Cheap Honda Passport Car Insurance in 2026 (Save With These 10 Companies!)

Progressive, Erie, and USAA are top pick for cheap Honda Passport car insurance, offering monthly rates as low as $38. These insurers are known for their affordability and comprehensive coverage options, making them ideal for Honda Passport owners seeking budget-friendly insurance solutions.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated October 2024

Company Facts

Min. Coverage for Honda Passport

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Honda Passport

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Honda Passport

A.M. Best Rating

Complaint Level

Pros & Cons

The top choices for cheap Honda Passport car insurance include Progressive, Erie, and USAA, with Progressive standing out as the preferred option for its budget-friendly monthly rates starting at $38.

Erie and USAA also provide competitive rates and comprehensive coverage options, ensuring Honda Passport owners can find the right balance of cost and protection to meet their insurance needs effectively.

Our Top 10 Company Picks: Cheap Honda Passport Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $38 A+ Online Management Progressive

#2 $42 A+ Youth Discounts Erie

#3 $45 A++ Military Savings USAA

#4 $52 B Student Savings State Farm

#5 $56 A Roadside Assistance AAA

#6 $60 A+ Tailored Policies The Hartford

#7 $65 A Loyalty Rewards American Family

#8 $73 A++ Bundling Policies Travelers

#9 $78 A Coverage Options Liberty Mutual

#10 $84 A High-Risk Coverage The General

Protect your car from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

When comparing quotes, consider factors like deductible options and specific coverage benefits to make an informed decision that suits your individual circumstances.

- Progressive offers Honda Passport car insurance at $38/month

- Factors like age and location influence insurance rates

- Compare quotes for tailored coverage at competitive prices

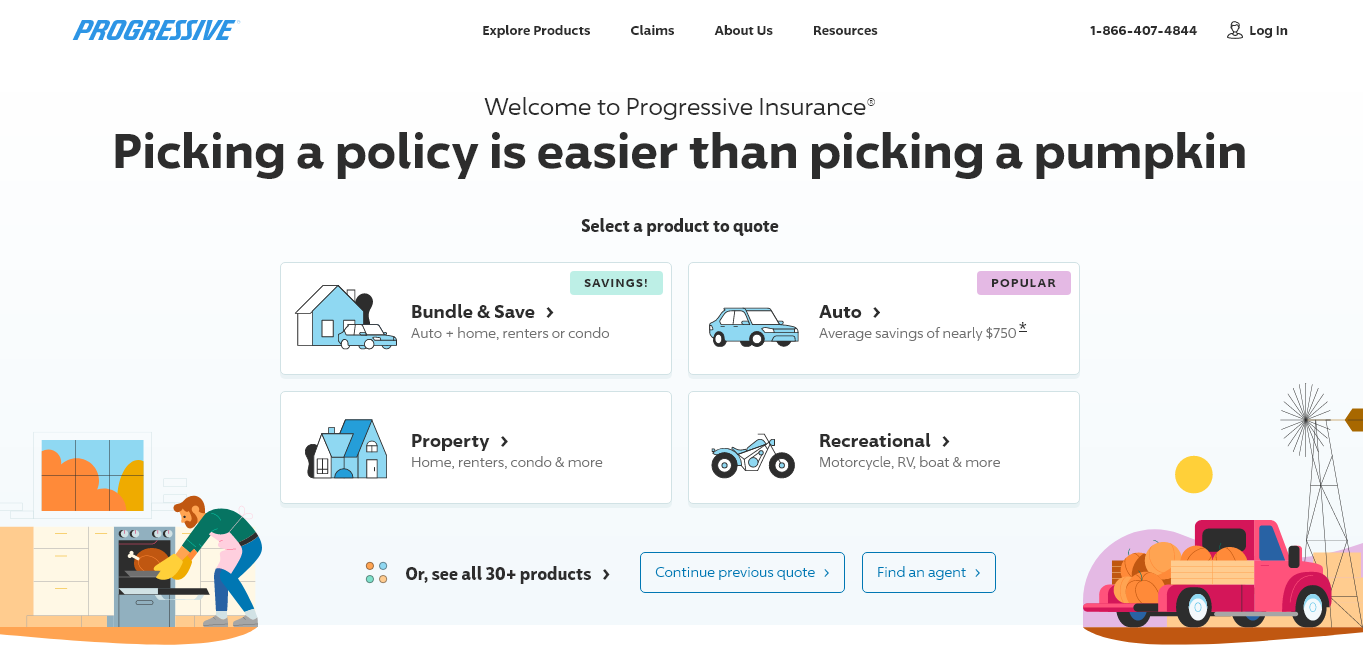

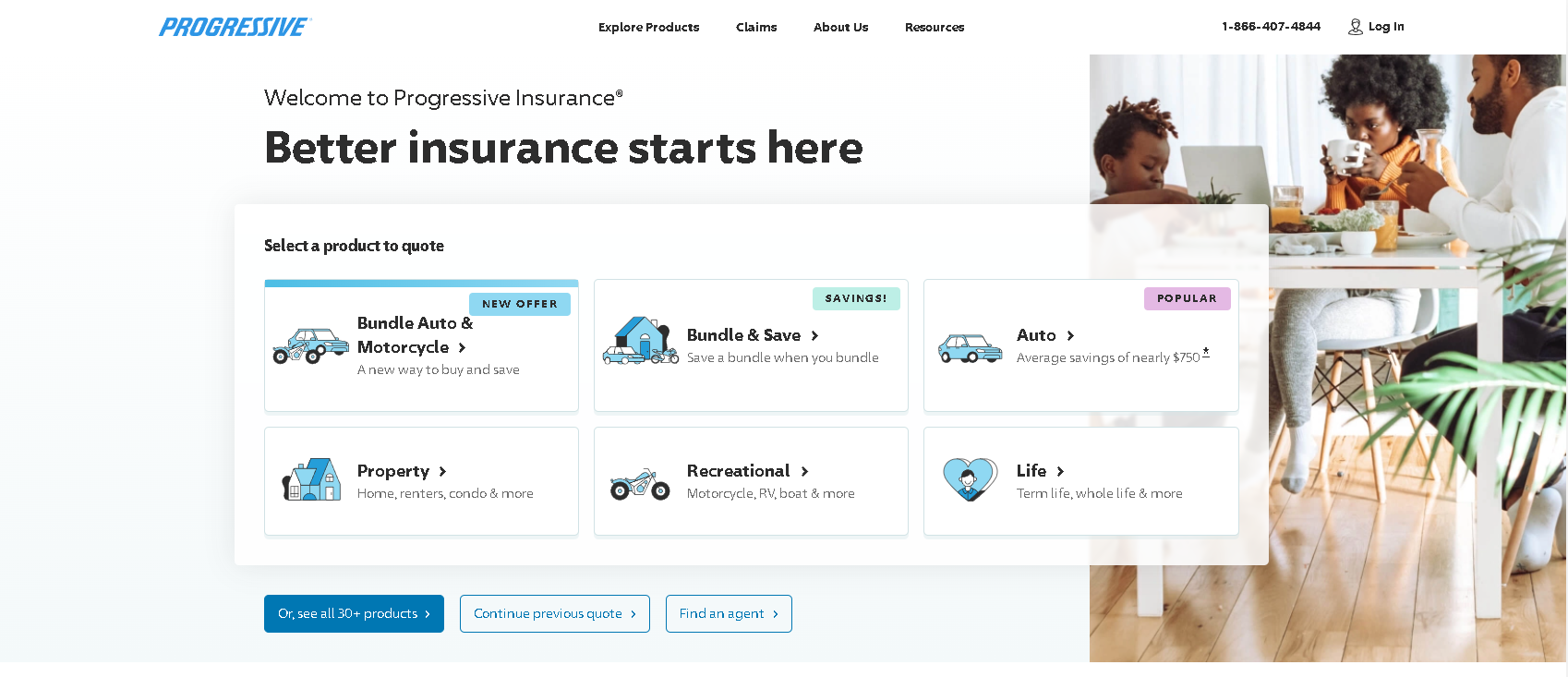

#1 – Progressive: Top Overall Pick

Pros

- Online Management: Progressive insurance review & ratings demonstrate the company’s user-friendly online tools and mobile app, making it easy for customers to manage policies, file claims, and access documents.

- Wide Range of Discounts: Offers numerous discounts such as multi-policy, multi-car, safe driver, and homeowner discounts, helping customers save on premiums.

- Name Your Price Tool: Unique feature that allows customers to input their budget and receive policy options that fit within that range, providing flexibility and customization.

Cons

- Average Customer Service: Some customers report issues with the responsiveness and effectiveness of Progressive’s customer service, particularly in handling complex claims or inquiries.

- Limited Availability: Progressive may not be available in all states, which could limit options for potential customers depending on their location.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for Youth Discounts

Pros

- Youth Discounts: Offers competitive rates and discounts specifically tailored for younger drivers, making it a cost-effective choice for families with teenage drivers.

- High Customer Satisfaction: Erie insurance review & ratings showcase the company’s excellent customer service, with high ratings for responsiveness and claims handling.

- Local Presence: Known for having a strong local agent network, which can provide personalized service and support.

Cons

- Limited Availability: Erie Insurance operates in a limited number of states, which could restrict options for customers outside those regions.

- Online Presence: While Erie provides good offline support through agents, its online customer interface and digital tools may not be as advanced or user-friendly as some competitors.

#3 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers exclusive benefits and discounts tailored to military members, veterans, and their families, including lower premiums and specialized coverage options.

- High Financial Strength: Rated A++ by A.M. Best, indicating superior financial stability and ability to pay claims.

- Member Benefits: Beyond insurance, USAA insurance review & ratings exhibit the company’s range of financial services and benefits, fostering loyalty and satisfaction among its members.

Cons

- Membership Requirements: USAA membership is limited to military members, veterans, and their families, which excludes the general public.

- Limited Branch Locations: While USAA offers online and telephone support, it has fewer physical branch locations compared to traditional insurers, potentially limiting in-person support options.

#4 – State Farm: Best for Student Savings

Pros

- Student Savings: State Farm insurance review & ratings feature the company’s discounts specifically designed for students, including good student discounts and discounts for students away at school without a car.

- Large Agent Network: Known for its extensive network of local agents, providing personalized service and support to customers across the country.

- Variety of Coverage Options: Offers a wide range of insurance products beyond auto, including home, life, and health insurance, allowing customers to bundle policies for additional savings.

Cons

- Mixed Customer Service Reviews: While State Farm has a strong local agent presence, customer reviews regarding the consistency and quality of customer service can vary.

- Higher Premiums: In some cases, State Farm’s premiums may be higher compared to competitors, especially for drivers without access to certain discounts or bundles.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5– AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA is renowned for its roadside assistance service, providing peace of mind to drivers with services such as towing, battery jump-starts, flat tire changes, and lockout assistance.

- Member Benefits: AAA insurance review & ratings reveal the company’s roadside assistance for the members can access discounts on travel, retail, dining, and other services, adding value beyond just insurance.

- Local Clubs: Operates through a network of local clubs, which can provide personalized service and assistance tailored to regional needs and conditions.

Cons

- Membership Costs: AAA membership fees are required to access its services, which may be seen as an additional cost for those primarily seeking auto insurance.

- Coverage Limitations: While AAA offers robust roadside assistance and member benefits, coverage options and premiums for auto insurance may not always be as competitive when compared to specialized insurers.

#6 – The Hartford: Best for Tailored Policies

Pros

- Tailored Policies: The Hartford offers customizable policies that can be tailored to specific needs, including specialized coverage options for older drivers and retirees.

- AARP Partnership: Offers auto insurance through a partnership with AARP, providing unique benefits and discounts for members aged 50 and older.

- Strong Financial Stability: The Hartford insurance review & ratings flaunt the company’s rated A+ by A.M. best, indicating strong financial stability and reliability in paying claims.

Cons

- Limited Availability: The Hartford may not be available in all states or regions, which could restrict options for potential customers depending on their location.

- Higher Premiums for Non-AARP Members: While AARP members benefit from exclusive discounts, non-members might find The Hartford’s premiums less competitive compared to other insurers.

#7 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family insurance review & ratings promote the company’s various loyalty programs and rewards for long-term customers, incentivizing continued patronage.

- Customizable Policies: Provides options to customize policies to fit specific needs, offering flexibility in coverage and premiums.

- Local Agents: Known for its extensive network of local agents who provide personalized service and support to customers.

Cons

- Availability: American Family operates primarily in the Midwest and a few other select states, limiting availability for customers in other regions.

- Limited Online Tools: While American Family offers some online services, its digital tools and mobile app may not be as advanced or user-friendly as those of larger national insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Bundling Policies

Pros

- Bundling Policies: Travelers offers discounts and benefits for bundling multiple insurance policies such as auto, home, and umbrella insurance.

- Wide Range of Coverage Options: Travelers insurance review & ratings present the company’s extensive options for coverage enhancements and additional features to customize policies.

- Strong Financial Strength: Rated A++ by A.M. Best, indicating superior financial stability and claims-paying ability.

Cons

- Higher Premiums: Travelers’ premiums may be higher compared to some competitors, especially for standalone auto insurance policies without bundling.

- Customer Service: Some customers report mixed experiences with Travelers’ customer service, with occasional issues in claims processing and responsiveness.

#9 – Liberty Mutual: Best for Coverage Options

Pros

- Coverage Options: Liberty Mutual offers a wide array of coverage options and add-ons, allowing customers to tailor their policies to meet specific needs.

- Discounts and Savings: Provides various discounts such as multi-policy, multi-car, safe driver, and hybrid vehicle discounts, helping customers save on premiums.

- Tech-driven Solutions: Liberty Mutual review & ratings exhibit the company’s technological innovations and digital tools to enhance customer experience and streamline processes.

Cons

- Mixed Customer Reviews: Liberty Mutual receives mixed reviews regarding customer service, with some customers expressing dissatisfaction with claims handling and support.

- Premium Pricing: In some cases, Liberty Mutual’s premiums may be higher compared to competitors, particularly for certain demographics or coverage types.

#10 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: The General car insurance review & ratings demonstrate the company’s insurance coverage for drivers with less-than-perfect driving records or considered high-risk by other insurers.

- Convenient Access: Offers easy online quotes and applications, making it accessible for customers looking for quick insurance solutions.

- SR-22 Filings: Provides SR-22 insurance filings for drivers who need to prove financial responsibility to the state.

Cons

- Limited Coverage Options: The General may have limited options and features compared to traditional insurers, particularly in terms of additional coverage and customization.

- Customer Service Concerns: Reviews suggest that customer service may not always meet expectations, with some complaints about responsiveness and claims processing efficiency.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Influencing Honda Passport Insurance Costs

Several factors significantly influence the cost of car insurance for a Honda Passport. These include age and driving experience, where younger and less experienced drivers typically face higher premiums compared to their more seasoned counterparts.

Additionally, geographical location plays a crucial role, with urban areas and regions prone to accidents or theft often resulting in increased insurance rates. A clean driving record is beneficial for lower premiums, whereas a history of accidents or traffic violations can escalate costs. For a thorough exploration, delve into our extensive guide titled “What is premium subsidies?”

Choosing a higher deductible can reduce premiums, and the level of coverage selected—such as liability, collision, and comprehensive—directly impacts insurance expenses. Safety features like anti-lock brakes and airbags may qualify for discounts, while higher annual mileage generally correlates with higher insurance rates due to increased accident risk.

Honda Passport Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $56 $120

American Family $65 $136

Erie $42 $96

Liberty Mutual $78 $140

Progressive $38 $112

State Farm $52 $108

The General $84 $148

The Hartford $60 $124

Travelers $73 $138

USAA $45 $102

These factors, along with others, are pivotal considerations for insurance companies when assessing premiums for Honda Passport owners, underscoring the importance of careful evaluation and comparison when seeking insurance coverage.

Understanding Car Insurance Types for Your Honda Passport

When insuring your Honda Passport, it’s crucial to understand these key coverage options:

- Liability Coverage: Protects against damages to others if you’re at fault, including bodily injury and property damage.

- Collision Coverage: Covers repairs to your Honda Passport from collisions with other vehicles or objects.

- Comprehensive Coverage: Safeguards your Honda Passport from non-collision incidents like theft, vandalism, or weather damage. For a comprehensive review, see our in-depth guide titled “Does my car insurance cover damage caused by a manufacturer defect?“

Each type of coverage can be tailored to suit your specific needs and budget, ensuring comprehensive protection for your Honda Passport.

Navigating Honda Passport Insurance Quotes: A Comparative Guide

When shopping for car insurance for your Honda Passport, it is recommended to obtain multiple quotes from different insurance providers. Comparing quotes allows you to evaluate coverage options and find the most competitive rates.

When obtaining quotes, ensure that you provide accurate and consistent information to each insurance company. This will help you obtain accurate and comparable quotes. When comparing quotes, take the time to review the coverage limits, deductibles, and any additional features or discounts offered by each provider. Consider both the cost and the level of coverage to make an informed decision.

Keep in mind that the cheapest quote may not always provide the best overall coverage or customer service. It’s essential to balance cost with quality when selecting car insurance for your Honda Passport. For a detailed breakdown, consult our comprehensive guide named “Types of Car Insurance Coverage.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Affordable Honda Passport Insurance

To secure affordable car insurance for your Honda Passport, consider these effective tips. First, compare quotes from various insurers to find the best rates available. Bundling your car insurance with other policies like home or renter’s insurance could also qualify you for discounts. Keeping a clean driving record is crucial, as it helps in maintaining lower premiums.

Additionally, inquire about potential discounts such as those for safe driving habits or vehicle safety features. While opting for a higher deductible can reduce premiums, ensure you can cover the deductible amount if needed. For a detailed overview, refer to our extensive guide called “What is embedded deductible?”

Daniel Walker Licensed Insurance Agent

Lastly, regularly review and update your coverage to align with your current needs and ensure adequate protection. By implementing these strategies, you can optimize your chances of obtaining affordable insurance for your Honda Passport without compromising on necessary coverage.

Understanding Car Insurance Costs for a Honda Passport

When considering insurance for your Honda Passport, several key factors influence the overall cost. Factors such as age and driving experience, location, and the vehicle’s value play significant roles in determining insurance premiums. These considerations are crucial for making informed decisions when selecting coverage options.

- Age and Driving Experience: Younger or less experienced drivers generally face higher insurance costs due to perceived higher risk.

- Location: Your zip code impacts insurance rates, with higher rates in areas prone to accidents or higher crime rates. For an in-depth investigation, peruse our comprehensive guide named “Car Accidents: What to do in Worst Case Scenarios.”

- Vehicle Value: The value of your Honda Passport affects insurance costs, with newer or more expensive vehicles typically leading to higher premiums.

These factors, among others like coverage options, deductible amount, driving record, and credit history, play a crucial role in determining car insurance costs for a Honda Passport. Understanding their impact can help you make informed decisions when seeking insurance coverage.

Understanding Honda Passport Car Insurance Costs

The average monthly cost of car insurance for a Honda Passport varies based on several factors previously mentioned. Full coverage typically ranges from $116 to $150 per month. Individual rates can significantly differ based on factors such as your driving history, location, and chosen coverage options.

When comparing insurance quotes, these variables are crucial as they directly influence your premiums. While the average monthly cost provides a general guideline, your actual rates may vary considerably depending on your specific circumstances.

Understanding these factors helps in making informed decisions when selecting the right insurance coverage for your Honda Passport. For a thorough examination, take a look at our detailed guide entitled “Full Coverage Car Insurance: A Complete Guide.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Smart Tips for Honda Passport Car Insurance

When purchasing car insurance for your Honda Passport, it’s crucial to navigate the process carefully to avoid common pitfalls that could impact both coverage and costs.

It’s crucial to avoid insufficient coverage by selecting adequate options to shield yourself from financial vulnerability in accidents or unforeseen incidents.

Always compare quotes from multiple insurers to maximize potential savings and secure the best deal. For a comprehensive assessment, refer to our detailed guide, “How to Get Free Insurance Quotes Online.” Additionally, explore available discounts to further reduce premiums and optimize your insurance savings.

By being mindful of these common mistakes and taking proactive steps to ensure adequate coverage and competitive pricing, you can make informed decisions that protect both your vehicle and your finances effectively.

Exploring Discounts and Savings Options for Honda Passport Car Insurance

Insurance providers offer a range of discounts and savings options to help reduce the cost of insuring your Honda Passport. These include safe driver discounts for maintaining a clean driving record, multi-policy discounts for bundling with other types of insurance, vehicle safety discounts for having features like anti-lock brakes and airbags, good student discounts for academically successful students.

At the same time having affiliation discounts for members of certain organizations. When obtaining car insurance quotes, it is prudent to inquire about these potential discounts to maximize your savings and ensure you receive the most cost-effective coverage. For a thorough analysis, consult our comprehensive guide named “Best Pay in Full Car Insurance Discounts.”

Understanding Coverage Options for Your Honda Passport

When insuring your Honda Passport, consider the following coverage options to ensure comprehensive protection and peace of mind.

- Liability Coverage: Required in most states, this covers damages to other parties if you’re at fault in an accident. It includes bodily injury and property damage liability, ensuring financial protection against third-party claims. For an extensive exploration, refer to our detailed guide entitled “Personal Injury Protection (PIP) Insurance: A Complete Guide.“

- Collision Coverage: Pays for damages to your Honda Passport from collisions, regardless of fault. This coverage is crucial for repairing or replacing your vehicle after an accident with another car or object.

- Comprehensive Coverage: Protects against non-collision-related damages such as theft, vandalism, or weather incidents. It covers a wide range of potential risks, providing peace of mind for unforeseen events.

By evaluating these coverage options and aligning them with your needs and budget, you can make informed decisions to best protect your Honda Passport.

Frequently Asked Questions

Which insurance company is usually the cheapest for Honda Passport car insurance and what is the lowest level of car insurance?

Geico and Progressive are often cited as affordable options for Honda Passport car insurance. Liability-only insurance is the lowest level of coverage required by law in most states.

What’s the cheapest car insurance for full coverage for a Honda Passport and which company gives the best insurance?

Progressive and State Farm are known for competitive rates on full coverage insurance for Honda Passports. Geico and USAA are often praised for providing excellent overall insurance options.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Which type of car insurance is the cheapest for a Honda Passport and what is the best insurance cover for it?

Liability-only insurance tends to be the cheapest type of car insurance for a Honda Passport. Full coverage insurance, which includes comprehensive and collision coverage, offers the best overall protection.

For a thorough understanding, refer to our detailed analysis titled “Liability Insurance.”

What is the steering problem with the Honda Passport and is it worth buying one for cheap insurance?

Some Honda Passport owners have reported steering issues related to alignment and responsiveness. Despite this, the Honda Passport is still considered a worthwhile choice for those seeking affordable insurance and reliable performance.

Is the Honda Passport noisy and how long will it last on cheap insurance?

Some owners find the Honda Passport to be noisy, particularly at higher speeds. With proper maintenance and affordable insurance coverage, a Honda Passport can last for many years.

What colors does the Honda Passport come in and where is it made for cheap insurance?

The Honda Passport comes in various colors, including metallic shades and classic tones, making it appealing for those seeking affordable insurance. It is manufactured in the United States, contributing to its reliability and accessibility for insurance coverage.

To expand your knowledge, refer to our comprehensive handbook titled “What is comprehensive coverage?”

What class is the Honda Passport and how much is the Honda Passport Hybrid for cheap insurance?

The Honda Passport is classified as a midsize SUV, offering spaciousness and utility that can influence insurance costs positively. The price of the Honda Passport Hybrid varies depending on location and market conditions, potentially affecting insurance rates.

How much is the Honda Passport Hybrid for cheap insurance and what is the most common problem with it?

The cost of the Honda Passport Hybrid can vary based on location and market conditions, impacting insurance affordability. Common issues reported with the Honda Passport Hybrid include occasional steering problems, which may affect insurance evaluations.

Will there be a 2024 Honda Passport and what is the most common problem with the Honda Passport for cheap insurance?

Yes, the 2024 Honda Passport is expected to be available, continuing its legacy as a practical choice for affordable insurance. The most common problems reported with the Honda Passport include occasional steering issues, which can influence insurance considerations.

To gain profound insights, consult our extensive guide titled “Cheapest Car Insurance Companies.”

Where is the Honda Passport made and what colors does it come in for cheap insurance?

The Honda Passport is manufactured in the United States, contributing to its reliability and availability for affordable insurance coverage. It comes in various colors, offering options that can influence insurance premiums positively.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Your specific zip code can affect premiums, with some areas experiencing higher incidences of accidents or theft. Understanding how your location influences rates and obtaining quotes specific to your zip code is essential when shopping for insurance.

Your specific zip code can affect premiums, with some areas experiencing higher incidences of accidents or theft. Understanding how your location influences rates and obtaining quotes specific to your zip code is essential when shopping for insurance.