How to File an Car Insurance Claim With Arcoa Risk Retention Group Inc

A Step-by-Step Guide on How to File an Car Insurance Claim With Arcoa Risk Retention Group Inc: Simplifying the Process for a Hassle-Free Experience

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Licensed Insurance Agent

Kristine Lee is a licensed insurance agent and one of The Zebra’s in-house content strategists. With a background in copywriting, she covers the ins and outs of the home and car insurance industries. She has been a contributor to numerous publications focused on the nuances of insurance, including on The Points Guy.

Kristine Lee

Updated September 2024

Car insurance claims are an essential aspect of owning a vehicle. Accidents happen, and having the right coverage can make the difference between a smooth claims process and a frustrating experience. In this article, we will guide you through the process of filing a car insurance claim with Arcoa Risk Retention Group Inc, an insurance company renowned for its excellent customer service and comprehensive coverage options.

Understanding the Importance of Car Insurance Claims

Car insurance claims play a vital role in ensuring that policyholders receive the financial support they need after an accident or incident that damages their vehicle. Without a proper understanding of the claims process, policyholders may find themselves overwhelmed and unsure of what steps to take. By familiarizing yourself with the process, you can navigate the claims process confidently and ensure a smooth experience.

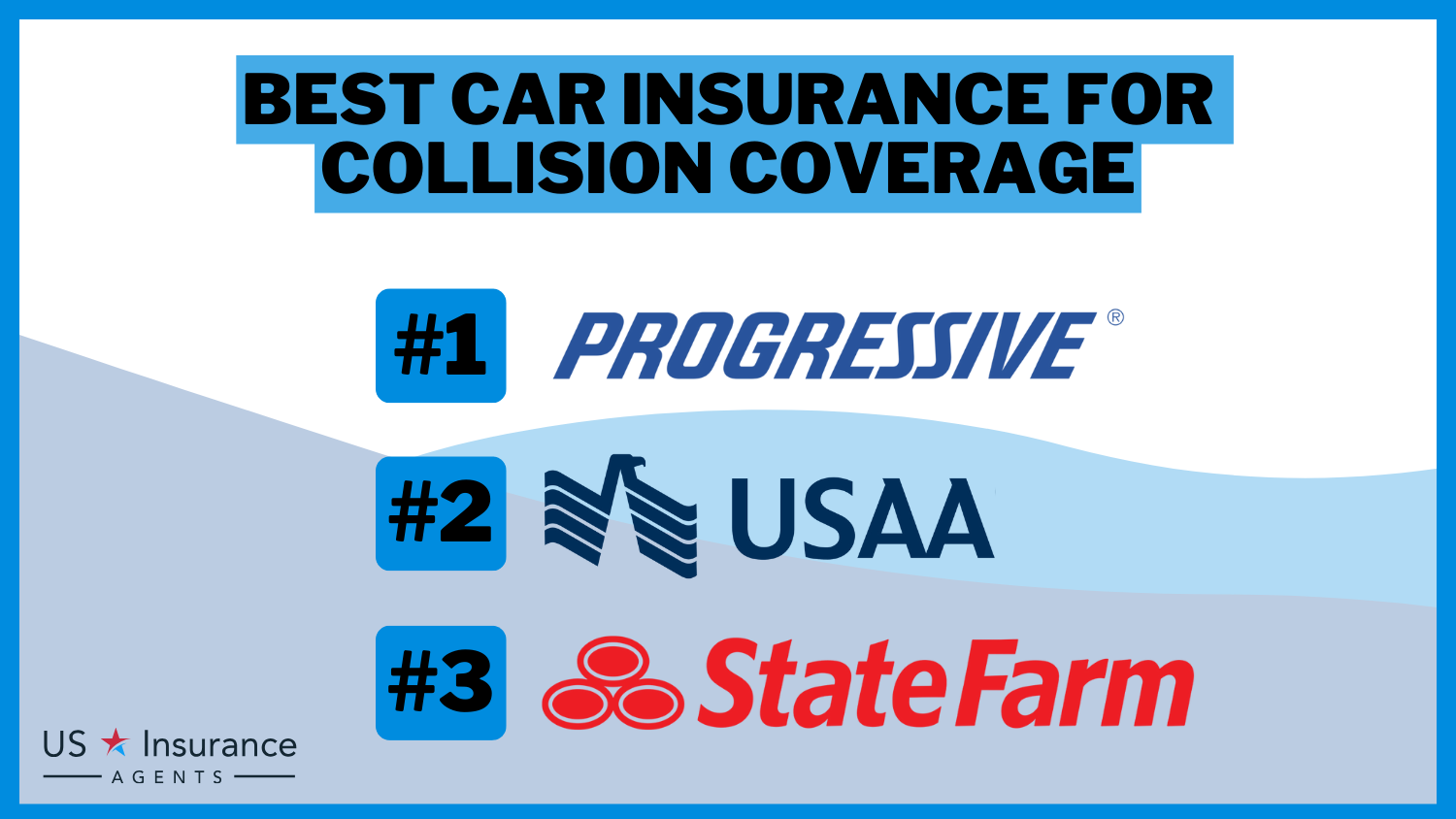

One important aspect of car insurance claims is understanding the different types of coverage available. Most car insurance policies include liability coverage, which helps pay for damages to another person’s vehicle or property if you are at fault in an accident. Additionally, comprehensive coverage can help cover damages to your vehicle caused by non-collision incidents such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, helps pay for damages to your vehicle if you are involved in a collision with another vehicle or object. By understanding the specific coverage options in your policy, you can ensure that you have the appropriate protection in place for various types of incidents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Introduction to Arcoa Risk Retention Group Inc

Arcoa Risk Retention Group Inc is a leading provider of car insurance coverage, known for its exceptional customer service and comprehensive policies. As a policyholder, you can rest assured that Arcoa will be there for you when you need it the most. From the moment you purchase a policy to the claims process, their team of professionals will guide you through every step, providing the support and expertise you need.

Arcoa Risk Retention Group Inc has been in the insurance industry for over 20 years, establishing a strong reputation for reliability and trustworthiness. With their extensive experience, they have developed a deep understanding of the unique risks faced by car owners and have tailored their policies to provide the most comprehensive coverage possible.

In addition to their exceptional customer service, Arcoa Risk Retention Group Inc also offers competitive rates and flexible payment options. They understand that every individual has different financial needs and strive to provide affordable insurance solutions without compromising on the quality of coverage.

The Benefits of Choosing Arcoa Risk Retention Group Inc for Your Car Insurance

When it comes to car insurance, choosing the right provider is crucial. Arcoa offers a range of benefits that make them an excellent choice for your car insurance needs. These benefits include extensive coverage options tailored to your specific needs, competitive premiums, excellent customer service, and a streamlined claims process. By selecting Arcoa as your car insurance provider, you can have peace of mind knowing that you have chosen a company that prioritizes your needs.

In addition to these benefits, Arcoa Risk Retention Group Inc also offers a variety of discounts and rewards programs for their car insurance policyholders. These programs can help you save money on your premiums and provide additional perks such as roadside assistance and rental car coverage. Arcoa understands the importance of affordability and convenience when it comes to car insurance, and they strive to provide their customers with the best value for their money.

Steps to Take Before Filing a Car Insurance Claim

Before filing a car insurance claim with Arcoa, there are several essential steps you should take to ensure a smooth and successful process. First, assess the damage and check if there are any immediate safety concerns. Next, gather relevant information such as the details of the incident, contact information of any involved parties or witnesses, and photographs of the damage. Additionally, it is crucial to review your insurance policy to understand your coverage and any applicable deductibles. By taking these steps, you will be well-prepared to file your claim with Arcoa.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Gathering the Necessary Information for Your Car Insurance Claim

When filing a car insurance claim with Arcoa, it is crucial to gather all the necessary information to support your case. This includes details about the incident, such as the date, time, and location, as well as a description of what happened. Additionally, gather any relevant documents, such as police reports, medical records, or repair estimates. The more information you provide, the smoother the claims process will be with Arcoa.

Contacting Arcoa Risk Retention Group Inc: Who to Reach Out To

When it comes to filing a car insurance claim with Arcoa, it is essential to know who to contact. Reach out to Arcoa’s claims department, which will guide you through the process and answer any questions you may have. Their knowledgeable representatives will assist you in understanding the necessary steps and documentation required for your claim.

Documentation Needed for Filing a Car Insurance Claim with Arcoa Risk Retention Group Inc

Documentation is a crucial aspect of filing a car insurance claim with Arcoa. To ensure a smooth claims process, make sure you have the following documents ready when filing your claim: your insurance policy details, incident report, photographs of the damage, repair estimates, any medical records if applicable, and any other supporting documentation relevant to your claim. By providing comprehensive documentation, you increase the chances of a successful and efficient claims process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Claims Process with Arcoa Risk Retention Group Inc

Filing a car insurance claim with Arcoa involves a well-defined process that ensures you receive the support you need in a timely manner. Once you have provided all the necessary information and documentation, Arcoa’s claims department will review your claim and assess its validity. Through clear communication, they will keep you updated on the progress of your claim, ensuring transparency throughout the process. Understanding the claims process can help manage expectations and reduce stress during an already challenging time.

Filling Out the Car Insurance Claim Form: A Step-by-Step Guide

When filing a car insurance claim with Arcoa, you will need to complete a claim form. The form will require you to provide details about the incident, including the date, time, and location, as well as a description of what occurred. Additionally, you will need to provide your policy details, contact information, and any supporting documentation. The claim form is designed to gather all the necessary information to process your claim efficiently.

Tips for Providing Accurate and Detailed Information in Your Car Insurance Claim

Accurate and detailed information is crucial when filing a car insurance claim. To ensure a smooth process, follow these tips:1. Be thorough: Provide a detailed account of the incident, including all relevant information.2. Use accurate language: Use precise and factual language when describing the accident or damage.3. Include supporting documentation: Attach any relevant documents to support your claim, such as photographs or repair estimates.4. Provide contact information: Ensure that your contact information is correct and up-to-date for seamless communication with Arcoa.By following these tips, you can provide precise and detailed information, increasing the chances of a successful claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Submitting Your Car Insurance Claim: Methods and Options Available with Arcoa Risk Retention Group Inc

Arcoa understands that flexibility and convenience are essential when it comes to submitting a car insurance claim. They offer various options for claim submission, including online forms, email, and phone. Choose the method that works best for you and ensures a smooth and hassle-free claims process.

What to Expect After Submitting Your Car Insurance Claim with Arcoa Risk Retention Group Inc

After submitting your car insurance claim with Arcoa, you can expect timely and transparent communication throughout the process. Arcoa’s claims department will review your claim and assess its validity. They will keep you informed about the progress of your claim, ensuring you are aware of any updates or additional information required. Rest assured that Arcoa works diligently to process claims efficiently and provide the support you need during this time.

Evaluating the Damage: How Arcoa Risk Retention Group Inc Assesses Car Insurance Claims

Arcoa employs professionals who specialize in evaluating car insurance claims. Their experts will assess the damage sustained by your vehicle, ensuring prompt and accurate evaluation. By employing a rigorous assessment process, Arcoa aims to provide fair and efficient resolution to your claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Role of Adjusters in the Car Insurance Claims Process with Arcoa Risk Retention Group Inc

Adjusters play a crucial role in the car insurance claims process with Arcoa. They are responsible for investigating and evaluating the claim, determining liability, and negotiating settlements. Arcoa’s team of experienced adjusters will guide you through the process, ensuring fair and accurate assessments to reach a satisfactory resolution.

Resolving Disputes or Issues with Your Car Insurance Claim through Arcoa Risk Retention Group Inc

In some cases, disputes or issues may arise during the car insurance claims process. If you experience any concerns or disagreements, Arcoa’s claims department is available to help resolve these matters. Their team of professionals will address your concerns and work towards a fair and satisfactory resolution. By maintaining open communication with Arcoa, you can navigate any challenges with confidence.

Timeframe for Processing and Receiving Payment for Your Car Insurance Claim

Arcoa understands the importance of timely processing and payment for car insurance claims. While the timeframe may vary depending on the specifics of your claim, Arcoa strives to process claims efficiently to provide prompt assistance. After the evaluation process, once your claim has been approved, you can expect to receive payment within a reasonable timeframe. This promptness sets Arcoa apart, ensuring that you can start the necessary repairs or replacements promptly.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Deductibles and Coverage Limits in Your Car Insurance Policy with Arcoa Risk Retention Group Inc

It is essential to understand the deductibles and coverage limits outlined in your car insurance policy with Arcoa. Deductibles are the amount you are responsible for paying out of pocket before the insurance coverage takes effect. Coverage limits indicate the maximum amount of coverage provided under your policy. Familiarize yourself with these terms to ensure you have a clear understanding of your financial responsibilities and how Arcoa will support you in various scenarios.

Common Mistakes to Avoid When Filing a Car Insurance Claim

When filing a car insurance claim, it is crucial to avoid common mistakes that can detract from your chances of a successful claim. Some common mistakes include:1. Failing to gather sufficient evidence: Ensure you collect all the necessary information and documentation to support your claim.2. Delaying the claim: File your claim as soon as possible after the incident to avoid potential complications.3. Providing incomplete or inaccurate information: Detail the incident accurately and provide all the necessary information to avoid delays in processing your claim.4. Neglecting to review your policy: Familiarize yourself with the coverage and deductibles outlined in your policy to avoid surprises.By avoiding these mistakes, you can enhance your chances of a seamless car insurance claims process with Arcoa.

Tips for Maximizing Your Settlement Amount with Arcoa Risk Retention Group Inc

To maximize your settlement amount when filing a car insurance claim with Arcoa, consider the following tips:1. Provide comprehensive documentation: Submit all relevant documents, such as photographs, repair estimates, and medical records, to support the extent of your damages.2. Cooperate with adjusters: Work closely with Arcoa’s team of adjusters, providing them with any additional information or clarifications they may require.3. Keep a meticulous record: Maintain a detailed record of all expenses related to the incident, such as medical bills or rental car costs, to ensure you receive proper reimbursement.4. Seek professional advice if necessary: If you have any doubts or concerns about your claim, consult with a legal or insurance professional to ensure you are receiving fair compensation.By following these tips, you can maximize your settlement amount and ensure that you receive the appropriate compensation for your damages.In conclusion, filing a car insurance claim with Arcoa Risk Retention Group Inc is a straightforward process when you understand the necessary steps and requirements. By following the guidelines outlined in this article, you can navigate the claims process with confidence, ensuring a prompt and satisfactory resolution. Remember to stay organized, provide accurate information, and communicate effectively with Arcoa’s claims department, all of which will contribute to a positive claims experience with Arcoa.

Frequently Asked Questions

What is Arcoa Risk Retention Group Inc?

Arcoa Risk Retention Group Inc is an insurance company that specializes in providing car insurance coverage.

How do I file a car insurance claim with Arcoa Risk Retention Group Inc?

To file a car insurance claim with Arcoa Risk Retention Group Inc, you can follow these steps:

1. Contact Arcoa Risk Retention Group Inc’s claims department or customer service.

2. Provide the necessary information about the incident, such as the date, time, and location of the accident, as well as details about the parties involved and any witnesses.

3. Provide any supporting documentation, such as photographs, police reports, or medical records.

4. Cooperate with Arcoa Risk Retention Group Inc’s claims adjuster throughout the process and provide any additional information or documentation as requested.

What information do I need to provide when filing a car insurance claim?

When filing a car insurance claim, you typically need to provide the following information:

– Your policy number and personal details (name, contact information, etc.).

– Date, time, and location of the incident.

– Description of what happened and how the accident occurred.

– Information about the parties involved, including their names, contact details, and insurance information if available.

– Any supporting documentation, such as photographs, police reports, or medical records.

What should I do after a car accident before filing an insurance claim?

After a car accident, it is important to take the following steps before filing an insurance claim:

1. Ensure your safety and the safety of others involved by moving to a safe location if possible.

2. Check for injuries and call emergency services if necessary.

3. Exchange information with the other party involved, including names, contact details, and insurance information.

4. Take photographs of the accident scene, including any damages to vehicles or property.

5. Gather witness information, if applicable.

6. Report the accident to the police, especially if there are injuries or significant damages.

7. Notify your insurance company, such as Arcoa Risk Retention Group Inc, as soon as possible to initiate the claims process.

How long does it take to process a car insurance claim with Arcoa Risk Retention Group Inc?

The time it takes to process a car insurance claim with Arcoa Risk Retention Group Inc can vary depending on the complexity of the claim and the availability of information. Generally, the process can take anywhere from a few days to a few weeks. It is recommended to stay in touch

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.