Cheap Toyota Tacoma Car Insurance in 2026 (Save Money With These 10 Companies)

USAA, State Farm, and Progressive are the top providers for cheap Toyota Tacoma car insurance, starting at just $40 monthly. These providers stand out for their affordability, comprehensive coverage options, and superior customer service, making them ideal for Toyota Tacoma owners seeking quality and value.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated September 2024

Company Facts

Min. Coverage for Toyota Tacoma

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Tacoma

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Tacoma

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Toyota Tacoma car insurance are USAA, State Farm, and Progressive, known for their competitive rates and robust coverage options.

These companies provide exceptional value by blending affordability with comprehensive protection for Toyota Tacoma owners. They cater to diverse needs with flexible policies that include discounts for safety features and clean driving records.

Our Top 10 Company Picks: Cheap Toyota Tacoma Car Insurance

Company Rank Monthly Rates Multi-Policy Discount Best For Jump to Pros/Cons

#1 $40 10% Military Families USAA

#2 $46 26% Reliable Support State Farm

#3 $50 16% Digital Convenience Progressive

#4 $57 18% Broad Coverage Allstate

#5 $72 23% Family Bundles American Family

#6 $78 12% Diverse Discounts Geico

#7 $82 12% Comprehensive Plans Liberty Mutual

#8 $85 11% Flexible Policies Travelers

#9 $97 18% Customizable Plans Farmers

#10 $110 12% High-Risk Drivers The General

Opting for one of these insurers ensures reliable coverage tailored to the specific requirements of Toyota Tacoma drivers. See details on our article titled “Toyota Car Insurance Discount.”

Enter your ZIP code above to compare rates from the top providers near you.

- USAA is the top choice for cheap Toyota Tacoma car insurance

- Coverage options cater specifically to the unique needs of Toyota Tacoma owners

- Discounts are available for Tacoma’s safety features and responsible driving

#1 – USAA: Top Overall Pick

Pros

- Military Discounts: USAA offers exclusive rates starting at $40/month for Toyota Tacoma owners who are military members.

- Loyalty Rewards: USAA rewards long-term customers with loyalty discounts on Toyota Tacoma insurance. Unlock details in our article titled “USAA Insurance Review & Ratings.”

- Superior Claims Service: USAA is renowned for its efficient claims service, ensuring quick resolutions for Toyota Tacoma owners.

Cons

-

Limited Availability: USAA’s services are only available to military families, limiting access for the general public seeking Toyota Tacoma insurance.

- Restrictive Policy Adjustments: Changes to policies, including for Toyota Tacoma coverage, can be more restrictive compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Reliable Support

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies for Toyota Tacoma.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage of Toyota Tacoma.

- Wide Coverage: State Farm offers various options tailored specifically to Toyota Tacoma’s needs. Discover more about offerings in our article titled “State Farm Insurance Review & Ratings.”

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is lower compared to some competitors for Toyota Tacoma insurance.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain Toyota Tacoma coverage levels.

#3 – Progressive: Best for Digital Convenience

Pros

- Customizable Plans: Progressive offers flexible coverage options that can be tailored to the specific needs of Toyota Tacoma owners.

- Online Tools: Progressive’s digital tools streamline the process of managing and adjusting Toyota Tacoma insurance policies.

- Competitive Pricing: Progressive offers Toyota Tacoma insurance starting at $50/month, competitive within the industry. Read up on the “Progressive Insurance Review & Ratings” for more information.

Cons

- Customer Service Variability: Some customers may experience variability in service quality when insuring their Toyota Tacoma with Progressive.

- Claims Processing Times: Claim resolution times for Toyota Tacoma insurance can vary, which may not be ideal for all owners.

#4 – Allstate: Best for Broad Coverage

Pros

- Multiple Coverage Options: Allstate provides a wide range of coverage choices for Toyota Tacoma insurance. Check out insurance savings in our complete article titled “Allstate Insurance Review & Ratings.”

- Discounts for Safety Features: Owners of Toyota Tacoma with enhanced safety features can receive discounts from Allstate.

- Strong Local Presence: Allstate agents provide personalized service and support for Toyota Tacoma insurance needs.

Cons

- Higher Rates: Allstate’s monthly rates for Toyota Tacoma insurance are higher, starting at $57.

- Policy Upselling: Allstate agents may frequently push for additional coverages, which might not always be necessary for every Toyota Tacoma owner.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Family Bundles

Pros

- Family Plan Discounts: American Family offers substantial discounts when families bundle their Toyota Tacoma insurance with other vehicles.

- Teen Safe Driver Program: Provides additional discounts and educational resources for families with teen drivers of Toyota Tacoma.

- Responsive Customer Service: Known for customer-centric service, assisting Toyota Tacoma families effectively. Access comprehensive insights into our article titled “American Family Insurance Review & Ratings.”

Cons

- Higher Premiums for Teens: Insurance rates for families with teenage drivers of Toyota Tacoma might be higher at American Family.

- Limited Availability: Coverage options and availability for Toyota Tacoma insurance can vary significantly by state with American Family.

#6 – Geico: Best for Diverse Discounts

Pros

- Variety of Discounts: Geico offers a wide range of discounts for Toyota Tacoma owners, including safe driver and multi-vehicle discounts.

- Competitive Base Rates: Geico provides Toyota Tacoma insurance starting at $78/month, offering competitive pricing with numerous discount options.

- Fast Claims Processing: Geico is known for its efficient claims process, helping Toyota Tacoma owners get back on the road quickly. See more details on our article titled “Geico Car Insurance Discounts.”

Cons

- Variable Customer Service: Customer service quality can vary, potentially affecting Toyota Tacoma owners’ satisfaction.

- Policy Customization Limitations: While Geico offers basic coverage, options for more specific customization for Toyota Tacoma may be limited.

#7 – Liberty Mutual: Best for Comprehensive Plans

Pros

- Tailored Coverage: Liberty Mutual offers highly customizable insurance plans to meet the specific needs of Toyota Tacoma owners.

- Accident Forgiveness: Liberty Mutual provides accident forgiveness policies, which can prevent premium increases for Toyota Tacoma after the first at-fault accident.

- New Car Replacement: For new Toyota Tacoma owners, Liberty Mutual offers new car replacement insurance if your car is totaled. If you want to learn more about the company, head to our article titled “Liberty Mutual Review & Ratings.”

Cons

- Higher Price Point: Liberty Mutual’s premiums, starting at $82/month for Toyota Tacoma insurance, are on the higher side.

- Complex Policy Details: Some Toyota Tacoma owners may find the policy options and terms to be overly complex.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Flexible Policies

Pros

- Flexible Payment Options: Travelers offers flexible payment plans that can ease the financial burden for Toyota Tacoma owners.

- Intuitive Online Management: Easy online policy management for Toyota Tacoma owners, allowing quick adjustments and claims filing.

- Wide Range of Add-Ons: Extensive optional coverages that Toyota Tacoma owners can add to tailor their policies. Delve into our evaluation of our article titled “Travelers Insurance Review & Ratings.”

Cons

- Inconsistent Pricing: Pricing can vary greatly depending on the region and the specific needs of Toyota Tacoma owners.

- Customer Support Issues: Some Toyota Tacoma owners report less than satisfactory interactions with customer support.

#9 – Farmers: Best for Customizable Plans

Pros

- Customization at Core: Farmers offers highly customizable Toyota Tacoma insurance plans, allowing owners to tweak coverages as needed.

- Dedicated Agents: Personalized service through dedicated agents who understand the specific needs of Toyota Tacoma owners.

- Discount for Anti-Theft Devices: Discounts available for Toyota Tacoma equipped with anti-theft devices. Discover insights in our article titled “Farmers Insurance Review & Ratings.”

Cons

- Higher Cost for Custom Features: Custom features in insurance plans can lead to higher costs for Toyota Tacoma owners.

- Rate Fluctuations: Toyota Tacoma owners may experience rate fluctuations at renewal, depending on claims and changes in the market.

#10 – The General: Best for High-Risk Drivers

Pros

- Acceptance of High-Risk Drivers: The General specializes in providing coverage for high-risk Toyota Tacoma drivers who may have trouble finding insurance elsewhere.

- Flexible Payment Options: Offers flexible payment plans to accommodate the financial situations of high-risk Toyota Tacoma owners. More information is available about this provider in our article titled “The General Car Insurance Review & Ratings.”

- Quick Coverage Setup: Fast and efficient setup of insurance policies for Toyota Tacoma, even for those with less-than-perfect driving records.

Cons

- Higher Premiums: Due to the focus on high-risk drivers, The General’s rates for Toyota Tacoma insurance are typically higher, starting at $110/month.

- Limited Coverage Options: Coverage options can be more basic, which might not meet the needs of all Toyota Tacoma owners looking for comprehensive benefits.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

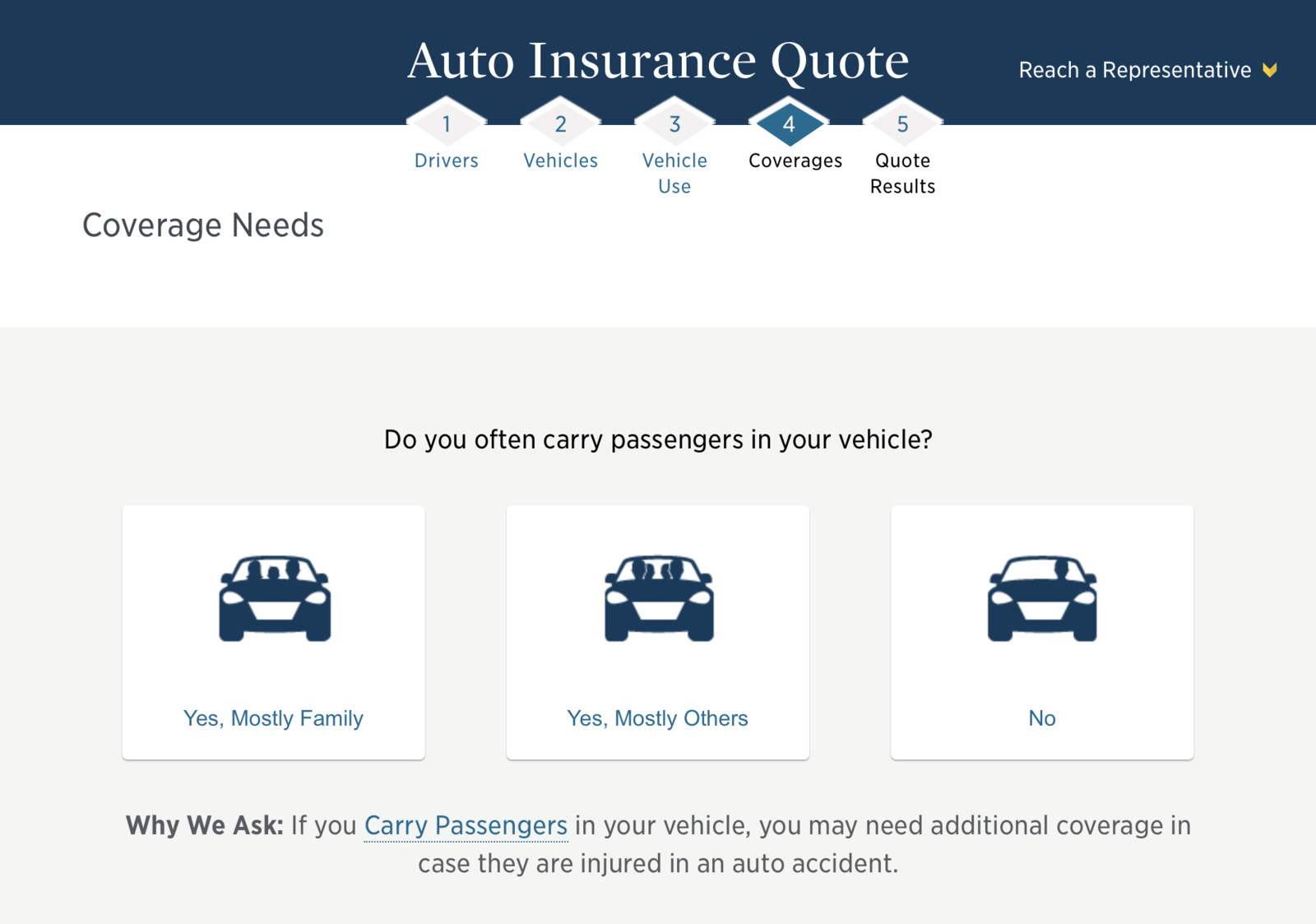

Comparative Monthly Insurance Rates for Toyota Tacoma: Minimum vs. Full Coverage

When selecting car insurance for a Toyota Tacoma, understanding the cost differences between minimum and full coverage options is crucial. Here’s a detailed look at the monthly rates provided by various insurance companies:

Toyota Tacoma Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $57 $126

American Family $72 $160

Farmers $97 $215

Geico $78 $145

Liberty Mutual $82 $160

Progressive $50 $105

State Farm $46 $98

The General $110 $230

Travelers $85 $180

USAA $40 $88

Allstate, American Family, and Farmers present higher full coverage rates, reflecting comprehensive protection which typically includes liability, collision, and comprehensive coverage. For instance, Allstate offers minimum coverage at $57 and full coverage at $126, indicating a significant increment for extensive protection. Similarly, Farmers charges $97 for minimum coverage while escalating to $215 for full coverage.

USAA offers the most affordable rates for Toyota Tacoma insurance, with minimum coverage at $40 and full at $88. Progressive and State Farm also have competitive rates under $100, accommodating various budgets and coverage needs for Tacoma owners. Check out our comprehensive guide titled “State Farm Car Insurance Review & Ratings” to see if this provider is right for you.

Factors That Determine the Cost of Toyota Tacoma Car Insurance

There are several factors that insurance companies consider when calculating the cost of car insurance for a Toyota Tacoma. The model of your Toyota Tacoma affects insurance rates due to differences in safety features, engine power, and theft risk. Features like anti-lock brakes, airbags, and advanced driver assistance systems can lower premiums significantly. Learn more in our guide titled “Is car theft covered by car insurance?”

Insurance rates for your Toyota Tacoma vary by trim level and model, with higher trims costing more due to pricier repairs. Additionally, younger, less experienced drivers typically face higher premiums due to greater accident risks. Your credit score also affects your rates, as a higher score indicates financial responsibility and lowers risk assessments by insurers.

Geographical location is another important factor; where you live can significantly influence your insurance rates due to variables like crime rates, accident frequency, and local repair costs. Lastly, opting for comprehensive coverage, which protects against theft, vandalism, and non-collision damage, can increase your premiums but provides valuable protection for your vehicle.

Understanding the Influence of Vehicle Model on Insurance Premiums

The specific model of your Toyota Tacoma can have a direct impact on your insurance premiums. Insurance companies assess the risk associated with each vehicle model based on historical claims data, safety ratings, and theft rates. Models with a higher likelihood of accidents and expensive repairs generally result in higher insurance premiums.

For example, a Toyota Tacoma TRD Pro, with its off-road capabilities and powerful engine, may be deemed riskier to insure compared to a base model Tacoma. The increased risk of accidents during off-road adventures and the higher cost of repairs for specialized parts could lead to higher insurance premiums.

On the other hand, a base model Toyota Tacoma SR5 with standard safety features and a less powerful engine may attract lower insurance rates due to its lower risk profile. In general, insurance costs tend to be higher for vehicles with more expensive trims and features. Check out insurance savings in our complete guide titled “Does my car insurance cover damage caused by an overheated engine?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Analyzing the Safety Features of Toyota Tacoma and Its Impact on Insurance Rates

The safety features equipped in your Toyota Tacoma can influence the cost of your insurance premiums. Insurance providers often offer discounts on policies that include safety features because these features can reduce the severity of an accident and the likelihood of injuries.

The Toyota Tacoma is known for its robust safety features, which can help mitigate the impact of accidents and improve driver and passenger safety. Standard safety features commonly found in the Tacoma include anti-lock brakes, stability control, traction control, and a suite of airbags.

With advanced safety technologies becoming increasingly common, some Toyota Tacoma models also offer additional features such as lane departure warning, blind-spot monitoring, rearview cameras, and adaptive cruise control. These features enhance road safety and may lower insurance premiums by reducing accident and injury risks. Discover insights in our article titled “Adaptive Cruise Control Car Insurance Discount.”

Comparing Insurance Costs for Different Toyota Tacoma Trims and Models

When considering the cost of insurance for a Toyota Tacoma, it is important to compare the insurance costs for different trims and models. Insurance providers may charge varying rates based on the specific features and capabilities of each trim level.

For instance, a base model Toyota Tacoma SR may have lower insurance premiums compared to a TRD Off-Road or Limited trim due to the higher cost of repairs and parts associated with the more advanced trims. Additionally, models with additional features that contribute to a better safety rating may also be eligible for lower insurance rates.

It is advisable to obtain insurance quotes for different trims and models of the Toyota Tacoma to identify any variations in insurance costs. By comparing multiple quotes, you’ll gain a clearer understanding of the potential insurance rates associated with each trim level of the Toyota Tacoma to make an informed decision. Explore our review of the article titled “How to Get Free Insurance Quotes Online.”

The Role of Driver’s Age and Experience in Determining Toyota Tacoma Insurance Rates

It is no secret that age and driving experience play a crucial role in determining the cost of insurance for any vehicle, including the Toyota Tacoma. Younger drivers with less driving experience are generally considered higher risk and may face higher insurance premiums. Discover more about offerings in our guide titled “What age do you get cheap car insurance?”

Insurance companies often categorize drivers into different age groups, with teenagers and young adults typically facing the highest rates due to their limited experience and higher likelihood of accidents. As drivers gain more experience, their premiums usually decrease over time.

When insuring a Toyota Tacoma, it is important to consider the impact of age and experience on insurance rates. Younger drivers may want to explore options for adding their Toyota Tacoma to their parent’s insurance policy, as this can sometimes lead to lower premiums. Additionally, completing a defensive driving course or maintaining a clean driving record can help to reduce insurance costs, regardless of age.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring The Relationship Between Credit Score And Car Insurance Premiums For A Toyota Tacoma

Surprisingly, your credit score can affect the cost of insurance premiums for your Toyota Tacoma. Many insurance companies consider credit history when determining the risk profile of a driver and setting insurance rates. Gain detailed understanding from our article titled “Understanding Credit: A Score that Impacts Everything from Your Cell Phone Bill to Car Insurance.”

Jeff Root Licensed Insurance Agent

Individuals with a higher credit score are often seen as more responsible and less likely to file claims. As a result, insurance providers may offer lower premiums to drivers with good credit scores. On the other hand, individuals with poor credit scores may face higher insurance rates due to the perceived higher risk they pose.

If you are insuring a Toyota Tacoma and have a lower credit score, it is crucial to explore insurance options from different providers. Some companies may offer more competitive rates for individuals with lower credit scores, while others may not factor credit scores into their underwriting process at all.

Examining the Geographical Location’s Effect on Toyota Tacoma Insurance Prices

The geographical location where you reside can have a significant impact on the cost of insurance for your Toyota Tacoma. Insurance companies take into account various factors related to your location when determining premiums. Delve into our evaluation of guide titled “The Most and Least Car-Dependent States.”

Areas with higher crime rates and greater instances of theft and vandalism typically attract higher insurance rates. Similarly, cities with more congested traffic and a higher likelihood of accidents tend to have higher insurance premiums compared to rural areas.

Repair costs can also vary by location, potentially impacting insurance rates as well. Areas with higher labor rates and increased costs for vehicle repairs can result in higher premiums. Therefore, it is essential to consider the location where you will be using and storing your Toyota Tacoma when obtaining insurance quotes.

Tips for Finding Affordable Car Insurance Options for Your Toyota Tacoma

Finding affordable car insurance for your Toyota Tacoma while ensuring adequate coverage can be achieved with careful planning and strategic actions. To begin, it’s crucial to compare insurance quotes from multiple providers to assess differences in costs and coverage, ensuring you provide accurate information to receive precise quotes.

Consider bundling your Tacoma’s insurance with other policies, such as homeowners or renters insurance, which can often qualify you for multi-policy discounts. Another effective way to reduce your premium is by opting for higher deductibles; however, make sure that you can comfortably afford these higher out-of-pocket costs in case of an accident.

It’s also beneficial to focus on maintaining or improving your credit score, as a good credit rating can significantly lower your insurance rates. Don’t forget to inquire about various discounts that you may be eligible for, including safe driver discounts, multi-car discounts, or discounts for installing anti-theft devices. Maintaining a clean driving record by avoiding accidents and traffic violations can also help keep your premiums low.

Lastly, consider looking into usage-based insurance programs that use telematics devices or smartphone apps to monitor driving habits and offer discounts for safe driving, providing another avenue to reduce costs while maintaining comprehensive coverage. Access comprehensive insights into our guide titled “Allstate Drivewise vs. USAA SafePilot: Which Service Is the Best.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Comprehensive Coverage for Protecting Your Toyota Tacoma

Comprehensive coverage is an essential aspect of car insurance when it comes to protecting your Toyota Tacoma. This coverage provides financial protection against non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by falling objects.

While comprehensive coverage may increase your insurance premiums, it offers valuable peace of mind by ensuring that you are protected from unforeseen events. A stolen or vandalized Toyota Tacoma can lead to substantial financial loss, which comprehensive coverage helps to mitigate. Gain in-depth understanding through our guide titled “Collision Mitigation Car Insurance Discount.”

When considering whether to include comprehensive coverage in your policy, evaluate the potential risks associated with your geographic location, the value of your vehicle, and your budget. Assessing these factors will help you determine the level of coverage needed to adequately protect your Toyota Tacoma.

How to Save Money on Toyota Tacoma Car Insurance Without Compromising Coverage

While finding cost-effective insurance for your Toyota Tacoma is important, maintaining adequate coverage is equally crucial. To save money on car insurance without compromising coverage, start by shopping around. Obtain quotes from multiple insurance providers using online comparison tools and by contacting local agents to ensure you find the most competitive rates.

Take advantage of various discounts and incentives offered by insurance providers, such as safe driver discounts, good student discounts, low-mileage discounts, or discounts for completing defensive driving courses. Consider paying your insurance premium annually rather than monthly, as some providers offer discounts for upfront annual payments.

Regularly review and adjust your insurance to match your needs, maintain good credit, and practice safe driving to keep premiums low. Installing anti-theft devices in your Toyota Tacoma, like alarms or tracking systems, can also deter theft and reduce your insurance costs. Learn more in our guide titled “Car Insurance Teen Discount GPS Tracker.”

Understanding the Claims Process When Insuring a Toyota Tacoma

In the unfortunate event of an accident or damage to your Toyota Tacoma, it is essential to understand the claims process and work effectively with your insurance provider to ensure a smooth resolution. Here are the general steps involved in filing a claim:

- Report the Incident: Contact your insurance provider immediately to report the accident or damage. Provide all necessary details and documentation, including photos, police reports, and witness statements, if applicable.

- Assess the Damage: Your insurance provider will evaluate the extent of the damage to your Toyota Tacoma to determine the cost of repairs. They may send an adjuster to inspect the vehicle or request photos or estimates from authorized repair shops.

- Claim Settlement: Once the damage has been assessed, your insurance provider will provide a settlement to cover the cost of repairs or replacement, minus any deductibles specified in your policy. Review the settlement details carefully and discuss any concerns or questions you may have with your insurance provider.

- Repair or Replacement: You can choose a repair shop to address the damages according to the settlement offered by your insurance provider. Ensure you choose an authorized repair facility capable of effectively repairing your Toyota Tacoma to its pre-damaged condition.

- Claim Resolution: After the repairs are completed, your insurance provider will finalize the claim process. They may request photos of the repaired vehicle or an inspection to confirm the repairs were carried out appropriately.

By understanding the claims process and maintaining open communication with your insurance provider, you can navigate the process smoothly and address any issues or concerns that may arise during the claims process. Check out insurance savings in our complete guide titled “How to File a Car Insurance Claim.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Choosing a Car Insurance Provider for Your Toyota Tacoma

When selecting a car insurance provider for your Toyota Tacoma, it’s essential to consider several factors to ensure you choose the right provider for your specific needs. First, assess the financial stability of potential insurers. A financially secure company is more capable of handling claims and ensuring prompt payments if you need to file a claim. Discover insights in our article titled “A.M. Best Ratings Explained.”

Additionally, consider the reputation and customer service of the insurance providers. Reading reviews and getting recommendations from family and friends can help you gauge the level of customer support you might receive. Finally, evaluate the coverage options each provider offers. Make sure they have the necessary coverage that suits your specific needs and budget for your Toyota Tacoma.

Use our free quote comparison tool below to find the cheapest coverage in your area.

Frequently Asked Questions

What factors affect the cost of Toyota Tacoma car insurance?

The cost of Toyota Tacoma car insurance can be influenced by various factors, including the driver’s age, driving history, location, coverage levels, deductible amount, and the insurance provider’s rates and discounts.

Are Toyota Tacomas expensive to insure?

The insurance cost for a Toyota Tacoma can vary depending on several factors, but in general, Tacomas are not considered to be among the most expensive vehicles to insure. However, insurance rates can still vary significantly based on individual circumstances.

What are some ways to lower the cost of Toyota Tacoma car insurance?

There are several strategies to potentially reduce the cost of Toyota Tacoma car insurance. These include maintaining a clean driving record, opting for higher deductibles, bundling insurance policies, taking advantage of available discounts, and comparing quotes from multiple insurance providers.

Access comprehensive insights into our guide titled “Can I bundle my car insurance with other policies?”

Is car insurance more expensive for new Toyota Tacoma models?

Typically, newer Toyota Tacoma models may have slightly higher insurance rates compared to older models. This is because newer vehicles tend to have higher market values and may require more expensive repairs or replacement parts.

Does the Toyota Tacoma’s safety rating affect insurance rates?

Yes, the safety rating of the Toyota Tacoma can impact insurance rates. Vehicles with higher safety ratings are generally considered less risky to insure, which may result in lower insurance premiums. It is advisable to check with insurance providers to see if they consider the Tacoma’s safety features in determining rates.

Can the location where I live affect the cost of insuring a Toyota Tacoma?

Yes, your location significantly influences the cost of insuring a Toyota Tacoma. Urban areas often have higher rates due to increased risks of theft and accidents, while rural areas may offer lower premiums. Factors such as local crime rates, traffic density, and state regulations also impact insurance costs.

Learn more by reading our guide titled “Best Car Insurance in Your State.”

How much is insurance for 2024 Tacoma?

The average insurance cost for a 2024 Tacoma varies, with USAA generally offering the lowest starting rate.

Who is known for cheapest Toyota Tacoma car insurance?

USAA is often recognized for offering the cheapest Toyota Tacoma car insurance, especially for military families.

Why is Toyota Tacoma insurance so expensive?

Toyota Tacoma insurance can be expensive due to its high repair costs, theft rates, and the vehicle’s performance capabilities.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool below.

What is the cheapest level of Toyota Tacoma car insurance?

The cheapest level of Toyota Tacoma car insurance is typically minimum liability coverage.

Who is most likely to pay a low premium for Toyota Tacoma car insurance?

Who is cheaper for Toyota Tacoma, Geico or Progressive?

Where is Toyota Tacoma car insurance the most expensive?

What is the most trusted Toyota Tacoma car insurance company?

Who typically has the cheapest insurance for Toyota Tacoma?

How to lower Toyota Tacoma car insurance rates?

At what age is Toyota Tacoma car insurance cheapest?

What is the best insurance company for trucks like the Toyota Tacoma?

What is the cheapest liability insurance for a truck like the Toyota Tacoma?

What’s the cheapest Toyota to insure?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.