Best Business Insurance for Snow Plow Companies in 2026 (Our Top 10 Picks)

The best business insurance for snow plow companies, boasting enticing discounts of up to 20% and competitive monthly rates, is offered by Progressive, alongside USAA and State Farm, leading the charge in tailored protection. Discover why they're the top choices for your snow plow company.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Real Estate Agent

Angie Watts is a licensed real estate agent with Florida Executive Realty. Specializing in residential properties since 2015, Angie is a real estate writer who published a book educating homeowners on how to make the most money when they sell their homes. Her goal is to educate and empower both home buyers and sellers so they can have a stress-free shopping and/or selling process. She has studi...

Angie Watts

Updated January 2025

Company Facts

Full Coverage for Snow Plow Companies

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Snow Plow Companies

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Snow Plow Companies

A.M. Best Rating

Complaint Level

Pros & Cons

The best business insurance for snow plow companies are Progressive, USAA, and State. Among the top contenders, Progressive snow plow insurance emerges as the clear leader, offering competitive affordable coverage and enticing discounts of up to 20%.

Tailored protection from USAA and State Farm also makes them standout choices for snow plow companies. With their extensive experience and diverse coverage options, they cater specifically to the unique needs of snow plow companies, ensuring maximum protection and support.

Our Top 10 Picks: Best Business Insurance for Snow Plow Companies

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 20% | Online Convenience | Progressive | |

| #2 | 10% | 25% | Military Savings | USAA | |

| #3 | 17% | 30% | Many Discounts | State Farm | |

| #4 | 25% | 20% | Add-on Coverages | Allstate | |

| #5 | 20% | 10% | Usage Discount | Nationwide |

| #6 | 15% | 10% | Accident Forgiveness | Travelers | |

| #7 | 5% | 20% | Deductible Reduction | The Hartford |

| #8 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #9 | 10% | 15% | Local Agents | Farmers | |

| #10 | 25% | 25% | Cheap Rates | Geico |

Find out why these companies are the best options for safeguarding your snow plow business and ensure peace of mind during winter operations. Enter your ZIP code above to get started on comparing business insurance quotes.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Snow Plow Insurance Costs

The snow plow insurance cost for your business depends on various factors. These include the size and type of your snow removal fleet, the number of employees, your location, previous claims history, and the coverage options you choose. Understanding these factors will help you determine the snow plowing insurance cost and customize your insurance policy accordingly.

- Size and Type of Fleet: The number and types of vehicles in your snow removal fleet impact insurance costs.

- Number of Employees: The size of your workforce is a factor in determining insurance costs.

- Location: The geographic area where your snow plow business operates can influence insurance costs.

- Claims History: Your previous claims history plays a role in determining insurance costs.

- Coverage Options: The specific coverage options you choose for your snow plowing insurance will impact the overall cost.

Understanding the complexities of insurance for snow removal companies or insurance for snow removal contractors is crucial for any business owner in this industry. From the size and composition of your fleet to your location and claims history, numerous factors influence insurance costs.

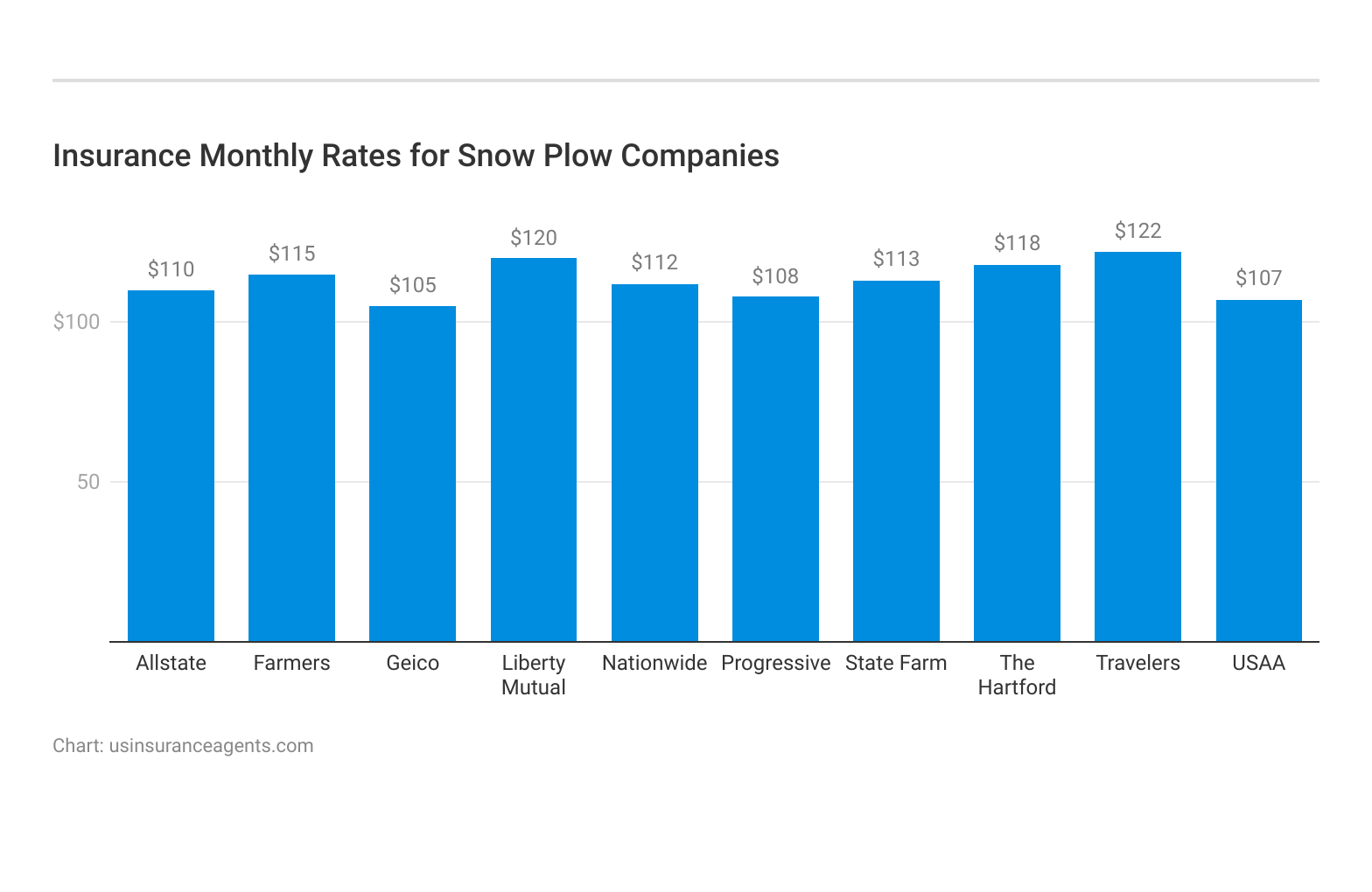

Business Insurance Monthly Rates for Snow Plow Companies

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $110 | $220 |

| Farmers | $115 | $230 |

| Geico | $105 | $210 |

| Liberty Mutual | $120 | $240 |

| Nationwide | $112 | $224 |

| Progressive | $108 | $216 |

| State Farm | $113 | $226 |

| The Hartford | $118 | $236 |

| Travelers | $122 | $244 |

| USAA | $107 | $214 |

Additionally, the coverage options you choose play a significant role in determining premiums. Explore more insights on “How does the insurance company determine my premium?”. By carefully analyzing these factors and collaborating closely with your insurance provider, you can customize your policy to meet your specific needs and budget.

Scott W. Johnson Licensed Insurance Agent

Investing time and effort into this process ensures that your business is adequately protected against the unique risks associated with snow plowing operations.

Essential Coverages for Snow Plow Businesses

Operating a snow plow business comes with its own set of risks and challenges, particularly when it comes to navigating through treacherous winter conditions. Ensuring the protection of your business is paramount, and that begins with having the right insurance coverages in place. Let’s delve into the essential insurance policies that are vital for safeguarding your snow plow operations.

- Commercial Auto Insurance: Commercial auto insurance stands as protection to your fleet of snow removal vehicles and the attached plow equipment. This coverage provides financial security in the event of accidents, collisions, or damage incurred during your snow plowing operations. This ensures that your business can continue to operate smoothly without bearing the burden of unexpected repair costs.

- General Liability Insurance: offers a crucial layer of protection by shielding your business from liability claims stemming from bodily injury, property damage, or other mishaps that may occur during your snow plowing activities. Whether it’s a slip-and-fall incident on a client’s property or damage caused by a plow to a parked car, this safeguards the financial health of your business.

- Workers’ Compensation Insurance: another indispensable coverage that ensures the well-being of your employees. Snow removal is physically demanding work, and accidents or injuries can happen despite the utmost precautions. With workers’ compensation coverage in place, you can rest assured knowing that your employees are protected financially in the event of work-related injuries or illnesses.

In conclusion, securing the right insurance coverages is essential for the longevity and prosperity of your snow plow business. From protecting your vehicles and equipment to ensuring the well-being of your employees and shielding your business from potential liabilities, these insurance policies offer peace of mind in the face of winter’s challenges.

By investing in comprehensive insurance coverage, you not only mitigate risks but also demonstrate your dedication to operating a responsible and sustainable snow plow business.

Customized Snow Plow Insurance Solutions

Every snow plow business has unique needs, and it’s important to have insurance coverage tailored to your specific requirements. Our team of commercial insurance specialists can assist you in creating a customized insurance plan that addresses the risks and challenges faced by your snow removal business.

Whether it’s determining the right level of coverage or exploring additional endorsements, we’re here to help you protect your business effectively.

- Unique Needs: Every snow plow business is different, with its own set of risks and challenges. It’s essential to have insurance coverage that is specifically tailored to address these unique needs.

- Personalized Approach: Our team of commercial insurance specialists understands the intricacies of the snow removal industry. We take a personalized approach to create an insurance plan that meets the specific requirements of your business.

- Risk Assessment: We conduct a thorough risk assessment to identify the potential risks associated with your snow plow operations. This assessment helps us determine the level of coverage needed to adequately protect your business.

As you navigate the demands of your snow plow business, having the right insurance coverage is paramount to safeguarding your operations and assets. Our commitment to understanding the nuances of your industry ensures that we tailor a personalized insurance solution that aligns perfectly with your unique needs.

From assessing risks to fine-tuning coverage levels and exploring additional endorsements, our team stands ready to support you every step of the way. With our expertise and your dedication, you can confidently weather any storm knowing your business is comprehensively protected. Reach out to us today and let’s fortify your snow removal venture for success.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benefits of Snow Plow Insurance

Navigating the challenges of operating a snow plow business involves more than just clearing pathways. It’s essential to safeguard your enterprise against potential risks and liabilities. Snow plow insurance emerges as a vital asset, offering a shield against various uncertainties.

This section outlines the manifold benefits that snow plow insurance bestows upon your business, ensuring not only legal compliance but also financial security and peace of mind.

- Legal Compliance: Many jurisdictions require snow plow businesses to have insurance coverage, ensuring compliance with legal obligations.

- Financial Protection: Insurance protects your business assets, vehicles, and equipment, providing financial coverage in case of accidents, damages, or lawsuits.

- Peace of Mind: With the right comprehensive coverage, you can focus on running your snow removal operations without constantly worrying about potential risks or liabilities.

In essence, snow plow insurance transcends mere financial investment. By ensuring legal compliance, providing financial protection, and nurturing peace of mind, insurance empowers you to navigate the winter landscape with confidence and resilience. Embrace the benefits of snow plow insurance, and equip your business with the robust armor it needs to weather any storm.

Streamlining Your Coverage: The Online Quote Process

Obtaining insurance quotes online for your snow plow business insurance is a straightforward process that can save you time and effort. To get started, simply visit the websites of insurance providers such as Progressive, USAA, or State Farm, which offer convenient online tools for requesting quotes.

Once on the website, navigate to the business insurance section and locate the option for obtaining a quote. Provide basic information about your snow plow business, such as location, fleet size, number of employees, and any previous claims history.

After entering this information, the online quote tool will generate a personalized quote based on your business needs. Customize coverage levels and select additional endorsements as needed. Review the quote and proceed to purchase the insurance policy directly online. Alternatively, speak with a licensed insurance agent for further assistance.

Obtaining an online quote for your snow plow business insurance is a convenient and efficient way to ensure that you have the coverage you need to protect your business. By taking advantage of the online tools offered by insurance providers, you can quickly compare quotes from multiple companies and find the best coverage at the most competitive rates.

Case Studies: Real-Life Examples of Snow Plow Companies Benefiting From Business Insurance

Discover how real snow plow companies benefited from choosing the right insurance coverage. These case studies showcase how businesses like yours found tailored solutions to protect their operations and ensure peace of mind during winter operations.

- Case Study #1 – Alpine Snow Removal: During a sudden blizzard, accidents on icy roads led to numerous claims. Comprehensive business insurance swiftly covered repair costs and legal expenses, ensuring minimal disruption.

- Case Study #2 – Frosty Flurries Snow Services: An injured team member received medical care and wage replacement through workers’ compensation coverage, protecting the company from potential lawsuits.

- Case Study #3 – Peak Performance Plowing: Despite meticulous maintenance, a snow plow malfunction caused property damage. Liability coverage promptly covered the costs, highlighting the importance of preparedness in the snow removal industry.

These case studies underscore the vital role of having tailored insurance coverage for snow plow businesses. By mitigating financial risks and ensuring swift assistance in times of need, the right insurance can safeguard operations and provide peace of mind, allowing companies to focus on delivering top-notch service during winter operations.

Schimri Yoyo Licensed Agent & Financial Advisor

Investing in comprehensive insurance not only protects the business but also fosters trust and confidence among clients, ultimately contributing to long-term success in the snow removal industry.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Wrap Up: Protect Your Snow Plow Business With Tailored Insurance Coverage

In conclusion, securing the right insurance coverage is crucial for the success of your snow plow business. Our exploration of the best insurance companies for snow plow providers highlights Progressive, USAA, and State Farm as leading choices, offering tailored protection with competitive rates and discounts.

Comprehensive insurance coverage mitigates risks and demonstrates a commitment to responsible operations. Snow plow insurance is not just a financial investment; it’s a strategic imperative that fortifies business foundations, empowering companies to navigate winter challenges with confidence and resilience. Embracing tailored coverage equips businesses with the necessary protection to weather any storm in the snow removal industry.

Our free quote tool below makes it easy to compare affordable coverage options for your business — simply enter your ZIP code to find the best commercial insurance company for you.

Frequently Asked Questions

What factors affect the cost of snow plow insurance for my business?

The cost of snow plow insurance depends on various factors, including the size and type of your snow removal fleet, the number of employees, your location, previous claims history, and the specific coverage options you choose. Understanding these factors and working closely with your insurance provider can help customize your policy to align with your needs and budget.

Learn more about our comprehensive guide on “Fleet Vehicle Insurance“.

Is snow plow insurance required by law for my business, or is it just a recommended coverage?

In many cases, snow plow insurance is not only recommended but also required by law. It is often specified in snow removal contracts as well. Not having the appropriate insurance coverage can lead to legal and financial consequences. It’s crucial to ensure that your business is adequately covered.

Protect your company’s fleet of vehicles with commercial insurance. Enter your ZIP code below to find the cheapest coverage for your business.

What are the essential coverages for snow plow businesses?

Snow plow businesses should consider essential coverages such as commercial auto coverage, general liability coverage, and workers’ compensation coverage. These coverages help protect your vehicles, business operations, and employees from potential risks and liabilities associated with snow removal activities.

How can I customize my snow plow insurance policy to meet the unique needs of my business?

Every snow plow business is unique, and it’s essential to have insurance coverage tailored to your specific requirements. Working with a team of commercial insurance specialists can help you determine the right level of coverage and explore additional endorsements, ensuring your policy addresses the risks and challenges faced by your snow removal business.

What are the benefits of having snow plow insurance for my business?

Snow plow insurance offers several benefits, including financial protection in case of accidents, coverage for legal expenses, and assistance with medical care and wage replacement for injured employees. Having the right insurance coverage ensures peace of mind while operating in the snow removal industry.

Discover how a medical discount plan can reduce your healthcare costs

How deep does plowing go?

Deep plowing entails excavating to depths exceeding 50 cm (20 in), unlike conventional plowing, which usually extends no further than 20 cm (8 in). The aim of deep plowing is to modify the enduring soil water retention characteristics.

Can you put a plow on any truck?

Before committing to purchasing a snow plow, it’s essential to ensure that your truck is capable. The most suitable trucks for snow plows typically feature an AWD system to enhance traction, ample ground clearance to navigate through piled snow, and a short bed for balanced weight distribution.

Explore further details in our guide titled “Top 10 Companies: Best Auto Insurance for Commercial Truck Drivers.“

What is the difference between snow plowing and snow removal?

Snow plowing and snow removal are related tasks, with snow removal involving additional steps beyond simple plowing. Snow removal entails clearing the property of snow and then collecting it to transport off-site, rather than leaving it stored on the property.

Is it worth buying a snow plow?

In general, a snowplow can significantly ease the burden of heavy snowfall. However, it’s important to recognize that it constitutes an investment. Thus, thorough research regarding your vehicle, its weight limits, and its compatibility with various snowplows is crucial.

Is snow blowing a good business?

Running a snow removal business can be profitable. Despite spending on business insurance, long hours and occasional sleep deprivation, especially during peak periods, the short season yields significant profits.

What equipment do you need to start a snow removal business?

How do I market my snow removal business?

How to start a snow blower business?

How do you make money from shoveling snow?

What is a snow mover called?

Should snow be removed from cars?

What is the best driveway for snow removal?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.