Cheap Subaru WRX Car Insurance in 2026 (Find Savings With These 10 Companies)

Discover the best providers for cheap Subaru WRX car insurance with Travelers, The Hartford, and Progressive starting at $27 monthly. These companies are recognized for offering comprehensive coverage, exceptional customer service, and competitive rates, ensuring great value for your Subaru WRX.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated September 2024

Company Facts

Min. Coverage for Subaru WRX

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Subaru WRX

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Subaru WRX

A.M. Best Rating

Complaint Level

Pros & Cons

The top providers for cheap Subaru WRX car insurance are Travelers, The Hartford, and Progressive, known for their affordability and excellent coverage.

Understanding the factors that influence your premiums, such as the car’s safety features and your driving history, can help you secure the best rates. This article will guide you through choosing the right coverage for your WRX, highlighting the importance of comparing quotes and considering additional protections like collision and comprehensive insurance.

Our Top 10 Company Picks: Cheap Subaru WRX Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $27 A++ Specialized Coverage Travelers

#2 $34 A+ Organization Discount The Hartford

#3 $37 A+ Coverage Options Progressive

#4 $40 A++ Discount Availability Auto-Owners

#5 $51 A+ Personalized Policies Erie

#6 $52 A Tailored Policies Safeco

#7 $53 B Student Savings State Farm

#8 $55 A+ Multi-Policy Savings Nationwide

#9 $72 A+ Usage-Based Discount Allstate

#10 $106 A Teen Discounts The General

Dive into how location and vehicle modifications impact your insurance costs, ensuring you make an informed decision for your high-performance vehicle. Learn more in our “Subaru Car Insurance Discount.”

Enter your ZIP code above to compare rates from the top providers near you.

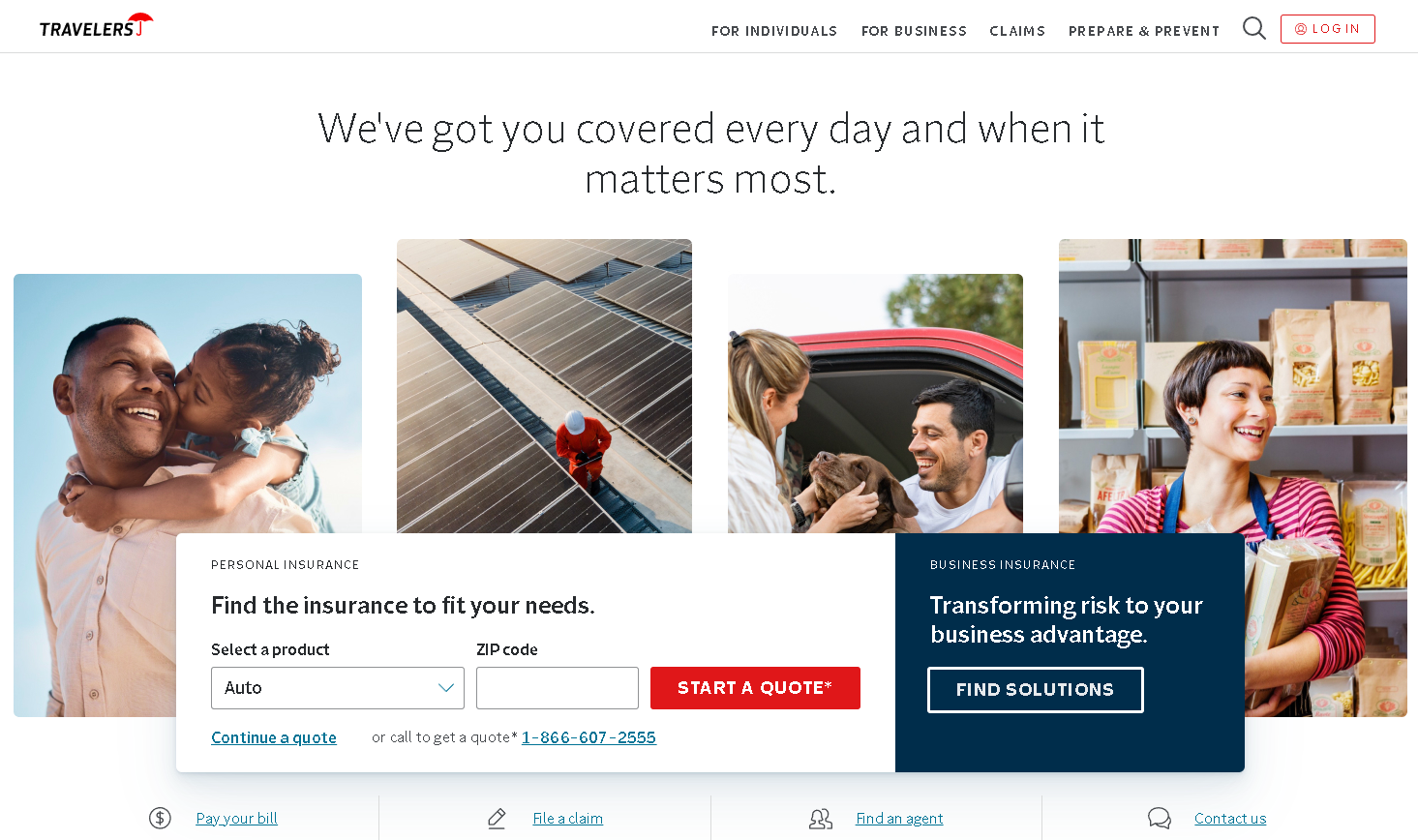

#1 – Travelers: Top Overall Pick

Pros

- Competitive Pricing: Travelers offers one of the lowest monthly rates at $27 for Subaru WRX insurance, paired with a superior A++ A.M. Best rating.

- Customizable Policies: Tailored coverage options specifically suited for the unique needs of Subaru WRX owners.

- Excellent Claims Service: Known for efficient and customer-friendly claims processing for Subaru WRX drivers. Check out our guide titled “Travelers Insurance Review & Ratings” for additional insights.

Cons

- Higher Premiums for High-Risk Areas: Premiums can significantly increase for Subaru WRXs parked in high-risk locations.

- Selective Coverage Acceptance: Travelers may not accept all Subaru WRX models, especially older or highly modified ones.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – The Hartford: Best for Organization Discount

Pros

- Organization Member Discounts: Offers a $34 monthly rate with discounts for members of certain organizations driving a Subaru WRX.

- Strong Financial Stability: Backed by an A+ rating from A.M. Best, ensuring reliability in claim settlements for Subaru WRX insurance.

- Reputation for Customer Satisfaction: High marks in customer service and support for Subaru WRX insurance policies. Delve into our evaluation of our article titled “The Hartford Insurance Review & Ratings.”

Cons

- Age-Specific Benefits: Benefits and discounts may favor older Subaru WRX owners over younger drivers.

- Coverage Limits: Some policy offerings for Subaru WRX might be more restrictive compared to competitors.

#3 – Progressive: Best for Coverage Options

Pros

- Variety of Coverage Options: Progressive provides extensive coverage choices for Subaru WRX at $37 monthly, ensuring a good fit for various needs.

- Loyalty Rewards: Progressive offers loyalty benefits and discounts that enhance value for long-term Subaru WRX insurance customers.

- Online Tools and Resources: Advanced online management tools for Subaru WRX insurance policies, enhancing user convenience. To learn more about their offerings, check out our article titled “Progressive Insurance Review & Ratings.”

Cons

- Variable Customer Service: Customer service quality for Subaru WRX insurance can vary regionally.

- Rate Fluctuations: Subaru WRX insurance rates may fluctuate more with Progressive, depending on driving records and claims history.

#4 – Auto-Owners: Best for Discount Availability

Pros

- Multiple Discount Opportunities: At $40 monthly, Auto-Owners provides various discount options for Subaru WRX owners, enhancing affordability.

- Superior Claims Handling: Known for efficient claims processing with a high A++ A.M. Best rating. Here’s the full review of article titled “Auto-Owners Insurance Review & Ratings.”

- Personalized Service: Offers personalized service through local agents, beneficial for Subaru WRX insurance needs.

Cons

- Limited Availability: Auto-Owners’ insurance for Subaru WRX may not be available in all states.

- Strict Qualification Criteria: Stringent criteria for obtaining the maximum discounts on Subaru WRX policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Erie: Best for Personalized Policies

Pros

- Tailored Insurance Solutions: Erie offers personalized policy options for Subaru WRX at $51 monthly, fitting diverse owner needs.

- Rate Lock Feature: Provides a rate lock feature that ensures stable premiums for Subaru WRX insurance. If you want to learn more about the company, head to our article titled “Erie Car Insurance Discounts.’

- Exceptional Local Agent Support: Strong support network of local agents providing dedicated service for Subaru WRX owners.

Cons

- Higher Base Rates: Base rates for Subaru WRX are higher compared to some other providers.

- Limited Geographic Coverage: Erie’s availability for Subaru WRX insurance is restricted to certain regions.

#6 – Safeco: Best for Tailored Policies

Pros

- Customized Coverage: Safeco offers tailored insurance policies for Subaru WRX owners, ensuring a perfect fit for specific needs at $52 monthly.

- Optional Add-Ons: Wide range of add-on coverages which enhance protection for Subaru WRX, such as roadside assistance and rental reimbursement.

- Discounts for Safe Driving: Safeco rewards Subaru WRX owners who have safe driving records with substantial discounts. Take a closer look at our article titled “Safeco Insurance Review & Ratings” for additional information.

Cons

- Pricing Variability: Rates for Subaru WRX can vary significantly based on the driver’s profile and geographic location.

- Customer Service Concerns: Some customers report inconsistent experiences with Safeco’s service for Subaru WRX insurance claims.

#7 – State Farm: Best for Student Savings

Pros

- Good for Young Drivers: State Farm offers competitive rates and discounts for students driving Subaru WRX, making it an attractive option for younger drivers.

- Extensive Network: Large network of agents providing personalized service and support for Subaru WRX insurance. For more detailed information on their services, read our article titled “State Farm Insurance Review & Ratings.”

- Robust Mobile App: State Farm’s mobile app provides easy management of Subaru WRX insurance policies and claims.

Cons

- Higher Rates for Some Profiles: Despite student discounts, rates for Subaru WRX can be higher for certain profiles, especially those with less favorable driving records.

- Limited High-Risk Coverage: State Farm might offer less competitive terms for Subaru WRX owners considered to be high-risk drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Multi-Policy Savings

Pros

- Multi-Policy Discounts: Nationwide offers substantial savings for Subaru WRX owners who bundle their policies, making it cost-effective at $55 monthly.

- Wide Acceptance: Welcomes a broad range of drivers and Subaru WRX models, including those with higher risk or modified vehicles. Dive into our comprehensive “Nationwide Insurance Review & Ratings” to uncover valuable details.

- Accident Forgiveness: Nationwide provides accident forgiveness features, which can prevent premium increases after the first at-fault accident.

Cons

- Variable Pricing: While Nationwide offers discounts, base rates for Subaru WRX insurance can be inconsistent and depend heavily on personal factors.

- Policy Customization Limits: Some Subaru WRX owners may find the available customization options for coverage less extensive than those offered by competitors.

#9 – Allstate: Best for Usage-Based Discount

Pros

- Drivewise Program: Allstate’s Drivewise program offers substantial discounts for safe driving, making it attractive for Subaru WRX owners conscious of their driving habits.

- Comprehensive Coverage Options: Provides a range of coverage options that cater specifically to the needs of Subaru WRX owners.

- Strong Online Tools: Robust online tools and mobile app for managing Subaru WRX insurance policies conveniently. To find out more, explore our guide titled “Allstate Insurance Review & Ratings.”

Cons

- Higher Rates in Some Areas: Allstate’s rates for Subaru WRX insurance can be on the higher side in certain geographic areas.

- Customer Service Variability: Reports of varying quality in customer service experiences among Subaru WRX insurance holders.

#10 – The General: Best for Teen Discounts

Pros

- Focused on High-Risk Drivers: The General caters especially to teen and high-risk Subaru WRX drivers, offering them viable insurance options.

- Flexible Payment Options: Provides flexible payment methods which can be beneficial for Subaru WRX owners managing tight budgets. Take a deep dive into our article titled “The General Car Insurance Review & Ratings” for more information.

- Quick Claim Processing: Known for quick and efficient claims processing, which is crucial for Subaru WRX owners needing fast resolutions.

Cons

- Higher Premiums: Generally, The General charges higher premiums for Subaru WRX insurance to offset the risk of insuring high-risk drivers.

- Limited Coverage Features: Coverage options are not as comprehensive as some other insurers, which might impact Subaru WRX owners looking for extensive protection.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Subaru WRX Monthly Insurance Costs: Minimum vs. Full Coverage

Understanding the cost implications of different coverage levels can help Subaru WRX owners make informed decisions. The following data presents a comparative look at monthly rates for both minimum and full coverage across various insurance providers. For Subaru WRX owners, choosing between minimum and full coverage involves assessing both cost and risk.

Subaru WRX Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $72 | $188 |

| Auto-Owners | $40 | $105 |

| Erie | $51 | $134 |

| Nationwide | $55 | $137 |

| Progressive | $37 | $96 |

| Safeco | $52 | $136 |

| State Farm | $53 | $140 |

| The General | $106 | $277 |

| The Hartford | $34 | $89 |

| Travelers | $27 | $70 |

For instance, Travelers offers the most economical option at $27 for minimum and $70 for full coverage, appealing to those seeking affordability without compromising on substantial protection. On the higher end, The General quotes $106 for minimum and a steep $277 for full coverage, reflecting its focus on high-risk drivers. See our guide titled “Travelers Car Insurance Discounts” to determine if this provider suits your needs.

Middle-range options like State Farm and Erie offer balanced rates at $53 and $51 for minimum coverage, respectively, scaling up to around $140 and $134 for full. This spectrum of prices shows that Subaru WRX owners have diverse options to suit their budget and coverage needs, from basic legal compliance to comprehensive protection against potential losses.

Factors That Influence Subaru WRX Car Insurance Rates

Insurers assess several factors when setting insurance rates for a Subaru WRX. The car’s value and higher repair costs due to its high-performance nature significantly impact rates, as does its popularity among younger, less experienced drivers. Additionally, the WRX’s advanced safety features like anti-lock brakes and airbags can lead to lower rates by reducing accident risk.

The driver’s age and driving record are also significant factors that insurers consider. Younger drivers or those with a history of accidents or traffic violations may be seen as higher-risk drivers, resulting in higher insurance premiums. On the other hand, drivers with a clean driving record and more experience behind the wheel can benefit from lower insurance rates.

Additionally, the location where the Subaru WRX is primarily driven and parked can also impact insurance rates. Urban areas with higher accident and theft rates often have higher insurance premiums for the Subaru WRX than rural areas with lower risks. Insurers consider location-based incident likelihoods when setting rates. Unlock details in our guide titled “Car Accidents: What to do in Worst Case Scenarios.”

Understanding the Insurance Requirements for Subaru WRX Owners

Before insuring a Subaru WRX, it’s essential to understand the insurance requirements for this particular vehicle. As with any car insurance, the state you reside in will dictate the legal minimum coverage requirements. It typically includes liability coverage to pay for damages and medical expenses of other parties involved in an accident caused by the insured Subaru WRX.

However, liability coverage only covers expenses for others, not damages to your own vehicle. To protect your Subaru WRX against damages from accidents, you may want to consider additional coverage options, such as collision insurance and comprehensive insurance. Collision insurance covers repair costs or total loss from accidents, and comprehensive insurance protects against theft, vandalism, or natural disasters.

When determining the insurance requirements for your Subaru WRX, it’s also important to consider the value of your vehicle. If your WRX is newer or customized, consider extra coverage for total loss protection, such as gap insurance, which covers the difference between your vehicle’s actual value and your loan or lease balance. Learn more in our guide titled “Is gap insurance transferable from one vehicle to another?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Average Cost of Insurance for Subaru WRX Compared to Other Sports Cars

The average cost of insurance for a Subaru WRX varies, potentially offering lower rates than other sports cars due to its safety and reliability reputation. For instance, Travelers offers the lowest reported monthly rate at $27 for minimum coverage, while providers like The General quote as high as $106 for the same. Such variations underscore the influence of factors like the WRX’s high repair costs and its appeal to higher-risk drivers.

Personal factors like age, driving history, and location significantly influence insurance rates for a Subaru WRX. Younger drivers under 25 often face higher premiums due to a perceived greater risk of accidents, while older, more experienced drivers typically enjoy lower rates. For deeper insight, delve into our source article titled “Cheapest Car Insurance for 23-Year-Old Drivers.”

Another factor that can impact insurance costs for a Subaru WRX is the location where the car is primarily driven and parked. Insurance rates can vary based on factors such as the crime rate in the area, the frequency of accidents, and the likelihood of theft. For example, if the car is primarily driven and parked in a high-crime area, the insurance rates may be higher compared to a low-crime area.

Tips for Getting the Best Car Insurance Rates for Your Subaru WRX

To secure the best car insurance rates for your Subaru WRX, consider several effective strategies. Start by shopping around; request quotes from multiple insurers to compare rates and coverage options, as different companies may assess risks differently.

Opting for higher deductibles can also reduce your premiums, as you’ll take on more of the repair costs in case of an accident—just ensure the deductible is an amount you can afford comfortably. Additionally, explore available discounts specifically for Subaru WRX owners, such as multi-policy, good student, or safe driver discounts, which can significantly lower your insurance costs.

Installing anti-theft devices like alarms or GPS tracking can further reduce rates by decreasing the risk of theft. Lastly, your driving habits play a crucial role; maintaining a clean record and limiting annual mileage can qualify you for additional rate reductions, especially if you primarily use your WRX for commuting rather than extended travel.

Exploring the Different Types of Coverage Options for Subaru WRX Owners

As mentioned earlier, Subaru WRX owners have several coverage options beyond basic liability insurance. Collision insurance provides financial protection by covering repairs or reimbursing the value of your Subaru WRX in the event of an accident, irrespective of who is at fault. Comprehensive insurance safeguards your vehicle against non-collision incidents such as theft, vandalism, fire, or natural disasters.

Kristine Lee Licensed Insurance Agent

For accidents involving drivers who lack adequate insurance, uninsured/underinsured motorist insurance can help cover your medical expenses and damages. Additionally, medical payments coverage handles medical expenses resulting from an accident, regardless of fault. For further insights, explore our guide titled “Best Car Insurance for Medical Payments Coverage.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Make Subaru WRX Insurance Rates Higher or Lower

Several factors can either increase or decrease insurance rates for a Subaru WRX:

- Age and Driving History: Younger drivers or those with a history of accidents or traffic violations may experience higher insurance rates.

- Location: Insurance rates can vary depending on your geographical location. Areas with higher rates of accidents or theft may result in higher insurance premiums.

- Vehicle Modifications: Modifying your Subaru WRX with aftermarket additions or performance enhancements may increase insurance rates since they can raise the value of the vehicle and potentially increase its risk profile.

Several factors, including age, driving history, location, and vehicle modifications, play a critical role in determining insurance rates for a Subaru WRX. Understanding these variables can help owners strategically manage their insurance costs and secure the most favorable rates. See more details on our guide titled “Can I get car insurance for a car that is modified or customized?”

Comparison of Insurance Rates for New and Used Subaru WRX Models

The insurance rates for new and used Subaru WRX models can differ due to various factors. Newer models may have higher insurance rates since their value is higher, which increases the potential repair costs for the insurer. On the other hand, used Subaru WRX models may have lower insurance rates due to their lower market value.

However, other factors such as the vehicle’s features, safety ratings, and the driver’s profile will also affect the insurance rates, irrespective of the new or used status of the Subaru WRX. For a deeper understanding, explore our guide titled “How do I add or remove drivers from my Travelers car insurance policy?”

How Your Driving Record Affects the Cost of Insuring a Subaru WRX

Your driving record plays a crucial role in determining the cost of insuring a Subaru WRX. Insurance companies typically check your history of accidents, traffic violations, and claims to assess your risk as a driver.

A clean driving record with no accidents or violations indicates responsible driving and can help lower your insurance rates. Contrarily, a history of accidents or traffic violations can result in higher insurance premiums due to the increased risk you pose as a driver. Discover insights in our guide titled “How does my driving record affect my parents insurance rates?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact of Location on Subaru WRX Car Insurance Premiums

When it comes to car insurance premiums for a Subaru WRX, your location matters. Insurers take into account the area where you live, as different regions may have unique risk factors relating to accidents, vandalism, or theft.

Urban areas with high traffic or higher rates of vehicle-related crimes usually result in higher insurance premiums compared to rural areas with less traffic and lower incidents. Therefore, it’s important to consider the potential impact of your location on your Subaru WRX car insurance premiums. Delve into our evaluation of guide titled “How does the insurance company determine my premium?”

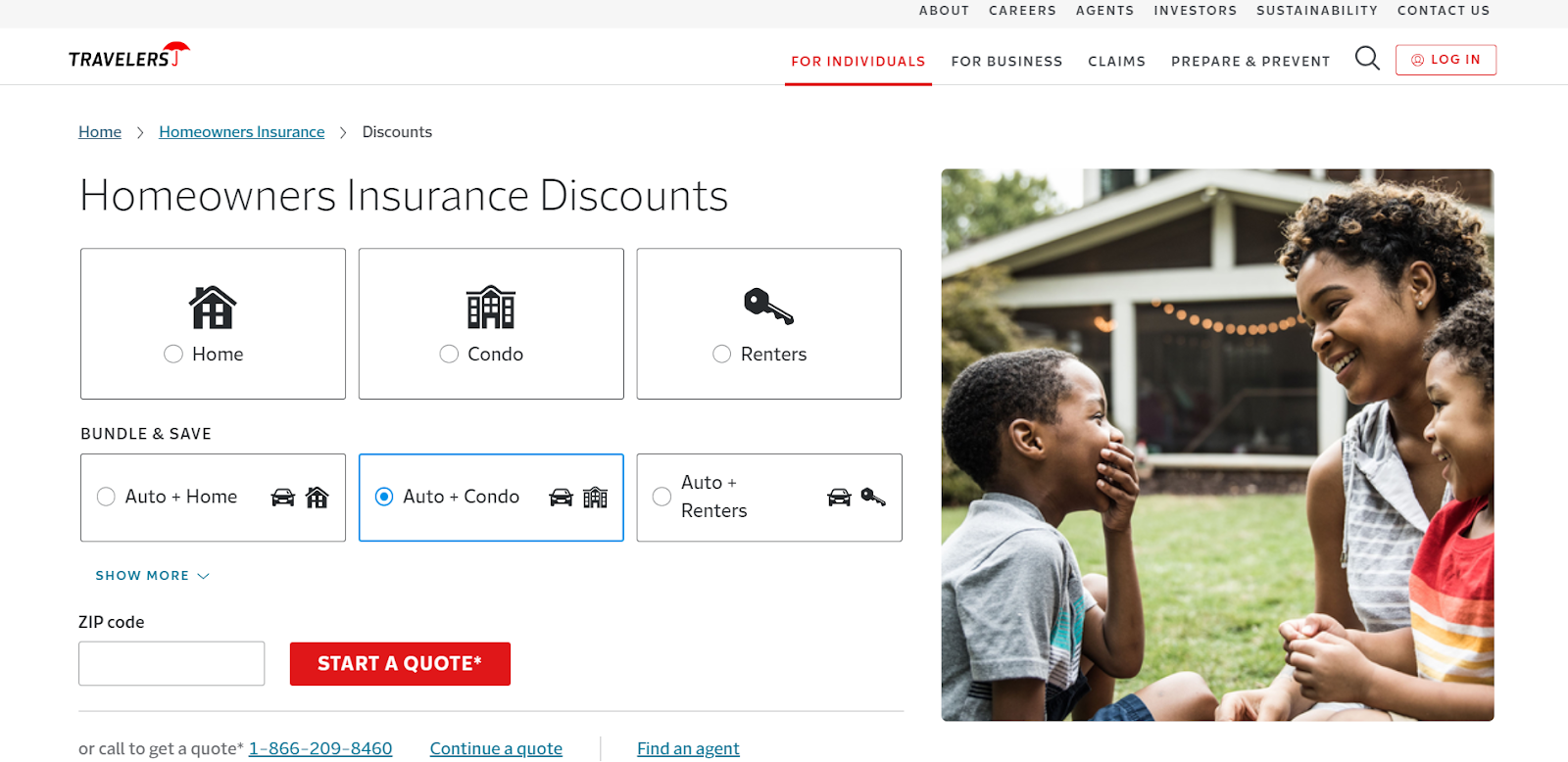

Discount Opportunities for Subaru WRX Owners to Lower Their Insurance Costs

To help lower insurance costs for Subaru WRX owners, many insurance companies offer various discounts. These discounts can vary between insurers, but commonly available ones include:

- Multi-Policy Discount: If you have multiple insurance policies with the same provider, such as homeowner’s insurance or renter’s insurance, you may be eligible for a discount on your Subaru WRX insurance.

- Good Student Discount: Students with good academic performance may qualify for a discount on their insurance premiums.

- Safe Driver Discount: If you maintain a clean driving record with no accidents or traffic violations, you may be eligible for a safe driver discount. Access comprehensive insights into our article titled “Best Safe Driver Car Insurance Discounts.”

To maximize savings on Subaru WRX insurance, owners should explore various discounts offered by insurance companies. Common discounts include multi-policy bundles, good student rates for high academic achievers, and safe driver discounts for those with clean driving records, each providing significant opportunities to reduce premiums.

Common Mistakes to Avoid When Insuring Your Subaru WRX

When insuring your Subaru WRX, it’s crucial to avoid several common mistakes to ensure optimal coverage and cost-effectiveness. One significant error is not comparing quotes; failing to shop around and compare insurance quotes from different companies can lead to unnecessarily high premiums.

Additionally, underinsuring your Subaru WRX by opting for the bare minimum coverage requirements might leave you financially vulnerable in the event of an accident. It’s important to assess your needs thoroughly and choose appropriate coverage levels.

Jeff Root Licensed Insurance Agent

Another common oversight is not updating your insurance policy when circumstances change, such as moving to a new address or modifying your Subaru WRX, which can lead to coverage gaps or unexpected issues during the claims process. Discover more about offerings in our article titled “How to File a Car Insurance Claim.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Consider When Shopping Around for Subaru WRX Car Insurance Quotes

When shopping around for Subaru WRX car insurance quotes, keep the following factors in mind:

- Coverage Options: Ensure that the insurance quotes you receive include the coverage options you require for adequate protection.

- Policy Limits: Verify that the policy limits offered in the quotes are sufficient to cover potential damages or liabilities.

- Deductibles: Take note of the deductibles associated with each quote, as this will affect your out-of-pocket expenses in case of an accident. Check out insurance savings in our complete guide titled “What is the difference between a deductible and a premium in car insurance?”

- Claims Process: Research the insurer’s reputation for claims handling and customer service to ensure a smooth experience if you ever need to file a claim.

When finalizing Subaru WRX car insurance, ensure that quotes reflect your desired coverage, adequate policy limits, and manageable deductibles to align with your financial and protection needs. Additionally, it’s crucial to assess the insurer’s claims process and customer service reputation to guarantee a seamless experience in the event of a claim.

Understanding the Deductible Options and Their Effect on the Overall Cost of Insurance for Your Subaru WRX

When choosing an insurance policy for your Subaru WRX, you’ll encounter different deductible options. The deductible is the amount you must pay out of pocket before the insurance coverage kicks in.

Today we announced an agreement to acquire @corvusinsurance, an industry-leading cyber insurance managing general underwriter. Learn more about how this transaction helps us build upon our cyber capabilities: https://t.co/27rwzbTQDX pic.twitter.com/MWop4atnDH

— Travelers (@Travelers) November 3, 2023

Typically, higher deductibles result in lower insurance premiums, as you are assuming more financial responsibility in the event of a claim. However, it’s crucial to choose a deductible amount that you can comfortably afford to pay out of pocket if an accident occurs.

How Modifications and Aftermarket Additions Can Affect Your Subaru WRX Car Insurance Rates

If you’re considering modifying your Subaru WRX or adding aftermarket parts, it’s crucial to understand how these changes can impact your car insurance rates. Modifications that increase the performance or value of your vehicle can result in higher insurance rates.

This is because modified vehicles may carry higher repair costs or be at a greater risk of theft. Thus, it’s important to inform your insurance provider about any modifications or aftermarket additions to ensure that you have proper coverage. See more details on our guide titled “Does Erie Insurance car insurance cover a stolen car?”

In conclusion, the cost of Subaru WRX car insurance can vary based on several factors, including the vehicle’s value, safety features, location, driving record, and coverage options. By understanding these factors and following the tips mentioned, Subaru WRX owners can navigate the insurance landscape and secure the best insurance rates for their beloved sports car.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Frequently Asked Questions

What factors affect the cost of Subaru WRX car insurance?

The cost of Subaru WRX car insurance can be influenced by several factors such as the driver’s age, location, driving record, insurance coverage limits, deductible amount, and the level of insurance discounts they qualify for.

Access comprehensive insights into our guide titled “Best Car Insurance for Teens in Michigan.”

Are Subaru WRX cars generally more expensive to insure?

Subaru WRX cars are often considered to be higher performance vehicles, which can lead to higher insurance premiums compared to more standard vehicles. However, insurance rates can vary depending on individual circumstances and other factors.

Does the Subaru WRX’s safety rating impact insurance costs?

Yes, the safety rating of the Subaru WRX can impact insurance costs. Generally, vehicles with higher safety ratings tend to have lower insurance premiums since they are considered less risky to insure.

Do insurance rates for Subaru WRX cars vary by location?

Yes, insurance rates for Subaru WRX cars can vary by location. Factors such as the frequency of accidents and thefts in a particular area, as well as local laws and regulations, can influence insurance premiums.

Can I get discounts on Subaru WRX car insurance?

Yes, it is possible to qualify for discounts on Subaru WRX car insurance. Insurance companies often offer discounts for factors such as having a good driving record, completing defensive driving courses, bundling multiple policies, or having certain safety features installed in the vehicle.

Learn more by reading our guide titled “Can I bundle my Travelers car insurance with other policies?”

Should I compare quotes from different insurance providers for Subaru WRX car insurance?

Yes, it is highly recommended to compare quotes from different insurance providers when shopping for Subaru WRX car insurance. Comparing quotes helps you find the best rates and coverage options, ensuring you select a provider that offers both value and reliable support.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.