Cheap Saturn Relay Car Insurance in 2026 (10 Best Companies for Savings)

Erie, AAA, and Auto-Owners offer the best options for cheap Saturn Relay car insurance, with rates as low as $22/mo. These providers excel in affordability and coverage, making them top choices for cost-effective protection. Explore how these companies stand out in offering the most value for Saturn Relay owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated January 2025

Company Facts

Min. Coverage for Saturn Relay

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Saturn Relay

A.M. Best Rating

Complaint Level

Pros & Cons

Erie, AAA, and Auto-Owners offer the best options for cheap Saturn Relay car insurance, with rates as low as $22 per month.

These providers shine not only for their competitive pricing but also for their comprehensive coverage and strong customer satisfaction. Erie stands out as the top choice overall due to its exceptional blend of cost-effectiveness and coverage benefits.

Our Top 10 Company Picks: Cheap Saturn Relay Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

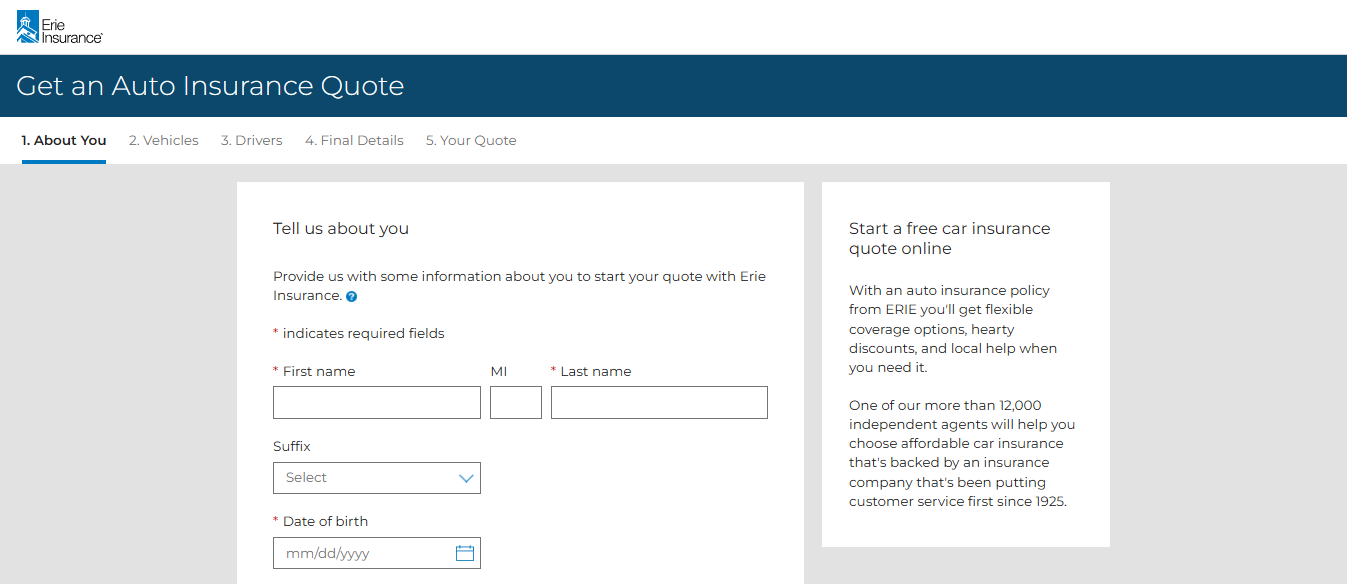

#1 $22 A+ Youth Discounts Erie

#2 $32 A Roadside Assistance AAA

#3 $33 A++ Safe-Driving Discounts Auto-Owners

#4 $37 A++ Specialized Coverage Travelers

#5 $42 A+ Exclusive Benefits The Hartford

#6 $43 A+ Vanishing Deductible Nationwide

#7 $45 A+ Customer Service Amica Mutual

#8 $52 A Group Discounts Farmers

#9 $66 A Policy Options Liberty Mutual

#10 $85 A High-Risk Coverage The General

Discover how these leading companies can help you find the best value for your Saturn Relay insurance needs. Avoid overpaying for your car insurance by entering your ZIP code above in our free comparison tool to find which company has the lowest rates.

#1 – Erie: Top Overall Pick

Pros

- Affordable Rates: Erie offers competitive pricing for Saturn Relay insurance, making it a cost-effective choice for many drivers of the Saturn Relay, as highlighted in the Erie Insurance Review & Ratings.

- Comprehensive Coverage: The insurance includes extensive coverage options such as collision, comprehensive, and liability for the Saturn Relay, ensuring broad protection for your vehicle.

- Accident Forgiveness: Erie provides accident forgiveness options, which can help prevent your premiums from increasing after a first at-fault accident involving your Saturn Relay.

Cons

- Limited Availability: Erie’s coverage for the Saturn Relay is not available in all states, which may restrict options for some drivers.

- Fewer Discounts: The range of discounts available for Saturn Relay insurance may be less extensive compared to other insurers, potentially limiting savings opportunities.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA includes comprehensive roadside assistance in many of its policies for the Saturn Relay, which is valuable for unexpected breakdowns, as highlighted in the AAA insurance review & ratings.

- Discounts: Offers various discounts such as multi-policy discounts, safe driver discounts, and discounts for good credit for Saturn Relay insurance, which can lower your overall premium.

- Member Benefits: AAA members receive additional perks, including travel discounts and other benefits not available with many other insurers, which can be advantageous for Saturn Relay drivers.

Cons

- Higher Premiums: Insurance rates for the Saturn Relay might be higher compared to some competitors, particularly in certain regions or for certain driver profiles.

- Limited Customization: Some policies for the Saturn Relay may offer fewer options for customization compared to other insurers, potentially limiting the ability to tailor coverage.

#3 – Auto-Owners: Best for Competitive Rates

Pros

- Competitive Rates: Auto-Owners provides affordable insurance rates for the Saturn Relay, making it a cost-effective choice.

- Comprehensive Coverage: Offers a wide range of coverage options, including collision, comprehensive, and liability for the Saturn Relay, with additional endorsements available.

- Discounts: Provides various discounts, including multi-policy and safe driving discounts, to help lower premiums for Saturn Relay insurance.

Cons

- Availability Issues: Coverage for the Saturn Relay may not be available in all states, potentially limiting options for some drivers, as mentioned in the Auto-Owners insurance review & ratings.

- Limited Online Tools: Fewer online tools and resources for managing policies and claims for the Saturn Relay compared to some other providers.

#4 – Travelers: Best for Flexible Coverage Options

Pros

- Flexible Coverage Options: Travelers offers a variety of coverage options and policy add-ons for the Saturn Relay, allowing customization to meet specific needs.

- Discounts Available: Various discounts are available for the Saturn Relay, including those for safe driving, bundling policies, and more, which can reduce overall costs.

- Accident Forgiveness: Travelers provides accident forgiveness options to help keep premiums stable after a first at-fault accident involving the Saturn Relay, as mentioned in the Travelers insurance review & ratings.

Cons

- Higher Rates in Some Areas: Premiums for the Saturn Relay can be higher in certain regions, which may impact affordability.

- Complex Policies: The variety of coverage options and add-ons for the Saturn Relay can make policies complex and may require careful review to ensure all needs are met.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for AARP Member Benefits

Pros

- AARP Member Benefits: Offers special discounts and benefits for AARP members, which can result in cost savings and additional perks for Saturn Relay insurance, as highlighted in the The Hartford insurance review & ratings.

- Good Coverage Options: Provides extensive coverage options tailored to various needs, including customizable endorsements for the Saturn Relay.

- Discounts for Safety Features: Offers discounts for vehicles equipped with safety features, which can help reduce premiums for the Saturn Relay.

Cons

- Higher Premiums for Older Vehicles: Insurance costs can be higher for older models like the Saturn Relay compared to newer vehicles.

- Limited Discount Options: May have fewer discount opportunities for Saturn Relay insurance compared to some other providers.

#6 – Nationwide: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Nationwide offers a broad range of coverage options for the Saturn Relay, including accident forgiveness and comprehensive protection.

- Good Discounts: Various discounts are available for Saturn Relay insurance, such as those for bundling policies, safe driving, and multi-car.

- Digital Tools: Provides robust online tools for managing policies, tracking claims, and accessing support for Saturn Relay insurance.

Cons

- Premium Costs: Insurance for the Saturn Relay can be more expensive compared to some other insurers, particularly for high-risk drivers or older vehicles, as noted in the Nationwide insurance review & ratings.

- Complex Claims Process: The claims process for the Saturn Relay can be more cumbersome for some customers, requiring thorough documentation and follow-up.

#7 – Amica: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Extensive coverage options with the ability to customize policies to fit individual needs for the Saturn Relay.

- Discounts: Offers various discounts for the Saturn Relay, including safe driving discounts and multi-policy savings.

- Online Tools: User-friendly online tools for managing policies and accessing support for Saturn Relay insurance, as detailed in the Amica Homeowners Insurance Review.

Cons

- Higher Rates: Premiums for the Saturn Relay may be higher for certain driver profiles or high-risk individuals.

- Limited Local Agents: Fewer local agents available for in-person service, which might be less convenient for some Saturn Relay owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Flexible Coverage Options

Pros

- Flexible Coverage Options: Broad range of coverage options and customization available for the Saturn Relay to meet various needs, as highlighted in the Farmers insurance review & ratings.

- Discounts: Offers multiple discounts for the Saturn Relay, including those for bundling policies, good driving records, and more.

- Accident Forgiveness: Provides accident forgiveness options to keep premiums stable after a first at-fault accident involving the Saturn Relay.

Cons

- Higher Premiums: Rates for the Saturn Relay can be higher compared to some other insurance providers, especially for certain demographics or high-risk drivers.

- Complex Policies: Policies for the Saturn Relay can be complex, with a variety of options and endorsements that may require careful understanding.

#9 – Liberty Mutual: Best for Wide Range of Coverage

Pros

- Wide Range of Coverage: Extensive coverage options for the Saturn Relay, including specialized add-ons and endorsements.

- Discounts Available: Various discounts for safe driving, bundling policies, and having certain safety features in your Saturn Relay.

- Good Digital Tools: Robust online tools for managing policies, tracking claims, and accessing support for Saturn Relay insurance.

Cons

- Higher Premiums: Insurance costs for the Saturn Relay can be more expensive compared to some competitors, particularly for older vehicles or high-risk drivers, as noted in the Liberty Mutual Review & Ratings.

- Mixed Customer Reviews: Customer satisfaction ratings for Saturn Relay insurance are more varied compared to other top insurers, with some mixed feedback on service and claims handling.

#10 – The General: Best for Accessible Coverage

Pros

- Accessible Coverage: Easier to obtain insurance with flexible terms for the Saturn Relay, which can be valuable for drivers with less-than-perfect records.

- Affordable Rates: Typically offers lower premiums for the Saturn Relay compared to major insurers, making it a budget-friendly option, according to The General car insurance review & ratings.

- Good for High-Risk Drivers: Provides coverage options for high-risk drivers, including those with poor driving records or other risk factors related to the Saturn Relay.

Cons

- Limited Coverage Options: Fewer coverage options and add-ons available for the Saturn Relay compared to larger insurers, which may limit customization.

- Customer Service Issues: Lower ratings for customer service and claims processing for the Saturn Relay, with some feedback indicating slower response times and less thorough support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect the Cost of Saturn Relay Car Insurance

Saturn Relay Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $84 |

| Amica Mutual | $45 | $148 |

| Auto-Owners | $33 | $85 |

| Erie | $22 | $57 |

| Farmers | $52 | $136 |

| Liberty Mutual | $66 | $170 |

| Nationwide | $43 | $112 |

| The General | $85 | $222 |

| The Hartford | $42 | $109 |

| Travelers | $37 | $97 |

Here’s an overview of the key factors that affect the cost of insurance for your Saturn Relay. Insurance providers consider several elements when determining your premium for a Saturn Relay.

These factors include:

- Driver’s Age and Driving Record

- Type and Year of Saturn Relay

- Vehicle Location

- Selected Coverage Options

- Deductible Amount

Each of these factors plays a role in determining the premium you will pay for your Saturn Relay car insurance. Discover our comprehensive guide to “How much is car insurance?” for additional insights.

Another factor that can affect the cost of Saturn Relay car insurance is the driver’s annual mileage. Insurance providers may consider the number of miles driven per year when determining the premium. Drivers who have a higher annual mileage may be seen as having a higher risk of being involved in accidents, which can result in higher insurance rates.

In addition, the driver’s marital status can also impact the cost of car insurance for a Saturn Relay. Married drivers may be eligible for lower insurance rates compared to single drivers. This is because insurance providers often view married individuals as being more responsible and less likely to engage in risky driving behaviors.

Understanding the Insurance Rating Factors for Saturn Relay

Insurance rating factors are used by insurers to assess the level of risk associated with insuring a particular vehicle. For the Saturn Relay, insurance rating factors consider elements such as the vehicle’s crash test ratings, repair costs, and theft rates. Additionally, the claim history of the model can also affect insurance rates.

Jimmy McMillan Licensed Insurance Agent

Before purchasing a Saturn Relay, it’s worth researching insurance rating factors and understanding their potential impact on the cost of insurance. Another important insurance rating factor for the Saturn Relay is the driver’s personal driving record. Insurers take into account factors such as the driver’s age, driving experience, and any previous accidents or traffic violations.

A clean driving record can help lower insurance rates for the Saturn Relay, while a history of accidents or violations may result in higher premiums. It’s essential for potential owners of the Saturn Relay to maintain a good driving record to ensure more affordable insurance coverage. For further details, check out our in-depth “How much insurance coverage do I need?” article.

Saturn Relay Car Insurance Coverage Options

When selecting car insurance for your Saturn Relay, it’s essential to consider the various coverage options available to you. These options include liability coverage, which is required by law in most states, as well as comprehensive and collision coverage.

Liability coverage protects you financially if you cause damage to another person’s property or injure someone in an accident, while comprehensive and collision coverage provide additional protection for your own vehicle. By understanding the different coverage options, you can choose the ones that best suit your needs and budget.

Another important coverage option to consider for your Saturn Relay car insurance is uninsured/underinsured motorist coverage. This type of coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

Uninsured/underinsured motorist coverage can help pay for medical expenses, property damage, and other costs resulting from the accident. In addition to the coverage options mentioned above, you may also want to consider adding roadside assistance coverage to your Saturn Relay car insurance policy.

Roadside assistance coverage provides services such as towing, fuel delivery, lockout assistance, and tire changes in case your vehicle breaks down or you encounter other roadside emergencies. Having roadside assistance coverage can give you peace of mind knowing that help is just a phone call away when you need it.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Saturn Relay Insurance Quotes

One way to ensure you’re getting the best price for your Saturn Relay is to compare car insurance quotes from multiple providers. Different insurers may offer different rates and discounts, so it’s worth taking the time to shop around. Online comparison tools can help simplify the process by allowing you to input your information once and receive quotes from multiple insurers.

This way, you can make an informed decision and select the insurance that offers the best coverage at the most competitive price. When comparing quotes from multiple insurance providers, it’s important to consider not only the price but also the coverage options.

Some insurers may offer lower rates but provide less comprehensive coverage, while others may have higher premiums but offer additional benefits such as roadside assistance or accident forgiveness. By carefully reviewing the coverage details of each quote, you can ensure that you’re selecting the insurance that best meets your needs and provides adequate protection for your Saturn Relay.

In addition to comparing quotes, it’s also beneficial to research the reputation and customer satisfaction ratings of the insurance providers you’re considering. Online reviews and ratings can provide valuable insights into the quality of service and claims handling of different insurers.

It’s worth taking the time to read customer experiences and feedback to ensure that you’re choosing an insurance provider that is reliable and responsive in the event of an accident or claim.

Tips for Affordable Saturn Relay Insurance

Looking for ways to lower the cost of your Saturn Relay car insurance? Here are some valuable tips:

- Consider increasing your deductible amount, which can lower your premium.

- Take advantage of available discounts, such as those for safe driving records, multiple policies with the same insurer, or completing a defensive driving course.

- Install safety features and anti-theft devices in your vehicle to reduce the risk of accidents and theft.

- Maintain a good credit score, as insurance providers often use credit information to assess risk.

- Explore the possibility of bundling your Saturn Relay car insurance with other policies, such as homeowners or renters insurance, to benefit from potential discounts.

By applying these tips, you can potentially lower the cost of your Saturn Relay car insurance.

Additionally, it is important to regularly review and compare car insurance quotes from different providers. Rates can vary significantly between insurers, so taking the time to shop around and compare options can help you find the most affordable coverage for your Saturn Relay. Online comparison tools and websites can make this process easier by allowing you to quickly compare quotes from multiple insurers in one place.

Driving History and Saturn Relay Insurance Rates

Your driving history plays a significant role in determining the cost of car insurance for your Saturn Relay. Insurance providers assess factors such as accidents, moving violations, and claims history to calculate the level of risk you represent as a driver. If you have a clean driving record, you are likely to pay lower premiums compared to someone with a history of accidents or traffic violations.

Additionally, insurance providers may also consider the length of your driving history when determining your car insurance rates for the Saturn Relay. Expand your understanding with our thorough “Insurance Quotes Online” overview.

Generally, drivers with a longer history of safe driving are seen as less risky and may be eligible for further discounts on their premiums. On the other hand, if you are a new driver or have recently obtained your driver’s license, you may be considered higher risk and could face higher insurance costs until you establish a positive driving record.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Age & Model Impact on Saturn Relay Insurance

The age and model of your Saturn Relay can also influence the cost of car insurance. Generally, newer vehicles tend to have higher insurance rates due to higher repair costs and theft rates. Older models may have lower insurance premiums, but other factors such as safety features and crash test ratings can still impact the cost.

When considering a Saturn Relay, it’s important to research its insurance rates to ensure it aligns with your budget. In addition to the age and model of your Saturn Relay, there are other factors that can affect the cost of car insurance.

One important factor is your driving history. If you have a clean driving record with no accidents or traffic violations, you may be eligible for lower insurance rates. On the other hand, if you have a history of accidents or violations, your insurance premiums may be higher. Learn more by visiting our detailed “What age do you get cheap car insurance?” section.

Saturn Relay Insurance Discounts & Savings

Insurance providers offer various discounts and savings opportunities for Saturn Relay owners. These could include discounts for safe driving records, loyalty to a particular insurer, bundling multiple policies, or having specific safety features installed in your vehicle.

It’s important to ask insurers about potential discounts and explore all avenues to reduce your insurance costs. Get more insights by reading our expert “Lesser Known Car Insurance Discounts for” advice.

Credit Score’s Role in Saturn Relay Insurance Rates

Many insurance providers consider an individual’s credit score when calculating car insurance rates. Individuals with a good credit score tend to have lower insurance premiums compared to those with poor credit.

Maintaining a good credit score can not only benefit your overall financial health but also contribute to lower insurance costs for your Saturn Relay. For more information, explore our informative “Car Insurance Startups Change How You Buy Car Insurance” page.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bundling Saturn Relay Insurance for Savings

One way to potentially save money on your Saturn Relay car insurance is by bundling it with other insurance policies. For example, combining your car insurance with your homeowner’s or renter’s insurance under the same insurer can often lead to discounts.

It’s worth reaching out to your insurance provider and discussing the possibility of bundling to maximize savings. Explore our detailed analysis on “Can I bundle my car insurance with other policies?” for additional information.

Saturn Relay Insurance Deductible Options and Effects

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. When choosing car insurance for your Saturn Relay, you’ll have different deductible options. A higher deductible typically results in lower insurance premiums, while a lower deductible may increase your premium.

It’s essential to find the right balance between a deductible amount that works for your budget and an insurance premium that provides the necessary coverage. Discover our comprehensive guide to “What is the difference between a deductible and a premium in car insurance?” for additional insights.

Location’s Role in Saturn Relay Insurance Rates

The location where you live and primarily drive your Saturn Relay can significantly impact your car insurance rates. Insurers consider factors such as population density, crime rates, and accident statistics when assessing risk.

If you live in an area with a higher risk of accidents or theft, your insurance rates may be higher compared to areas with lower risk. For further details, check out our in-depth “How to Get Free Insurance Quotes Online” article.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Comprehensive and Collision Coverage for Your Saturn Relay

When determining the coverage options for your Saturn Relay, it’s important to consider the different aspects of comprehensive and collision coverage. Learn more by visiting our detailed “Collision vs. Comprehensive Car Insurance” section.

Comprehensive coverage typically protects against non-collision events such as theft, vandalism, or natural disasters, while collision coverage provides protection for damage caused by a collision with another vehicle or object. By understanding these coverage options and assessing your needs, you can make an informed decision about the level of protection you want for your Saturn Relay.

Lower Saturn Relay Insurance with Safety Features and Anti-Theft Devices

Saturn Relay vehicles often come equipped with various safety features and anti-theft devices that can help lower your car insurance costs. These may include features such as anti-lock brakes, airbags, stability control, and alarm systems.

Insurance providers often offer discounts for vehicles with these safety features, as they reduce the risk of accidents and theft. By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Dani Best Licensed Insurance Producer

Before purchasing a Saturn Relay, it’s worth considering the available safety features to potentially lower your insurance premiums. In conclusion, the cost of car insurance for your Saturn Relay is influenced by several factors, including your driving history, the age and model of your vehicle, your location, and the coverage options you choose.

By understanding these factors and exploring discount opportunities, you can find affordable car insurance for your Saturn Relay. Take the time to compare quotes from multiple insurance providers and consider the tips provided in this article to ensure you are getting the best coverage at the most competitive price. Dive deeper into “Safety Car Insurance Discounts” with our complete resource.

Frequently Asked Questions

What is the lowest form of Saturn Relay car insurance?

The lowest form of Saturn Relay car insurance is usually minimum liability coverage, which meets state-required insurance limits.

Can I get a quote for Saturn Relay car insurance online?

Yes, most insurers offer online quotes by filling out necessary details on their websites.

Which company has the cheapest Saturn Relay insurance?

Erie Insurance offers the cheapest Saturn Relay insurance, with competitive rates and comprehensive coverage options.

Explore our detailed analysis on “Cheapest Car Insurance for 23-Year-Old Drivers” for additional information.

What is the average cost of Saturn Relay car insurance?

Costs vary, so get quotes from multiple providers for an accurate estimate.

Is Saturn Relay car insurance more expensive for young drivers?

Yes, young drivers typically face higher premiums due to increased risk.

What is the cheapest form of Saturn Relay car insurance?

The cheapest form of Saturn Relay car insurance typically includes basic liability coverage, which offers the minimum protection required by law.

Get more insights by reading our expert “Liability Insurance: A Complete Guide” advice.

What factors affect the cost of Saturn Relay car insurance?

Insurance costs vary based on driver age, location, driving history, coverage limits, deductibles, and provider pricing.

Which company has the cheapest Saturn Relay insurance?

Erie Insurance offers the cheapest Saturn Relay insurance, with competitive rates and comprehensive coverage options.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What is the best type of Saturn Relay car insurance?

The best type of Saturn Relay car insurance includes full coverage, which combines collision, comprehensive, and liability insurance for extensive protection.

Continue reading our full “Collision Car Insurance: A Complete Guide” guide for extra tips.

How much is full coverage Saturn Relay car insurance?

The cost of full coverage Saturn Relay car insurance averages around $150 per month, depending on factors like location and driving history.

What Saturn Relay car insurance is the best?

Are there any discounts available for Saturn Relay car insurance?

What Saturn Relay car insurance is the cheapest for full coverage?

What are the best Saturn Relay car insurance options?

What is the best Saturn Relay car insurance cover?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.