Cheap Renters Insurance With No Credit Check in 2026 (Save With These 10 Companies!)

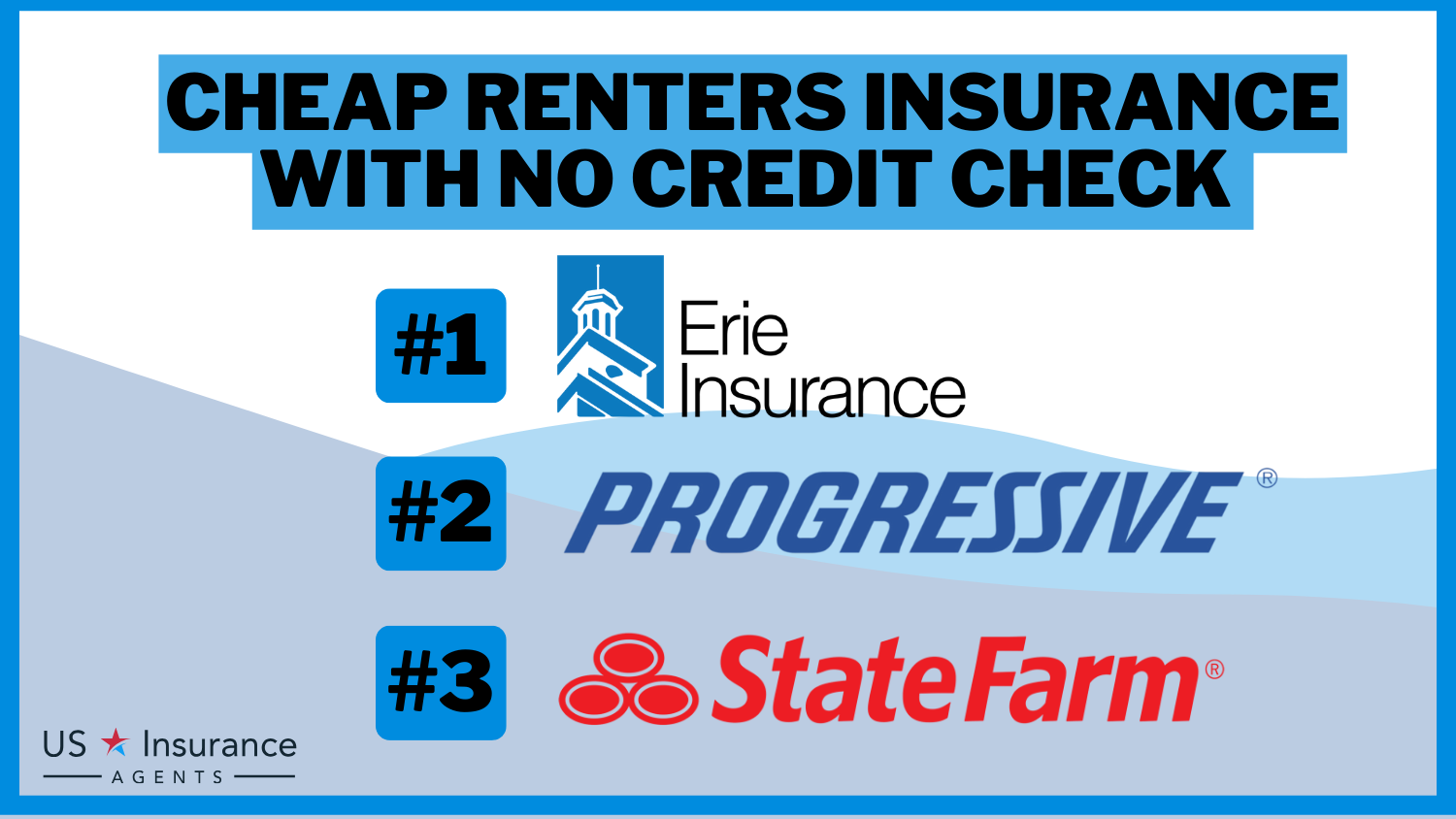

Erie, Progressive, and State Farm offer the best cheap renters insurance with no credit check, starting at just $65 monthly. These top providers cater to renters seeking affordable options without compromising on coverage quality, ensuring financial protection and peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Renters With No Credit Check

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Renters With No Credit Check

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Renters With No Credit Check

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThis article explores the unique benefits these companies offer, ensuring that individuals with bad credit can still obtain reliable insurance without a financial burden.

Our Top 10 Company Picks: Cheap Renters Insurance With No Credit Check

Company Rank Monthly Rates Multi-Vehicle Discount Best For Jump to Pros/Cons

#1 $65 10% Customer Satisfaction Erie

#2 $68 12% Competitive Rates Progressive

#3 $70 20% Reliable Coverage State Farm

#4 $71 20% Broad Coverage Nationwide

#5 $72 25% Flexible Policies Liberty Mutual

#6 $73 20% Personalized Service American Family

#7 $74 8% Comprehensive Option Travelers

#8 $75 10% Military Support USAA

#9 $78 20% Fleet Expertise Farmers

#10 $80 25% Strong Reputation Allstate

We delve into how these providers accommodate renters by focusing on factors beyond credit scores, such as rental history and employment stability.

Our goal is to guide you through choosing a policy that not only fits your budget but also provides ample protection for your belongings. Learn more in our “Understanding Credit: A Score that Impacts Everything from Your Cell Phone Bill to Car Insurance.”

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- Erie is the best choice for affordable renters insurance without a credit check

- Tailored coverage options for renters with challenging credit histories

- Policies ensure renters get comprehensive protection beyond just credit

</ul>

#1 – Erie: Top Overall Pick

Pros

- Consistent Praise: Erie consistently receives high marks for customer satisfaction.

- Loyal Customer Base: Strong retention rates due to exceptional service and fair claim resolutions.

- Competitive Pricing: Offers some of the most competitive rates in the industry. See more details on our Erie insurance review & ratings.

Cons

- Limited Availability: Erie’s insurance products are not available in all states.

- Fewer Branches: Fewer physical branches, which may affect those preferring in-person service.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Customizable Plans: Progressive allows customers to tailor their insurance coverage extensively.

- Discounts Available: Offers a variety of discounts, including a notable 12% for multi-vehicle policies.

- Online Tools: Advanced online tools for quotes, claims, and customer support. Check out insurance savings in our complete Progressive car insurance review & ratings.

Cons

- Variable Customer Service: Some customers report inconsistent experiences with service.

- Policy Upselling: Frequent upselling of additional features can complicate the buying process.

#3 – State Farm: Best for Reliable Coverage

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored for different business needs. Discover more about offerings in our State Farm car insurance review & ratings.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

#4 – Nationwide: Best for Broad Coverage

Pros

- Extensive Coverage Options: Nationwide offers a wide array of coverage options to meet diverse needs.

- Strong Financial Backing: Robust financial health ensures reliable claim payouts. Access comprehensive insights into our Nationwide insurance review & ratings.

- Enhanced Features: Provides additional features and benefits in standard policies.

Cons

- Higher Premiums: Generally higher premiums compared to other insurers.

- Complex Policy Terms: Policies can be complex and difficult to understand for new customers.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Flexible Policies

Pros

- Customization: Offers extensive customization options for policies. Delve into our evaluation of Liberty Mutual car insurance review & ratings.

- Large Discount Opportunities: Notable for offering up to a 25% discount on multi-policy bundles.

- Wide Network: Large network of agents and services available nationwide.

Cons

- Higher Rates for Some: Rates can be higher than average, especially for customers without bundles.

- Customer Service Variability: Some customers report variability in service quality.

#6 – American Family: Best for Personalized Service

Pros

- Dedicated Agents: Known for personalized service through dedicated agents.

- Discounts for Loyalty: Rewards long-term customers with loyalty discounts. Unlock details in our American Family insurance review & ratings.

- Innovative Coverage Options: Continuously introduces innovative products and services.

Cons

- Availability Issues: Not available in every state, limiting its reach.

- Higher Premiums Without Discounts: Premiums can be expensive without qualifying for discounts.

#7 – Travelers: Best for Comprehensive Option

Pros

- Broad Range of Products: Offers a comprehensive suite of insurance products. Discover insights in our Travelers insurance review & ratings.

- Discounts for Various Qualifications: Provides discounts for multiple scenarios, including safe driving.

- Strong Industry Reputation: Known for its strong reputation and stability in the insurance market.

Cons

- Strict Eligibility Requirements: Some products have strict eligibility requirements.

- Premium Pricing: Premiums can be on the higher side, especially for more comprehensive plans.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Support

Pros

- Exclusive to Military: Exclusively serves military members and their families, ensuring tailored services.

- Highly Competitive Rates: Often offers the best rates for eligible members. If you want to learn more about the company, head to our USAA Insurance Review & Ratings.

- Exceptional Customer Support: Frequently praised for its customer service and claims process.

Cons

- Limited Eligibility: Only available to military members, veterans, and their families.

- Less Flexibility: Fewer options for non-military related insurance needs.

#9 – Farmers: Best for Fleet Expertise

Pros

- Specialized in Fleet Insurance: Offers expert coverage options for fleet vehicles. Read up on the “Farmers Car Insurance Review & Ratings” for more information.

- Risk Management Solutions: Provides comprehensive risk management solutions for businesses.

- Accessible Agents: Wide network of agents provides accessible and personalized service.

Cons

- Higher Costs for Individuals: Individual policyholders may face higher costs.

- Complex Claims Process: Some users report a complex claims process.

#10 – Allstate: Best for Strong Reputation

Pros

- Comprehensive Coverage: Known for offering comprehensive and flexible coverage options.

- Rewards Safe Drivers: Offers substantial discounts and rewards for safe driving.

- Effective Claims Process: Efficient and user-friendly claims processing system. Learn more in our Allstate insurance review & ratings.

Cons

- Higher Rates: Generally higher rates compared to some competitors.

- Sales Pressure: Some customers report pressure to purchase additional features.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Rates for No-Credit-Check Car Insurance

Navigating car insurance options as a renter with no credit check can be challenging. The monthly rates vary significantly depending on the coverage level and the provider. Below is a breakdown of the minimum and full coverage rates across various insurance companies.

Renters Insurance With No Credit Check: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $160

American Family $73 $148

Erie $65 $135

Farmers $78 $155

Liberty Mutual $72 $150

Nationwide $71 $145

Progressive $68 $140

State Farm $70 $140

Travelers $74 $150

USAA $75 $145

For those seeking basic protection, minimum coverage rates start as low as $65 with Erie and can go up to $80 with Allstate. On the other hand, full coverage, which offers comprehensive protection, ranges from $135 with Erie to $160 with Allstate. See more details on our “Full Coverage Car Insurance: A Complete Guide.”

Other notable providers include Progressive and State Farm, with full coverage rates at $140. This detailed insight allows renters to compare and choose based on their budget and coverage needs, ensuring they find the most cost-effective option without a credit check.

The Importance of Renters Insurance

You may not realize how important renters insurance can be for you, with or without bad credit. If you do not have renters insurance and your home is destroyed or burglarized, you would have to replace everything out of your own pocket. Similarly, any damage you cause to someone else or their property would be your sole responsibility to pay for.

With good credit, getting caught without renters insurance would be an inconvenience, as you could simply put a lot of the property you have to replace on your various credit lines. Without good credit, replacing stolen or damaged property could amount to more than you are able to pay. Check out insurance savings in our complete “Best Renters Insurance: A Complete Guide.”

Credit Scores and Insurance Premiums

Rather than pulling your credit history and going through it line by line, the financial industry has developed credit scores which break the sum total of your credit report into an easy to understand numerical index that provides a standard that works for all financial transactions.

The higher your credit score, the lower your premiums will be, and vice versa.

Shopping for High Risk Coverage

Just because your credit limits the choices for renters insurance coverage, you still have the option of shopping for the best prices available. The best place to start is probably online, getting free renters insurance quotes from a website that provides cost comparisons between a number of similar companies. Unlock details in our “Insurance Quotes Online.”

Adjust Your Deductible

One way to lower your premiums is to raise your deductibles. The key to raising your deductible, though, is to be careful not to set it too high for you to be able to pay out of pocket at a moment’s notice.

Higher deductibles mean lower premiums, but insurance companies will require you to pay the deductible before they settle a claim.

Case Studies: Real-World Scenarios for Top Insurance Providers

Below are case studies based on real-world scenarios. These examples demonstrate how the top insurance providers—Erie, Progressive, and State Farm—can meet the specific needs of renters seeking car insurance without a credit check.

- Case Study #1 — Erie: Swift Response to a Rental Car Accident: John, a freelance photographer, chose Erie for its strong customer satisfaction reputation. On a business trip, he was involved in a minor car accident with his rental. Erie’s prompt and efficient claims process allowed John to quickly return to his work, stress-free, with all damages covered under Erie’s comprehensive coverage.

- Case Study #2 — Progressive: Adapting to a New Driver’s Needs: Sarah, a recent college graduate, selected Progressive for its competitive rates and flexible options. As a new driver, she valued their excellent customer service during her first claim following a minor fender bender, demonstrating their support for inexperienced drivers.

- Case Study #3 — State Farm: Handling Major Damages from a Natural Disaster: Michael, a long-time State Farm customer, experienced severe hailstorm damage to his vehicle. State Farm quickly assessed and addressed the damages, efficiently navigating the claims process, reducing stress, and swiftly restoring his vehicle.

These case studies highlight the effective solutions and excellent customer service provided by Erie, Progressive, and State Farm.

Each scenario underscores the importance of choosing an insurance provider that not only offers competitive rates but also excels in customer support and claims handling, ensuring peace of mind for renters in any situation. Discover more about offerings in our “Cheapest Renters Insurance.”

Melanie Musson Published Insurance Expert

Comparing quotes is integral to finding the best rates possible. Enter your ZIP code below into our free tool today to see what quotes might look like for you.

Frequently Asked Questions

Can I still get renters insurance if I have bad credit?

Yes, you can still get renters insurance even if you have bad credit. However, it’s important to note that insurance companies may consider your credit score when determining your rates. People with bad credit may experience higher renters insurance rates compared to those with good credit.

For additional details, explore our comprehensive resource titled “Does your car insurance rate go up the more cars you have?“

Why is renters insurance important for people with bad credit?

Renters insurance is crucial for everyone, including those with bad credit. If your home is destroyed or burglarized and you don’t have insurance, you would be responsible for replacing everything out of your own pocket. Additionally, if you cause damage to someone else’s property, you would have to pay for it yourself. Renters insurance provides financial protection in such situations.

Will my bad credit affect my renters insurance premiums?

Yes, your credit score can impact your renters insurance premiums. Insurance companies often use credit scores as a factor to assess policyholders’ risk. Generally, higher credit scores result in lower premiums, while lower credit scores may lead to higher premiums.

Are there any discounts available for renters insurance with bad credit?

While you may face higher rates initially, there are some discounts available that can help make your premiums more affordable. It’s advisable to inquire about any potential discounts that insurance companies offer, as these can help offset the impact of bad credit on your rates.

How can I find affordable renters insurance with bad credit?

Despite having bad credit, you can still find affordable renters insurance by comparing quotes from different insurance providers. Starting your search online is a convenient option, as many websites offer free renters insurance quotes and allow you to compare prices from multiple companies.

To find out more, explore our guide titled “How To Get Free Insurance Quotes Online.”

Does renters insurance affect credit score?

No, purchasing renters insurance does not affect your credit score as it does not involve extending credit.

What is renters insurance no credit check?

Renters insurance no credit check refers to policies where the provider does not review your credit history as part of the application process.

Can I get renters insurance with bad credit?

Yes, you can obtain renters insurance even with bad credit; some companies do not base their decision or pricing on your credit score.

Is renters insurance available without a credit check?

Yes, some insurance providers offer renters insurance without a credit check, focusing instead on other factors like rental history.

To learn more, explore our comprehensive resource on “Which car insurance companies don’t use credit score when calculating rates?“

Does renters insurance typically involve a credit check?

Many insurers do conduct a credit check for renters insurance to assess risk and determine premiums, though it is not a hard inquiry that affects your score.

Does renters insurance build credit?

Does renters insurance require a credit check?

Why do renters insurance companies check credit?

Is a credit check required for insurance?

What options are available for car insurance for bad credit?

Is auto insurance for people with bad credit more expensive?

Is USAA insurance really cheaper?

Which insurance companies that don’t check credit?

Does getting a renters insurance quote affect credit score?

Does USAA run a credit check?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.