Best Business Insurance for Advertising Firms in 2026 (Top 10 Companies)

Best business insurance for advertising firms reveals Travelers, Nationwide, and State Farm lead with competitive rates and offering discounts of up to 10%. Following the top is Nationwide and StatFarm providing excellent coverage options ensuring your advertising company is well-protected.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated January 2025

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Advertising Firms

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Advertising Firms

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Advertising Firms

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

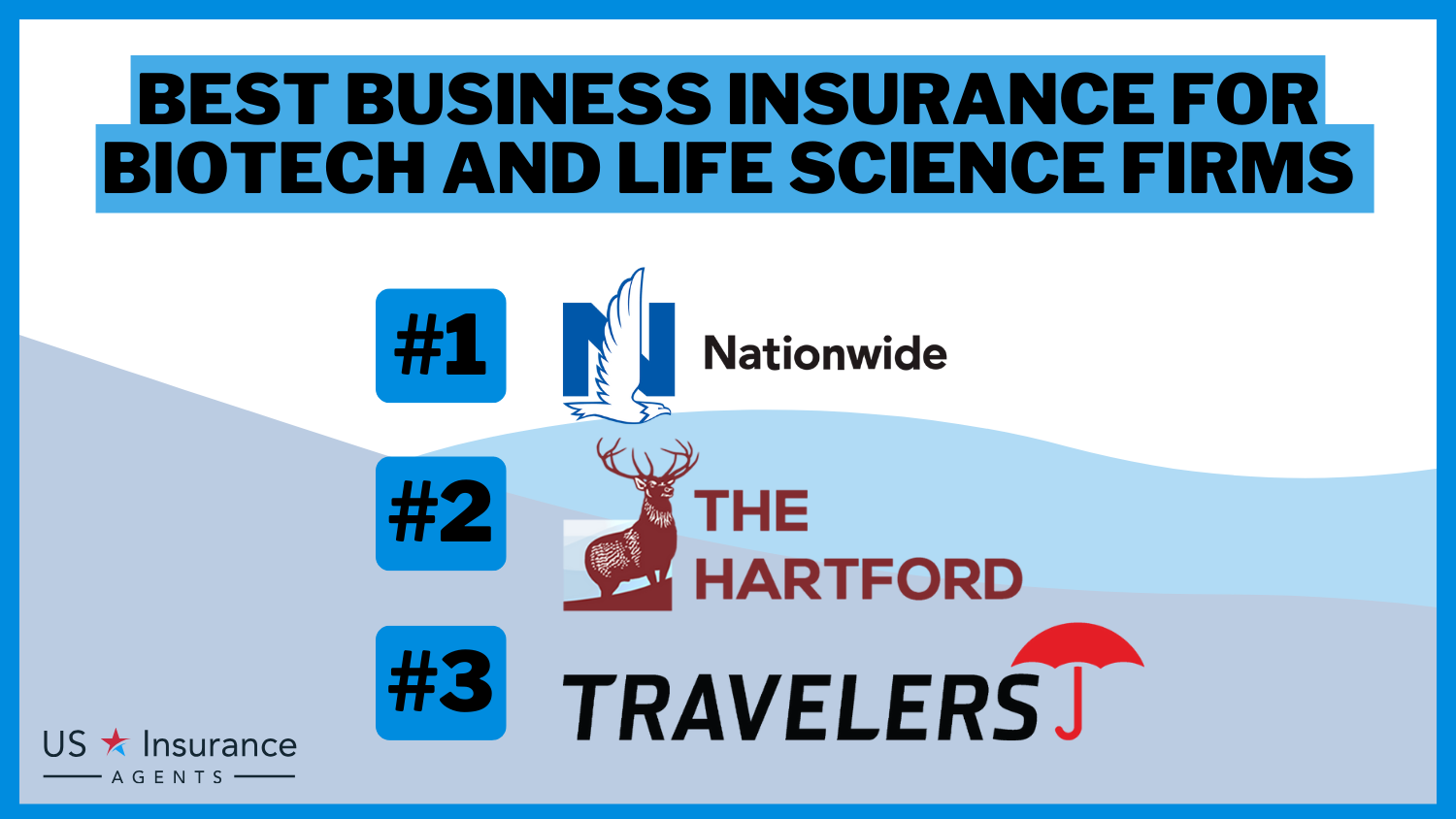

18,155 reviewsThe top picks for best business insurance for advertising firms are Travelers, Nationwide, and State Farm, known for their exceptional coverage and competitive rates.

These companies stand out for their comprehensive policies tailored to meet the unique needs of advertising firms, ensuring robust protection against industry-specific risks.

Our Top 10 Company Picks: Best Business Insurance for Advertising Firms

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 10% | Accident Forgiveness | Travelers | |

| #2 | 25% | 20% | Usage Discount | Nationwide | |

| #3 | 17% | 10% | Many Discounts | State-Farm | |

| #4 | 25% | 10% | Customizable Polices | Liberty Mutual |

| #5 | 5% | 30% | Online Convenience | Progressive | |

| #6 | 25% | 30% | Add-on Coverages | Allstate | |

| #7 | 5% | 10% | Local Agents | Farmers | |

| #8 | 29% | 10% | Student Savings | American-Family | |

| #9 | 15% | 10% | Policy Options | Hanover | |

| #10 | 25% | 10% | 24/7 Support | Erie |

This guide dives into the critical reasons these insurers top the list, providing advertising firms with the insight needed to choose the best coverage for their business.

Enter your ZIP code above to get started on comparing business insurance quotes.

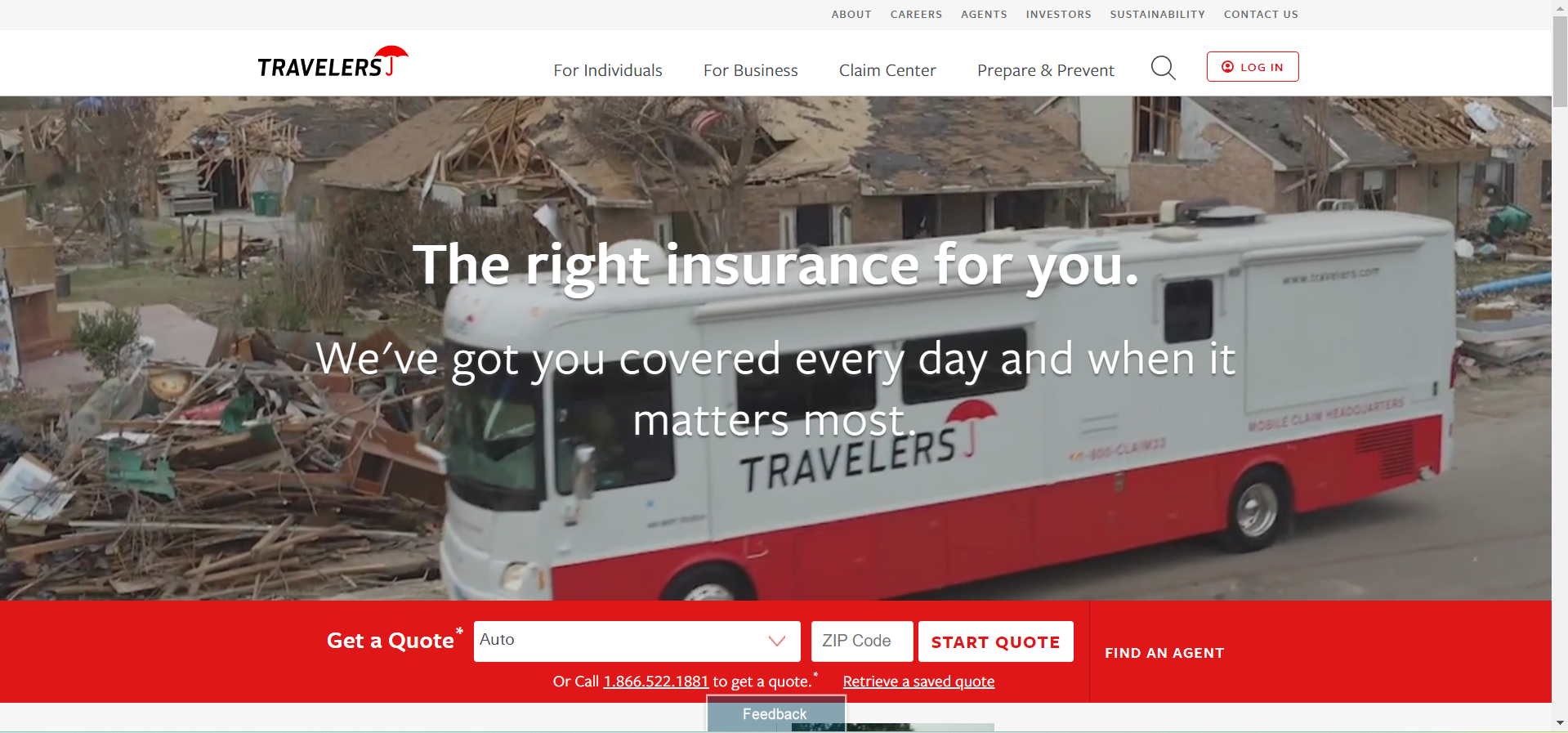

#1 – Travelers: Top Overall Pick

Pros

- Substantial Savings: Travelers insurance review & ratings offers up to a 10% multi-policy discount, beneficial for advertising firms seeking to lower their insurance costs.

- Diverse Discounts: Provides a variety of discounts, including accident forgiveness, to cater to the unique needs of advertising firms.

- Competitive Rates: Features competitive rates for good drivers, making it a cost-effective choice for advertising firms.

Cons:

- Limited Low-Mileage Discounts: Offers limited options for low-mileage discounts, potentially missing out on savings for firms with minimal vehicular use.

- Discount Cap: The multi-policy discount is capped at 10%, restricting the maximum savings available for firms purchasing bundled policies.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Usage-Based Discounts

Pros:

- Cost-Effectiveness: Offers competitive rates for good drivers, making it a cost-effective choice for business insurance for advertising firms.

- Usage-Based Discounts: Nationwide insurance review & ratings highlights a strong emphasis on usage-based discounts, rewarding efficient and safe business operations.

- Insurance Options Diversity: Offers a widely acclaimed brand that supplies a varied selection of insurance solutions.

Cons:

- Discount Limitations: The multi-policy discount may not be as substantial for some advertising firms, potentially impacting overall savings.

- Limited Low-Mileage Discounts: Offers limited options for low-mileage discounts, which could be a downside for firms with minimal on-the-road activity.

#3 – State Farm: Best for Diverse Discounts

Pros:

- Variety of Discounts: A wide range of discount opportunities are available for various customer needs.

- Savings on Bundling: Customers can save up to 17% by bundling multiple policies.

- Good Driver Rewards: Competitive insurance rates are offered to drivers with good records.

Cons:

- Limited Low-Mileage Discounts: The State Farm insurance review & ratings indicate limited discount opportunities for low-mileage drivers.

- Discount Cap: The multi-policy discount is capped at a maximum of 17%.

#4 – Liberty Mutual: Best for Customizable Policies

Pros:

- Significant Savings: Secure up to 25% in savings with the multi-policy discount.

- Customizable Coverage: Customize policies to perfectly fit individual coverage needs.

- Industry Competitiveness: Take advantage of competitive rates that distinguish us within the industry.

Cons:

- Limited Low-mileage Savings: In Liberty Mutual review & ratings, it’s noted that the options for low-mileage discounts are somewhat restricted

- Savings Cap: The multi-policy discount is maxed out at 25%, setting a limit on potential savings.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Online Convenience

Pros

- Affordability: Competitive insurance rates are offered with a notable multi-policy discount of up to 30%.

- Convenience: Progressive insurace review & ratings have a strong emphasis on online management tools enhances user convenience.

- Diversity: A broad spectrum of coverage options and add-ons is available to meet various insurance requirements.

Cons

- Restrictions on Discounts: Limited low-mileage discount options are available, which may not cater to infrequent drivers.

- Discount Limitation: The multi-policy discount is capped at 5%, potentially diminishing the benefits for customers with multiple policies.

#6 – Allstate: Best for Add-On Coverages

Pros:

- Multi-Policy Discount: AllState offers up to a 25% discount for customers who bundle multiple policies, leading to significant savings.

- Customizable Coverage: A broad selection of add-on coverages are available, allowing AllState customers to tailor their protection extensively.

- Competitive Rates for Safe Drivers: AllState insurance review & ratings provides competitive insurance rates for good drivers, rewarding those with safe driving records.

Cons

- Limited Low-Mileage Discounts: AllState’s options for discounts based on low mileage are limited, which may be a drawback for infrequent drivers.

- Cap on Multi-Policy Discounts: Although AllState’s multi-policy discounts are substantial, they are capped at 30%, which limits the maximum savings for customers bundling various policies.

#7 – Farmers: Best for Personalized Service

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Student Savings

Pros

- Substantial Savings: American Family offers up to a 29% discount on multi-policy bundles, leading to significant savings for customers.

- Student Savings: Eligible students can access special savings with American Family, acknowledging their academic efforts.

- Competitive Rates: For those with a clean driving record, American Family insurance review & ratings provides competitively priced premiums.

Cons

- Limited Low-Mileage Discounts: American Family has restricted options for those seeking discounts based on low mileage, potentially missing out on savings for infrequent drivers.

- Discount Cap: The multi-policy discount offered by American Family maxes out at 29%, limiting the potential for additional savings regardless of the number of bundled policies.

#9 – The Hanover: Best for Policy Options

Pros:

- Savings: Up to 15% off with The Hanover’s insurance review and ratings offer multi-policy discount for bundled insurance options.

- Customization: Offers a wide range of customizable policy options to meet diverse needs.

- Competitive Rates: The Hanover features industry-competitive pricing across its insurance products.

Cons:

- Limited Low-Mileage Discounts: Fewer savings opportunities for those who drive less with The Hanover.

- Discount Cap: The multi-policy discount is capped at 15%, limiting the savings potential for extensive bundling.

#10 – Erie: Best for Customer Support

Pros:

- Substantial Savings: Erie offers up to a 25% multi-policy discount, rewarding customers who bundle multiple policies with significant savings.

- Competitive Rates: For those with a clean driving record, Erie provides competitive rates, ensuring good drivers can enjoy lower premiums.

- 24/7 Support: Erie insurance review and ratings ensures customer assistance is always available, with access to 24/7 support for any queries or issues.

Cons:

- Limited Low-Mileage Discounts: Erie’s offerings for low-mileage discounts are limited, which may not meet the needs of infrequent drivers.

- Discount Cap: The multi-policy discount at Erie is capped at 25%, setting a limit on the maximum savings customers

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Insurance for Advertising Firms

Advertising firms, as integral players in the dynamic realm of marketing and promotion, are exposed to an array of potential risks and liabilities inherent to their operations. From client disputes to unexpected accidents, the nature of their work entails a myriad of uncertainties that can disrupt their business continuity and financial stability.

Melanie Musson Published Insurance Expert

General liability insurance protects advertising firms against third-party injury or property damage claims, covering medical and legal costs. Media liability insurance, designed for agencies, covers legal expenses and damages from professional errors or omissions.

Business Insurance Monthly Rates for Advertising Firms by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $220 | $440 |

| Chubb | $225 | $450 |

| Farmers | $215 | $430 |

| Liberty Mutual | $230 | $460 |

| Nationwide | $205 | $410 |

| Progressive | $210 | $420 |

| State Farm | $195 | $390 |

| The Hartford | $220 | $440 |

| Travelers | $200 | $400 |

| USAA | $190 | $380 |

A Business Owner’s Policy combines general liability with property insurance, offering a broad coverage package. Workers’ compensation is essential for employee injuries, covering medical bills and lost wages, and is legally required. Cyber liability insurance shields against data breach costs and legal fees.

These types of insurance provide comprehensive coverage for the unique risks faced by advertising firms. By having the right insurance policies in place, agencies can focus on their core business operations with peace of mind knowing they are protected from potential financial losses and legal liabilities.

The Factors of Cost for Insurance in Advertising Firms

The cost of insurance for advertising firms can fluctuate significantly, contingent upon a multitude of variables. Here are some factors that can influence the cost:

- Size of the Agency: The size of the agency, including its annual revenue and number of employees, can impact insurance costs. Larger agencies may have higher premiums due to increased operations and potential risks.

- Nature of the Work: Certain advertising specialties, such as digital marketing or social media management, may have different risk profiles and, consequently, different insurance premiums. For a comprehensive analysis, refer to our detailed guide titled “How does the insurance company determine my premium?“

- Coverage Limits and Deductibles: The coverage limits and deductibles you choose for your insurance policies can influence the cost. Higher coverage limits and lower deductibles generally result in higher premiums.

- Claims History: A history of previous claims or lawsuits can impact insurance costs. Agencies with a track record of claims may face higher premiums due to the perceived risk.

- Location: The geographic location of the agency can also affect insurance costs. Factors such as local regulations, litigation trends, and regional risks can influence premiums.

It’s important to note that each advertising agency is unique, and insurance costs will vary accordingly. To determine the specific cost of insurance for your agency, it’s best to consult with insurance providers who can assess your needs and provide accurate quotes based on your specific circumstances.

Furthermore, evolving market trends, regulatory changes, and emerging risks within the advertising landscape can also impact insurance costs, necessitating a dynamic approach to risk management within these firms.

Obtaining Insurance for Advertising Agency

Whether you’re a seasoned professional or just starting out, navigating the world of business insurance can seem daunting. However, securing the right coverage for your media or advertising agency doesn’t have to be complicated. Follow these three easy steps to secure the right insurance policy for your business:

- Provide Your Company Information: Have your business details readily available, including revenue and the number of employees.

- Complete the Online Application: Fill out the application form, providing the necessary information about your agency.

- Purchase a Policy: Once you’ve completed the application, you can purchase a policy online. Licensed insurance agents work with top-rated U.S. providers to ensure you receive the appropriate coverage for your media or ad agency, whether you work independently or have employees.

By following these straightforward steps, you can ensure that your media or advertising agency is adequately covered, giving you peace of mind to focus on what you do best.

And as always, if you have any questions or need further assistance, don’t hesitate to reach out to licensed insurance professionals for guidance tailored to your specific situation.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Business Insurance for Advertising Firms

Discover how advertising firms navigate business insurance choices through five case studies. In this series of case studies, we delve into how these firms strategically navigate their insurance needs, highlighting five distinct pathways to safeguarding success.

- Case Study #1 – Travelers Safeguarding Success: Travelers emerged as their top choice, providing a robust 10% multi-policy discount, accident forgiveness, and competitive rates. AdVantage values Travelers for its excellence in the dynamic world of business insurance.

- Case Study #2 – Nationwide Navigating Usage-Based Discounts: Nationwide became their go-to choice, offering competitive rates for good drivers and a strong emphasis on usage-based discounts. AdSolutions benefits from Nationwide’s diverse range of insurance options.

- Case Study #3 – State Farm Discount Diversity Dynamo: State Farm proved to be their best match, boasting diverse discount options, including an impressive 17% multi-policy discount. PixelPerfect appreciates State Farm’s competitive rates and the variety of discounts tailored to their needs.

- Case Study #4 – Progressive Protection Perks: Progressive stood out for its innovative protection perks, including the Snapshot program, which personalizes rates based on driving habits. The company particularly values Progressive’s commitment to technology-driven solutions that align with their forward-thinking business model.

- Case Study #5 – Liberty Mutual Customization King: Liberty Mutual shone through with its unparalleled customization options, allowing businesses to tailor their policies down to the finest detail. With offerings like the Business Owner’s Policy (BOP) that combines property and liability insurance into one convenient package, and a range of industry-specific solutions.

These examples emphasize the importance of tailored insurance solutions for advertising firms’ success and security. As we conclude our journey through these case studies, it’s evident that the landscape of business insurance for advertising firms is multifaceted, requiring a nuanced approach to coverage selection.

Jeff Root Licensed Life Insurance Agent

From Travelers’ robust discounts to Liberty Mutual’s unmatched customization options, each firm has found a unique ally in securing their operations. Through these examples, we gain insights into the vital role insurance plays in fostering resilience and growth within the advertising sector.

Conclusion: Best Business Insurance for Advertising Firms

Business insurance is crucial for advertising firms to protect themselves from a wide range of risks and liabilities. Advertising firms face unique challenges, such as potential lawsuits over published content, defamation claims, copyright infringement, and cyber threats.

It’s advisable to seek quotes from multiple insurance providers to find the most cost-effective options that meet your agency’s unique requirements. By investing in comprehensive business insurance, advertising firms can focus on their core operations, knowing they are well-protected against potential financial losses, lawsuits, and other unforeseen circumstances.

Find the best commercial insurance for your business needs by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

What factors influence the cost of insurance for advertising firms?

The cost of insurance for advertising firms can vary based on factors such as the size of the agency, annual revenue, number of employees, coverage limits, and deductibles. Smaller agencies generally pay lower premiums compared to larger companies. Consult with insurance providers to get accurate quotes based on your agency’s specific circumstances.

Why is comprehensive business insurance crucial for advertising firms?

Comprehensive business insurance is crucial for advertising firms as it protects them from a wide range of risks and liabilities. This includes potential lawsuits over published content, defamation claims, copyright infringement, cyber threats, and accidents involving agency-owned vehicles. Having the right insurance coverage provides peace of mind and financial protection.

Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

What are the key types of insurance that advertising firms require?

Advertising firms require various types of insurance, including general liability insurance, media liability insurance, business owner’s policy (BOP), workers’ compensation insurance, cyber liability insurance, and commercial auto insurance. These policies provide comprehensive coverage for the unique risks faced by advertising firms.

To gain further insights, consult our comprehensive guide titled “What is Worker’s compensation?”

Can insurance coverage for advertising firms be customized?

Yes, insurance coverage can be customized to meet the specific needs of advertising firms. Working with insurance providers allows agencies to tailor their coverage based on factors such as the nature of their work, size of the agency, and unique risks they face. Customization ensures that the agency has the appropriate level of protection.

How does the process of obtaining business insurance for advertising firms work?

Obtaining business insurance for advertising firms is a straightforward process. Agencies can complete an online application, providing necessary details about their business. Insurance professionals then work with top-rated U.S. providers to find the right coverage. Policies can be purchased online, and a certificate of insurance can be obtained for proof of coverage.

What are the best business insurance companies for advertising firms in 2024?

Travelers, Nationwide, and State Farm are considered the best business insurance providers for advertising firms in 2024. These companies offer competitive rates, with an average monthly rate of $99, and discounts up to 10%, ensuring comprehensive coverage tailored to the unique needs of advertising firms.

To learn more, check out our Best Business Insurance: A Complete Guide

What are business insurance ads?

Business insurance ads are promotional materials designed to inform and attract businesses to insurance products and services. These ads can appear in various formats, including online banners, social media posts, television commercials, and print advertisements.

What are the benefits of having a Business Owner’s Policy (BOP) for advertising firms?

A Business Owner’s Policy (BOP) for advertising firms combines general liability insurance and property insurance into one package. This policy offers broad coverage, including protection against property damage, bodily injury, and business interruption. It is beneficial because it simplifies management and can be more cost-effective than purchasing separate policies.

Why should advertising agencies consider commercial auto insurance?

Advertising agencies that own or use vehicles for business purposes should consider commercial auto insurance. This policy covers liability and physical damage in the event of vehicle-related accidents. It ensures that damages, medical expenses, and legal costs are covered, which is crucial for agencies frequently on the road for shoots, client meetings, or other business activities.

For additional details, explore our comprehensive resource titled “Commercial Auto Insurance: A Complete Guide.”

How does media liability insurance protect advertising agencies?

Media liability insurance is crucial for advertising agencies as it covers legal claims arising from the content they produce and distribute. This includes protection against allegations of defamation, invasion of privacy, copyright infringement, and errors in content. It helps agencies handle the financial repercussions of such claims, preserving their reputation and operational stability.

What role does cyber liability insurance play for advertising agencies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.