Cheap Maserati GranTurismo Car Insurance in 2026 (Big Savings With These 10 Companies!)

For those seeking cheap Maserati GranTurismo car insurance, Erie, American Family, and Farmers stand out as top choices. With rates starting at $162 per month, these companies offer competitive premiums and comprehensive coverage options tailored for your Maserati GranTurismo needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated October 2024

Company Facts

Min. Coverage for Maserati

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Maserati

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Maserati

A.M. Best Rating

Complaint Level

Pros & Cons

If looking for cheap Maserati GranTurismo car insurance, discover these top three providers, Erie, American Family, and Farmers. These companies excel in offering competitive rates and extensive coverage options tailored to luxury car owners.

Whether you prioritize cost-effectiveness or comprehensive protection, this guide explores how these insurers can meet your needs, ensuring your prized vehicle is well-covered on the road.

Our Top 10 Company Picks: Cheap Maserati GranTurismo Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $162 A+ Customer Service Erie

#2 $168 A Costco Members American Family

#3 $173 A Customizable Policies Farmers

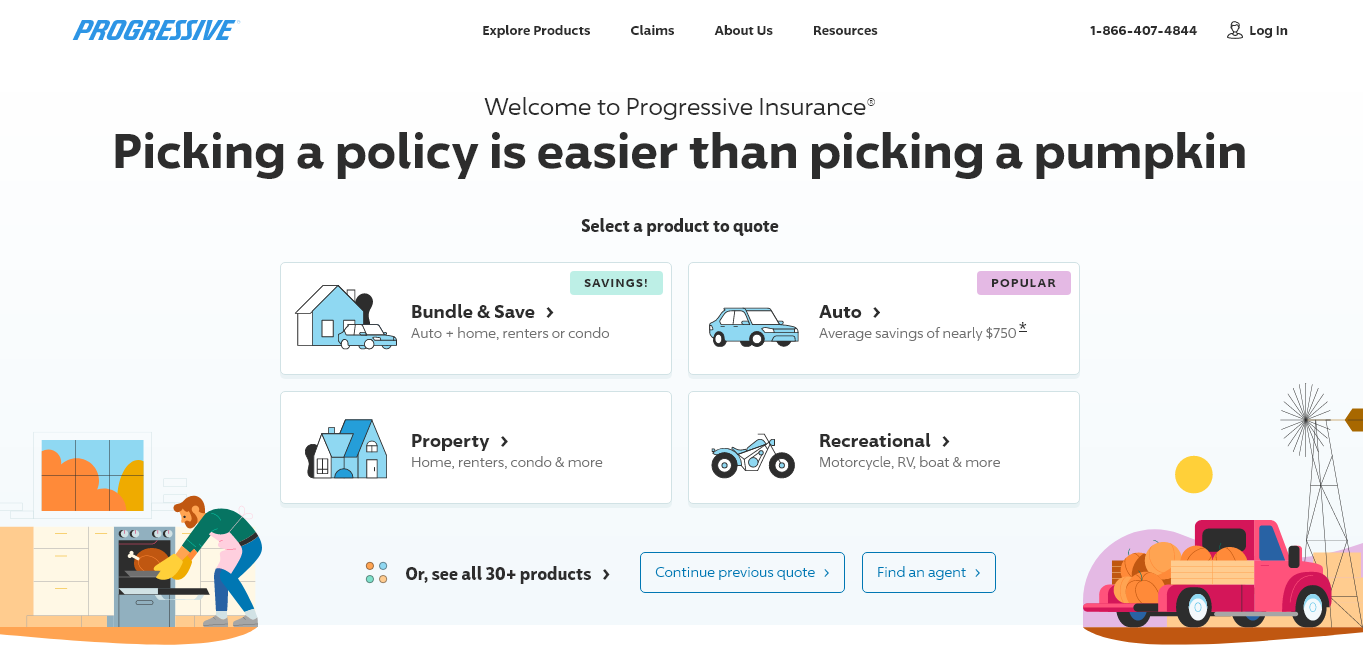

#4 $179 A+ Budgeting Tools Progressive

#5 $184 A+ Usage-Based Coverage Nationwide

#6 $188 A Customizable Policies Liberty Mutual

#7 $191 A++ Unique Coverage Travelers

#8 $196 B Agency Network State Farm

#9 $203 A+ Infrequent Drivers Allstate

#10 $209 A++ High-Value Vehicles Chubb

Understanding these factors and exploring your options is essential to finding affordable car insurance for your Maserati GranTurismo. Check out insurance savings in our complete guide “How To Get Free Insurance Quotes Online.”

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

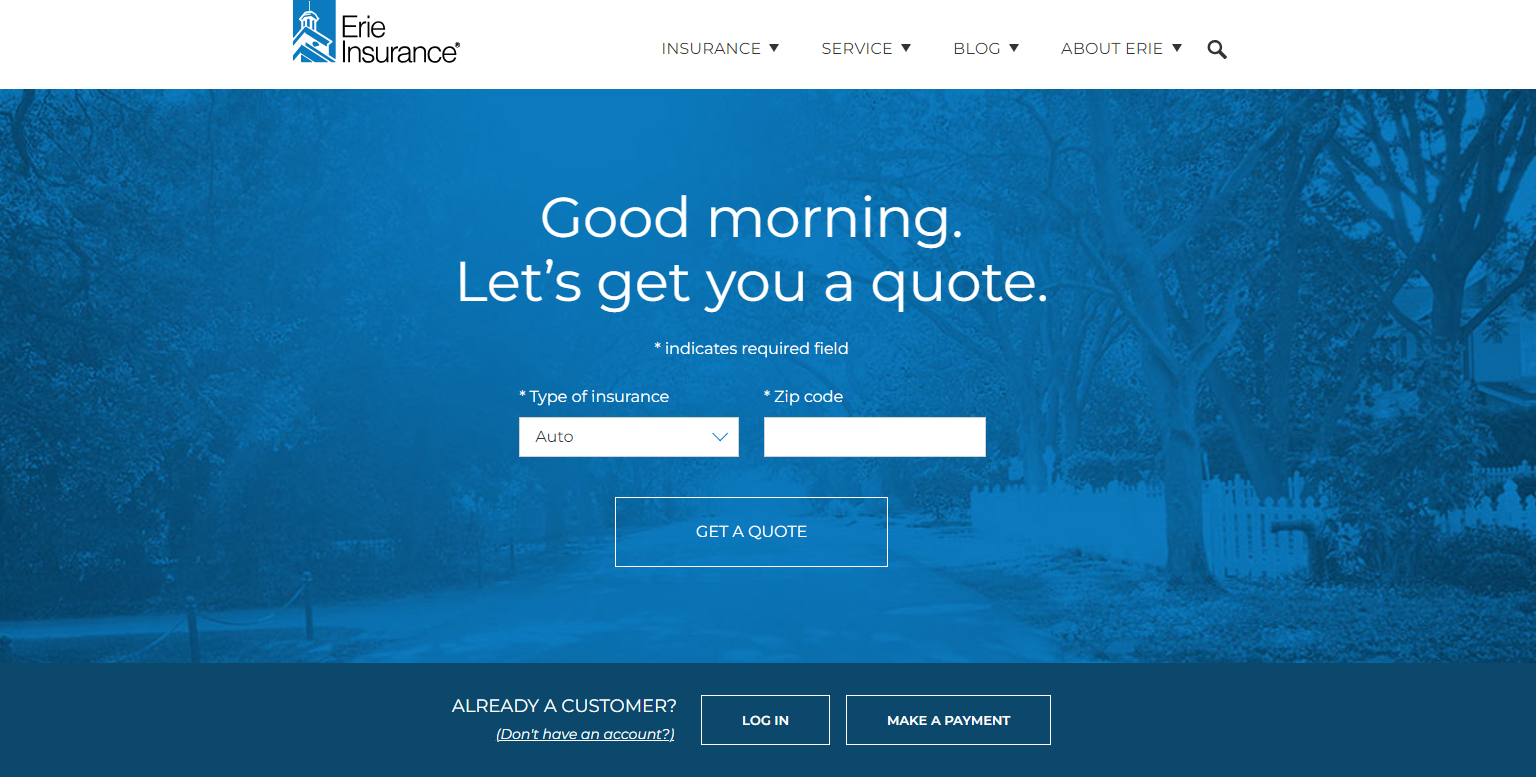

#1 – Erie: Top Overall Pick

Pros

- Competitive Rates: Erie offers one of the lowest monthly rates at $162, making it budget-friendly for customers.

- High A.M. Best Rating: With an A+ rating, Erie ensures financial stability and reliability for policyholders.

- Personalized Service: Erie is known for its exceptional customer service, catering well to individual needs like insuring a Maserati GranTurismo. Check out insurance savings in our complete guide titled “Erie Insurance Review & Ratings.”

Cons

- Regional Availability: Erie’s coverage may be limited to certain regions, potentially excluding customers outside their service area.

- Limited Discounts: While competitive, Erie may have fewer discount options compared to larger national insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Best for Costco Members

Pros

- Special Costco Member Benefits: American Family provides exclusive benefits and discounts for Costco members, including competitive rates starting at $168 per month.

- Strong Financial Rating: Rated A by A.M. Best, American Family offers financial stability and security.

- Flexible Policies: American Family offers customizable policies suitable for diverse needs, such as insuring a Maserati GranTurismo. Unlock details in our titled “American Family Insurance Review & Ratings.”

Cons

- Membership Requirements: Exclusive benefits for Costco members may exclude non-members from accessing certain discounts.

- Higher Starting Rate: Although competitive, the starting rate of $168 may be slightly higher compared to some competitors.

#3 – Farmers: Best for Customizable Policies

Pros

- Customizable Coverage Options: Farmers Insurance allows for highly customizable policies, ideal for tailored coverage needs such as insuring a Maserati GranTurismo. Discover more about offerings in our “Farmers Insurance Review & Ratings.”

- A.M. Best Rating: Rated A, Farmers Insurance demonstrates strong financial stability and reliability.

- Variety of Discounts: Farmers offers various discounts that can help lower premiums for policyholders.

Cons

- Higher Premiums: Despite discounts, Farmers may have higher premiums compared to some competitors.

- Complexity in Policy Customization: Extensive customization options may lead to complexity in understanding policy features and coverage.

#4 – Progressive: Best for Budgeting Tools

Pros

- Advanced Budgeting Tools: Progressive provides innovative budgeting tools that help customers manage insurance costs effectively, including for a Maserati GranTurismo.

- Top A.M. Best Rating: Progressive holds an A+ rating, indicating superior financial strength and stability.

- Competitive Pricing: Progressive offers competitive rates starting at $179 per month, making it accessible to budget-conscious customers. See more details on our guide “Progressive Insurance Review & Ratings.”

Cons

- Coverage Limitations: Progressive’s coverage options may have limitations in certain areas or for specific types of vehicles.

- Customer Service Variability: While generally positive, customer service experiences may vary depending on location and specific circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage-Based Coverage

Pros

- Usage-Based Insurance Options: Nationwide offers innovative usage-based coverage options that can benefit occasional drivers or those with specific usage patterns, including owners of a Maserati GranTurismo.

- High A.M. Best Rating: Nationwide maintains an A+ rating, ensuring strong financial stability and reliability.

- Broad Coverage Options: Nationwide provides extensive coverage choices to meet diverse customer needs. Check out insurance savings in our complete guide “Nationwide Insurance Review & Ratings.”

Cons

- Cost for Usage-Based Plans: While beneficial, usage-based plans may not always result in the lowest premiums compared to traditional policies.

- Availability Limitations: Specific usage-based plans or benefits may not be available in all states or regions.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Policies: Liberty Mutual offers extensive customization options, allowing customers to tailor policies to their specific needs, including for a Maserati GranTurismo.

- A.M. Best Rating: Liberty Mutual maintains an A rating, indicating strong financial stability and trustworthiness.

- Additional Coverage Options: Liberty Mutual provides additional coverage options that can enhance policyholder protection. Discover more about offerings in our article titled “Liberty Mutual Review & Ratings.”

Cons

- Cost Considerations: Despite customization, premiums at Liberty Mutual may be higher for certain coverage levels or customization options.

- Service Accessibility: Customer service availability and responsiveness may vary based on location or specific circumstances.

#7 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage Offerings: Travelers Insurance provides unique coverage options that may be beneficial for niche needs, including insuring a Maserati GranTurismo. Discover more about offerings in our article titled “Travelers Insurance Review & Ratings.”

- Top A.M. Best Rating: With an A++ rating, Travelers demonstrates exceptional financial strength and stability.

- Discount Opportunities: Travelers offers various discounts that can help reduce overall insurance costs.

Cons

- Premium Costs: Unique coverage options may come at a higher premium compared to standard policies offered by other insurers.

- Policy Complexity: Specialty coverage options may involve more complex policy terms and conditions, requiring careful review.

#8 – State Farm: Agency Network Specialist

Pros

- Extensive Agency Network: State Farm boasts a large network of local agents, providing personalized service and accessibility for customers, including those with a Maserati GranTurismo.

- Discover more about offerings in our article called “State Farm Insurance Review & Ratings.”

- Competitive Rates: Although starting at $196 per month, State Farm offers competitive rates and discounts.

- Multiple Policy Discounts: State Farm provides significant discounts for bundling multiple insurance policies.

Cons

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, including insuring high-value vehicles like a Maserati GranTurismo.

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is lower compared to some competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#9 – Allstate: Best for Infrequent Drivers

Pros

- Discounts for Infrequent Drivers: Allstate offers specific discounts tailored for infrequent drivers, potentially reducing premiums for those with limited mileage, such as owners of a Maserati GranTurismo.

- High A.M. Best Rating: Allstate maintains an A+ rating, reflecting strong financial stability and reliability.

- Additional Features: Allstate includes additional features in their policies that may enhance overall coverage. Learn more in our guide titled “Allstate Insurance Review & Ratings.”

Cons

- Cost for Infrequent Drivers: While discounts are available, premiums for infrequent drivers may still be higher compared to other insurers offering similar benefits.

- Service Accessibility: Customer service experiences may vary depending on location and specific circumstances.

#10 – Chubb: Best for High-Value Vehicles

Pros

- Expertise in High-Value Vehicles: Chubb specializes in insuring high-value vehicles like the Maserati GranTurismo, offering tailored coverage options.

- Top A.M. Best Rating: Chubb holds an A++ rating, indicating superior financial strength and stability.

- Global Coverage: Chubb provides global coverage options, suitable for high-net-worth individuals with international insurance needs. Access comprehensive insights into our article called “Chubb Insurance Review & Ratings.”

Cons

- Premium Costs: Insuring high-value vehicles typically comes with higher premiums, which may be a consideration for budget-conscious customers.

- Policy Complexity: Policies for high-value vehicles may involve more intricate terms and conditions, requiring thorough review and understanding.

Maserati GranTurismo Insurance Rates: Monthly Premiums

When considering insurance for a Maserati GranTurismo, understanding the monthly rates for different coverage levels is crucial. The following table provides insights into the minimum and full coverage rates offered by various insurance providers, allowing potential buyers to make informed decisions based on their budget and coverage needs.

Among the listed providers, Erie offers the most competitive rates, starting at $162 for minimum coverage and $287 for full coverage. American Family follows closely with rates of $168 and $299, respectively. Chubb, known for insuring high-value vehicles, offers rates starting at $209 for minimum coverage and $345 for full coverage.

Maserati GranTurismo Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $203 | $339 |

| American Family | $168 | $299 |

| Chubb | $209 | $345 |

| Erie | $162 | $287 |

| Farmers | $173 | $304 |

| Liberty Mutual | $188 | $323 |

| Nationwide | $184 | $317 |

| Progressive | $179 | $311 |

| State Farm | $196 | $334 |

| Travelers | $191 | $329 |

Farmers and Liberty Mutual provide mid-range options, with Farmers offering minimum coverage at $173 and full coverage at $304, while Liberty Mutual starts at $188 for minimum coverage and $323 for full coverage. Nationwide’s rates starting at $184 for minimum coverage and $317 for full coverage, and Progressive offering rates starting at $179 for minimum coverage and $311 for full coverage.

State Farm and Travelers round out the list with rates starting at $196 and $191, respectively, for minimum coverage, and $334 and $329 for full coverage.

Understanding these rates helps in selecting the right insurance coverage that fits both budget and protection requirements. Delve into our evaluation of our article called “How much is Car Insurance?“

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Influence the Cost of Maserati Granturismo Car Insurance

There are several key factors that insurance providers consider when determining the cost of car insurance for a Maserati GranTurismo. One of the primary factors is the value and age of the vehicle. Being a luxury sports car, the Maserati GranTurismo tends to have a higher value, which increases the cost of insurance as the insurer would have to pay out more in the event of a total loss.

Additionally, newer models may have higher insurance premiums due to the higher cost of replacement parts and repairs.Another significant factor is the driver’s personal profile. Insurance companies take into account the driver’s age, driving history, and location. Younger and less experienced drivers tend to have higher insurance premiums, as they are considered higher-risk individuals.

A clean driving record with no accidents or citations can help reduce insurance costs. Lastly, the location where the vehicle is primarily driven and stored also plays a role in insurance pricing. Areas with higher crime rates and a higher likelihood of accidents may result in higher insurance premiums.

Additionally, the coverage options and deductibles chosen by the policyholder can also impact the cost of Maserati GranTurismo car insurance. Higher coverage limits and lower deductibles typically result in higher premiums, as the insurance company would have to pay out more in the event of a claim.

Check out insurance savings in our complete article called “What is the difference between a deductible and a premium in car insurance?”

On the other hand, opting for lower coverage limits and higher deductibles can help lower insurance costs, but it also means the policyholder would have to pay more out of pocket in the event of an accident or damage.Furthermore, the frequency and type of use of the Maserati GranTurismo can also affect insurance rates.

If the car is used for daily commuting or long-distance travel, it may be considered a higher risk and result in higher premiums. On the other hand, if the car is primarily used for leisure or occasional driving, insurance costs may be lower. Insurance companies may also take into account the annual mileage of the vehicle, as higher mileage can increase the likelihood of accidents and therefore impact insurance rates.

Understanding the Insurance Coverage Options for Maserati Granturismo

When insuring your Maserati GranTurismo, it’s crucial to understand the various coverage options available. The most basic coverage is liability insurance, which covers damages and injuries you may cause to others in an accident. Comprehensive insurance, on the other hand, covers damages to your vehicle from non-collision incidents, such as theft, vandalism, or weather damage.

It’s essential to carefully consider the coverage options that best suit your needs and budget. It’s worth noting that if you have financed or leased your Maserati GranTurismo, the lender or leasing company may require you to carry comprehensive insurance coverage to protect their investment. Therefore, it’s important to check and fulfill the insurance requirements stipulated in your loan or lease agreement.

Another important coverage option to consider for your Maserati GranTurismo is collision insurance. This type of coverage helps pay for damages to your vehicle in the event of a collision with another vehicle or object. Collision insurance is especially beneficial if you are at fault for the accident or if the other party involved does not have sufficient insurance to cover the damages.

In addition to collision insurance, you may also want to consider adding uninsured/underinsured motorist coverage to your insurance policy. Learn more in our guide titled, “How to Document Damage for Car Insurance Claims.”

This coverage protects you in the event that you are involved in an accident with a driver who does not have insurance or whose insurance coverage is insufficient to cover the damages. Uninsured/underinsured motorist coverage can help pay for medical expenses, vehicle repairs, and other related costs.

Tips for Finding Affordable Car Insurance for a Maserati Granturismo

While the cost of insuring a Maserati GranTurismo may be higher, there are ways to find more affordable coverage. One tip is to compare quotes from different insurance providers to ensure you’re getting the best rate possible. Each insurance company has its own criteria and pricing model, so getting multiple quotes can help you identify the most competitive option.

Consider bundling your Maserati GranTurismo car insurance with other insurance policies, such as homeowners or renters insurance. Many insurance companies offer discounts for bundling policies, which can help lower the overall cost of your insurance premiums.

Melanie Musson Published Insurance Expert

Maximizing discounts is another strategy to explore. Insurance companies often offer discounts for various factors, such as having a safe driving record, completing a defensive driving course, or installing anti-theft devices in your vehicle. By taking advantage of these discounts, you can potentially reduce your insurance costs. Access comprehensive insights into our “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

Additionally, it’s important to maintain a good credit score. Insurance companies often take into account your credit history when determining your insurance premiums. By maintaining a good credit score, you may be eligible for lower rates on your Maserati GranTurismo car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Average Annual Cost of Insuring a Maserati Granturismo

The cost of insuring a Maserati GranTurismo can vary depending on several factors, including the insurance provider, coverage options, and the driver’s personal profile. On average, however, owners of a Maserati GranTurismo can expect to pay several thousand dollars per year for car insurance.

It’s important to keep in mind that this average cost is only a guideline, and individual rates may vary significantly. To get an accurate estimate of how much your specific policy will cost, it’s advisable to obtain quotes from insurance companies that specialize in high-end vehicles like the Maserati GranTurismo.

Factors that can influence the cost of insuring a Maserati GranTurismo include the driver’s age, driving record, and location. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums.

Additionally, the location where the vehicle is primarily driven and stored can impact insurance rates. Areas with higher rates of theft or vandalism may result in higher premiums. Discover insights in our article called “Best Anti Theft System Car Insurance Discounts.”

Maserati GranTurismo Insurance Providers

When insuring your Maserati GranTurismo, it’s essential to choose an insurance provider that understands the unique needs and risks associated with high-end luxury vehicles. Many insurance companies offer coverage specifically designed for luxury sports cars, and researching these specialty insurers can be beneficial.

They often have a thorough understanding of the intricacies involved in insuring vehicles like the Maserati GranTurismo and may offer more tailored coverage options. More information is available about this provider in our guide titled “Car Insurance: A Complete Guide.”

Researching customer satisfaction ratings and reviews for insurance providers can also help you make an informed decision. Reading about other Maserati GranTurismo owners’ experiences with different insurers can provide valuable insights into the quality of service and claims handling.

Factors to Consider When Choosing Car Insurance for Your Maserati Granturismo

When selecting car insurance for your Maserati GranTurismo, there are several factors to consider. One important factor is the level of coverage you need. While it may be tempting to opt for the minimum required coverage, it’s essential to evaluate your personal situation and assess the potential risks associated with owning a luxury sports car.

Consider the deductible amount as well. The deductible is the amount you would have to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but it’s important to choose a deductible that you can comfortably afford in the event of a claim. If you want to learn more about the company, head to our article called “Types of Car Insurance Coverage.”

If you plan on modifying or adding aftermarket accessories to your Maserati GranTurismo, it’s crucial to inform your insurance provider. Modifying your vehicle can affect its value, safety features, and overall risk profile, which may impact your insurance rates. Failure to disclose modifications could potentially result in denied claims or even policy cancellation.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insuring a Luxury Sports Car: Maserati GranTurismo Considerations

Insuring a luxury sports car like the Maserati GranTurismo requires some special considerations. One of the most important is the need for adequate coverage to safeguard your significant investment. Standard liability coverage may not be enough to fully protect your vehicle against unforeseen events. Read up on the “Liability Insurance: A Complete Guide” for more information.

Additionally, maintaining good credit is important when insuring a luxury vehicle. Insurance companies often consider credit scores when determining insurance premiums, as statistics show a correlation between credit history and the likelihood of filing claims. Therefore, it’s important to manage your credit responsibly and review your credit reports regularly.

Additional Coverage Options for Maserati GranTurismo Insurance

In addition to the basic coverage options, there may be additional coverage options worth considering for your Maserati GranTurismo insurance policy. One example is gap insurance, which covers the difference between the amount you owe on your vehicle and its actual cash value in the event of a total loss. This can be particularly beneficial if you have a loan or lease on your Maserati GranTurismo.

Other options to explore include roadside assistance coverage, rental car reimbursement, and uninsured/underinsured motorist coverage. These additional coverage options can provide added peace of mind and further protect you and your Maserati GranTurismo in various situations.

Location’s Impact on Maserati GranTurismo Insurance Costs

Location plays a significant role in determining the cost of insuring a Maserati GranTurismo. Insurance companies take into account the risk associated with the area where the vehicle is primarily driven and stored.

Urban areas with higher population densities and higher crime rates tend to have higher insurance premiums. Additionally, areas prone to severe weather conditions or higher accident rates may also result in increased insurance costs. If you want to learn more about the company, head to our article called “What is Premium?”

One way to potentially lower the cost of insuring your Maserati GranTurismo is to bundle your car insurance with other policies, such as homeowners or renters insurance. Many insurance companies offer discounts for bundling policies, which can result in overall savings.

Additionally, bundling your policies with a single insurer can simplify the administrative process, as you’ll only have to deal with one company for multiple insurance needs. Unlock details in our article called “Car and Home Insurance Discounts.”

Maserati GranTurismo Insurer Reviews & Ratings

Before choosing an insurance provider for your Maserati GranTurismo, it’s advisable to research customer satisfaction ratings and reviews. Online platforms and consumer advocacy organizations often provide ratings and reviews for insurance companies, allowing you to gauge the quality of service and claims handling.

Reviews from other Maserati GranTurismo owners can provide valuable insights into a company’s responsiveness and reliability. Discover insights in our guide titled “Insurance Quotes Online.”

Specialty Insurers for Maserati GranTurismo Coverage

Specialty insurers that cater to high-end vehicles like the Maserati GranTurismo may offer tailored coverage options specifically designed for luxury sports cars. These insurers often have a better understanding of the unique needs and risks associated with luxury vehicles, providing more comprehensive coverage and specialized claims handling.

Exploring these specialty insurers can help ensure that your Maserati GranTurismo has the appropriate coverage it deserves. Read up on the “Collision vs. Comprehensive Car Insurance: Which coverage is right for you?” for more information.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Good Credit for Maserati GranTurismo Insurance

When insuring a Maserati GranTurismo, maintaining good credit is important. Insurance companies often consider credit scores when determining insurance premiums, as they believe a strong credit history indicates a lower likelihood of filing claims. Therefore, it’s important to manage your credit responsibly, pay bills on time, and review your credit reports regularly to ensure accuracy and address any discrepancies.

If you want to learn more about the company, head to our guide titled “Best Credit Union Car Insurance Discounts.”

Impact of Modifications on Maserati GranTurismo Insurance Rates

If you plan on making modifications or adding aftermarket accessories to your Maserati GranTurismo, it’s important to inform your insurance provider. Modifying your vehicle can impact its value, performance, and risk profile, which may result in changes to your insurance rates.

Failure to disclose modifications could potentially lead to denied claims or even policy cancellation. It’s crucial to discuss any modifications with your insurance provider to ensure that your coverage accurately represents the current condition and value of your Maserati GranTurismo.

By understanding the various factors that influence the cost of Maserati GranTurismo car insurance and exploring your options, you can make informed decisions and find the most affordable coverage for your luxury sports car. Remember to thoroughly research insurance providers, consider available discounts, and carefully assess the coverage options best suited to your needs.

With the right approach, you can protect your investment and enjoy the thrill of driving your Maserati GranTurismo with peace of mind. Learn more in our guide titled “Can I get car insurance for a car that is modified or customized?”

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Frequently Asked Questions

What factors affect the cost of Maserati GranTurismo car insurance?

The cost of Maserati GranTurismo car insurance can be influenced by various factors, including the driver’s age, driving record, location, coverage limits, deductible amount, and the type of insurance policy.

For additional details, explore our comprehensive resource titled “Best Car Insurance for 21-Year-Old Drivers.”

Are Maserati GranTurismo cars expensive to insure?

Insuring a Maserati GranTurismo can be relatively expensive compared to insuring other vehicles. This is primarily due to the high value of the car, expensive repair costs, and the likelihood of it being targeted by thieves.

What are some ways to potentially reduce the cost of Maserati GranTurismo car insurance?

There are a few strategies that can help lower the cost of Maserati GranTurismo car insurance. These include maintaining a clean driving record, opting for a higher deductible, bundling insurance policies, installing anti-theft devices, and comparing quotes from multiple insurance providers.

Are there any specific insurance requirements for Maserati GranTurismo cars?

Yes, Maserati GranTurismo cars typically require a higher level of coverage due to their value. It is often recommended to have comprehensive and collision coverage in addition to the state’s minimum liability insurance requirements.

Does the cost of Maserati GranTurismo car insurance vary by location?

Yes, the cost of Maserati GranTurismo car insurance can vary depending on the location. Factors such as the crime rate, population density, and local insurance regulations can impact the insurance rates in a particular area.

To find out more, explore our guide titled “Is car theft covered by car insurance?”

How much is insurance on a Maserati GranTurismo?

Insuring a Maserati GranTurismo with Nationwide typically costs around $190 per month. However, the exact rate can vary based on factors like your age, the car’s model year, and other variables. Use the quote tables below to get a personalized estimate of your potential cost.

Is Maserati cheap to maintain?

Maintaining and repairing a Maserati can be costly and time-consuming due to the difficulty in sourcing and replacing parts. Even an oil change can be pricey, as Maseratis require fully synthetic oil.

Is Maserati GranTurismo a luxury car?

The Trident’s Luxury Sports Car | Maserati US. Experience the GranTurismo lifestyle. Embark on a journey that is both physical and emotional, leading your senses into unexplored realms where curiosity is your only guide.

What type of car insurance is cheapest?

Usually, full coverage insurance is the most affordable, but prices vary based on personal factors.

To find out more, explore our guide titled “Full Coverage Car Insurance: A Complete Guide.”

What color car is the most expensive to insure?

The color of your car doesn’t impact your insurance rate. Instead, insurers consider factors like the car’s age, location, usage, and your driving record to determine the rates.

Why is a Maserati so expensive?

Does Maserati hold value?

How long do Maserati engines last?

Is Maserati GranTurismo reliable?

Is Maserati GranTurismo a supercar?

Is Maserati GranTurismo a future classic?

How much is a Maserati GranTurismo worth?

Is Maserati a good car to buy?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.