Cheap Chevrolet Bolt EV Car Insurance in 2026 (Big Savings With These 10 Companies!)

Nationwide, Safeco, and Progressive are our top picks for economical and cheap Chevrolet Bolt EV car insurance, beginning at $55 per month. These insurers prioritize delivering value-driven and comprehensive coverage plans, aiming to provide clients with peace of mind and robust security for their needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated October 2024

Company Facts

Min. Coverage for Chevrolet Bolt EV

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Bolt EV

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Bolt EV

A.M. Best Rating

Complaint Level

Pros & Cons

The Chevrolet Bolt EV is an innovative and eco-friendly electric vehicle that has gained popularity among car enthusiasts and environmentally conscious drivers. However, before purchasing this sleek and efficient car, it is crucial to consider the cost of car insurance. Enter your ZIP code now to begin.

- State Farm provides liability coverage beginning at just $55 per month

- Discover high-quality and affordable auto insurance options

- Depend on advisors to select the most economical car insurance policy

#1 – Nationwide: Top Overall Pick

Pros

- Affordability: Competitive rates starting at $55 per month, making it one of the most economical options. Learn more through our Nationwide insurance review.

- Customer Satisfaction: Nationwide is known for good customer service and a strong financial stability rating.

- Coverage Options: Offers comprehensive coverage options suitable for various needs, including electric vehicles.

Cons

- Availability: May not be available in all states or regions, limiting accessibility for some customers.

- Discounts: While competitive in pricing, may have fewer discount options compared to other providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Safeco: Best for Discount Options

Pros

- Affordability: Offers competitive rates starting at $57 per month, making it a budget-friendly option.

- Discount Opportunities: Provides various discounts, such as for safe driving and bundling policies, helping customers save further.

- Claims Satisfaction: Known for efficient claims processing and good customer satisfaction in handling claims.

Cons

- Coverage Limitations: Some policies may have limitations on coverage options compared to other providers.

- Regional Availability: Availability may vary by region, potentially limiting access for some customers. Read more through our Safeco insurance review.

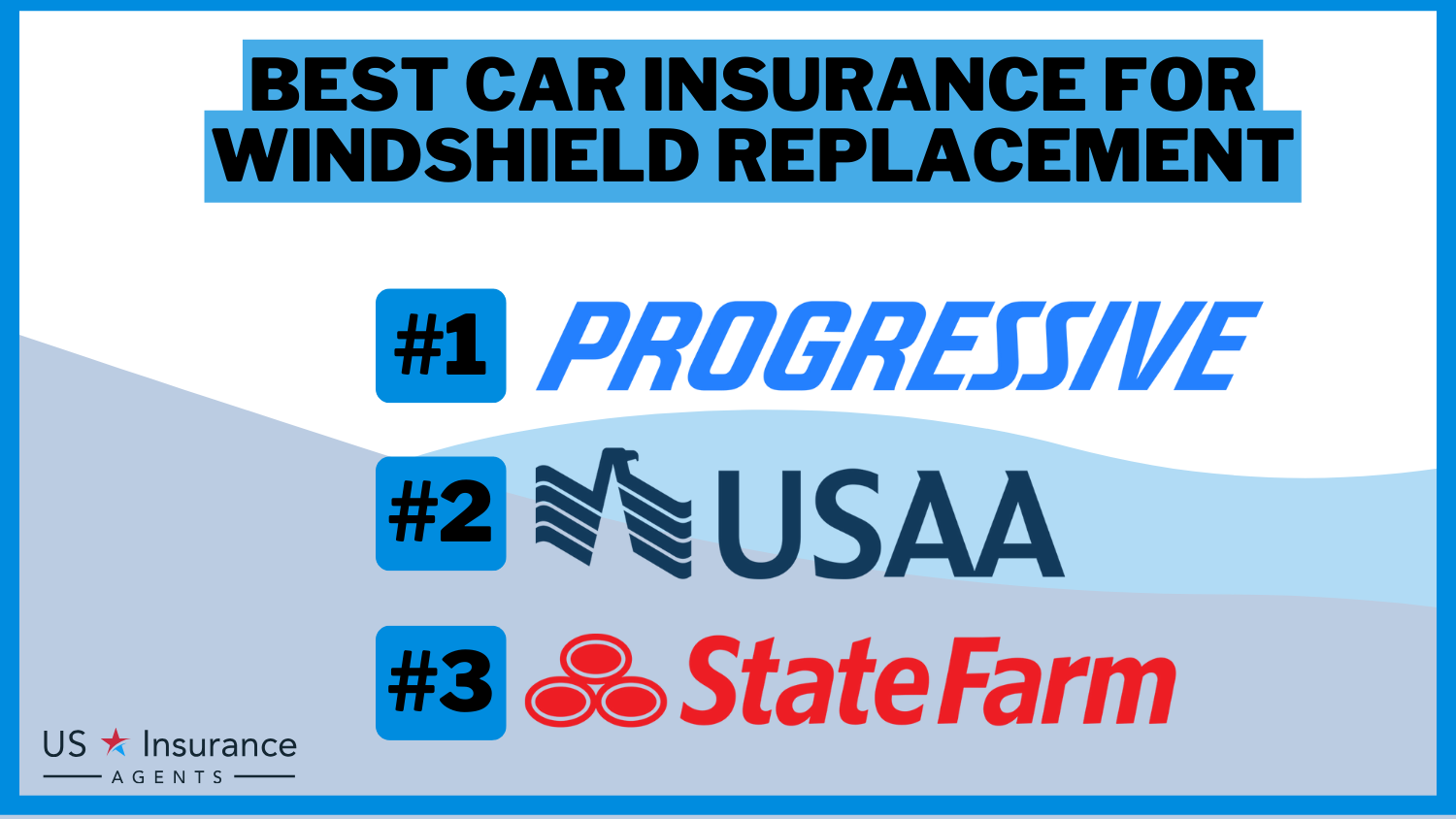

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Offers competitive rates starting at $60 per month, appealing to cost-conscious consumers.

- Technology: Provides advanced online tools and mobile app functionalities for managing policies and claims. Learn more through our Progressive insurance review.

- Bundle Discounts: Offers significant savings through bundling options with other insurance products.

Cons

- Customer Service: Mixed reviews regarding customer service experiences, with some customers reporting dissatisfaction.

- Claims Process: Claims processing time and complexity might be higher compared to other insurers.

#4 – American Family: Best for Loyalty Rewards

Pros

- Coverage Customization: Offers customizable coverage options to tailor insurance policies to individual needs.

- Customer Rewards: Provides loyalty rewards and incentives for long-term customers, enhancing customer retention.

- Financial Stability: Known for strong financial stability, providing reassurance to policyholders.

Cons

- Higher Premiums: Premiums start at $62 per month, slightly higher compared to some competitors. Read more through our American Family insurance review.

- Service Area: Limited availability in certain states or regions, restricting access for potential customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Customer Satisfaction

Pros

- Customer Service: High customer satisfaction ratings for personalized service and claims handling.

- Policy Options: Offers a wide range of policy options and customizable coverage to meet diverse needs.

- Stability: Strong financial stability and reputation for reliability in the insurance industry. Learn more through our Auto-Owners insurance review.

Cons

- Cost: Premiums start at $64 per month, which may be higher compared to more budget-friendly options.

- Availability: Limited availability in some states or regions, potentially limiting options for certain customers.

#6 – Travelers: Best for Safe Driver

Pros

- Competitive Rates: Offers competitive rates starting at $65 per month, appealing to budget-conscious consumers.

- Coverage Options: Provides a wide range of coverage options, including specialized protections for electric vehicles.

- Financial Strength: Strong financial stability and a good reputation in the insurance industry.

Cons

- Customer Service: Some mixed reviews regarding customer service experiences, with occasional reports of delays in claims processing.

- Discounts: While offers discounts, they may not be as extensive or widely available compared to other insurers. Learn more through our Travelers insurance review.

#7 – Farmers: Best for Usage Based

Pros

- Coverage Variety: Offers a variety of coverage options, including options specific to electric vehicles like the Chevrolet Bolt EV. Read more through our Farmers insurance review.

- Additional Features: Provides additional features such as roadside assistance and rental car reimbursement in comprehensive policies.

- Claims Handling: Generally good reputation for efficient claims processing and customer support.

Cons

- Cost: Premiums start at $68 per month, which may be higher compared to some competitors.

- Availability: Availability and coverage options may vary by state, potentially limiting choices for some customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Chubb: Best for High-Value Vehicles

Pros

- High-Value Vehicles: Specializes in insuring high-value vehicles like the Chevrolet Bolt EV, offering tailored coverage options.

- Coverage Options: Provides comprehensive coverage that includes specialized protections for luxury and electric vehicles.

- Customer Support: Known for excellent customer service and personalized assistance. Read more through our Chubb insurance review.

Cons

- Cost: Higher premium rates starting at $70 per month, making it one of the more expensive options on the list.

- Availability: Limited availability and may not be accessible to all consumers, especially in certain regions or states.

#9 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers accident forgiveness programs, allowing policyholders to maintain rates after an accident. Follow us more through our Liberty Mutual insurance review.

- Bundle Discounts: Provides significant savings through bundling home and auto insurance policies.

- Digital Experience: User-friendly website and mobile app for managing policies and claims.

Cons

- Cost: Premiums start at $72 per month, making it one of the more expensive options on the list.

- Customer Satisfaction: Mixed reviews regarding customer service quality and claims handling efficiency.

#10 – Allstate: Best for Bundling Options

Pros

- Bundling Options: Offers extensive bundling options with other insurance products, potentially reducing overall costs. Read more through our Allstate insurance review.

- Coverage Features: Comprehensive coverage options with additional perks like roadside assistance and rental car reimbursement.

- Brand Reputation: Well-known brand with a strong presence and good financial stability in the insurance market.

Cons

- Higher Premiums: Premiums start at $75 per month, which may be less competitive for budget-conscious consumers.

- Claims Experience: Some reports of delays in claims processing and customer service issues.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect Chevrolet Bolt EV Car Insurance Rates

Understanding the Insurance Coverage Options for a Chevrolet Bolt EV

Comparing Car Insurance Quotes for a Chevrolet Bolt EV

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Average Cost of Car Insurance for a Chevrolet Bolt EV

Frequently Asked Questions

What factors affect the cost of insurance for a Chevrolet Bolt EV?

The cost of insurance for a Chevrolet Bolt EV can be influenced by various factors such as the driver’s age, location, driving history, coverage limits, deductible amount, and the insurance company’s policies.

Are electric cars generally more expensive to insure than gasoline-powered cars?

Electric cars like the Chevrolet Bolt EV can sometimes be more expensive to insure due to their higher overall value, specialized parts, and potentially higher repair costs. However, insurance rates can vary depending on other factors as well. Enter your ZIP code now to begin.

Does the cost of insurance for a Chevrolet Bolt EV vary by location?

Are there any discounts available to help reduce the insurance cost for a Chevrolet Bolt EV?

Yes, there may be discounts available to help reduce the insurance cost for a Chevrolet Bolt EV. Some insurance companies offer discounts for safety features, such as advanced driver assistance systems, anti-theft devices, or for being a low-mileage driver. It’s best to check with individual insurance providers to see what discounts they offer.

Can I compare insurance quotes for a Chevrolet Bolt EV from different companies?

Yes, it is highly recommended to compare insurance quotes from different companies when insuring a Chevrolet Bolt EV. Insurance rates can vary significantly between providers, so obtaining multiple quotes allows you to find the best coverage options at the most competitive price. Enter your ZIP code now to start.

What are the starting monthly insurance rates for a Chevrolet Bolt EV with Nationwide, Safeco, and Progressive?

How does coverage for electric vehicles like the Chevrolet Bolt EV differ from traditional gasoline-powered cars?

Insurance for electric vehicles like the Chevrolet Bolt EV considers unique factors such as specialized parts, higher repair costs, and risks associated with battery technology and charging infrastructure.

What factors influence the cost of insurance for a Chevrolet Bolt EV, according to the article?

Insurance costs for a Chevrolet Bolt EV depend on factors like driver age, location, driving history, credit score, vehicle value, and selected coverage options (e.g., liability, comprehensive). Enter your ZIP code now to start.

Which insurance provider offers accident forgiveness programs for Chevrolet Bolt EV owners?

How does bundling insurance policies potentially reduce costs for insuring a Chevrolet Bolt EV?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.