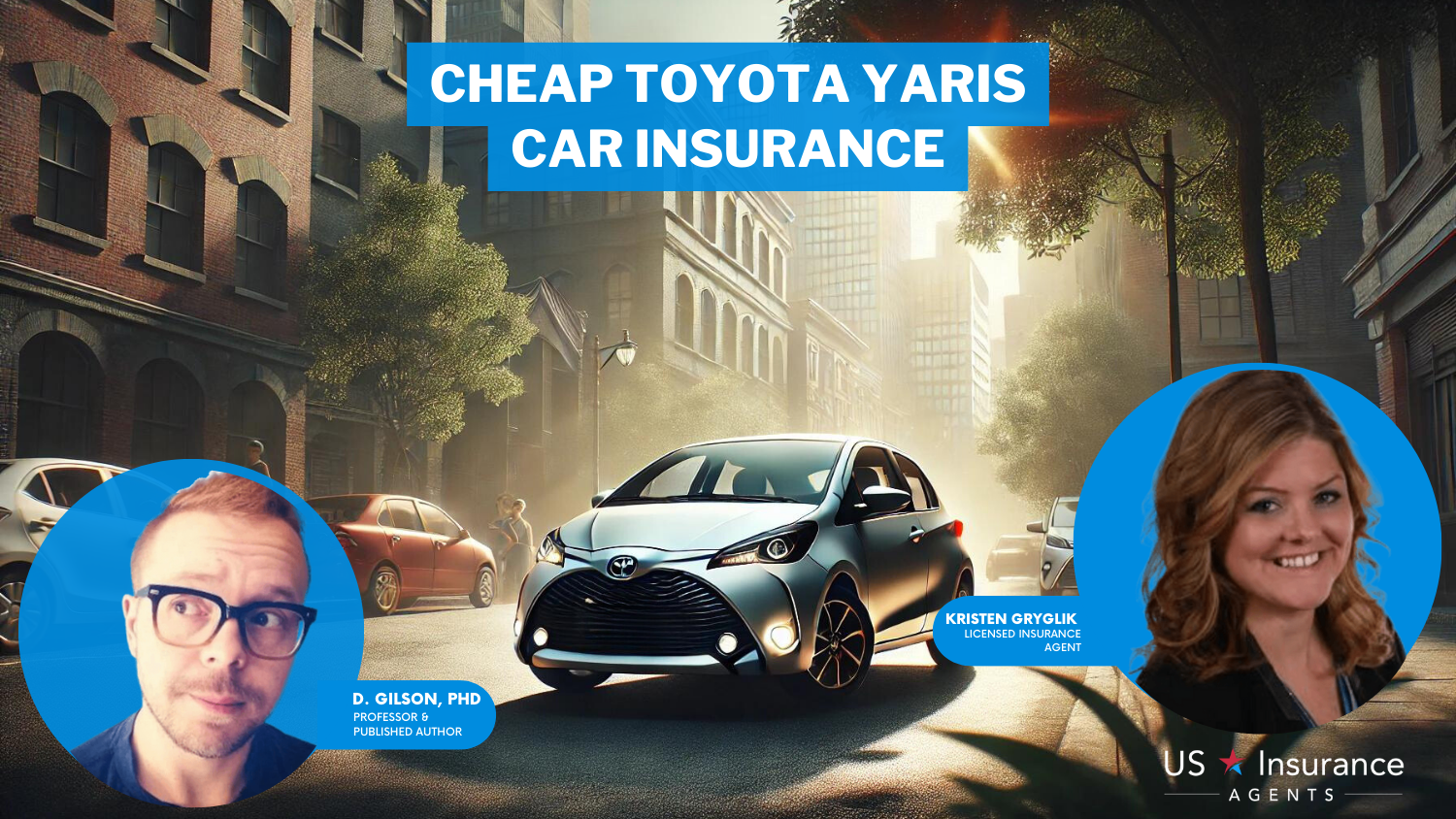

Cheap Toyota Yaris Car Insurance in 2026 (Cash Savings With These 10 Companies)

If you're looking for cheap Toyota Yaris car insurance, top choices include Progressive, USAA, and State Farm. Progressive starts at just $45 per month, making these insurers standout options due to their competitive pricing and extensive coverage offerings designed specifically for Toyota Yaris owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated January 2025

Company Facts

Min. Coverage for Toyota Yaris

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Yaris

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Yaris

A.M. Best Rating

Complaint Level

Pros & Cons

Following a thorough analysis of cheap Toyota Yaris car insurance, our top recommendations are Progressive, USAA, and State Farm which offer comprehensive coverage.

Car insurance is an essential expense for every vehicle owner, and understanding the cost of insuring a Toyota Yaris is important for those considering purchasing this popular compact car.

Our Top 10 Company Picks: Cheap Toyota Yaris Car Insurance

Company Rank Monthly Rates Good Driver Discount Best For Jump to Pros/Cons

#1 $45 15% Qualifying Coverage Progressive

#2 $61 20% Military Members USAA

#3 $79 20% Customer Service State Farm

#4 $93 10% Drivewise Programs Allstate

#5 $119 10% Deductible Options Nationwide

#6 $137 10% Deductible Options Liberty Mutual

#7 $152 15% Safe Drivers Farmers

#8 $168 15% Discount Options Travelers

#9 $183 20% Claims Service American Family

#10 $194 10% Client Centric Auto-Owners

Many factors determine the cost of car insurance for a Toyota Yaris. In this article, we’ll explore how living in the most and least car-dependent states can affect your insurance rates, giving you a comprehensive understanding of these variables. Enter your ZIP code now.

#1 – Progressive: Top Overall Pick

Pros

- Affordable Rates: Progressive offers competitive rates starting at $45 per month, which is particularly beneficial for Toyota Yaris drivers and owners who are looking for budget-friendly options. With a 15% good driver discount, Toyota Yaris enthusiasts can save even more. This affordability ensures that maintaining coverage for a Toyota Yaris is cost-effective.

- Discount Opportunities: Progressive provides several discount programs, including those for safe driving and bundling policies, which are advantageous for Toyota Yaris drivers. The Snapshot program tracks driving behavior to offer potential savings, which can be particularly appealing to Yaris owners who prioritize safe driving. These discounts help reduce overall insurance costs.

- Snapshot Program: The Snapshot program by Progressive tracks driving habits and offers discounts based on safety, which is beneficial for Toyota Yaris enthusiasts who consistently follow good driving practices. This program provides an opportunity to earn savings by demonstrating responsible driving behavior, which can lead to substantial premium reductions.

Cons

- Customer Service Issues: Some Toyota Yaris drivers report challenges with Progressive’s customer service, including delays and difficulties with claims processing. This can be frustrating during critical times when prompt assistance is needed. Ensuring clear communication with representatives may help mitigate these concerns.

- Policy Clarity: Toyota Yaris owners have sometimes found Progressive’s policy terms and conditions to be unclear, leading to unexpected surprises. It’s crucial for Yaris enthusiasts to thoroughly review policy details to avoid misunderstandings and ensure they understand their coverage specifics. See more details on our guide “Progressive Insurance Review & Ratings.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Members

Pros

- Specialized Rates: USAA offers competitive rates starting at $61 per month for military members and their families, which includes Toyota Yaris drivers in this group. Their good driver discount of 20% is particularly advantageous for Yaris owners who maintain a clean driving record. This specialization ensures that military members receive optimal rates for their Toyota Yaris.

- Top-Rated Service: USAA is highly praised for its customer service and claims satisfaction, making it a great choice for Toyota Yaris drivers who value exceptional support. Their high level of service and responsiveness ensures that claims are handled efficiently, providing peace of mind for Yaris enthusiasts.

- Comprehensive Coverage: USAA offers a range of comprehensive coverage options, including roadside assistance and rental car reimbursement, which are valuable for Toyota Yaris enthusiasts. These add-ons ensure extensive protection and peace of mind in various driving situations, enhancing overall coverage.

Cons

- Eligibility Restrictions: USAA’s coverage is limited to military members and their families, excluding non-military Toyota Yaris drivers from their competitive rates and services. This restriction means that those outside this group cannot benefit from USAA’s offerings. Eligibility constraints may limit access for some Yaris owners.

- Website Usability: Some Toyota Yaris drivers find USAA’s website and app less intuitive compared to other insurers, which can affect ease of managing their policy. Navigation challenges may make it harder for Yaris enthusiasts to access and utilize online services effectively. Read more through our USAA insurance review.

#3 – State Farm: Best for Customer Service

Pros

- Strong Customer Service: State Farm is known for its excellent customer service, which is beneficial for Toyota Yaris owners who seek reliable support. Their customer service team is well-regarded for being helpful and responsive, contributing to a positive overall experience. Their 20% good driver discount is an additional advantage for Yaris drivers. See more details on our article called “State Farm Insurance Review & Ratings.”

- Various Discounts: State Farm provides multiple discount opportunities, such as those for good students, safe drivers, and multi-policy holders, which are advantageous for Toyota Yaris drivers. Their 20% discount for good drivers helps lower premiums for those with a clean driving record. These discounts contribute to overall affordability.

- Local Agents: With a large network of local agents, State Farm offers personalized service, which is valuable for Toyota Yaris owners who prefer face-to-face interactions. This extensive network allows for a more tailored insurance experience and direct support. Local agents help ensure that Yaris drivers receive attentive service.

Cons

- Higher Rates for Young Drivers: State Farm’s rates can be higher for younger Toyota Yaris drivers or those with less driving experience, reflecting the increased risk. This can make insurance less affordable for younger Yaris enthusiasts. Exploring other options may be necessary if you fall into this category.

- Limited Online Tools: State Farm’s online tools and resources are more limited compared to some competitors, which may impact the convenience of managing your Toyota Yaris insurance policy online. This limitation can make it harder for tech-savvy Yaris drivers to access and manage their insurance efficiently.

#4 – Allstate: Best for Drivewise Programs

Pros

- Drivewise Program: Allstate’s Drivewise program rewards safe driving with potential discounts, which is beneficial for Toyota Yaris enthusiasts who practice safe driving habits. This program tracks driving behavior to offer savings based on how safely you drive. The 10% good driver discount further enhances the value of this program.

- Accident Forgiveness: Allstate offers accident forgiveness, which prevents your first accident from impacting your rates. This feature is particularly valuable for Toyota Yaris drivers who may have a minor accident but want to avoid rate increases. The 10% good driver discount adds further value to their offerings.

- Discount Variety: Allstate provides numerous discounts, including those for bundling multiple policies and safe driving, which benefit Toyota Yaris drivers. These discounts help reduce overall insurance costs, making it easier for Yaris owners to find savings. Their range of discounts enhances overall affordability.

Cons

- Higher Premiums: Some Toyota Yaris drivers report that Allstate’s premiums can be higher compared to other insurance providers. This can impact affordability, especially for those looking for the lowest rates. Comparing Allstate’s rates with other insurers may be necessary to find the best value.

- Claims Processing: There have been reports of slower claims processing times with Allstate, which can be frustrating for Toyota Yaris drivers needing timely assistance. Delays in handling claims can impact overall satisfaction and the efficiency of managing your insurance policy. Read more through our Allstate insurance review.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Deductible Options

Pros

- Flexible Deductibles: Nationwide offers a range of deductible options, which is advantageous for Toyota Yaris drivers who want to manage their budget. This flexibility allows you to adjust your deductible to fit your financial situation while maintaining appropriate coverage. Their 10% good driver discount enhances affordability. Learn more in our guide titled “Nationwide Insurance Review & Ratings.”

- Good Customer Service: Nationwide is known for strong customer service and support, which is valuable for Toyota Yaris drivers seeking reliable assistance. Their reputation for handling claims efficiently contributes to a positive overall experience. Their customer service ensures that Yaris enthusiasts receive timely support.

- Discount Opportunities: Nationwide offers various discounts, such as for safe driving and bundling policies, which are advantageous for Toyota Yaris drivers. These discounts help reduce insurance costs, making coverage more affordable for Yaris owners. Their 10% good driver discount is particularly beneficial.

Cons

- Higher Rates for Certain Drivers: Rates can be higher for drivers with a history of traffic violations or accidents, which affects Toyota Yaris owners with less-than-perfect driving records. This increased cost reflects the higher risk associated with these drivers. Exploring other insurance options may be necessary for those impacted.

- User Experience: Some Toyota Yaris drivers find Nationwide’s website and mobile app less user-friendly compared to other insurers, which can affect the convenience of managing their policy. Improving user experience could enhance satisfaction for Yaris owners who prefer digital interactions.

#6 – Liberty Mutual: Best for Deductible Options

Pros

- Flexible Deductibles: Liberty Mutual offers a variety of deductible options, which is beneficial for Toyota Yaris drivers who want to adjust their coverage to fit their budget. This flexibility allows you to manage premiums and out-of-pocket costs effectively. Their 10% good driver discount further enhances affordability.

- Discount Opportunities: Liberty Mutual provides several discount programs, including those for safe driving and bundling policies, which benefit Toyota Yaris owners. These discounts help reduce overall insurance costs, making coverage more affordable for Yaris drivers. Their 10% good driver discount is particularly advantageous.

- Online Tools: Liberty Mutual offers a range of online tools for managing your policy, which is valuable for Toyota Yaris drivers who prefer digital interactions. Their user-friendly website and app make it easier to access and manage your insurance coverage efficiently. Read more through our Liberty Mutual insurance review.

Cons

- Higher Premiums: Some Toyota Yaris drivers report that Liberty Mutual’s premiums can be higher compared to other providers, which may impact affordability. Comparing rates with other insurers is recommended to ensure you are getting the best value. The higher cost may be a consideration for budget-conscious Yaris owners.

- Claims Processing: There have been reports of slower claims processing times with Liberty Mutual, which can be frustrating for Toyota Yaris drivers needing timely support. Ensuring prompt and efficient handling of claims is essential for overall satisfaction. Delays in processing can affect the overall insurance experience.

#7 – Farmers: Best for Safe Drivers

Pros

- Discount Opportunities: Farmers provides several discount programs, including those for good drivers and bundling policies, which help reduce insurance costs for Toyota Yaris drivers. The 20% good driver discount is particularly valuable for those with a clean driving record. Discounts make coverage more affordable for Yaris owners.

- Flexible Payment Options: Farmers offers a variety of payment options, including monthly installments, which can be advantageous for Toyota Yaris drivers who prefer flexible payment plans. This flexibility helps manage premiums and budget effectively. Payment options cater to the financial needs of Yaris owners.

- Accident Forgiveness: Farmers’ accident forgiveness feature helps prevent your first accident from increasing your rates, which is beneficial for Toyota Yaris drivers. This feature provides protection against rate hikes following a minor accident, offering additional peace of mind. Accident forgiveness is particularly useful for Yaris owners who want to avoid premium increases.

Cons

- Higher Rates for Younger Drivers: Farmers’ premiums can be higher for younger Toyota Yaris drivers, reflecting the increased risk associated with less experienced drivers. This can make insurance less affordable for younger Yaris enthusiasts. Exploring other options may be necessary for those impacted by higher rates.

- Claims Processing Delays: Some Toyota Yaris drivers report slower claims processing times with Farmers, which can be frustrating during critical times. Efficient handling of claims is crucial for overall satisfaction, and addressing these delays can improve the experience for Yaris owners. Learn more through our Farmers insurance review.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Discount Options

Pros

- Affordable Rates: Travelers offers competitive rates starting at $50 per month, which is advantageous for Toyota Yaris drivers looking for cost-effective insurance. Their 15% good driver discount helps further reduce premiums, making insurance more affordable for Yaris owners. Competitive pricing ensures value for Yaris enthusiasts.

- Range of Discounts: Travelers provides a variety of discounts, including those for safe driving and bundling policies, which benefit Toyota Yaris drivers. These discounts can help lower overall insurance costs, making it easier for Yaris owners to save money. The 15% discount for good drivers is particularly beneficial. Discover more about offerings in our article titled “Travelers Insurance Review & Ratings.”

- Strong Financial Stability: Travelers is known for its financial stability, ensuring that Toyota Yaris drivers have reliable coverage in the event of a claim. Their strong financial standing contributes to peace of mind, knowing that claims will be handled effectively. This reliability is important for Yaris owners seeking dependable insurance.

Cons

- Limited Coverage Options: Travelers may offer fewer additional coverage options compared to some competitors, which can limit choices for Toyota Yaris drivers looking for specific add-ons. This limitation may affect those seeking more comprehensive coverage options. Exploring other insurers may provide more choices for Yaris owners.

- Customer Service Concerns: Some Toyota Yaris drivers report issues with Travelers’ customer service, including delays and difficulty resolving claims. Effective customer support is crucial for overall satisfaction, and addressing these concerns can improve the experience for Yaris enthusiasts. Prompt and effective service is essential for managing your policy.

#9 – American Family: Best for Claims Service

Pros

- Discount Opportunities: AmFam provides various discounts, such as those for safe driving, bundling policies, and low mileage, which are advantageous for Toyota Yaris drivers. The 20% good driver discount can significantly lower premiums for those with a clean driving record. These discounts help make insurance more affordable for Yaris owners.

- Strong Customer Service: American Family is known for its high level of customer service, which is valuable for Toyota Yaris drivers who seek reliable support. Their responsive customer service team ensures that any issues or claims are handled efficiently. Good customer support enhances overall satisfaction for Yaris enthusiasts.

- Flexible Payment Plans: AmFam offers a variety of payment options, including monthly installments, which is beneficial for Toyota Yaris drivers who prefer flexible payment plans. This flexibility allows Yaris owners to manage their premiums and budget effectively. Payment options cater to different financial situations. Read more through our American Family insurance review.

Cons

- Higher Premiums for Certain Drivers: American Family’s premiums can be higher for drivers with a history of accidents or traffic violations, which may affect Toyota Yaris drivers with less-than-perfect records. This can impact affordability for those with previous issues. Exploring other insurers might be necessary for those facing higher rates.

- Limited Availability: American Family’s coverage is not available in all states, which may limit access for Toyota Yaris drivers in certain regions. Ensuring availability in your area is essential for obtaining coverage. Checking regional availability can help Yaris owners find suitable insurance options.

#10 – Auto-Owners: Best for Client Centric

Pros

- Affordable Rates: Auto-Owners Insurance offers competitive rates starting at around $47 per month, which is advantageous for Toyota Yaris drivers looking for cost-effective coverage. Their discounts, including a 20% good driver discount, help lower premiums for Yaris owners. Competitive pricing ensures value for Yaris enthusiasts.

- Comprehensive Coverage: Auto-Owners provides a range of coverage options, including accident forgiveness and roadside assistance, which benefit Toyota Yaris drivers. These features enhance overall protection and provide peace of mind for various driving scenarios. Comprehensive coverage options cater to the needs of Yaris owners. Learn more through our Auto-Owners insurance review.

- Strong Customer Service: Auto-Owners is praised for its excellent customer service and claims handling, which is valuable for Toyota Yaris drivers seeking reliable support. Their responsive customer service ensures that any issues or claims are managed effectively. Good customer support contributes to overall satisfaction.

Cons

- Limited Online Tools: Auto-Owners’ online tools and resources are less comprehensive compared to some competitors, which may impact the convenience of managing your policy online. Toyota Yaris drivers who prefer digital interactions might find this limitation challenging. Improving online tools could enhance the user experience for Yaris owners.

- Availability Restrictions: Auto-Owners Insurance is not available in all states, which may limit access for Toyota Yaris drivers in certain regions. Checking availability in your area is essential for obtaining coverage. Ensuring regional availability can help Yaris enthusiasts find suitable insurance options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect Toyota Yaris Car Insurance Rates

When it comes to determining the cost of car insurance for a Toyota Yaris, several factors come into play. One of the primary factors is the age and model of the vehicle. Newer models tend to have higher insurance rates due to the higher cost of repairs or replacement.

Additionally, the Yaris is considered a compact car, and typically, smaller vehicles may be subject to higher insurance rates as they may not fare as well in accidents compared to larger vehicles.

Toyota Yaris Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $173 $285

American Family $150 $202

Auto-Owners $138 $178

Farmers $160 $221

Liberty Mutual $145 $192

Nationwide $130 $176

Progressive $143 $184

State Farm $119 $152

Travelers $141 $187

USAA $123 $148

Another crucial factor that affects insurance rates for a Toyota Yaris is the driver’s personal driving record. Insurance companies analyze the driver’s history, including any past violations or accidents. A clean driving record usually leads to lower insurance premiums compared to drivers with previous incidents, as it demonstrates responsible and safe driving habits.

Location is another significant factor that affects insurance rates for a Toyota Yaris. Your place of residence impacts the likelihood of theft or vandalism, as well as the frequency of accidents in the area. Generally, if you live in an urban area with higher crime rates or heavy traffic, you may expect higher insurance premiums.

Additionally, the level of coverage and deductible chosen by the policyholder can also impact the insurance rates for a Toyota Yaris. Opting for higher coverage limits and lower deductibles may result in higher premiums, as the insurance company assumes more risk.

On the other hand, choosing lower coverage limits and higher deductibles can help lower the insurance costs, but it also means the policyholder will have to pay more out of pocket in the event of a claim.

Understanding the Basics of Car Insurance for Toyota Yaris

Before diving deeper into the factors that affect insurance rates for a Toyota Yaris, let’s briefly cover the basics of car insurance. Car insurance typically consists of several components, such as liability coverage, collision coverage, comprehensive coverage, and personal injury protection (PIP) insurance.

Liability coverage is mandatory in most states and covers the cost of any damage or injuries caused to other parties involved in an accident where the insured driver is at fault. Collision coverage, on the other hand, covers damages to the insured vehicle if it collides with another vehicle or object.

Comprehensive coverage provides protection against non-collision-related damages, such as theft, vandalism, or natural disasters. Lastly, personal injury protection covers medical expenses for the insured driver and their passengers in the event of an accident. Enter your ZIP code now to begin.

The Importance of Shopping Around for Toyota Yaris Car Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Different Insurance Providers for Toyota Yaris Coverage

When comparing insurance providers for your Toyota Yaris coverage, it is crucial to consider not only the premiums but also the reputation and customer service of the company. To find the best car insurance, look for insurers with positive customer reviews, strong financial stability, and a history of efficiently handling claims.

Tim Bain

Licensed Insurance Agent

Additionally, exploring discounts or incentives offered by insurers that you may qualify for can help you get the best car insurance rates and significantly reduce your insurance costs. Enter your ZIP code now to begin comparing.

Frequently Asked Questions

What factors affect the cost of Toyota Yaris car insurance?

Several factors can affect the cost of Toyota Yaris car insurance, including the driver’s age, location, driving history, credit score, coverage limits, deductibles, and the insurance provider’s pricing policies.

Are Toyota Yaris cars expensive to insure?

The cost of insurance for Toyota Yaris cars can vary depending on multiple factors. However, generally speaking, the Toyota Yaris is considered an affordable car to insure compared to many other vehicles in its class. Enter your ZIP code now to begin.

Does the trim level of the Toyota Yaris impact insurance rates?

Yes, the trim level of the Toyota Yaris can impact insurance rates. Higher trim levels often come with additional features and higher values, which may increase the cost of insurance coverage.

Additionally, what age do you get cheap car insurance can influence how much you pay. Younger drivers might face higher rates regardless of trim level, while older, more experienced drivers may benefit from lower premiums.

Is it more expensive to insure a new Toyota Yaris compared to an older model?

In general, insuring a new Toyota Yaris may be slightly more expensive compared to an older model. Newer cars typically have higher values, which can lead to higher insurance premiums.

However, other factors such as safety features and repair costs may also influence the insurance rates.

What is the starting monthly rate for Toyota Yaris insurance with Progressive?

Progressive offers Toyota Yaris insurance starting at $45 per month. This competitive rate is ideal for budget-conscious drivers looking for comprehensive coverage. Enter your ZIP code now to begin.

Which insurance company offers a 20% good driver discount for Toyota Yaris drivers?

USAA provides a 20% good driver discount for Toyota Yaris drivers, which can be a significant factor in finding the best car insurance discount.

This discount helps reduce insurance costs for those with a clean driving record, making it an attractive option for Yaris owners seeking affordable premiums.

What makes State Farm a top choice for Toyota Yaris insurance?

State Farm is highly rated for its excellent customer service. Toyota Yaris owners appreciate their responsive support and reliable claims handling.

Which insurer is known for its Drivewise program and competitive rates for Toyota Yaris owners?

Allstate is known for its Drivewise program, which rewards safe driving habits. Toyota Yaris owners can benefit from additional savings through this program. Enter your ZIP code now to begin.

What are some of the coverage options provided by American Family for Toyota Yaris drivers?

American Family offers robust claims service and comprehensive coverage options. Toyota Yaris drivers can choose from various plans to suit their needs and preferences.

Additionally, obtaining insurance quotes online through American Family’s website can streamline the process, allowing you to compare different coverage options and find the best fit for your Toyota Yaris.

How does Auto-Owners Insurance support Toyota Yaris drivers with its discount programs?

Auto-Owners Insurance provides discounts tailored to Toyota Yaris drivers, focusing on client-centric benefits. Their programs aim to offer affordable rates while maintaining high coverage quality.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.