Does Amica Mutual Insurance car insurance cover damage caused by a deer or other wildlife?

Does Amica Mutual Insurance car insurance provide coverage for damage caused by deer or other wildlife? Find out what damages are covered and how to file a claim.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated January 2025

Amica Mutual Insurance is a well-known provider of car insurance, but what exactly are the coverage options when it comes to damage caused by deer or other wildlife? In this article, we will delve into the specifics of Amica Mutual Insurance car insurance and explore their comprehensive coverage.

Understanding The Coverage Options Of Amica Mutual Insurance Car Insurance

When it comes to car insurance, Amica Mutual Insurance offers a range of coverage options to protect policyholders from various risks and incidents. This includes coverage for damage caused by collisions, theft, vandalism, and even natural disasters. However, coverage for damage caused by wildlife may fall under a specific provision in their policy.

In addition to the coverage options mentioned above, Amica Mutual Insurance also offers comprehensive coverage. This type of coverage protects policyholders from non-collision incidents, such as fire, hail, falling objects, and damage caused by animals. Comprehensive coverage can provide peace of mind knowing that your vehicle is protected from a wide range of potential risks.

Furthermore, Amica Mutual Insurance offers optional add-ons to enhance your car insurance coverage. These add-ons include roadside assistance, rental car reimbursement, and gap coverage. Roadside assistance provides assistance in case of a breakdown or emergency, while rental car reimbursement covers the cost of a rental car if your vehicle is being repaired. Gap coverage helps bridge the gap between the actual cash value of your vehicle and the amount you owe on your loan or lease in the event of a total loss.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring The Specifics Of Amica Mutual Insurance’S Car Insurance Policy

Turn to Amica Mutual Insurance’s policy details, and you’ll find that their car insurance includes comprehensive coverage. Comprehensive coverage is designed to protect against non-collision events that can cause damage to your vehicle, such as hitting an animal. This means that if your car is damaged by a deer or other wildlife, you may be eligible for coverage.

In addition to comprehensive coverage, Amica Mutual Insurance’s car insurance policy also offers collision coverage. Collision coverage is designed to protect against damage to your vehicle that occurs as a result of a collision with another vehicle or object. This means that if you are involved in a car accident and your vehicle is damaged, Amica Mutual Insurance may provide coverage for the repairs or replacement of your vehicle.

A Closer Look At Amica Mutual Insurance’S Comprehensive Coverage

Comprehensive coverage often covers damage resulting from acts of nature, such as weather-related incidents or animal-related accidents. With Amica Mutual Insurance, the specifics of this coverage can vary, so it’s important to review your policy and understand the terms and conditions.

Additionally, Amica Mutual Insurance’s comprehensive coverage may also include protection against theft, vandalism, and fire damage. This means that if your vehicle is stolen, vandalized, or damaged in a fire, you may be eligible for reimbursement or repair coverage. It’s crucial to familiarize yourself with the details of your policy to ensure you have a clear understanding of the extent of your comprehensive coverage.

Is Damage Caused By Deer Or Other Wildlife Covered Under Amica Mutual Insurance Car Insurance?

If you are an Amica Mutual Insurance policyholder and your car is damaged by a deer or other wildlife, you will likely be covered under their comprehensive coverage. However, it’s crucial to review your policy documents or contact an Amica representative directly to confirm the extent of this coverage and any applicable deductibles.

It’s important to note that while Amica Mutual Insurance may cover damage caused by deer or other wildlife, there may be certain limitations or exclusions. For example, some policies may have a cap on the amount they will pay for wildlife-related damage, or they may require you to pay a higher deductible for these types of claims. Additionally, coverage may vary depending on the specific circumstances of the incident, such as whether the damage occurred on a public road or in a designated wildlife area. To ensure you have a clear understanding of your coverage, it is recommended to carefully review your policy or reach out to an Amica representative for clarification.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Examining The Extent Of Coverage For Wildlife-Related Accidents With Amica Mutual Insurance

With Amica Mutual Insurance’s coverage for wildlife-related accidents, you can expect financial protection for damages caused by collisions with animals. This can include not only deer but also other wildlife such as elk, moose, or even smaller creatures like rabbits or raccoons. It’s important to note, however, that any damages caused by intentional acts or negligence may not be covered.

What To Do If Your Car Is Damaged By A Deer Or Other Wildlife: Amica Mutual Insurance’S Guidelines

If you find yourself in the unfortunate situation of having your car damaged by a deer or other wildlife, it’s important to follow the proper steps to ensure a smooth claims process. Amica Mutual Insurance provides guidelines on how to report the incident, gather evidence, and file a claim. Remember to document the damage, take photos if possible, and promptly notify your insurance provider to initiate the claim process.

Clarifying The Claim Process For Wildlife-Related Damage With Amica Mutual Insurance

When filing a claim for wildlife-related damage with Amica Mutual Insurance, you can expect a detailed process. It typically involves providing the necessary information about the incident, filling out relevant forms, and possibly working with an adjuster to assess the extent of the damage. Being prepared and providing accurate information will help facilitate your claim and ensure a fair resolution.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips For Preventing Wildlife Accidents And Minimizing The Risk Of Damage

While Amica Mutual Insurance provides coverage for damage caused by wildlife, it’s always a good idea to take steps to prevent such accidents whenever possible. Here are some tips:

- Be cautious when driving in areas known for high wildlife activity, especially during dawn and dusk when animals are most active.

- Pay attention to road signs indicating wildlife crossing areas and reduce your speed accordingly.

- Use your high beams when appropriate to increase visibility.

- If you spot an animal near the road, slow down and honk your horn to try to scare it away.

- Do not swerve suddenly to avoid hitting an animal, as this may cause more severe accidents.

- Ensure your car’s headlights, taillights, and brake lights are properly functioning to increase visibility to animals.

Comparing Amica Mutual Insurance’S Coverage For Wildlife-Related Accidents To Other Providers

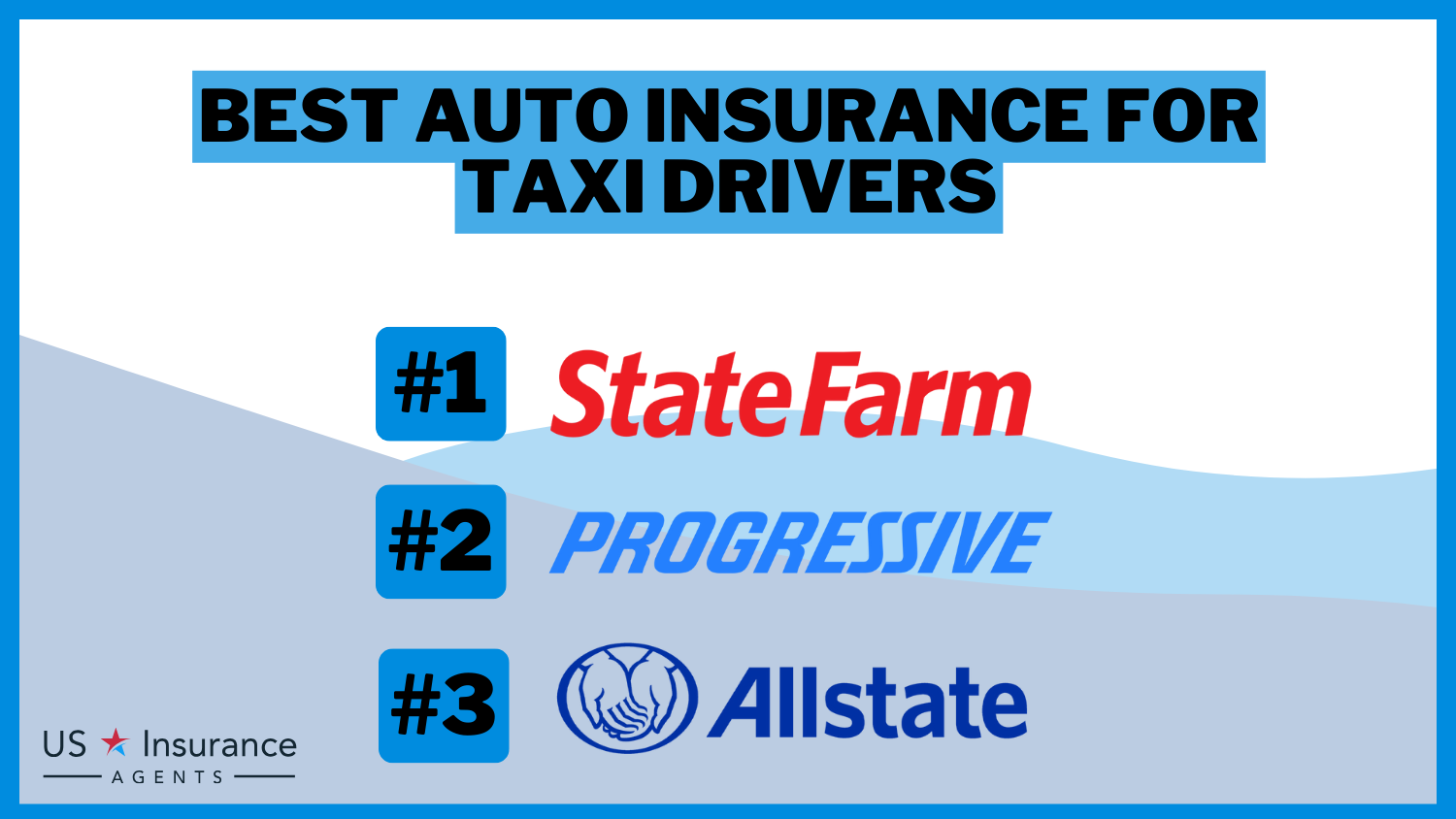

When discussing insurance coverage for wildlife-related accidents, it’s important to consider how Amica Mutual Insurance stacks up against other providers. While Amica is known for its comprehensive coverage, it’s always recommended to compare multiple insurance companies and their offerings to find the best fit for your needs.

Understanding The Limitations And Exclusions Of Amica Mutual Insurance Car Insurance In Relation To Wildlife Damage

It’s crucial to be aware of any limitations or exclusions in your Amica Mutual Insurance car insurance policy when it comes to wildlife damage. While comprehensive coverage often includes protection for wildlife-related accidents, there may still be specific circumstances or conditions where coverage may not apply. Reading and understanding your policy contract thoroughly will help you fully grasp these limitations.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are There Any Additional Costs Or Deductibles Associated With Filing A Claim For Wildlife-Related Damage With Amica Mutual Insurance?

When filing a claim for wildlife-related damage with Amica Mutual Insurance, it’s important to familiarize yourself with any additional costs or deductibles that may be involved. Depending on your policy, you may be responsible for paying a deductible amount before your insurance coverage kicks in. Reviewing your policy documents or contacting an Amica representative will provide you with a clear understanding of the financial aspects of your claim.

Real-Life Experiences: Stories Of Policyholders Who Have Filed Claims For Wildlife-Related Accidents With Amica Mutual Insurance

To gauge the real-life experiences of policyholders who have filed claims for wildlife-related accidents with Amica Mutual Insurance, it’s beneficial to seek out customer reviews and testimonials. Hearing firsthand accounts can provide valuable insights into the claims process, customer satisfaction, and overall handling of wildlife-related incidents.

Evaluating The Customer Satisfaction And Feedback Regarding Amica Mutual Insurance’S Handling Of Wildlife-Related Claims.

Customer satisfaction is a crucial aspect when it comes to insurance providers. To evaluate Amica Mutual Insurance’s handling of wildlife-related claims, it’s essential to consider customer feedback and ratings. Pay attention to reviews that specifically mention wildlife incidents, responsiveness, and the overall claims experience. This can help you gauge the level of satisfaction other policyholders have had with Amica’s handling of such claims.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Expert Advice: Tips From Professionals On Dealing With Wildlife-Related Incidents And Insurance Claims

Lastly, seeking expert advice from professionals in the field can be advantageous. Wildlife experts, insurance agents, or even legal advisors can provide valuable guidance on how to navigate wildlife-related incidents and insurance claims effectively. Take advantage of their knowledge and expertise to ensure you are well-prepared and informed.

Conclusion

In conclusion, if you are an Amica Mutual Insurance policyholder, you may be covered for damage caused by deer or other wildlife under their comprehensive coverage. However, it’s crucial to review your policy documents, understand the terms and conditions, and contact a representative if you have any specific questions or concerns. By being aware of the coverage options, claims process, and taking preventative measures, you can mitigate the risk of wildlife-related accidents and ensure a smooth experience with Amica Mutual Insurance.

Frequently Asked Questions

Does Amica Mutual Insurance car insurance cover damage caused by a deer or other wildlife?

Yes, Amica Mutual Insurance car insurance typically covers damage caused by a deer or other wildlife. However, coverage may vary depending on the specific policy and coverage options chosen.

What types of damage caused by wildlife are usually covered by Amica Mutual Insurance car insurance?

Amica Mutual Insurance car insurance usually covers various types of damage caused by wildlife, including collisions with deer, elk, moose, and other animals, as well as damage caused by hitting an animal carcass on the road.

Does Amica Mutual Insurance car insurance cover damage to the vehicle caused by hitting a deer?

Yes, Amica Mutual Insurance car insurance typically covers damage to the insured vehicle caused by hitting a deer or other wildlife. This coverage is usually included under the comprehensive coverage section of the policy.

Is there a deductible for claims related to wildlife damage under Amica Mutual Insurance car insurance?

Yes, there is usually a deductible for claims related to wildlife damage under Amica Mutual Insurance car insurance. The deductible amount can vary depending on the policy and coverage options chosen by the insured.

Are there any specific requirements or conditions for filing a wildlife damage claim with Amica Mutual Insurance?

Yes, there may be specific requirements or conditions for filing a wildlife damage claim with Amica Mutual Insurance. It is important to review the policy documents or contact the insurance provider directly to understand the specific requirements, such as reporting the incident promptly and providing necessary documentation.

Does Amica Mutual Insurance car insurance cover

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.