Cheap Toyota RAV4 Hybrid Car Insurance in 2026 (Find Savings With These 10 Companies)

Farmers, State Farm, and Nationwide are the best insurers for cheap Toyota RAV4 Hybrid car insurance, offering monthly rates around $45. Farmers excels in multi-policy discounts, State Farm is renowned for unparalleled customer satisfaction, and Nationwide delivers exceptional accident forgiveness.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated September 2024

Company Facts

Min. Coverage for Toyota RAV4 Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota RAV4 Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota RAV4 Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Toyota RAV4 Hybrid car insurance are Farmers, State Farm, and Nationwide, with monthly rates starting around $45.

These leading insurers provide diverse benefits such as multi-policy discounts, high customer satisfaction, and robust accident forgiveness options. For a comprehensive analysis, refer to our detailed guide titled “If you have an accident while driving with an expired license will insurance cover damages?”

Our Top 10 Company Picks: Cheap Toyota RAV4 Hybrid Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $45 A++ Multi-Policy Discounts Farmers

![]()

#2 $48 B Customer Satisfaction State Farm

#3 $50 A+ Accident Forgiveness Nationwide

![]()

#4 $55 A++ Customizable Coverage Progressive

#5 $59 A+ Low Mileage Drivers Erie

![]()

#6 $64 A+ Safe Drivers Allstate

![]()

#7 $68 A+ Budget-Conscious The General

#8 $72 A New-Car Replacement Liberty Mutual

![]()

#9 $77 A++ Teen Drivers American Family

![]()

#10 $84 A++ Military Families USAA

Each offers unique advantages to suit different preferences and needs. By comparing these options, you can secure optimal coverage at the best possible rate.

Ready to find affordable car insurance? Get started today by entering your ZIP code above into our free comparison tool.

- Farmers offers Toyota RAV4 Hybrid car insurance with rates around $45 per month

- Coverage options vary widely, impacting overall insurance costs

- Multi-Policy discounts can significantly lower your overall insurance costs

#1 – Farmers: Top Overall Pick

Pros

- Multi-Policy Discounts: Farmers insurance review & ratings promote the company’s significant savings when bundling your Toyota RAV4 Hybrid insurance with other policies, such as home or life insurance, which can help lower overall costs.

- Comprehensive Coverage Options: They provide a variety of coverage options tailored to the Toyota RAV4 Hybrid, including specialized coverage for battery and electrical systems.

- Strong Claims Service: Farmers is known for efficient and effective claims handling, ensuring your Toyota RAV4 Hybrid is repaired and back on the road as soon as possible.

Cons

- Higher Rates for Younger Drivers: Farmers may have higher rates for younger drivers, which could be a downside if the insured Toyota RAV4 Hybrid is driven by a new or younger driver.

- Limited Discounts: Compared to some competitors, Farmers might offer fewer discounts specifically targeted at hybrid vehicles like the Toyota RAV4 Hybrid, potentially missing out on additional savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Satisfaction

Pros

- Accident Forgiveness: With State Farm’s accident forgiveness program, your first at-fault accident won’t raise your rates, providing peace of mind if you’re involved in a minor incident with your Toyota RAV4 Hybrid.

- Customer Satisfaction: State Farm insurance review & ratings manifest the company’s high marks for customer satisfaction, which means you can expect responsive service and reliable support for your Toyota RAV4 Hybrid.

- Safe Driver Discounts: They offer discounts for safe driving, which can benefit you if you maintain a clean driving record with your Toyota RAV4 Hybrid.

Cons

- Higher Premiums for Some Drivers: State Farm’s premiums might be higher for certain demographics, such as those with less driving experience, a history of claims, or owners of specific vehicles like the Toyota RAV4 Hybrid.

- Limited Hybrid-Specific Coverage: Their coverage options for the Toyota RAV4 Hybrid may not be as extensive or specialized for hybrid vehicles compared to other insurers.

#3 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide offers accident forgiveness, meaning your rates won’t increase after your first at-fault accident, which is beneficial for protecting your Toyota RAV4 Hybrid from premium hikes.

- Customizable Coverage: They provide a range of customizable coverage options, allowing you to tailor your policy to meet the specific needs of your Toyota RAV4 Hybrid.

- Strong Customer Service: Nationwide insurance review & ratings reveal the company’s strong customer service, ensuring that any issues with your Toyota RAV4 Hybrid are addressed promptly and effectively.

Cons

- Higher Premiums for Younger Drivers: Similar to State Farm, Nationwide’s rates might be higher for younger or less experienced drivers, impacting the affordability of coverage for your Toyota RAV4 Hybrid.

- Limited Discounts for Hybrid Vehicles: Nationwide may offer fewer discounts specifically for hybrid vehicles like the Toyota RAV4 Hybrid, which could result in missed savings opportunities.

#4 – Progressive: Best for Customizable Coverage

Pros

- Customizable Coverage: Progressive insurance review & ratings unveil the company’s extensive customization of your policy, which is beneficial for tailoring coverage to the unique aspects of your Toyota RAV4 Hybrid.

- Snapshot Program: Their Snapshot program can lower rates based on your driving habits, potentially saving money if you drive safely with your Toyota RAV4 Hybrid.

- 24/7 Customer Support: Progressive offers round-the-clock customer support, ensuring you can get assistance with your Toyota RAV4 Hybrid insurance needs at any time.

Cons

- Potentially Higher Rates for High-Risk Drivers: Progressive’s rates can be higher for drivers with a history of accidents or violations, which might affect the cost of insuring your Toyota RAV4 Hybrid.

- Complex Policy Options: The wide range of options and add-ons can be overwhelming and may require careful navigation to ensure you’re getting the best coverage for your Toyota RAV4 Hybrid.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Erie: Best for Low Mileage Drivers

Pros

- Low Mileage Discounts: Erie provides discounts for low mileage drivers, which can be advantageous if your Toyota RAV4 Hybrid is not driven extensively.

- Excellent Customer Service: Erie insurance review & ratings introduce the company’s customer service, and reliable support and quick claims processing, ensuring your Toyota RAV4 Hybrid is well taken care of.

- Comprehensive Coverage: They offer comprehensive coverage options that include protection for the specialized components of Toyota RAV4 Hybrid vehicles.

Cons

- Limited Availability: Erie’s insurance for the Toyota RAV4 Hybrid might not be available in all states, which could be a drawback if you’re located outside their service area.

- Higher Rates for High-Risk Drivers: Similar to other insurers, Erie may charge higher rates for drivers with a history of accidents or claims, potentially affecting the cost of coverage for your Toyota RAV4 Hybrid.

#6 – Allstate: Best for Safe Drivers

Pros

- Safe Driver Discounts: Allstate offers significant discounts for safe drivers, which is beneficial if you maintain a clean driving record with your Toyota RAV4 Hybrid.

- New Car Replacement: They provide a new car replacement option if your Toyota RAV4 Hybrid is totaled, ensuring you can replace it with a new model without financial strain.

- Accident Forgiveness: Allstate insurance review & ratings broadcast the company’s accident forgiveness program helps prevent rate increases after your first at-fault accident, offering added protection for your Toyota RAV4 Hybrid vehicle.

Cons

- Higher Premiums for Some Drivers: Allstate’s premiums can be higher for certain driver profiles, which might impact the affordability of insuring your Toyota RAV4 Hybrid.

- Limited Hybrid-Specific Benefits: heir benefits and discounts specifically for hybrid vehicles like the Toyota RAV4 Hybrid might not be as extensive as those offered by other insurers.

#7 – The General: Best for Budget-Conscious

Pros

- Budget-Conscious Coverage: The General offers affordable coverage options, which can be a good fit if you’re looking to save on insurance for your Toyota RAV4 Hybrid.

- Easy Online Access: The General car insurance review & ratings publicize the company’s convenient online tools for managing your policy and making claims, simplifying the process for your Toyota RAV4 Hybrid insurance needs.

- Flexible Payment Plans: Toyota RAV4 Hybrid owners can benefit from flexible payment plans that allow you to manage your insurance costs more effectively.

Cons

- Limited Comprehensive Coverage: The General may offer fewer comprehensive coverage options, which might be a downside if you need extensive protection for your Toyota RAV4 Hybrid.

- Potentially Lower Customer Service Ratings: Customer service ratings for the Toyota RAV4 Hybrid may not be as high as other insurers, which could affect your experience with claims and support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for New-Car Replacement

Pros:

- New-Car Replacement: Liberty Mutual offers new-car replacement coverage, which is beneficial if your Toyota RAV4 Hybrid is totaled and you need to replace it with a new vehicle.

- Accident Forgiveness: Liberty Mutual review & ratings advertise the company’s offering accident forgiveness for the Toyota RAV4 Hybrid, ensuring your rates don’t increase after your first at-fault accident.

- Customizable Coverage Options: They provide various customizable coverage options, allowing you to tailor your policy to meet the needs of your Toyota RAV4 Hybrid.

Cons:

- Higher Premiums for Some Drivers: Liberty Mutual’s premiums might be higher for certain driver profiles, affecting the overall cost of coverage for your Toyota RAV4 Hybrid.

- Limited Discounts for Hybrid Vehicles: Their discounts specifically for the Toyota RAV4 Hybrid may not be as comprehensive as those offered by other insurers.

#9 – American Family: Best for Teen Drivers

Pros

- Teen Driver Discounts: American Family offers discounts for policies that include teen drivers, which can be beneficial if your Toyota RAV4 Hybrid is driven by a younger family member.

- Comprehensive Hybrid Coverage: They provide comprehensive coverage options tailored for Toyota RAV4 Hybrid vehicles, ensuring protection for specialized components.

- Excellent Customer Service: American Family insurance review & ratings illustrate the company’s strong customer service, offering reliable support for any issues with your Toyota RAV4 Hybrid.

Cons:

- Higher Premiums for Certain Drivers: Premiums with American Family may be higher for some drivers, such as those with a Toyota RAV4 Hybrid, potentially impacting the affordability of your policy.

- Limited Availability: Insurance for the Toyota RAV4 Hybrid might not be available in all states, which could be a drawback depending on your location.

#10 – USAA: Best for Military Families

Pros

- Military Families Discounts: USAA insurance review & ratings disclose the company’s specialized discounts for military families, which can be advantageous if you’re serving or have served in the military and own a Toyota RAV4 Hybrid.

- Comprehensive Coverage Options: They provide a wide range of comprehensive coverage options, including specialized protection for Toyota RAV4 Hybrid vehicles.

- High Customer Satisfaction: USAA consistently ranks highly in customer satisfaction, ensuring responsive service and support for your Toyota RAV4 Hybrid.

Cons

- Eligibility Restrictions: USAA’s coverage is limited to military members and their families, so if you’re not eligible, you won’t be able to access their services for a Toyota RAV4 Hybrid.

- Potentially Higher Rates for New Drivers: Rates for new or inexperienced drivers may be higher, which could impact the cost of insuring your Toyota RAV4 Hybrid if it’s driven by a new driver.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Factors Influencing Toyota RAV4 Hybrid Insurance Costs

When insuring your Toyota RAV4 Hybrid, several factors influence your premium costs. These include your location, with urban areas often having higher rates due to increased crime compared to rural settings. Your driving record also plays a role, as a clean record typically results in lower rates, while a history of accidents or violations can raise premiums.

Toyota RAV4 Hybrid Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $64 $120

American Family $77 $135

Erie $59 $110

Farmers $45 $100

Liberty Mutual $72 $125

Nationwide $50 $105

Progressive $55 $108

State Farm $48 $102

The General $68 $115

USAA $84 $117

Additionally, in some states, your credit score can impact rates, with lower scores potentially leading to higher premiums. To broaden your understanding, explore our comprehensive resource on insurance coverage titled “How does the insurance company determine my premium?”

The coverage options you select, such as liability-only versus full coverage, also affect costs, as do additional options like comprehensive or collision coverage. Finally, the deductible amount you choose can influence premiums, with higher deductibles often resulting in lower rates but requiring more out-of-pocket expense in the event of a claim.

Essential Insurance Coverage Options for Your Toyota RAV4 Hybrid

Before seeking insurance quotes for your Toyota RAV4 Hybrid, it’s crucial to understand the various coverage options available. Liability coverage, required in most states, offers financial protection if you cause an accident resulting in injury or property damage to others. Collision coverage pays for damages to your vehicle from collisions with other vehicles or objects.

Comprehensive coverage protects against non-collision-related incidents such as theft, vandalism, or storm damage. Medical payments coverage covers medical expenses for you and your passengers from an accident, regardless of fault.

Are you wasting gas or saving it? When you merge, are you doing it right? Read on as automotive experts and researchers bust some controversial car and driving myths.https://t.co/vfzk0wFECp

— Farmers Insurance (@WeAreFarmers) September 26, 2023

Uninsured/underinsured motorist coverage helps if you’re in an accident with a driver who lacks sufficient insurance. For an in-depth examination, consult our thorough guide entitled “Uninsured/Underinsured Motorist Insurance Coverage.” Consider your specific needs, budget, and state-mandated minimum requirements when selecting coverage options.

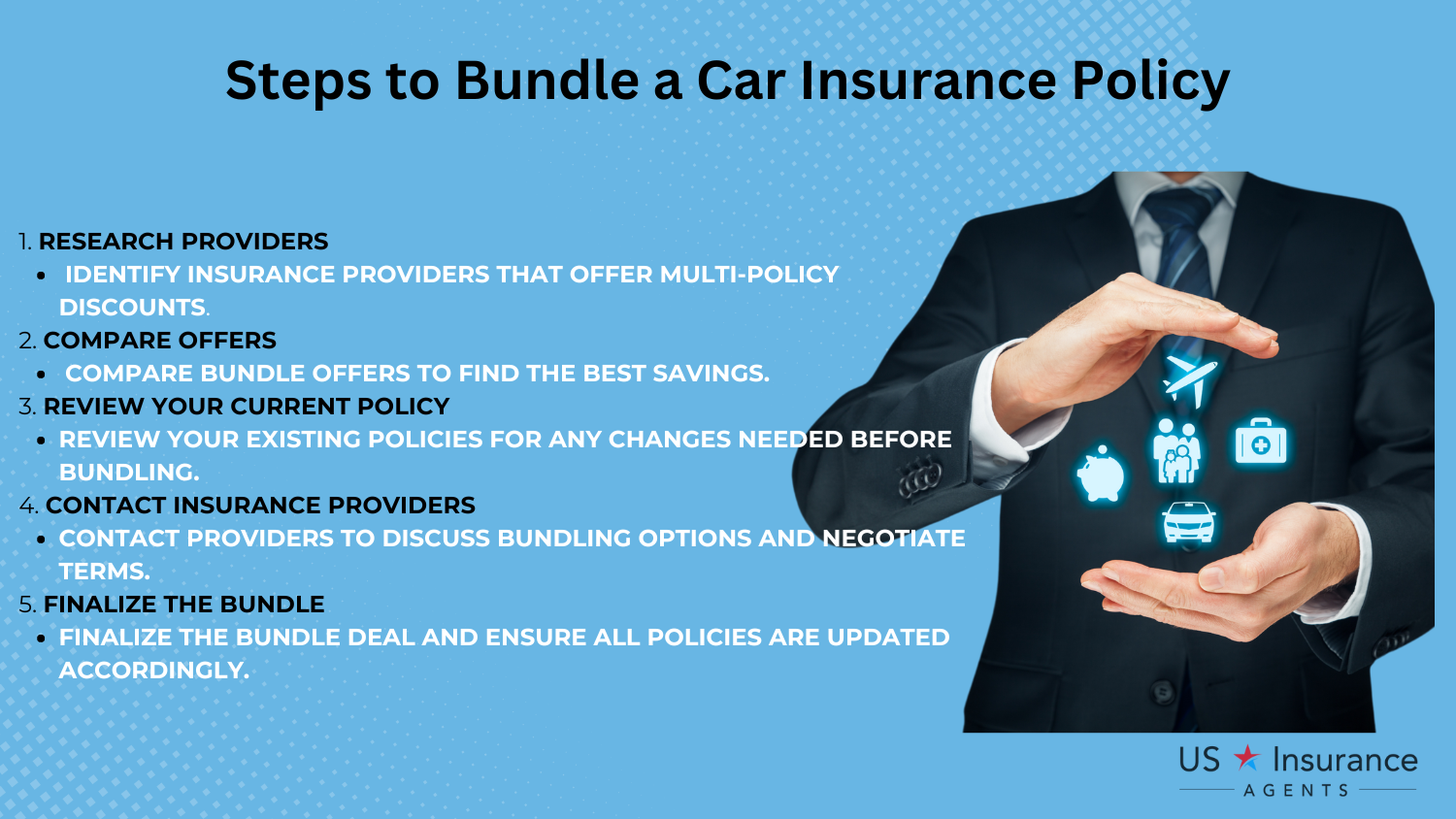

Tips to Save Money on Toyota RAV4 Hybrid Car Insurance

Saving money on your Toyota RAV4 Hybrid car insurance is possible by following a few key strategies. Here are some tips to help reduce your insurance premiums.

- Shop Around for Quotes: Research and compare quotes from multiple insurers to find the best rate.

- Bundle Policies: Combine your car insurance with other policies like homeowner’s or renter’s insurance for multi-policy discounts. For a thorough exploration, delve into our extensive guide titled “Best Multi Policy Car Insurance Discounts.”

- Maintain a Clean Driving Record: Avoid violations and accidents to keep your premiums as low as possible.

By shopping around for the best rates, bundling your auto insurance with other policies such as home or renters insurance, and consistently maintaining a clean driving record, you can potentially save a significant amount on your Toyota RAV4 Hybrid car insurance.

Start implementing these tips today to enjoy lower premiums, enhance your coverage, and maximize your savings over time, ensuring that you get the most value for your money while driving with confidence and peace of mind.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Insights for the Toyota RAV4 Hybrid

When insuring a Toyota RAV4 Hybrid compared to other SUVs, several factors come into play. Hybrid vehicles like the RAV4 Hybrid generally offer lower insurance premiums than traditional gasoline counterparts due to their reputation for safety and reduced environmental risk. Insurance providers often offer discounts and incentives for hybrid or electric vehicle owners.

Additionally, the safety features of the Toyota RAV4 Hybrid, such as advanced driver-assistance systems, lane departure warning, forward collision warning, and automatic emergency braking, can significantly impact insurance rates. For a detailed breakdown, consult our comprehensive guide named “Collision Car Insurance: A Complete Guide.”

Will my auto insurance cover the cost to replace property stolen from my car? https://t.co/cHecDqHCYE pic.twitter.com/rlfxSFvd0m

— Farmers Insurance (@WeAreFarmers) August 19, 2021

These features help prevent or mitigate accidents, leading insurers to view the vehicle as less likely to be involved in accidents, which can result in lower premiums. Therefore, comparing rates and coverage options from multiple insurers and prioritizing safety features when purchasing a Toyota RAV4 Hybrid can lead to savings on your insurance premiums.

Monthly Insurance Costs for the Toyota RAV4 Hybrid

When insuring your Toyota RAV4 Hybrid, compare offerings from different providers to find the best deal. Rates, coverage options, and discounts can vary significantly. Obtain quotes from both large and local insurers, and read reviews to gauge reliability.

The average monthly cost of insuring a Toyota RAV4 Hybrid varies by state, influenced by regulations and local market conditions. For an exhaustive analysis, check out our complete guide entitled “Finding Affordable Insurance for Hybrid Cars.”

Generally, expect to pay between $50 and $100 monthly. For a precise estimate, get quotes based on your location and circumstances.

Discounts Available for Insuring a Toyota RAV4 Hybrid

Insuring a Toyota RAV4 Hybrid comes with several potential discounts that can help reduce your premium. Here are some common discounts available for hybrid vehicles.

- Green Vehicle Discount: Insurance companies often offer discounts for hybrid or electric vehicles to promote eco-friendly transportation.

- Safety Feature Discounts: Discounts are available for vehicles equipped with advanced safety features like those in the Toyota RAV4 Hybrid. For a comprehensive review, see our in-depth guide titled “Safety Features Car Insurance Discount.”

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowner’s or renter’s insurance, can result in a discount.

Taking advantage of these discounts can lead to significant savings on your Toyota RAV4 Hybrid insurance. The green vehicle discount rewards the eco-friendly nature of hybrids, while safety feature discounts acknowledge the reduced risk associated with advanced safety systems.

Bundling your insurance policies can provide further savings and streamline your insurance management. To maximize these benefits, contact your insurance provider to inquire about available discounts and ensure you’re getting the best possible rate for your specific circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving Record and Insurance Rates for the Toyota RAV4 Hybrid

Your driving record significantly impacts your Toyota RAV4 Hybrid insurance rates, as insurers assess your risk based on your history. Drivers with clean records, free of accidents or tickets, typically enjoy lower premiums, while those with a history of incidents face higher rates.

Practicing safe driving habits can help maintain a clean record and reduce insurance costs. Additionally, shopping around for the best insurance rates is essential.

Accidents can be scary, but knowing what to do after a crash can help you be better prepared for the unexpected. Take these 5 steps after an accident: https://t.co/pjrDcz9I4L pic.twitter.com/Zxc45LwVx3

— Farmers Insurance (@WeAreFarmers) February 29, 2024

Premiums vary between providers, so comparing quotes from multiple insurers can save you money. Researching and obtaining quotes also allows you to consider factors like customer service and claims satisfaction when selecting an insurance provider. For a detailed overview, refer to our extensive guide called “Your Insurance Agent’s Role in the Claims Process.”

Frequently Asked Questions

What is the average insurance cost for a Toyota RAV4 Hybrid in 2024?

The average insurance cost for a Toyota RAV4 Hybrid in 2024 is typically between $50 and $100 per month. Rates vary based on factors such as location, coverage level, and driving history.

How does the insurance cost of the 2024 Toyota RAV4 compare to other hybrids?

The insurance cost for the 2024 Toyota RAV4 is competitive with other hybrid models. While it may not always be the cheapest, its rates are generally reasonable due to its advanced safety features and lower environmental impact.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Is a Toyota RAV4 expensive to insure compared to the average insurance cost for a Toyota RAV4?

The Toyota RAV4’s insurance cost is considered moderate. While it may be higher than the average for other Toyota vehicles, this includes comprehensive coverage, which can increase premiums but offers extensive protection.

For a thorough analysis, consult our comprehensive guide named “What is comprehensive coverage?”

What factors influence the Toyota RAV4 insurance cost and the cheapest hybrid RAV4 options?

Toyota RAV4 insurance costs are influenced by factors like driving history, location, and coverage options. The cheapest hybrid RAV4 options typically offer lower insurance premiums due to their eco-friendly features and safety systems.

How much should I pay monthly for a 2024 RAV4 Hybrid and how much do you save with a RAV4 Hybrid?

Monthly payments for a 2024 RAV4 Hybrid usually range from $50 to $100. Opting for a hybrid model can lead to savings on insurance due to its fuel efficiency and lower risk profile.

What is the cheapest Toyota to insure and how does it compare to the 2024 RAV4 Hybrid?

The cheapest Toyota to insure is often the Toyota Corolla. Compared to the 2024 RAV4 Hybrid, the Corolla generally has lower insurance rates due to its lower value, repair costs, and often included road assistance features.

For an extensive exploration, refer to our detailed guide entitled “Roadside Assistance Coverage: A Complete Guide.”

How much is Toyota comprehensive car insurance for the 2024 RAV4 and what brands have the cheapest insurance?

Comprehensive car insurance for the 2024 RAV4 varies, reflecting its value and coverage needs. Brands like Farmers, State Farm, and Nationwide often offer competitive rates for Toyota vehicles.

How far can a 2024 RAV4 Hybrid go on a tank of gas and how does it affect Toyota RAV4 Hybrid car insurance costs?

The 2024 RAV4 Hybrid can travel approximately 600-700 kilometers on a full tank. Its fuel efficiency and lower environmental impact can positively influence insurance costs by reducing risk factors.

Is it worth buying a RAV4 Hybrid considering the insurance cost and how much is the RAV4 Hybrid per month?

Buying a RAV4 Hybrid can be worthwhile due to its potential savings on insurance and lower fuel costs. Monthly payments generally range between $50 and $100, and the hybrid’s efficiency can help offset higher injury-related insurance costs.

To gain further insights, consult our comprehensive guide titled “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

Will there be a 2024 RAV4 and what colors will it come in?

Yes, the 2024 RAV4 will be available with a variety of colors. Expect classic shades such as white, black, and silver, along with new options, depending on the model and trim level.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.