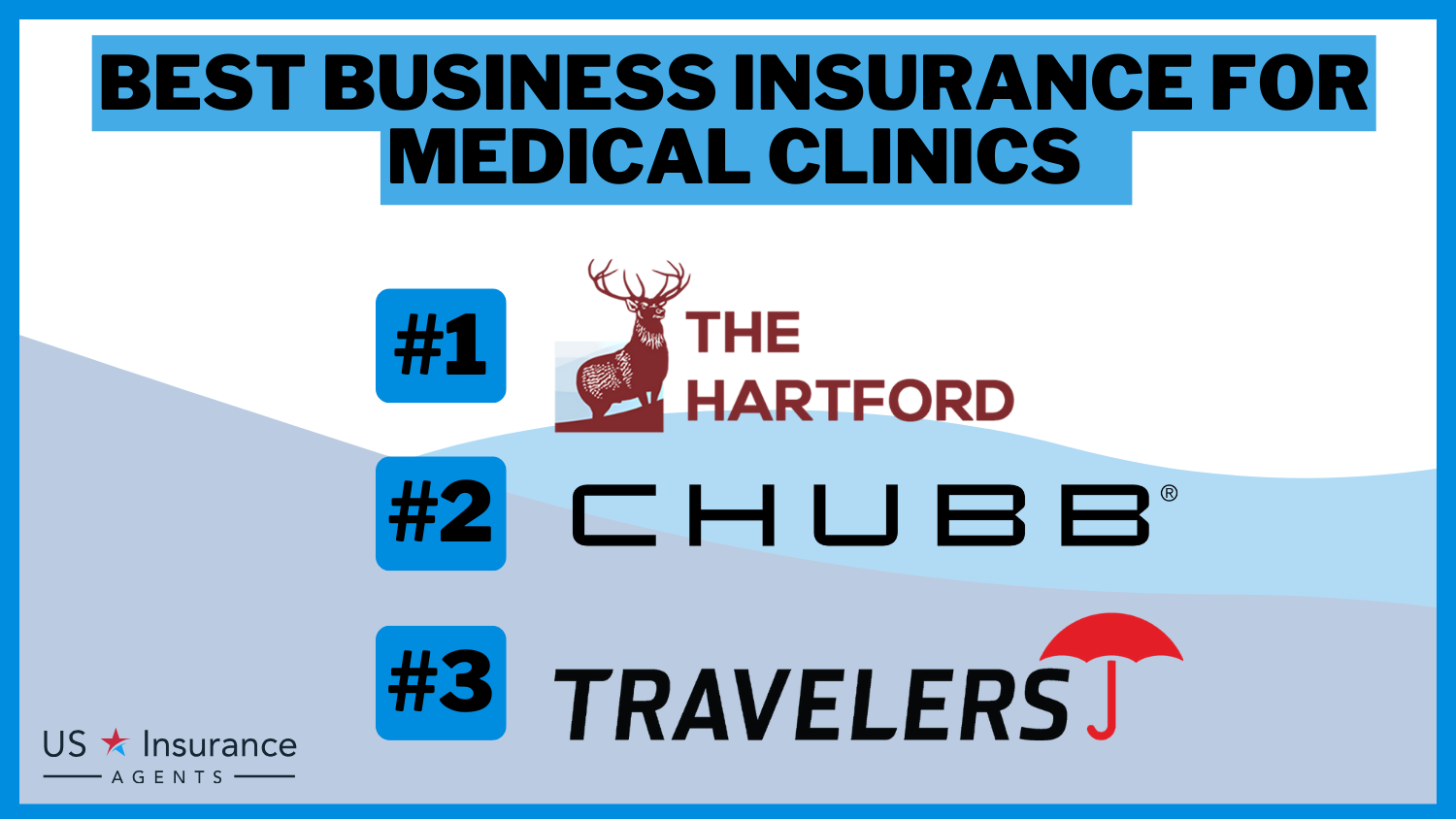

Best Business Insurance for Medical Clinics in 2026 (Top 10 Companies)

The Hartford, Chubb, and Travelers are the best business insurance for medical clinics, offering rates as low as $180. With their tailored coverage options, your medical clinic can thrive in a secure environment, ensuring peace of mind against unforeseen risks and liabilities.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Chris Tepedino is a feature writer that has written extensively about home, life, and car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. ...

Chris Tepedino

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

765 reviews

765 reviewsCompany Facts

Full Coverage for Medical Clinics

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 82 reviews

82 reviewsCompany Facts

Full Coverage for Medical Clinics

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Medical Clinics

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsWith a range of coverage options and customizable policies, The Hartford ensures that medical clinics can find the perfect insurance solution to meet their needs.

Our Top 10 Company Picks: Best Business Insurance for Medical Clinics

| Company | Rank | Professional Liability Discount | Property Insurance Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 12% | Tailored Coverage | The Hartford |

| #2 | 12% | 10% | Customizable Policies | Chubb | |

| #3 | 10% | 8% | Policy Options | Travelers | |

| #4 | 13% | 11% | Specialized Coverage | CNA | |

| #5 | 9% | 7% | Local Agents | State Farm | |

| #6 | 11% | 9% | Online Convenience | Progressive | |

| #7 | 14% | 12% | Businessowners Policy | Nationwide |

| #8 | 10% | 8% | Bundle Discounts | Allstate | |

| #9 | 12% | 10% | Organization Discount | Farmers | |

| #10 | 11% | 9% | Technology-Driven Solutions | Liberty Mutual |

Whether you’re a small clinic or a large medical facility, The Hartford’s expertise and reliability make it the top choice for safeguarding your practice.

Shield your business from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

#1 – The Hartford: Top Pick Overall

Pros

- Tailored Coverage: The Hartford is recognized for providing tailored coverage, ensuring that medical clinics can get insurance plans specifically designed to meet their unique needs.

- High A.M. Best Rating: With an A+ rating from A.M. Best, The Hartford demonstrates financial strength and reliability, instilling confidence in their policyholders.

- Low Complaint Level: The Hartford maintains a low complaint level, suggesting a high level of customer satisfaction and efficient claims handling. Take a look at our comprehensive The Hartford insurance review & ratings for further details.

Cons

- No Average Monthly Rate Information: The absence of average monthly rate information makes it challenging for potential clients to estimate the cost of coverage.

- Limited Customer Reviews: With only 69 reviews available, there might be limited customer feedback for potential clients to consider.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Chubb: Best for Customizable Policies

Pros

- Customizable Policies: Chubb stands out for offering customizable policies, allowing medical clinics to tailor their insurance coverage to their specific requirements.

- High A.M. Best Rating: With an A++ rating from A.M. Best, Chubb showcases financial strength and stability, indicating a reliable insurance provider.

- Low Complaint Level: Chubb maintains a low complaint level, indicating customer satisfaction and effective claims management. Explore our Chubb insurance review & ratings to gain deeper insights.

Cons

- No Average Monthly Rate Information: Similar to The Hartford, the lack of average monthly rate information makes it difficult for potential clients to estimate costs.

- Limited Customer Reviews: Although Chubb has a substantial number of reviews (1,731), potential clients might want more reviews for a comprehensive understanding of customer experiences.

#3 – Travelers: Best for Policy Options

Pros

- Diverse Policy Options: Travelers is recognized for offering a variety of policy options, allowing medical clinics to choose coverage that aligns with their specific needs.

- A.M. Best Rating: With an A+ rating from A.M. Best, Travelers demonstrates financial strength, providing clients with confidence in the stability of their chosen insurer.

- Low Complaint Level: Similar to the others, Travelers maintains a low complaint level, indicating a positive customer service experience. Dive into our Travelers insurance review & ratings for additional information.

Cons

- Limited Information on Average Monthly Rate: The absence of information on average monthly rates may hinder potential clients in assessing the affordability of coverage.

- No Specific Mention of Customizable Policies: Unlike some competitors, the content does not explicitly mention Travelers offering customizable policies, potentially limiting flexibility.

#4 – CNA: Best for Specialized Coverage

Pros

- Specialized Coverage: CNA is highlighted for providing specialized coverage, indicating a focus on meeting the unique insurance needs of medical clinics.

- A.M. Best Rating: CNA’s A.M. Best Rating reflects financial strength, assuring clients of the company’s stability and ability to fulfill its obligations. Investigate our CNA insurance review & ratings to uncover more insights.

- Discounts for Professional Liability and Property Insurance: Offering discounts of 13% and 11% for professional liability and property insurance, respectively, makes CNA an attractive option for cost-conscious clients.

Cons

- No Specific Information on Complaint Level: The content does not provide information on the complaint level, leaving potential clients without insights into customer satisfaction.

- Limited Details on Other Coverage Aspects: The content does not delve into other aspects of coverage, such as customization options or technology-driven solutions, limiting the overall view of CNA’s offerings.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm is recognized for its network of local agents, providing a personalized and accessible approach to customer service for medical clinics.

- Discounts for Professional Liability and Property Insurance: Offering discounts of 9% and 7% for professional liability and property insurance, respectively, contributes to potential cost savings.

- Organization Discount: State Farm provides an organization discount, potentially beneficial for medical clinics looking for cost-effective coverage. Delve into our State Farm insurance review & ratings to discover valuable insights.

Cons

- No A.M. Best Rating Mentioned: The content does not explicitly mention State Farm’s A.M. Best Rating, leaving potential clients without information on the company’s financial strength.

- Limited Details on Complaint Level: There is no specific information on the complaint level, limiting insights into the overall satisfaction of State Farm’s customers.

#6 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive is highlighted for offering online convenience, making it easy for medical clinics to manage their insurance needs digitally. Examine our Progressive insurance review & ratings to learn more about what we offer.

- Discounts for Professional Liability and Property Insurance: Offering discounts of 11% and 9% for professional liability and property insurance, respectively, contributes to potential cost savings.

- Technology-Driven Solutions: Progressive is mentioned as a provider of technology-driven solutions, appealing to medical clinics looking for modern and efficient insurance processes.

Cons

- No Average Monthly Rate Information: The content does not provide information on average monthly rates, making it challenging for potential clients to estimate costs.

- Limited Details on Complaint Level: The content lacks specific information on the complaint level, leaving potential clients without insights into Progressive’s customer service reputation.

#7 – Nationwide: Best for Business Owners Policy

Pros

- Business Owners Policy: Nationwide is recognized for its Business Owners Policy, providing a comprehensive coverage solution for medical clinics. Review our Nationwide insurance review & ratings to get a better understanding of our services.

- Discounts for Professional Liability and Property Insurance: Offering discounts of 14% and 12% for professional liability and property insurance, respectively, contributes to potential cost savings.

- A.M. Best Rating: Nationwide’s A.M. Best Rating reflects financial strength, instilling confidence in clients regarding the company’s stability.

Cons

- No Average Monthly Rate Information: The absence of information on average monthly rates makes it challenging for potential clients to estimate costs.

- Limited Details on Customizable Policies: The content does not explicitly mention Nationwide offering customizable policies, potentially limiting flexibility in coverage.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Bundle Discounts

Pros

- Bundle Discounts: Allstate is recognized for offering bundle discounts, providing potential cost savings for medical clinics combining multiple insurance policies.

- Discounts for Professional Liability and Property Insurance: Offering discounts of 10% and 8% for professional liability and property insurance, respectively, contributes to potential cost savings.

- A.M. Best Rating: Allstate’s A.M. Best Rating reflects financial strength, providing clients with confidence in the company’s stability. Browse through our Allstate insurance review & ratings to find out more.

Cons

- No Specific Information on Complaint Level: The content does not provide specific information on the complaint level, leaving potential clients without insights into customer satisfaction.

- Limited Details on Customizable Policies: The content does not delve into specific details regarding customizable policies, potentially limiting flexibility in coverage.

#9 – Farmers: Best for Organizational Discount

Pros

- Organization Discount: Farmers offers an organization discount, potentially beneficial for medical clinics seeking cost-effective coverage. Check out our Farmers insurance review & ratings to get a clearer picture.

- Discounts for Professional Liability and Property Insurance: Offering discounts of 12% and 10% for professional liability and property insurance, respectively, contributes to potential cost savings.

- A.M. Best Rating: Farmers’ A.M. Best Rating reflects financial strength, providing clients with confidence in the company’s stability.

Cons

- No Average Monthly Rate Information: The absence of information on average monthly rates makes it challenging for potential clients to estimate costs.

- Limited Details on Customizable Policies: The content does not explicitly mention Farmers offering customizable policies, potentially limiting flexibility in coverage.

#10 – Liberty Mutual: Best for Technology-Driven Solutions

Pros

- Technology-Driven Solutions: Liberty Mutual is highlighted for offering technology-driven solutions, appealing to medical clinics seeking modern and efficient insurance processes.

- Discounts for Professional Liability and Property Insurance: Offering discounts of 11% and 9% for professional liability and property insurance, respectively, contributes to potential cost savings.

- A.M. Best Rating: Liberty Mutual’s A.M. Best Rating reflects financial strength, providing clients with confidence in the company’s stability. Refer to our Liberty Mutual review & ratings for a detailed overview.

Cons

- No Specific Information on Complaint Level: The content does not provide specific information on the complaint level, leaving potential clients without insights into customer satisfaction.

- No Average Monthly Rate Information: The absence of information on average monthly rates makes it challenging for potential clients to estimate costs.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Essential Coverage for Medical Clinic Businesses

When it comes to safeguarding your medical clinic, having the right insurance coverage is essential. Business Insurance for Medical Clinics offers core coverage options tailored to meet the unique needs of your practice. From protecting your property to mitigating liabilities, these coverages provide comprehensive protection for your medical clinic. Here are the core coverage for medical clinic businesses:

- Commercial Property Insurance: Safeguard your clinic’s physical assets, including office buildings, equipment, and storage units, against damage caused by unexpected events such as fires, storms, or theft.

- General Liability Insurance: Protect your clinic from potential lawsuits and claims arising from bodily injury or property damage caused by your operations, products, or services, ensuring your financial stability and reputation. Explore our source article titled “Commercial General Liability (CGL) Insurance: A Complete Guide”.

- Business Income Insurance: In the event of an unexpected interruption to your clinic’s operations, such as a fire or equipment breakdown, this coverage helps replace lost income and covers essential expenses, ensuring your clinic can continue running smoothly.

- Professional Liability Insurance/Malpractice Insurance: Specifically designed for healthcare professionals, this coverage protects your clinic from claims of negligence, errors, or omissions in the provision of professional services, providing financial protection and peace of mind.

- Cyber Liability Insurance: As medical clinics handle sensitive patient information and rely on digital systems, this coverage safeguards against the financial consequences of data breaches, cyber-attacks, and unauthorized access, ensuring the security of patient data and mitigating potential legal liabilities.

By having comprehensive core coverage for your medical clinic, you can confidently protect your clinic from a wide range of potential risks and liabilities. Enhance your medical clinic’s insurance coverage with options like Employee Practices Liability Insurance, Valuable Papers and Records Insurance, Cyber Liability Insurance, Professional Liability Insurance, and Business Interruption Insurance.

Jeff Root Licensed Life Insurance Agent

These expanded choices provide comprehensive protection against various risks, ensuring financial support in case of lawsuits, cyber threats, or business disruptions, and ensuring continuity for your clinic’s operations.

Exploring Business Insurance Products for Medical Clinics

In addition to core coverage options, business insurance products for medical clinics reveals a comprehensive coverage tailored to address specific risks encountered by such practices. Equipment Breakdown Insurance shields vital equipment from mechanical or electrical failures, while Crime Insurance guards against financial losses due to theft or forgery.

Surety Bonds provide financial assurances, and Umbrella Liability Insurance extends coverage limits for broader protection. Cyber Liability Insurance addresses data breach risks, and Business Auto Insurance protects clinic vehicles. These additional products enhance the comprehensive protection offered, enabling clinics to focus on delivering quality care while safeguarding their assets and reputation.

Affordable Business Insurance for Medical Clinics

Cost is an important consideration when it comes to business insurance for medical clinics. The exact cost of insurance coverage can vary depending on several factors such as the size of your clinic, the location, the type of services provided, and the coverage limits required.

When securing business insurance for your medical clinic, gather quotes from multiple providers for the best value showcasing medical discount plan. Factors like clinic size, location, services provided, claims history, coverage limits, and deductibles impact insurance costs. Prioritize coverage and policy quality over cost. Compare rates from reputable providers to find the right balance between affordability and coverage for your clinic.

Business Insurance for Medical Clinics: Monthly Rates by Coverage Level & Provider

| Insurance Provider | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $200 | $500 |

| Chubb | $250 | $600 |

| CNA | $220 | $550 |

| Farmers | $180 | $480 |

| Liberty Mutual | $210 | $520 |

| Nationwide | $190 | $500 |

| Progressive | $230 | $550 |

| State Farm | $200 | $480 |

| The Hartford | $240 | $600 |

| Travelers | $220 | $560 |

The table above displays monthly rates for business insurance in medical clinics across various providers and coverage levels. For minimum coverage, rates range from $180 to $250, while full coverage rates range from $480 to $600. Notably, Farmers offers the lowest minimum coverage rate at $180, while Chubb and The Hartford offer the highest full coverage rates at $600.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Quotes for Business Insurance for Medical Clinics

When it comes to obtaining quotes for Business Insurance for Medical Clinics, there are several options available to ensure you find the best coverage for your specific needs. Here are the five steps you can take to obtain quotes:

- Research online. Look for insurance providers that specialize in business insurance for medical clinics. Visit their websites and explore the coverage options they offer. Some websites have tools that allow you to request a quote online.

- Contact insurance agents. Reach out to insurance agents who specialize in commercial insurance for medical clinics. They can guide you through the quoting process and provide personalized assistance.

- Request multiple quotes. Don’t settle for the first quote you receive. Request quotes from different insurance providers to compare coverage options and premiums. This helps you make an informed decision.

- Provide accurate information. Ensure that you provide accurate details about your medical clinic, including property, equipment, employees, and specific risks. Accurate information helps insurance providers assess your needs and provide appropriate quotes.

- Consider bundling policies. If you have other insurance policies, consider bundling them with your business insurance for medical clinics. Bundling can lead to cost savings, as many insurance companies offer discounts.

Remember, obtaining quotes is just the first step. Take the time to carefully review the coverage details, policy limits, exclusions, and deductibles before making a decision.

It’s essential to choose a reputable insurance provider that offers comprehensive coverage, excellent customer service, and competitive rates.

Case Studies: Business Insurance Illustrative Examples for Medical Clinics

These case studies provide insightful examples of how different types of business insurance can benefit medical clinics in various situations:

- Case Study #1 – Property Insurance: Dr. Smith’s clinic suffered fire damage, but with property insurance, costs for repairs and replacements were covered, ensuring minimal financial impact and swift recovery.

- Case Study #2 – General Liability Insurance: When a patient sued Dr. Johnson’s clinic after slipping on a wet floor, general liability insurance covered legal expenses and settlements, protecting the clinic’s finances and reputation.

- Case Study #3 – Business Income Insurance: After a natural disaster forced Dr. Rodriguez’s clinic to close temporarily, business income insurance compensated for lost income, ensuring financial stability during the shutdown.

These demonstrate how a comprehensive insurance strategy tailored to the specific risks faced by medical clinics can help protect against unforeseen circumstances, minimize financial losses, and ensure continuity of operations.

Laura Walker Former Licensed Agent

By investing in the right insurance coverage, medical clinic owners can mitigate risks and focus on delivering quality healthcare services to their patients.

In Review: Securing Your Medical Clinic With Business Insurance

Business Insurance for Medical Clinics offers essential coverage to safeguard your practice from risks and liabilities. Core coverage options such as property insurance, general liability insurance, and business income insurance protect your clinic’s assets, mitigate lawsuits, and cover income losses during unexpected interruptions. (Read more: How To Get Free Insurance Quotes Online)

Additional coverage options like equipment breakdown insurance and umbrella liability insurance provide extra layers of protection. Specialized coverage such as employee practices liability insurance and valuable papers and records insurance further enhance your clinic’s security.

By obtaining quotes from reputable insurance providers and taking proactive steps to secure the right coverage, you can ensure the long-term success and financial stability of your medical clinic. Compare your rideshare insurance options by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What are the core coverage options provided by Business Insurance for Medical Clinics?

Business Insurance for Medical Clinics offers core coverage options tailored to meet the unique needs of medical practices. These include commercial property insurance, general liability insurance, business income insurance, professional liability insurance, and cyber liability insurance.

To delve deeper into commercial insurance, explore our comprehensive guide on “Commercial Insurance: A Complete Guide“.

How do I choose the right insurance provider for my medical clinic?

To choose the right insurance provider, consider factors such as coverage rates, options, discounts, and reviews. Top contenders in the medical clinic insurance space include The Hartford, Chubb, and Travelers. Compare quotes from multiple providers to find the one that best suits your clinic’s needs.

Find the best commercial car and truck insurance for your business needs by entering your ZIP code below into our free comparison tool today.

What factors can influence the cost of business insurance for medical clinics?

The cost of business insurance for medical clinics can vary based on factors such as the size of the clinic, location, services provided, and coverage limits. Obtaining quotes from different insurance providers and comparing rates is essential to find the best value for your coverage.

Are there additional insurance products available for medical clinics beyond core coverage options?

Yes, Business Insurance for Medical Clinics offers additional insurance products to address specific risks faced by medical practices. These include coverages like equipment breakdown insurance, umbrella liability insurance, and employee practices liability insurance.

How can I obtain quotes for Business Insurance for Medical Clinics?

Obtain insurance quotes online by entering your ZIP code into a free quote tool, comparing rates from multiple providers, and reviewing coverage details, limits, and deductibles.

Are there any discounts or cost-saving strategies available for medical clinics seeking business insurance?

Yes, insurance providers may offer discounts based on factors such as clinic safety measures, claims history, and bundling multiple policies. Additionally, implementing risk management practices, and maintaining a good clinic safety record.

What are the pros and cons of top insurance providers like The Hartford, Chubb, and Travelers?

Pros include tailored coverage options and expertise in the healthcare industry. Cons may involve higher rates for full coverage.

What are some examples of case studies illustrating the benefits of business insurance for medical clinics?

Case studies demonstrate how insurance can protect against unforeseen circumstances, minimize financial losses, and ensure continuity of operations.

What are the essential coverage options for medical clinic businesses?

Essential coverage includes commercial property insurance, general liability insurance, business income insurance, professional liability insurance, and cyber liability insurance.

How can medical clinic owners ensure they have the right insurance coverage?

By carefully reviewing coverage details, policy limits, exclusions, and deductibles, and choosing a reputable provider offering comprehensive coverage, excellent customer service, and competitive rates.

Ready to find the best fleet insurance? Enter your ZIP code in our comparison tool below to see affordable commercial insurance rates in your area.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.