Cheap Ford Taurus X Car Insurance in 2026 (Secure Low Rates With These 10 Companies)

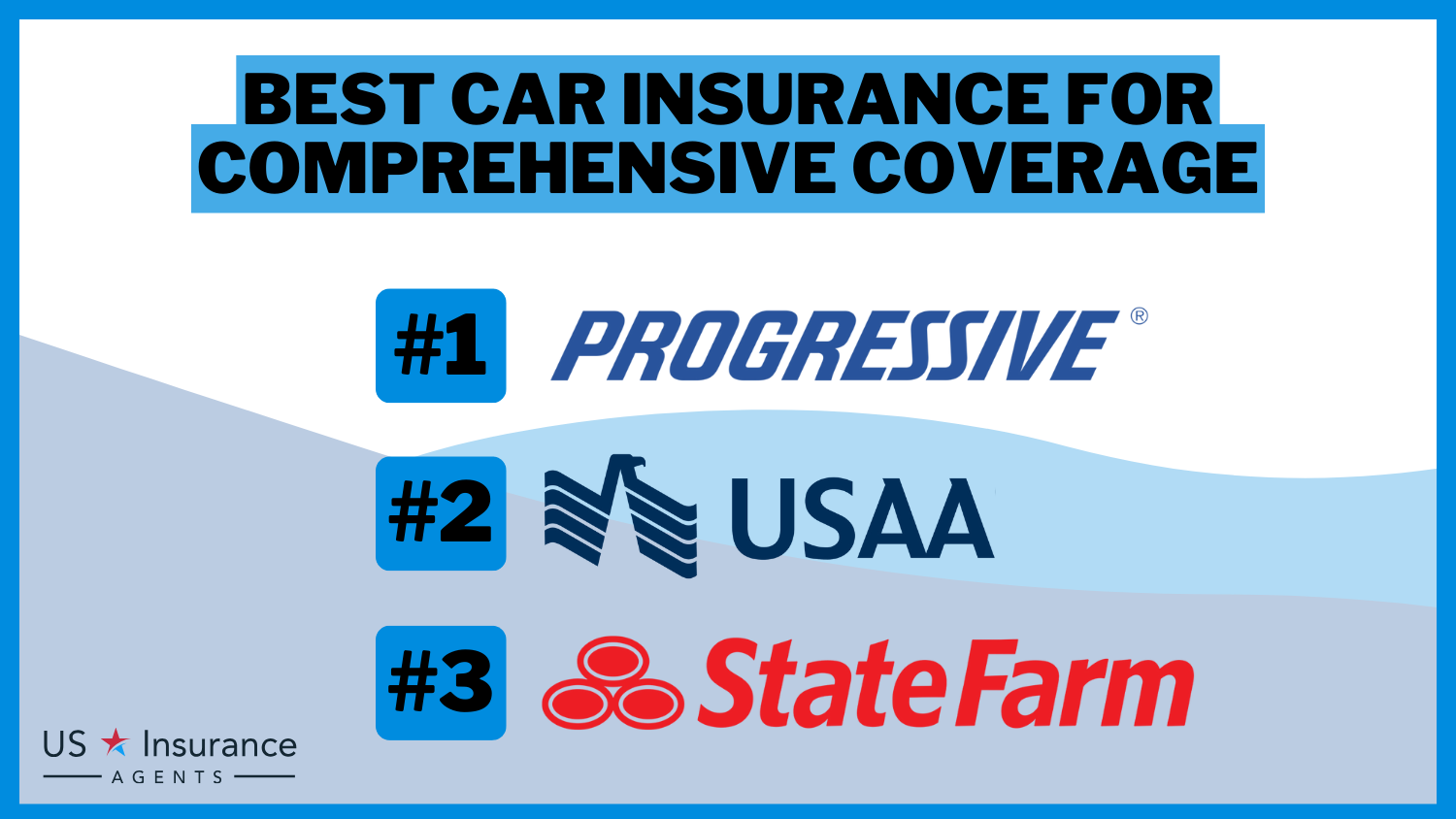

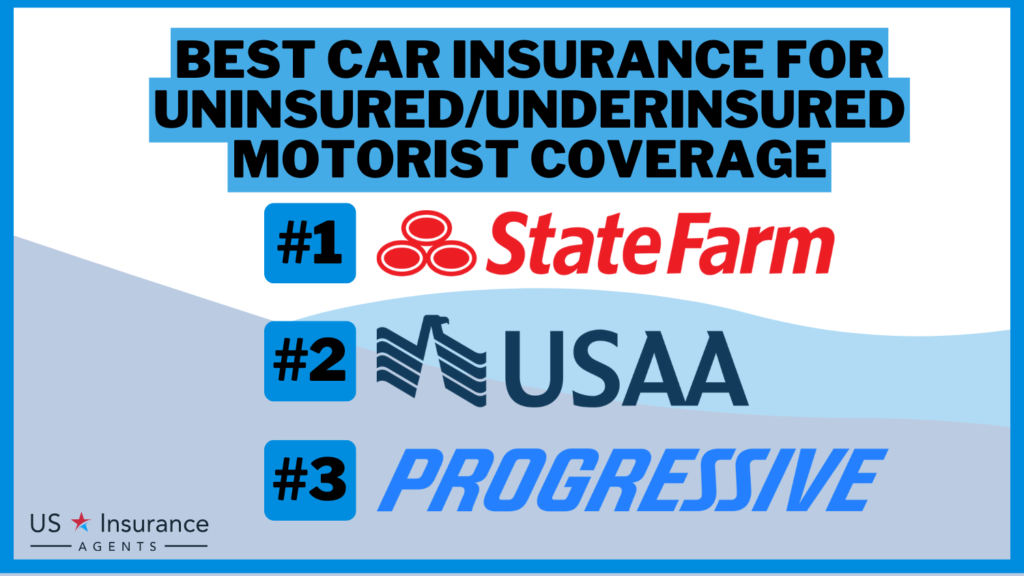

State Farm, American Family, and Progressive stand out as our leading providers offering cheap Ford Taurus X car insurance starting at $47 per month. These insurers emphasize accessible and extensive coverage choices, ensuring dependable protection and peace of mind for their customers' driving requirements.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated January 2025

Company Facts

Min. Coverage for Ford Taurus X

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Ford Taurus X

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Ford Taurus X

A.M. Best Rating

Complaint Level

Pros & Cons

Car insurance is an essential factor to consider when owning a Ford Taurus X. The cost of insurance will depend on various factors such as the driver’s age, location, driving record, and the coverage type chosen. In this comprehensive guide, we will explore all the factors that affect the cost of car insurance for Ford Taurus X, along with comparing quotes, and understanding its impact. Enter your ZIP code now to begin.

- State Farm offers liability coverage starting from just $47 per month

- Discover premium yet budget-friendly options for auto insurance

- Rely to help choose the most cost-effective car insurance policy

#1 – State Farm: Top Overall Pick

Pros

- Affordability: Offers one of the lowest monthly rates, making it a budget-friendly option. Follow us through our State Farm insurance review.

- Customer Service: Known for excellent customer service and personalized attention.

- Wide Availability: State Farm has a large network of agents and offices, providing convenient access for customers.

Cons

- Coverage Options: Some customers may find their coverage options less flexible compared to other insurers.

- Discount Availability: While generally competitive, their discount offerings may not be as extensive as some other providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Best for Budget Conscious

Pros

- Personalized Service: Known for providing personalized service through local agents, fostering strong customer relationships.

- Discount Opportunities: Offers various discounts, such as multi-policy, good student, and defensive driving discounts.

- Community Involvement: Actively involved in community initiatives, which may resonate well with some customers.

Cons

- Limited Availability: Coverage may not be available in all states, which could limit options for potential customers. Follow us through our American Family insurance review.

- Higher Premiums for Some: While generally competitive, premiums for certain demographics or regions may be higher compared to other insurers.

#3 – Progressive: Best for Tech Savvy

Pros

- Technology Integration: Progressive is known for its innovative use of technology in insurance, offering tools like Snapshot for personalized rates.

- Multiple Policy Discounts: Offers significant discounts for bundling auto with other types of insurance.

- User-Friendly Online Platform: Provides a straightforward online interface for managing policies and claims. Follow us through our Progressive insurance review.

Cons

- Price Fluctuations: Progressive’s rates can vary more based on individual driving habits and changes in credit scores.

- Claims Processing: Some customers have reported longer processing times for claims compared to other insurers.

#4 – USAA: Best for Veteran Families

Pros

- Exclusive Membership: Provides insurance exclusively to military members, veterans, and their families, often at competitive rates.

- Top-rated Customer Service: Consistently receives high ratings for customer satisfaction and claims processing.

- Financial Stability: USAA is known for its strong financial stability and ability to pay out claims promptly. Read more through our USAA insurance review.

Cons

- Membership Eligibility: Limited to military personnel, veterans, and their families, excluding the general public.

- Limited Branch Locations: Physical branch locations are limited, which may impact accessibility for some members.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Policy Flexibility

Pros

- Customizable Policies: Offers a wide range of coverage options and customizable policies to suit individual needs.

- Additional Benefits: Provides additional benefits like new car replacement and better car replacement options.

- Discount Programs: Offers various discount programs, such as multi-policy, safety features, and hybrid vehicle discounts.

Cons

- Higher Premiums: Monthly premiums may be higher compared to some other insurers listed. Read more through our Liberty Mutual insurance review.

- Mixed Customer Service Reviews: While some customers report positive experiences, others have noted issues with claims processing and customer service.

#6 – Nationwide: Best for Discount Variety

Pros

- Multi-policy Discounts: Offers significant discounts for bundling auto with home or renters insurance.

- Strong Financial Stability: Nationwide has a solid financial reputation and can handle large claims. Learn more through our Nationwide insurance review.

- Wide Range of Coverage Options: Provides a variety of coverage options to meet different needs and budgets.

Cons

- Customer Service Variability: Reviews on customer service are mixed, with some customers reporting positive experiences and others noting challenges.

- Potentially Higher Premiums: Monthly premiums may be higher compared to some competitors, depending on individual circumstances.

#7 – Allstate: Best for Claims Satisfaction

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options, including unique add-ons like sound system insurance.

- Strong Financial Stability: Known for its solid financial standing and ability to handle large claims. Read more through our Allstate insurance review.

- Good Customer Satisfaction: Generally receives positive feedback for customer service and claims handling.

Cons

- Higher Premiums: Monthly premiums are on the higher side compared to some other insurers.

- Limited Discounts: Discounts offered by Allstate may be more limited compared to competitors like State Farm or Progressive.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personal Service

Pros

- Personalized Service: Farmers agents often provide personalized service, which some customers appreciate. Learn more through our Farmers insurance review.

- Additional Coverage Options: Offers additional coverage options like glass repair, customized equipment coverage, and rideshare insurance.

- Discount Opportunities: Provides various discounts, including multi-policy, affinity group, and good driver discounts.

Cons

- Higher Premiums: Monthly premiums may be higher compared to other insurers for similar coverage.

- Claims Handling: Some customers have reported issues with claims handling and customer service experiences.

#9 – Geico: Best for Family Plans

Pros

- Competitive Pricing: Known for offering competitive rates and discounts that can help lower premiums.

- User-Friendly Online Platform: Provides a simple and efficient online experience for managing policies and filing claims.

- Wide Range of Discounts: Offers a broad range of discounts, such as multi-vehicle, good student, and federal employee discounts.

Cons

- Customer Service: Reviews on customer service are mixed, with some customers reporting challenges in communication and claims handling.

- Policy Options: Geico’s policy options may be more standardized compared to insurers offering more customization. Read more through our Geico insurance review.

#10 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Offers a wide range of coverage options, including specialized insurance for businesses and high-value items.

- Strong Financial Strength: Travelers has a strong financial standing, ensuring stability and reliability.

- Discount Programs: Provides various discount programs, such as multi-policy, safe driver, and hybrid vehicle discounts.

Cons

- Higher Premiums: Monthly premiums may be higher compared to competitors for similar coverage levels. Read more through our Travelers insurance review.

- Claims Processing: Some customers have reported longer wait times and challenges in claims processing.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect the Cost of Car Insurance for Ford Taurus X

Understanding the Different Types of Car Insurance Coverage for Ford Taurus X

Tips for Finding Affordable Car Insurance Rates for Ford Taurus X

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Quotes for Ford Taurus X: A Comprehensive Guide

Frequently Asked Questions

What factors affect the cost of Ford Taurus X car insurance?

The cost of Ford Taurus X car insurance can be influenced by several factors such as the driver’s age, location, driving history, coverage options, deductible amount, and the insurance company’s pricing policies.

Are Ford Taurus X cars generally more expensive to insure compared to other vehicles?

The insurance cost for a Ford Taurus X car may vary depending on various factors, but it is not necessarily more expensive to insure compared to other vehicles. Insurance rates are determined by multiple factors, including the car’s safety features, repair costs, and theft rates. Enter your ZIP code now to begin.

What are some tips for finding affordable insurance for a Ford Taurus X?

Does the age of the Ford Taurus X affect its insurance cost?

The age of the Ford Taurus X can impact the insurance cost to some extent. Generally, newer vehicles may have higher insurance rates due to their higher market value and repair costs. However, factors like safety features and the car’s popularity among thieves also play a role in determining the insurance cost.

Can I get discounts on Ford Taurus X car insurance?

Yes, you may be eligible for various discounts on Ford Taurus X car insurance. Insurance companies often offer discounts for factors such as safe driving records, multiple policies with the same company, anti-theft devices. Enter your ZIP code now to start.

What are the primary factors that influence the cost of car insurance for a Ford Taurus X according to the article?

According to the article, factors such as age, location, driving history, chosen coverage options, lending your car to an uninsured driver, credit score, and vehicle safety features all play a role in determining the cost of car insurance for a Ford Taurus X.

Which three insurance companies are highlighted as offering the most competitive rates for insuring a Ford Taurus X?

State Farm, American Family, and Progressive are highlighted as offering competitive rates starting at $47, $50, and $52 per month respectively for insuring a Ford Taurus X.

How does the article suggest consumers can potentially lower their insurance premiums for a Ford Taurus X?

The article suggests consumers can potentially lower their insurance premiums by comparing quotes from different providers, bundling policies, maintaining a good credit score, opting for higher deductibles, and taking advantage of available discounts like safe driver or multi-policy discounts. Enter your ZIP code now to begin.

What are some of the coverage options mentioned in the article that consumers should consider when insuring their Ford Taurus X?

According to the article, why is it important for consumers to compare quotes from multiple insurance providers before choosing a policy for their Ford Taurus X?

According to the article, comparing quotes from multiple insurance providers is crucial because it allows consumers to find the best rates and coverage options that suit their specific needs and budget, potentially saving money on premiums and ensuring adequate protection.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.