Cheap Audi S7 Car Insurance in 2026 (Save Money With These 10 Companies!)

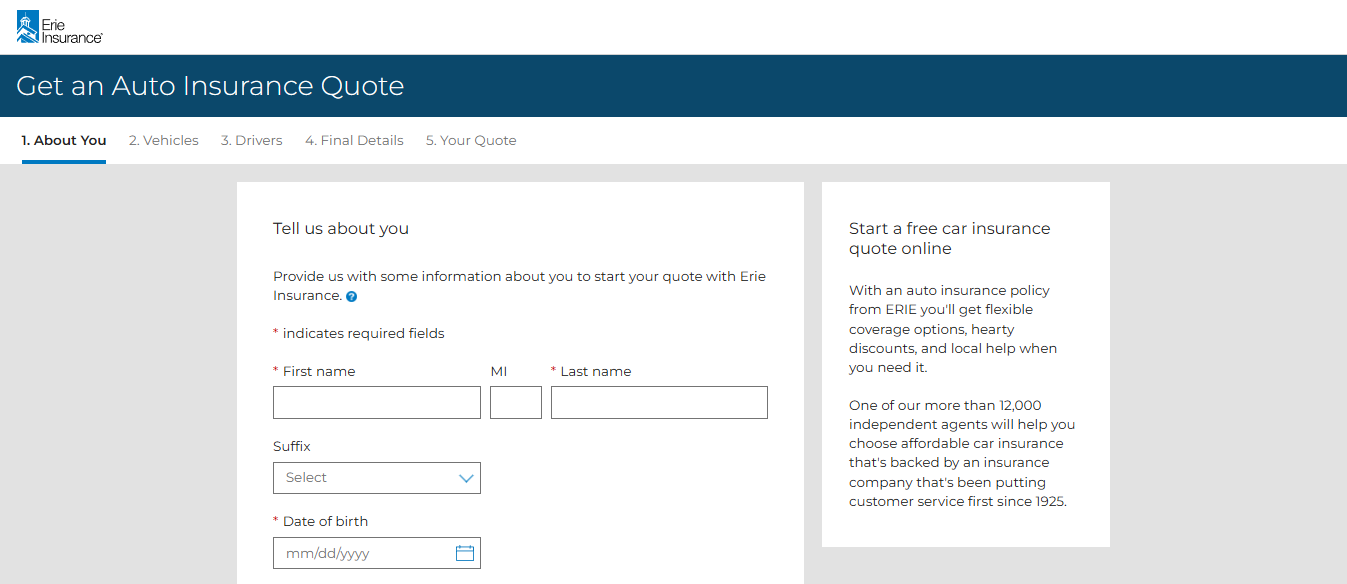

Cheap Audi S7 car insurance is available from Erie Insurance, Progressive, and Allstate, the three most affordable providers, with rates starting at $66 per month. These companies offer comprehensive coverage options and excellent customer service, making them top choices for insuring your Audi S7.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

Company Facts

Min. Coverage for Audi S7

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Audi S7

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Audi S7

A.M. Best Rating

Complaint Level

Pros & Cons

The top providers for cheap Audi S7 car insurance are Erie Insurance, Progressive, and Allstate, offering rates starting at $66 per month.

These companies stand out for their competitive pricing, comprehensive coverage options, and strong customer service. This article explores how these factors contribute to their top rankings. Find out how to save on your Audi S7 insurance without sacrificing quality coverage.

Our Top 10 Company Picks: Cheap Audi S7 Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $66 | A+ | Personalized Policies | Erie |

| #2 | $72 | A+ | Competitive Rates | Progressive | |

| #3 | $80 | A+ | Usage-Based Discount | Allstate | |

| #4 | $85 | B | Customer Service | State Farm | |

| #5 | $92 | A | Roadside Assistance | AAA |

| #6 | $95 | A | Safe Drivers | Farmers | |

| #7 | $100 | A++ | Coverage Options | Travelers | |

| #8 | $109 | A++ | Online Convenience | Geico | |

| #9 | $220 | A+ | Multi-Policy Savings | Nationwide |

| #10 | $233 | A | 24/7 Support | Liberty Mutual |

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool above to see affordable car insurance quotes.

- Erie Insurance offers top coverage for Audi S7 at $66/month

- Find cheap Audi S7 car insurance tailored to your needs

- Get tips for affordable Audi S7 insurance

#1 – Erie: Top Overall Pick

Pros

- Affordable Rates: Erie insurance review & ratings highlight Erie’s competitive rates, positioning it as one of the more cost-effective choices on the market.

- Customer Service: Erie insurance review & ratings highlight Erie’s reputation for exceptional customer service, consistently earning high marks in customer satisfaction surveys.

- Comprehensive Coverage Options: Erie provides a wide range of coverage options and add-ons to tailor policies to individual needs.

Cons

- Limited Availability: Erie’s coverage is only available in 12 states and the District of Columbia, limiting accessibility for many potential customers.

- Slow Claims Process: Some customers report a slower claims process compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive offers competitive pricing, particularly for safe drivers and policy bundles.

- Online Tools: Progressive insurance review & ratings highlight that Progressive’s intuitive website and mobile app simplify policy management, claim filing, and resource access.

- Extensive Coverage Options: Progressive provides a wide range of coverage options, including specialized insurance for unique needs like rideshare drivers.

Cons

- Customer Service Variability: While Progressive offers extensive digital tools, some customers report mixed experiences with customer service.

- Complex Discounts: Progressive’s discount structure can be complex, making it challenging for some customers to maximize savings.

#3 – Allstate: Best for Usage-Based Discount

Pros

- Strong Financial Stability: Allstate boasts strong financial ratings, providing peace of mind for policyholders.

- Wide Range of Coverage Options: Allstate offers a comprehensive selection of insurance products, including auto, home, and life insurance.

- Innovative Digital Tools: Allstate insurance review & ratings highlight that Allstate’s digital tools, like Drivewise, incentivize safe driving and offer discounts for policyholders.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some competitors, particularly for certain demographics.

- Mixed Customer Service Reviews: While Allstate offers extensive coverage and digital tools, customer service reviews vary, with some customers reporting dissatisfaction.

#4 – State Farm: Best for Customer Service

Pros

- Extensive Agent Network: State Farm insurance review & ratings highlight the company’s extensive network of local agents who offer personalized service and support.

- Variety of Discounts: State Farm offers numerous discounts, including multi-policy, safe driver, and good student discounts.

- Comprehensive Coverage Options: State Farm provides a wide range of insurance products, allowing customers to meet all their insurance needs in one place and potentially unlock more discounts..

Cons

- Higher Premiums in Some Regions: State Farm’s premiums may be higher in certain regions compared to other insurers.

- Limited Digital Tools: While State Farm provides basic online tools, its digital offerings may not be as robust as some competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – AAA Insurance: Best for Roadside Assistance

Pros

- Member Discounts: AAA members can enjoy exclusive discounts and benefits on insurance policies.

- Roadside Assistance: The AAA insurance review & ratings indicate that roadside assistance is included within their policies, offering extra benefits to those insured.

- Strong Customer Service Reputation: AAA has a strong reputation for customer service, with dedicated agents available to assist policyholders.

Cons

- Limited Availability: AAA Insurance may have limited availability in certain states, restricting access for potential customers.

- Coverage Options: While AAA offers basic coverage options, it may not have as many customization options as some competitors.

#6 – Farmers Insurance: Best Safe Drivers

Pros

- Customizable Coverage Options: Farmers Insurance offers customizable coverage options to tailor policies to individual needs.

- Local Agents: Farmers’ network of local agents provides personalized service and assistance.

- Discounts for Safe Driving: The Farmers insurance review & ratings demonstrate the company’s tailored coverage options for those with safe driving habits and home security enhancements.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to some competitors, particularly for certain demographics.

- Limited Availability: Farmers Insurance may have limited availability in certain regions, limiting accessibility for potential customers.

#7 – Travelers: Best for Coverage Options

Pros

- Strong Financial Stability: Travelers insurance review & ratings demonstrate tailored coverage options, reflecting the company’s commitment to meeting individual needs.

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options, including specialized insurance for unique needs.

- Discounts for Safe Driving: Travelers provides discounts for safe driving habits and bundling policies.

Cons

- Higher Premiums: Travelers’ premiums may be higher compared to some competitors, particularly for certain demographics.

- Customer Service Variability: While Travelers offers extensive coverage options, customer service reviews vary, with some customers reporting dissatisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Online Convenience

Pros

- Competitive Rates: Geico offers competitive pricing, particularly for safe drivers and policy bundles.

- Digital Tools: Managing policies, filing claims, and accessing resources with Geico car insurance discount is a breeze thanks to its intuitive website and mobile application.

- Extensive Coverage Options: Geico provides a wide range of coverage options, including specialized insurance for unique needs like rideshare drivers.

Cons

- Customer Service Variability: While Geico offers extensive digital tools, some customers report mixed experiences with customer service.

- Limited Availability: Geico may have limited availability in certain regions, restricting access for potential customers.

#9 – Nationwide: Best for Multi-Policy Savings

Pros

- Customizable Coverage Options: Nationwide offers customizable coverage options to tailor policies to individual needs.

- Multi-Policy Discounts: Nationwide provides discounts for bundling multiple policies, such as auto and home insurance.

- Strong Financial Stability: Nationwide insurance review & ratings reveal the company’s tailored coverage options, ensuring personalized protection for policyholders.

Cons

- Higher Premiums: Nationwide’s premiums may be higher compared to some competitors, particularly for certain demographics.

- Limited Availability: Nationwide Insurance may have limited availability in certain regions, limiting accessibility for potential customers.

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- Comprehensive Coverage Options: Liberty Mutual insurance review & ratings encompass a diverse array of coverage choices tailored to address a multitude of insurance requirements.

- Multi-Policy Discounts: Liberty Mutual provides discounts for bundling multiple policies, such as auto and home insurance.

- Strong Customer Service Reputation: Liberty Mutual has a strong reputation for customer service, with dedicated agents available to assist policyholders.

Cons

- Higher Premiums: Liberty Mutual’s premiums may be higher compared to some competitors, particularly for certain demographics.

- Limited Digital Tools: While Liberty Mutual provides basic online tools, its digital offerings may not be as robust as some competitors.

Several factors play a role in determining the cost of car insurance for an Audi S7. These factors include:

- Age and Driving Experience: Inexperienced drivers often face higher premiums due to increased accident risks. A clean driving record and experience can lead to reduced rates.

- Vehicle Value: The cost of insurance is influenced by the market value of your car, especially for luxury models like the Audi S7, which incur higher repair or replacement expenses.

- Location: Insurance costs vary based on location, with urban areas typically having higher premiums due to higher population densities and crime rates.

The way you use your Audi S7 can impact your insurance rates. If you primarily use your car for personal use and have a low annual mileage, you may be eligible for lower premiums. To gain further insights, consult our comprehensive guide titled “How does the insurance company determine my premium?.”

Audi S7 Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $92 | $164 |

| Allstate | $80 | $148 |

| Erie | $66 | $135 |

| Farmers | $95 | $179 |

| Geico | $109 | $211 |

| Liberty Mutual | $233 | $244 |

| Nationwide | $220 | $230 |

| Progressive | $72 | $140 |

| State Farm | $85 | $154 |

| Travelers | $100 | $195 |

However, if you use your vehicle for business purposes or have a high annual mileage, your insurance rates may be higher due to increased risk of accidents and wear and tear on the car.

Understanding the Different Insurance Coverage Options for the Audi S7

When it comes to insuring your Audi S7, you have several coverage options to consider:

- Liability Coverage: This coverage pays for damages and injuries you cause to others in an accident. It is required by law in most states.

- Collision Coverage: This coverage pays for damages to your Audi S7 resulting from a collision with another vehicle or object. For additional details, explore our comprehensive resource titled “Collision Car Insurance: A Complete Guide.”

- Comprehensive Coverage: This coverage protects your Audi S7 against non-collision related damages, such as theft, vandalism, or natural disasters.

It’s important to note that the cost of insurance coverage for an Audi S7 can vary depending on several factors, including your driving history, location, and the level of coverage you choose.

Additionally, some insurance providers may offer additional optional coverage options for your Audi S7, such as roadside assistance or rental car reimbursement. It’s recommended to carefully review and compare different insurance policies to ensure you have the right coverage for your Audi S7 at the best possible price.

While insurance for luxury cars can be expensive, there are several tips you can follow to find more affordable coverage for your Audi S7:

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options.

- Consider Higher Deductibles: Choosing a higher deductible can lower your premium, but keep in mind that you’ll have to pay more out of pocket in the event of a claim.

In connection having bundle policies as home or life insurance, consider bundling them with your Audi S7 insurance. Many insurance companies offer discounts for bundling policies.

Take advantage of discounts is important to inquire about available discounts, such as safe driver discounts, anti-theft device discounts, or discounts for completing driver education courses.

- Improve Your Credit Score: Insurance companies often consider your credit score when determining your premium. Maintaining a good credit score can help you secure more affordable car insurance rates for your Audi S7.

- Install Safety Features: Adding safety features to your Audi S7, such as anti-lock brakes, airbags, and a security system, can help lower your insurance premium. Insurance companies often offer discounts for vehicles equipped with these safety features.

By exploring these avenues, you can optimize your insurance coverage for your Audi S7, ensuring both protection and cost-effectiveness.

Scott W. Johnson Licensed Insurance Agent

Remember, each step you take towards safer driving and proactive policy management can lead to significant savings in the long run.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving Record’s Impact on Audi S7 Insurance

Having a clean driving record is crucial when it comes to reducing your Audi S7 insurance premiums. Insurance companies view drivers with a history of accidents or traffic violations as higher risk, and they charge higher rates to compensate for that risk.

Maintaining a safe driving record can help you qualify for lower insurance rates. To delve deeper, refer to our in-depth report titled “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

In addition to maintaining a safe driving record, there are other factors that can help reduce your Audi S7 insurance premiums.

- Install Safety Features: Insurance companies frequently provide discounts for vehicles with anti-lock brakes, airbags, and anti-theft devices.

- Bundle Policies: Combine your Audi S7 insurance with other policies like homeowner’s or renter’s insurance to potentially reduce premiums.

Many insurance companies offer discounts for customers who have multiple policies with them, so it’s worth exploring this option to see if you can save money.

Savings Strategies for Audi S7 Insurance Coverage

When navigating the complex landscape of insurance premiums for your Audi S7, strategic decisions can make a substantial difference. Consider these tips to potentially reduce your insurance costs and secure optimal coverage.

- Consider Higher Deductibles: As mentioned earlier, choosing a higher deductible can lower your premiums, but be prepared for a larger out-of-pocket expense if you need to make a claim. For a thorough understanding, refer to our detailed analysis titled “What is embedded deductible?.”

- Take Advantage of Discounts: Many insurance companies offer a range of discounts for things like safe driving, bundling policies, or installing anti-theft devices. Be sure to ask about available discounts and take advantage of them.

- Maintain a Good Credit Score: In some cases, insurance companies consider credit scores when determining premiums. Improving and maintaining a good credit score can help you qualify for lower rates.

By implementing these suggestions, you can navigate the intricacies of insurance premiums for your Audi S7 with greater confidence and potentially unlock significant savings.

Remember, proactive measures such as adjusting deductibles, leveraging discounts, and maintaining a healthy credit score can all contribute to more favorable insurance rates.

Choosing Insurance for Your Audi S7: Key Factors

Selecting the right insurance provider for your Audi S7 requires careful consideration of various factors crucial to your peace of mind and financial security. When choosing an insurance provider for your Audi S7, it’s important to consider several factors:

- Reputation and Financial Stability: Research the insurance company’s reputation and financial stability to ensure they can meet their obligations in the event of a claim.

- Coverage Options and Limits: Evaluate the coverage options and limits offered by the insurance company to make sure they meet your needs. To expand your knowledge, refer to our comprehensive handbook titled “What is comprehensive coverage?.”

- Customer Service: Look for an insurance provider with a reputation for excellent customer service and quick claims processing.

By prioritizing factors such as reputation, financial stability, coverage options, and customer service, you can confidently choose an insurance provider that meets your Audi S7’s needs and ensures a smooth claims process.

Remember, investing time in researching and comparing insurance companies can lead to a more tailored and satisfactory coverage experience, offering you the peace of mind you deserve on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unlocking Savings: Audi S7 Insurance Discounts and Incentives Explained

Insuring an Audi S7 may make you eligible for certain discounts and incentives. While each insurance company offers different incentives, common ones for luxury vehicles like the Audi S7 include:

- Safe Driver Discounts: If you have a clean driving record without any accidents or traffic violations, you may qualify for a safe driver discount.

- Anti-Theft Device Discounts: Installing security features, such as an alarm system or a GPS tracking device, can help lower your insurance premiums. To gain profound insights, consult our extensive guide titled “Is car theft covered by car insurance?.”

- Multi-Policy Discounts: Many insurance companies offer discounts to customers who have multiple policies, such as home and auto insurance, with them.

The cost of Audi S7 car insurance can vary depending on several factors such as age, driving history, location, and the value of the vehicle.

By understanding these factors, exploring different coverage options, comparing rates, and taking advantage of available discounts, you can find affordable car insurance for your Audi S7 without compromising coverage.

Real-World Scenarios: Affordable Audi S7 Car Insurance

Understanding how affordable Audi S7 car insurance can protect you in real-life situations is crucial. Here are three brief case studies illustrating the benefits of comprehensive coverage.

- Case Study #1 – Vehicle Theft: An Audi S7 is stolen from a public parking lot. The owner’s comprehensive insurance with Progressive at $68 per month swiftly covers the loss, allowing the owner to replace the vehicle with minimal financial strain.

- Case Study #2 – Accident Coverage: An Audi S7 owner is involved in a collision, causing extensive damage. The owner’s $70 per month Erie policy covers all repair costs and provides a rental car, ensuring no major inconvenience or financial burden.

- Case Study #3 – Liability Claim: An Audi S7 owner rear-ends another vehicle, causing minor injuries and damage. The owner’s Allstate insurance at $66 per month covers medical expenses and repair costs, preventing significant out-of-pocket expenses and legal issues. For a comprehensive overview, explore our detailed resource titled “Personal Injury Protection (PIP) Insurance.”

These scenarios highlight the importance of choosing the right insurance for your Audi S7. Comprehensive coverage can save you from significant financial burdens and ensure peace of mind on the road.

Michelle Robbins Licensed Insurance Agent

Regularly comparing quotes and understanding your options will help you find the best policy for your needs.

Conclusion: Finding Affordable Insurance for Your Audi S7

Securing the right insurance for your Audi S7 involves a delicate balance between cost and coverage. By considering factors like driving history, location, and coverage needs, alongside exploring discounts and bundling options, you can optimize your insurance expenses without compromising on protection. For detailed information, refer to our comprehensive report titled “Car and Home Insurance Discounts.”

Remember to regularly compare quotes from reputable providers to ensure you’re getting the best deal possible. With these strategies in mind, you can confidently hit the road in your Audi S7, knowing you’re covered without breaking the bank.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

How much is insurance for an Audi S7 compared to a 2014 Audi A6?

Insurance costs vary depending on factors like model year, driving history, and coverage level. Generally, newer models like the Audi S7 may have higher insurance premiums compared to older models like the 2014 Audi A6.

How much does it cost to insure an Audi, such as the Audi Q7?

Insurance costs for Audi vehicles like the Q7 depend on factors including the model year, driver’s profile, and coverage options. Typically, luxury SUVs like the Q7 may have higher insurance premiums due to their value and features.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Is Audi insurance expensive compared to other brands?

Audi car insurance costs can vary but are generally higher due to factors like the brand’s luxury status, repair costs, and advanced features. However, insurance rates can vary based on the model, driving history, and location.

To gain in-depth knowledge, consult our comprehensive resource titled “How much is car insurance.”

How much is insurance for a 2024 Audi A6?

Insurance premiums for a 2024 Audi A6 can vary based on factors like the driver’s profile, coverage level, and location. Generally, newer models may have higher insurance costs due to their higher value and repair expenses.

Why is insurance for an Audi A4 so expensive?

Insurance rates for Audi A4 vehicles can be higher due to factors like the car’s value, repair costs, and advanced features. Additionally, insurance premiums are influenced by the driver’s profile, driving history, and location.

Which Audi car typically has the cheapest insurance rates?

Generally, Audi models with lower values and less powerful engines may have cheaper insurance rates. Entry-level models like the Audi A3 or smaller SUVs like the Audi Q3 might have lower premiums compared to higher-end models.

For a comprehensive analysis, refer to our detailed guide titled “What age do you get cheap car insurance?.”

Is Audi Q7 insurance economical or expensive?

Insurance for the Audi Q7 can be more expensive compared to other vehicles due to its luxury status, higher value, and advanced features. However, insurance costs can vary based on the driver’s profile and coverage options.

How much does Audi Q7 insurance cost per month on average?

The average monthly cost of insurance for an Audi Q7 can vary depending on factors like the driver’s age, location, and driving history. Generally, insurance premiums for luxury SUVs like the Q7 may be higher compared to other vehicles.

What is an S7 tracker, and how does it relate to insurance?

An S7 tracker typically refers to a GPS tracking system installed in an Audi S7 to monitor its location. Some insurance companies offer discounts for vehicles equipped with trackers as they are considered less risky for theft.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Full Coverage Car Insurance: A Complete Guide.”

Is insurance higher for an Audi S7 compared to an S5?

Insurance rates for Audi S7 and S5 models can vary based on factors like the car’s value, performance, and features. Generally, the S7, being a higher-end model, may have higher insurance premiums compared to the S5.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.