Best Business Insurance for Antique Stores in 2026 (Your Guide to the Top 10 Providers)

Chubb, Liberty Mutual, and Travelers have the best business insurance for antique stores, offering comprehensive coverage, excellent customer service, and competitive rates starting at $90 monthly. These companies provide tailored solutions for antique stores, ensuring valuable protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Chris Tepedino is a feature writer that has written extensively about home, life, and car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. ...

Chris Tepedino

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Company Facts

Full Coverage for Antique Stores

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Antique Stores

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Antique Stores

A.M. Best Rating

Complaint Level

Pros & Cons

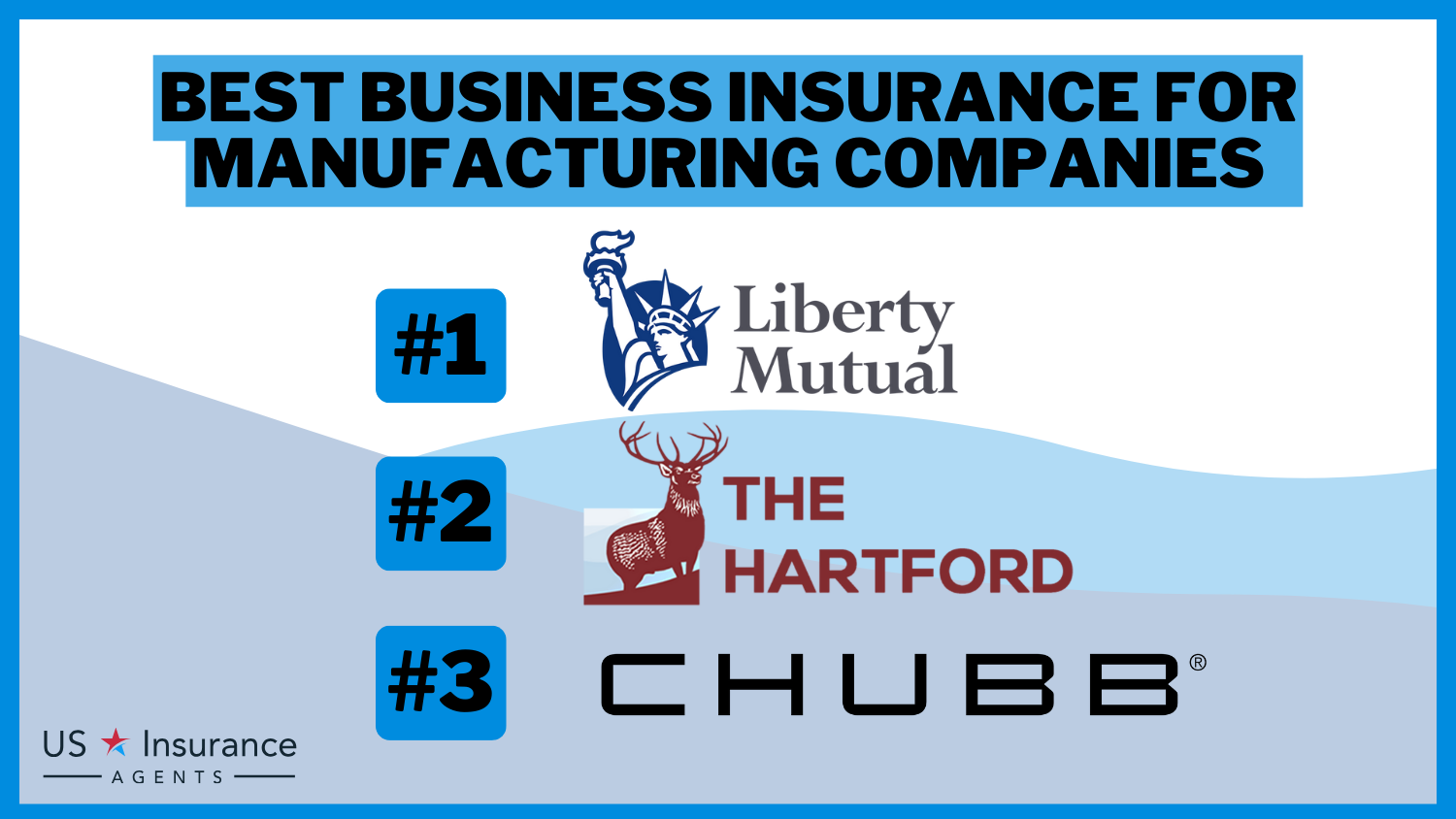

The leading providers for the best business insurance for antique stores are Chubb, Liberty Mutual, and Travelers, renowned for their exceptional coverage and competitive rates. These companies stand out as some of the best insurance companies in the industry, known for their commitment to providing comprehensive protection and excellent customer service.

Our Top 10 Company Picks: Best Business Insurance for Antique Stores

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 10% | High-Risk Savings | Chubb | |

| #2 | 25% | 30% | Customizable Coverage | Liberty Mutual |

| #3 | 13% | 15% | Tailored Coverage | Travelers | |

| #4 | 20% | 20% | Specialized Coverage | Nationwide |

| #5 | 10% | 31% | Competitive Rates | Progressive | |

| #6 | 15% | 30% | Customizable BOP | State Farm | |

| #7 | 25% | 22% | Customizable Policies | Allstate | |

| #8 | 5% | 15% | Local Agents | Farmers | |

| #9 | 5% | 20% | Quick Claims | The Hartford |

| #10 | 29% | 20% | Safe-Driving Discounts | American Family |

Our free quote tool above makes it easy to compare affordable coverage options for your business — simply enter your ZIP code to find the best commercial insurance company for you.

#1 – Chubb: Top Overall Pick

Pros

- Specialized Coverage: Chubb is known for providing specialized coverage tailored to the unique needs of antique stores. This ensures that businesses in this niche receive comprehensive protection for their valuable collections.

- High Financial Strength: Chubb insurance review & ratings has a strong financial standing, often receiving high ratings from credit rating agencies. This is reassuring for policyholders, indicating the company’s ability to fulfill claims even in challenging economic conditions.

- Global Presence: Chubb operates on a global scale, offering businesses the advantage of international coverage. This can be beneficial for antique stores with a diverse range of assets and potential risks spanning multiple locations.

Cons

- Premium Costs: Chubb’s high-quality coverage often comes at a premium cost. While businesses benefit from specialized protection, the expense may be a limiting factor for small antique stores with tighter budgets.

- Limited Online Presence: Chubb’s online services and digital tools might be considered less user-friendly compared to some competitors. This can be a drawback for businesses seeking seamless and convenient online interactions for policy management and claims.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Liberty Mutual: Best for Customizable Coverage

Pros

- Diverse Insurance Offerings: Liberty Mutual offers a wide range of insurance products, including coverage for antique stores. This versatility allows customers to consolidate their insurance needs with one provider, simplifying the management of policies. See details in our Liberty Mutual Review & Ratings.

- Advanced Technology: The company has invested in advanced technology, providing customers with user-friendly online tools and mobile apps for policy management, claims processing, and other interactions. This can enhance the overall customer experience.

- Discount Opportunities: Liberty Mutual frequently offers various discounts, such as bundling discounts for multiple policies, safe driver discounts, and more. This can result in cost savings for customers who qualify for these discounts.

Cons

- Mixed Customer Service Reviews: Liberty Mutual’s customer service reviews are mixed, with some customers expressing satisfaction while others report challenges in claims processing and communication. This variability in customer experiences may be a consideration for potential policyholders.

- Average Financial Strength: While Liberty Mutual maintains a stable financial standing, its ratings from credit agencies are typically in the middle range. Some competitors may have higher financial strength ratings, which could be a factor for businesses seeking the utmost financial stability from their insurance provider.

#3 – Travelers: Best for Tailored Coverage

Pros

- Extensive Coverage Options: Travelers provides a broad array of insurance products, allowing businesses, including antique stores, to tailor their coverage to specific needs. This versatility can be advantageous for businesses with diverse risk profiles. More information is available about this provider in our Travelers Insurance Review & Ratings.

- Strong Financial Stability: Travelers is often recognized for its strong financial stability, receiving high ratings from credit agencies. This financial strength can instill confidence in policyholders that the company is well-equipped to handle claims, even in challenging economic conditions.

- Risk Control Services: Travelers offers risk control services to help businesses identify and mitigate potential risks. This proactive approach to risk management can be valuable for antique stores looking to minimize the likelihood of incidents and losses.

Cons

- Potentially Higher Premiums: Some customers have reported that Travelers’ premiums may be relatively higher compared to other insurers. While the company offers comprehensive coverage, businesses with budget constraints might find the cost to be a consideration.

- Mixed Customer Reviews: Customer reviews for Travelers vary, with some expressing satisfaction with the company’s services, while others report challenges in claims processing and communication. This mixed feedback suggests that customer experiences may differ, warranting careful consideration.

#4 – Nationwide: Best for Specialized Coverage

Pros

- Comprehensive Coverage Options: Nationwide offers a wide range of insurance products, providing businesses, including antique stores, with comprehensive coverage options. This allows policyholders to tailor their insurance plans to meet specific needs. Read up on our Nationwide Insurance Review & Ratings.

- Member Benefits: As a mutual insurance company, Nationwide operates on behalf of its policyholders. This structure often leads to member benefits, such as potential policyholder dividends or other perks, enhancing the overall value for customers.

- Nationwide Brand Recognition: Nationwide is a well-established and recognized brand in the insurance industry. This brand recognition can instill trust and confidence in customers, especially those seeking stability and reliability in their insurance provider.

Cons

- Mixed Customer Service Reviews: Nationwide’s customer service reviews are mixed, with some customers reporting positive experiences and others expressing dissatisfaction. This variability in customer feedback suggests that the quality of customer service may vary.

- May not be the Cheapest Option: While Nationwide provides comprehensive coverage, it may not always be the most budget-friendly option. Some competitors might offer lower premiums, making Nationwide potentially less attractive for businesses seeking cost-effective solutions.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Competitive Rates

Pros

- Competitive Pricing and Discounts: Progressive is known for its competitive pricing and a variety of discounts. This can make it an attractive option for businesses, including antique stores, looking for cost-effective insurance solutions. Check out insurance savings in the comprehensive Progressive insurance review & ratings.

- Innovative Technology: Progressive has invested in innovative technology, providing customers with user-friendly online tools and mobile apps. This includes features like online quotes, easy policy management, and a mobile app for convenient access to information and claims processing.

- Name Your Price Tool: Progressive’s “Name Your Price” tool allows customers to customize their coverage and set a budget. This transparency in pricing can be appealing for businesses that want flexibility in choosing coverage that aligns with their financial goals.

Cons

- Mixed Customer Service Reviews: Progressive’s customer service reviews vary, with some customers praising the company’s service, while others express dissatisfaction. The quality of customer service may not be consistently high for all policyholders.

- May not Cater to Specialized Needs: While Progressive offers a range of insurance products, it may not provide highly specialized coverage for certain niche businesses or unique risks. Businesses with specific and complex insurance needs may need to assess if Progressive can fully meet those requirements.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Personalized Agent Support: Farmers has an extensive network of local agents, providing personalized support to policyholders. This can be beneficial for businesses, including antique stores, that prefer a hands-on and localized approach to insurance.

- Comprehensive Coverage Options: Farmers offers a wide range of insurance products, allowing businesses to consolidate their coverage needs with one provider. This can simplify policy management for businesses with diverse insurance requirements. Delve into the evaluation of Farmers insurance review & ratings.

- Innovative Policy Features: Farmers is known for introducing innovative policy features. For example, their “Smart Plan Home” and “Signal” programs offer unique benefits and discounts based on policyholder behavior. These innovations can be attractive to businesses seeking cutting-edge insurance solutions.

Cons

- Potentially Higher Premiums: Some customers have reported that Farmers’ premiums may be on the higher side compared to other insurers. Businesses with budget constraints might find the cost to be a consideration.

- Mixed Customer Reviews: Farmers’ customer reviews vary, with some expressing satisfaction and others reporting challenges in claims processing and customer service. The mixed feedback suggests that the quality of customer experience may differ among policyholders.

#9 – The Hartford: Best for Quick Claims

Pros

- Specialized Business Insurance: The Hartford specializes in business insurance, providing tailored coverage for various industries, including antique stores. This specialization can be advantageous for businesses seeking comprehensive and industry-specific coverage. Unlock details in the The Hartford insurance review & ratings.

- Risk Management Services: The Hartford offers risk management services to help businesses identify and mitigate potential risks. This proactive approach can be valuable for antique stores looking to minimize the likelihood of incidents and losses.

- Strong Financial Stability: The Hartford is typically recognized for its strong financial stability, receiving high ratings from credit agencies. This financial strength can instill confidence in policyholders regarding the company’s ability to fulfill claims.

Cons

- May not be the Cheapest Option: While The Hartford provides specialized coverage, it may not always be the most budget-friendly option. Some competitors might offer lower premiums, making The Hartford potentially less attractive for cost-conscious businesses.

- Limited Online Presence: The Hartford’s online tools and digital presence may be perceived as less advanced compared to some competitors. Businesses seeking a seamless online experience for policy management may find this to be a drawback.

#10 – American Family: Best for Safe-Driving Discounts

Pros

- Bundle and Save Options: American Family offers bundling options, allowing businesses to combine multiple insurance policies for potential cost savings. This can be advantageous for businesses looking to streamline their insurance needs. Discover insights in our American Family Insurance Review & Ratings.

- Local Agent Network: American Family has a network of local agents, providing businesses with personalized support. This localized approach can be beneficial for antique stores that value face-to-face interactions and a strong community presence.

- Innovative Coverage Options: American Family introduces innovative coverage options. For example, their “DreamSecure Simplified” life insurance provides a simplified and easy-to-understand policy, catering to customers who prefer straightforward coverage.

Cons

- Mixed Customer Service Reviews: Customer service reviews for American Family are mixed, with some customers expressing satisfaction and others reporting challenges. The quality of customer service may vary among policyholders.

- Limited Geographic Availability: American Family primarily operates in certain regions, limiting its availability compared to larger national insurers. Businesses located outside its service areas may need to consider alternative providers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Insurance for Antique Business Owners

Running an antique shop comes with its fair share of risks, making it crucial to secure your business with antique shop insurance. Here are several factors that can influence the cost of antique shop insurance. Here are some key considerations:

- Location: The location of your antique shop plays a significant role in insurance costs. Shops located in busy areas with high foot traffic may face a higher risk of accidents or injuries, leading to higher insurance premiums. On the other hand, shops in less populated areas may have lower insurance costs due to a lower probability of incidents.

- Revenue: The amount of money your antique shop generates can impact insurance costs. Higher revenue typically indicates a larger business with more risks, necessitating comprehensive insurance coverage. Conversely, if you’re just starting out and have a lower income, a standard insurance policy may be more suitable.

- Size: The size of your antique shop, including the number of employees, is another crucial factor. Larger businesses with multiple employees require more comprehensive coverage, as there is a higher risk of accidents or injuries. Insuring your employees is essential, as any work-related injuries would require costly medical expenses.

Regardless of your shop’s size or revenue, understanding these factors empowers you to make informed decisions tailored to your specific needs, ensuring that your business is adequately protected against unforeseen circumstances. Additionally, analyzing business insurance monthly rates for antique stores by coverage type reveals intriguing insights into varying costs across insurers.

Business Insurance Monthly Rates for Antique Stores by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $109 | $325 |

| American Family | $98 | $309 |

| Chubb | $110 | $390 |

| Farmers | $90 | $276 |

| Liberty Mutual | $106 | $358 |

| Nationwide | $95 | $293 |

| Progressive | $107 | $328 |

| State Farm | $108 | $341 |

| The Hartford | $114 | $374 |

| Travelers | $105 | $347 |

Chubb offers the highest minimum coverage at $110, while Farmers provides the lowest at $90. However, when considering full coverage, Farmers maintains its competitive edge with a rate of $276, while The Hartford tops the list at $374.

Such variations underscore the importance of thorough comparison shopping to ensure antique store owners secure the most suitable coverage at the best rates, emphasizing the significance of understanding specific business needs and gaining knowledge in commercial insurance.

Navigating Antique Business Insurance

Discovering the world of Antique business insurance involves understanding the unique risks and coverage needs of antique businesses. Given the varying factors such as the value of antiques, business size, and location, selecting the right business insurance policy is crucial.

Business owners must assess their specific requirements, including property protection, liability coverage, and potential risks like theft or damage. Comparing quotes from reputable insurers and considering additional coverage options such as business interruption insurance can provide comprehensive protection.

Jeff Root Licensed Life Insurance Agent

By navigating these aspects thoughtfully, antique business owners can safeguard their investments and ensure financial security against unforeseen events.

Exploring the Various Types of Antique Business Insurance Coverage

There are several types of insurance coverage that are commonly recommended for antique shops. Here are the main types of insurance that antique shop owners typically consider:

- General Liability Insurance: General liability insurance provides coverage for third-party claims of bodily injury, property damage, or personal injury. It protects your antique shop from lawsuits and legal expenses if someone is injured on your premises or if you accidentally damage someone else’s property. Learn more on our “Commercial General Liability (CGL) Insurance: A Complete Guide“.

- Commercial Property Insurance: Commercial property insurance protects the physical assets of your antique shop, including the building, inventory, equipment, and fixtures. It provides coverage against perils such as fire, theft, vandalism, and natural disasters. This insurance helps to repair or replace damaged property, ensuring that your business can recover and continue operations.

- Product Liability Insurance: Product liability insurance is crucial for antique shops that sell antique items. It provides coverage for any claims arising from injuries or damages caused by the products you sell. Antique items can be fragile or have potential hazards, and this insurance protects your business from liability if someone is harmed by an antique item they purchased from your shop.

- Business Interruption Insurance: Business interruption insurance provides coverage for lost income and ongoing expenses if your antique shop is forced to temporarily close due to a covered event, such as a fire, natural disaster, or other insured perils. It helps to cover operating expenses, employee salaries, and any loss of income during the period of closure.

- Workers’ Compensation Insurance: If you have employees working in your antique shop, workers’ compensation insurance is usually required by law. It provides coverage for medical expenses, disability benefits, and lost wages if an employee is injured or falls ill while on the job.

- Cyber Liability Insurance: In the digital age, cyber liability insurance has become increasingly important for businesses, including antique shops. It provides coverage for expenses related to data breaches, cyberattacks, and the legal and financial consequences that may arise from them.

These are some of the main types of insurance coverage that antique shop owners typically consider. The specific insurance needs of your antique shop may vary based on factors such as the size of your business, the value of your inventory, the number of employees, and the location.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Obtaining an Online Quote for Antique Store Insurance

In today’s digital age, obtaining an online quote for antique store insurance has become a convenient and efficient process. With just a few clicks, antique business owners can access a wealth of information and compare quotes from multiple insurance providers. Here’s a step-by-step guide to help you navigate the process:

- Research Insurance Providers: Before seeking quotes, it’s essential to research reputable insurance providers that specialize in business insurance for antique stores. Look for companies with a strong financial standing, positive customer reviews, and experience in insuring businesses similar to yours.

- Visit Insurance Comparison Websites: Utilize insurance quotes online on comparison websites to streamline the quote-gathering process. These platforms allow you to input your business information once and receive quotes from multiple insurance companies simultaneously. Make sure to choose a trusted comparison website to ensure accuracy and reliability.

- Provide Business Information: To receive accurate quotes, you’ll need to provide relevant information about your antique store. This may include details such as your business location, square footage, annual revenue, number of employees, inventory value, and any specific insurance coverage requirements.

- Customize Coverage Options: During the quote process, you’ll have the opportunity to customize coverage options based on your unique needs and preferences. Consider factors such as property protection, liability coverage, business interruption insurance, and specialty coverage for valuable items.

- Review and Compare Quotes: Once you’ve received quotes from various insurance providers, take the time to review and compare them carefully. Pay attention to coverage limits, deductibles, exclusions, and premium costs. Keep in mind that the cheapest quote may not always offer the most comprehensive coverage.

- Seek Clarification: If you have any questions or concerns about the quotes you receive, don’t hesitate to reach out to the insurance companies for clarification. A knowledgeable insurance agent or representative can provide guidance and help you make informed decisions.

- Select the Best Option: After thorough evaluation and comparison, select the insurance option that best meets your antique store’s needs and budget. Remember to consider factors such as coverage quality, customer service reputation, claims handling efficiency, and overall value.

- Finalize the Policy: Once you’ve chosen an insurance provider and coverage option, finalize the policy by completing the necessary paperwork and payment process. Be sure to review the policy documents carefully to ensure all details are accurate and meet your expectations.

- Regularly Review and Update Coverage: After securing insurance coverage for your antique store, it’s important to regularly review and update your policy as needed. As your business evolves and grows, your insurance needs may change, so it’s essential to stay informed and adequately protected.

By following these steps, antique store owners can efficiently obtain online quotes for business insurance and secure comprehensive coverage to protect their valuable assets.

Look into their policy terms, including coverage limits, exclusions, and deductibles, ensuring they align with your business’s unique needs. Additionally, explore Chubb’s accessibility and efficiency in handling claims, as seamless claims processing can be vital during challenging times.

By carefully evaluating these factors alongside coverage options and costs, you can confidently navigate the insurance landscape and safeguard your antique business against uncertainties.

Case Studies: How Insurance Safeguards Antique Stores

Explore the vital role of insurance in safeguarding antique stores. These case studies delve into how various types of insurance coverage protect businesses from unforeseen events, ensuring financial stability and peace of mind.

- Case Study #1 – Property Insurance: A severe storm damages an antique store’s historic building, causing water leakage and ruining valuable items. Property insurance funds repairs and item replacement.

- Case Study #2 – Liability Insurance: A customer’s fall leads to a negligence lawsuit against an antique store. Liability insurance covers expenses and settlements, protecting against financial losses.

- Case Study #3 – Business Interruption Insurance: Evacuation orders due to wildfires force an antique store to close temporarily. Business interruption insurance compensates for lost income and expenses.

- Case Study #4 – Specialty Coverage for Valuable Items: Despite security measures, a rare artifact is stolen from an antique store. Specialty coverage reimburses the value and covers damages, minimizing financial impact.

These case studies vividly demonstrate the importance of insurance for antique stores. From property damage and liability claims to business interruptions and theft, insurance coverage provides invaluable protection against diverse risks.

Laura Walker Former Licensed Agent

By understanding these scenarios, antique store owners can make informed decisions to mitigate potential losses and secure their businesses for the future.

Summing up: The Importance of Business Insurance for Antique Stores

Selecting the right insurance policy for your antique business is a crucial step in protecting your assets and mitigating potential risks.

By following a systematic approach, including assessing your risks, researching insurance providers, comparing coverage options, seeking professional advice, reviewing policy terms, considering the cost, seeking recommendations, and regularly reviewing and updating your coverage, you can make an informed decision that includes understanding what comprehensive coverage entails.

Remember, insurance is an investment that provides peace of mind and safeguards your antique business against unexpected events and liabilities.

Compare personalized quotes for commercial insurance by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

What types of insurance coverage are commonly recommended for antique shops?

Antique shop owners often consider several types of insurance coverage, including property insurance, liability insurance, business interruption insurance, and specialty coverage for valuable items. The specific coverage needs may vary based on factors like the business’s size, inventory value, number of employees, and location.

To learn more, explore our comprehensive resource on “Best Business Insurance: A Complete Guide“.

How can I select the ideal insurance coverage for my antique business?

Selecting the right insurance policy involves evaluating your options, seeking professional advice when needed, and choosing a policy that provides comprehensive coverage for specific risks. The process includes assessing risks, researching insurance providers, comparing coverage options, and considering the cost.

Can you provide examples of how insurance safeguards antique stores through case studies?

Certainly! Case studies illustrate how different types of insurance, such as property insurance, liability insurance, business interruption insurance, and specialty coverage, safeguard antique stores in various scenarios. These examples highlight the importance of having adequate insurance to protect against unforeseen events and liabilities.

Use our free quote comparison tool below and find the best business insurance company for your budget and needs.

What factors can influence the cost of insurance for an Antique Business?

The cost of antique business insurance can be influenced by factors such as the size of the business, the value of the antiques, the level of coverage needed, and the type of coverage chosen. Other considerations include the location of the business, the type of building housing the antiques, and security measures in place.

To find out more, explore our guide titled “How does the insurance company determine my premium?”

What is the importance of having specialty coverage for valuable items in an antique store?

Specialty coverage is crucial for protecting highly valuable items against theft or damage, ensuring the store can recover the full value of these items without significant financial loss.

Are there case studies that demonstrate how insurance has safeguarded antique stores?

Yes, case studies illustrate how various types of insurance, such as property and liability insurance, have protected antique stores from financial losses due to unexpected events.

How should an antique store owner go about selecting the right insurance coverage?

Owners should assess risks, compare coverage options from various providers, seek professional advice, and consider cost to select a policy that offers comprehensive protection.

For additional details, explore our comprehensive resource titled “How to Get Free Insurance Quotes Online“.

What role does location play in determining the insurance costs for an antique business?

The business’s location can impact insurance costs, with factors like the type of building housing the antiques and local security measures playing a significant role.

What does antique dealers insurance cover?

Antique dealers insurance typically covers a range of risks associated with running an antique business, including property damage, liability claims, theft, and business interruption. It may also offer specialized coverage for valuable antiques and artifacts.

How often should antique store owners review and update their insurance coverage?

It’s recommended to regularly review and update insurance coverage to ensure it remains aligned with the current needs and risks of the business.

For more information on how often you should review and update your insurance coverage, check out our related article titled “How often should I review and update my car insurance coverage?“

How much does antique dealer insurance cost?

What are the key steps to take when exploring insurance options for an antique business?

Do I need insurance for my antique mall?

How can I find the right insurance for antique dealers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.