Best Business Insurance for Wholesale Distributors in 2026 (Top 10 Companies)

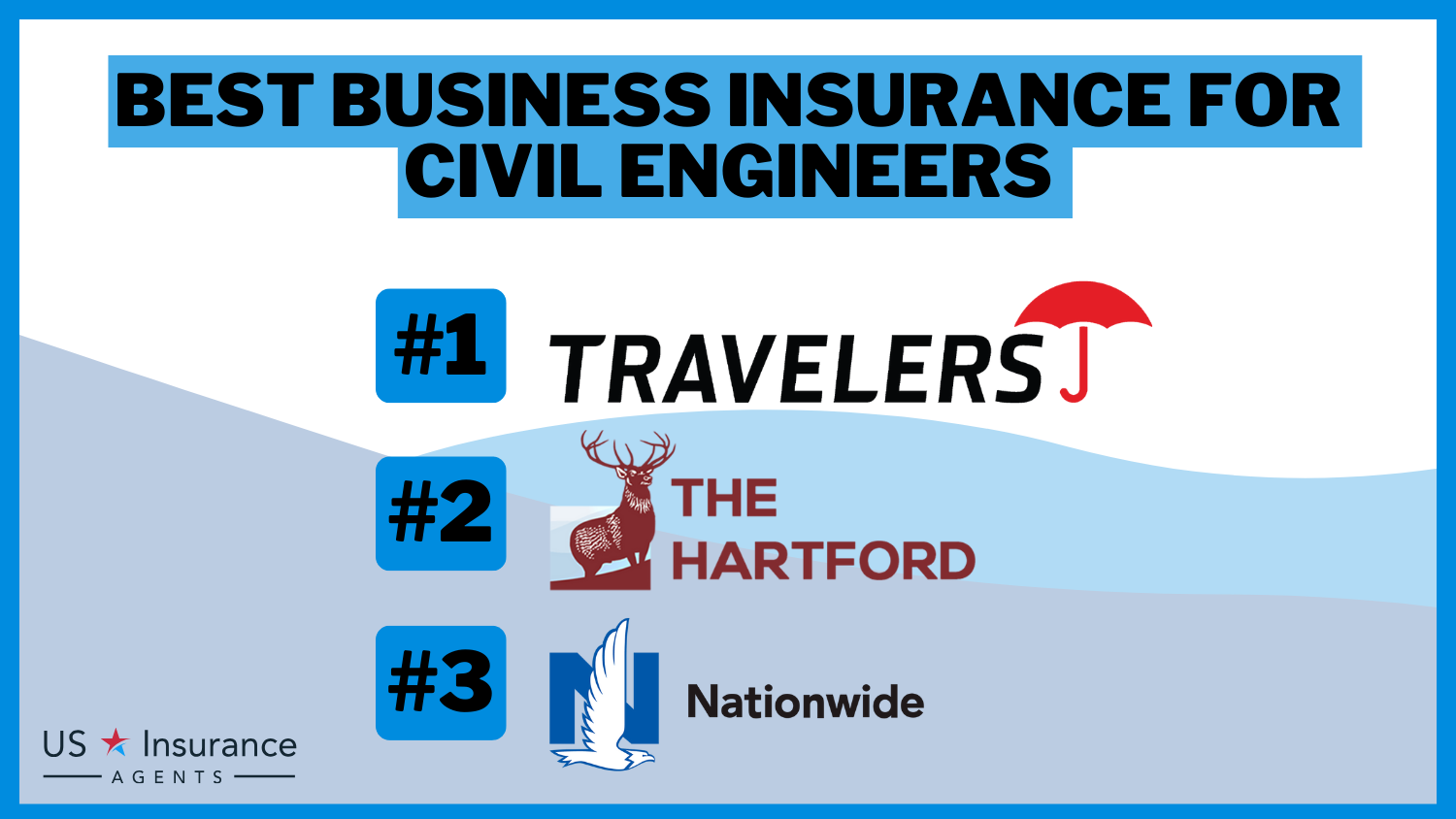

The best business insurance for wholesale distributors are Travelers, Nationwide, and The Hartford, offering significant discounts, with savings ranging from 10% to 20%. These insurers tailor policies to protect wholesale distributors' operations ensuring comprehensive coverage and peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Company, Healthl...

Melissa Morris

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated January 2025

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Wholesale Distributors

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Wholesale Distributors

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage for Wholesale Distributors

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviewsThe top pick overall for the best business insurance for wholesale distributors is Travelers, offering competitive and affordable coverage rates with discounts of up to 20%. Wholesale distributors can trust Travelers, Nationwide, and The Hartford for tailored coverage that safeguards operations effectively.

With policies ranging from general liability to workers’ compensation, these insurers provide comprehensive protection against risks, ensuring long-term success. Compare quotes today and secure the ideal coverage for your wholesale distribution business.

Our Top 10 Company Picks: Best Business Insurance for Wholesale Distributors

| Company | Rank | Multi-Vehicle Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | 18% | Comprehensive Coverage | Travelers | |

| #2 | 18% | 15% | Industry Expertise | Nationwide |

| #3 | 22% | 18% | Risk Management | The Hartford |

| #4 | 15% | 12% | Local Presence | State Farm | |

| #5 | 18% | 15% | Affordable Options | Progressive | |

| #6 | 20% | 18% | Coverage Options | Liberty Mutual |

| #7 | 15% | 12% | Customizable Policies | Allstate | |

| #8 | 20% | 18% | Equipment Coverage | Farmers | |

| #9 | 18% | 15% | Global Reach | Chubb | |

| #10 | 15% | 12% | Liability Coverage | Hiscox |

Enter your ZIP code above to get started on comparing business insurance quotes.

#1 – Travelers: Top Overall Pick

Pros

- Comprehensive Coverage: Travelers offers a comprehensive coverage plan, ensuring that wholesale distributors have a wide range of protection for their business operations.

- Business Insurance Discount: With a generous discount of up to 20%, Travelers provides cost-effective solutions for wholesale distributors.

- Additional Discount: The company also provides an additional discount of up to 18%, further enhancing the affordability of their insurance policies.

- Reputation: Travelers insurance review & ratings are widely recognized for the company’s solid standing in the insurance sector, which fosters trust among its clients.

Cons

- Cost for Additional Coverage: While the base coverage is discounted, the cost for additional coverage may not be as competitive.

- Complex Policies: Some clients may find Travelers’ policies to be complex, requiring a thorough understanding to ensure proper coverage.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Industry Expertise

Pros

- Industry Expertise: Nationwide excels in industry expertise, making it an ideal choice for wholesale distributors seeking specialized knowledge in their field.

- Business Insurance Discount: Offering a substantial discount of up to 18%, Nationwide provides cost-effective insurance solutions.

- Additional Discount: The company extends an additional discount of up to 15%, enhancing the overall affordability of their insurance products.

- Customer Service: Nationwide insurance review & ratings highlight the company’s standout customer service, guaranteeing swift and supportive aid for its clientele.

Cons

- Localized Presence: Nationwide’s localized presence may limit its accessibility for businesses operating in regions with fewer offices.

- Strict Qualification Criteria: Some wholesale distributors may find Nationwide’s qualification criteria to be stringent, potentially limiting eligibility.

#3 – The Hartford: Best for Risk Management

Pros

- Risk Management: The Hartford specializes in risk management, offering valuable services to help wholesale distributors mitigate potential risks.

- Business Insurance Discount: The Hartford insurance review & ratings showcase significant savings potential, offering an impressive discount of up to 22% on insurance premiums.

- Additional Discount: An additional discount of up to 18% adds to the overall cost-effectiveness of The Hartford’s insurance plans.

- Specialized Services: The company offers specialized services to help wholesale distributors assess and address their specific risk management needs.

Cons

- Limited Coverage Options: Some clients may find The Hartford’s coverage options to be more limited compared to other providers.

- Higher Premiums for Additional Services: While the base coverage is discounted, premiums for additional risk management services may be relatively higher.

#4 – State Farm: Best for Localized Presence

Pros

- Local Presence: State Farm’s emphasis on local presence makes it an attractive option for wholesale distributors seeking personalized service.

- Business Insurance Discount: State Farm insurance review & ratings reveal that the company provides competitive pricing on its insurance policies, with discounts of up to 15% available.

- Additional Discount: An additional discount of up to 12% further contributes to the overall affordability of State Farm’s coverage.

- Community Involvement: State Farm is actively involved in community initiatives, reflecting a commitment to social responsibility.

Cons

- Less Comprehensive Coverage: Some clients may find that State Farm’s coverage is less comprehensive compared to other providers.

- Limited Global Reach: State Farm’s global reach may be limited, making it less suitable for wholesale distributors with international operations.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Budget-Friendly Options

Pros

- Affordable Options: Progressive is known for providing affordable insurance options, making it a budget-friendly choice for wholesale distributors.

- Business Insurance Discount: With a discount of up to 18%, Progressive ensures that clients enjoy significant savings on their insurance premiums.

- Additional Discount: An additional discount of up to 15% further enhances the cost-effectiveness of Progressive’s insurance plans.

- Technology Integration: Progressive insurance review & ratings showcase how the company harnesses technology to simplify procedures, delivering convenient and effective services.

Cons

- Limited Industry Expertise: Progressive may lack the industry-specific expertise that some wholesale distributors seek in an insurance provider.

- Complex Claims Process: The claims process with Progressive may be perceived as more complex, potentially causing delays in settlements.

#6 – Liberty Mutual: Best for Coverage Options

Pros

- Coverage Options: Liberty Mutual review & ratings accentuate offering a wide array of coverage options, allowing wholesale distributors to tailor their insurance plans to specific needs.

- Business Insurance Discount: With a discount of up to 20%, Liberty Mutual provides a competitive edge in terms of pricing.

- Additional Discount: An additional discount of up to 18% enhances the overall affordability of Liberty Mutual’s insurance products.

- Financial Strength: The company’s financial strength and stability instill confidence in clients, ensuring long-term reliability.

Cons

- Policy Complexity: Some wholesale distributors may find Liberty Mutual’s policies to be complex, requiring careful consideration.

- Limited Specialization: Liberty Mutual may not offer the same level of specialization in certain industries compared to more niche providers.

#7 – Allstate: Best for Coverage Customization

Pros

- Customizable policies: Allstate stands out for its customizable policies, allowing wholesale distributors to tailor coverage to their specific requirements.

- Business insurance discount: With a discount of up to 15%, Allstate provides competitive pricing for its insurance plans.

- Additional discount: An additional discount of up to 12% adds to the overall affordability of Allstate’s coverage.

- Risk assessment tools: Allstate insurance review & ratings offer beneficial risk assessment resources, assisting wholesale distributors in comprehending and mitigating potential risks.

Cons

- Limited industry focus: Allstate may lack the same level of industry focus as more specialized insurance providers.

- Potentially higher premiums for customization: While customization is a strength, clients may experience higher premiums for highly tailored policies.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Equipment Coverage

Pros

- Equipment Coverage: Farmers excels in providing equipment coverage, catering to the unique needs of wholesale distributors reliant on specialized machinery.

- Business Insurance Discount: With a discount of up to 20%, Farmers offers competitive pricing for its insurance policies.

- Additional Discount: An additional discount of up to 18% enhances the overall cost-effectiveness of Farmers’ insurance products.

- Claims Handling: Farmers insurance review & ratings boast efficient claims handling, ensuring quick and hassle-free settlements for clients.

Cons

- Limited Global Presence: Farmers may have limited global presence, making it less suitable for wholesale distributors with international operations.

- Less Diverse Coverage Options: Some clients may find that Farmers’ coverage options are not as diverse as those offered by other providers.

#9 – Chubb: Best for Global Coverage

Pros

- Global Reach: Chubb insurance review & ratings underscores global reach makes it an ideal choice for wholesale distributors with international operations, ensuring coverage across various regions.

- Business Insurance Discount: Offering a discount of up to 18%, Chubb provides cost-effective insurance solutions.

- Additional Discount: An additional discount of up to 15% enhances the overall affordability of Chubb’s insurance plans.

- Specialized Services: Chubb offers specialized services, catering to the unique needs of wholesale distributors in various industries.

Cons

- Potentially Higher Premiums for Global Coverage: While Chubb offers global reach, clients may experience higher premiums for comprehensive international coverage.

- Complex Application Process: Some wholesale distributors may find Chubb’s application process to be more complex compared to other providers.

#10 – Hiscox: Best for Liability Coverage Specialisation

Pros

- Liability Coverage: Hiscox specializes in liability coverage, offering comprehensive protection for wholesale distributors concerned about legal and financial risks.

- Business Insurance Discount: With a discount of up to 15%, Hiscox provides competitive pricing for its insurance policies.

- Additional Discount: An additional discount of up to 12% enhances the overall affordability of Hiscox’s insurance products.

- Online Convenience: Hiscox offers convenient online services, making it easy for wholesale distributors to manage their insurance needs.

Cons

- Limited Coverage Options: Hiscox may have a more limited range of coverage options compared to larger, more diversified insurance providers.

- Potentially Higher Premiums for Specialized Coverage: Clients seeking highly specialized coverage may experience higher premiums with Hiscox compared to more niche providers. Explore our “How does the insurance company determine my premium?” for more information.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Business Insurance Rates for Wholesale Distributors

When it comes to protecting your wholesale distribution business, having the right insurance coverage is essential. Understanding the monthly rates offered by various insurance providers can help you make informed decisions about your insurance needs.

When considering insurance options, Allstate offers minimum coverage starting at $200 per month and full coverage at $500. Chubb for $250 and full coverage for $600, while Farmers offers rates of $180 for minimum coverage and $450 for full coverage. Hiscox’s rates stand at $220 for minimum coverage and $550 for full coverage, with Liberty Mutual offering minimum coverage for $190 and full coverage for $480.

Business Insurance for Wholesale Distributors: Monthly Rates by Coverage Level & Provider

| Insurance Provider | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $200 | $500 |

| Chubb | $250 | $600 |

| Farmers | $180 | $450 |

| Hiscox | $220 | $550 |

| Liberty Mutual | $190 | $480 |

| Nationwide | $210 | $520 |

| Progressive | $195 | $500 |

| State Farm | $185 | $470 |

| The Hartford | $230 | $580 |

| Travelers | $240 | $600 |

Nationwide and Progressive provide minimum coverage for $210 and $195, respectively, and full coverage for $520 and $500. State Farm offers minimum coverage for $185 and full coverage for $470, and The Hartford provides minimum coverage for $230 and full coverage for $580. Lastly, Travelers offers minimum coverage for $240 and full coverage for $600.

Ensuring adequate insurance coverage is a critical aspect of managing a wholesale distribution business. By comparing monthly rates from different insurance providers, you can find the coverage that best suits your business needs and budget.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Remember to regularly review and update your insurance policy to adapt to changes in your business operations and industry regulations.

Essential Coverage: Tailored Insurance Policies for Wholesalers and Distributors

What can insurance protect you from? To ensure the protection and resilience of your wholesale or distribution business, it is of utmost importance to have the following insurance policies in place. These policies act as a safety net, shielding your business from potential risks and liabilities:

- General Liability Insurance: General liability insurance is a fundamental coverage for your wholesale or distribution business. It provides protection against third-party liability claims, including client injuries and property damage accidents. By bundling general liability insurance with commercial property insurance, you can often save costs through a Business Owner’s Policy (BOP).

- Workers’ Compensation Insurance: Workers’ compensation insurance is typically mandatory in most states for wholesalers and distributors with employees. This coverage not only fulfills legal requirements but also safeguards your business from potential work injury costs. Even as a sole proprietor, having workers’ compensation coverage can protect you from work-related injury expenses that might be denied by health insurance.

- Business Owner’s Policy: A Business Owner’s Policy (BOP) offers a comprehensive and cost-effective solution by combining commercial property insurance and general liability insurance into a single package. This type of policy is often tailored to meet the specific needs of wholesale and distribution businesses, providing coverage for assets and liabilities in a streamlined manner.

In summary, securing these essential insurance policies is crucial for protecting your wholesale or distribution business from risks and liabilities. Whether it’s general liability insurance, workers’ compensation coverage, or a Business Owner’s Policy, these measures provide a vital safety net for your business’s continuity and success.

Comprehensive Protection: Exploring Supplementary Insurance Policies for Enhanced Coverage

In addition to the essential coverages, there are other insurance policies that wholesalers and distributors should consider based on their business requirements:

- Commercial Umbrella Insurance: Commercial umbrella insurance enhances your liability coverage beyond primary policies, safeguarding against claims exceeding limits. It bolsters protection for general liability, commercial auto, or employer’s liability insurance, ensuring comprehensive coverage for your wholesale or distribution business.

- Commercial Auto Insurance: For wholesale or distribution businesses using vehicles, commercial auto insurance is crucial. It shields against liability claims, property damage, and theft/vandalism involving business vehicles. Understanding your state’s requirements for commercial auto insurance is vital.

- Cyber Liability Insurance: Cyber liability insurance shields wholesalers and distributors from financial losses due to data breaches and cyberattacks. It’s essential, particularly if your business deals with sensitive data like credit card numbers or personal information.

- Property Insurance: Property insurance is vital for wholesalers and distributors with commercial space. It covers physical assets like buildings, inventory, and equipment against events such as fire, vandalism, or theft, ensuring business continuity after unexpected incidents.

- Product Liability Insurance: Product liability insurance is essential for wholesalers and distributors dealing with physical goods. It covers legal expenses and damages if a distributed product causes harm, safeguarding your financial interests and reputation from costly claims.

What is insurance as used in business? Wholesalers and distributors should carefully consider additional insurance policies tailored to their specific business needs. By securing comprehensive coverage, businesses can mitigate risks and ensure financial protection against unforeseen events.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Securing Coverage Online for Wholesale Distributors

Getting an insurance quote online for business insurance has never been easier. Follow these simple steps to secure the coverage you need:

- Research insurance providers. Start by researching reputable insurance providers that offer coverage tailored to wholesale distributors. Look for companies with positive reviews and a strong reputation for customer service.

- Visit insurance websites. Once you’ve identified potential insurance providers, visit their websites to explore their offerings in detail. Look for information specifically related to business insurance for wholesale distributors.

- Use online quote tools. Most insurance websites have online quote tools that allow you to input your business information and receive a customized quote quickly. These tools typically ask for details such as the size of your business, the nature of your operations, and the coverage limits you require.

- Provide accurate information. When using the online quote tool, make sure to provide accurate information about your business. This ensures that the quote you receive is tailored to your specific needs and circumstances.

- Review your options. Once you’ve received quotes from multiple insurance providers, take the time to review and compare them carefully. Pay attention to factors such as coverage limits, deductibles, premiums, and any additional benefits or discounts offered.

- Contact insurance representatives. If you have any questions or need clarification about the quotes you’ve received, don’t hesitate to reach out to insurance representatives for assistance. They can provide valuable insights and help you make an informed decision.

- Finalize your coverage. After comparing quotes and weighing your options, select the insurance provider and policy that best meets your needs. Complete the necessary paperwork and payment online to finalize your coverage and gain peace of mind knowing your business is protected.

Obtaining an online quote for business insurance offers convenience and efficiency, allowing you to compare multiple options from the comfort of your own home or office. By taking advantage of online quote tools and leveraging the expertise of insurance representatives, you can make well-informed decisions that protect your wholesale distribution business effectively.

Don’t delay securing the coverage you need – start exploring online quotes today to safeguard your business against unforeseen risks and ensure its long-term success.

Case Studies: Unveiling How Wholesalers and Distributors Leverage Insurance for Business Growth

In this section, we’ll explore real-life case studies showcasing how insurance coverage has played a crucial role in protecting wholesale distributors from unforeseen risks and helping them navigate challenging situations.

- Case Study #1 – Property Damage Protection: A wholesale distributor of electronics faced a fire incident damaging their warehouse and inventory. Robust property insurance provided financial aid for repairs, inventory replacement, and business interruption.

- Case Study #2 – Liability Mitigation: A consumer goods distributor encountered a legal dispute due to product harm. Product liability insurance covered legal expenses and damages, safeguarding financial interests and reputation. Discover our “What is stop-loss?” for more insights.

- Case Study #3 – Employee Safety Assurance: A construction materials distributor experienced a workplace accident. Workers’ compensation insurance covered medical expenses and rehabilitation, ensuring the injured contractor’s well-being and legal compliance.

- Case Study #4 – Cyber Threat Defense: A high-end fashion wholesaler suffered a data breach. Cyber liability insurance aided in data recovery, legal consultations, and public relations efforts, mitigating financial and reputational fallout.

These case studies underscore the importance of having adequate insurance coverage tailored to the specific risks faced by wholesale distributors. From property damage to liability disputes and cyber threats, the right insurance policies provide a safety net that safeguards businesses and ensures their resilience in the face of adversity.

Schimri Yoyo Licensed Agent & Financial Advisor

By learning from these real-life examples, wholesale distributors can make informed decisions about their insurance needs and protect their long-term success.

In Review: Safeguard Your Wholesale and Distribution Business With Insurance

In conclusion, protecting your wholesale distribution business with comprehensive insurance coverage is essential for mitigating risks, ensuring financial security, and maintaining business continuity. By understanding the key insurance policies available, such as general liability, workers’ compensation, and others, you can tailor your coverage to the specific needs of your business.

These policies offer protection against client injuries, work-related accidents, property damage, liability claims, and cyber threats. Remember to consult with licensed insurance professionals to assess your unique risks and obtain tailored advice. Don’t overlook the importance of securing the right insurance coverage – it’s a crucial investment in the long-term success and stability of your wholesale distribution business.

Our free quote tool below makes it easy to compare affordable coverage options for your business — simply enter your ZIP code to find the best commercial insurance company for you.

Frequently Asked Questions

What are the essential insurance policies for wholesale distributors?

Wholesale distributors should consider general liability, workers’ compensation, and commercial auto insurance for comprehensive coverage. Combining these in a Business Owner’s Policy (BOP) can often save costs.

Learn more on our “Commercial Insurance: A Complete Guide“.

Why is workers’ compensation insurance important for wholesalers?

Workers’ compensation is crucial for wholesalers, as it not only fulfills legal requirements but also safeguards businesses from potential work injury costs, providing protection for employees and the business.

Get commercial insurance that doesn’t break your budget by using our free comparison tool below.

What is the purpose of a Business Owner’s Policy (BOP) for wholesalers and distributors?

A BOP offers a cost-effective solution by combining commercial property and general liability insurance. It provides comprehensive coverage tailored to meet the specific needs of wholesale and distribution businesses.

What supplementary insurance policies should wholesalers consider?

Wholesalers should consider commercial umbrella insurance for added liability insurance coverage, commercial auto insurance for vehicle protection, and cyber liability insurance to safeguard against digital threats.

How can insurance protect wholesalers from property damage incidents?

Property insurance is crucial for wholesalers owning or leasing commercial space. It covers physical assets, including buildings and inventory, in case of events like fire, vandalism, or theft, ensuring swift recovery and business continuity.

What is the difference between a distributor and a wholesaler?

Typically, a distributor serves as a manufacturer’s “sales partner,” tasked with facilitating their entry into fresh markets or channels. Conversely, a wholesaler directly purchases from a manufacturer and then sells products to a retailer; their interaction tends to be purely transactional and easier to delineate.

What are the three types of distributors?

Three distribution channel types exist: direct, indirect, and hybrid. In a direct channel, the company sells its products directly to the customer. For instance, online stores or suppliers use direct distribution channel.

Discover our “Best Business Insurance for eBay Businesses (Top 10 Companies)” for more information.

Is a distributor considered a wholesaler?

Distributors seek out wholesalers who will resell their products. Wholesalers collaborate closely with retailers to meet their requirements by purchasing products in large quantities at discounted rates. While distributors perform some similar functions as wholesalers, they typically assume a more proactive role.

How does a wholesale distributor work?

A wholesale distribution enterprise acts as a middleman, acquiring products in large quantities and at reduced rates from manufacturers, then selling them in smaller batches to other businesses such as retailers and e-commerce vendors.

Which distribution channel is the best for a business?

Retailers represent one of the most widely utilized and efficient distribution channels. They encompass supermarkets, department stores, specialty shops, and big-box retailers. Marketers collaborating with retailers now have the opportunity to showcase their products in physical stores, online platforms, or both.

Delve into our “10 Best Business Insurance Providers for Grocery Stores” for more insights.

Which product is best for distribution?

How do I choose a distributor?

Who is an example of a distributor?

What is the difference of wholesale and retail?

What is a wholesale agent?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.