Cheap Pontiac Solstice Car Insurance in 2026 (Top 10 Companies for Savings)

Progressive, State Farm, and Allstate are top choices for cheap Pontiac Solstice car insurance, with rates starting at $40 per month. These leading insurers offer both low rates and comprehensive coverage, ensuring budget-friendly options. Explore how these providers can meet your insurance needs effectively.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated January 2025

Company Facts

Min. Coverage for Pontiac Solstice

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Pontiac Solstice

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Pontiac Solstice

A.M. Best Rating

Complaint Level

Pros & Cons

Progressive, State Farm, and Allstate stand out as the top picks for cheap Pontiac Solstice car insurance, with rates starting as low as $40 per month.

These top providers excel in delivering affordable rates while offering comprehensive coverage options tailored to your needs. Explore how each company compares on factors like customer service, discounts, and coverage to find the best value for your Pontiac Solstice insurance.

Our Top 10 Company Picks: Cheap Pontiac Solstice Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $40 A+ Snapshot Program Progressive

#2 $45 B Personalized Service State Farm

#3 $48 A+ Range of Discounts Allstate

#4 $50 A++ Special Discounts Geico

#5 $52 A Specialized Coverage Farmers

#6 $55 A+ Customizable Policies Nationwide

#7 $58 A Enhanced Coverage American Family

#8 $60 A Safety Discounts Liberty Mutual

#9 $62 A Comprehensive Options AAA

#10 $65 A++ Membership Discounts Travelers

Maximize your savings and ensure reliable protection with the leading choices in car insurance. Avoid overpaying for your car insurance by entering your ZIP code above in our free comparison tool to find which company has the lowest rates.

- Progressive, State Farm, and Allstate offer the cheapest Pontiac Solstice rates

- Get rates as low as $40/mo with these top providers for affordable insurance

- Compare coverage options and discounts to find the best value for your needs

#1 – Progressive: Top Overall Pick

Pros

- Affordable Premiums: Progressive offers competitive rates for the Pontiac Solstice, making it an attractive option for budget-conscious drivers. Their pricing structure is designed to provide value without sacrificing coverage quality.

- Discount Opportunities: Progressive provides numerous discounts specifically beneficial for Pontiac Solstice owners, such as multi-policy and safe driver discounts. These discounts can significantly reduce the overall cost of insurance, making it more affordable, according to Progressive insurance review & ratings.

- Comprehensive Coverage: Progressive offers extensive coverage options, ensuring Pontiac Solstice owners can customize their policy to fit their specific needs. This includes options for liability, collision, comprehensive, and more.

Cons

- Customer Service: Some Pontiac Solstice owners report that Progressive’s customer service can be less responsive compared to competitors. This can lead to frustration when quick assistance is needed.

- Repair Network: Progressive has a limited network of repair shops for Pontiac Solstice, which might lead to inconvenience if repairs are needed, especially in less populated areas.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Safe Driving Discounts

Pros

- Safe Driving Discounts: State Farm offers substantial discounts for Pontiac Solstice drivers with good driving records. These discounts can lead to significant savings over time, rewarding drivers for maintaining a clean driving history.

- Comprehensive Coverage: State Farm provides a wide range of coverage options tailored for the Pontiac Solstice, allowing owners to select the best protection for their needs. This includes options for liability, collision, comprehensive, and more.

- Roadside Assistance: State Farm offers reliable roadside assistance services, which can be a lifesaver for Pontiac Solstice owners in case of emergencies on the road, as highlighted in the State Farm insurance review & ratings.

Cons

- Higher Premiums: Pontiac Solstice owners may find State Farm’s premiums to be higher compared to other insurers. This can be a drawback for those looking for the most affordable option.

- Limited Online Tools: State Farm has fewer online tools and resources for managing Pontiac Solstice insurance policies compared to some of its tech-savvy competitors. This can be a limitation for tech-oriented customers who prefer managing their policies digitally.

#3 – Allstate: Best for Extensive Discounts

Pros

- Extensive Discounts: Allstate offers various discounts that can significantly lower premiums for Pontiac Solstice owners, such as bundling and good student discounts. These discounts provide multiple opportunities for savings.

- Comprehensive Coverage Options: Pontiac Solstice owners can benefit from a wide range of coverage options. Allstate offers flexible policies that can be tailored to meet specific needs, including liability, collision, and comprehensive coverage.

- Accident Forgiveness: Allstate’s accident forgiveness program can be beneficial for Pontiac Solstice drivers. This feature prevents insurance rates from increasing after the first accident, providing peace of mind for drivers.

Cons

- Higher Premiums: Allstate’s premiums for Pontiac Solstice may be higher than some competitors, which can be a drawback for those seeking the cheapest option, according to Allstate insurance review & ratings.

- Policy Changes: Some Pontiac Solstice owners report that making policy changes can be cumbersome and time-consuming, leading to potential inconvenience.

#4 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico is known for offering some of the lowest rates for Pontiac Solstice insurance, making it a popular choice for cost-conscious drivers. Their pricing strategy aims to provide affordable options without compromising on coverage.

- Discounts: Geico offers various discounts that benefit Pontiac Solstice drivers, such as multi-vehicle and good driver discounts. These discounts can add up to significant savings over time, as highlighted in the Geico Car Insurance Discounts.

- Efficient Claims Process: Geico is known for its efficient and hassle-free claims process, which can be a major advantage for Pontiac Solstice owners needing quick resolutions.

Cons

- Limited Local Agents: Geico has fewer local agents available for Pontiac Solstice owners who prefer face-to-face interactions. This can be a drawback for those who value personal service.

- Repair Shop Restrictions: Pontiac Solstice owners may have to use Geico-approved repair shops, which could be limiting in terms of choice and convenience.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customized Policies

Pros

- Customized Policies: Farmers offers customizable insurance policies for Pontiac Solstice owners, allowing them to tailor coverage to their specific needs. This flexibility is a significant advantage for those with unique insurance requirements.

- Comprehensive Coverage: Farmers provides extensive coverage options for the Pontiac Solstice, including liability, collision, comprehensive, and more. This ensures that owners have access to the protection they need, as highlighted in the Farmers insurance review & ratings.

- Accident Forgiveness: Farmers’ accident forgiveness program can be beneficial for Pontiac Solstice drivers. This feature helps maintain stable premiums even after an accident.

Cons

- Higher Rates: Some Pontiac Solstice owners might find Farmers’ rates to be higher than average, which can be a disadvantage for those looking for cheaper options.

- Customer Service: Farmers has mixed reviews on customer service experience for Pontiac Solstice insurance, with some customers reporting less satisfactory interactions.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Pontiac Solstice owners can benefit from Nationwide’s vanishing deductible feature, which reduces the deductible amount for every year of safe driving.

- Comprehensive Coverage: Nationwide offers a wide range of coverage options for the Pontiac Solstice, including liability, collision, comprehensive, and more. This allows for flexible and tailored insurance plans.

- Accident Forgiveness: Nationwide’s accident forgiveness program is advantageous for Pontiac Solstice drivers, preventing rate increases after an accident.

Cons

- Pricing: Pontiac Solstice insurance rates may be higher with Nationwide compared to other companies, which could be a concern for cost-conscious drivers.

- Claims Process: Some Pontiac Solstice owners report a slow claims process, which can be frustrating when quick resolutions are needed, as noted in the Nationwide insurance review & ratings.

#7 – American Family: Best for Competitive Rates

Pros

- Competitive Rates: American Family offers competitive rates for Pontiac Solstice insurance, making it an appealing option for budget-conscious drivers. Their pricing is designed to offer good value for money, as highlighted n the American Family insurance review & ratings.

- Comprehensive Coverage: American Family provides a variety of coverage options tailored for the Pontiac Solstice, including liability, collision, and comprehensive coverage. This ensures that owners have the protection they need.

- Discount Opportunities: Various discount opportunities are available for Pontiac Solstice drivers, such as safe driver and loyalty discounts. These discounts can significantly lower the overall insurance cost.

Cons

- Limited Online Tools: American Family offers fewer online tools and resources for managing Pontiac Solstice insurance policies compared to some competitors. This can be a drawback for tech-savvy customers.

- Regional Availability: Coverage and service quality may vary by region for Pontiac Solstice owners, which could lead to inconsistencies in service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Flexible Coverage Options

Pros

- Flexible Coverage Options: Liberty Mutual offers a wide range of coverage options for Pontiac Solstice owners, including liability, collision, comprehensive, and more. This flexibility allows for tailored insurance plans.

- Accident Forgiveness: The accident forgiveness program at Liberty Mutual is beneficial for Pontiac Solstice drivers, helping to keep premiums stable after an accident, as mentioned in the Liberty Mutual Review & Ratings.

- Discount Opportunities: Liberty Mutual provides various discounts, including for multiple policies and safe driving, which benefit Pontiac Solstice owners. These discounts can lead to substantial savings.

Cons

- Higher Premiums: Some Pontiac Solstice owners may find Liberty Mutual’s premiums to be on the higher side, which can be a disadvantage for those looking for the cheapest option.

- Repair Shop Network: Pontiac Solstice owners might be restricted to using Liberty Mutual-approved repair shops, which can limit their choices and convenience.

#9 – AAA: Best for Member Benefits

Pros

- Member Benefits: Pontiac Solstice owners benefit from AAA’s membership perks, including travel discounts, roadside assistance, and more. These additional benefits add significant value to the insurance policy.

- Comprehensive Coverage: AAA offers extensive coverage options for the Pontiac Solstice, including liability, collision, comprehensive, and more. This ensures that owners have the necessary protection.

- Roadside Assistance: AAA’s renowned roadside assistance program is a significant advantage for Pontiac Solstice owners, providing peace of mind during travel.

Cons

- Premium Costs: Pontiac Solstice insurance premiums may be higher with AAA compared to other insurers, which can be a drawback for budget-conscious drivers, as detailed in the AAA insurance review & ratings.

- Regional Availability: Service quality and availability may vary by region for Pontiac Solstice owners, potentially leading to inconsistencies in customer experience.

#10 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers provides a wide range of coverage options tailored for the Pontiac Solstice, including liability, collision, comprehensive, and more. This ensures that owners have access to the protection they need.

- Discounts: Travelers offers various discounts beneficial to Pontiac Solstice owners, such as multi-policy and good driver discounts. These discounts can help lower the overall cost of insurance.

- Accident Forgiveness: The accident forgiveness program at Travelers is advantageous for Pontiac Solstice drivers, helping to keep premiums stable after an accident, as mentioned in the Travelers insurance review & ratings.

Cons

- Higher Rates: Some Pontiac Solstice owners might find Travelers’ rates to be higher than average, which can be a concern for those looking for cheaper options.

- Limited Local Agents: Travelers has fewer local agents available for face-to-face interactions for Pontiac Solstice owners, which can be a drawback for those who prefer personal service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Pontiac Solstice Insurance Costs

Several factors play a pivotal role in determining the cost of car insurance for a Pontiac Solstice, as insurance providers assess multiple variables to evaluate the level of risk associated with insuring this particular vehicle.

Pontiac Solstice Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $62 $155

Allstate $48 $125

American Family $58 $145

Farmers $52 $135

Geico $50 $120

Liberty Mutual $60 $140

Nationwide $55 $130

Progressive $40 $110

State Farm $45 $115

Travelers $65 $150

These factors include the model year of the Pontiac Solstice, the driver’s personal driving record, the location and driving environment, the deductible amount, comprehensive and collision coverage options, and any modifications or customizations made to the vehicle. Understanding how these elements influence insurance rates is crucial for potential Pontiac Solstice owners.

For instance, newer models of the Pontiac Solstice are generally more expensive to insure due to their higher value and the potential cost of repairs or replacement.

Additionally, the driver’s personal driving record is a significant factor, with insurance companies assessing the driver’s history of accidents, traffic violations, and claims to determine their level of risk. Drivers with a clean record are typically rewarded with lower insurance premiums.

Understanding the Insurance Rates for Pontiac Solstice

When comparing insurance rates for a Pontiac Solstice, it is important to consider that these rates can vary significantly depending on the insurance provider. Different providers assess risk in unique ways and offer varying coverage options. Researching multiple car insurance providers and obtaining quotes tailored to your specific circumstances is key to finding the best insurance rate for your Pontiac Solstice.

Additionally, it is worth noting that insurance rates for the Pontiac Solstice may also be influenced by factors such as the driver’s age, driving record, and location. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums.

Furthermore, the area in which the vehicle is primarily driven and parked can impact rates, with urban areas typically having higher rates due to increased risk of theft or accidents. It is important to provide accurate and detailed information when obtaining insurance quotes to ensure that the rates provided are reflective of your specific circumstances.

Comparing Car Insurance Quotes for Pontiac Solstice

Comparing car insurance quotes from different providers allows Pontiac Solstice owners to make informed decisions about their insurance policy. While cost is a significant factor, it’s essential also to consider the coverage options and customer service offered by each provider.

Exploring multiple quotes ensures that potential Pontiac Solstice owners choose the insurance policy that best suits their needs. Additionally, when comparing car insurance quotes for Pontiac Solstice, it is important to take into account any specific features or modifications of the vehicle.

Some insurance providers may offer specialized coverage for unique features such as convertible tops or performance enhancements. By considering these factors, Pontiac Solstice owners can ensure that their insurance policy adequately protects their investment and provides the necessary coverage for their specific vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Lower Your Pontiac Solstice Car Insurance Premiums

Reducing car insurance premiums is a common goal for many vehicle owners. To lower Pontiac Solstice car insurance premiums, owners can adopt several practical strategies. These include maintaining a clean driving record, choosing a higher deductible amount, and taking advantage of potential discounts offered by the insurance provider. Implementing these tips can significantly reduce insurance costs over time.

In addition to these strategies, another effective way to lower Pontiac Solstice car insurance premiums is to install anti-theft devices in the vehicle. These devices, such as car alarms or GPS tracking systems, can help deter theft and reduce the risk of the car being stolen or vandalized.

Insurance providers often offer discounts for vehicles equipped with anti-theft devices, as they are considered less risky to insure. Therefore, installing such devices can lead to further savings on car insurance premiums. Discover our comprehensive guide to “What are some ways to lower my car insurance premiums?” for additional insights.

Why Research Car Insurance Providers for Pontiac Solstice

Researching and evaluating various car insurance providers is crucial when insuring a Pontiac Solstice. Each provider offers different coverage options, rates, and levels of customer service. Thoroughly researching multiple insurance providers enables Pontiac Solstice owners to make an informed decision, choosing the provider that can offer the most suitable coverage at a competitive rate.

One important factor to consider when researching car insurance providers for a Pontiac Solstice is the specific coverage options they offer. While all providers are required to offer certain basic coverage, such as liability insurance, there may be additional options that are important for Pontiac Solstice owners.

These could include comprehensive coverage to protect against theft or damage from non-collision incidents, or collision coverage to cover repairs in the event of an accident. Another aspect to consider when researching car insurance providers is their reputation for customer service.

It is important to choose a provider that is known for their prompt and efficient claims handling, as well as their responsiveness to customer inquiries and concerns. Reading reviews and testimonials from other Pontiac Solstice owners can provide valuable insights into the level of customer service provided by different insurance providers. Dive deeper into “Insurance Quotes Online” with our complete resource.

Common Mistakes to Avoid When Insuring Your Pontiac Solstice

When insuring a Pontiac Solstice, it is essential to be aware of potential mistakes that can lead to higher insurance costs or insufficient coverage. Some common mistakes include failing to disclose modifications or customizations made to the vehicle, neglecting to compare quotes from multiple providers, and not considering the impact of location on insurance rates.

Daniel Walker Licensed Insurance Agent

Avoiding these pitfalls helps Pontiac Solstice owners make the most of their car insurance coverage. One additional mistake to avoid when insuring your Pontiac Solstice is failing to maintain a good driving record. Insurance providers often consider your driving history when determining your premium rates.

If you have a history of accidents or traffic violations, you may be deemed a higher risk and charged higher premiums. It is important to drive safely and responsibly to maintain a clean driving record and keep your insurance costs down. Another mistake to avoid is not taking advantage of available discounts. Learn more by visiting our detailed “Commonly Misunderstood Insurance Concepts” section.

Many insurance companies offer various discounts that can help reduce your premium costs. These discounts may include safe driver discounts, multi-policy discounts, or discounts for installing anti-theft devices in your vehicle. It is important to inquire about these discounts and see if you qualify for any of them to maximize your savings on insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Model Year Affects Pontiac Solstice Insurance Costs

The model year of a Pontiac Solstice can significantly impact insurance costs. Newer models often come with advanced safety features, leading to potentially lower insurance rates. However, the cost of insuring older models may be higher due to factors such as scarcity of replacement parts and higher repair costs.

Understanding how the model year affects insurance costs is crucial when budgeting for Pontiac Solstice car insurance. Another factor to consider when it comes to the model year of your Pontiac Solstice and insurance costs is the depreciation value.

As a car gets older, its value decreases, which can affect the cost of insurance. Insurance companies may offer lower coverage limits or higher deductibles for older models, as the potential payout in the event of a total loss is lower. Read our extensive guide on “How much is car insurance?” for more knowledge.

In addition, the model year can also impact the availability of certain insurance discounts. Some insurance companies offer discounts for vehicles with newer safety features, such as lane departure warning systems or automatic emergency braking. These discounts may not be available for older models that lack these advanced safety technologies.

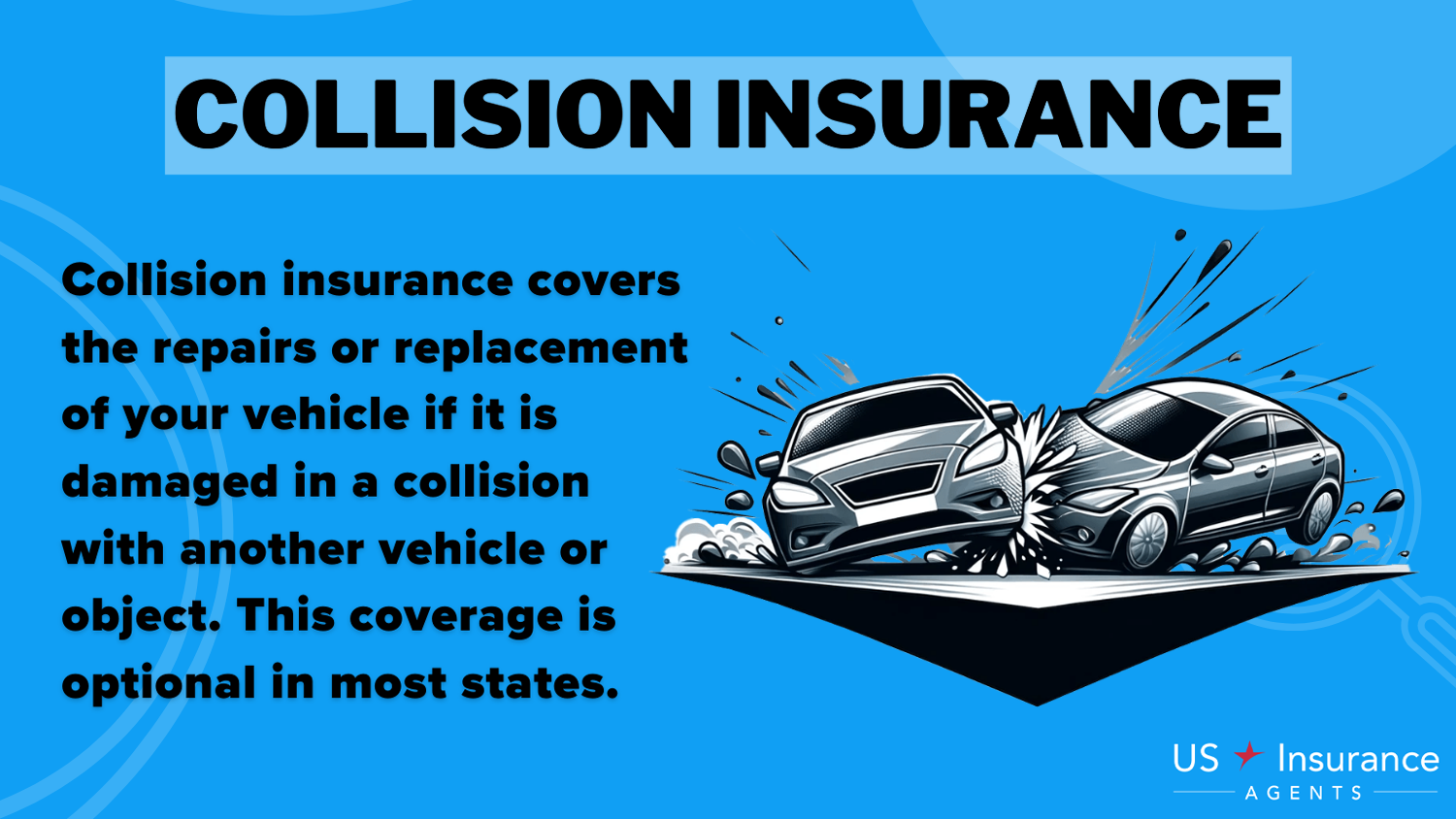

Coverage Options for Pontiac Solstice Insurance

When purchasing car insurance for a Pontiac Solstice, owners have various coverage options to consider. Comprehensive coverage offers protection against damages not caused by collisions, such as theft or weather-related incidents. Collision coverage, on the other hand, provides coverage for damages resulting from accidents involving other vehicles or objects.

Pontiac Solstice owners can choose from these coverage options, tailoring their insurance policy to their specific needs. Additionally, Pontiac Solstice owners may also want to consider adding uninsured/underinsured motorist coverage to their car insurance policy. For more information, explore our informative “Types of Car Insurance Coverage” page.

This type of coverage protects the policyholder in the event of an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. Uninsured/underinsured motorist coverage can provide financial protection and peace of mind for Pontiac Solstice owners, ensuring that they are not left with hefty expenses in the event of an accident with an uninsured or underinsured driver.

Driving Record’s Impact on Pontiac Solstice Insurance Rates

A Pontiac Solstice owner’s driving record has a direct impact on their insurance rates. Insurance providers typically consider factors such as previous accidents, traffic violations, and the number of years without claims.

Maintaining a clean driving record can help Pontiac Solstice owners secure more competitive insurance rates and potentially qualify for additional discounts. Explore our detailed analysis on “Full Coverage Car Insurance: A Complete Guide” for additional information.

How Location Affects Pontiac Solstice Insurance Costs

The location in which a Pontiac Solstice is primarily driven and parked directly affects insurance costs. Urban areas with higher traffic density and increased propensity for theft and accidents tend to have higher insurance rates.

Conversely, rural areas with lower risk factors typically have more affordable insurance rates. It is crucial for Pontiac Solstice owners to consider their location when budgeting for insurance. Get more insights by reading our expert “What states require car insurance?” advice.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Deductibles Affect Pontiac Solstice Insurance Costs

Deductibles play a key role in determining Pontiac Solstice car insurance costs. A deductible is the amount a policyholder must pay out of pocket before insurance coverage starts. Choosing a higher deductible can result in lower insurance premiums, while a lower deductible can provide more immediate financial assistance in the event of a claim.

Finding the right balance between an affordable premium and a manageable deductible is a crucial decision for Pontiac Solstice owners. Discover our comprehensive guide to “What is the difference between a deductible and a premium in car insurance?” for additional insights.

Average Cost of Comprehensive & Collision Coverage for Pontiac Solstice

The average cost of comprehensive and collision coverage for a Pontiac Solstice can vary based on numerous factors. These include the model year, location, driving record, and desired coverage limits. For further details, check out our in-depth “Collision vs. Comprehensive Car Insurance” article.

As a general guideline, comprehensive and collision coverage typically account for a significant portion of the overall insurance premium. Evaluating the average costs of these coverage types helps Pontiac Solstice owners make informed decisions when selecting their insurance policy.

Benefits of Bundling Pontiac Solstice Insurance

Bundling your Pontiac Solstice car insurance with other policies, such as home or renters insurance, can offer several benefits. Insurance providers frequently offer discounts when multiple policies are bundled together. Bundling not only allows for potential cost savings but also simplifies insurance management by consolidating policies with a single provider.

Pontiac Solstice owners should explore the advantages of bundling policies to optimize their insurance coverage. Expand your understanding with our thorough “Can I bundle my car insurance with other policies?” overview.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Mods Affect Pontiac Solstice Insurance Rates

Modifications and customizations made to a Pontiac Solstice can impact insurance rates. Changes that enhance performance or alter the appearance of the vehicle may result in higher insurance costs. Additionally, certain modifications, such as engine upgrades or aftermarket parts, can lead to increased repair costs in the event of an accident.

Fully disclosing any modifications or customizations when obtaining insurance quotes is crucial to ensure accurate coverage and avoid potential issues in the future. Read our extensive guide on “Can I get car insurance for a car that is modified or customized?” for more knowledge.

Tips for Finding Affordable Car Insurance for a Pontiac Solstice

Finding affordable car insurance for a Pontiac Solstice requires careful consideration and research. To secure competitive rates, Pontiac Solstice owners should consider obtaining quotes from multiple insurance providers, maintaining a clean driving record, choosing higher deductibles, and exploring potential discounts.

Dani Best Licensed Insurance Producer

Additionally, reviewing the coverage options, including comprehensive and collision coverage, ensures that insurance costs align with specific needs. Investing time and effort in these strategies can help Pontiac Solstice owners find affordable car insurance that offers reliable coverage and peace of mind. See if you’re getting the best deal on car insurance by entering your ZIP code below.

In conclusion, the cost of Pontiac Solstice car insurance is influenced by various factors, including the model year, driving record, location, deductibles, coverage options, modifications, and customization. Dive deeper into “Car Insurance Discounts by Age” with our complete resource.

Thoroughly understanding these elements and researching multiple insurance providers are essential steps in finding the right insurance policy. By considering these factors and following the provided tips, Pontiac Solstice owners can secure affordable car insurance that meets their needs and provides the necessary protection for their valuable vehicle.

Frequently Asked Questions

Are Pontiac Solstice vehicles costly to insure?

Yes, Pontiac Solstice vehicles tend to be more expensive to insure because they are sports cars, which usually have higher premiums due to their performance and repair costs.

How can you reduce the insurance cost for a Pontiac Solstice?

To lower insurance costs, consider increasing your deductible, maintaining a clean driving record, bundling policies, and asking about available discounts.

Does the driver’s age impact Pontiac Solstice insurance rates?

Yes, younger drivers often face higher premiums, while older, more experienced drivers generally enjoy lower rates.

Explore our detailed analysis on “What age do you get cheap car insurance?” for additional information.

Is it more expensive to insure a new Pontiac Solstice versus an older model?

Yes, insuring a new Pontiac Solstice is usually more costly due to the higher value and repair costs compared to older models.

What are some recommended insurance companies for Pontiac Solstice owners?

Progressive, State Farm, and Allstate are recommended for Pontiac Solstice owners for their competitive rates and comprehensive coverage options.

What is the lowest form of Pontiac Solstice car insurance?

The lowest form of Pontiac Solstice car insurance typically refers to the most basic coverage available, which often includes liability insurance only.

Get more insights by reading our expert “Liability Insurance: A Complete Guide” advice.

What is the name of the lowest Pontiac Solstice car insurance?

The name of the lowest Pontiac Solstice car insurance is usually referred to as the minimum liability coverage or basic liability insurance.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Which Pontiac Solstice is the cheapest to insure?

Generally, older models or those with fewer features are the cheapest Pontiac Solstice to insure due to their lower value and repair costs.

What is the best Pontiac Solstice car insurance?

The best Pontiac Solstice car insurance is often determined by factors like coverage options, customer service, and affordability. Companies like Progressive, State Farm, and Allstate are top contenders.

Continue reading our full “Best Insurance Companies” guide for extra tips.

What is the cheapest level of Pontiac Solstice car insurance?

The cheapest level of Pontiac Solstice car insurance typically includes minimum liability coverage, which offers basic protection at a lower cost.

What is the cheapest Pontiac Solstice car insurance called?

What is the most expensive Pontiac Solstice car insurance?

What is the cheapest category for Pontiac Solstice car insurance?

What are the cheapest full coverage Pontiac Solstice car insurance options?

Which age group has the cheapest Pontiac Solstice car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.