Best Business Insurance for Record Stores in 2026 (Top 10 Companies)

State Farm, Allstate, and Nationwide have the best business insurance for record stores, offering competitive rates starting at $55 per month. These top picks stand out for their ability to offer customizable coverage designed to address the distinct requirements and potential risks faced by record stores.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her researching, writing, and communications talents in the areas of human resources...

Karen Condor

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage For Record Stores

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage For Record Stores

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage For Record Stores

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm, Allstate and Nationwide emerges as the top picks for the best business insurance options for record stores, offering competitive rates and tailored coverage.

The coverage options provided by these insurers demonstrate a remarkable level of flexibility, showcasing their ability to tailor policies precisely to meet the unique and varied needs of record stores.

Our Top 10 Company Picks: Best Business Insurance for Record Stores

| Company | Rank | Business Policy Discount | Commercial Property Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Customizable Coverage | State Farm | |

| #2 | 15% | 12% | Interruption Support | Allstate | |

| #3 | 12% | 8% | Retail Expertise | Nationwide |

| #4 | 10% | 5% | Local Assistance | Farmers | |

| #5 | 12% | 7% | Tailored Solutions | Liberty Mutual |

| #6 | 10% | 5% | Flexible Options | Progressive | |

| #7 | 15% | 8% | Industry Knowledge | Travelers | |

| #8 | 12% | 10% | Comprehensive Solutions | The Hartford |

| #9 | 10% | 5% | Personal Service | Auto-Owners | |

| #10 | 10% | 7% | Online Convenience | Safeco |

These insurers make sure every part of a record store’s business is protected. They cover things like customer accidents, inventory damage, and business interruptions, giving record store owners peace of mind.

Shield your business from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

#1 – State Farm: Top Overall Pick

Pros

- Customizable Coverage: State Farm stands out for its highly customizable coverage options, allowing businesses to tailor their insurance to specific needs.

- Generous Discounts: Offering up to 15% discounts, State Farm provides potential cost savings for record store owners.

- Reputation: State Farm insurance review & ratings highlight State Farm’s enduring reputation for dependability and integrity.

Cons

- Potentially Higher Rates: While customizable, State Farm’s coverage may come with a higher premium compared to some competitors.

- Complex Policy Options: The abundance of options might be overwhelming for businesses looking for a straightforward policy.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Interruption Assistance

Pros

- Interruption Support: Allstate insurance review & ratings highlight the company’s exceptional provision of interruption assistance, particularly beneficial for record stores encountering business disturbances.

- Competitive Discounts: Offering up to 15% discounts, Allstate ensures cost-effective solutions for businesses.

- Financial Stability: Allstate’s strong financial standing contributes to its reliability in covering potential claims.

Cons

- Slightly Higher Premiums: Some customers may find Allstate’s premiums slightly higher compared to other competitors.

- Customer Service Feedback: While generally positive, there are occasional reports of less-than-ideal customer service experiences.

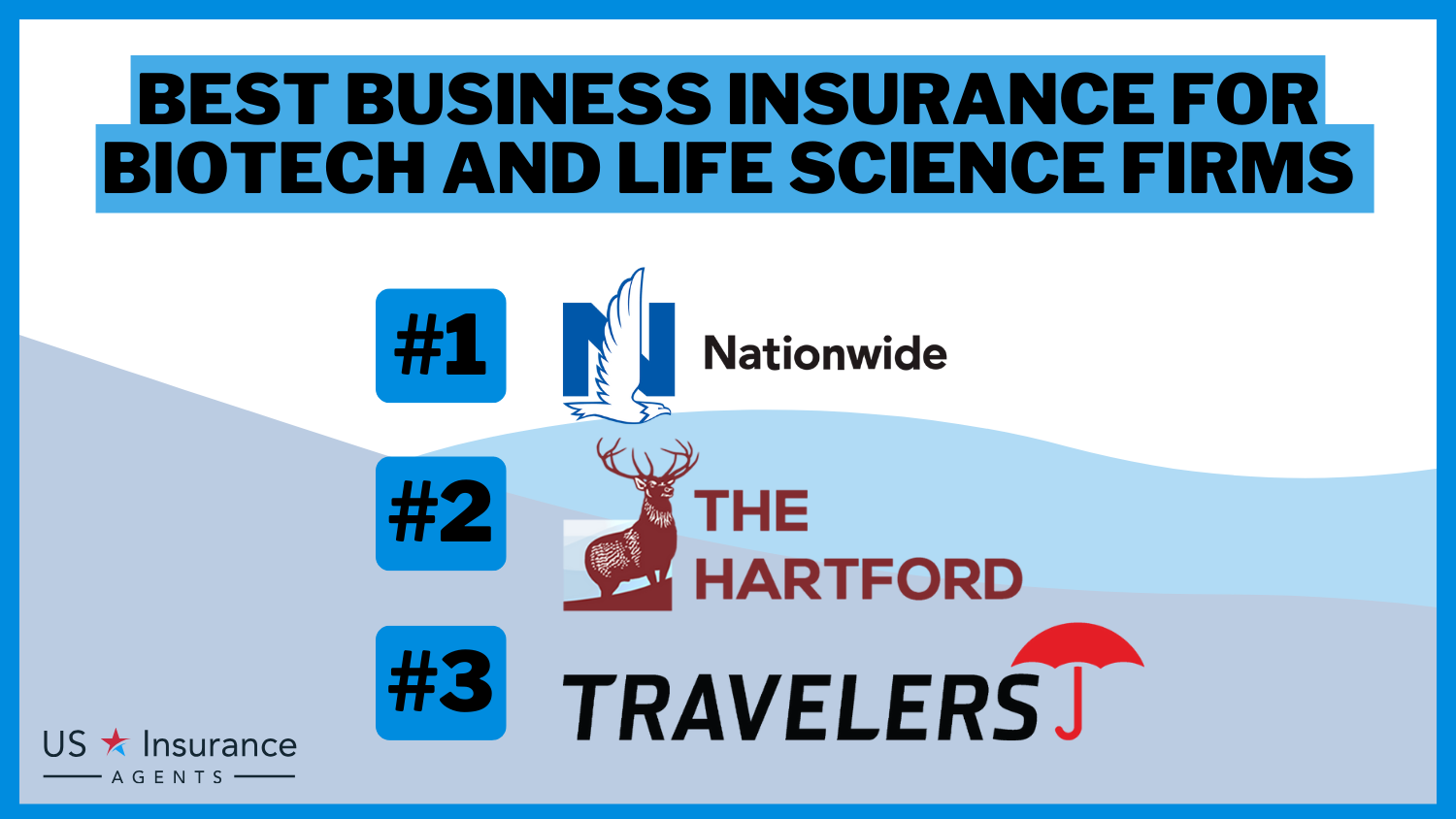

#3 – Nationwide: Best for Navigating Retail

Pros

- Retail Expertise: Nationwide specializes in retail expertise, catering specifically to the needs of record stores.

- Competitive Discounts: Nationwide insurance review & ratings show that the company offers appealing savings of up to 12% through discounts.

- Strong Financial Rating: Nationwide’s A+ rating ensures confidence in its ability to cover potential claims.

Cons

- Limited Customization: Nationwide’s coverage may be less customizable compared to some competitors.

- Average Customer Service: While generally satisfactory, customer service may not stand out as a strong suit.

#4 – Farmers: Best for Local Assistance

Pros

- Local Assistance: Farmers insurance review & ratings shine in delivering specialized assistance, particularly valuable for businesses requiring localized support.

- Competitive Discounts: Competitive discounts of up to 10% contribute to cost-effective insurance solutions.

- Varied Coverage Options: Farmers offers a diverse range of coverage options, accommodating different business needs.

Cons

- Policy Complexity: Some businesses may find Farmers’ policy options more complex than desired.

- Potentially Higher Premiums: While offering discounts, Farmers’ premiums may be relatively higher in some cases.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Tailored Solutions

Pros

- Tailored Solutions: Liberty Mutual stands out for its commitment to providing tailored solutions, ensuring comprehensive coverage.

- Competitive Discounts: Liberty Mutual insurance review & ratings highlight significant cost savings for businesses, with competitive discounts of up to 12% playing a crucial role.

- Financial Stability: Liberty Mutual’s financial stability enhances its reliability in covering potential claims.

Cons

- Slightly Higher Premiums: Some businesses may find Liberty Mutual’s premiums slightly higher compared to other competitors.

- Claim Processing Time: Occasional reports suggest longer wait times for claim processing, affecting reimbursement speed.

#6 – Progressive: Best for Flexible Options

Pros

- Flexible Options: Progressive offers flexibility in coverage options, allowing businesses to tailor insurance to specific needs.

- Business Discounts: Progressive insurance review & ratings highlight substantial savings for businesses through competitive discounts of up to 10%, driving down overall costs.

- User-Friendly Tools: Progressive provides easy-to-use online tools for seamless policy management.

Cons

- Customer Service Feedback: While generally positive, there are occasional reports of less-than-ideal customer service experiences.

- Limited Local Assistance: Businesses seeking extensive on-the-ground support may find Progressive’s offerings less comprehensive.

#7 – Travelers: Best for Industry Expertise

Pros

- Industry Knowledge: Travelers insurance review & ratings focuses on industry expertise, providing tailored knowledge to suit the requirements of record stores.

- Competitive Discounts: Competitive discounts of up to 15% contribute to overall cost savings for businesses.

- Comprehensive Coverage: Travelers provides comprehensive solutions, ensuring thorough protection for record stores.

Cons

- Claim Processing Time: Some customers report longer waiting times for claim processing, affecting reimbursement speed.

- Policy Complexity: Travelers’ policy options may be intricate for businesses seeking straightforward coverage.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Comprehensive Solutions

Pros

- Comprehensive Solutions: The Hartford excels in providing comprehensive solutions, ensuring thorough coverage for record stores.

- Competitive Discounts: Businesses can achieve significant cost savings through competitive discounts, which can reach up to 12%, as part of The Hartford insurance review & ratings.

- Financial Stability: The Hartford’s strong financial standing enhances its reliability in covering potential claims.

Cons

- Policy Complexity: Some businesses may find The Hartford’s policy options more complex than desired.

- Potentially Higher Premiums: While offering discounts, The Hartford’s premiums may be relatively higher in some cases.

#9 – Auto-Owners: Best for Personal Specialist

Pros

- Personal Service: Auto-Owners insurance review & ratings highlight the company’s standout performance in delivering tailored service, characterized by a hands-on approach to insurance provision.

- Competitive Discounts: Competitive discounts of up to 10% contribute to overall cost savings for businesses.

- Financial Stability: Auto-Owners’ strong financial standing enhances its reliability in covering potential claims.

Cons

- Limited Online Convenience: Businesses seeking extensive online tools may find Auto-Owners’ offerings less comprehensive.

- Potentially Higher Premiums: While offering discounts, Auto-Owners’ premiums may be relatively higher in some cases.

#10 – Safeco: Best for Online Convenience

Pros

- Online Convenience: Safeco stands out for its online convenience, offering user-friendly tools for seamless policy management.

- Competitive Discounts: Safeco insurance review & ratings highlight substantial savings opportunities with competitive discounts, potentially reducing business expenses by up to 10%.

- Financial Stability: Safeco’s strong financial standing enhances its reliability in covering potential claims.

Cons

- Limited Local Assistance: Localized support from Safeco may not be as extensive as with some other providers.

- Policy Complexity: Some businesses may find Safeco’s policy options more complex than desired.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Protect Your Record Store With General Liability Insurance

General liability insurance is a crucial component of business insurance for record stores. It provides essential coverage against a wide range of risks that could potentially arise in your day-to-day operations. Here are some key points to understand about general liability insurance:

- Accidental Injuries: If a customer gets hurt in your store, this insurance can cover their medical expenses and protect you from potential lawsuits.

- Property Damage: If customer property gets damaged in your store, whether due to accidents or disasters, this insurance helps cover the costs of repair or replacement.

- Advertising Claims: If a competitor accuses your marketing of defaming their business and sues you, general liability insurance covers your legal fees and potential damages.

- Product Liability: If a customer claims that a product you sold caused them harm, this insurance covers legal expenses and potential damages from product liability lawsuits.

Having general liability insurance for your record store is not only a smart financial decision but also offers peace of mind. It acts as a safety net, ensuring that you can focus on providing excellent service and a memorable experience to your customers, knowing that you have coverage in place.

Jeff Root Licensed Life Insurance Agent

Remember, every business is unique, so it’s essential to consult with insurance providers who understand the specific needs of record stores to customize your coverage accordingly.

Essential Business Insurance Coverage for Record Stores

As a record store owner, it’s important to have the right types of insurance coverage to protect your business. In addition to general liability insurance, there are other key types of coverage you should consider:

- Commercial Property Insurance: This insurance protects your record store’s building, inventory, and equipment from damage or loss caused by fire, theft, or natural disasters.

- Product Liability Insurance: If a customer claims that a product you sold them caused injury or damage, product liability insurance covers the legal fees and potential settlements or damages.

- Workers’ Compensation Insurance: Workers’ compensation required by most states, workers’ compensation insurance provides coverage for medical expenses and lost wages if an employee gets injured or becomes ill while working.

- Commercial Umbrella Insurance: This type of insurance provides additional liability coverage beyond the limits of your general liability policy, giving you extra protection in case of major accidents or lawsuits.

Having these additional coverage options ensures that your record store is well-protected from various risks, allowing you to focus on running your business with peace of mind.

Business Insurance for Record Stores: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $60 | $92 |

| Auto-Owners | $65 | $160 |

| Farmers | $70 | $170 |

| Liberty Mutual | $62 | $155 |

| Nationwide | $58 | $100 |

| Progressive | $55 | $140 |

| Safeco | $63 | $158 |

| State Farm | $59 | $86 |

| The Hartford | $61 | $152 |

| Travelers | $57 | $143 |

Business insurance rates for record stores vary by coverage level and insurer. State Farm offers competitive rates, with minimum coverage at $59 and full coverage at $86 per month, while Nationwide and Progressive also provide affordable options.

Determining the Cost of General Liability Insurance for Record Stores

General liability insurance costs for record stores vary based on factors like size and location. On average, stores spend $300 to $600 annually for $1 million coverage, but individual rates can differ due to factors such as revenue, claims history, and coverage choices. Factors that can influence the cost of general liability insurance for record stores include:

- Store Size and Location: The physical size of the store and its location can impact insurance premiums, with larger stores or those located in high-risk areas often facing higher rates due to increased exposure to potential risks.

- Annual Revenue and Sales Volume: Insurance premiums may be influenced by a store’s annual revenue and sales volume, as higher revenue can indicate greater exposure to liability risks and potential claims.

- Previous Insurance Claims: A record store’s history of insurance claims can affect premiums, with a higher frequency or severity of past claims potentially leading to increased rates as insurers perceive a higher risk of future claims. To deepen your comprehension, delve into our extensive guide on auto insurance entitled “Your Insurance Agent’s Role in the Claims Process.”

- Coverage Limits and Deductibles: he coverage limits chosen for general liability insurance and the deductible amount selected can impact premiums. Higher coverage limits and lower deductibles typically result in higher premiums, while lower coverage limits and higher deductibles may lead to lower premiums.

- Risk Management Practices: Insurers consider a store’s risk management practices when determining premiums. Implementing effective risk management strategies, such as maintaining a safe environment for customers and employees, can potentially lead to lower insurance rates by reducing the likelihood of claims.

Record stores can save on general liability insurance by bundling it with other coverages in a Business Owner’s Policy (BOP), which combines various insurances into a comprehensive package for potential cost savings.

When considering the cost of general liability insurance, it’s crucial to compare rates from different insurers to ensure you’re getting the best coverage at the most competitive price for your record store.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Business Insurance Rates for Record Stores

When it comes to securing business insurance for your record store, it’s crucial to find the best rate that offers comprehensive coverage. To help you in your search, consider the following four steps:

- Research and compare. Look into multiple insurance providers that specialize in coverage for record stores. Compare their rates and coverage options to find the most suitable one.

- Request customized quotes. Contact the insurance providers you’re interested in and ask for personalized quotes based on your record store’s needs. Inquire about any available discounts or bundle options. To access more details, compare our online quotes using “Insurance Quotes Online.”

- Compare rates and policy features. Carefully review the quotes you receive, comparing rates and policy features. Consider coverage limits, deductibles, and any additional services offered.

- Read reviews and recommendations. Read reviews and seek recommendations from other record store owners who have used the insurance providers you’re considering. Their experiences can offer valuable insights.

Conduct thorough research to find the best business insurance rate for your record store, and regularly review coverage to ensure it meets evolving needs. Gain peace of mind by safeguarding your store with adequate coverage.

Essential Measures for Safeguarding Your Record Store Business

To safeguard your record store comprehensively, adopt six key measures: proactively fortify security, update insurance coverage, and prioritize the safety of your business, staff, and valuable inventory.

Melanie Musson Published Insurance Expert

Implementing proactive security measures and regularly updating insurance coverage enhances your record store’s resilience, safeguarding against potential risks and ensuring sustained success in the long term. Here are the additional six steps to consider:

- Enhance physical security. Install a reliable securiy system, including surveillance cameras and alarm systems, to deter theft and unauthorized access. Adequate lighting inside and outside the store can also help deter criminal activities. Check out our ranking of the top providers: Best Business Insurance for Alarm Companies

- Train your staff. Provide comprehensive training on security protocols, emergency procedures, and the proper handling of valuable inventory. Encourage employees to report any suspicious activities promptly.

- Fire safety precautions. Install fire detection and suppression systems, such as smoke detectors and fire extinguishers. Regularly inspect and maintain these systems, and educate your staff on fire safety protocols and evacuation procedures.

- Protect digital assets. Implement strong cybersecurity measures to safeguard customer data, financial information, and any digital inventory management systems. Use secure networks, firewalls, and antivirus software.

- Review insurance coverage. Regularly assess and update your insurance coverage to reflect the current value of your inventory, equipment, and business operations. Work with an insurance professional to ensure you have adequate coverage.

- Maintain a clean and organized environment. Keep your record store clean, well-maintained, and free of hazards. Regularly address maintenance issues and practice proper housekeeping to reduce the risk of accidents.

Enhance your record store’s resilience with proactive security measures and updated insurance coverage for long-term success. Secure premises, educate staff, and regularly assess safeguards to mitigate potential risks.

Case Studies: Real-Life Examples of Business Insurance for Record Stores

- Case Study #1 – General Liability Insurance: Alex, a record store owner, had a new location. When an employee caused a customer’s injury, Alex’s general liability insurance covered medical expenses, preventing a lawsuit and preserving the store’s financial stability.

- Case Study #2 – Commercial Property Insurance: Sarah’s record store swiftly recovered from a fire thanks to commercial property insurance, covering inventory replacement and repairs, ensuring minimal financial impact and uninterrupted operations. For a comprehensive grasp, consult our in-depth analysis titled “Is Electric a good insurance company?“

- Case Study #3 – Product Liability Insurance: Mike, a record store owner, expanded his offerings to include vintage record players. When a malfunctioning player damaged a customer’s vinyl collection, Mike’s product liability insurance covered legal fees and compensated for damages, shielding his business from financial risk.

- Case Study #4 – Workers’ Compensation Insurance: Lisa’s record store employee, Mark, slipped and injured his back while stocking shelves, necessitating medical treatment and time off. Workers’ compensation insurance covered his medical bills and provided wage replacement, ensuring financial stability for both Mark and the store during his absence.

By mitigating financial risks associated with employee injuries, property damage, or other liabilities, insurance ensures the continuity of operations even in the face of adversity.

Laura Walker Former Licensed Agent

Remember, protecting your business with the right insurance coverage is key to ensuring its longevity and success. Stay tuned for more case studies and insights in the world of business insurance.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rounding Off: Protect Your Record Store With Business Insurance

Business insurance is essential for protecting your record store against risks like accidents and property damage, with options such as general liability, commercial property, product liability, and workers’ compensation coverage providing tailored protection.

Enhance your record store’s safety and resilience with security measures, fire safety protocols, and regular insurance reviews; compare quotes for the best coverage and invest in business insurance for long-term success and peace of mind.

Cheap commercial insurance coverage is just a click away. Insert your ZIP code into our free tool below to compare quotes from highly rated insurers.

Frequently Asked Questions

Should you insure your record collection?

Records are fragile Although some of your collection may be difficult, if not impossible to replace, or hold an emotional rather than financial significance, a good insurance policy will at least financially compensate you and make losing some of your collection easier.

Can I add additional coverage to my business insurance policy as my record store grows?

Yes, most insurance providers offer the flexibility to add or adjust coverage to meet your evolving business needs. As your record store expands, you can consider adding coverage such as business interruption insurance or cyber liability insurance for enhanced protection.

Enter your ZIP code below to get started on comparing business insurance quotes.

Is business insurance required for my record store even if it’s a small, home-based operation?

Yes, even small, home-based record stores can benefit from business insurance. General liability insurance, for example, can protect against customer injuries or property damage that may occur on your premises.

Take a look at our list of the leading service providers: Best Business Insurance for Home-Based Businesses

What is the best way to keep a record collection?

No matter where the records are stored, avoid stacking them horizontally at all costs. The pressure from the weight of the vinyl’s on top of one another can cause damage. Always place them vertically, as you would with books.

How do you take care of a record collection?

This means being extra cautious and mindful when the records are in between being played and in storage.

How do I get my record collection insured?

So, if your collection is large and valuable, it would be best to buy a separate policy since the value of each record may exceed the maximum coverage limit provided under your standard home insurance policy (learn more in Personal Property Floaters 101).

For a thorough understanding, refer to our detailed analysis titled “Homeowners Insurance: A Complete Guide.”

How can insurance lessen the risk in a business?

Adopting insurance policies encourages businesses to implement good risk management practices. By identifying areas of concern, insurance in risk management can cover businesses and establish safety measures, protocols, and compliance standards that minimize the likelihood of incidents occurring.

What does general insurance cover?

General insurance covers non-life assets, such as your home, vehicle, health, and travel. You get compensation for damages or losses incurred due to flood, fire, theft, accidents, or any man-made disasters.

What insurance is most important for a business?

General liability insurance, also known as business or commercial liability insurance, is essential coverage for various claims, including bodily injury, property damage, personal or advertising injury, medical payments, products-completed operations, and damages to premises rented to you.

To enhance your understanding, explore our comprehensive resource titled “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

Does errors and omissions insurance cover?

E&O insurance is a kind of specialized liability protection against losses not covered by traditional liability insurance. It protects you and your business from claims if a client sues for negligent acts, errors or omissions committed during business activities that result in a financial loss.

Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.