Best Business Insurance for Canoe Rentals in 2026 (Top 10 Companies)

Travelers, Nationwide, and Progressive emerge as top picks for the best business insurance for canoe rentals, offering rates as low as $65 per month. These companies offers tailored insurance to protect your business from liabilities like injuries or property damage during canoe rentals operations.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Canoe Rentals

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Canoe Rentals

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Canoe Rentals

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsTravelers, Nationwide, Progressive are the topic pick for the best business insurance for canoe rentals, offering tailored coverage options.

These companies offers comprehensive coverage options designed to safeguard against potential liabilities, including accidents causing bodily injury or property damage during canoe rental activities.

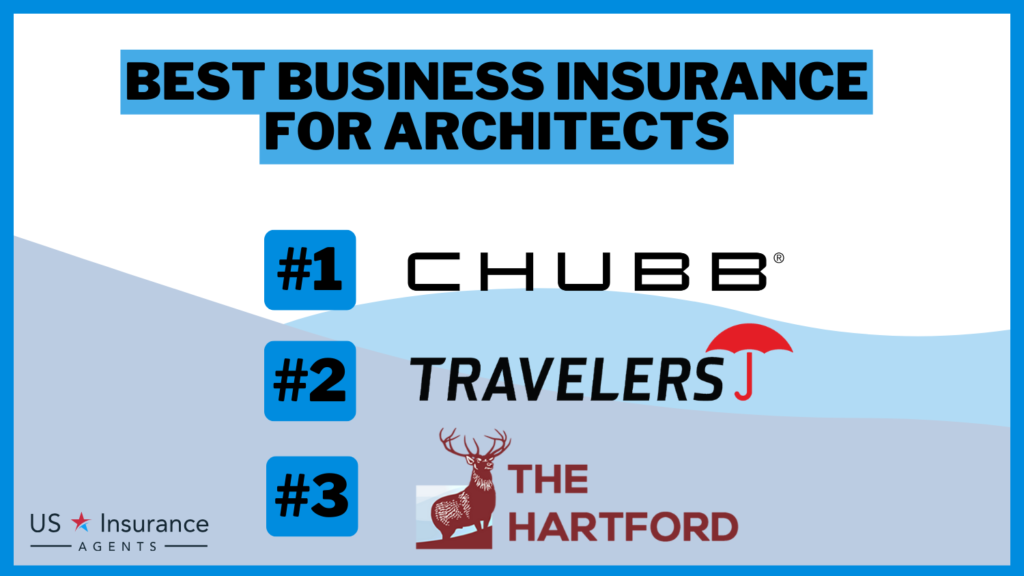

Our Top 10 Company Picks: Best Business Insurance for Canoe Rentals

| Company | Rank | Multi-Policy Discount | Safety & Security Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 5% | Coverage Options | Travelers | |

| #2 | 20% | 5% | Customized Policies | Nationwide | |

| #3 | 15% | 5% | Online Convenience | Progressive | |

| #4 | 17% | 5% | Local Presence | State Farm | |

| #5 | 25% | 5% | Trusted Protection | Allstate | |

| #6 | 12% | 5% | Industry Expertise | The Hartford |

| #7 | 15% | 5% | Customer Reviews | Liberty Mutual |

| #8 | 18% | 5% | High-Value Coverage | Chubb | |

| #9 | 10% | 5% | Add-On Coverages | Farmers | |

| #10 | 15% | 5% | Risk Management | CNA |

From personalized policies to exceptional customer service, insurance providers ensures peace of mind for your business, allowing you to focus on delivering exceptional experiences to your customers.

Protect your business today by entering your ZIP code above into our comparison tool for free commercial insurance quotes.

#1 – Travelers: Top Overall Pick

Pros

- Competitive Discounts: Travelers insurance review & ratings highlight cost-effective solutions for businesses with discounts of up to 10% for multi-policy and up to 5% for safety measures.

- Diverse Coverage Options: The company stands out with a range of coverage options, allowing customization based on the unique needs of canoe rental operations.

- Reputable Brand: Travelers’ established reputation contributes to trust and reliability for businesses seeking insurance coverage.

Cons

- Moderate Multi-Policy Discount: While offering a multi-policy discount, the rate of up to 10% is moderate compared to some competitors.

- Limited Safety Discount: The safety and security discount of up to 5% may be lower than what other companies provide.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Bundling Benefits

Pros

- Substantial Multi-Policy Discount: Nationwide offers an impressive up to 20% multi-policy discount, potentially providing significant savings for businesses bundling their insurance.

- Customized Policies: Nationwide insurance review & ratings emphasize personalized offerings, empowering businesses to craft policies perfectly suited to their canoe rental ventures.

- Competitive Safety Discount: The up to 5% safety discount complements the multi-policy discount, contributing to overall affordability.

Cons

- Less Online Convenience: Nationwide may lag in online convenience compared to some competitors, which could be a drawback for tech-savvy businesses.

- Limited Industry Expertise: While competitive, Nationwide’s expertise in the canoe rental industry might be perceived as less specialized than other providers.

#3 – Progressive: Best for Digital Advantage

Pros

- Online Convenience: Progressive insurance review & ratings highlight the company’s notable focus on digital services, offering convenience to businesses handling their insurance needs online.

- Competitive Multi-Policy Discount: With up to 15% off for multi-policy holders, Progressive offers a compelling incentive for businesses to bundle their insurance.

- Varied Coverage Options: The company provides a range of coverage options, allowing businesses to tailor their insurance to specific needs.

Cons

- Moderate Safety Discount: The up to 5% safety discount may be considered moderate compared to the higher percentages offered by some competitors.

- Industry Expertise: While offering diverse coverage, Progressive may lack the industry-specific expertise that some businesses seek in an insurance provider.

#4 – State Farm: Best for Local Assurance

Pros

- Competitive Multi-Policy Discount: State Farm offers up to 17% off for multi-policy holders, providing substantial savings for businesses bundling their insurance.

- Local Presence: State Farm insurance review & ratings highlight the importance of local accessibility, guaranteeing businesses convenient access to in-person assistance, which cultivates a tailored and swiftly responsive service.

- Established Reputation: State Farm’s long-standing reputation contributes to the trust and reliability that businesses may seek in an insurance provider.

Cons

- Limited Multi-Policy Discount: While competitive, the up to 17% multi-policy discount may be perceived as slightly lower compared to some other leading providers.

- Moderate Safety Discount: The up to 5% safety discount is standard, and businesses seeking higher safety incentives may find more attractive options elsewhere.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Maximum Savings

Pros

- Exceptional Multi-Policy Discount: Allstate offers an impressive up to 25% discount for multi-policy holders, potentially providing substantial cost savings.

- Trusted Protection: Allstate’s emphasis on trusted protection is reinforced by its long-standing presence in the insurance industry.

- Diverse Coverage Options: Businesses have the flexibility to create comprehensive insurance packages with a variety of coverage options offered by Allstate insurance review & ratings.

Cons

- Limited Industry Expertise: Allstate’s industry-specific expertise in canoe rentals may be perceived as less specialized compared to some competitors.

- Moderate Safety Discount: The up to 5% safety discount may be considered standard, and businesses seeking higher safety incentives might explore alternative options.

#6 – The Hartford: Best for Expertise Unleashed

Pros

- Industry Expertise: The Hartford stands out for its industry-specific expertise, offering tailored solutions for the unique needs of canoe rental businesses.

- Competitive Multi-Policy Discount: With up to 12% off for multi-policy holders, The Hartford provides a reasonable incentive for businesses to bundle their insurance.

- Varied Coverage Options: The Hartford insurance review & ratings highlight its extensive range of coverage choices, enabling businesses to tailor their insurance to their unique needs.

Cons

- Moderate Multi-Policy Discount: The up to 12% multi-policy discount may be perceived as moderate compared to some competitors offering higher percentages.

- Standard Safety Discount: The up to 5% safety discount is in line with industry standards, and businesses seeking higher safety incentives may explore other options.

#7 – Liberty Mutual: Best for Customer-Centric

Pros

- Competitive Multi-Policy Discount: Liberty Mutual offers up to 15% off for multi-policy holders, providing businesses with significant potential cost savings.

- Customer Reviews: Customer feedback enhances the credibility and dependability of Liberty Mutual’s insurance offerings, as reflected in Liberty Mutual insurance review & ratings.

- Varied Coverage Options: The company provides diverse coverage options, allowing businesses to tailor their insurance to specific needs.

Cons

- Moderate Safety Discount: The up to 5% safety discount may be considered standard, and businesses seeking higher safety incentives might explore alternative options.

- Potential for Mixed Customer Reviews: While generally positive, customer reviews may vary, and businesses should consider the mixed sentiments expressed by some customers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Chubb: Best for Elite Coverage

Pros

- High-Value Coverage: Chubb is known for providing high-value coverage, catering to businesses seeking comprehensive protection for their canoe rental operations.

- Competitive Multi-Policy Discount: With up to 18% off for multi-policy holders, Chubb offers a substantial incentive for businesses to bundle their insurance.

- Industry Reputation: The credibility and trustworthiness of Chubb’s insurance offerings are bolstered by its robust industry reputation, as evidenced in Chubb insurance review & ratings.

Cons

- Limited Safety Discount: The up to 5% safety discount may be perceived as standard, and businesses seeking higher safety incentives might explore alternative options.

- Potential Complexity: Chubb’s high-value coverage might come with added complexity, and businesses looking for a straightforward insurance solution may find it overwhelming.

#9 – Farmers: Best for Enhanced Protection

Pros

- Add-On Coverages: Farmers insurance review & ratings highlights the company for its customizable coverage options, empowering clients to bolster their insurance with extra safeguards.

- Competitive Multi-Policy Discount: With up to 10% off for multi-policy holders, Farmers offers a reasonable incentive for businesses to bundle their insurance.

- Established Presence: Farmers’ established presence in the insurance industry contributes to the credibility and reliability of its offerings.

Cons

- Limited Multi-Policy Discount: The up to 10% multi-policy discount may be perceived as moderate compared to some competitors offering higher percentages.

- Moderate Safety Discount: The up to 5% safety discount is standard, and businesses seeking higher safety incentives may explore alternative options.

#10 – CNA: Best for Managing Risk

Pros

- Risk Management: CNA insurance review & ratings highlight the companies reputation for prioritizing risk management, offering businesses strategic approaches to address and minimize potential difficulties.

- Competitive Multi-Policy Discount: With up to 15% off for multi-policy holders, CNA offers a compelling incentive for businesses to bundle their insurance.

- Customer Reviews: Positive customer reviews contribute to the trustworthiness and reliability of CNA’s insurance services.

Cons

- Limited Safety Discount: The up to 5% safety discount may be considered standard, and businesses seeking higher safety incentives might explore alternative options.

- Limited Industry Expertise: CNA’s industry-specific expertise in canoe rentals may be perceived as less specialized compared to some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Insurance Coverage for Canoe Rentals: Protecting Your Assets and Liabilities

From mitigating liability risks to safeguarding your valuable assets, we’ll explore the various coverage options tailored for canoe, kayak, and rowboat tour and rental businesses.

Jeff Root Licensed Life Insurance Agent

By understanding the types of coverage available and selecting the right insurance provider, you can ensure peace of mind while running your business.

- General Liability: General liability insurance protects your business from third-party claims for bodily injury or property damage. This coverage is essential for safeguarding your company in case accidents occur during rental or tour activities.

- Property Insurance: Property insurance covers your business’s physical assets, including canoes, kayaks, rowboats, and other equipment. In the event of theft, damage, or loss, this coverage ensures that you can recover the value of your property.

- Accident/Excess Medical: Accidents can happen unexpectedly, leading to injuries that require medical attention. Accident/excess medical insurance provides coverage for medical expenses incurred by customers or employees during rental or tour activities.

Whether it’s general liability coverage, property insurance, or accident/excess medical coverage, investing in comprehensive insurance solutions tailored for your business can provide the security you need to focus on delivering exceptional experiences to your customers.

Business Insurance for Canoe Rentals: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $70 | $140 |

| Chubb | $75 | $150 |

| CNA | $72 | $144 |

| Farmers | $68 | $136 |

| Liberty Mutual | $78 | $156 |

| Nationwide | $65 | $130 |

| Progressive | $67 | $134 |

| State Farm | $73 | $146 |

| The Hartford | $76 | $152 |

| Travelers | $74 | $148 |

Explore business insurance options for canoe rentals with monthly rates ranging from $65 to $78 for minimum coverage and $130 to $156 for full coverage, offered by leading providers like Allstate, Chubb, CNA, Farmers, Liberty Mutual, Nationwide, Progressive, State Farm, The Hartford, and Travelers.

Why Choose Business Insurance for Canoe Rentals: Tailored Coverage and Peace of Mind

Operating a rental or tour business involving canoes, kayaks, and rowboats exposes you to potential liability risks. It’s important to protect your business with the right insurance coverage. Here’s why choosing insurance coverage specifically designed for canoe, kayak, and rowboat tour and rental businesses is a wise decision. To gain further insights, consult our comprehensive guide titled “Boat Safety: Tips, Quotes and Resources”

- Tailored Coverage: Insurance providers understand the unique risks associated with the industry and can offer coverage that addresses those specific needs.

- Financial Protection: With proper insurance coverage, you can protect your business from potential claims and mitigate the financial risks associated with accidents or property damage.

- Peace of Mind: Having insurance coverage provides peace of mind, knowing that your business is protected in case of unforeseen incidents.

Whether it’s accidents causing bodily injury to customers or property damage during rental activities, the inherent nature of water-based recreational services necessitates proactive measures to safeguard your business interests.

By doing so, you not only ensure compliance with legal requirements but also provide essential protection for your business against unforeseen circumstances that could otherwise result in significant financial losses and reputational damage.

Case Studies: Utilizing Insurance Solutions for Canoe Rentals and Tour Businesses

From averting potential liabilities to fortifying financial resilience, these case studies serve as illuminating examples highlighting the indispensable significance of implementing tailored insurance solutions.

- Case Study #1 – General Liability Coverage: Scenic River Canoe, a popular rental company, saw a customer accidentally damage a private dock during a rental. With General Liability coverage, they were shielded from property damage claims, covering repair costs and averting financial strain. For additional details, explore our comprehensive resource titled “Renters Insurance: A Complete Guide“

- Case Study #2 – Property Insurance: River Adventures is a reputable canoe rental business with a large inventory of canoes, kayaks, and rowboats. One night, their storage facility suffers severe damage due to a fire caused by an electrical malfunction. With Property Insurance, River Adventures is able to recover the value of their damaged canoes and other equipment.

- Case Study #3 – Accident/Excess Medical Coverage: Nature Paddlers offers scenic river canoe tours, ensuring memorable experiences. When a participant sustains injury, accident/excess medical coverage covers medical expenses, highlighting the importance of business insurance for canoe rentals.

By learning from real-life scenarios and understanding the critical role that insurance plays in mitigating liabilities and protecting assets, businesses in the canoe rental and tour industry can better prepare themselves for the challenges ahead.

Melanie Musson Published Insurance Expert

Remember, investing in comprehensive insurance coverage isn’t just a precautionary measure; it’s a strategic decision that empowers businesses to thrive in an ever-evolving landscape while providing peace of mind for both owners and customers alike.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Roundup: Safeguard Your Canoe Rental Business: Mitigate Risks With the Right Insurance Coverage

Operating a canoe, kayak, or rowboat rental or tour business entails inherent risks, where accidents and liability claims can lead to significant financial losses. Obtaining tailored insurance coverage is vital, offering solutions such as general liability, property insurance, and accident/excess medical coverage to safeguard against potential losses and ensure business protection. To learn more, explore our comprehensive resource titled “Liability Insurance: A Complete Guide”

Take time to assess insurance options, weighing expertise, service, and coverage comprehensiveness. Investing in proper coverage ensures peace of mind, empowering focus on customer experiences. Safeguard your watercraft rental business, navigating with confidence against unforeseen incidents.

Protect your company and employees with adequate coverage — enter your ZIP code below to instantly compare commercial insurance quotes with our free comparison tool.

Frequently Asked Questions

What does canoe rental insurance cover?

Canoe rental insurance typically covers liability for bodily injury or property damage that may occur during the rental period. It may also include coverage for theft, vandalism, and damage to the rented canoe.

Do I need canoe insurance if I own my canoe?

While owning a canoe doesn’t legally require insurance, it’s highly recommended, especially if you plan to use it frequently or rent it out. Canoeing insurance can protect you financially from unexpected accidents or damages.

Don’t overpay for your commercial insurance – enter your ZIP code below to find the cheapest rates possible.

What does general insurance cover?

General insurance covers home, your travel, vehicle, and health (non-life assets) from fire, floods, accidents, man-made disasters, and theft. Different types of general insurance include motor insurance, health insurance, travel insurance, and home insurance.

To delve deeper, refer to our in-depth report titled “Health Insurance: A Complete Guide.“

How much does kayak rental business insurance cost?

The cost of kayak rental business insurance can vary depending on factors such as the size of your business, the number of kayaks you rent out, your location, and the coverage limits you choose. Generally, annual premiums can range from a few hundred to several thousand dollars.

What does kayak rental insurance cover?

Kayak rental insurance typically provides liability coverage for accidents or injuries that occur during the rental period. It may also cover theft, damage to the kayak, and other related risks.

What damages a kayak?

The most damage I see to kayaks is from handling on land. Kayaks that have been dropped, jumped off the kayak trailer, stored on racks and filled with water during the winter or various forms of transport damage. If possible, avoid handling the kayak by yourself.

For a thorough understanding, refer to our detailed analysis titled “Cars, Trains, Planes, and More – Transportation Vehicles in the U.S.”

Can kayaks be insured?

If you have a nonmotorized boat, like a kayak, sailboat, canoe, or dinghy, you can likely get boat insurance to cover it from damages while it’s in use.

What is kayak rental business insurance?

Kayak rental business insurance is a specialized insurance policy designed to protect business owners who rent out kayaks. It typically includes liability coverage, property damage coverage, and other specific protections tailored to the needs of kayak rental businesses.

How do you protect a kayak from theft?

Use a Kayak Locking Cable, Paddleboard Lock, or Canoe Lock As mentioned earlier, your goal is to make stealing your boat or board as hard as possible so thieves will move on or choose other targets. Works with recreational, touring, sit on top and fishing kayaks and also hard-bodied paddleboards.

Check out our ranking of the top providers: Best Business Insurance for Fishing Guides

How can I lower my kayak rental insurance cost?

To potentially lower the cost of kayak rental insurance, you can consider factors such as implementing safety protocols, maintaining a clean claims history, bundling insurance policies, and choosing higher deductibles. Additionally, shopping around and comparing quotes from multiple insurers can help you find the most competitive rates.

How much is marine insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.