Best Business Insurance for Health Insurance Companies in 2026 (Our Top 10 Picks)

Chubb, Travelers, and The Hartford stand out as top picks for the best business insurance for health insurance companies, offering specialized coverage and comprehensive solutions. Their competitive rates, starting at a 20% discount, make them compelling options for businesses seeking robust insurance protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated January 2025

Company Facts

Full Coverage for Health Insurers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Health Insurers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Health Insurers

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best business insurance for health insurance companies are Chubb, Travelers, and The Hartford, acclaimed for their specialized coverage and comprehensive solutions.

Chubb stands out as the premier choice, offering competitive rates and comprehensive coverage tailored for health insurance companies. With specialized policies addressing the unique needs of the industry, Chubb ensures robust protection for your business.

Our Top 10 Picks: Best Business Insurance for Health Insurance Companies

| Company | Rank | Multi-Policy Discount | Industry-Specific Discount | Best For | See Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Tailored Coverage | Chubb | |

| #2 | 12% | 8% | Customizable Coverage | Travelers | |

| #3 | 14% | 9% | Organization Discount | The Hartford |

| #4 | 12% | 7% | Bundling Policies | Nationwide |

| #5 | 13% | 8% | Add-on Coverages | Liberty Mutual |

| #6 | 13% | 8% | Online Convenience | Progressive | |

| #7 | 14% | 9% | Safe-Driving Discounts | Allstate | |

| #8 | 11% | 6% | Local Agents | Farmers | |

| #9 | 12% | 7% | Student Savings | Markel | |

| #10 | 10% | 5% | Customizable Policies | American Family |

In this article it emphasizes the advantages of evaluating options from various online and offline insurers, empowering informed decisions aligned with individual health insurance business requirements.

Protect your business today by entering your ZIP code above into our comparison tool for free commercial insurance quotes.

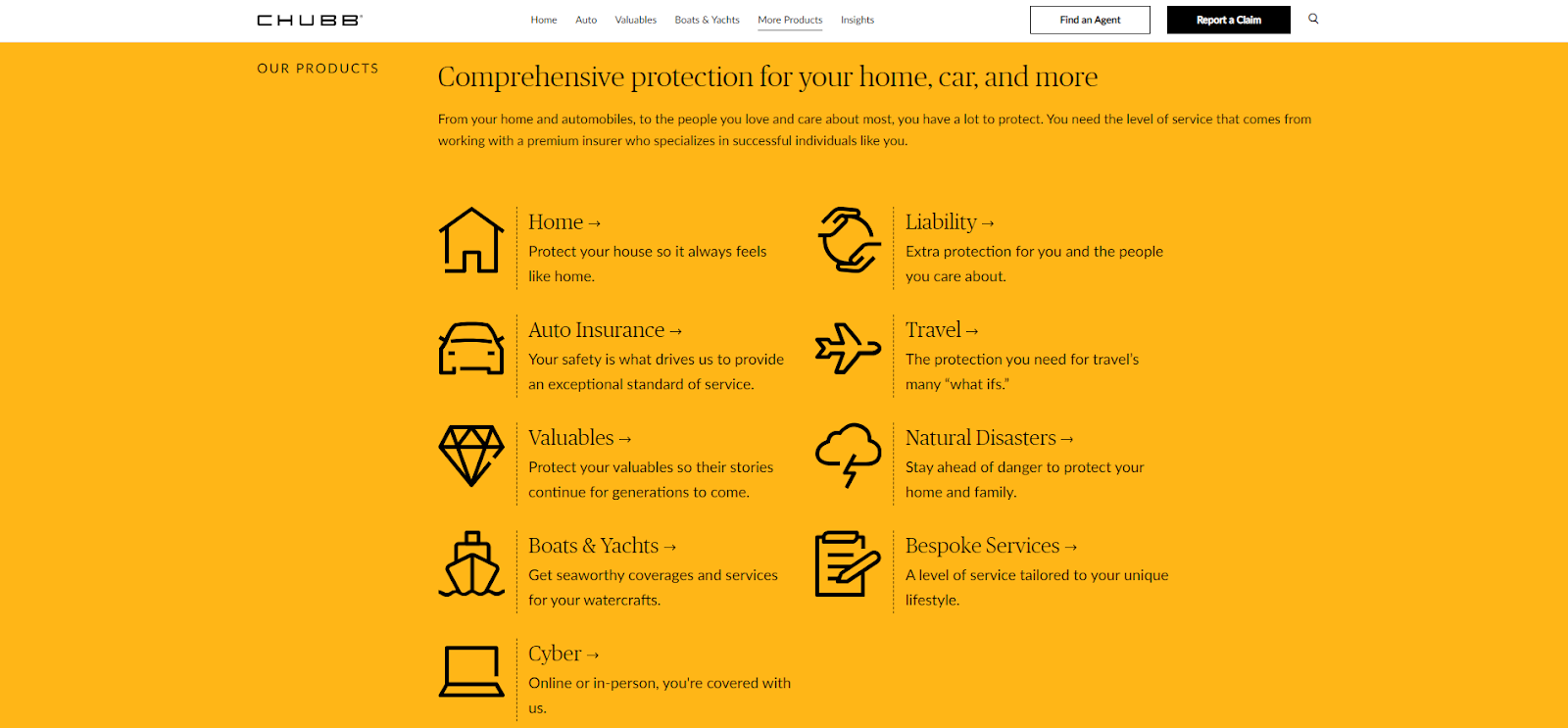

#1 – Chubb: Top Overall Pick

Pros

- High Financial Strength: Chubb insurance review & ratings highlight the company’s strong financial stability, providing assurance to policyholders.

- Global Presence: Offers coverage internationally, making it suitable for businesses with global operations.

- Wide Range of Coverage Options: Provides various insurance products, including specialty coverages for niche industries.

Cons

- Premiums Might be Higher: Chubb’s policies can be relatively more expensive compared to some other insurers.

- Limited Online Presence: Online quoting and policy management options may not be as robust as some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Navigating Coverage

Pros

- Extensive Coverage Options: Offers a wide range of insurance products, including business, auto, home, and specialty lines.

- Strong Financial Ratings: Our Travelers insurance review & ratings show the company is highly regarded for its financial strength, ensuring reliable coverage.

- Risk Control Services: Provides risk control services to help businesses reduce potential liabilities.

Cons

- Mixed Customer Service Reviews: Some customers report mixed experiences with Travelers’ customer service.

- Policy Customization Limitations: Limited flexibility in customizing policies compared to some other insurers.

#3 – The Hartford: Best for Tailored Excellence

Pros

- Specialized Business Coverages: The Hartford insurance review & ratings showcase specialized coverages for various industries, including technology and healthcare.

- Strong Financial Stability: Generally receives positive financial strength ratings.

- Personal and Business Insurance: Provides both personal and business insurance solutions.

Cons

- Limited Online Presence: Online services and policy management options may be less comprehensive.

- Mixed Customer Reviews: Some customers report mixed experiences with customer service.

#4 – Nationwide: Best for Diverse Protection

Pros

- Wide Range of Products: Offers various insurance products, including auto, home, business, and specialty lines.

- Member Discounts: Provides discounts for members of affiliated organizations and partners.

- Strong Financial Ratings: Our Nationwide insurance review & ratings highlight the company’s consistent financial strength, ensuring reliable coverage for policyholders.

Cons

- Variable Customer Service: Customer service experiences can vary, with some customers reporting dissatisfaction.

- Limited Regional Presence: The availability of certain products and services may vary by region.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Global Insurance

Pros

- Extensive Coverage Options: Offers a wide array of insurance products, including personal, business, and specialty lines.

- Discount Programs: Liberty Mutual insurance review & ratings reveal the company’s commitment to providing various discount programs for policyholders.

- Digital Tools and Mobile App: User-friendly digital tools and a mobile app for easy policy management.

Cons

- Mixed Customer Reviews: Some customers report mixed experiences with customer service and claims handling.

- Possibly Higher Premiums: Premiums may be relatively higher, especially for certain coverage types.

#6 – Progressive: Best for Competitive Coverage

Pros

- Competitive Rates: Our Progressive insurance review & ratings reveal the company’s solid reputation for competitive rates, especially in car insurance.

- Online Tools: User-friendly online tools and a mobile app for policy management.

- Snapshot Program: Offers a usage-based insurance program for potential premium discounts.

Cons

- Limited Business Insurance: Business insurance offerings may not be as comprehensive as some competitors.

- Customer Service Reviews: Some customers report mixed experiences with great customer service.

#7 – Allstate: Best for Versatile Protection

Pros

- Versatile Coverage Options: An Allstate insurance review & ratings indicate the company offers a comprehensive array of insurance products for both personal and business requirements.

- Discount Programs: Provides various discount programs for policyholders.

- Digital Tools: User-friendly online tools and a mobile app for convenient policy management.

Cons

- Possibly Higher Premiums: Premiums may be relatively higher, especially for certain coverage types.

- Claims Handling: Some customers report dissatisfaction with the claims handling process.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Insurance

Pros

Pros

- Variety of Insurance Products: Offers a range of insurance products, including auto, home, business, and life insurance.

- Discount Programs: Provides various discount programs for policyholders.

- Local Agents: Farmers insurance review & ratings demonstrate the company’s commitment to personalized service through its network of local agents.

Cons

- Possibly Higher Premiums: Premiums may be relatively higher, especially for certain coverage types.

- Claims Handling: Some customers report dissatisfaction with the claims handling process.

#9 – Markel: Best for Specialized Solutions

Pros

- Specialized Insurance Solutions: In our Markel insurance review & ratings, we emphasize the company’s dedication to providing specialized insurance solutions for niche industries.

- Flexible Coverage Options: Offers flexibility in tailoring coverage to the unique needs of businesses.

- Risk Management Services: Provides risk management services to help businesses identify and mitigate risks.

Cons

- Limited National Presence: Markel may have a more limited national presence compared to larger insurers.

- May not be Ideal for all Businesses: May not cater to the insurance needs of all types of businesses.

#10 – American Family: Best for Safeguarding Dreams

Pros

- Versatile Insurance Products: Offers a range of insurance products, including auto, home, business, and life insurance.

- Local Agents: Our American Family insurance review & ratings highlight the company’s reliance on a network of local agents for personalized service, ensuring tailored assistance for customers.

- Digital Tools: Provides user-friendly online tools and a mobile app for policy management.

Cons

- Limited National Presence: May not have as extensive a national presence as some larger insurers.

- Possibly Higher Premiums: Premiums may be relatively higher, especially for certain coverage types.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Essential Business Insurance Policies for Health Insurance Companies

To ensure comprehensive coverage, healthcare professionals should consider the following insurance policies:

- General Liability Insurance: General liability insurance covers basic third-party risks in a healthcare practice, such as injuries to patients or visitors. It is often a requirement for commercial leases and provides protection against lawsuits related to accidents or injuries that occur on your premises.

- Business Owner’s Policy (BOP):A Business Owner’s Policy combines commercial property insurance and general liability coverage into one package. It offers a cost-effective solution for healthcare specialists, providing protection for property damage, liability claims, business interruption, and access to a specialist network.

- Worker’s Compensation Insurance: Most states mandate workers’ compensation insurance for healthcare businesses with employees. This coverage protects employees in case of work-related injuries or illnesses and helps cover medical expenses, lost wages, and rehabilitation costs.

- Professional Liability Insurance: Professional liability insurance, also known as malpractice insurance for medical professionals, is crucial for protecting against claims of negligence or errors that result in patient harm. It covers legal expenses and damages awarded in malpractice lawsuits.

- Commercial Car Insurance: If your healthcare business owns vehicles used for work purposes, commercial car insurance is necessary. It provides coverage for accidents involving your business vehicles and helps protect your business from liability and property damage claims.

- Cyber Liability Insurance: With the increasing threat of data breaches and cyberattacks, healthcare businesses need protection against potential financial losses and reputational damage. Cyber liability insurance covers expenses related to data breaches, including legal fees, notification costs, and credit monitoring services.

These essential business insurance policies form the cornerstone of comprehensive coverage for health insurance companies. By proactively investing in these policies, healthcare professionals can mitigate risks, safeguard their assets, and ensure the continued delivery of quality services to their clients.

Jeff Root Licensed Life Insurance Agent

Embracing these insurance policies not only mitigates financial risks but also fosters confidence among stakeholders, including employees, clients, and partners. By demonstrating a commitment to comprehensive risk management, health insurance companies can uphold their reputation for reliability and trustworthiness in the industry.

Business Insurance Monthly Rates for Health Insurance Companies

Insurance Company Minimum Coverage Full Coverage

Allstate $44 $66

American Family $47 $68

Chubb $45 $65

Farmers $45 $66

Liberty Mutual $43 $63

Markel $46 $66

Nationwide $46 $68

Progressive $47 $69

The Hartford $43 $62

Travelers $48 $70

Explore competitive monthly insurance rates tailored for health insurance companies, covering both full and minimum coverage options. Compare leading providers such as Chubb, The Hartford, and Travelers alongside others like Nationwide, Liberty Mutual, and Allstate. Ensure comprehensive coverage for your health insurance business while optimizing costs to suit your needs.

Factors Affecting Insurance Costs for Health Insurance Companies

The cost of best business insurance for individual health insurance professionals depends on key factors, including the size and type of the healthcare practice, coverage limits and deductibles, location, number of employees, and annual revenue. Consulting with experienced professionals is crucial for tailoring coverage to specific business needs and mitigating financial risks effectively.

- Size and Type of the Healthcare Practice: The size and type of your healthcare practice significantly influence insurance costs. Factors considered include the number of patients served, services offered, and physical footprint. Larger practices with broader services may incur higher coverage limits and costs.

- Coverage Limits and Deductibles: Coverage limits signify the maximum payout for a claim, while deductibles represent the out-of-pocket amount before coverage begins. Opting for higher limits and lower deductibles, as well as considering whether to set an excess, offers extensive protection but may lead to increased premiums. Balancing adequate coverage with affordability is key.

- Location of the Practice: Know your area of cover. The location of your healthcare practice influences insurance costs due to regional factors such as local regulations, market conditions, and risks specific to the area. For example, a practice located in an area prone to natural disasters or with higher crime rates may have higher insurance premiums to account for increased risks.

- Number of Employees: The number of employees in your healthcare practice affects insurance costs, particularly for workers’ compensation insurance. The more employees you have, the higher the risk of work-related injuries or illnesses. Insurance premiums for workers’ compensation coverage are typically based on the number of employees and the nature of their work.

- Annual Revenue: The annual revenue of your healthcare practice may be considered when determining insurance costs. Higher revenue levels may indicate a greater exposure to risk, which could result in higher insurance premiums. Insurance providers may take into account revenue as an indicator of the practice’s size, patient volume, and overall financial standing.

Consulting with an experienced insurance professional who specializes in serving healthcare professionals is highly recommended. They can assess your unique practice, take into account these factors, and provide personalized advice on selecting the appropriate coverage limits, deductibles, and understanding the associated costs.

Understanding the complexities of insurance costs for health insurance companies is essential for safeguarding and ensuring financial stability. By considering key factors and seeking guidance from experienced professionals, you can tailor your coverage to meet your specific needs effectively.

Case Studies: Real-Life Examples – Business Insurance in Action for Health Insurance Companies

Business insurance is essential for health insurance companies, offering protection against various risks. These case studies showcase how insurance coverage helps navigate legal, property, and operational challenges, ensuring seamless operations and client satisfaction.

- Case Study #1 – Legal Protection: Safeguard Insurance Solutions used general liability insurance to cover medical expenses and legal fees after a visitor’s injury, preserving financial stability amidst legal challenges.

- Case Study #2 – Cybersecurity Assurance: Evergreen Health Insurance Agency relied on cyber liability insurance to respond to a cyberattack, safeguarding sensitive customer data and maintaining trust.

- Case Study #3 – Professional Integrity: Vanguard Health Insurance Corporation defended against negligence claims with professional liability insurance, protecting their reputation and financial assets.

- Case Study #4 – Employee Well-Being: Nova Health Insurance Services supported an injured employee with workers’ compensation insurance, demonstrating commitment to staff welfare and legal compliance.

Business insurance serves as a vital shield for health insurance companies, providing a safeguard against various inherent risks. These case studies highlight the significance of adopting comprehensive insurance strategies, enabling companies to navigate challenges seamlessly and ensure uninterrupted service delivery to clients.

Melanie Musson Published Insurance Expert

Embracing the appropriate insurance coverage not only strengthens the company’s foundation but also instills confidence in its leadership, paving the way for sustained growth and success in the dynamic landscape of health insurance.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Summary: Safeguard Your Health Care Practice With Business Insurance

Protecting your health insurance practice with the right insurance coverage is crucial for financial stability and risk management. Healthcare professionals, whether doctors, therapists, or facility owners, should consider essential insurance policies such as general liability, a Business Owner’s Policy (BOP), workers’ compensation, professional liability, commercial auto, and cyber liability insurance.

These policies provide comprehensive protection against third-party risks, property damage, lawsuits, work-related injuries, and cyber threats. The importance of each insurance policy and assessing your specific needs will help you shape your policy and make informed decisions about coverage limits and deductibles.

While the cost of insurance varies based on factors such as practice size, location, and revenue, consulting with experienced insurance professionals will ensure you obtain accurate cost estimates and tailored advice. By investing in the right insurance coverage, you can safeguard your healthcare practice, protect your assets, and have peace of mind knowing that you are prepared for unexpected events and liabilities.

Our free comparison tool makes it easy to stick to your business insurance budget – enter your ZIP code below to get started and ensure you’re knowledgeable about your budget.

Frequently Asked Questions

What factors determine the cost of business insurance for health insurance professionals?

The cost of business insurance depends on factors such as the size and type of the healthcare practice, coverage limits and deductibles, location, number of employees, and annual revenue.

Take an in-depth look at everything you need to know with our comprehensive report titled “What does health insurance cover?” and make informed decisions about your healthcare coverage.

What are the essential insurance policies that health insurance professionals should consider?

Essential insurance policies include general liability, a Business Owner’s Policy (BOP), workers’ compensation, professional liability, commercial auto, and cyber liability insurance.

What risks do these insurance policies protect against?

These policies provide protection against third-party risks, property damage, lawsuits, work-related injuries, and cyber threats.

Enter your ZIP code below to get started on comparing business insurance quotes.

How can health insurance professionals assess their specific insurance needs?

Understanding the importance of each insurance policy and assessing the practice’s specific needs will help professionals make informed decisions about coverage limits and deductibles.

For more information, check out our detailed guide “Health Insurance: A Complete Guide” for expert insights on navigating the complexities of health insurance confidently.

What factors influence the cost of insurance?

The cost of insurance varies based on factors such as practice size, location, and revenue.

Why is it important to consult with experienced insurance professionals?

Consulting with experienced professionals ensures obtaining accurate cost estimates and tailored advice for selecting appropriate coverage.

What benefits does general liability insurance offer?

General liability insurance provides protection against third-party claims, including bodily injury, property damage, and obtaining accurate quotes.

To learn more, explore our comprehensive resource on health insurance titled “How To Get Free Insurance Quotes Online.”

Can insurance policies be customized for specific practice needs?

Yes, insurance policies can be tailored to address the unique requirements of each healthcare practice.

How can insurance coverage safeguard a healthcare practice?

Investing in the right insurance coverage protects the practice’s assets and ensures preparedness for unexpected events and liabilities.

Enter your ZIP code below to get started on comparing business insurance quotes.

What is liability insurance and why is it important for health insurance companies?

Liability insurance is a type of coverage that protects businesses from financial losses resulting from claims of negligence, injury, or property damage caused to third parties.

What extras should I consider when purchasing business insurance for my health insurance company?

What products do you offer for health insurance companies seeking business insurance?

How can I ensure I’m getting a fair price for business insurance for my health insurance company?

What type of insurance is best for a small business?

Where can I find useful links and websites related to business insurance for health insurance companies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Pros

Pros