Cheap Toyota Avalon Hybrid Car Insurance in 2026 (Save Big With These 10 Companies!)

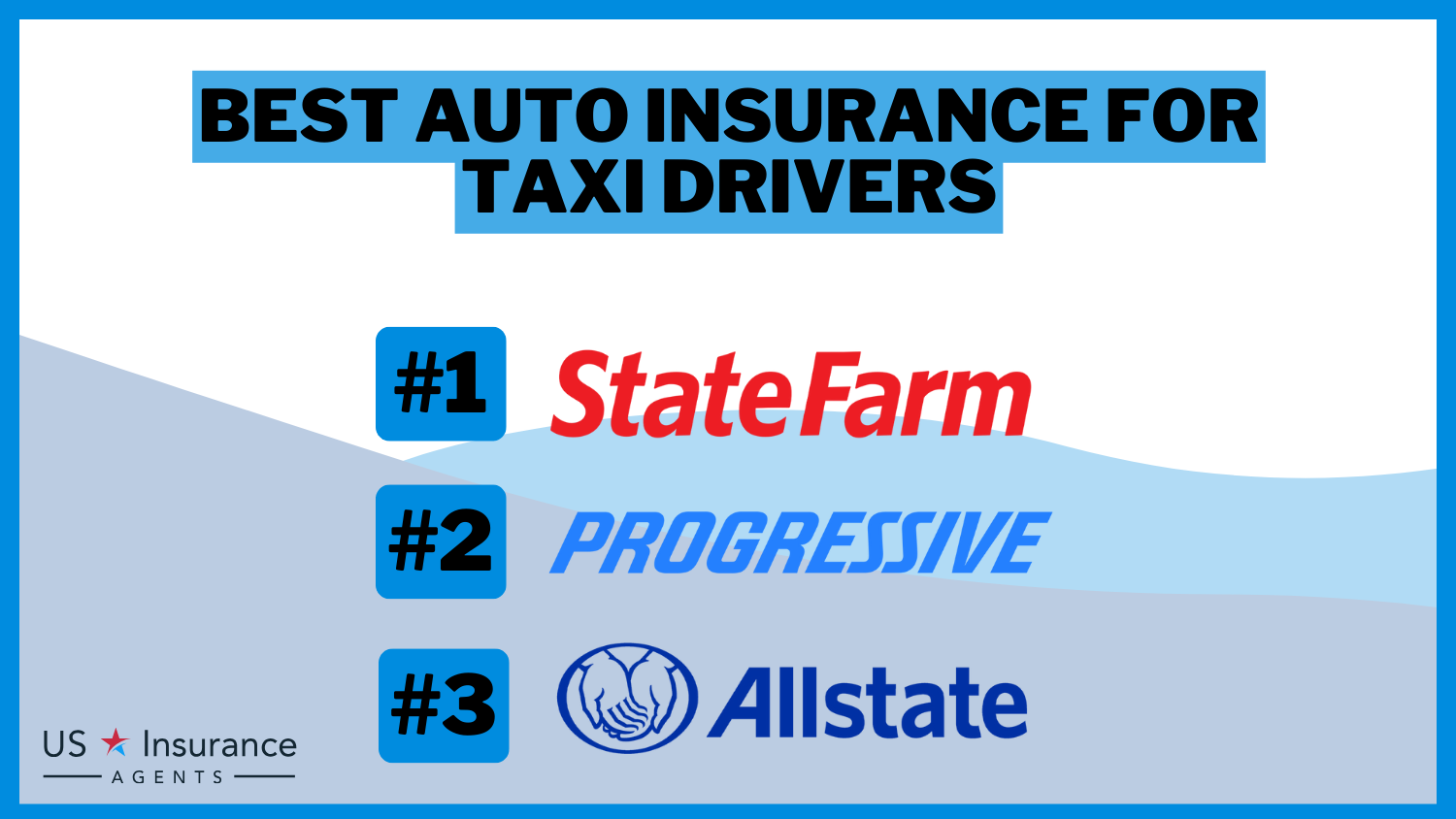

State Farm, Progressive, and Allstate are the top choices for cheap Toyota Avalon Hybrid car insurance, offering some of the most affordable rates. With prices starting as low as $48/mo, these providers stand out for their combination of competitive rates, extensive coverage options, and strong customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2025

Company Facts

Min. Coverage for Toyota Avalon Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Avalon Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Avalon Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Progressive, and Allstate are the top choices for cheap Toyota Avalon Hybrid car insurance, with rates starting as low as $48 per month.

These top providers stand out not only for their low premiums but also for their strong coverage options and customer service. By comparing quotes from these companies, you can find the best combination of affordability and comprehensive protection for your hybrid vehicle.

Our Top 10 Company Picks: Cheap Toyota Avalon Hybrid Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $48 B Customer Service State Farm

#2 $52 A+ Qualifying Coverage Progressive

#3 $55 A+ Infrequent Drivers Allstate

#4 $58 A+ Widespread Availability Nationwide

#5 $61 A Customizable Policies Farmers

#6 $63 A Add-on Coverages Liberty Mutual

#7 $66 A Costco Members American Family

#8 $69 A++ Bundling Policies Travelers

#9 $71 A+ Dividend Payments Amica

#10 $73 A+ Diminishing Deductible The Hartford

Explore your options today to secure the best rates for your Toyota Avalon Hybrid. Avoid overpaying for your car insurance by entering your ZIP code above in our free comparison tool to find which company has the lowest rates.

#1 – State Farm: Top Overall Pick

Pros

- Discounts for Safety Features: State Farm offers substantial discounts for Toyota Avalon Hybrid vehicles equipped with advanced safety features like adaptive cruise control and blind spot monitoring. This is particularly beneficial for Toyota Avalon Hybrid owners as these features are often standard, as highlighted in the State Farm insurance review & ratings.

- Usage-Based Programs: The Drive Safe & Save program can lead to significant savings for Toyota Avalon Hybrid policyholders who exhibit safe driving behaviors. The program tracks driving habits and rewards cautious driving with lower premiums.

- Wide Network of Agents: State Farm has a large network of agents across the country, providing personalized service and assistance with policy management and claims for Toyota Avalon Hybrid owners.

Cons

- Higher Premiums for Younger Drivers: Younger or inexperienced drivers of the Toyota Avalon Hybrid may face higher premiums with State Farm. This can make it less affordable for young Avalon Hybrid owners.

- Limited Online Tools: Some customers find State Farm’s online tools and mobile app less user-friendly for managing Toyota Avalon Hybrid policies compared to competitors, which can be a drawback for those who prefer managing their policies digitally.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program uses telematics to monitor driving habits and can result in significant savings for safe drivers of the Toyota Avalon Hybrid. This can be especially beneficial for Toyota Avalon Hybrid owners who drive responsibly.

- Wide Range of Discounts: Progressive offers a variety of discounts for Toyota Avalon Hybrid owners, including multi-policy, multi-vehicle, safe driver, and even discounts for paying in full. These discounts can help reduce the overall cost of Toyota Avalon Hybrid insurance.

- Competitive Rates: Progressive is known for offering competitive rates for Toyota Avalon Hybrid insurance, often providing lower premiums compared to other insurers for the same coverage levels, according to Progressive insurance review & ratings.

Cons

- Higher Rates for High-Risk Drivers: Drivers with poor credit scores or negative driving records may face higher premiums for their Toyota Avalon Hybrid with Progressive, making it less affordable for these individuals.

- Potential for Privacy Concerns: The Snapshot program involves monitoring driving habits, which might raise privacy concerns for some Toyota Avalon Hybrid policyholders.

#3 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise program rewards safe driving with discounts, potentially lowering insurance costs for Toyota Avalon Hybrid owners who drive carefully.

- Comprehensive Coverage Options: Allstate offers extensive coverage options for the Toyota Avalon Hybrid, including new car replacement, accident forgiveness, and roadside assistance. These options provide additional protection and peace of mind.

- Bundling Discounts: Allstate provides significant discounts for bundling multiple policies, such as home and auto insurance, which can lead to overall cost savings for Toyota Avalon Hybrid owners.

Cons

- Higher Premiums: Allstate generally has higher premiums for the Toyota Avalon Hybrid compared to other insurers, which can be a drawback for budget-conscious Toyota Avalon Hybrid owners, according to Allstate insurance review & ratings.

- Limited Availability of Discounts: While Allstate offers a variety of discounts, they may not be as extensive or easily accessible for Toyota Avalon Hybrid owners compared to other insurers.

#4 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Nationwide’s SmartRide program rewards safe driving with discounts, which can result in substantial savings for cautious drivers of the Toyota Avalon Hybrid, as highlighted in the Nationwide insurance review & ratings.

- Vanishing Deductible: Nationwide offers a vanishing deductible program for Toyota Avalon Hybrid owners where the deductible decreases over time with safe driving, providing added financial relief in case of a claim.

- Comprehensive Coverage Options: Nationwide offers a wide range of coverage options for the Toyota Avalon Hybrid, including gap insurance, accident forgiveness, and roadside assistance, providing extensive protection.

Cons

- Higher Rates for Certain Drivers: Younger or high-risk drivers of the Toyota Avalon Hybrid may face higher premiums with Nationwide, making it less affordable for these individuals.

- Limited Online Features: Some customers find Nationwide’s online account management tools and mobile app lacking in user-friendliness and functionality compared to competitors for their Toyota Avalon Hybrid.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Eco-Friendly Discounts

Pros

- Eco-Friendly Discounts: Farmers offers specific discounts for hybrid and electric vehicles, making insurance more affordable for Toyota Avalon Hybrid owners, as highlighted in the Farmers insurance review & ratings.

- Comprehensive Coverage Options: Farmers provides extensive coverage options for the Toyota Avalon Hybrid, including new car replacement, glass deductible buyback, and customized equipment coverage, offering added protection and flexibility.

- Discounts for Safe Drivers: Farmers offers discounts for maintaining a clean driving record, further reducing insurance costs for Toyota Avalon Hybrid owners.

Cons

- Higher Than Average Rates: Farmers generally has higher premiums for the Toyota Avalon Hybrid compared to other major insurers, which can be a drawback for budget-conscious customers.

- Limited Availability: Farmers’ coverage options and discounts may not be available in all states, limiting access for some Toyota Avalon Hybrid owners.

#6 – Liberty Mutual: Best for RightTrack Program

Pros

- RightTrack Program: Liberty Mutual’s RightTrack program rewards safe driving behaviors with potential savings up to 30%, benefiting cautious Toyota Avalon Hybrid drivers.

- New Car Replacement: Liberty Mutual offers new car replacement coverage for the Toyota Avalon Hybrid, which provides the replacement of a totaled Toyota Avalon Hybrid with a new one within the first year of ownership.

- Comprehensive Discounts: Liberty Mutual offers multiple discount options for the Toyota Avalon Hybrid, including for hybrid vehicles, multi-policy bundling, and safety features, helping reduce overall insurance costs.

Cons

- Higher Base Rates: Liberty Mutual generally has higher initial premiums for the Toyota Avalon Hybrid before discounts are applied, which can be a drawback for budget-conscious customers.

- Potential for Rate Increases: Some customers report unexpected rate increases with Liberty Mutual, which can be frustrating and financially challenging for Toyota Avalon Hybrid owners, as noted in the Liberty Mutual Review & Ratings.

#7 – American Family: Best for Hybrid Vehicle Discounts

Pros

- Hybrid Vehicle Discounts: American Family offers specific discounts for hybrid and electric vehicles, making insurance more affordable for Toyota Avalon Hybrid owners, as mentioned in the American Family insurance review & ratings.

- Wide Range of Coverage Options: American Family offers comprehensive coverage options for the Toyota Avalon Hybrid, including gap insurance, accident forgiveness, and rental reimbursement, providing extensive protection.

- Multi-Policy Discounts: American Family offers significant discounts for bundling multiple policies, such as auto and home insurance, leading to overall cost savings for Toyota Avalon Hybrid owners.

Cons

- Higher Premiums for Some Drivers: Drivers with poor credit or negative driving records may face higher premiums for the Toyota Avalon Hybrid with American Family, making it less affordable for these individuals.

- Limited Discount Availability: While American Family offers a variety of discounts, they may not be as extensive or easily accessible for Toyota Avalon Hybrid owners compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Travelers’ IntelliDrive program rewards safe driving with discounts, potentially lowering insurance costs for Toyota Avalon Hybrid owners who drive carefully.

- Comprehensive Coverage Options: Travelers provides a wide range of coverage options for the Toyota Avalon Hybrid, including gap insurance, accident forgiveness, and roadside assistance, offering extensive protection for policyholders.

- Bundling Discounts: Travelers offers substantial discounts for bundling multiple policies, such as auto and home insurance, leading to overall cost savings for Toyota Avalon Hybrid owners, as mentioned in the Travelers insurance review & ratings.

Cons

- Mixed Customer Reviews: Some customers report dissatisfaction with Travelers’ claims handling and customer service, indicating inconsistency in service quality for Toyota Avalon Hybrid owners.

- Potential for Privacy Concerns: The IntelliDrive program involves monitoring driving habits, which might raise privacy concerns for some Toyota Avalon Hybrid policyholders.

#9 – Amica: Best for Good Driver Discounts

Pros

- Good Driver Discounts: Amica offers substantial discounts for maintaining a clean driving record, further reducing insurance costs for Toyota Avalon Hybrid owners.

- Dividend Policies: Amica offers dividend policies that return a portion of the premium to the policyholder, providing additional financial benefits for Toyota Avalon Hybrid owners.

- Comprehensive Coverage Options: Amica provides extensive coverage options for the Toyota Avalon Hybrid, including new car replacement, accident forgiveness, and rental reimbursement, offering added protection and flexibility.

Cons

- Higher Initial Premiums: Amica generally has higher base premiums for the Toyota Avalon Hybrid before applying discounts, which can be a drawback for budget-conscious customers.

- Fewer Online Tools: Amica’s online tools and mobile app may not be as advanced or user-friendly as those offered by larger insurers for the Toyota Avalon Hybrid, as detailed in the Amica Homeowners Insurance Review.

#10 – The Hartford: Best for AARP Discounts

Pros

- AARP Discounts: The Hartford offers special discounts for AARP members, which can be beneficial for older drivers of the Toyota Avalon Hybrid, as highlighted in the The Hartford insurance review & ratings.

- Strong Claims Handling: The Hartford is known for efficient and reliable claims processing, ensuring prompt and fair settlements for Toyota Avalon Hybrid policyholders.

- Comprehensive Coverage Options: The Hartford provides a wide range of coverage options for the Toyota Avalon Hybrid, including new car replacement, accident forgiveness, and roadside assistance, offering extensive protection.

Cons

- Higher Premiums for Younger Drivers: The Hartford typically has higher rates for younger or inexperienced drivers of the Toyota Avalon Hybrid, making it less affordable for these individuals.

- Age Restrictions: Some discounts and programs are only available to older drivers, particularly AARP members, which can limit benefits for younger Toyota Avalon Hybrid policyholders.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Influence Toyota Avalon Hybrid Car Insurance Rates

When it comes to determining the cost of car insurance for a Toyota Avalon Hybrid, several factors come into play. One of the primary factors is the model and year of the vehicle. Insurance companies will consider the Avalon Hybrid’s safety features, repair costs, and potential for theft or vandalism.

Toyota Avalon Hybrid Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $134

American Family $66 $152

Amica $71 $162

Farmers $61 $143

Liberty Mutual $63 $147

Nationwide $58 $138

Progressive $52 $129

State Farm $48 $121

The Hartford $73 $168

Travelers $69 $158

Additionally, personal factors such as the driver’s age, driving history, location, and credit score can also influence insurance rates. Another factor that can influence car insurance rates for a Toyota Avalon Hybrid is the driver’s annual mileage.

Insurance companies may take into account how often the vehicle is driven and the distance traveled each year. Drivers who have a lower annual mileage may be eligible for lower insurance rates as they are considered to have a lower risk of accidents or damage.

Toyota Avalon Hybrid Insurance Coverage Options

When selecting car insurance for your Toyota Avalon Hybrid, it is crucial to understand the different coverage options available. These options typically include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

Liability coverage provides protection for the damage caused to another person’s property or injuries sustained by others in an accident you are deemed responsible for. Collision coverage, on the other hand, covers repairs or replacement costs for your vehicle in the event of a collision.

Kristine Lee Licensed Insurance Agent

Comprehensive coverage protects against damages caused by factors other than accidents, such as theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage provides financial protection if you are involved in an accident with a driver who is not adequately insured.

It is important to note that the cost of car insurance for a Toyota Avalon Hybrid may vary depending on several factors. These factors can include your driving record, age, location, and the level of coverage you choose.

Additionally, some insurance companies may offer additional coverage options specifically tailored for hybrid vehicles, such as coverage for the battery or other hybrid-specific components. It is recommended to compare quotes from different insurance providers to find the best coverage and price for your Toyota Avalon Hybrid.

Comparing Car Insurance Quotes for the Toyota Avalon Hybrid

One of the best ways to find the most competitive insurance rates for your Toyota Avalon Hybrid is to obtain multiple car insurance quotes. Different insurance providers offer different rates, so comparing quotes allows you to identify the most affordable option that meets your coverage needs.

Jimmy helps Jake jazz up the jingle. pic.twitter.com/OFYjSTwy2G

— State Farm (@StateFarm) December 14, 2023

It is essential to consider not only the premium but also other factors such as deductibles, policy limits, and any additional coverage options. When comparing car insurance quotes for your Toyota Avalon Hybrid, it’s important to keep in mind that the cheapest option may not always be the best choice.

While affordability is a significant factor, it’s equally important to consider the reputation and financial stability of the insurance provider. Reading customer reviews and checking their claims process can give you a better understanding of their reliability and customer service.

Additionally, some insurance companies offer discounts or special benefits for hybrid vehicles, so be sure to inquire about any potential savings specific to your Toyota Avalon Hybrid.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Save Money on Toyota Avalon Hybrid Car Insurance

While car insurance is a necessary expense, there are several ways to save money on your Toyota Avalon Hybrid insurance premiums. One strategy is to maintain a clean driving record. Insurance providers often offer lower rates to drivers with a history of safe driving. Additionally, bundling your car insurance with other policies, such as home or renters insurance, may lead to discounts.

Taking advantage of available discounts, such as those for safety features, anti-theft devices, or completing defensive driving courses, can also help reduce insurance costs. Finally, opting for a higher deductible can lower your premium, but it is important to ensure you can handle the out-of-pocket costs if an accident occurs.

Another way to save money on your Toyota Avalon Hybrid car insurance is to consider usage-based insurance. This type of insurance uses telematics technology to track your driving habits, such as mileage, speed, and braking patterns.

By demonstrating safe driving behavior, you may be eligible for lower insurance premiums. Usage-based insurance can be a great option for drivers who have low annual mileage or who consistently practice safe driving habits.

Toyota Avalon Hybrid Insurance Rates Across States

Insurance rates can vary significantly from state to state when it comes to insuring a Toyota Avalon Hybrid. Factors such as state regulations, traffic density, crime rates, and repair costs can all influence insurance premiums. It is advisable to research and compare average insurance rates for the Avalon Hybrid in your state to get an idea of what you might expect to pay.

For example, in California, the average monthly cost of insuring a Toyota Avalon Hybrid is around $100, while in New York, it can be as high as $150. On the other hand, states like Vermont and Maine tend to have lower insurance rates for the Avalon Hybrid, with average premiums ranging from $70 to $85 per month.

These variations in insurance costs are due to a combination of factors, including state-specific regulations, local driving habits, and the frequency of accidents and thefts in each area. Explore our detailed analysis on “What states require car insurance?” for additional information.

Avalon Hybrid Safety Features & Insurance Premiums

The Toyota Avalon Hybrid boasts several advanced safety features that can positively impact insurance premiums. Insurance providers often offer discounts for vehicles equipped with safety features such as anti-lock brakes, electronic stability control, advanced airbags, and lane departure warning systems.

These features not only enhance the safety of the vehicle but also reduce the risk of accidents, making them attractive to insurance companies when determining premiums. One specific safety feature of the Toyota Avalon Hybrid that can have a significant impact on insurance premiums is the adaptive cruise control.

This feature uses sensors to maintain a safe distance from the vehicle ahead, automatically adjusting the speed to match the flow of traffic. By reducing the likelihood of rear-end collisions, insurance companies may offer lower premiums for vehicles equipped with this technology. In addition to the safety features mentioned, the Toyota Avalon Hybrid also includes a blind spot monitoring system.

This system uses sensors to detect vehicles in the driver’s blind spots and alerts them with visual or audible warnings. By providing an extra layer of protection against lane-change accidents, this feature can further reduce the risk of claims and potentially lead to lower insurance premiums. Get more insights by reading our expert “Safety Car Insurance Discounts” advice.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts Available for Insuring a Toyota Avalon Hybrid

As mentioned earlier, insurance providers often offer various discounts for insuring a Toyota Avalon Hybrid. It is essential to inquire about these discounts when obtaining quotes. Some common discounts include multi-policy discounts, multi-vehicle discounts, safe driver discounts, and discounts for vehicles equipped with anti-theft devices or advanced safety features.

Taking advantage of these discounts can significantly reduce the overall cost of insuring your Toyota Avalon Hybrid. In addition to the discounts mentioned above, some insurance providers may also offer discounts for certain demographic groups, such as students, senior citizens, or members of specific professional organizations. Continue reading our full “Lesser Known Car Insurance Discounts for” guide for extra tips.

It is worth checking with your insurance provider to see if you qualify for any of these additional discounts. Furthermore, some insurance companies may offer loyalty rewards programs, where policyholders can earn discounts or benefits for maintaining a long-term relationship with the company. These loyalty programs can provide further cost savings for insuring your Toyota Avalon Hybrid.

Common Toyota Avalon Hybrid Insurance Mistakes

When purchasing car insurance for your Toyota Avalon Hybrid, it is crucial to avoid common mistakes that could result in higher premiums or inadequate coverage. One common mistake is only considering the minimum required coverage. While it may save you money in the short term, it could leave you financially vulnerable in the event of an accident.

Additionally, failing to compare quotes from multiple insurance providers can result in higher premiums. It is also important to understand the policy terms, including deductibles, policy limits, and any exclusions, to ensure you have adequate coverage. For more information, explore our informative “Commonly Misunderstood Insurance Concepts” page.

Top Tips for Toyota Avalon Hybrid Insurance Providers

Choosing the right insurance provider for your Toyota Avalon Hybrid is crucial in obtaining the most affordable and comprehensive coverage. Start by researching reputable insurance companies and reading customer reviews. Look for insurers with a good track record of customer service and reliable claims handling.

It may also be beneficial to consult with insurance agents or brokers who specialize in auto insurance. They can provide expert advice and help you navigate the complexities of finding the best insurance provider for your specific needs. Expand your understanding with our thorough “Insurance Quotes Online” overview.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Toyota Avalon Hybrid Insurance Costs

Calculating the cost of insuring a Toyota Avalon Hybrid involves considering several factors. In addition to the insurance company’s rates, you must factor in the coverage options you choose, deductibles, policy limits, your driving history, and any applicable discounts.

It is advisable to review your insurance needs regularly and consider adjusting your coverage based on changes in these factors to ensure you are getting the best value for your money. Read our extensive guide on “How much is car insurance?” for more knowledge.

How to Get Car Insurance Quotes for a Toyota Avalon Hybrid

Obtaining car insurance quotes for your Toyota Avalon Hybrid may seem daunting, but it doesn’t have to be. Most insurance providers offer online quoting tools that allow you to receive quotes quickly and conveniently.

You will typically need to provide information such as your driver’s license number, vehicle identification number (VIN), and details about your driving history. It is crucial to be accurate and provide all the requested information to ensure you receive accurate quotes. Dive deeper into “How to Get Free Insurance Quotes Online” with our complete resource.

Benefits of Comprehensive Coverage for Toyota Avalon Hybrid

Comprehensive coverage is an essential aspect of protecting your Toyota Avalon Hybrid. While collision coverage focuses on accidents with other vehicles, comprehensive coverage safeguards against other potential damages.

This includes protection against theft, vandalism, fire, natural disasters, and damage caused by falling objects. Comprehensive coverage provides the peace of mind that comes with knowing you are financially protected from a wide range of risks. Learn more by visiting our detailed “What is included in comprehensive car insurance?” section.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liability Coverage Options for Toyota Avalon Hybrid

Liability coverage is a fundamental aspect of car insurance, protecting you from liability if you cause an accident that results in property damage or bodily injury to others. When it comes to liability coverage options for your Toyota Avalon Hybrid car insurance, it is important to consider the recommended coverage to protect your assets adequately.

Many insurance experts suggest carrying higher liability limits than the minimum required by your state to ensure you are protected in the event of a significant accident. For further details, check out our in-depth “Liability Insurance: A Complete Guide” article.

Hybrid Technology’s Impact on Toyota Avalon Hybrid Insurance

Hybrid technology has revolutionized the automotive industry, offering enhanced fuel efficiency and reduced emissions. The advanced technology in the Toyota Avalon Hybrid may influence insurance costs to a certain extent. Hybrid vehicles generally have lower operating costs, including fuel consumption, which can be attractive to insurance providers.

Jeffrey Manola Licensed Insurance Agent

Additionally, insurers may offer specific discounts for hybrid vehicles due to their positive environmental impact. However, it is important to note that insurance rates also consider other factors, as mentioned earlier, such as the model, safety features, and repair costs, in addition to the hybrid technology itself. Explore our detailed analysis on “How much insurance coverage do I need?” for additional information.

As you can see, several factors come into play when determining the cost of insuring a Toyota Avalon Hybrid. By understanding these factors and exploring the coverage options available, you can make informed decisions to protect yourself and your investment. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Remember to compare quotes, take advantage of available discounts, and select an insurance provider that offers the best coverage at a competitive rate. With this knowledge, you can confidently navigate the world of car insurance and ensure your Toyota Avalon Hybrid is adequately protected at a cost that suits your budget.

Frequently Asked Questions

Is car insurance more expensive for hybrid vehicles like the Toyota Avalon Hybrid?

In general, car insurance for hybrid vehicles like the Toyota Avalon Hybrid may be slightly more expensive than for their non-hybrid counterparts. This is because hybrid vehicles often have higher repair costs and specialized parts, which can impact insurance rates.

What are the recommended coverage options for insuring a Toyota Avalon Hybrid?

When insuring a Toyota Avalon Hybrid, it is generally recommended to have at least the minimum required liability coverage mandated by your state. However, it is often advisable to consider additional coverage options such as collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage to provide more extensive protection for your vehicle and yourself.

What factors affect the cost of Toyota Avalon Hybrid car insurance?

The cost of Toyota Avalon Hybrid car insurance can be influenced by various factors including the driver’s age, location, driving history, coverage limits, deductible amount, and the insurance provider’s rates.

Get more insights by reading our expert “Full Coverage Car Insurance: A Complete Guide” advice.

How can I find the most affordable insurance quotes for a Toyota Avalon Hybrid?

To find the most affordable insurance quotes for a Toyota Avalon Hybrid, compare quotes from multiple insurers and look for discounts on hybrid vehicles and safe driving records.

Is Toyota Avalon Hybrid expensive to insure?

Yes, Toyota Avalon Hybrid insurance can be higher compared to non-hybrid vehicles due to factors like repair costs and the advanced technology of hybrid systems. Hybrids generally have higher insurance premiums because of their complex technology and potentially higher repair costs.

Are there any discounts available for Toyota Avalon Hybrid car insurance?

Yes, there are potential discounts available for Toyota Avalon Hybrid car insurance. Some insurance providers offer discounts for safety features, such as anti-lock brakes and airbags, as well as for hybrid or eco-friendly vehicles. Additionally, maintaining a clean driving record and bundling car insurance with other policies can also lead to discounts.

Explore our detailed analysis on “Car Insurance Discounts by Age” for additional information.

What are the typical Toyota Avalon Hybrid insurance costs?

Toyota Avalon Hybrid insurance costs can vary significantly based on factors like the driver’s age, driving history, location, and the level of coverage chosen. On average, insurance premiums can be around $48 per month for basic coverage, but costs can increase based on personal and vehicle-related factors.

What should I look for in a Toyota Avalon Hybrid insurance comparison?

In a Toyota Avalon Hybrid insurance comparison, focus on affordability, coverage options, customer service quality, and the insurer’s financial stability. Evaluate each company’s rates, coverage plans, and reputation to find the best overall value for your insurance needs.

How can I find the cheapest Toyota Avalon Hybrid insurance?

To find the cheapest Toyota Avalon Hybrid insurance, compare quotes from multiple insurers, look for discounts for safe driving, use anti-theft devices, and consider bundling insurance policies. Shopping around and utilizing available discounts are key to securing the lowest rates.

Continue reading our full “Cheapest Car Insurance Companies” guide for extra tips.

Where can I get affordable Toyota Avalon Hybrid car insurance?

Affordable Toyota Avalon Hybrid car insurance can be obtained by comparing quotes from leading insurance providers like State Farm, Progressive, and Allstate, and seeking out discounts specifically for hybrid vehicles or safe driving records.

What factors influence Toyota Avalon Hybrid insurance rates?

How can I lower Toyota Avalon Hybrid insurance premiums?

What are typical Toyota Avalon Hybrid insurance premiums?

Who offers the cheapest Toyota Avalon Hybrid insurance?

What are the best insurance rates for Toyota Avalon Hybrid?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.