Best Business Insurance for Roller Skating Rinks in 2026 (Top 10 Companies)

Nationwide, The Hartford, and Liberty Mutual are the top picks for the best business insurance for roller skating rinks, with rates starting at $85 monthly. These insurers offer tailored coverage for roller skating rinks, providing comprehensive protection against accidents, injuries, and property damage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2025

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Roller Skating Rinks

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage for Roller Skating Rinks

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Roller Skating Rinks

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

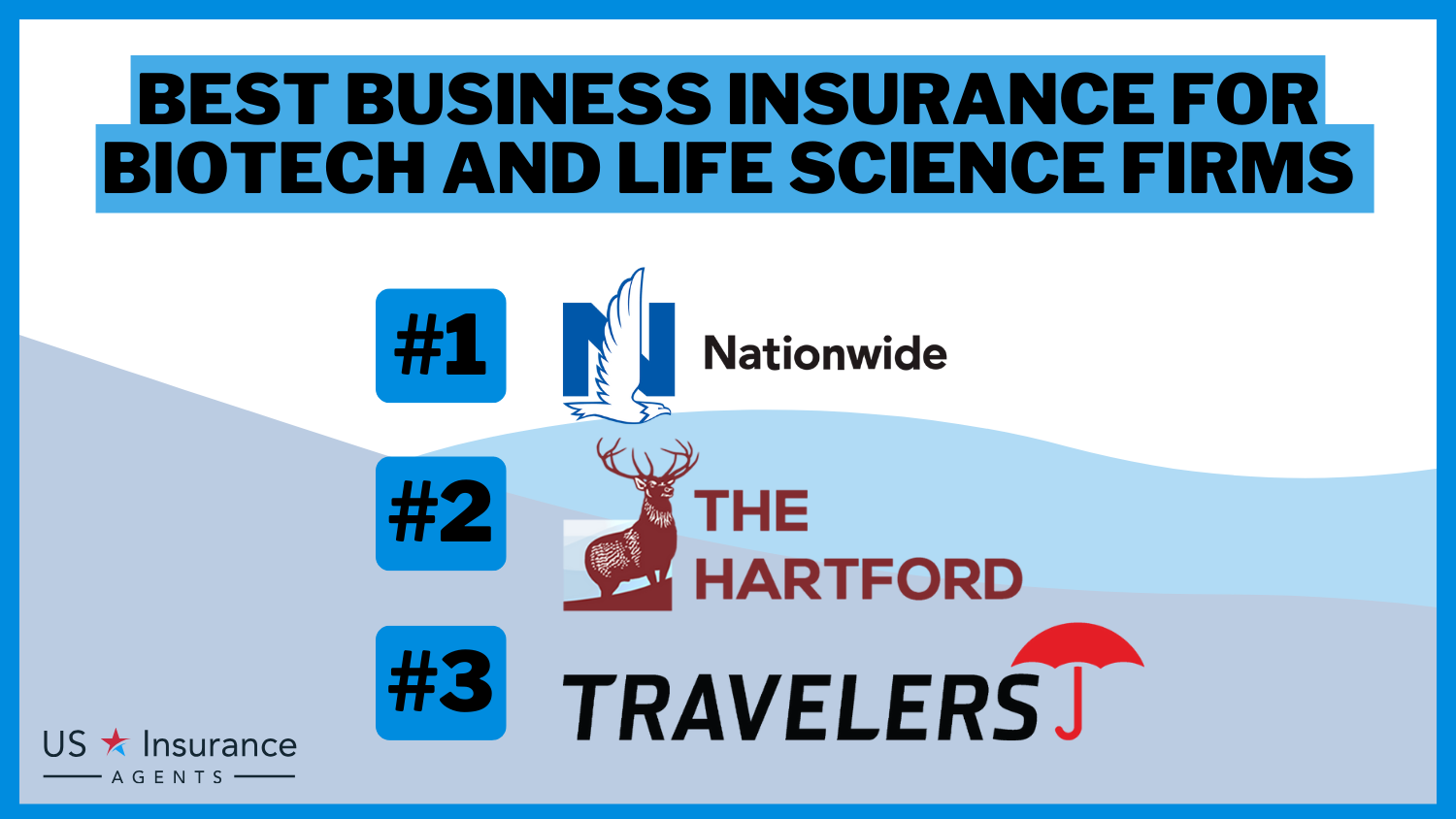

Our Top 10 Company Picks: Best Business Insurance for Roller Skating Rinks

| Company | Rank | A.M Best | Industry Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A+ | 10% | Specialized Coverage | Nationwide |

| #2 | A+ | 8% | Comprehensive Policies | The Hartford |

| #3 | A | 7% | Customized Solutions | Liberty Mutual |

| #4 | A++ | 5% | Industry Experience | State Farm | |

| #5 | A | 5% | Risk Management | Farmers | |

| #6 | A+ | 5% | Flexible Policies | Progressive | |

| #7 | A+ | 10% | Loss Prevention | Travelers | |

| #8 | A+ | 7% | Customer Service | Allstate | |

| #9 | A++ | 5% | Local Support | Auto-Owners | |

| #10 | A | 5% | Online Convenience | Safeco |

These insurers stand out with versatile coverage options, industry expertise, and exceptional customer satisfaction, ensuring roller skating rink owners can glide confidently into the future.

Protect your company and employees with adequate coverage — enter your ZIP code above to instantly compare commercial insurance quotes with our free comparison tool.

#1 – Nationwide: Top Overall Pick

Pros

- Specialized Coverage: Nationwide insurance review & ratings highlight its notable provision of customized coverage tailored to meet the distinct requirements of roller skating rinks.

- High A+ Rating: With an A+ rating from A.M. Best, Nationwide demonstrates financial strength, instilling confidence in their ability to fulfill claims.

- Generous Discounts: Roller skating rink owners can benefit from up to 10% discounts, enhancing affordability.

Cons

- Potentially Higher Rates: While offering specialized coverage, Nationwide’s rates might be comparatively higher for businesses on a tight budget.

- Limited Online Convenience: Some users may find that Nationwide’s online services lack the convenience and features offered by other providers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – The Hartford: Best for Holistic Assurance

Pros

- Comprehensive Policies: The Hartford provides comprehensive insurance policies, ensuring roller skating rinks have a broad range of coverage.

- A+ Rating: With an A+ rating, The Hartford insurance review & ratings showcases financial stability, assuring customers of reliable insurance services.

- Competitive Rates: Roller rink owners can enjoy up to 8% discounts, making The Hartford an attractive option in terms of affordability.

Cons

- Average Customer Reviews: While financially stable, The Hartford might receive mixed customer reviews, indicating potential areas for improvement.

- Less Customization: Some businesses might find The Hartford’s policies less customizable compared to other providers.

#3 – Liberty Mutual: Best for Personalized Solutions

Pros

- Customized Solutions: Liberty Mutual excels in providing customized insurance solutions, catering to the specific needs of roller skating rinks.

- Solid A Rating: Liberty Mutual Insurance review & ratings highlight the company’s strong financial stability, evidenced by an A rating, ensuring their capability to fulfill policyholder obligations.

- Overall Discounts: Roller rink owners can enjoy competitive rates with up to 7% discounts, enhancing overall affordability.

Cons

- Average A Rating: While strong, Liberty Mutual’s A rating may not be as high as some competitors, potentially impacting customer perceptions.

- Complex Policies: Some businesses might find Liberty Mutual’s policies more complex and less straightforward than those of other providers.

#4 – State Farm: Best for Industry Expertise

Pros

- Exceptional A++ Rating: State Farm boasts the highest A++ rating, showcasing unparalleled financial stability and reliability.

- Industry Experience: State Farm insurance review & ratings highlight its expertise in addressing the unique obstacles encountered by roller skating rinks, underscoring its deep industry knowledge.

- Competitive Discounts: While not the highest, State Farm offers competitive discounts to make coverage more affordable.

Cons

- Limited Discounts: Compared to some competitors, State Farm’s discount offerings might be less enticing for cost-conscious businesses.

- Less Specialized Coverage: The emphasis on industry experience might mean State Farm’s coverage isn’t as tailored to the unique risks of roller skating rinks.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Risk-Managed Assurance

Pros

- A Rating: Farmers insurance review & ratings are strong, with a solid A rating indicating financial stability and the ability to fulfill obligations.

- Risk Management Focus: Farmers excels in risk management strategies, providing roller skating rinks with tools to mitigate potential challenges.

- Competitive Discounts: Roller rink owners can benefit from up to 5% discounts, contributing to overall affordability.

Cons

- Average Ratings: While stable, Farmers’ A rating might be considered average compared to providers with higher ratings.

- Less Specialization: Farmers may not provide as specialized coverage for roller skating rinks as some competitors.

#6 – Progressive: Best for Flexibility

Pros

- A+ Rating: Progressive insurance review & ratings showcase a robust A+ score, reflecting its financial stability and dependable service in meeting policyholder requirements.

- Flexible Policies: Progressive stands out for offering flexible insurance policies, allowing roller skating rinks to tailor coverage to their unique requirements.

- Competitive Discounts: While not the highest, Progressive provides competitive discounts to enhance affordability.

Cons

- Limited Discounts: Some businesses may find that Progressive’s discount offerings are not as generous as those of other providers.

- Mixed Customer Reviews: Progressive may receive mixed customer reviews, suggesting varying experiences with their services.

#7 – Travelers: Best for Preventing Loss

Pros

- A+ Rating: Travelers insurance review & ratings showcase a robust A+ rating, indicating strong financial stability and dependability specifically tailored for roller skating rinks.

- Significant Discounts: With up to 10% discounts for loss prevention, Travelers offers substantial savings on insurance premiums.

- Loss Prevention Focus: Travelers excels in loss prevention strategies, helping roller rinks proactively mitigate risks.

Cons

- Potentially Higher Base Rates: While discounts are significant, Travelers’ base rates might be higher compared to some competitors.

- Complex Policies: Some businesses might find Travelers’ policies more intricate, potentially leading to confusion.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Customer Service

Pros

- A+ Rating: Allstate insurance review & ratings showcase a robust A+ score, guaranteeing customers financial security and dependability.

- Overall Discounts: With discounts focused on customer service, Allstate provides cost savings for roller skating rinks.

- Customer Service Excellence: Allstate is recognized for its excellent customer service, offering support when it’s needed most.

Cons

- Average Ratings: While stable, Allstate’s A+ rating might be considered average compared to providers with higher ratings.

- Limited Local Support: Some businesses might find Allstate’s local support options less comprehensive compared to certain competitors.

Read more:

#9 – Auto-Owners: Best for Local Security

Pros

- Exceptional A++ Rating: Auto-Owners holds the highest A++ rating, assuring roller rinks of unparalleled financial stability.

- Competitive Discounts: Auto-Owners insurance review & ratings highlight the company’s competitive discounts, which enhance its overall affordability.

- Emphasis on Local Support: With a focus on local support, Auto-Owners provides personalized assistance to roller skating businesses.

Cons

- Less Online Convenience: Businesses that prioritize online interactions may find Auto-Owners’ online services less convenient.

- Limited Specialization: Auto-Owners might not offer as specialized coverage for roller skating rinks as some competitors.

#10 – Safeco: Best for Convenient Access

Pros

- A Rating: Safeco maintains a solid A rating, indicating financial stability and the ability to meet policyholder obligations.

- Overall Discounts: Roller skating rinks can benefit from competitive discounts, contributing to overall affordability.

- Online Convenience: Safeco insurance review & ratings highlight Safeco’s strong suit in offering convenient online services, simplifying insurance management for businesses.

Cons

- Average Ratings: While stable, Safeco’s A rating might be considered average compared to providers with higher ratings.

- Potentially Less Personalized Service: Some businesses may find Safeco’s services less personalized compared to certain competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Ideal Business Insurance for Roller Skating Rinks

General liability insurance is crucial for roller skating businesses as it covers a wide range of risks. This policy protects against accidents, injuries, and property damage caused by the business’s operations.

Jeff Root Licensed Life Insurance Agent

However, it’s important to note that additional coverage may be necessary to address all potential risks. Apart from general liability insurance, roller skating businesses can benefit from purchasing additional coverage:

- Property Insurance: If you own the building where your roller skating business operates, property insurance is essential to protect the structure, build-outs, and equipment.

- Workers’ Compensation Insurance: If your business has employees, workers’ compensation insurance is necessary to cover medical care and lost wages resulting from work-related injuries or illnesses.

- Business Interruption Insurance: This coverage provides financial assistance to compensate for revenue losses after a covered incident, allowing your business to recover and reopen.

- Liquor Liability Insurance: If your roller skating rink includes a bar, liquor liability insurance is important to cover alcohol-related incidents, as required by many states. To gain further insights, consult our comprehensive guide titled “Restaurant & Bar Business Insurance: A Complete Guide.”

By prioritizing comprehensive coverage that addresses the specific risks inherent to your establishment, you can glide confidently towards success while safeguarding your business and patrons alike.

Understanding the Cost of General Liability Insurance for Roller Skating Rinks

Choosing the right insurer is crucial for protecting your roller skating rink. Opt for online insurers for affordability and convenience. Compare providers specializing in recreational businesses to understand roller rink risks. Research customer reviews and financial stability for reliability, ensuring optimal coverage and peace of mind.

When insuring your roller skating business, understanding the cost of general liability insurance is crucial. Costs typically range between $300 and $800 annually for $1 million coverage, influenced by factors like location and claims history.

Optimize savings and coverage with a Business Owner’s Policy (BOP), bundling liability, business interruption, and property insurance. Streamline insurance needs, unlock potential discounts, and ensure comprehensive protection aligned with your budget.

Business Insurance for Roller Skating Rinks: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $90 | $170 |

| Auto-Owners | $95 | $175 |

| Farmers | $100 | $180 |

| Liberty Mutual | $92 | $172 |

| Nationwide | $88 | $168 |

| Progressive | $85 | $165 |

| Safeco | $93 | $173 |

| State Farm | $89 | $169 |

| The Hartford | $91 | $171 |

| Travelers | $86 | $166 |

Explore competitive monthly insurance rates for roller skating rinks, ranging from $85 to $100 for minimum coverage and $165 to $180 for full coverage. Choose the best option for your needs and budget, securing financial stability while keeping the rink thriving with excitement for patrons.

Protecting Your Roller Skating Business

General liability insurance serves as a crucial safeguard for your roller skating business, offering protection in a myriad of situations. From bustling skate sessions to vibrant events, protecting your roller skating business involves understanding the risks and implementing the right insurance coverage to mitigate them.

- Rental Equipment Accident: If a customer’s rented skate malfunctions and causes an injury, general liability insurance would likely cover legal fees and settlements. For additional details, explore our comprehensive resource titled “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

- Customer Injury: In cases where a customer is injured due to negligence, such as poor lighting or inadequate warnings, general liability insurance can provide coverage.

- Liability for Negligence: If employees fail to inform a customer about potential risks, leading to an injury, general liability insurance may cover settlements or compensation.

With the right strategies in place, your rink can continue to be a thriving hub of excitement and enjoyment for patrons, ensuring a bright and prosperous future ahead.

Melanie Musson Published Insurance Expert

By prioritizing safety measures and securing comprehensive insurance coverage, you can safeguard your roller skating business against potential risks and uncertainties.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Proactive Measures for Roller Skating Rinks: Strengthening Business Protection

In addition to having the right insurance coverage, implementing proactive measures is essential to safeguard your roller skating business. Consider the following steps to enhance business protection:

- Implement safety protocols. Establish comprehensive safety protocols and procedures to minimize accidents and injuries. Regularly inspect and maintain skating equipment, rink surfaces, and facilities to ensure a safe environment for customers and employees.

- Employee training. Provide thorough training to your staff on safety procedures, emergency response protocols, and effective customer interaction. Empower them with the knowledge and skills to handle various situations and promote a culture of safety within your business.

- Enhanced security measures. Invest in appropriate security systems, including surveillance cameras, alarm systems, and access controls, to deter theft, vandalism, and unauthorized entry. Regularly assess and update these measures to stay ahead of potential security threats. Check out our ranking of the top providers: Best Business Insurance for Alarm Companies

- Document and maintain records. Keep detailed records of incidents, repairs, and safety measures implemented. This documentation can be invaluable in case of an insurance claim or legal dispute, providing evidence of your commitment to maintaining a safe environment.

By implementing these proactive measures, you can minimize risks, protect your customers and employees, and demonstrate your dedication to maintaining a secure and enjoyable roller skating experience.

With a commitment to proactive risk management, your roller skating business can continue to thrive as a cherished community destination for years to come.

Case Studies: Business Insurance in Action for Roller Skating Rinks

Whether it’s liability coverage for injuries sustained on the premises or property insurance for equipment damage, delving into these examples illuminates the importance of tailored insurance solutions in ensuring the resilience and continuity of roller skating businesses.

- Case Study #1 – Tailored Protection for a Thriving Roller Rink: A bustling city’s popular roller skating rink chose Nationwide for comprehensive insurance, benefitting from tailored protection and a 10% discount. Nationwide’s A+ rating and commitment to understanding the rink’s needs provided peace of mind, ensuring reliable and affordable coverage.

- Case Study #2 – Holistic Assurance for Diverse Roller Rink Needs: In a suburban town, a new roller skating business found comprehensive insurance with The Hartford, offering tailored policies for diverse needs. With an A+ rating and up to 8% discount, The Hartford provided financial stability and flexible coverage, becoming the top choice for roller rink owners seeking holistic assurance.

- Case Study #3 – Personalized Solutions for a Unique Roller Skating Experience: In a quaint town, a family-owned roller skating rink sought insurance tailored to its needs. Liberty Mutual offered A-rated coverage with tailored solutions and up to 7% discounts, ensuring financial stability and personalized support for every skater.

By prioritizing comprehensive insurance coverage, you can effectively safeguard your business against unforeseen events and liabilities, ensuring its resilience and longevity. To learn more, explore our comprehensive resource titled “Liability Insurance: A Complete Guide.”

Laura Walker Former Licensed Agent

Whether it’s protecting against property damage, liability claims, or business interruptions, investing in robust insurance solutions provides the peace of mind and financial security necessary to navigate the dynamic landscape of roller skating rink ownership with confidence.

Safeguarding Your Roller Skating Business: Key Takeaways on Business Insurance

As we wrap up our discussion on business insurance for roller skating rinks, let’s recap the essentials. Obtaining coverage is crucial for protecting your business from risks. Consider general liability insurance alongside tailored options like property, workers’ compensation, and business interruption insurance.

Selecting the right insurer and implementing safety measures ensure confidence in operations. Compare rates for affordable and personalized coverage, securing your rink’s future while delivering an exceptional experience. Protect your assets, employees, and customers—invest in comprehensive business insurance today.

Find affordable options for commercial insurance by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

Why do they call it figure skating?

Figure skating derives its name from the patterns (or figures) skaters make on the ice, an element that was a major part of the sport until recently. There are various kinds of figure skating, including freestyle, pairs, ice dance, and synchronized team skating.

What is the most common injury in figure skating?

Ankle sprains are among the most common injuries in figure skaters, with a prevalence of greater than 50%.

Cheap commercial insurance coverage is just a click away. Insert your ZIP code into our free tool below to compare quotes from highly rated insurers.

Is being a figure skater a job?

Figure skaters competing at the highest levels of international competition are not “professional” skaters. They are sometimes referred to as amateurs, even though some earn money. Professional skaters include those who have lost their ISU eligibility and those who perform only in shows.

To delve deeper, refer to our in-depth report titled “Professional Liability (Errors & Omissions) Insurance: A Complete Guide.”

What is target or targeted customers?

A target customer is a more specific person or group of people within a market. Slightly different from the general target market, the target customer is the individual or group that might purchase the product.

What is target market and customers?

A target market is a specific group of people with shared characteristics that a business markets its products or services to. Companies use target markets to thoroughly understand their potential customers and craft marketing strategies that help them meet their business and marketing objectives.

What is the target market for skating rinks?

With skating rinks, you’ve got multiple targets. You’ve got kids, teenagers, adults looking for nostalgia, or even athletes training for competitions. Each group needs a tailored approach because what gets a parent to book a birthday party won’t necessarily attract a pro skater.

Explore our list of the leading providers to discover the best options available: Best Health Insurance For Sports Commentators

What is roller skating insurance?

Roller skating insurance is a specialized form of business insurance designed to protect roller skating rinks and businesses in the industry against various risks, including liability for injuries, property damage, and other unforeseen events specific to roller skating operations.

What is rolling skating insurance?

Rolling skating insurance is essentially the same as roller skating insurance. It encompasses insurance coverage tailored to meet the unique needs of roller skating businesses, providing protection against liabilities and risks associated with operating a roller skating facility or business.

What is skate event insurance?

Skate event insurance is a type of insurance coverage designed to protect organizers and participants of roller skating events, competitions, or exhibitions. It typically covers liabilities related to injuries, property damage, and other unforeseen incidents that may occur during the event.

For a thorough understanding, refer to our detailed analysis titled “Commercial Insurance: A Complete Guide.”

Why is roller skating insurance important for business owners?

Roller skating insurance is crucial for business owners in the industry as it provides financial protection against potential liabilities and risks associated with running a roller skating business. From covering medical expenses for injured patrons to safeguarding against property damage lawsuits, roller skating insurance offers peace of mind and ensures the long-term viability of the business.

Enter your ZIP code below to get started on comparing business insurance quotes.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.