Cheap Mazda CX-5 Car Insurance in 2026 (Save Big With These 10 Companies!)

Auto-Owners, Nationwide, and State Farm offer the best rates for cheap Mazda CX-5 car insurance, starting at just $54 a month. Discover why these companies lead with cost-effective policies for your Mazda CX-5, providing optimal coverage and exceptional service tailored to Mazda owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated November 2024

Company Facts

Min. Coverage for Mazda CX-5

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mazda CX-5

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mazda CX-5

A.M. Best Rating

Complaint Level

Pros & Cons

These providers excel in customer satisfaction and offer a variety of customizable options tailored to the needs of Mazda CX-5 owners. Understanding the factors that influence the cost of your policy, such as location, driving history, and vehicle safety features, can help you secure the best rates.

Our Top 10 Company Picks: Cheap Mazda CX-5 Car Insurance

Company Rank Monthly Rates Multi-Policy Discount Best For Jump to Pros/Cons

#1 10% $54 Employer Plans Auto-Owners

#2 15% $56 Local Agents Nationwide

#3 13% $59 Customer Satisfaction State Farm

#4 14% $62 Financial Stability Liberty Mutual

#5 11% $64 Older Drivers The Hartford

#6 12% $66 Flexible Policies Geico

#7 10% $69 Budget-Friendly Mercury

#8 10% $71 High-Risk Drivers USAA

#9 11% $74 Online Experience Travelers

#10 13% $76 Customizable Coverage Erie

Compare quotes and coverage options from these leading companies to ensure you receive the most cost-effective insurance for your Mazda CX-5. Unlock details in our articled “Best Mazda Car Insurance Discounts.”

Instantly compare quotes by entering your ZIP code above.

- Auto-Owners leads with the most cheap Mazda CX-5 insurance

- Coverage options cater to the specific safety features of the Mazda CX-5

- Policy customization allows Mazda owners to meet unique driving needs

#4 – Liberty Mutual: Best for Financial Stability

Pros

- Strong Financial Backing: Liberty Mutual’s excellent financial stability ensures reliable claims processing for Mazda CX-5 insurance.

- Tailored Discounts: Offers a 14% multi-policy discount, benefiting Mazda CX-5 owners who bundle their insurance needs. If you want to learn more about the company, head to our article titled “Liberty Mutual Review & Ratings.”

- Competitive Premiums: With monthly rates starting at $62, Liberty Mutual balances cost and coverage for Mazda CX-5 owners effectively.

Cons

- Higher Base Rates: Base rates for Mazda CX-5 insurance might be higher than some competitors, even with discounts.

- Policy Customization Limits: While stable, Liberty Mutual may offer less customization for individual Mazda CX-5 insurance needs compared to others.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Erie: Best for Older Drivers

Pros

- Senior-Focused Benefits: Erie offers tailored benefits and discounts for older Mazda CX-5 drivers, enhancing affordability and accessibility.

- Competitive Multi-Policy Discounts: An 11% discount on bundling policies suits Mazda CX-5 owners looking for comprehensive coverage.

- Reasonable Rates: Monthly rates of $64 make Erie a competitive choice for Mazda CX-5 insurance among senior drivers, as highlighted in the “Erie Insurance Review & Ratings.”

Cons

- Age-Based Limitations: Some benefits and discounts for the Mazda CX-5 may be restricted to older drivers, limiting wider appeal.

- Coverage Specificity: While excellent for seniors, Erie’s Mazda CX-5 insurance offerings may not be as competitive for younger drivers.

#6 – Geico: Best for Flexible Policies

Pros

- Adaptable Coverage Options: Geico offers a variety of flexible policy options that cater to the unique needs of Mazda CX-5 owners.

- Solid Discounts: Provides a 12% multi-policy discount, appealing to Mazda CX-5 owners looking to bundle insurance products.

- Check out insurance savings in our complete article titled “Geico Car Insurance Discounts.”

- Affordable Premiums: With rates starting at $66, Geico ensures Mazda CX-5 insurance remains accessible to a broad customer base.

Cons

- Variable Customer Service: Customer service quality can fluctuate, potentially affecting Mazda CX-5 owners’ satisfaction.

- Rate Fluctuations: Premiums for Mazda CX-5 insurance may vary significantly based on geographic and demographic factors.

#7 – Mercury: Best for Budget-Friendly

Pros

- Cost Efficiency: Mercury offers highly competitive rates for Mazda CX-5 insurance, starting at just $69 a month. See more details on our article titled “Mercury Insurance Review & Ratings.”

- Focused on Affordability: Tailored for budget-conscious Mazda CX-5 owners, Mercury emphasizes low-cost insurance solutions.

- Good Multi-Policy Discount: A 10% discount for bundling various insurance policies makes it attractive for Mazda CX-5 owners.

Cons

- Basic Coverage Options: Mercury may offer more limited coverage features for Mazda CX-5 compared to premium insurers.

- Regional Availability: Services and offerings for Mazda CX-5 insurance may not be consistently available across all regions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for High-Risk Drivers

Pros

- Tailored to High-Risk Profiles: USAA provides specialized services and rates for Mazda CX-5 owners with high-risk driving histories.

- Competitive Rates for Risky Profiles: Attractive insurance options at $71 per month for those who often find premiums prohibitive. Access comprehensive insights into our article titled “USAA Insurance Review & Ratings.”

- Robust Customer Service: Known for excellent customer support, ensuring Mazda CX-5 owners receive comprehensive help and guidance.

Cons

- Membership Restrictions: USAA’s services for Mazda CX-5 insurance are limited to military members and their families.

- Coverage Limitations: While supportive of high-risk drivers, options may be less flexible for those with a more stable driving record.

#9 – Travelers: Best for Online Experience

Pros

- Advanced Online Tools: Travelers offers an exceptional online platform, making insurance management easy for Mazda CX-5 owners.

- Customizable Policies: Offers a wide range of options that can be tailored specifically for the needs of Mazda CX-5 drivers. Delve into our evaluation of our article titled “Travelers Insurance Review & Ratings.”

- Competitive Multi-Policy Discount: An 11% discount on bundled policies enhances the appeal for those insuring a Mazda CX-5.

Cons

- Higher Online Dependency: Heavy reliance on online tools may deter Mazda CX-5 owners who prefer personal interaction.

- Premium Variability: While competitive, rates for Mazda CX-5 insurance may fluctuate based on extensive personal and vehicle data.

#10 – The Hartford: Best for Customizable Coverage

Pros

- Extensive Customization Options: As mentioned in our The Hartford insurance review & ratings, The Hartford provides highly customizable insurance policies tailored to Mazda CX-5 specifications.

- Focus on Mature Drivers: Offers tailored benefits for older drivers, making it a top choice for senior Mazda CX-5 owners.

- Strong Multi-Policy Discounts: A 13% discount for bundling policies, benefiting Mazda CX-5 owners looking for comprehensive coverage.

Cons

- Age-Focused Offerings: The Hartford’s focus on older drivers might limit its appeal to younger Mazda CX-5 owners.

- Premium Costs: Despite discounts, premiums for Mazda CX-5 insurance can be relatively higher due to tailored and extensive coverage options.

Mazda CX-5 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Auto-Owners $54 $90

Erie $64 $100

Geico $66 $102

Liberty Mutual $62 $98

Mercury $69 $105

Nationwide $56 $92

State Farm $59 $95

The Hartford $76 $113

Travelers $74 $110

USAA $71 $108

The table showcases the monthly rates for both minimum and full coverage across several insurance companies. Auto-Owners presents the most competitive rate for minimum coverage at $54, and also offers a reasonable full coverage option at $90. On the higher end, The Hartford charges $76 for minimum coverage and $113 for full coverage, reflecting the broad range in pricing.

Other insurers like Erie, Geico, and Liberty Mutual offer varying rates that balance affordability with comprehensive protection, demonstrating the diversity of options available for Mazda CX-5 owners seeking suitable car insurance.

Factors That Determine Mazda CX-5 Car Insurance Rates

Insurance companies consider several factors when determining the cost of car insurance for a Mazda CX-5. These factors include the driver’s age, gender, location, driving record, and credit history. Younger drivers generally have higher insurance rates compared to older and more experienced drivers. Additionally, male drivers often have higher insurance rates than females.

The location where the car is primarily driven also plays a role, as insurance rates can vary depending on the area’s crime rate and accident statistics. Furthermore, a clean driving record and good credit history can contribute to lower insurance rates. Another factor that can affect Mazda CX-5 car insurance rates is the vehicle’s safety features. Learn more in our guide titled “Safety Features Car Insurance Discount.”

Insurance companies consider safety features like anti-lock brakes, airbags, and electronic stability control, which can lower premiums by reducing accident risks. Repair or replacement costs for the Mazda CX-5 also affect rates, particularly if parts are expensive or scarce. Mazda CX-5 owners should weigh these factors to secure the best coverage at an affordable price.

Understanding the Insurance Coverage Options for Mazda CX-5

When it comes to insuring your Mazda CX-5, there are various coverage options to consider. The most basic form of coverage is liability insurance, which covers damages to other vehicles and property in the event of an accident that you are responsible for. Additionally, collision insurance covers damages to your own vehicle resulting from a collision. Read up on the “Best Collision Mitigation Car Insurance Discounts” for more information.

Comprehensive insurance provides coverage for non-collision-related damages such as theft, vandalism, and natural disasters. It is important to carefully evaluate these coverage options to determine the level of protection that suits your needs and budget. Another important coverage option to consider for your Mazda CX-5 is uninsured/underinsured motorist coverage.

This type of insurance protects you in the event that you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. Uninsured/underinsured motorist coverage helps cover medical expenses, lost wages, and other damages from accidents. Including this in your policy ensures adequate protection.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Quotes for Mazda CX-5

Insurance companies may offer different rates for insuring a Mazda CX-5. It is advisable to obtain quotes from multiple insurance providers to compare prices and coverage options. When comparing quotes, be sure to consider the deductibles, coverage limits, and any additional benefits or discounts offered by each provider.

Additionally, take into account the reputation and customer reviews of the insurance companies, as excellent customer service and reliability are crucial factors when selecting an insurance provider. It is also important to note that the cost of car insurance for a Mazda CX-5 can vary based on factors such as the driver’s age, driving record, and location.

Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums. Additionally, insurance rates can vary based on where the vehicle is primarily driven and parked, with urban areas typically having higher rates due to increased theft and accident risks. Therefore, providing accurate information when obtaining insurance quotes ensures the most precise pricing and coverage options.

Tips to Save Money on Mazda CX-5 Car Insurance

There are several ways to potentially save money on Mazda CX-5 car insurance. One effective strategy is to maintain a clean driving record by obeying traffic laws and avoiding accidents. Insurance companies typically offer discounts for safe driving records. Additionally, consider bundling your car insurance with other insurance policies, such as home or life insurance, as many insurance providers offer discounts for multiple policies.

Installing security devices, such as anti-theft systems or dashcams, can also potentially reduce your insurance premiums. Furthermore, taking defensive driving courses or maintaining good grades if you are a student can result in additional discounts. It is recommended to discuss these potential savings opportunities with your insurance provider to maximize your cost savings.

Choosing a higher deductible can reduce Mazda CX-5 car insurance premiums, but ensure it’s affordable if you need to claim. Also, frequently comparing quotes from various providers can help secure competitive rates. Use online tools to easily compare different quotes side by side. Delve into our evaluation of our guide titled “How can I track the progress of my car insurance claim with Nationwide?”

The Average Cost of Mazda CX-5 Car Insurance

While the actual cost of Mazda CX-5 car insurance varies depending on individual circumstances, it is helpful to understand the average cost. According to recent data, the average monthly cost of Mazda CX-5 car insurance in the United States is around $117. This cost can be higher or lower depending on factors such as the driver’s age, location, driving history, and the level of coverage chosen.

Melanie Musson Published Insurance Expert

It is important to keep in mind that this is just an average, and your own insurance rates may vary. It is also worth noting that insurance rates can vary between different insurance providers. While the average cost mentioned above provides a general idea, it is recommended to obtain quotes from multiple insurance companies to compare rates and coverage options.

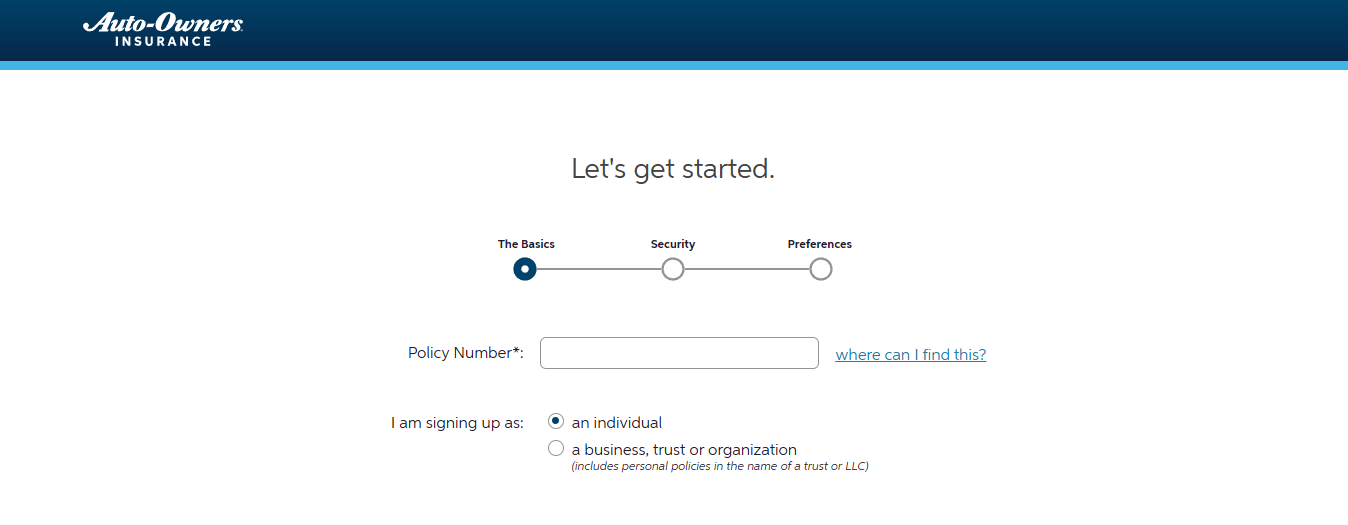

Additionally, taking steps to maintain a good driving record and considering factors such as bundling insurance policies or installing safety features in your Mazda CX-5 can potentially help lower your insurance premiums. To gain further insights, consult our comprehensive guide titled “How can I pay my Auto-Owners Insurance insurance premium?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts and Incentives for Insuring a Mazda CX-5

Insurance providers often offer discounts and incentives specifically for Mazda CX-5 owners. These discounts may include loyalty discounts for staying with the same insurance company for a certain period, discounts for owning multiple Mazda vehicles, or savings for being a member of certain professional organizations.

Be sure to ask your insurance provider about any available discounts or incentives related to insuring a Mazda CX-5. For a comprehensive analysis, refer to our detailed guide titled “Multi Vehicle Car Insurance Discount.”

Finding the Best Car Insurance Company for Your Mazda CX-5

Choosing the right car insurance company for your Mazda CX-5 requires careful consideration. In addition to comparing prices, it is important to research the reputation and financial stability of the insurance providers you are considering. Look for companies that have a strong customer service record and positive reviews from their clients.

Additionally, check if the insurance company offers convenient online tools for managing your policy and filing claims. By selecting a reliable and customer-friendly insurance provider, you can ensure a smooth and satisfactory insurance experience.

The Importance of Comprehensive Coverage for Your Mazda CX-5

Comprehensive coverage is an essential option to consider when insuring your Mazda CX-5. While liability and collision coverage protect against damages resulting from accidents, comprehensive coverage provides additional protection against a range of non-collision-related damages. This includes situations such as theft, vandalism, fire, natural disasters, and falling objects.

Comprehensive coverage can offer peace of mind and financial security in unforeseen circumstances, ensuring that you are adequately protected against potential risks that are beyond your control.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Your Driving Record Affects the Cost of Mazda CX-5 Car Insurance

Your driving record has a significant impact on the cost of Mazda CX-5 car insurance. Insurance companies consider factors such as traffic violations, accidents, and claims history when determining your insurance rates. A clean driving record with no accidents or violations generally results in lower insurance premiums, as it demonstrates responsible and safe driving habits.

On the other hand, a history of accidents or traffic tickets can lead to higher insurance costs. It is crucial to maintain a good driving record to keep your insurance rates as low as possible. For a comprehensive overview, explore our detailed resource titled “Best Safe Driver Car Insurance Discounts.”

Understanding the Deductible Options for Mazda CX-5 Insurance Policies

When selecting an insurance policy for your Mazda CX-5, it is important to understand the concept of deductibles. A deductible is the amount you are required to pay out of pocket before your insurance coverage takes effect. Deductibles can vary depending on the coverage type and the insurance company.

Typically, a higher deductible results in lower insurance premiums, but it also means you will need to cover a larger portion of the costs in the event of a claim. Therefore, it is crucial to choose a deductible amount that you can comfortably afford in case of an incident. To gain further insights, consult our comprehensive guide titled “What is the difference between a deductible and a premium in car insurance?”

Factors to Consider When Selecting the Right Amount of Coverage for Your Mazda CX-5

Choosing the appropriate amount of coverage for your Mazda CX-5 involves considering various factors. These include the value of your vehicle, your financial situation, and your personal comfort level. If you have a newer or more expensive Mazda CX-5, you may want to consider higher coverage limits to adequately protect your investment.

Laura Walker Former Licensed Agent

Additionally, if you have significant assets or savings, you may want to consider higher liability insurance coverage to provide greater financial protection in case of a lawsuit. It is important to strike a balance between adequate coverage and affordability to ensure your peace of mind.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Getting Affordable Car Insurance Quotes Specifically for a Mazda CX-5

If you are looking for affordable car insurance quotes specifically for your Mazda CX-5, there are a few tips to keep in mind. First, maintain a good driving record and avoid accidents and traffic violations. This can help you qualify for better insurance rates. To gain profound insights, consult our extensive guide titled “Car Accidents: What to do in Worst Case Scenarios.”

Also, consider bundling your car insurance with other insurance policies from the same provider to potentially receive a multi-policy discount. Additionally, comparing quotes from multiple insurance companies can help you find the best rates and coverage options available in the market. Finally, ask your insurance provider about any specific discounts or incentives offered for insuring a Mazda CX-5.

The Impact of Location on Mazda CX-5 Car Insurance Rates

As mentioned earlier, the location where your Mazda CX-5 is primarily driven can have a significant impact on your car insurance rates. Insurance companies consider factors such as crime rates, accident statistics, and population density when assessing insurance risks in different areas. Urban areas with higher population density and traffic often have higher insurance rates than rural or suburban areas.

Additionally, areas with higher crime rates may experience increased rates of theft and vandalism, leading to higher insurance premiums. It is important to be aware of these regional differences when budgeting for Mazda CX-5 car insurance. For additional details, explore our comprehensive resource titled “Is car theft covered by car insurance?”

Examining the Safety Features That Can Lower Your Mazda CX-5 Insurance Premiums

The Mazda CX-5 is equipped with several advanced safety features that can help lower your insurance premiums. These features include advanced driver assistance systems, such as lane departure warning, adaptive cruise control, and blind-spot monitoring. Additionally, the Mazda CX-5 has earned excellent safety ratings, which can also positively impact insurance rates.

Insurance companies often offer discounts for vehicles equipped with safety features that reduce the risk of accidents and injuries. Be sure to inform your insurance provider about these safety features to potentially receive any applicable discounts and lower your insurance costs. Discover insights in our guide titled “Cheapest Car Insurance Companies.”

Jeff Root Licensed Insurance Agent

In conclusion, Mazda CX-5 car insurance costs vary based on factors like age, location, driving record, and coverage level. By understanding these factors, exploring coverage options, comparing quotes, and utilizing discounts, you can secure optimal insurance at a reasonable cost. Regularly review and adjust your policy to match your evolving needs.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Frequently Asked Questions

What factors affect the cost of insurance for a Mazda CX-5?

The cost of insurance for a Mazda CX-5 can be influenced by various factors such as the driver’s age, location, driving history, coverage options, deductible amount, and the specific model and trim of the CX-5.

Gain deeper insights by perusing our article named “What age do you get cheap car insurance?”

Does the cost of insurance for a Mazda CX-5 vary by location?

Yes, the cost of insurance for a Mazda CX-5 can vary depending on the location. Insurance companies consider factors like crime rates, population density, and accident statistics in a particular area when determining insurance premiums.

Are there any discounts available for Mazda CX-5 car insurance?

Yes, many insurance providers offer discounts for Mazda CX-5 owners. These discounts can include safe driver discounts, multi-policy discounts, anti-theft device discounts, and good student discounts. It’s recommended to check with different insurance companies to explore all available discounts.

Is it more expensive to insure a new Mazda CX-5 compared to an older model?

In general, insuring a new Mazda CX-5 may be slightly more expensive compared to an older model. This is because new vehicles typically have a higher market value and may require more expensive repairs or replacement parts. However, other factors such as safety features and crash test ratings can also affect insurance rates.

Can I save money on Mazda CX-5 insurance by increasing my deductible?

Increasing your deductible can potentially lower your Mazda CX-5 insurance premiums. However, it’s important to consider your financial situation and ability to pay the deductible in case of an accident.

Uncover more by delving into our article entitled “What is Premium?”

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.