Cheap Oldsmobile Aurora Car Insurance in 2026 (Earn Savings With These 10 Companies)

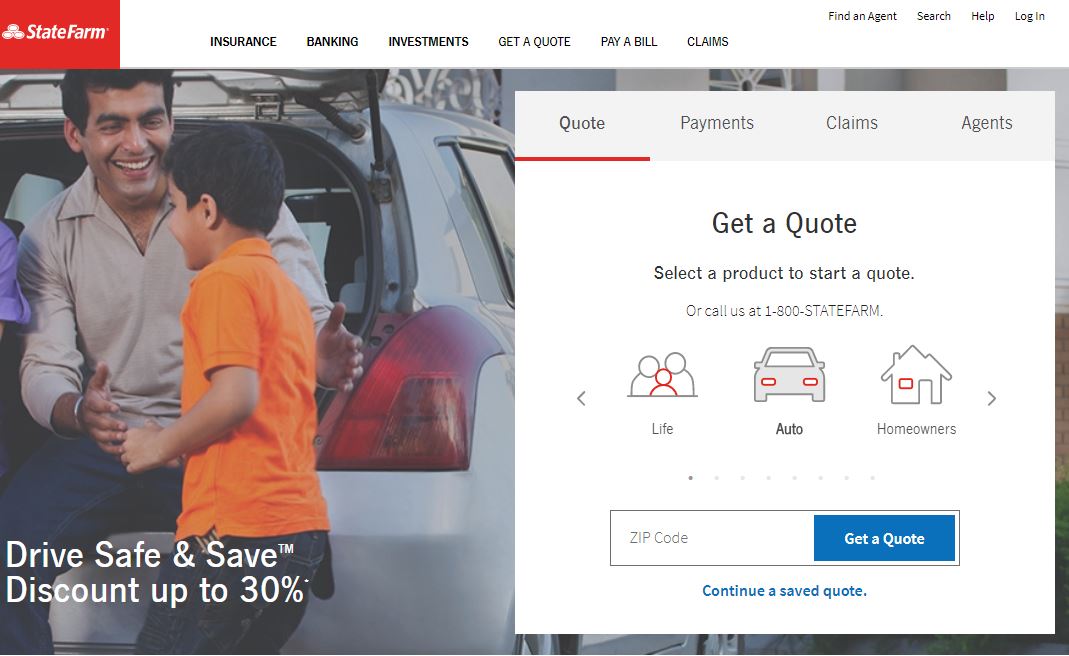

State Farm, USAA, and Progressive offer the best rates for cheap Oldsmobile Aurora car insurance, starting at $74 monthly. These providers excel due to their affordable premiums, comprehensive coverage options, superior customer service, and excellent claims processing for Oldsmobile Aurora owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated October 2024

Company Facts

Min. Coverage for Oldsmobile Aurora

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Oldsmobile Aurora

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Oldsmobile Aurora

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Oldsmobile Aurora car insurance are State Farm, USAA, and Progressive, renowned for their comprehensive coverage and customer service.

These companies stand out in the competitive insurance market by offering tailor-made policies that cater specifically to Oldsmobile Aurora owners, ensuring affordability without compromising on quality. Factors such as the driver’s age, driving record, and the car’s safety features significantly influence insurance costs.

Our Top 10 Company Picks: Cheap Oldsmobile Aurora Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $74 B Safe Driving State Farm

#2 $77 A++ Military Discounts USAA

#3 $81 A+ Snapshot Program Progressive

#4 $86 A+ Drivewise Program Allstate

#5 $89 A++ Affordable Rates Geico

#6 $93 A+ Accident Forgiveness Nationwide

#7 $97 A Customizable Policies Liberty Mutual

#8 $102 A Comprehensive Coverage Farmers

#9 $108 A Multiple Discounts American Family

#10 $113 A++ IntelliDrive Program Travelers

By comparing quotes and understanding what each policy entails, Oldsmobile Aurora owners can secure the best insurance options suited to their needs. See details on our article titled “Best Oldsmobile Car Insurance Discounts.”

Use our free quote comparison tool above to find the cheapest coverage in your area.

#1 – State Farm: Top Overall Pick

Pros

- Customized Discounts: State Farm offers tailored discounts for safe drivers of Oldsmobile Aurora, potentially lowering premiums significantly.

- Comprehensive Coverage Options: For Oldsmobile Aurora owners, State Farm provides a range of coverage choices, including collision and comprehensive insurance.

- Bundling Policies: State Farm offers significant discounts for bundling multiple policies, beneficial for Oldsmobile Aurora owners. Discover more about offerings in our article titled “State Farm Insurance Review & Ratings.”

Cons

- Higher Premiums for Some Coverage Levels: Despite discounts, State Farm’s premiums can be higher for certain Oldsmobile Aurora coverage levels.

- Limited Multi-Policy Discounts: The multi-policy discount is not as competitive for Oldsmobile Aurora owners compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discounts

Pros

- Exclusive Military Discounts: USAA offers special rates and discounts for military members who own an Oldsmobile Aurora, starting at $77 monthly.

- Top-Tier Customer Service: USAA is known for exceptional customer support tailored to Oldsmobile Aurora owners in the military community.

- Highest Financial Stability: With an A++ rating from A.M. Best, USAA guarantees robust support for Oldsmobile Aurora insurance claims. Unlock details in our article titled “USAA Insurance Review & Ratings.”

Cons

- Availability Restricted to Military Families: USAA’s Oldsmobile Aurora insurance is only available to military members and their families, limiting accessibility.

- Limited Physical Locations Claims: Fewer in-person service options for managing Oldsmobile Aurora insurance claims.

#3 – Progressive: Best for Snapshot Program

Pros

- Usage-Based Savings: Progressive’s Snapshot program can offer significant discounts for Oldsmobile Aurora drivers based on driving behavior.

- Flexible Payment Options: Progressive provides multiple payment methods to suit the budgetary needs of Oldsmobile Aurora owners.

- Strong Financial Health: With an A+ A.M. Best rating, Progressive assures reliability in handling Oldsmobile Aurora insurance claims. Read up on the “Progressive Insurance Review & Ratings” for more information.

Cons

- Variable Rates Post-Trial: For Oldsmobile Aurora owners, rates may increase after the initial discount period of the Snapshot program.

- Snapshot Program May Not Suit All Drivers: Not all Oldsmobile Aurora drivers may benefit from the Snapshot program, depending on their driving habits.

#4 – Allstate: Best for Drivewise Program

Pros

- Drivewise Rewards Safe Driving: Allstate’s Drivewise program offers real-time feedback and rewards for safe driving, potentially lowering rates for Oldsmobile Aurora owners.

- Multiple Coverage Options: Offers a wide range of coverage types specifically suited for Oldsmobile Aurora, allowing customization based on individual needs.

- High Financial Rating: With an A+ rating from A.M. Best, Allstate ensures dependable claims service for Oldsmobile Aurora insurance. See more details on our article titled “Allstate Insurance Review & Ratings.”

Cons

- Premiums May Increase with Claims: Oldsmobile Aurora owners might see a rise in premiums after filing claims, even when using the Drivewise program.

- Drivewise Program Requires Data Sharing: Some Oldsmobile Aurora owners may be uncomfortable with the data sharing required by Allstate’s Drivewise program.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Affordable Rates

Pros

- Competitive Pricing: Geico offers some of the most affordable insurance rates for Oldsmobile Aurora owners, starting at $89 monthly.

- Rapid Claims Processing: Known for its efficiency, Geico provides quick and reliable claims service for Oldsmobile Aurora insurance. Check out insurance savings in our complete article titled “Geico Car Insurance Discounts.”

- Extensive Discounts Available: Geico provides a variety of discounts that Oldsmobile Aurora owners can qualify for, enhancing affordability.

Cons

- Customer Service Variability: Some Oldsmobile Aurora owners may experience variability in customer service quality.

- Policy Customization May Be Limited: While rates are competitive, some Oldsmobile Aurora owners may find options for policy customization limited compared to other insurers.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide offers accident forgiveness policies that prevent rates from increasing after a first at-fault accident, benefiting Oldsmobile Aurora owners.

- Wide Range of Discounts: Provides several discount opportunities for Oldsmobile Aurora insurance that can significantly lower premiums.

- Strong Support Network: Nationwide’s extensive agent network ensures personalized service and support for Oldsmobile Aurora owners. More information is available about this provider in our article titled “Nationwide Insurance Review & Ratings.”

Cons

- Higher Base Rates: Initial premiums for Oldsmobile Aurora insurance may be higher, although discounts can mitigate this.

- Claims Satisfaction Varies: Some Oldsmobile Aurora owners may find variations in satisfaction with the claims process.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Tailored Policies: Liberty Mutual offers highly customizable insurance policies for Oldsmobile Aurora, allowing for specific coverage adjustments.

- Variety of Discounts: Offers a range of discounts that can significantly reduce premiums for Oldsmobile Aurora insurance. If you want to learn more about the company, head to our article titled “Liberty Mutual Review & Ratings.”

- Strong Financial Standing: An A rating from A.M. Best ensures reliability in claim handling for Oldsmobile Aurora owners.

Cons

- Can Be Pricier Without Discounts: Without qualifying for discounts, Oldsmobile Aurora insurance through Liberty Mutual can be relatively expensive.

- Customer Service Inconsistencies: Some Oldsmobile Aurora owners may experience inconsistent customer service levels.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Farmers offers a wide array of insurance options, providing thorough protection for Oldsmobile Aurora vehicles.

- Dedicated Claims Service: Known for robust customer support, Farmers provides dedicated claims assistance for Oldsmobile Aurora owners.

- Tailored Discounts: Farmers offers specific discounts for Oldsmobile Aurora that can make premiums more affordable. Discover insights in our article titled “Farmers Insurance Review & Ratings.”

Cons

- Higher Premiums Without Discounts: Premiums for Oldsmobile Aurora insurance can be high unless significant discounts are applied.

- Complex Policy Options: Some Oldsmobile Aurora owners may find the range of coverage options complex and challenging to navigate.

#9 – American Family: Best for Multiple Discounts

Pros

- Multiple Discount Opportunities: American Family offers various discounts that can substantially lower insurance costs for Oldsmobile Aurora owners.

- Personalized Coverage Plans: Provides personalized insurance plans tailored to the specific needs of Oldsmobile Aurora owners. Access comprehensive insights into our article titled “American Family Insurance Review & Ratings.”

- Responsive Customer Support: American Family is known for its responsive and helpful customer support for Oldsmobile Aurora insurance queries.

Cons

- Regional Availability Issues: American Family’s availability can be limited depending on the region, affecting some Oldsmobile Aurora owners.

- Rate Fluctuations: Premiums for Oldsmobile Aurora insurance may fluctuate, affecting budget planning for some owners.

#10 – Travelers: Best for IntelliDrive Program

Pros

- Telematics-Based Savings: Travelers’ IntelliDrive program tracks driving behavior to offer potential savings on Oldsmobile Aurora insurance.

- Flexible Policy Options: Offers a variety of flexible insurance options to meet the diverse needs of Oldsmobile Aurora owners. Delve into our evaluation of our article titled “Travelers Insurance Review & Ratings.”

- Strong Financial Rating: With an A++ rating from A.M. Best, Travelers ensures reliable financial stability for handling Oldsmobile Aurora insurance claims.

Cons

- IntelliDrive Requires Constant Monitoring: The IntelliDrive program requires constant driving monitoring, which may not appeal to all Oldsmobile Aurora owners.

- Premiums Can Increase Post-Program: After the initial discount period, premiums for Oldsmobile Aurora may increase based on the collected driving data.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Insurance Rates for Oldsmobile Aurora

When considering car insurance for your Oldsmobile Aurora, understanding the difference between minimum and full coverage rates offered by various providers can guide your decision-making process. This section delves into the monthly costs associated with both coverage types across different insurers. Discover more about offerings in our article titled “Full Coverage Car Insurance: A Complete Guide.”

Oldsmobile Aurora Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $86 $167

American Family $108 $198

Farmers $102 $192

Geico $89 $172

Liberty Mutual $97 $185

Nationwide $93 $179

Progressive $81 $160

State Farm $74 $148

Travelers $113 $206

USAA $77 $153

For Oldsmobile Aurora owners, monthly insurance rates vary significantly between minimum and full coverage options. For instance, State Farm provides the most affordable rates, charging $74 for minimum and $148 for full coverage. In contrast, Travelers presents the highest rates at $113 for minimum and $206 for full coverage.

Other insurers like USAA and Progressive also offer competitive rates, with USAA at $77 for minimum and $153 for full, and Progressive at $81 for minimum and $160 for full coverage. This variability highlights the importance of comparing what each type of coverage entails and its cost, ensuring you choose a plan that best fits your insurance needs and budget.

Factors That Influence the Cost of Oldsmobile Aurora Car Insurance

When determining the cost of car insurance for an Oldsmobile Aurora, insurance companies consider several key factors.

These include the age and model year of your vehicle, your driving record and history, your location, the level of coverage you choose, the deductible you select, and any additional safety features and anti-theft devices installed in your vehicle. Discover insights in our article titled “Anti Theft System Car Insurance Discount.”

Each of these factors significantly influences the overall cost of insuring your Oldsmobile Aurora. For example, the age and model year of your vehicle typically have a notable impact on insurance costs. Generally, newer vehicles command higher premiums due to their increased value and potentially higher repair costs. Conversely, older vehicles often attract lower premiums due to depreciation and reduced coverage needs.

Understanding the Insurance Rates for Oldsmobile Aurora Vehicles

Insurance rates for Oldsmobile Aurora vehicles can fluctuate depending on several factors. One of the primary considerations is the age and model year of your vehicle. Generally, older vehicles tend to have lower insurance rates since they are typically valued at a lower amount. However, this can also depend on the specific make and model of your Oldsmobile Aurora.

Additionally, insurance rates can be influenced by the safety features installed in your vehicle. Features such as anti-lock brakes, airbags, and traction control can reduce the risk of accidents and increase the safety of your Aurora. Insurance companies often offer discounts for vehicles equipped with such safety features, which can lower your insurance premiums.

Another factor that can affect insurance rates for Oldsmobile Aurora vehicles is the driver’s personal driving record. Insurance companies consider factors such as the driver’s age, driving experience, and history of accidents or traffic violations. Drivers with clean records often receive lower insurance rates. Explore our analysis in the titled article “Traffic School Can Lower Your Car Insurance Rates.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Average Cost of Insuring an Oldsmobile Aurora

While it’s impossible to provide an exact figure for the cost of insuring an Oldsmobile Aurora, we can discuss the average cost as a rough estimate. According to industry data, the average monthly premium for insuring an Oldsmobile Aurora ranges from approximately $67 to $100. However, it’s essential to remember that this figure can vary significantly based on the aforementioned factors, as well as other personal circumstances.

Factors that can influence the cost of insuring an Oldsmobile Aurora include the driver’s age, driving record, location, and the types of car insurance coverage chosen. Younger drivers or those with a history of accidents or traffic violations may face higher premiums.

Additionally, living in an area with a high crime rate or a high number of accidents can also result in higher insurance costs. It’s important to shop around and compare quotes from different insurance providers to ensure you’re getting the best coverage at the most competitive price.

Tips for Finding Affordable Car Insurance for an Oldsmobile Aurora

When searching for affordable car insurance for your Oldsmobile Aurora, it’s advisable to research and compare quotes from multiple providers. Each company has its own rate-setting methods, so comparing multiple quotes can give you a clearer market perspective. Additionally, consider bundling your car insurance with other policies, such as homeowners or renters insurance, as this can often lead to discounted rates.

Another effective way to reduce your insurance premium is to maintain a clean driving record. Avoiding accidents and traffic violations can lower your insurance rates. Consider increasing your deductible to reduce monthly premiums, but ensure it remains affordable in case of a claim. Access comprehensive insights into our article titled “How to Document Damage for Car Insurance Claims.”

It’s also worth exploring any available discounts that insurance providers may offer specifically for Oldsmobile Aurora owners. Some companies offer discounts for safety features installed in the vehicle, such as anti-lock brakes or airbags. Additionally, membership in certain professional organizations or alumni associations may qualify you for group discounts on car insurance. Always ask about these discounts when getting quotes.

Exploring Different Coverage Options for Oldsmobile Aurora Car Insurance

When buying car insurance for your Oldsmobile Aurora, it’s crucial to evaluate the available coverage options. The main types include liability insurance, which is mandatory in most states and covers damages and injuries you cause in an at-fault accident. Comprehensive coverage protects your vehicle from non-collision damage like theft or vandalism.

Selecting the right coverage for your Oldsmobile Aurora depends on your needs and preferences. Consulting with an insurance professional can help tailor the coverage to suit you. Consider collision coverage as well; it covers repairs or replacement after an accident, beneficial if you often drive in heavy traffic or have had past accidents.

In addition to liability, comprehensive, and collision coverage, consider exploring options like uninsured/underinsured motorist coverage. This type of coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. It offers financial protection and peace of mind if you’re in an accident with an uninsured or underinsured driver.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Your Driving Record Affects the Cost of Insuring an Oldsmobile Aurora

Your driving record has a significant impact on the cost of insuring an Oldsmobile Aurora. Insurance companies consider your history of accidents and traffic violations as an indicator of risk. If you have a clean driving record with no or minimal previous incidents, you are likely to be eligible for lower insurance rates. Conversely, a history of accidents or violations may lead to higher premiums.

Kristine Lee Licensed Insurance Agent

To maintain affordable insurance rates, it’s essential to practice safe driving habits and obey traffic laws. This not only keeps you and others safe on the road but can also have a positive impact on your insurance premiums. Learn more in our guide titled “Car Driving Safety Guide for Teens and Parents.”

Additionally, insurance companies may also take into account other factors when determining the cost of insuring an Oldsmobile Aurora. These factors can include your age, location, and the amount of coverage you choose. Younger drivers and those in high-risk areas often pay more for insurance. Choosing comprehensive coverage or higher liability limits also raises costs.

The Impact of Your Location on Oldsmobile Aurora Car Insurance Rates

Where you live can also influence the cost of insuring your Oldsmobile Aurora. Insurance rates are often higher in densely populated areas where the risk of accidents and theft is higher. Additionally, areas prone to severe weather conditions or a high incidence of auto theft may result in higher insurance rates.

When obtaining insurance quotes, it’s important to provide your exact location to receive accurate estimates. Keep in mind that rates can vary between different regions and even within a specific city or town. Gain in-depth understanding through our guide titled “Best Car Insurance in Your State.”

Safety Features That Can Lower Your Oldsmobile Aurora Insurance Premium

The safety features installed in your Oldsmobile Aurora can potentially lower your insurance premiums. Insurance companies consider vehicles equipped with advanced safety features as less likely to be involved in accidents and therefore less risky to insure. Check out insurance savings in our complete guide titled “Safety Features Car Insurance Discount.”

Some of the safety features that might make you eligible for discounts include anti-lock brakes (ABS), airbags, electronic stability control (ESC), and traction control. Moreover, if your vehicle has anti-theft devices like alarm systems or vehicle recovery systems, you might be able to lower your insurance premiums further.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money on Oldsmobile Aurora Car Insurance Without Sacrificing Coverage

It’s possible to save money on Oldsmobile Aurora car insurance without compromising on coverage. One effective way to achieve this is by increasing your deductible. By opting for a higher deductible, you can reduce your monthly premiums.

However, it’s crucial to ensure that your deductible amount is affordable in case of an accident. An additional strategy is to take advantage of any discounts or special programs offered by insurance companies.

For instance, some insurers offer discounts for good student drivers, multiple vehicles on the same policy, or for completing defensive driving courses. Exploring these options and discussing them with your insurance provider can potentially lead to significant cost savings. Delve into our evaluation of guide titled “How to Identify a Car Insurance Company Using a Policy Number.”

Understanding Deductibles and How They Affect Your Oldsmobile Aurora Car Insurance Costs

A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. The deductible you select has a direct impact on the cost of your Oldsmobile Aurora car insurance. Generally, choosing a higher deductible will result in lower monthly premiums, while a lower deductible will result in higher premiums.

It’s important to carefully consider your budget and financial situation when selecting a deductible. Make sure to choose an amount that you can comfortably afford in the event of an accident or claim. Unlock details in our guide titled “Best Car Insurance for Drivers After an Accident in California.”

The Benefits of Bundling Your Oldsmobile Aurora Car Insurance With Other Policies

Many insurance companies offer discounts to policyholders who choose to bundle their car insurance with other policies. Bundling refers to purchasing multiple insurance policies, such as auto and homeowners insurance, from the same provider. This can result in premium discounts that can ultimately save you money on your Oldsmobile Aurora car insurance.

Aside from cost savings, bundling your insurance policies also offers the convenience of dealing with a single insurance company for all your coverage needs. This can simplify the claims process and make it easier to manage your insurance policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing the Cost of Insuring Different Models of the Oldsmobile Aurora

It’s worth noting that the cost of insuring different models of the Oldsmobile Aurora can vary. Factors such as the model year, trim level, and engine size can impact insurance rates. Typically, more expensive and powerful models incur higher insurance premiums due to greater repair costs and performance capabilities. Learn more in our guide titled “Does my car insurance cover damage caused by an overheated engine?”

Ty Stewart Licensed Insurance Agent

When deciding on a specific model of the Oldsmobile Aurora, it’s advisable to obtain insurance quotes for the particular vehicle you are considering. This will provide you with a clearer understanding of the potential insurance costs associated with that specific model.

Exploring Discounts and Special Programs Available for Insuring an Oldsmobile Aurora

Insurance companies often have discounts and special programs catered specifically to insuring an Oldsmobile Aurora. These discounts can vary by insurance provider, but they may include discounts for safe driving records, low annual mileage, or loyalty to a specific insurer. Discover insights in our guide titled “Best Car Insurance for UBI/Pay-Per-Mile.”

It’s essential to shop around and inquire with different insurers to determine what discounts and programs they offer for insuring an Oldsmobile Aurora. By taking advantage of these discounts and programs, you can potentially lower your insurance premiums and save money.

Navigating Oldsmobile Aurora Insurance: Strategies for Cost-Effective Coverage

In conclusion, the cost of insuring an Oldsmobile Aurora depends on various factors such as the age and model of the vehicle, your driving record, chosen coverage options, and location. By considering these factors, comparing insurance quotes, and exploring available discounts, you can find affordable car insurance for your Oldsmobile Aurora without sacrificing the coverage you need.

Remember to keep your driving record clean, install safety features in your vehicle, and consider bundling your insurance policies to maximize your savings. With these strategies in mind, you’ll be well-prepared to navigate the process of obtaining car insurance for your Oldsmobile Aurora. Read up on the “Can I bundle my car insurance with other policies?” for more information.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Frequently Asked Questions

What factors affect the cost of Oldsmobile Aurora car insurance?

The cost of Oldsmobile Aurora car insurance can be influenced by several factors, including the driver’s age, location, driving history, credit score, coverage limits, deductible amount, and the level of insurance coverage chosen.

For additional details, explore our comprehensive resource titled “Best Safe Driver Car Insurance Discounts.”

How can I find the best insurance rates for an Oldsmobile Aurora?

To find the best insurance rates for an Oldsmobile Aurora, it is recommended to shop around and compare quotes from multiple insurance providers. Additionally, maintaining a clean driving record, opting for higher deductibles, and bundling multiple policies with the same insurer can help lower insurance costs.

Are there any specific safety features of the Oldsmobile Aurora that can reduce insurance costs?

Yes, certain safety features of the Oldsmobile Aurora may qualify for insurance discounts. These can include anti-lock brakes, airbags, anti-theft devices, traction control, and electronic stability control. It is advisable to check with insurance providers to determine the specific discounts available.

Does the age of the Oldsmobile Aurora affect its insurance cost?

Yes, the age of the Oldsmobile Aurora can impact its insurance cost. Generally, newer vehicles may have higher insurance premiums due to their higher value. As the car ages, its value depreciates, which may result in lower insurance costs.

Can I get insurance for an older model of the Oldsmobile Aurora?

Yes, insurance is available for older Oldsmobile Aurora models, but costs and availability vary by insurer and the car’s condition. Compare rates to find the best policy.

To find out more, explore our guide titled “How to Get Free Insurance Quotes Online.”

Who typically has the cheapest Oldsmobile Aurora car insurance?

State Farm typically offers the cheapest car insurance for the Oldsmobile Aurora.

What is the best car insurance for older cars, like the Oldsmobile Aurora?

The best car insurance for older cars like the Oldsmobile Aurora is often found with providers that offer classic or specialized older car insurance policies.

At what age is Oldsmobile Aurora car insurance cheapest?

Oldsmobile Aurora car insurance is typically cheapest for drivers in their 50s, who often benefit from lower rates due to their experience.

What car insurance is the cheapest for full coverage of Oldsmobile Aurora?

Progressive often has the cheapest rates for full coverage of an Oldsmobile Aurora.

To learn more, explore our comprehensive resource on “Progressive Car Insurance Discounts.”

Is it worth having full coverage on an Oldsmobile Aurora car?

Having full coverage on an Oldsmobile Aurora can be worth it if the car has a significant value or is financed.

Should you keep full coverage on a paid-off Oldsmobile Aurora car?

Does credit score affect Oldsmobile Aurora car insurance?

Which gender pays more for Oldsmobile Aurora car insurance?

Does Oldsmobile Aurora car insurance go down when a car is paid off?

What is the lowest form of car insurance for Oldsmobile Aurora?

Is 300 dollars a lot for Oldsmobile Aurora car insurance?

Does Oldsmobile Aurora car insurance go down as you age?

What age is Oldsmobile Aurora car insurance most expensive?

Is it worth having full coverage on a 10-year-old car, like Oldsmobile Aurora?

Does your credit go up if your insurance pays off your Oldsmobile Aurora car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.