Best Car Insurance for FedEx Drivers in 2026 (Top 10 Companies Ranked)

Uncover the best car insurance for FedEx drivers with Progressive, USAA, and State Farm as the top providers, offering coverage rates as low as $22 monthly. Ensure your protection on the road with tailored coverage options to meet your specific needs and preferences.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

Company Facts

Full Coverage for Fedex Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for FedEx Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for FedEx Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Progressive, USAA, and State Farm have the best car insurance for FedEx drivers. USAA tops the list for FedEx drivers seeking comprehensive protection and savings.

Our Top 10 Company Picks: Best Car Insurance for Fedex Drivers

| Company | Rank | Safe Driver Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | 10% | Customizable Policies | Progressive | |

| #2 | 25% | 22% | Tailored Coverage | USAA | |

| #3 | 30% | 17% | Specialized Insurance | State Farm | |

| #4 | 25% | 10% | Bundling Discounts | Allstate | |

| #5 | 30% | 25% | Bundling Policies | Liberty Mutual |

| #6 | 10% | 25% | Customizable coverage | Farmers | |

| #7 | 10% | 20% | Student Savings | Nationwide |

| #8 | 30% | 13% | Local Agents | Travelers | |

| #9 | 10% | 22% | Online Convenience | American Family | |

| #10 | 30% | 10% | Add-on Coverages | Esurance |

This article explores the unique insurance needs of FedEx drivers, providing insights to help them choose optimal coverage for protection of drivers, vehicles, and packages.

Enter your ZIP code above to discover tailored rates from top car insurance providers. Drive confidently, knowing your loved ones are protected with the right coverage.

- Discover custom coverage for FedEx drivers, ensuring comprehensive protection

- Enjoy discounts up to 30% and rates as low as $22 with top insurer Progressive

- Compare quotes from Progressive, USAA, and State Farm for the best coverage

#1 – Progressive: Top Overall Pick

Pros

- Up to 30% discounts: Progressive offers significant discounts for policyholders.

- Up to 10% savings: Progressive insurance review & ratings reveal additional savings options, enhancing affordability for FedEx drivers.

- Flexibility with customization: Policies are highly customizable, providing tailored coverage.

Cons

- Overwhelming customization: The abundance of options might be overwhelming for some customers.

- Potential higher premiums: Premiums may be higher compared to competitors with less customization.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Tailored Coverage

Pros

- Up to 25% discounts: USAA provides substantial discounts for eligible members.

- Impressive savings: USAA insurance review & ratings highlight up to 22% savings on insurance policies for FedEx drivers.

- Tailored for military members: USAA offers coverage specifically designed for military members and their families.

Cons

- Limited eligibility: Available exclusively for military members and their families.

- Restrictive application process: Some customers may find the application process.

#3 – State Farm: Best for Specialized Insurance

Pros

- Up to 30% discounts: State Farm insurance review & ratings showcase significant discounts on policies for FedEx drivers.

- Up to 17% savings: Enjoy substantial savings with multi-policy discounts.

- Diverse coverage options: Specialized insurance options cater to diverse needs.

Cons

- Slightly higher premiums: Premiums may be slightly higher compared to some competitors.

- Claims processing delays: Customer service reviews suggest occasional delays in claims processing.

#4 – Allstate: Best for Bundling Discounts

Pros

- Up to 25% discounts: Allstate provides attractive discounts for bundled policies.

- Up to 10% savings: Additional savings available for policyholders.

- Convenient bundling: Allstate insurance review & ratings highlight how bundling discounts offer added savings for FedEx drivers.

Cons

- Communication issues: Some customers report communication challenges with the company.

- Potential premium increases: Premiums may increase after the initial policy period.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Bundling Policies

Pros

- Up to 30% discounts: Liberty Mutual offers substantial discounts for policyholders.

- Impressive up to 25% savings: Enjoy impressive savings with bundled policies.

- Convenient bundling: Liberty Mutual insurance review & ratings emphasize how bundling options provide added convenience for FedEx drivers.

Cons

- Potential higher premiums: Premiums may be higher compared to some competitors.

- Claims resolution delays: Policyholders may experience delays in claims resolution.

#6 – Farmers: Best for Customizable Coverage

Pros

- Up to 10% discounts: Farmers offers discounts for policyholders.

- Up to 25% savings: Enjoy savings with multi-policy discounts.

- Flexible customization: Policies are customizable to suit individual needs.

Cons

- Limited discounts: Discounts may not be as high as some competitors.

- Varied customer satisfaction: Farmers insurance review & ratings indicate that customer satisfaction ratings vary among FedEx drivers.

#7 – Nationwide: Best for Student Savings

Pros

- Up to 10% discounts: Nationwide offers discounts for eligible students.

- Up to 20% savings: Nationwide insurance review & ratings reveal how FedEx drivers can enjoy savings with multi-policy discounts.

- Student savings options: Tailored savings options for young drivers.

Cons

- Limited non-student discounts: Discounts may be limited for non-student drivers.

- Potential premium variations: Some customers report higher premiums for certain coverage types.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Local Agents

Pros

- Up to 30% discounts: Travelers offers substantial discounts for policyholders.

- Up to 13% savings: Enjoy additional savings with multi-policy discounts.

- Access to local agents: Personalized service with local agency support.

Cons

- Discount variability: Travelers insurance review & ratings demonstrate how discounts may vary based on location for FedEx drivers.

- Challenges in agent access: Some customers report challenges in reaching local agents promptly.

#9 – American Family: Best for Online Convenience

Pros

- Up to 10% discounts: American Family offers discounts for policyholders.

- Up to 22% savings: Enjoy savings with multi-policy discounts.

- Convenient online services: Accessible online services for policy management.

Cons

- Moderate discounts: American Family insurance review & ratings indicate that discounts may not be as high as some competitors for FedEx drivers.

- Website glitches: Customer reviews suggest occasional glitches in the online platform.

#10 – Esurance: Best for Add-On Coverages

Pros

- Up to 30% discounts: Esurance offers substantial discounts for policyholders.

- Up to 10% savings: Enjoy additional savings with multi-policy discounts.

- Variety of add-ons: Esurance insurance review & ratings highlight a variety of add-on coverages available for FedEx drivers seeking enhanced protection.

Cons

- Claims process challenges: Some customers report challenges in the claims process.

- Potential premium variations: Premiums may be higher for specific coverage options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Coverage for FedEx Drivers – A Comparative Look at Top Insurance Providers’ Unique Coverage Rates

Navigating the world of car insurance is crucial for FedEx drivers who rely on their vehicles for work. Securing the right coverage ensures protection against unforeseen circumstances. In this section, we delve into the specific coverage rates offered by various insurance companies for FedEx drivers, shedding light on both full and minimum coverage options.

Car Insurance Monthly Rates for FedEx Drivers by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

Determining the most suitable car insurance coverage is an essential decision for FedEx drivers, balancing affordability and protection. Examining the average monthly rates across leading insurance providers reveals noteworthy insights. Progressive offers competitive rates with full coverage at $105 and minimum coverage at $39.

USAA stands out with remarkably low rates of $59 for full coverage and $22 for minimum coverage, making it an appealing choice for budget-conscious drivers. State Farm strikes a balance at $86 for full coverage and $33 for minimum coverage.

Allstate, Liberty Mutual, Farmers, Nationwide, Travelers, American Family, and Esurance present varying rates, showcasing the diverse options available to FedEx drivers. It’s crucial for drivers to evaluate these rates in tandem with their individual needs to make informed decisions about their car insurance coverage.

Read More: FedEx Employee Discount Car Insurance

Factors to Consider When Choosing Car Insurance for FedEx Drivers

When selecting car insurance for FedEx drivers, several crucial factors should be considered to ensure adequate coverage and protection. Here are key considerations:

- Coverage Needs: Evaluate the specific coverage needs based on the nature of FedEx driving responsibilities, such as liability, collision, and comprehensive coverage.

- Affordability: Balance between coverage and affordability by comparing quotes from different insurance providers to find competitive rates.

- Discounts and Special Offers: Explore discounts and special offers tailored for FedEx drivers, such as bundling policies or safe driving discounts, to maximize savings.

- Customer Service: Assess the customer service reputation and responsiveness of insurance providers to ensure reliable support during claims or inquiries.

- Legal Requirements: Understand the minimum coverage requirements mandated by the state of operation to avoid penalties and ensure compliance.

By carefully considering these factors, FedEx drivers can make informed decisions and select car insurance policies that best meet their needs and budget.

Tips for Saving Money on Car Insurance as a FedEx Driver

While having adequate insurance coverage is crucial, it is also important to find ways to save money on premiums. One way to achieve this is by maintaining a good driving record. Insurance companies often offer lower rates to drivers with a clean record, as they are seen as less of a risk

Jeff Root Licensed Life Insurance Agent

Additionally, taking advantage of any available discounts, such as those for bundling home and car insurance, can contribute to significant savings. FedEx drivers should also consider taking defensive driving courses to demonstrate their commitment to safe driving practices, which may result in lower insurance costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

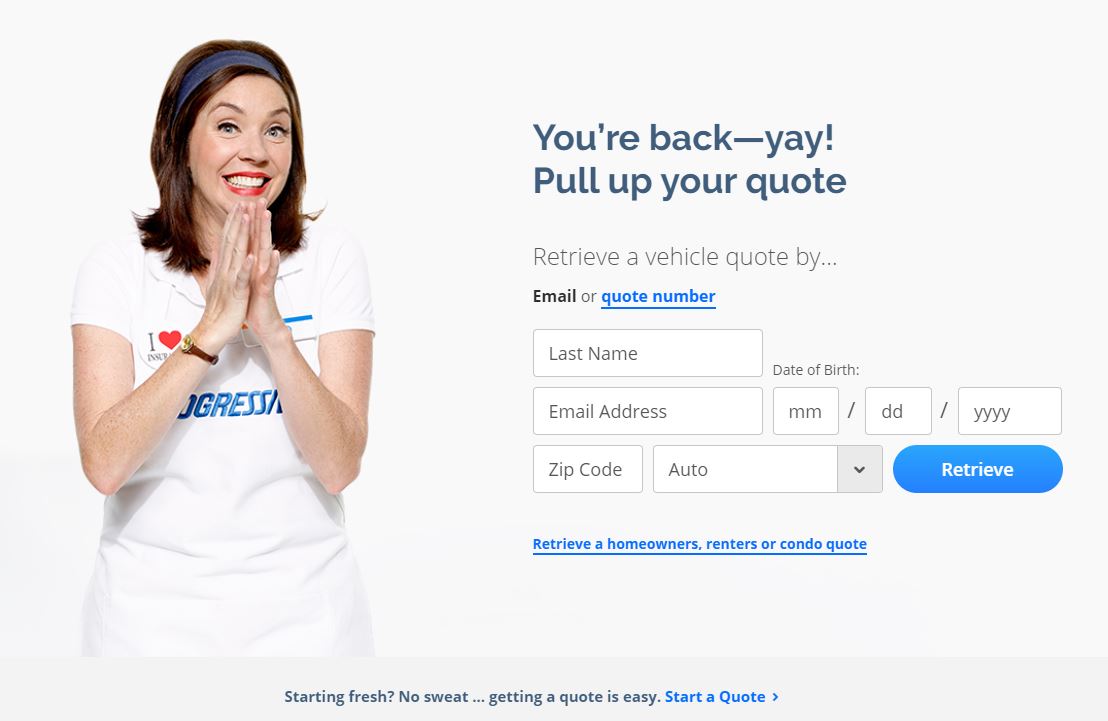

Obtaining a Car Insurance Quote for FedEx Drivers

To obtain a car insurance quote tailored for FedEx drivers, start by researching and comparing quotes from multiple insurance providers to find the best coverage options. Ensure you have relevant personal and vehicle information on hand, including driver’s license details, vehicle make and model, and driving history

Contact insurance companies either online, by phone, or in person, and provide the necessary information to receive a customized quote. Review and compare the quotes you receive, paying attention to coverage details, premiums, deductibles, and available discounts.

By following these steps, you can obtain car insurance quotes tailored to your specific needs, helping you make an informed decision about your coverage options.

How To File an Car Insurance Claim as a FedEx Driver

In the unfortunate event of an accident or other covered incident, FedEx drivers need to know how to navigate the car insurance claims process. The first step is to notify the insurance provider as soon as possible. This can typically be done through a dedicated claims hotline or by contacting the driver’s insurance agent directly.

The driver will be required to provide relevant details about the incident, such as the location, date, and any eyewitness accounts if available. It is crucial to document the incident thoroughly and provide any requested information promptly to ensure a smooth claims experience.

Discounts and Special Offers on Car Insurance for FedEx Drivers

FedEx drivers, like many other professionals, can benefit from various discounts and special offers when purchasing car insurance. Insurance companies often provide incentives to attract and retain customers, and FedEx drivers are no exception. Here are some common discounts and special offers available to FedEx drivers:

- Multi-Policy Discounts: Bundle policies for savings.

- Safe Driver Discounts: Rewards for clean driving records.

- Affiliation Discounts: Savings for FedEx employees.

- Good Student Discounts: Lower rates for academic achievement.

- Vehicle Safety Features: Discounts for safety-equipped vehicles.

- Defensive Driving Courses: Savings for course completion.

- Low Mileage Discounts: Reduced rates for less driving.

By taking advantage of these discounts and special offers, FedEx drivers can save money on their car insurance premiums while still maintaining the coverage they need. It’s essential to explore all available options and compare quotes from different insurance providers to find the best rates and discounts for your specific needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Your Driving Record Affects Your Car Insurance Rates as a FedEx Driver

As mentioned earlier, maintaining a clean driving record can significantly impact car insurance rates for FedEx drivers. Drivers with a history of accidents, traffic violations, or points on their license are considered higher risk by insurance companies.

Car Insurance Monthly Rates for FedEx Drivers by Driving Record

| Insurance Company | One Ticket | Clean Record | One DUI | One Accident |

|---|---|---|---|---|

| Allstate | $188 | $160 | $270 | $225 |

| American Family | $136 | $117 | $194 | $176 |

| Esurance | $146 | $114 | $209 | $180 |

| Farmers | $173 | $139 | $193 | $198 |

| Liberty Mutual | $212 | $174 | $313 | $234 |

| Nationwide | $137 | $115 | $237 | $161 |

| Progressive | $140 | $105 | $140 | $186 |

| State Farm | $96 | $86 | $112 | $102 |

| Travelers | $134 | $99 | $206 | $139 |

| USAA | $67 | $59 | $108 | $78 |

Consequently, insurance premiums for these individuals are often higher compared to those with a clean record. By practicing safe driving habits and consistently following traffic laws, FedEx drivers can keep their insurance rates lower and potentially qualify for additional discounts.

Navigating the Claims Process: What Every FedEx Driver Should Know

Being involved in an accident or other incident can be challenging for FedEx drivers. However, understanding how to navigate the claims process can make a significant difference. FedEx drivers should know their insurance policy details, including the contact information for their insurance provider and the procedures for filing a claim.

It is also important to document the incident thoroughly, including taking photos of any damage and collecting relevant information from other parties involved. By being prepared and informed, drivers can ensure a smoother claims experience and expedite the resolution of their claims.

Read More:

- Why You Should Always Take Pictures After a Car Accident

- How to Document Damage for Car Insurance Claims

- How to File a Car Insurance Claim

What to do in Case of an Accident: A Step-by-Step Guide for FedEx Drivers

Accidents can be highly stressful experiences, but knowing the steps to take can help FedEx drivers handle the situation professionally and efficiently. In the event of an accident, FedEx drivers should follow these steps to navigate the situation effectively:

- Prioritize safety: Ensure the safety of everyone involved by moving to a safe location away from traffic, if possible. Contact emergency services if there are injuries or significant damage.

- Exchange information: Gather important details from all parties involved, including names, contact information, driver’s license numbers, vehicle registration, and insurance information.

- Document the scene: Take photographs of the accident scene, including vehicle damage, road conditions, and any relevant road signs or signals. Obtain witness statements if available.

- Notify your insurance provider: Report the accident to your insurance provider as soon as possible, providing accurate and detailed information about the incident. Follow their instructions for filing a claim.

- Seek medical attention: If you or anyone else involved in the accident sustains injuries, seek prompt medical attention. Keep records of any medical treatment received and expenses incurred.

- Cooperate with authorities: Cooperate fully with law enforcement officers investigating the accident. Provide factual information and avoid admitting fault or making statements that could be used against you later.

- Follow up: Stay informed about the progress of your insurance claim and cooperate with any requests for additional information or documentation. Keep records of all communication related to the accident.

By following these steps, FedEx drivers can ensure a smooth and efficient resolution of the accident situation, minimizing disruptions to their work and personal life.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact of Vehicle Type on Car Insurance Premiums for FedEx Drivers

The type of vehicle used by a FedEx driver can also affect car insurance premiums. Insurance companies take into account several factors when determining rates, including the make, model, and year of the vehicle

Generally, more luxurious or high-performance vehicles tend to have higher insurance premiums due to factors such as repair costs and increased risk of theft or accidents.

FedEx drivers should consider these factors when selecting a vehicle, particularly if they are concerned about insurance costs and want to keep their premiums more affordable.

Delivering Confidence: Case Studies With Progressive, USAA, and State Farm for FedEx Driver

Explore real-life scenarios showcasing how top insurance providers cater to the unique needs of FedEx drivers.

- Case Study #1: Delivering Confidence – Meet Michael, a seasoned FedEx driver, who found peace of mind with Progressive. With tailored coverage options and discounts up to 30%, Michael enjoys rates as low as $22 per month.

- Case Study #2: Specialized Coverage – Discover Lisa’s story as a dedicated FedEx driver who relies on USAA for specialized insurance. With discounts up to 22%, USAA provides Lisa with comprehensive protection and peace of mind on the road.

- Case Study #3: Reliable Protection – Learn how John, a seasoned courier, trusts State Farm for reliable insurance coverage. With significant discounts on policies, John drives with confidence knowing his needs are met.

These case studies exemplify how top insurance providers like Progressive, USAA, and State Farm cater to FedEx drivers’ needs with tailored coverage options and competitive rates.

Laura Walker Former Licensed Agent

Through thorough research and comparison, FedEx drivers can find tailored coverage. Car insurance provides peace of mind beyond financial protection for the road ahead.

Conclusion: Securing Peace of Mind on the Road

In conclusion, choosing the best car insurance for FedEx drivers involves careful consideration of various factors such as coverage options, cost, and discounts. Progressive, USAA, and State Farm stand out as top choices, offering tailored coverage and significant savings.

By understanding their unique insurance needs and exploring available options, FedEx drivers can secure the protection they need on the road. Compare quotes today — enter your ZIP code below and drive with confidence knowing you’re covered by the right insurance plan.

Frequently Asked Questions

Are there specific insurance companies that cater FedEx driver accident policy or FedEx auto insurance?

While there may not be insurers exclusively for FedEx drivers, companies like Progressive, USAA, and State Farm offer tailored coverage options with discounts ranging from 10% to 30%.

Is commercial car insurance necessary for FedEx independent contractor insurance?

Yes, independent FedEx contractors should consider commercial car insurance, providing broader coverage for business-related activities, ensuring they are adequately protected in case of accidents or incidents on the job.

What factors should FedEx drivers consider when choosing car insurance?

FedEx drivers should evaluate coverage options, cost, customer service, and potential discounts. Key considerations include the value of packages transported, the potential for accidents or injuries, and the specific needs of their job. Enter your zip code below to get started.

How does a driving record affect car insurance rates for FedEx drivers?

Maintaining a clean driving record is crucial for FedEx drivers, as it significantly impacts insurance rates. Safe driving practices can lead to lower premiums and potentially qualify for additional discounts.

What is the role of liability coverage for FedEx drivers?

Liability coverage is critical for FedEx drivers as it provides financial protection in case of accidents, safeguarding them from expensive lawsuits and compensating affected parties if the driver is found at fault.

What factors determine Fedex insurance rates?

Fedex insurance rates are determined by various factors including the driver’s age, driving history, location, vehicle type, and coverage options chosen. Insurance companies may also consider the frequency of package delivery and the value of goods transported.

How are claims processed in case of a FedEx agent accident?

In a FedEx agent accident, they should immediately notify their insurance provider and report the incident. Providing accurate details about the accident and cooperating with the claims process is essential to ensure a smooth resolution.

Does FedEx offer FedEx independent contractor insurance?

FedEx does not provide insurance directly to independent contractors. However, independent contractors may be required to obtain their own commercial auto insurance to cover their vehicles and liability while performing Fedex-related tasks.

What is the Fedex independent contractor insurance policy?

Fedex independent contractor insurance policy may vary depending on the contractor’s insurance coverage. Independent contractors should review their insurance policies carefully to understand their coverage in the event of an accident.

Are there discounts available for Fedex drivers with USAA insurance?

Yes, USAA offers discounts for Fedex drivers, including the USAA Fedex discount. These discounts may vary depending on the driver’s eligibility criteria and USAA’s terms and conditions.

How are Fedex insurance rates calculated for standard coverage?

What is the FedEx insurance fee for commercial auto insurance?

What does FedEx standard insurance coverage include?

How do FedEx insurance rates vary for different types of vehicles?

What type of coverage is recommended for FedEx independent contractor insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.