Cheap Mercedes-Benz Mercedes-Maybach S 600 Car Insurance in 2026 (10 Affordable Companies)

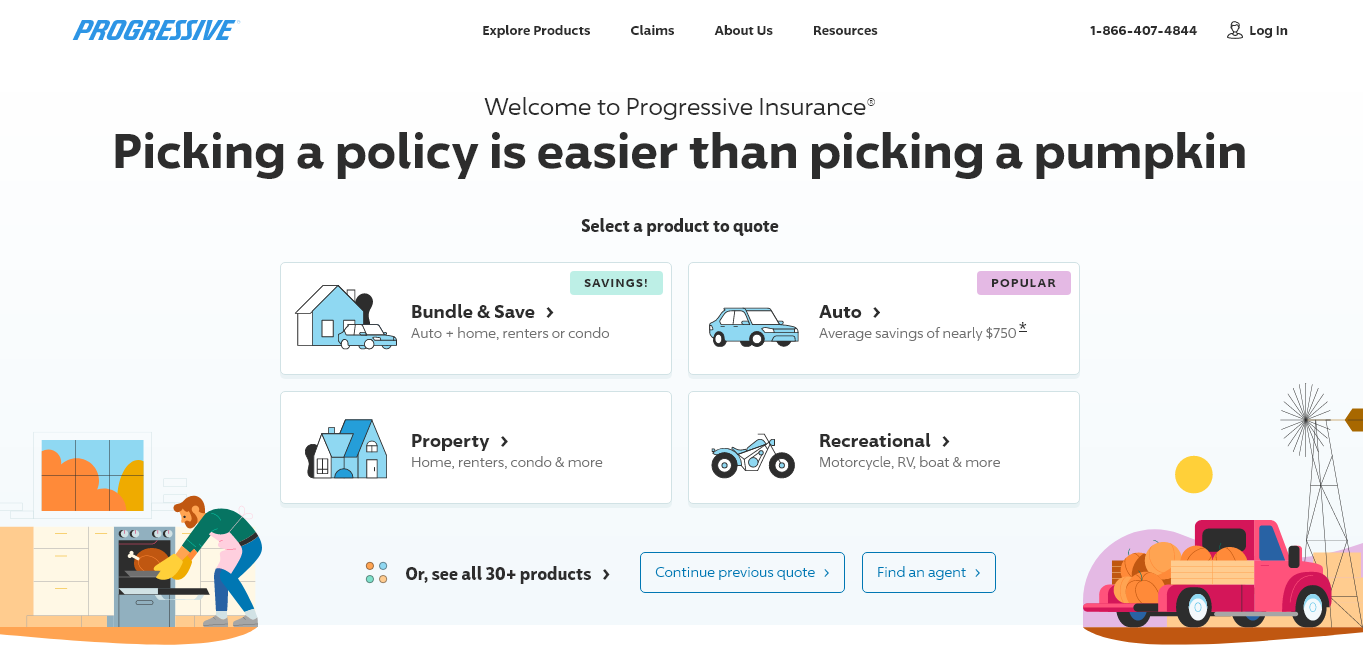

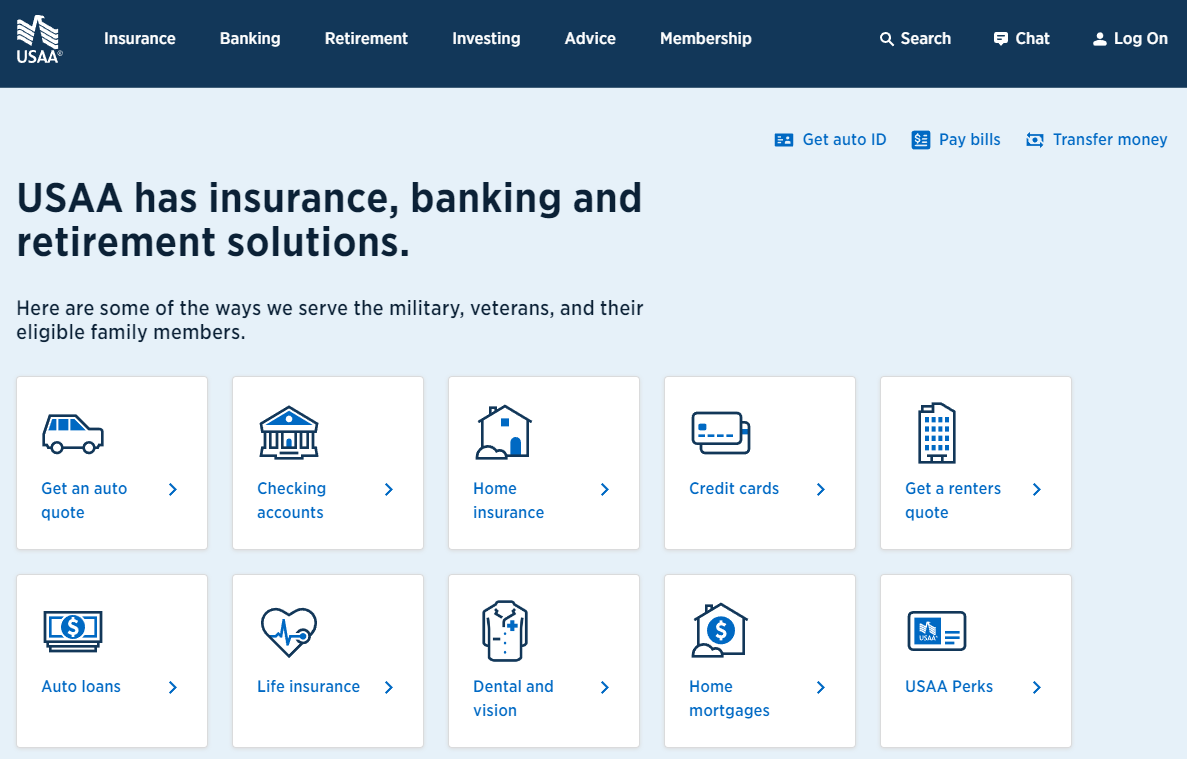

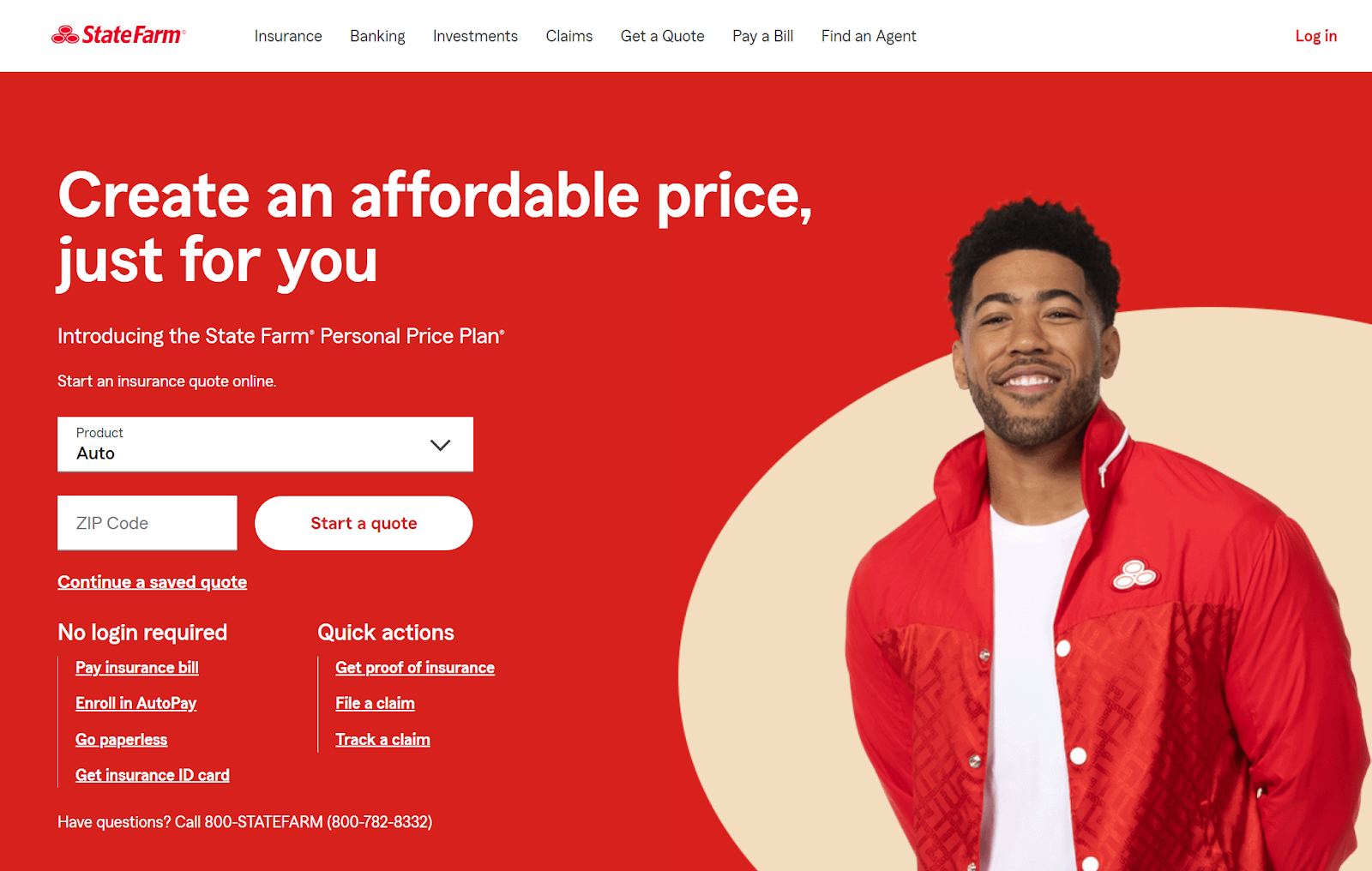

For cheap Mercedes-Benz Mercedes-Maybach S 600 car insurance, Progressive, USAA, and State Farm stand out as top choices. With rates as low as $125/mo, these providers offer the best combination of affordability and coverage. Explore how these companies compare and find the right insurance for your luxury vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2024

Company Facts

Min. Coverage for Mercedes-Benz Mercedes-Maybach S 600

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mercedes-Benz Mercedes-Maybach S 600

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mercedes-Benz Mercedes-Maybach S 600

A.M. Best Rating

Complaint Level

Pros & Cons

When seeking cheap Mercedes-Benz Mercedes-Maybach S 600 car insurance, Progressive, USAA, and State Farm emerge as standout options with rates as low as $125 per month. Find cheap car insurance quotes by entering your ZIP code above.

These providers excel in balancing cost-effectiveness with comprehensive coverage, crucial for insuring luxury vehicles like the Mercedes-Maybach S 600.

Our Top 10 Company Picks: Cheap Mercedes-Benz Mercedes-Maybach S 600 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $125 A+ Custom Parts Progressive

#2 $138 A++ Military Discounts USAA

#3 $145 B Local Agents State Farm

#4 $153 A+ Vanishing Deductible Nationwide

#5 $161 A+ New Replacement Allstate

#6 $168 A Glass Coverage Farmers

#7 $176 A Better Replacement Liberty Mutual

#8 $183 A+ Customer Satisfaction Amica

#9 $191 A+ AARP Discounts The Hartford

#10 $198 A Teen Program American Family

Factors such as vehicle value, repair costs, and safety features play pivotal roles in determining premiums, making it essential to compare quotes from these top companies to find the types of car insurance coverage tailored to your needs and budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Mercedes-Maybach S 600 Insurance

Understanding the factors affecting Mercedes-Maybach S 600 insurance is essential for optimizing your coverage and costs. This luxury vehicle, known for its high value and premium features, naturally leads to higher insurance premiums.

Mercedes-Benz Mercedes-Maybach S 600 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $161 $315

American Family $198 $377

Amica $183 $353

Farmers $168 $328

Liberty Mutual $176 $341

Nationwide $153 $302

Progressive $125 $265

State Farm $145 $290

The Hartford $191 $365

USAA $138 $278

However, several variables, including vehicle specifics, driver details, and policy choices, play crucial roles in determining your insurance rates.

When insurance companies calculate the cost of insuring a Mercedes-Maybach S 600, they take into account multiple factors. These include:

- Vehicle Value: The higher the value of your car, the more expensive it will be to insure. The Mercedes-Maybach S 600 is a luxury vehicle with a hefty price tag, which means the insurance premium will reflect that.

- Repair and Replacement Costs: Luxury vehicles often require specialized parts and skilled technicians for repairs. As a result, insurance companies may charge higher premiums to cover the higher repair and replacement costs associated with the Mercedes-Maybach S 600.

- Safety Features: The safety features of your car can impact your insurance rates. The Mercedes-Maybach S 600 comes equipped with advanced safety technologies, such as collision avoidance systems and adaptive cruise control, which may lower your premium.

- Driving Record: Your individual driving record plays a significant role in determining your car insurance rates. If you have a history of accidents or traffic violations, you may face higher premiums for your Mercedes-Maybach S 600.

- Location: The area in which you live can also affect your insurance costs. If you reside in an area with a high crime rate or a higher likelihood of accidents, your premium may be higher.

By considering the various factors influencing Mercedes-Maybach S 600 insurance, you can make informed decisions to potentially lower your premiums. From choosing the right coverage levels to maintaining a clean driving record, being aware of these factors empowers you to effectively manage your insurance costs while enjoying the luxury and performance of your Mercedes-Maybach S 600.

Insurance Rates for Luxury Vehicles Like the Mercedes-Maybach S 600

Insuring a luxury vehicle often comes with higher insurance rates compared to regular cars. The insurance industry considers luxury cars like the Mercedes-Maybach S 600 to be high-value assets that come with unique risks and costs. Explore our detailed analysis on “How much is car insurance?” for additional information.

One of the primary reasons for the higher rates is the higher repair and replacement costs associated with luxury vehicles. The parts, expertise, and labor required to repair a luxury car like the Mercedes-Maybach S 600 can significantly exceed those of a regular vehicle. As a result, insurance providers need to account for these increased costs when determining insurance premiums.

Furthermore, luxury vehicles are often targeted by thieves, making them a higher risk in terms of theft. The Mercedes-Maybach S 600’s desirability and expensive components make it an attractive target for car thieves, which is another factor contributing to higher insurance rates.

It’s also important to note that luxury vehicles tend to have more powerful engines, which can increase the risk of accidents. Insurance companies take this factor into account when calculating the premium for a Mercedes-Maybach S 600.

Lastly, luxury vehicles are often driven by high-income individuals who may have a higher lifestyle to protect. This factor, combined with the high value of the vehicle, may lead insurance providers to assume that luxury car owners are more likely to file bigger and more expensive claims.

Comprehensive Coverage for Your Mercedes-Maybach S 600

When insuring a luxury vehicle like the Mercedes-Maybach S 600, it’s crucial to consider comprehensive coverage. Comprehensive coverage protects your car against damage or loss from events other than accidents, such as theft, vandalism, natural disasters, and more.

Jimmy McMillan Licensed Insurance Agent

Given the high value of the Mercedes-Maybach S 600, repairing or replacing it can be incredibly costly. Comprehensive coverage ensures that you are financially protected in case of unfortunate events that are out of your control.

While comprehensive coverage may increase the cost of your insurance premium, it provides peace of mind and financial security. Without comprehensive coverage, you would have to bear the full financial burden of repairing or replacing your Mercedes-Maybach S 600 should an unexpected incident occur.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Affordable Mercedes-Maybach S 600 Insurance

Securing affordable insurance for your Mercedes-Maybach S 600 can be challenging due to its luxury status. However, with the right strategies, you can reduce your premiums without sacrificing coverage.

This guide provides essential tips to help you find cost-effective insurance options for your Mercedes-Maybach S 600. Although insuring a luxury vehicle like the Mercedes-Maybach S 600 can be expensive, there are ways to find affordable car insurance without compromising on coverage.

Consider the following tips:

- Shop Around: Don’t settle for the first insurance quote you receive. Take the time to compare rates from different insurance providers to find the best deal for your Mercedes-Maybach S 600. Each company may have different pricing models and discounts to offer.

- Consider Higher Deductibles: Opting for a higher deductible can lower your insurance premium. However, keep in mind that you will have to pay this amount out of pocket in case of a claim, so make sure you can comfortably afford it.

- Bundle Your Policies: Bundling your car insurance with other policies, such as home or life insurance, could lead to multi-policy discounts. Check with your insurance provider to see if this option is available and take advantage of potential savings.

- Take Advantage of Discounts: Insurance companies often offer various discounts that can help reduce your premium. These can include safe driver discounts, low mileage discounts, or discounts for installing safety features on your Mercedes-Maybach S 600.

- Improve Your Credit Score: If your credit score is less than ideal, taking steps to improve it can lead to lower insurance rates. Paying bills on time, reducing debt, and keeping credit card balances low can positively impact your credit score.

Finding affordable insurance for your Mercedes-Maybach S 600 requires careful consideration and proactive measures.

By following these tips, you can enjoy the peace of mind that comes with comprehensive coverage at a reasonable price. Prioritize your vehicle’s protection while managing costs effectively.

Tips for Comparing Mercedes-Maybach S 600 Insurance Quotes

When comparing insurance quotes for your Mercedes-Maybach S 600, it’s crucial to look beyond just the price tag. While cost is important, assessing the coverage options and quality of service offered by each insurer is equally essential.

Firstly, ensure the coverage limits meet your needs to avoid being underinsured in case of accidents. While opting for lower limits may reduce premiums, it could compromise protection.

Secondly, compare deductibles across different insurers. While a higher deductible can lower premiums, choose an amount you can comfortably afford to pay if you need to make a claim.

Lastly, research customer reviews to gauge the insurer’s reputation for customer service and claims handling. Look for companies known for their reliability and ease of claims processing.

By taking these considerations into account and conducting thorough research, you’ll be better equipped to select the right car insurance for your Mercedes-Maybach S 600. Continue reading our full “Compare Car Insurance Quotes” guide for extra tips.

Mercedes-Maybach S 600 Coverage Options

When it comes to insuring your Mercedes-Maybach S 600, you have several coverage options to choose from. Understanding these options will help you decide which coverage is best suited to protect your luxury vehicle.

- Liability Coverage: This coverage is mandatory in most states and provides protection if you cause an accident resulting in bodily injury or property damage to others. It does not cover any damage to your own Mercedes-Maybach S 600.

- Collision Coverage: Collision car insurance protects your Mercedes-Maybach S 600 if it is involved in a collision with another vehicle or object. It includes the cost of repairs or replacement, minus the deductible you select.

- Comprehensive Coverage: Comprehensive coverage covers your Mercedes-Maybach S 600 for damages not resulting from a collision, such as theft, vandalism, fire, or natural disasters. It provides financial protection for a wide range of events that can cause damage to your luxury vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage to fully compensate you for your damages.

- Personal Injury Protection (PIP): PIP coverage pays for your medical expenses and sometimes lost wages if you or your passengers are injured in an accident, regardless of who is at fault. It can be especially beneficial when driving a luxury vehicle like the Mercedes-Maybach S 600, as medical expenses can be substantial.

It’s important to carefully evaluate your coverage needs and consult with your insurance provider to determine the most suitable combination of coverage options for your Mercedes-Maybach S 600.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Additional Coverage for Your Mercedes-Maybach S 600?

While deciding on whether to get additional coverage for your Mercedes-Maybach S 600 is ultimately a personal decision, there are several factors to consider before making a choice.

The high value of the Mercedes-Maybach S 600 and the potential costs associated with repairs or replacements may make additional coverage options an attractive option. Comprehensive coverage, for instance, provides valuable protection against a wide range of risks beyond accidents.

However, it’s essential to weigh the additional cost of these coverage options against the potential benefits. Assess your individual circumstances, driving habits, and tolerance for risk to determine if the added coverage is worth it for you.

Consulting with an insurance professional who specializes in luxury vehicles can provide valuable insight and help you make an informed decision tailored to your specific needs. For more information, explore our informative “Types of Car Insurance Coverage” page.

Driving History’s Impact on Mercedes-Maybach S 600 Insurance Rates

Your driving history significantly impacts your car insurance rates for a Mercedes-Maybach S 600. Insurance companies assess your driving record to determine risk and calculate premiums. A history of accidents or violations may result in higher premiums, while a clean driving record can lead to discounts and lower rates.

Insurance companies also consider factors such as how long you’ve been licensed, prior insurance coverage, and any gaps in coverage. Most providers focus on recent incidents when setting rates, so the impact of past accidents or violations decreases over time if you maintain a clean record. Expand your understanding with our thorough “Full Coverage Car Insurance: A Complete Guide” overview.

Maximizing Discounts on Luxury Car Insurance

When securing car insurance for your Mercedes-Maybach S 600, there are numerous ways to potentially lower your premiums and maximize discounts. Maintain a clean driving record to qualify for safe driving discounts, minimizing accidents and traffic violations. Enhance vehicle security with anti-theft devices to reduce theft risk and insurance rates.

Heidi Mertlich Licensed Insurance Agent

Bundle your car insurance with other policies like home or life insurance to capitalize on multi-policy discounts. Read our extensive guide on “Can I bundle my car insurance with other policies?” for more knowledge.

If your Mercedes-Maybach S 600 has low annual mileage, inquire about discounts for infrequent driving. Consider completing a defensive driving course to demonstrate safe driving skills and potentially qualify for insurance discounts. Students can also benefit from lower rates by maintaining good grades.

To ensure you’re getting the best deal, inquire directly with your insurance provider about tailored discounts available for your Mercedes-Maybach S 600. Each company offers unique incentives, so exploring all options can lead to significant savings. Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Frequently Asked Questions

How much is insurance on a Maybach?

Insurance costs for a Maybach can vary widely based on factors like the model year, driver’s age and location, driving history, and coverage limits.

Learn more by visiting our detailed “How To Get Free Insurance Quotes Online” section.

What is the cheapest Mercedes insurance?

The cheapest Mercedes insurance depends on various factors including the model, driver’s profile, and insurance provider discounts.

What is the most expensive Mercedes to insure?

Generally, high-performance or luxury models like the AMG variants are more expensive to insure due to higher repair costs and greater risk.

Which is the most expensive form of car insurance?

Comprehensive insurance tends to be the most expensive because it covers a wide range of risks including theft, vandalism, and natural disasters.

For further details, check out our in-depth “Collision vs. Comprehensive Car Insurance” article.

Which car is most expensive in Mercedes?

Among Mercedes-Benz models, high-performance AMG variants and luxury models like the Maybach are typically the most expensive.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What factors determine Mercedes-Benz S-Class Insurance Cost?

Factors include the model year, driver’s age and driving history, location, coverage types, and deductible chosen.

How much does it cost to insure my Mercedes-Benz S-Class?

Costs vary widely based on the above factors, but expect premiums to be higher than average due to the vehicle’s value and repair costs.

Discover our comprehensive guide to “How does the insurance company determine my premium?” for additional insights.

What is the Average Annual Cost to insure a Mercedes-Benz S-Class?

On average, annual costs can range significantly but often exceed typical insurance rates due to the vehicle’s luxury status.

How do I Compare all 2020 Mercedes-Benz S-Class insurance rates?

Use online tools or contact insurance providers directly to compare rates based on your specific details.

What are the Cheapest Insurance Companies for Mercedes-Benz vehicles?

Companies offering competitive rates vary by location and driver profile, but shopping around can help find the best rates.

Explore our detailed analysis on “Cheapest Car Insurance Companies” for additional information.

What is the Average Cost to Insure Per Year for a Mercedes-Benz S-Class?

How do I Compare all 2019 Mercedes-Benz S-Class insurance rates?

How does Mercedes-Benz S-Class Insurance Cost vary by Age of the driver?

How do I Compare all 2011 Mercedes-Benz S-Class insurance rates?

What are the Mercedes-Benz S-Class Insurance Rankings based on?

How do Mercedes-Benz S-Class Insurance Rates vary by State?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.