Cheap Scion xA Car Insurance in 2024 (Cash Savings With These 10 Companies)

The top providers for cheap Scion xA car insurance are Travelers, Safeco, and Erie, with rates starting as low as $25/month. For Scion xA drivers, Travelers delivers comprehensive coverage, Safeco offers flexible, tailored plans, and Erie shines with excellent customer service and competitive rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated January 2025

Company Facts

Min. Coverage for Scion xA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Scion xA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Scion xA

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Scion xA car insurance are Travelers, Safeco, and Erie. These providers stand out not only for their competitive rates but also for their comprehensive coverage options and excellent customer service.

Travelers offers the most affordable rates with a strong track record of reliability, Safeco provides great value with customizable policies, and Erie is known for its exceptional customer satisfaction.

Our Top 10 Company Picks: Cheap Scion xA Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $25 A++ Bundling Policies Travelers

#2 $27 A Online Tools Safeco

#3 $34 A+ Personalized Policies Erie

#4 $39 A++ Cheap Rates Geico

#5 $40 A++ Accident Forgiveness Auto-Owners

#6 $51 A++ Military Savings USAA

#7 $52 A Discount Availability American Family

#8 $54 A+ Competitive Rates Nationwide

#9 $81 A Coverage Options Liberty Mutual

#10 $106 A High-Risk Coverage The General

When searching for the best and most affordable insurance for your Scion xA, these companies should be at the top of your list.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Travelers offers the best rate for cheap Scion xA car insurance at $25/month

- Focus on companies with flexible coverage options to meet Scion xA needs

- Look for insurers that provide discounts specifically for Scion xA owners

#1 – Travelers: Top Overall Pick

Pros

- Affordable Rates: Travelers offers some of the cheapest Scion xA car insurance rates at $25/month, making it an excellent choice for those seeking budget-friendly options.

- Bundling Benefits: Travelers insurance review & ratings, shows that the company excels in bundling policies, which can further reduce the cost of cheap Scion xA car insurance, as highlighted in insurance reviews and ratings.

- Financial Stability: With an A++ rating from A.M. Best, Travelers provides high financial stability, ensuring reliable coverage for your Scion xA.

Cons

- Limited Customization: Travelers’ cheap Scion xA car insurance may come with limited customization options compared to other providers, potentially impacting personalization of coverage.

- Customer Service: The company’s customer service is decent but not as highly rated as some competitors, which might affect the quality of support for cheap Scion xA car insurance claims and inquiries.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Safeco: Best for Online Tools

Pros

- Competitive Rates: Based on our Safeco insurance review & ratings, they offer competitive rates for cheap Scion xA car insurance, with premiums starting at $27/month.

- Convenient Tools: Safeco’s online tools make managing your policy and filing claims straightforward, adding convenience to your cheap Scion xA car insurance experience.

- Strong Stability: Safeco boasts an A rating from A.M. Best, ensuring strong financial stability for your cheap Scion xA car insurance.

Cons

- Limited Coverage Options: Safeco’s cheap Scion xA car insurance may not offer as many extensive coverage options compared to other providers.

- Service Quality: While reliable, Safeco’s customer service for cheap Scion xA car insurance may not be as highly praised as that of some other insurers.

#3 – Erie: Best for Personalized Policies

Pros

- Personalized Policies: Erie’s personalized policies for cheap Scion xA car insurance are tailored to meet your specific needs, ensuring you get coverage that fits your situation.

- Affordable Rates: With rates at $34/month, Erie insurance review & ratings offers affordable options for cheap Scion xA car insurance without sacrificing the quality of coverage.

- Financial Strength: The A+ rating from A.M. Best underscores Erie’s strong financial stability, making their cheap Scion xA car insurance a reliable choice.

Cons

- Higher Rates: Compared to some competitors, Erie’s rates for cheap Scion xA car insurance can be higher, which might not align with all budget constraints.

- Service Quality: While Erie’s customer service is generally good, it may not be as robust as that of some other top insurers, which could impact your overall experience with their cheap Scion xA car insurance.

#4 – Geico: Best for Cheap Rates

Pros

- Low Rates: Geico provides some of the cheapest Scion xA car insurance rates at $39/month, which is ideal for budget-conscious drivers looking for affordable coverage.

- Extensive Discounts: The company is renowned for its extensive discounts, which can further reduce the cost of cheap Scion xA car insurance. To delve deeper, refer to our in-depth report titled “How can I pay my Geico insurance premium?“

- High Stability: With an A++ rating from A.M. Best, Geico offers strong financial security, ensuring reliable coverage for your Scion xA.

Cons

- Limited Customization: Geico’s cheap Scion xA car insurance may come with limited options for customization and add-ons, which might not suit drivers needing more tailored coverage.

- Variable Service: Although generally positive, Geico’s customer service can be inconsistent, with mixed reviews from customers regarding their experiences.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Accident Forgiveness

Pros

- Accident Forgiveness: According to our Auto-Owners insurance review & ratings, the company provides cheap Scion xA car insurance with accident forgiveness, which is beneficial for drivers with prior incidents.

- Competitive Pricing: With monthly rates starting around $40, Auto-Owners offers competitive pricing for cheap Scion xA car insurance.

- Strong Financials: The A++ rating from A.M. Best reflects Auto-Owners’ strong financial stability, ensuring reliable coverage for your cheap Scion xA car insurance needs.

Cons

- Higher Rates: Auto-Owners’ cheap Scion xA car insurance rates are slightly higher compared to the lowest-cost options available.

- Coverage Options: The coverage options provided by Auto-Owners might not be as extensive as those offered by some competitors, which could affect the value of cheap Scion xA car insurance.

#6 – USAA: Best for Military Savings

Pros

- Military Discounts: USAA offers substantial savings on cheap Scion xA car insurance for military members, making it an excellent cost-effective choice for them.

- Affordable Rates: With an average rate of $51/month, USAA provides highly competitive pricing for cheap Scion xA car insurance.

- Top Stability: An A++ rating from A.M. Best ensures that USAA maintains reliable financial stability for cheap Scion xA car insurance coverage. See more details on our USAA insurance review & ratings.

Cons

- Eligibility Limits: USAA’s cheap Scion xA car insurance is exclusively available to military members and their families, which restricts accessibility for non-military individuals.

- Higher Rates: Despite being competitive, USAA’s rates for cheap Scion xA car insurance may be higher compared to some other insurance providers.

#7 – American Family: Best for Discount Availability

Pros

- Discount Availability: American Family offers various discounts that can help you secure cheap Scion xA car insurance, making it more affordable for budget-conscious drivers. Learn more in our American Family insurance review & ratings.

- Affordable Pricing: With rates starting around $52/month, American Family provides reasonably priced options for cheap Scion xA car insurance, ensuring you get good value for your coverage.

- Good Stability: An A rating from A.M. Best indicates that American Family has reliable financial stability, which is important for maintaining consistent cheap Scion xA car insurance coverage.

Cons

- Higher Costs: Despite its various discounts, American Family’s rates for cheap Scion xA car insurance may still be slightly higher compared to some other insurance providers.

- Service Quality: The quality of customer service at American Family might not be as exceptional as that offered by some top competitors, which could impact your experience with cheap Scion xA car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Competitive Rates

Pros

- Competitive Rates: Nationwide offers competitive rates at $54/month for cheap Scion xA car insurance, making it a solid choice for budget-conscious drivers.

- Affordable Coverage: In line with our Nationwide insurance review & ratings, their rates are budget-friendly, providing comprehensive coverage for your Scion xA without breaking the bank.

- Strong Stability: With an A+ rating from A.M. Best, Nationwide ensures dependable financial stability, which is important when seeking reliable cheap Scion xA car insurance.

Cons

- Limited Discounts: Nationwide’s cheap Scion xA car insurance may not offer as many discounts as some competitors, which could affect overall savings.

- Service Variability: Customer service experiences with Nationwide may vary, potentially impacting your overall satisfaction with their cheap Scion xA car insurance.

#9 – Liberty Mutual: Best for Coverage Options

Pros

- Coverage Options: Liberty Mutual offers extensive coverage options for cheap Scion xA car insurance, catering to various needs and ensuring comprehensive protection..

- Customizable Policies: In accordance with our Liberty Mutual insurance review & ratings, the company provides customizable policies, enhancing your experience with cheap Scion xA car insurance.

- Solid Stability: With an A rating from A.M. Best, Liberty Mutual ensures reliable financial stability, which is reassuring for your cheap Scion xA car insurance.

Cons

- Higher Rates: Liberty Mutual’s rates for cheap Scion xA car insurance tend to be on the higher side, averaging $81/month.

- Limited Discounts: The discounts available for cheap Scion xA car insurance may not be as numerous or impactful compared to other insurers.

#10 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: The General specializes in high-risk coverage, making it a suitable choice for drivers with a less-than-perfect record who are seeking cheap Scion xA car insurance.

- Coverage Flexibility: The General offers flexible coverage options, which can be advantageous for those looking for affordable Scion xA car insurance. Discover more about offerings in our The General insurance review & ratings.

- Financial Stability: The A rating from A.M. Best indicates a solid foundation for reliable Scion xA car insurance coverage.

Cons

- Higher Costs: At $106 per month, The General’s rates for cheap Scion xA car insurance are higher compared to most other insurance providers.

- Limited Discounts: The discount options available are less extensive, which might not help in reducing the cost of cheap Scion xA car insurance as effectively as with other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

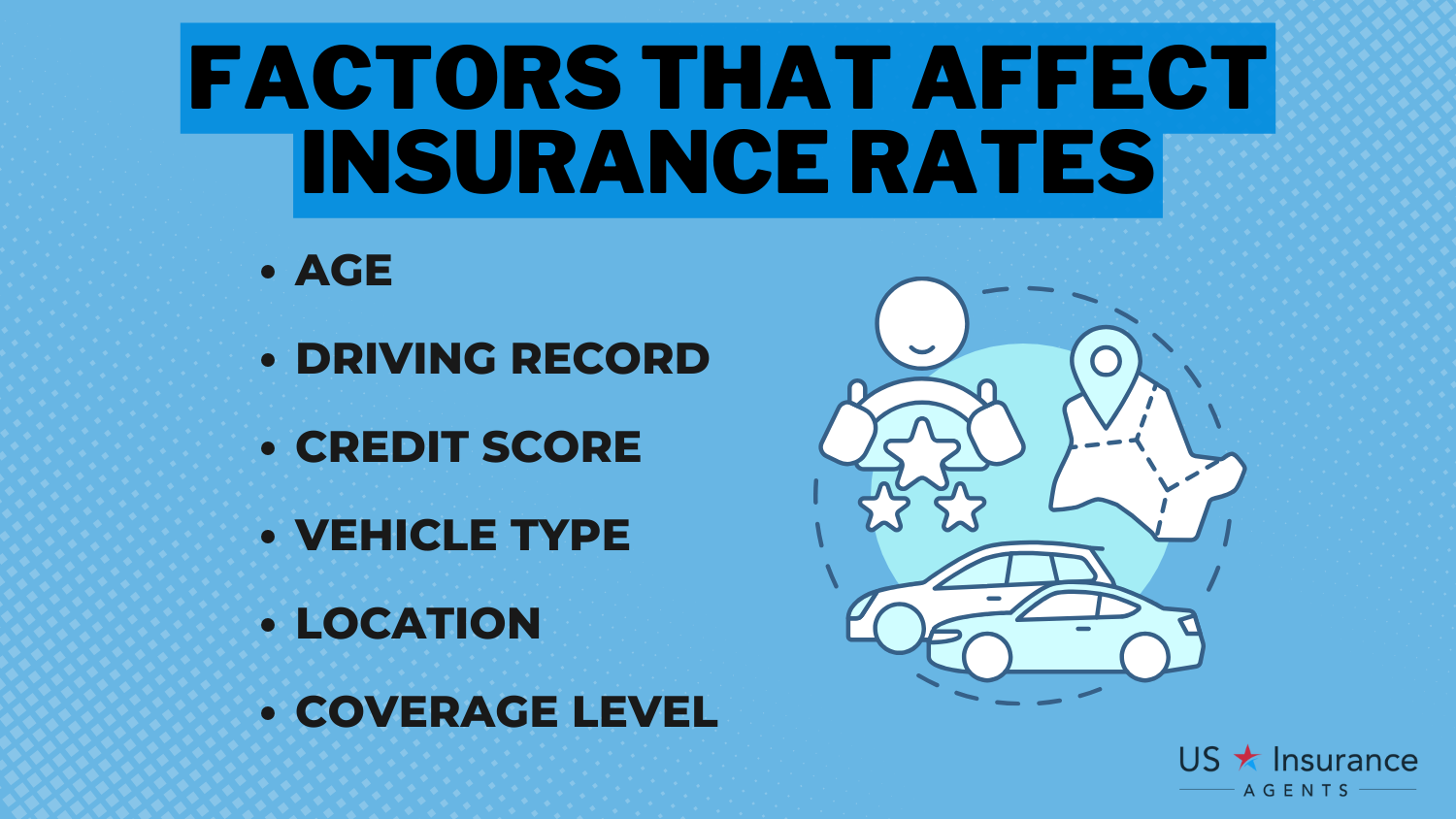

Factors Affecting Scion xA Car Insurance Costs and Average Rates

When it comes to determining the cost of car insurance for your Scion xA, several important factors come into play. Your driving record is a significant determinant; a history of traffic violations or accidents can classify you as a higher risk, which typically results in higher premiums. Additionally, your location has a major impact on insurance rates. Areas with high crime rates or heavy traffic are generally associated with elevated premiums.

Your age and driving experience also play a crucial role. Younger drivers and those with less driving experience usually face higher costs due to the perceived increased risk. In contrast, more experienced drivers with clean records may benefit from lower rates.

Furthermore, your credit score is another factor that insurers consider. A good credit score can positively influence your insurance rates, as it is often used to assess reliability and risk.

Dani Best Licensed Insurance Producer

The type of coverage you choose will also affect your premiums. Opting for comprehensive or higher liability coverage generally results in higher monthly costs. On average, the cost of insuring a Scion xA ranges from $75 to $125 per month. This range can fluctuate based on the factors mentioned: driving record, location, age, driving experience, and coverage options.

To ensure you get the best possible rate for your Scion xA, it is advisable to compare quotes from multiple insurance providers, helping you find competitive pricing and appropriate coverage tailored to your needs.

Scion xA Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $52 | $136 |

| Auto-Owners | $40 | $106 |

| Erie | $34 | $89 |

| Geico | $39 | $105 |

| Liberty Mutual | $81 | $212 |

| Nationwide | $54 | $137 |

| Safeco | $27 | $70 |

| The General | $106 | $277 |

| Travelers | $25 | $67 |

| USAA | $51 | $134 |

The table compares car insurance rates for minimum and full coverage across various companies. Travelers, Safeco and Erie offer the lowest rates, with Travelers’ at $67, Safeco’s at $70, and Erie’s full coverage at $8. Liberty Mutual and The General have the highest rates, with Liberty Mutual’s full coverage at $212 and The General’s at $277. Other companies fall in between these extremes with varying rates for both coverage types.

Tips to Lower Your Scion xA Car Insurance Premiums

If you’re looking to lower your Scion xA car insurance premiums, there are several effective strategies you can use. Maintaining a clean driving record by avoiding traffic violations and accidents can make you eligible for discounts. Installing safety features like anti-lock brakes, airbags, and theft deterrent systems can also reduce costs.

Consider opting for a higher deductible to lower your monthly premiums, but ensure you can afford the deductible if needed. Bundling your Scion xA insurance with other policies, such as home or renter’s insurance, often leads to discounts.

Take advantage of various discounts offered by insurance companies, such as good driver, good student, low mileage, and defensive driving course discounts. Regularly review and adjust your coverage to avoid over-insuring or underinsuring your vehicle.

Shopping around and comparing rates from multiple providers can help you find the best rates, and maintaining good credit can also lower your costs. By following these tips, you can reduce your Scion xA insurance premiums and save money.

The table lists various car insurance discounts available from top providers for the Scion xA. Each row represents a different insurance company, and the discounts they offer are specified. The discounts range from multi-policy and safe driver discounts to program-specific discounts like Nationwide’s SmartRide and USAA’s SafePilot.

Comparing Insurance Providers for the Best Scion xA Rates

When searching for car insurance for your Scion xA, it’s crucial to compare different insurance providers to find the best rates and coverage options. Each company uses its unique formula to assess risk and calculate premiums, leading to significant variations in rates. By obtaining quotes from multiple providers, you can compare these rates and offerings to determine the most cost-effective option for your needs.

Shopping around is essential as insurance rates can vary significantly between providers. By taking the time to compare different quotes, you can potentially save hundreds of dollars each year. It’s important to consider not only the cost of insurance but also the coverage and customer service offered by each provider.

Justin Wright Licensed Insurance Agent

Additionally, factors such as customer reviews, financial stability, and the reputation of the insurance company should be taken into account when making your decision.

By conducting thorough research and comparing insurance providers, you ensure that you are getting the best value for your Scion xA car insurance. Spending a little extra time researching and gathering quotes will help you make an informed decision, finding the best rates that meet your needs and budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Coverage Options for Your Scion xA

Selecting the right car insurance for your Scion xA requires a thorough understanding of the different insurance coverage options. It’s important to explore each type to ensure you choose the best protection for your vehicle. Here’s an in-depth overview of the available coverage options:

- Liability Insurance: This type of insurance helps cover the costs if you are at fault in an accident and cause injury or damage to another person or their property. However, it does not cover damage to your own vehicle.

- Comprehensive Coverage: This coverage helps cover damage to your car from incidents other than accidents, such as theft, vandalism, or natural disasters. It provides protection against a broad range of non-collision-related damages.

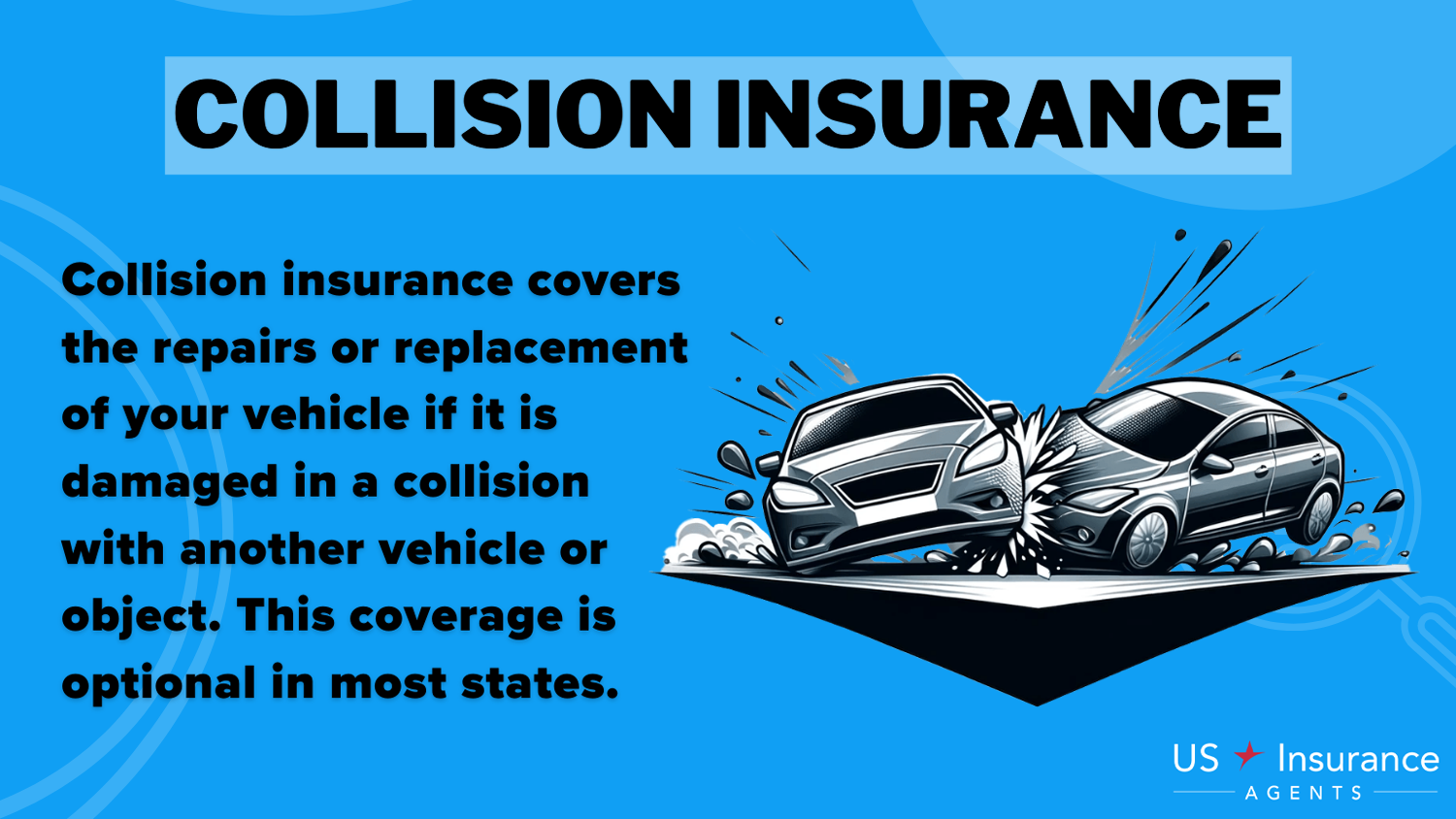

- Collision Coverage: This insurance covers damage to your car caused by accidents, regardless of fault. It ensures that damage resulting from collisions is repaired, whether you are responsible or not.

When choosing insurance for your Scion xA, consider the value of your vehicle to determine if comprehensive and collision coverage are needed. Evaluate your budget to decide how much you can spend on premiums, and assess your risk level to select the most suitable coverage for your needs. This approach will help you balance protection and affordability effectively.

Age and Experience Influencing Scion xA Car Insurance Rates

Age and driving experience are crucial factors that insurance providers use to determine car insurance premiums for your Scion xA. Younger drivers, especially those under 25, are generally perceived as higher risk, resulting in higher insurance costs due to their increased likelihood of accidents.

On the other hand, more mature drivers with extensive driving experience are often rewarded with lower premiums, as they are considered less risky.

Inexperienced drivers may face higher rates due to their limited track record. To help manage these costs, insurers frequently offer insurance discounts by age for completing defensive driving courses or other educational programs designed to enhance driving skills. These discounts can reduce premiums by showcasing a commitment to safe driving.

Understanding how age and driving experience affect your insurance rates and taking advantage of available discounts can help you manage and potentially lower your car insurance costs for your Scion xA.

Safety Features That Can Help Reduce Your Scion xA Insurance Costs

Equipping your Scion xA with advanced safety features can significantly impact your insurance premiums. Insurance companies often provide safety features insurance discounts for vehicles that are fitted with safety technologies, as these features help mitigate the risk of accidents and reduce the potential for injury. Here are some key safety features that can help lower your insurance costs:

- Anti-Lock Brakes (ABS): Anti-lock brakes prevent the wheels from locking up during hard braking, which helps maintain steering control and reduce stopping distances. Vehicles with ABS are generally considered safer, which can lead to lower insurance premiums.

- Airbags: Airbags provide crucial protection in the event of a collision by cushioning occupants and reducing the risk of injury. Modern vehicles with multiple airbags, including front, side, and curtain airbags, may qualify for additional discounts.

- Anti-Theft Devices: Features such as alarm systems, immobilizers, and tracking devices reduce the likelihood of theft. Vehicles equipped with these anti-theft technologies are less risky for insurers, potentially resulting in lower rates.

- Electronic Stability Control (ESC): ESC helps prevent skidding and loss of control by automatically applying brakes to individual wheels. This feature enhances vehicle stability, especially in adverse driving conditions, and can contribute to lower insurance costs.

By investing in these safety features for your Scion xA, you not only improve your vehicle’s safety but also have the opportunity to save on insurance premiums. Always check with your insurance provider to see which safety features are eligible for discounts and how they can affect your rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Comprehensive and Collision Coverage for Your Scion xA

Comprehensive and collision coverage are essential for insuring your Scion xA. Comprehensive coverage protects against non-collision damages like theft, vandalism, and natural disasters, while collision coverage handles damages from accidents. This ensures your Scion xA is well-protected in various situations.

On the other hand, collision coverage is designed to help with the costs of repairing or replacing your vehicle if you are involved in an accident, regardless of who is at fault. This includes damage from collisions with other vehicles or objects, as well as rollovers. Both types of coverage offer enhanced protection and peace of mind by covering a broader range of scenarios that could otherwise lead to significant financial loss.

Evaluating your personal needs and budget is crucial in determining whether comprehensive and collision coverage are appropriate for your situation, ensuring you have the right level of protection for your Scion xA.

The Pros and Cons of Bundling Your Scion xA Insurance With Other Policies

Bundling your Scion xA insurance with other policies, such as home or renter’s insurance, offers notable benefits. One major advantage is the potential for discounts, as many providers offer multi-policy insurance discounts, reducing your premiums. Additionally, bundling simplifies insurance management by consolidating all your policies under one provider, making renewals and claims easier to handle.

On the other hand, bundling may have its downsides. It may limit your ability to shop for the best rates and coverage for individual policies. The bundled package might not always offer the most competitive rates for each type of insurance. Therefore, it’s essential to weigh the discounts and coverage options before deciding to bundle your Scion xA insurance with other policies.

Choosing the Right Liability Limits for Your Scion xA Coverage

Choosing the right liability limits for your Scion xA coverage is crucial for ensuring you have adequate protection. Liability insurance is intended to cover the costs associated with property damage and injuries you may cause to others in an accident for which you are at fault. When determining the appropriate liability limits, you should consider several factors, including your assets, financial situation, and potential risk exposure.

Higher liability limits offer more comprehensive coverage but come with increased premiums. It’s essential to balance the need for sufficient coverage with what you can afford. Additionally, you should be aware of the minimum liability limits required by your state, as failing to meet these requirements can result in legal penalties.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Scion xA Car Insurance Tailored for Your Budget and Needs

Finding affordable car insurance that fits your budget and needs is crucial. Here are three fictional case studies based on real scenarios, demonstrating how different insurers provide tailored solutions. These examples are for illustration only and are designed to help guide your insurance decisions.

- Case Study #1 – The Ideal Choice for a Budget-Conscious Driver: Alex, a 35-year-old with a clean driving record, seeks affordable insurance for his Scion xA. In his low-crime area, Travelers offers a $25 monthly premium with comprehensive coverage for theft, vandalism, and accidents. Their customizable policies and user-friendly online tools make managing insurance easy and budget-friendly.

- Case Study #2 – Tailored Flexibility for the Savvy Driver: Sarah, a 29-year-old with a few minor infractions, chooses Safeco for her Scion xA, with a $27 monthly premium. Safeco’s flexible plans let her adjust her deductible and add protections as needed. Sarah appreciates Safeco’s customer service and user-friendly online tools for easy policy management and claims processing.

- Case Study #3 – Premium Protection with Personalized Service:John, a 40-year-old driver, opts for Erie for his Scion xA insurance due to its competitive $28/month rate and top-notch customer service. Erie’s comprehensive policy includes collision and comprehensive coverage, combining affordability with exceptional support and personalized service.

These fictional case studies highlight how different insurance providers can cater to various driver profiles and preferences. While these scenarios are based on real-world factors, they serve to illustrate the diverse options available when searching for car insurance.

Zach Fagiano Licensed Insurance Broker

Always consider your specific needs and circumstances when selecting an insurance provider to ensure you receive the best coverage and value for your situation.

Summary: Ultimate Guide to Affordable Scion xA Insurance

For affordable Scion xA car insurance, check out Travelers, Safeco, and Erie, with rates starting at $25/month. Travelers is budget-friendly, Safeco offers customization, and Erie has excellent customer service. Consider your driving record, location, age, and coverage type, as a clean record can lower premiums, while violations and high-risk areas may raise costs.

To find the best rates, compare insurance quotes and coverage options from different providers. Vehicle safety features and higher deductibles can lower costs, but ensure you can cover them if needed. Bundling car insurance with home or renter’s insurance can also reduce premiums. Understanding these factors and shopping around will help you get affordable, comprehensive coverage for your Scion xA.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

How can I find cheap Scion xA car insurance?

To find cheap Scion xA car insurance, compare quotes from multiple providers, consider bundling policies, and look for discounts such as safe driver, low mileage, and multi-policy discounts. Additionally, maintaining a clean driving record and opting for a higher deductible can help lower your premiums.

What discounts should I look for to get cheap Scion xA car insurance?

Look for discounts such as multi-policy, safe driver, low mileage, and good student discounts to get cheap Scion xA car insurance. Additionally, inquire about discounts for safety features, defensive driving courses, and being a member of certain organizations.

To enhance your understanding, explore our comprehensive resource on insurance titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

How does my driving record impact the cost of Scion xA car insurance?

Your driving record significantly impacts the cost of Scion xA car insurance. A clean driving record with no accidents or violations can help you secure lower rates, while a history of traffic violations or accidents can result in higher premiums.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Are there specific insurance providers that offer cheap Scion xA car insurance?

Yes, some insurance providers are known for offering competitive rates for Scion xA car insurance. Companies like Safeco, USAA, and Progressive often provide affordable options, but it’s important to get quotes from multiple insurers to find the best rate for your specific situation.

What type of cover is cheapest for car insurance?

Typically, fully comprehensive insurance is the least expensive, though prices are influenced by individual circumstances.

To gain profound insights, consult our extensive guide titled “Full Coverage Car Insurance: A Complete Guide.”

Can safety features on my Scion xA help reduce insurance costs?

Yes, safety features on your Scion xA, such as anti-lock brakes, airbags, and anti-theft systems, can help reduce insurance costs. Many insurers offer discounts for vehicles equipped with advanced safety features, which can contribute to cheaper premiums.

Is it possible to get cheap Scion xA car insurance with a high deductible?

Yes, opting for a higher deductible can lower your monthly premium for Scion xA car insurance. However, it’s important to choose a deductible amount that you can comfortably afford to pay out of pocket in the event of a claim.

What factors affect the cost of Scion xA car insurance?

The cost of Scion xA car insurance is influenced by factors such as your driving record, age, location, credit score, annual mileage, and the coverage options you choose. Safety features on your Scion xA and the car’s overall safety ratings can also impact insurance rates.

For a comprehensive overview, explore our detailed resource titled “Car Insurance: A Complete Guide.”

At what age is car insurance cheapest?

Car insurance is the cheapest for drivers between the ages of 35 and 55. Car insurance is very expensive for teens because they have a high risk of accidents, and then it decreases sharply as drivers age into their 20s and develop more reliable driving habits.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What color vehicles have the highest insurance?

The color of your car doesn’t affect your insurance rate. Instead, your insurance company uses other information, like your car’s age, location, usage, and your driving record, to help determine insurance rates. Learn more about the factors that impact auto insurance pricing.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.