cost compared to industry averages.

#9 – Erie: Best for Financial Stability Guardian

Pros

- Exceptionally Stable: Strong financial ratings, with an A+ from A.M. Best, ensuring reliability.

- Personalized Service: Known for providing highly personalized service through local agents.

- Competitive Premiums: Offers competitive pricing across its range of products. Learn more in our “Erie Insurance Review & Complaints: Auto, Home, Life, Marine & Business Insurance.”

Cons

- Limited Geographic Reach: Services are not available nationwide, limited to certain regions.

- Fewer Online Resources: Lacks comprehensive online tools and resources compared to larger insurers.

#10 – Metlife: Best for Solid Service Provider

Pros

- Reputation for Reliability: Well-established reputation for reliability and customer trust.

- Diverse Product Line: Offers a wide range of insurance products, covering various needs.

- Solid Financial Foundation: Rated A by A.M. Best, indicating strong financial health. See more details on our “MetLife Insurance Review & Ratings.”

Cons

- Transitioning Service Models: Recent changes in business model may affect customer service consistency.

- Higher End of Pricing Spectrum: Tends to be on the higher end of the pricing spectrum for basic coverage options.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Car Insurance Rates for Renters by Provider

Understanding the cost of car insurance tailored for renters involves examining the monthly rates provided by different insurers for both minimum and full coverage. This section explores these rates to aid renters in making informed decisions.

Car Insurance for Renters: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $49 $123

American Family $45 $110

Erie $33 $101

Farmers $47 $122

Liberty Mutual $57 $144

MetLife $48 $124

Nationwide $46 $115

State Farm $44 $108

Travelers $50 $120

USAA $36 $92

The table below showcases a comparison of monthly rates from various insurance companies. For minimum coverage, Erie offers the most affordable option at $33, while Liberty Mutual presents the highest rate at $57.

For those seeking full coverage, USAA provides the lowest rate at $92, and Liberty Mutual again ranks as the most expensive at $144. These variations highlight the importance of comparing rates across different providers to find the best match for your insurance needs and financial situation.

Learn more in our “Toggle Renters Insurance Review & Ratings.”

What Does Renters Insurance Cover

When you buy renters insurance, it works similarly to a traditional homeowners policy. The major difference is that renters insurance doesn’t cover the physical structure of your home. The building you live in will be covered by your landlord’s insurance instead.

Renters insurance focuses on you — your personal belongings, potential legal fees, and living expenses. Most renters policies offer coverage for personal property damage, personal liability, medical payments, and additional living expenses. Protecting yourself and your belongings is why you need renters insurance.

What Is Personal Property Damage Coverage

One of the most important aspects of your renters insurance policy is the coverage it offers for the things you own. However, not all types of damage are covered. Your personal property damage coverage usually protects you from the following incidents:

- Falling objects, especially trees or tree branches

- Ice and snow

- Explosions

- Mold and water damage from problems in your home

- Wind and hail

- Smoke and fire

- Vandalism and theft

As you can see, your renters insurance covers many unexpected events life can throw at you. However, it doesn’t cover everything. Most renters policies don’t cover damage from earthquakes or floods. You’ll need additional coverage added to your policy to protect yourself from these dangers.

See more details on our “How to Document Damage for a Renters Insurance Claim.”

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Is Personal Liability Coverage

If a guest is injured in your home, they can potentially sue you for damages. If you find yourself on the wrong end of a lawsuit, the personal liability portion of your insurance will protect you.

Personal liability pays for your legal fees when someone sues you. These fees include the price of your attorney and any damages you might need to pay to a plaintiff. Your insurance company will likely require you to use an attorney of their choice.

The average policy includes $100,000 of liability insurance, though most allow you to buy a higher limit if you feel like you need the extra protection. More information is available about this provider in our “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

What Is Medical Payments Coverage

An injured guest comes with more than just legal fees. The medical payments portion of your renters insurance covers health care expenses for your injured guest, even if the injury wasn’t your fault.

Medical payments covers expenses for hospital stays, dental care costs, x-rays, surgeries, and other procedures deemed necessary by a doctor. The average policy includes $5,000 worth of coverage, but many companies offer higher limits if you’d like to purchase more.

One caveat to medical payments coverage is that it only covers people who do not live on your property. Health expenses for roommates and family members you live with won’t be covered by your medical payments coverage. Check out insurance savings in our complete “Reasons Why You Need Renters Insurance.”

What Is Additional Living Expenses Coverage

The additional living expenses (ALE) portion of your renters insurance covers you if your home becomes unliveable after a covered event.

When you can’t stay in your home, your insurance will pay for alternative lodging, pet boarding fees, and restaurant bills. Some plans include other living expenses, like additional transportation expenses so you can get to work. Make sure to ask a representative to find out exactly what your policy covers.

Unlock details in our “Best Renters Insurance for People Living in High-Rise Apartments.”

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Does Renters Insurance Not Cover

While your renters insurance covers a lot, it doesn’t cover everything. Most home renters insurance policies don’t cover the following events:

- Earthquakes and floods

- Roommate’s property

- Bed bugs and other pests

- Car theft and damage

It’s important to understand what is and isn’t included in your policy before you need to make a claim. Understanding what your policy covers will help you get the most out of your renters insurance. Delve into our evaluation of “Home Preparedness – What to Do in an Earthquake.”

Which Companies Offer the Best Renters Insurance

The best renters insurance company for you depends on a variety of factors. When looking for good renters insurance, you should look at a company’s financial strength, customer service ratings, coverage options, and how many discounts they offer.

Many people want to bundle their renters insurance with other policies, especially car insurance. If that interests you, you should also look for companies that have good bundling options.

Jeff Root Licensed Life Insurance Agent

There are dozens of companies selling renters insurance. Some are large national companies, while others are small local businesses. While you should always explore your options, you can check out some of the best renters insurance companies below.

State Farm Renters Insurance

Although State Farm car insurance is better known, the company is also a great home rental insurance company. It’s especially good for people looking for a lot of customization options for their policies.

State Farm might be the right choice if you want to buy all your insurance from one place. State Farm sells a variety of coverage types, including auto, motorcycle, boat, homeowners, life, and supplemental health insurance. If you need more than one type of insurance, shopping at State Farm simplifies managing multiple policies.

State Farm sells renters insurance in all 50 states. Along with the basic types of insurance, State Farm sells the following add-on options:

- Replacement cost coverage

- Business property coverage

- Identity theft protection

- Waterbed liability coverage

- Drain or sewer backup coverage

- Personal injury endorsement

- Earthquake damage coverage

- Extra coverage for valuables

One drawback with State Farm is that the company doesn’t offer very many discounts. State Farm only lists a policy bundling and home alert discount to help you save money.

Amica Renters Insurance

Amica might not be as well-known as State Farm, but that doesn’t mean it’s not one of the top renters insurance providers. It offers the same basic renters insurance as most other companies, but Amica stands out for its superb customer service reviews.

According to the National Association of Insurance Commissioners (NAIC), Amica receives fewer complaints than similarly sized companies. Many customers appreciate Amica’s easy-to-use website, which makes paying bills, filing claims, and getting quotes simple.

Amica sells renters insurance in every state except Hawaii and Alaska. Although it offers fewer add-on options than some competitors, Amica still has a few good choices. These include:

- Personal property replacement coverage

- Smart device/computer coverage

- Scheduled personal property coverage

- Identity fraud protection

Amica might not have the most add-on options, but it makes up for it with ample discount opportunities. Renters can take advantage of discounts for being claims-free, paper-free, enrolling in autopay, bundling with car insurance, and being an Amica customer for at least two years.

Read more: Amica Car Insurance Discounts

Farmers Renters Insurance

For drivers looking to maximize their savings, Farmers might provide the best insurance for renters. Farmers struggles a bit with customer service ratings, but its low prices and ample coverage options often make up for it.

As one of the country’s largest insurance companies, Farmers offers many coverage options. From Farmers car insurance to term life insurance, Farmers can cover just about anything important to you. If you sign up for multiple Famers policies, you’ll likely be eligible for a bundling discount.

There are eight states in which Farmers doesn’t sell renters insurance, so you’ll need to check before you apply for a policy. Farmers offers the following add-ons for your renters insurance policy:

- Replacement costs

- Identity theft coverage

- Refrigerated goods replacement coverage

While it doesn’t offer as many add-ons as other companies, Farmers offers a long list of discount opportunities. These include being tobacco-free for two years, having a security system installed, bundling multiple policies, being claims-free, being a loyal customer, and working in certain professions.

Country Financial Renters Insurance

Country Financial isn’t the largest insurance company out there, but it has excellent customer service ratings, high policy limits, and plentiful coverage options.

According to the NAIC, Country Financial receives fewer complaints than similar companies. Country Financial sells renters insurance in just 19 states, but you might find it has the best coverage if you live in a qualifying area. You have to apply for a policy in-person, but Country Financial representatives have a reputation for being friendly and professional.

Country Financial offers the following types of coverage:

- High-value coverage

- Premier coverage for personal property

- Replacement cost coverage

- Identity theft coverage

- Water backup coverage

- Personal injury protection

Applying for a Country Financial policy is a little less convenient than at other companies, but the amount of coverage you can add makes it worth it. You can also take advantage of discounts for bundling policies, going five years without making a claim, paying your bills on time, and being a new customer.

Check out our Country Financial insurance review to learn more.

Lemonade Renters Insurance

Lemonade is a relative newcomer to the insurance scene, but it’s making a big splash. With a more modern take on renters insurance, Lemonade is a good option for people looking for a more digital experience.

While it’s currently only available in 28 states, Lemonade only does business online. You can still speak with a representative, but you won’t find a physical office. However, Lemonade receives more complaints than similar companies, and rates tend to be a bit high.

Aside from the basic types of coverage, you can purchase the following add-ons from Lemonade:

- Extra coverage for high-value items

- Water backup coverage

- Equipment breakdown coverage

While Lemonade doesn’t boast the largest list of add-ons, it does offer a few good options. It also provides limited choices, such Lemonade car insurance discounts, including savings for bundling policies, paying your policy in full, and installing safety features in your car.

How Much Does Good Renters Insurance Cost

Renters insurance is generally affordable, with some policies costing as little as $10 a month. The average person pays only $14 a month for renters insurance in the U.S.

Like all other types of insurance, you’ll see a great deal of price variation between companies. For example, Lemonade has a low average rate of $12 a month, while Farmers costs about $23 a month.

Laura Walker Former Licensed Agent

These price variations highlight why it’s so important to compare rates. You’ll also see different rates based on a variety of factors. For example, finding affordable renters insurance for people with bad credit can be much more difficult than if your score is higher. You’ll likely overpay for your renters insurance if you don’t research your options.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Do You Choose the Best Renters Insurance Policy

Most companies offer an easy application process for people looking for renters insurance. To find the best renters insurance for you, try the following tips:

- Determine Your Coverage Needs: Making a basic inventory of your belongings will help you determine how much coverage you need. Most renters policies start with $30,000 worth of personal belongings coverage, so you might need to buy more.

- Pick Your Coverage: If you live in an area without earthquake or flood risks, you’ll probably be fine with a standard policy. A representative can review your options to help you find the perfect policy.

- Compare Your Options: Comparing multiple companies is the best way to get the best coverage for your home. Some companies have cheaper rates, but better coverage is sometimes worth paying more for.

Once you know where you want to buy a policy from, applying for coverage is usually a simple task. Most companies offer online application options that you can complete in about 10 minutes. If you prefer not to fill out a digital application, you can also speak with a representative over the phone or in person.

Access comprehensive insights into our “Nationwide vs. Grange Insurance Renters Insurance.”

Find the Best Renters Insurance Today

With millions of Americans renting their homes, knowing where to buy a top renters insurance policy is more important than ever. Since rates are so affordable and the protection so valuable, there’s little reason to skip buying renters insurance or apartment insurance.

Even though renters insurance is affordable, you should always compare your options. From finding the right coverage to getting the best price, comparing policies between companies is the best way to get the right insurance for your home. Discover more about offerings in our “Best Renters Insurance for Families.”

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

Who has the best prices on renters insurance?

The best rental insurance quotes for you will depend on a variety of factors, like where you live and how much coverage you need. However, State Farm and Farmers tend to have the cheapest rates.

Access comprehensive insights into our guide titled “State Farm vs. USAA Renters Insurance.”

What are the two types of renters insurance?

The two main types of renters insurance are actual cash value (ACV) coverage and replacement cost coverage. ACV coverage pays for the depreciated value of your belongings, while replacement cost pays for what it takes to replace your items.

How is Lemonade insurance so cheap?

Lemonade renters insurance is actually one of the more expensive options on the market. Although you’ll pay higher rates, Lemonade offers excellent coverage options that make the price worth it.

Is it better to have a higher or lower deductible for renters insurance?

Your deductible is the amount you must pay before your insurance kicks in. If you choose a higher deductible, your monthly rates will be lower. A lower deductible means you’ll have less to pay from your own pocket if you need to make a claim.

What is renters insurance and why do I need it?

Renters insurance is a type of insurance policy that provides coverage for renters who live in an apartment, condo, or rental home. It can protect your personal belongings in case of theft, fire, or other covered events, and it can also provide liability coverage in case someone is injured in your rental unit and Renters insurance is important because your landlord’s insurance typically does not cover your personal property or liability.

Learn more by reading our guide titled “Landlord Insurance: A Complete Guide.”

Where do I get affordable renters insurance in Florida?

Affordable renters insurance in Florida can be sourced by comparing policies from multiple insurance companies online, checking for any state-specific discounts, and choosing a higher deductible to lower the premium.

How can I find affordable renters insurance in California?

To find affordable renters insurance in California, compare quotes from multiple providers, consider bundling with other policies, and look for discounts you might be eligible for, such as for security systems or smoke-free homes.

What is affordable renter insurance and where can I find it?

Affordable renter insurance offers financial protection for your personal belongings in a rented property at a cost-effective rate. You can find affordable options by comparing quotes from various insurance companies online or consulting with local agents.

Can I find affordable renters insurance in Georgia?

Yes, you can find affordable renters insurance in Georgia by shopping around, comparing rates from different insurers, and taking advantage of discounts for things like multiple policies or being a long-term customer.

To learn more, explore our comprehensive resource on “Best Renters Insurance for Low-Income Renters.”

What should I consider when looking for affordable renters insurance in Georgia?

When searching for affordable renters insurance in Georgia, check for regional discounts, such as for storm-proofing your home, and ensure the policy covers the specific risks associated with the area like floods or hurricanes.

What are some tips for finding affordable renters insurance in Florida?

Is affordable renters insurance legit?

How do I find a reliable affordable renters insurance review?

What is the average cost of renters insurance?

Is Alaska renters insurance different from other states?

How much is renters insurance in VA?

What does AAA renters insurance cover in California?

How much is USAA renters insurance?

What does AAA renters insurance cover in California?

How much renters insurance should a landlord require in Virginia?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.