Best Car Insurance for Medical Payments Coverage in 2026 (Top 10 Companies)

Uncover the best car insurance for medical payments coverage, such as Progressive, USAA, and State Farm, which offer up to a 30% discount. In a recent study, their winning combination of affordability and comprehensive protection stood out, ensuring you're covered when it matters most.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2025

13,283 reviews

13,283 reviewsCompany Facts

Medical Payments

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Medical Payments

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Medical Payments

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Choosing the right car insurance company can be challenging, especially when it comes to medical payments coverage. To help you make an informed decision, we’ve compiled a list of the top 10 best companies known for their exceptional offerings in this area. Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

Our Top 10 Company Picks: Best Car Insurance for Medical Payments Coverage

| Company | Rank | Multi-Car Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

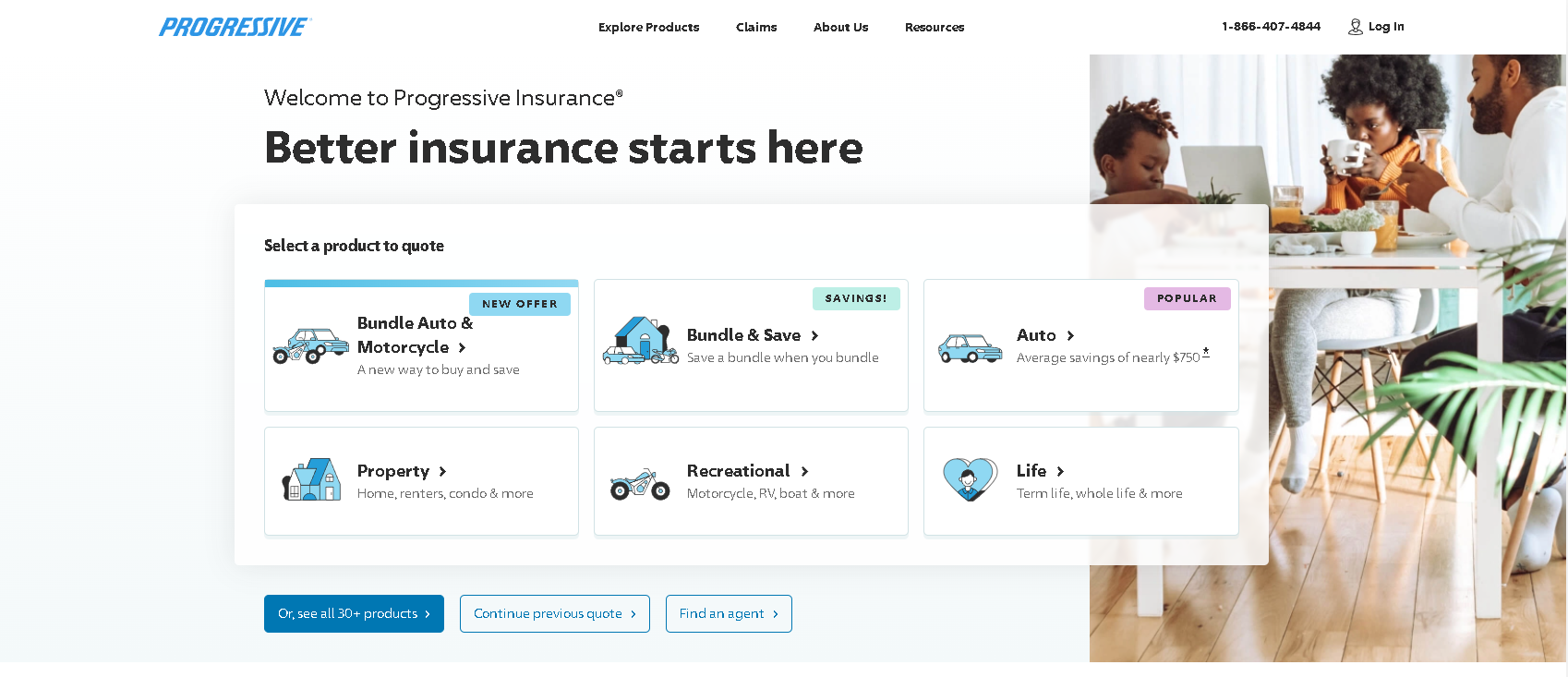

| #1 | 10% | 30% | Online Accessibility | Progressive | |

| #2 | 10% | 30% | Exceptional Service | USAA | |

| #3 | 17% | 30% | Local Agents | State Farm | |

| #4 | 25% | 20% | Coverage Options | Allstate | |

| #5 | 20% | 30% | Vanishing Deductible | Nationwide | |

| #6 | 12% | 30% | Additional Benefits | Liberty Mutual |

| #7 | 5% | 15% | Personalized Service | Farmers | |

| #8 | 8% | 23% | Competitive Rates | Travelers | |

| #9 | 25% | 26% | Digital Experience | Geico | |

| #10 | 25% | 30% | Rate Stability | Erie |

Whether you prioritize online accessibility, exceptional service, or competitive rates, this guide highlights the key features and benefits of each company to assist you in finding the perfect fit for your needs, including the best car insurance for personal injury protection.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Car Insurance for Medical Payments Coverage

Car accidents can happen at any time, and the medical expenses that can arise from such incidents can be overwhelming. Medical payments coverage, also known as MedPay, can help alleviate the financial burden by covering the medical bills resulting from a car accident. This coverage extends not only to the policyholder but also to their passengers and family members.

Car Insurance for Medical Payments: Monthly Rates by Provider

| Insurance Company | MedPay Rates |

|---|---|

| Allstate | $40 |

| Erie | $30 |

| Farmers | $35 |

| Geico | $25 |

| Liberty Mutual | $38 |

| Nationwide | $32 |

| Progressive | $34 |

| State Farm | $28 |

| Travelers | $37 |

| USAA | $29 |

When opting for comprehensive protection, considering full coverage rates is crucial. Allstate leads with a monthly rate of $190, while Liberty Mutual comes in at $215. State Farm stands out as a reliable choice with a competitive rate of $111. These figures provide a snapshot of the financial commitment for robust medical payments coverage.

For those seeking a more budget-friendly option, exploring minimum coverage rates is key. Geico offers an affordable choice at $93 per month, while Erie stands out with a minimal $71 monthly rate. USAA, known for military precision, combines reliability and cost-effectiveness with a monthly rate of $85. Understanding these rates helps tailor medical payments coverage to individual financial preferences.

For additional information, read our: 10 Deadliest Cities for Drivers

Exploring the Benefits of Medical Payments Coverage in Auto Insurance

When considering car insurance options, it is important to understand the benefits of having medical payments coverage. One significant advantage is the immediate coverage it provides for medical expenses. Unlike personal health insurance, which may require deductibles or copayments, medical payments coverage typically has no deductible and covers the full amount of eligible medical expenses up to the policy limit.

Another benefit of medical payments coverage is that it can fill the gaps left by other insurance policies. For example, if you have health insurance with high deductibles or limited coverage, medical payments coverage can help cover the out-of-pocket expenses. It can also cover expenses not typically covered by health insurance, such as dental treatment or chiropractic services directly related to the accident.

Additionally, medical payments coverage is not restricted to accidents involving other vehicles. It can also provide coverage for injuries resulting from single-car accidents, being hit by a vehicle while walking, or accidents that occur while in another individual’s vehicle.

Factors to Consider When Choosing Car Insurance With Medical Payments Coverage

When selecting a car insurance policy with medical payments coverage, there are several factors to consider. One important aspect is the coverage limit. The coverage limit represents the maximum amount the insurance company will pay for medical expenses per accident. It is crucial to choose a coverage limit that aligns with your personal needs and potential medical expenses.

Another factor to consider is the availability of stackable coverage. Stackable coverage allows you to combine the medical payments coverage from multiple vehicles under the same policy, increasing the overall coverage limit. This can be particularly beneficial if you have multiple vehicles or live in a household with several drivers.

It is also essential to assess the cost of the coverage and the reputation of the insurance provider. While you want to find affordable car insurance, it is equally important to select a reputable insurance company known for its prompt and fair claim settlements.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Different Car Insurance Providers for the Best Medical Payments Coverage

With numerous car insurance providers in the market, it is important to compare their offerings to find the best medical payments coverage. Look for insurance companies that have a strong financial stability rating and positive customer reviews. Additionally, compare the coverage limits, policy terms, and any additional benefits offered by each insurance provider.

Consider reaching out to insurance agents or using online comparison tools like compare car insurance quotes to obtain quotes from different companies. This will allow you to compare and contrast the offerings of each company side by side, giving you a better understanding of the value you can expect from their medical payments coverage.

best Car Insurance Companies Offering Comprehensive Medical Payments Coverage

While the best car insurance provider for medical payments coverage can vary depending on individual needs and preferences, some companies have proven to consistently offer comprehensive coverage and excellent customer service. Some of the top car insurance companies to consider include State Farm, Geico, Progressive, Allstate, and USAA (for military personnel and their families).

Each of these companies has a strong reputation for their coverage options and prompt claim settlement process. It’s important to review the specific features and benefits offered by each company to ensure they align with your requirements.

Learn more by reading our: Types of Car Insurance Coverage

How to Determine the Right Amount of Medical Payments Coverage for Your Car Insurance

Choosing the right amount of medical payments coverage for your car insurance can be challenging. It is crucial to consider your individual circumstances and potential medical expenses. Start by evaluating your personal health insurance coverage, including deductibles and copayments. Determine how much additional coverage you may need to cover potential gaps or out-of-pocket expenses.

Consider your income, personal savings, and the potential impact of medical expenses on your financial stability. It might be worth consulting with a trusted insurance agent or financial advisor to help you determine the appropriate coverage limit and ensure you have sufficient protection.

For additional details, read our: Car Insurance: A Complete Guide

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance With Reliable Medical Payments Coverage

While medical payments coverage is essential, it is understandable that you may also be concerned about the cost of insurance. To find affordable car insurance with reliable medical payments coverage, consider the following tips:

- Shop around and compare quotes from multiple insurance providers.

- Consider bundling your car insurance with other insurance policies, such as homeowners or renters insurance, to take advantage of multi-policy discounts.

- Review and update your auto insurance deductibles to find a balance between savings on premiums and potential out-of-pocket expenses.

- Take advantage of any available discounts, such as safe driver discounts or discounts for low-mileage drivers.

- Consider participating in defensive driving courses to potentially qualify for additional discounts.

By implementing these tips, you can help lower your overall insurance costs without compromising the reliability of your medical payments coverage.

Common Misconceptions About Medical Payments Coverage in Car Insurance Debunked

There are several common misconceptions about medical payments coverage in car insurance that can lead to misunderstandings. Let’s address a few of these misconceptions:

Misconception: Medical payments coverage duplicates personal health insurance.

Fact: While medical payments coverage covers medical expenses related to car accidents, it can complement personal health insurance by covering expenses not typically covered by health insurance policies or by filling gaps in coverage.

Misconception: Medical payments coverage is unnecessary if you have health insurance.

Fact: Medical payments coverage can be crucial in situations where you have high deductibles or limited coverage in your health insurance policy. It can help cover the immediate medical expenses resulting from a car accident, regardless of who was at fault.

Jeff Root Licensed Life Insurance Agent

Misconception: Medical payments coverage only applies to accidents involving other vehicles.

Fact: Medical payments coverage can apply to a variety of accidents, including single-car accidents, pedestrian accidents, or accidents that occur while riding in another person’s vehicle.

Navigating car insurance can be tricky, especially with misconceptions about medical payments coverage. In this article, we’ll debunk commonly misunderstood insurance concepts to clarify its importance and how it complements your health

The Role of Medical Payments Coverage in Protecting You and Your Passengers in an Accident

Car accidents can cause a range of injuries, from minor cuts and bruises to more severe injuries that require extensive medical treatment. Medical payments coverage plays a vital role in protecting you and your passengers by providing financial assistance for immediate medical expenses.

Regardless of who is at fault in an accident, medical payments coverage can help cover medical bills, ambulance fees, hospital stays, surgeries, and other necessary medical treatments. Having this coverage ensures that you and your loved ones can receive the care you need without worrying about the financial burden.

Unlock more content by reading our: Car Accidents: What to do in Worst Case Scenarios

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Claims Process for Medical Payments Coverage in Auto Insurance

In the unfortunate event that you or your passengers are injured in a car accident, it is important to understand the claims process for medical payments coverage. The process typically involves the following steps:

- Seek immediate medical attention for all injuries sustained.

- Keep thorough documentation of all medical expenses, including bills, receipts, and medical records.

- Contact your insurance provider as soon as possible to report the accident and initiate the claims process.

- Submit all required documentation, including medical records and bills, to support your claim.

- Work closely with your insurance company’s claims adjuster to ensure a smooth and timely settlement process.

Understanding the claims process and being proactive in providing the necessary documentation can help expedite the resolution of your medical payments claim.

Learn more by reading our: Full Coverage Car Insurance: A Complete Guide

Exploring Additional Benefits and Riders Available With Medical Payments Coverage in Car Insurance

Some car insurance providers may offer additional benefits or riders that can enhance your medical payments coverage. These additional options can provide added protection and peace of mind. Examples of such benefits and riders include:

- Uninsured/Underinsured Motorist Coverage: This coverage can help protect you and your passengers if you are involved in an accident caused by a driver who lacks insurance or has insufficient coverage. It can help cover medical expenses not covered by the at-fault driver’s insurance.

- Accidental Death and Dismemberment (AD&D) Coverage: This optional coverage can provide a lump sum payment in the event of death or serious injury resulting from a car accident.

- Lost Wages Coverage: Some policies may offer coverage for lost wages resulting from injuries sustained in a car accident, helping to protect your income if you are unable to work during your recovery.

Review the available riders and additional benefits offered by your insurance provider to see if they align with your needs and provide additional value to your medical payments coverage.

Expand your knowledge by checking our: Does USAA car insurance cover damage caused by a driver who is uninsured or underinsured?

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

How Your Personal Health Insurance Relates to Car Insurance With Medical Payments Coverage

Understanding how your personal health insurance relates to car insurance with medical payments coverage is essential to avoid confusion and ensure you have the necessary coverage. While personal health insurance offers coverage for various medical expenses, it may have limitations or deductibles that medical payments coverage can help fill.

Car insurance with medical payments coverage is specifically designed to cover the immediate medical expenses resulting from a car accident. It can provide additional financial protection and ensure that you receive the necessary medical treatment without incurring substantial out-of-pocket expenses. Personal health insurance and medical payments coverage can work together to provide comprehensive coverage for your medical needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Assessing the Financial Impact of Not Having Sufficient Medical Payments Coverage in Your Car Insurance Policy

Not having sufficient medical payments coverage in your car insurance policy can have a significant financial impact in the event of an accident. Without adequate coverage, you may be responsible for paying out-of-pocket for medical expenses, which can quickly accumulate and put a strain on your finances.

If you are at fault in an accident, you may also be held responsible for the medical expenses of the other party involved. Without sufficient coverage, you could face substantial liability and potential legal consequences. Consider looking for the best car insurance for liability insurance to ensure you have adequate protection.

It is crucial to assess your potential financial risk and consider the potential impact on your long-term financial stability. Having adequate medical payments coverage ensures that you are prepared for unexpected accidents or injuries and can avoid potential financial hardships.

Case Studies: Car Insurance Companies Ranked for Medical Payments Coverage

In this series, we examine the performance of top car insurance companies, including Progressive, USAA, and State Farm, in managing medical payments coverage. Through real-world case studies, we delve into their responsiveness, reliability, and commitment to policyholders facing accidents and injuries.

- Case Study #1 – Accident Protection With Progressive: ABC Autos, insured with Progressive, faced a multi-car collision resulting in severe damages. Progressive’s comprehensive coverage ensured swift repairs and covered medical bills for all parties involved. The prompt claims settlement exemplified Progressive’s commitment to immediate support, keeping ABC Autos on the road without undue financial strain.

- Case Study #2 – USAA’s Military Precision in Action: John, a USAA policyholder, encountered a hit-and-run incident. USAA’s specialized coverage addressed the damages and medical expenses seamlessly. The company’s military precision extended to efficient claims processing, showcasing USAA’s dedication to providing reliable and swift assistance to its valued policyholders.

- Case Study #3 – State Farm’s Trusted Shield for Comprehensive Protection: Emily, insured with State Farm, faced a complex situation involving a single-car accident. State Farm’s coverage extended beyond typical scenarios, addressing medical expenses and damages. The timely support reinforced State Farm’s reputation as a trusted shield, offering holistic protection for unforeseen events.

In this detailed analysis, we focus on three leading car insurance providers—Progressive, USAA, and State Farm—to assess their effectiveness in handling medical payments coverage. Through a series of case studies, we explore the strengths and weaknesses of each company, highlighting their ability to deliver timely and comprehensive support to policyholders in challenging situations.

Explore further by checking our: Will Liberty Mutual cover my medical bills resulting from an accident?

Steps to Take After an Accident to Maximize Your Benefits From Car Insurance With Medical Payments Coverage

In the aftermath of a car accident, taking the right steps can help maximize your benefits from your car insurance with medical payments coverage. Consider the following steps:

- Seek immediate medical attention for any injuries, regardless of how minor they may seem.

- Notify your insurance provider of the accident as soon as possible.

- Document all medical expenses, including bills, receipts, and medical records.

- Keep detailed records of all correspondence with your insurance company, including claim numbers and the names of representatives.

- Work closely with your insurance claims adjuster to provide the necessary documentation and information to support your claim.

By following these steps, you can ensure that you receive the full benefits entitled to you under your car insurance policy’s medical payments coverage.

For additional information, read our: Will Allstate cover my medical bills resulting from an accident?

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

Frequently Asked Questions

What is medical payments coverage in car insurance?

Medical payments coverage, also known as MedPay, is an optional coverage in car insurance that pays for medical expenses resulting from a car accident, regardless of who is at fault.

For more, check our: Why You Should Always Take Pictures After a Car Accident

Why should I consider getting medical payments coverage?

Medical payments coverage can be beneficial because it helps cover medical expenses for you and your passengers, regardless of fault. It can help pay for hospital bills, doctor visits, surgery, and other medical costs that may arise after an accident.

What does medical payments coverage typically cover?

Medical payments coverage typically covers medical expenses such as hospital bills, doctor visits, surgery, X-rays, dental treatment, ambulance fees, and funeral expenses resulting from a car accident.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

Does medical payments coverage only apply to car accidents?

No, medical payments coverage can also apply to other situations such as being hit by a car while walking or biking, injuries sustained as a passenger in someone else’s car, or even injuries sustained while using public transportation.

Learn more by reading our: Personal Injury Protection (PIP) Insurance: A Complete Guide

How much medical payments coverage should I get?

The amount of medical payments coverage you should get depends on your personal circumstances and preferences. It’s recommended to consider your potential medical expenses, existing health insurance coverage, and budget when deciding on the coverage amount.

Does medical payments coverage duplicate personal health insurance?

While medical payments coverage covers medical expenses related to car accidents, it can complement personal health insurance by covering expenses not typically covered by health insurance policies or by filling gaps in coverage.

Is medical payments coverage required by law?

Medical payments coverage is not typically required by law, but some states may have specific requirements or minimum coverage limits. It’s essential to check your state’s insurance regulations to understand your obligations.

Can I stack medical payments coverage from multiple vehicles?

Some insurance companies offer stackable medical payments coverage, allowing you to combine coverage limits from multiple vehicles under the same policy. This can be beneficial if you have multiple cars or live in a household with several drivers.

Discover more by reading our: What does car insurance cover?

How does medical payments coverage differ from bodily injury liability coverage?

Medical payments coverage pays for medical expenses for you and your passengers, while bodily injury liability coverage pays for medical expenses, legal fees, and other costs for other parties if you’re at fault in an accident. Both coverages can complement each other to provide comprehensive protection.

Can I use medical payments coverage for non-medical expenses?

No, medical payments coverage is specifically designed to cover medical expenses resulting from car accidents. It cannot be used for non-medical expenses such as vehicle repairs, property damage, or legal fees.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.