Cheapest Car Insurance for 18-Year-Old Drivers in 2026 (Save With These 10 Companies!)

Progressive, USAA, and State Farm offer the cheapest car insurance for 18-year-old drivers, with rates starting at $88. These companies understand the unique needs of 18-year-old drivers, offering tailored coverage and discounts to ensure affordability and quality protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

Company Facts

Min. Coverage for 18-Year-Old Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for 18-Year-Old Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for 18-Year-Old Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

The cheapest car insurance for 18-year-old drivers are offered by Progressive, USAA, and State Farm, with rates starting at $88. These top providers prioritize affordability without compromising coverage, making them ideal choices for young drivers.

From Progressive’s customizable options to USAA’s military savings and State Farm’s abundance of discounts, each company offers tailored solutions to suit the needs of 18-year-old drivers. When comparing rates and benefits, it’s clear that these three companies stand out as the best options for affordable and reliable car insurance for young drivers.

Our Top 10 Company Picks: Cheapest Car Insurance for 18-Year-Old Drivers

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $88 | A++ | Military Savings | USAA | |

| #2 | $125 | A++ | Many Discounts | State Farm | |

| #3 | $164 | A+ | Policy Options | Esurance | |

| #4 | $167 | A+ | Usage Discount | Nationwide | |

| #5 | $178 | A | Student Savings | American Family | |

| #6 | $223 | A+ | Add-on Coverages | Allstate | |

| #7 | $271 | A | Local Agents | Farmers | |

| #8 | $279 | A | Customizable Polices | Liberty Mutual | |

| #9 | $281 | A+ | Online Convenience | Progressive | |

| #10 | $310 | A++ | Accident Forgiveness | Travelers |

With a little understanding and some smart strategies, it is possible for 18-year-old drivers to find affordable car insurance without compromising on coverage.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring the Factors Affecting Car Insurance Rates for 18-Year-Olds

Understanding the factors impacting car insurance rates for 18-year-olds involves considering a clean driving record, coverage types such as minimum and full coverage car insurance, insurance providers, driving experience, vehicle type, and location.

Car Insurance Monthly Rates for 18-Year-Old Drivers by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $223 | $519 |

| American Family | $178 | $414 |

| Esurance | $164 | $513 |

| Farmers | $271 | $629 |

| Liberty Mutual | $279 | $626 |

| Nationwide | $167 | $387 |

| Progressive | $281 | $662 |

| State Farm | $125 | $284 |

| Travelers | $310 | $740 |

| USAA | $88 | $203 |

The table displays car insurance rates from different providers: Progressive offers $281 for minimum coverage and $662 for full; USAA provides $88 and $203; State Farm has $125 and $284. For 18-year-olds, utilizing discounts like good student offers and comparing quotes can lead to affordable coverage.

Car insurance rates for 18-year-olds are influenced by factors such as driving record, vehicle type, location, and gender. Moreover, driving experience also affects rates; more experienced drivers generally receive lower premiums. Young drivers should aim to gain as much driving experience as possible to potentially reduce their insurance costs.

Comprehensive Overview of the Cheapest Car Insurance for 18-Year-Old Drivers

This guide covers all the essential aspects of car insurance for 18-year-old drivers comprehensively and offers practical advice for navigating the insurance market. A comprehensive overview of the importance of car insurance for 18-year-old drivers, along with valuable tips for finding affordable coverage. Let’s break down some key points:

- Coverage Beyond Accidents: Highlighting that car insurance can cover theft or vandalism is important. Young drivers may not always consider these aspects, but they’re crucial for comprehensive protection.

- Tips for Affordability: Your tips for finding affordable insurance, such as comparing quotes, taking advantage of discounts, and opting for higher deductibles, are practical and helpful.

- Comparing Providers: Stressing the importance of comparing different insurance providers is crucial. Rates and coverage can vary significantly, so it’s essential for young drivers to shop around.

- Discounts and Savings: Explaining various discounts and savings options, from good student discounts to defensive driving courses, gives young drivers actionable steps to reduce their premiums.

- Building a Good Driving Record: Advising young drivers to enroll in defensive driving courses and practice safe driving habits is key to not only lowering insurance costs but also ensuring road safety.

- Impact of Vehicle Type and Location: Discussing how the type of vehicle and location can impact insurance rates helps young drivers make informed decisions about their choice of vehicle and where they live.

- Understanding Gender-Based Pricing: Highlighting gender-based differences in insurance pricing is important for young drivers to understand, even if it’s a factor they can’t control.

- Adding Parents to Policies: Explaining the benefits of adding parents to insurance policies can help young drivers leverage their parents’ experience and potentially save money. To learn more, delve into our guide titled “Car Driving Safety Guide for Teens and Parents“

- Driver Education Courses and Credit History: Emphasizing the importance of driver education courses and maintaining good credit history for lower insurance costs provides young drivers with actionable strategies for reducing premiums.

- Saving Money Without Sacrificing Coverage: Advising young drivers on how to save money without compromising coverage ensures they understand the balance between affordability and protection.

- Avoiding Common Mistakes: Educating young drivers about common mistakes to avoid when purchasing insurance ensures they make informed decisions and get the most out of their coverage.

By understanding coverage needs, exploring affordability options, and maintaining a good driving record, young drivers can find peace of mind on the road.

Jeff Root Licensed Life Insurance Agent

Remember to assess individual circumstances, take advantage of discounts, and seek guidance when needed. With careful planning, affordable insurance options can provide adequate protection for safe travels ahead.

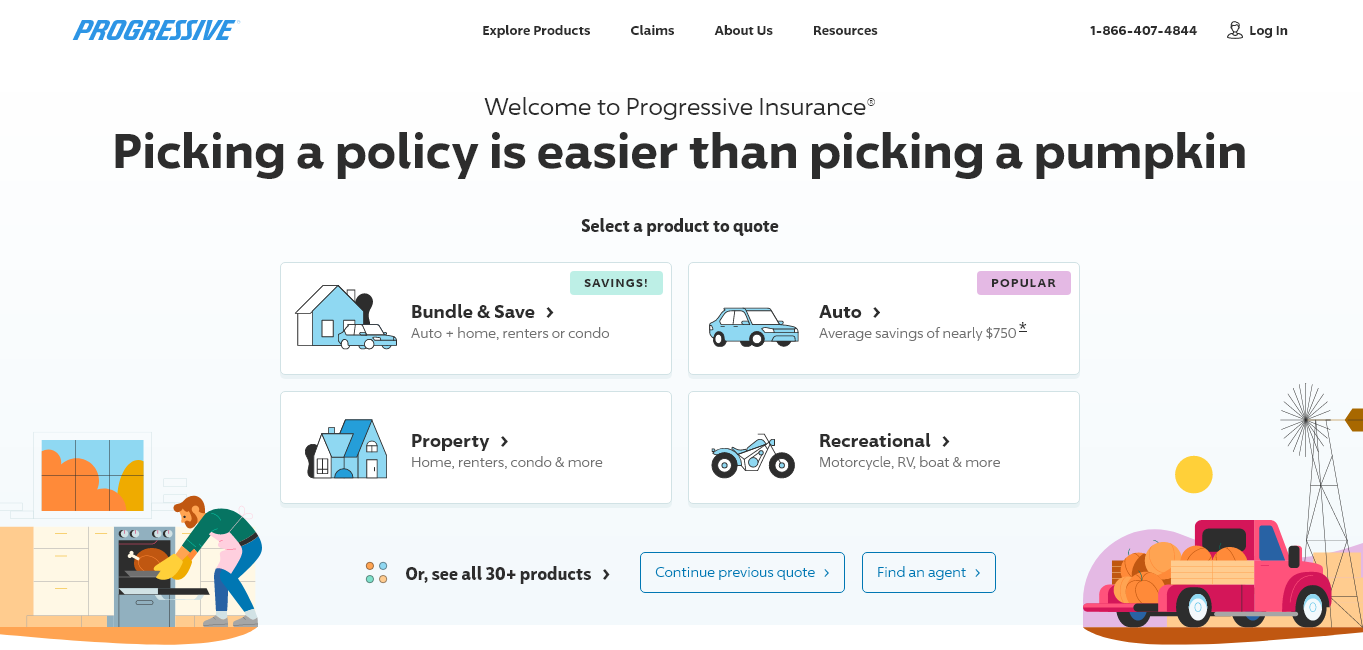

Obtaining Online Quotes for the Cheapest Car Insurance for 18-Year-Old Drivers

In today’s digital age, obtaining online quotes has become a convenient and efficient way to compare car insurance rates for 18-year-old drivers. Here’s how young drivers can leverage online resources to find the cheapest car insurance options tailored to their needs:

- Use Comparison Websites: These platforms allow users to input their information once and receive quotes from multiple insurance providers, saving time and effort.

- Provide Accurate Information: Ensure all details about driving history and vehicle are accurate to receive realistic quotes.

- Explore Discounts: Look for discounts like good student or defensive driving course discounts to lower premiums.

- Review Policy Options: Customize coverage levels and deductibles to find the right balance between affordability and protection.

- Seek Assistance: Utilize online chat support or customer service hotlines for clarification on terms or concepts.

By leveraging online resources and following these tips, 18-year-old drivers can efficiently compare car insurance rates and find the cheapest coverage options available to them.

Insurance quotes online empower young drivers to take control of their insurance decisions and secure affordable protection for their vehicles.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Navigating the Road to Affordable Coverage for 18-Year-Old Drivers

These case studies offer valuable insights into the diverse options available to 18-year-old drivers seeking affordable coverage without sacrificing quality or personalized service. Each scenario highlights a different approach to meeting the specific needs of young drivers.

- Case Study #1– Smart Savings for the Responsible Teen: Sarah, 18, sought affordable insurance without compromising coverage. Progressive offered competitive rates and discounts for her good student performance and clean driving record, providing her with peace of mind and cost-effective coverage tailored to her needs.

- Case Study #2– Family Savings for 18-Year-Old Driver: Michael, 18, from a military family, looked for insurance aligning with family values. USAA, known for serving military families, offered him exceptional rates and a sense of trust, fostering security within an insurance community that resonated with his background.

- Case Study #3– Customized Coverage for Varied Needs: Alex, 18, sought an insurer offering customization options without inflating premiums. State Farm provided him with flexibility, allowing him to tailor coverage to his preferences while maintaining affordability. This ensured he had personalized coverage that matched his unique needs.

Melanie Musson Published Insurance Expert

Choosing the best car insurance for comprehensive coverage is crucial. Whether through incentives for responsible behavior, specialized discounts for military families, or customizable coverage options, insurers have the opportunity to provide affordable coverage that meets the evolving needs of young drivers while fostering a sense of trust and security.

Summary of Affordable Car Insurance for 18-Year-Olds

Finding affordable car insurance options for 18-year-old drivers, highlights Progressive, USAA, and State Farm as top providers offering rates starting at $88. Emphasizing the importance of understanding factors affecting insurance costs, such as driving record, coverage types, and location.

It suggests strategies like comparing quotes, leveraging discounts, and opting for higher deductibles. Additionally, it explores the role of vehicle type, location, and gender in determining premiums, as well as the benefits of adding a parent to a policy and completing driver education courses. (Read more: How to Get Free Insurance Quotes Online).

The article aims to empower young drivers with knowledge to navigate the insurance landscape effectively while maintaining adequate coverage. Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Frequently Asked Questions

What factors affect the cost of car insurance for 18-year-old drivers?

The cost of car insurance for 18-year-old drivers is influenced by several factors, including the driver’s location, driving record, type of car, coverage options, and insurance company policies.

Access comprehensive insights in our review of “The Best Ways to Get the Cheapest Car Insurance Quotes.”

How can 18-year-old drivers find the cheapest car insurance?

18-year-old drivers can find the cheapest car insurance by comparing quotes from multiple insurance providers, maintaining a clean driving record, opting for a higher deductible, and considering discounts such as good student discounts or defensive driving course discounts.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Are there any specific car insurance companies that offer affordable rates for 18-year-old drivers?

While the rates may vary depending on various factors, some insurance companies that often offer affordable rates for 18-year-old drivers include Geico, State Farm, Progressive, Allstate, and Nationwide. However, it is recommended to compare quotes from multiple companies to find the best option for individual circumstances.

Does the type of car affect the cost of insurance for 18-year-old drivers?

Yes, the type of car does affect the cost of insurance for 18-year-old drivers. Generally, cars with higher safety ratings, lower horsepower, and lower values tend to have lower insurance premiums.

What are some tips for 18-year-old drivers to lower their car insurance premiums?

To lower car insurance premiums, 18-year-old drivers can consider maintaining a good academic record, completing a driver’s education course, driving a safe and reliable car, avoiding traffic violations and accidents, and bundling their car insurance with other insurance policies.

More information is available in our “How does the insurance company determine my premium?“

How does location influence car insurance costs for 18-year-olds?

Location plays a role in insurance costs due to factors like crime rates, traffic congestion, accident statistics, and availability of public transportation. Urban areas with better public transit may lead to lower premiums compared to rural areas.

Check out our guide “What age do you get cheap car insurance?”

Is gender a factor in determining car insurance rates for 18-year-old drivers?

Gender can impact rates, as statistics show young male drivers tend to be involved in more accidents than females. However, the influence of gender on rates may vary by insurer and region.

What benefits can adding a parent to an 18-year-old’s car insurance policy provide?

Adding a parent can lead to cost savings, as family policies often offer lower rates. Additionally, it may provide access to increased coverage options and benefits, leveraging the parent’s driving history.

How does completing driver education courses affect car insurance costs for 18-year-olds?

Completing driver education courses can result in lower insurance costs, as insurers often offer discounts for completion of recognized courses. These courses equip young drivers with essential skills and knowledge, reducing risks.

To discover additional details, consult our guide titled “Defensive Driving Courses Can Lower Your Car Insurance Rates“

What are common mistakes for 18-year-olds to avoid when purchasing car insurance?

Common mistakes include not shopping around for quotes, overlooking potential discounts, and underinsuring vehicles. It’s crucial for young drivers to be aware of these pitfalls to make informed decisions.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.