Best Business Insurance for Etsy Businesses in 2026 (Top 10 Companies)

Discover the best business insurance for Etsy businesses with leading providers such as Progressive, Travelers, and State Farm. Leverage general and product liability coverage for peace of mind and save up to 15% by bundling policies. Protect your venture with comprehensive coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Company Facts

Full Coverage for Etsy Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Etsy Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Etsy Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

The best business insurance for Etsy businesses centers around providing tailored protection from top companies such as Progressive, Travelers, and State Farm. Each of these leading providers offers specialized coverage, including general liability and product liability insurance, that can safeguard your venture against unforeseen risks.

With customizable policies and significant discounts of up to 20% for bundling, Etsy entrepreneurs can optimize coverage and ensure peace of mind. Enter your ZIP code above to get started on comparing business insurance quotes.

Our Top 10 Company Picks: Best Business Insurance for Etsy Businesses

| Company | Rank | Bundle Discount | Cyber Liability Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Quick Claims | Progressive | |

| #2 | 8% | 12% | Customizable Coverage | Travelers | |

| #3 | 7% | 14% | Comprehensive Coverage | State Farm | |

| #4 | 9% | 13% | Bundling Policies | Nationwide |

| #5 | 8% | 12% | Specialized Coverage | The Hartford |

| #6 | 6% | 10% | Customizable Policies | Liberty Mutual |

| #7 | 7% | 11% | Local Agents | Farmers | |

| #8 | 9% | 14% | Add-on Coverages | Allstate | |

| #9 | 6% | 12% | Student Savings | American Family | |

| #10 | 8% | 15% | Policy Options | Chubb |

Let these top insurers help your business succeed while mitigating potential liabilities, ensuring long-term sustainability and confidence in the face of unforeseen challenges.

- Best insurance companies for Etsy are Progressive, Travelers, and State Farm

- Save up to 20% with bundled policies

- Coverage includes general liability and product liability insurance

#1 – Progressive: Top Overall Pick

Pros

- Quick Claims: Progressive insurance review & ratings highlights the company’s efficient and fast claims processing.

- User-Friendly: Offers a user-friendly online platform for policy management.

- Discounts: Provides a variety of discounts, including multi-policy and safe driver discounts.

Cons

- Premiums: Some customers report higher premiums compared to competitors.

- Customer Service: Mixed reviews on customer service experiences.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Customizable Coverage

Pros

- Customizable Coverage: Allows customers to tailor coverage to their specific needs, as evidenced by the positive Travelers insurance review & ratings.

- Strong Financial Stability: Known for financial strength and stability.

- Multi-Policy Discounts: Offers discounts for bundling multiple policies.

Cons

- Premiums: Can be on the higher side for certain coverage options.

- Limited Local Agents: Availability of local agents may vary in some areas.

#3 – State Farm: Best for Shield Against Uncertainty

Pros

- Comprehensive Coverage: Offers a wide range of insurance products for comprehensive coverage.

- Financial Strength: Known for its financial stability and reliable service.

- Robust Online Tools: Provides a user-friendly online platform for policy management.

Cons

- Premiums: Some customers find premiums to be relatively higher, according to State Farm insurance review & ratings.

- Limited Discounts: May not have as many discounts compared to other providers.

#4 – Nationwide: Best for Unbeatable Bundling Policies

Pros

- Bundling Policies: Offers discounts for bundling home and auto insurance.

- Nationwide Network: A large network of agents and service centers is one of the features highlighted in Nationwide insurance review & ratings.

- Good Customer Service: Generally positive reviews on customer service.

Cons

- Limited Customization: Some customers may find less flexibility in policy customization.

- Pricing: Some reports suggest that premiums may be higher in certain regions.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Specialized Coverage Expertise

Pros

- Specialized Coverage: Tailors coverage for specific industries and professions.

- AARP Partnership: Offers exclusive benefits for AARP members.

- Positive Customer Feedback: Receives positive reviews for customer satisfaction, with The Hartford insurance review & ratings noting the company’s strong performance in the industry.

Cons

- Limited Availability: Not available in all states.

- Potential for Higher Premiums: Some customers report higher premiums.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Provides flexibility in policy customization.

- Multi-policy Discounts: Offers discounts for bundling policies.

- Digital Tools: Utilizes digital tools for convenient policy management.

Cons

- Mixed Customer Service Reviews: Some customers report mixed experiences with customer service.

- Pricing: Premiums may be higher in certain regions, according to Liberty Mutual review & ratings.

#7 – Farmers Insurance: Best for Personalized Service With Local Agents

Pros

- Local Agents: Emphasizes the availability of local agents for personalized service. Farmers Insurance review & ratings highlight the positive experiences customers have with their knowledgeable local agents.

- Diverse Coverage Options: Offers a variety of insurance products.

- Discounts: Provides various discounts, including multi-policy and safe driver discounts.

Cons

- Potential for Higher Premiums: Some customers find premiums to be on the higher side.

- Limited Online Tools: Online tools may not be as advanced as some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: Offers a wide range of add-on coverages for enhanced protection.

- Digital Innovation: Utilizes technology for policy management. Allstate insurance review & ratings can provide insight into their efficiency and customer satisfaction in these areas.

- Nationwide Presence: Available in most states with a large network of agents.

Cons

- Premiums: Some customers report higher premiums.

- Limited Customization: Policy customization options may be somewhat limited.

#9 – American Family: Best for Premiums Saving

Pros

- Student Savings: Provides discounts and savings for students. American Family insurance review & ratings suggests that the company offers favorable options for student insurance coverage.

- User-Friendly Apps: Offers user-friendly mobile apps for policy management.

- Local Agents: Emphasizes the importance of local agents for personalized service.

Cons

- Limited Coverage Options: Some customers may find fewer coverage options.

- Potential for Higher Premiums: Premiums could be higher in certain situations.

#10 – Chubb: Best for Diverse Policy Options

Pros

- Policy Options: Offers a range of policy options for tailored coverage. Chubb Insurance Review & Ratings are worth checking out for more information on the quality and performance of their services.

- High-Value Coverage: Specializes in providing coverage for high-value assets.

- Excellent Customer Service: Known for excellent customer service.

Cons

- Premiums: Premiums may be higher due to the focus on high-value coverage.

- Limited Availability: Not available in all regions.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

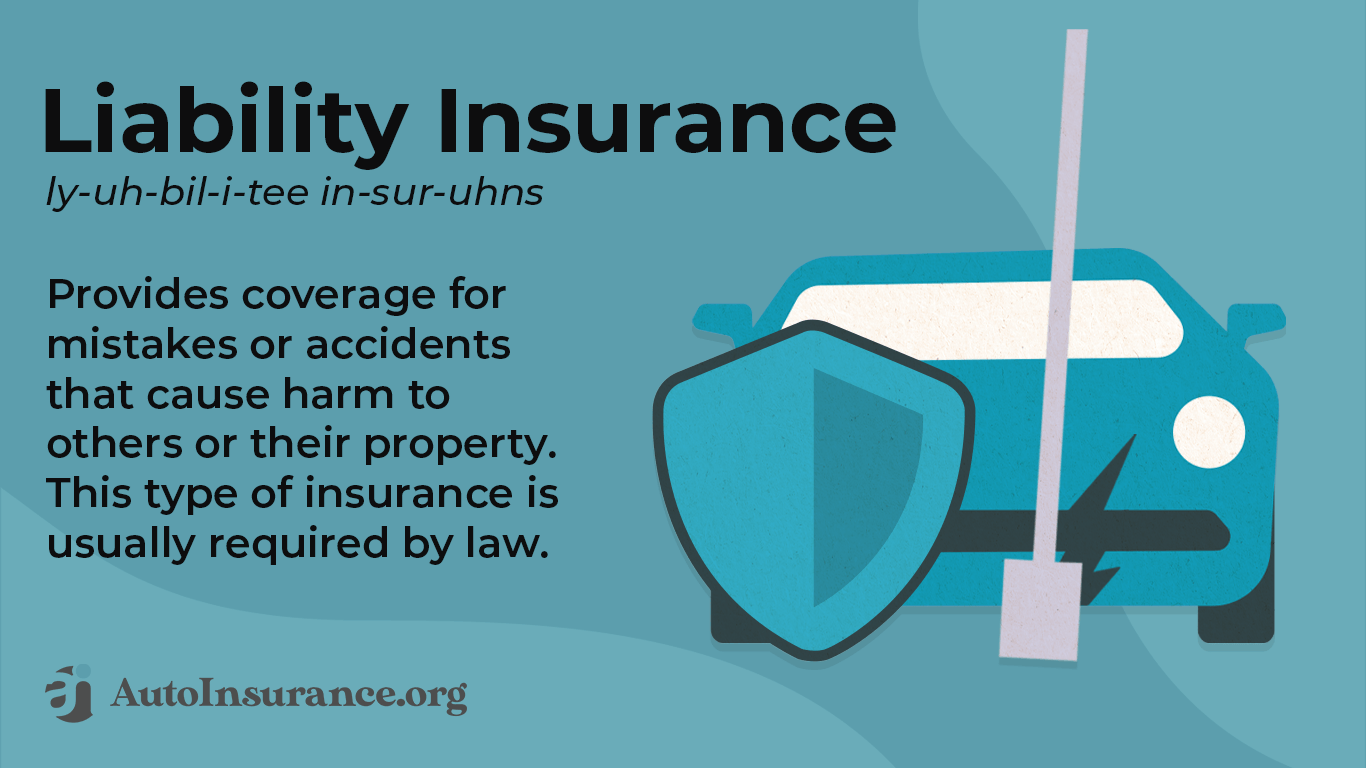

Importance of General Liability Insurance for Your Etsy Business

General liability insurance is a crucial policy for Etsy entrepreneur businesses. It provides broad coverage against potential risks and protects your business from financial losses resulting from claims and lawsuits. Let’s explore the key aspects of general liability insurance for your Etsy business:

- Bodily Injury Claims: If a customer or visitor is injured while on your business premises or as a result of using your products, general liability insurance covers their medical expenses, rehabilitation costs, and any potential legal fees if they decide to sue your business.

- Property Damage Claims: Accidental damage to someone else’s property can happen during interactions with your business, such as when delivering products or setting up a booth at an event. General liability insurance helps cover the repair or replacement costs of the damaged property.

- Personal and Advertising Injury Claims: General liability insurance also provides coverage for claims of personal and advertising injury, which includes accusations of libel, slander, copyright infringement, or false advertising.

- Completed Operations Coverage: This aspect of general liability insurance protects your business against claims arising from products or services that have been completed or delivered.

- Legal Defense Costs: General liability insurance also covers the costs of legal defense, including attorney fees, court fees, and settlements or judgments against your business. These expenses can be significant, and having insurance ensures that your business can afford to protect itself in legal proceedings.

Remember, general liability insurance is designed to protect your business from unforeseen events and claims.

Jeff Root Licensed Life Insurance Agent

It provides a safety net that allows you to focus on growing your Etsy business without the constant worry of potential liabilities.

Choosing General Liability Insurance for Your Etsy Business

When selecting a general liability insurance policy for your Etsy business, consider the following factors:

- Coverage Limits: Ensure that the policy provides sufficient coverage limits to protect your business adequately. Assess the potential risks and liabilities your business may face and choose coverage limits that align with your needs.

- Deductibles: Determine the deductible amount you are comfortable with. A deductible is the amount you are responsible for paying before the insurance coverage kicks in. Balancing the deductible amount with the premium cost is essential to find the right financial balance for your business. Learn more from “What is a High-Deductible Health Plan?“

- Exclusions and Limitations: Review the policy’s exclusions and limitations to understand what specific situations or claims may not be covered. It’s important to be aware of any limitations to avoid surprises when a claim arises.

- Additional Coverages: Assess if the general liability policy offers any additional coverages that may be relevant to your business. Some policies may include coverage for advertising liability, damage to rented premises, or medical expenses for third parties.

When choosing a general liability policy for your business, it’s crucial to evaluate all the aspects covered in this guide. Understanding coverage limits, deductibles, exclusions, and potential additional coverages can help you tailor a policy that best suits your needs.

Taking the time to thoroughly review these aspects will help ensure your business is protected and can handle unexpected situations confidently. Don’t hesitate to consult with an insurance professional for personalized advice and guidance.

Other Coverage Options for Etsy Entrepreneur Businesses

While general liability insurance is crucial, there are other types of coverage Etsy businesses should consider:

- Product Liability Insurance: When you sell products on Etsy, there’s always a possibility that a customer might claim that your product caused them harm or injury. It covers legal fees, settlements, and medical expenses if someone files a lawsuit against your business due to a faulty or defective product.

- Commercial Property Insurance: As an Etsy entrepreneur, you may have invested in equipment, tools, supplies, and inventory necessary for your business operations. Commercial property insurance provides coverage for physical assets related to your business, including your workshop, machinery, and inventory.

- Home-Based Business Insurance: Many Etsy entrepreneurs operate their businesses from their homes. Home-based business insurance offers protection for your business assets, such as equipment, inventory, and furniture, and it also provides liability coverage for injuries or accidents that occur in your home workspace.

- Commercial Umbrella Insurance: While general liability insurance covers most claims, there may be rare instances where a claim exceeds the limits of your primary coverage. Commercial umbrella insurance provides additional coverage for legal expenses, settlements, and damages that exceed the limits of your primary policies.

- Professional Liability Insurance: If you offer professional services or advice as part of your Etsy business, such as graphic design or consulting, professional liability insurance (also known as errors and omissions insurance) is crucial. This coverage can help cover legal fees, settlements, and judgments arising from such claims.

- Cyber Liability Insurance: With the increasing reliance on digital platforms and online transactions, cyber risks have become a significant concern for businesses. Cyber liability insurance helps protect your business in the event of a cyber attack, covering costs associated with data breaches, legal expenses, notification of affected parties, and potential liability claims.

These are just a few examples of the additional types of insurance that Etsy entrepreneur businesses should consider. The specific insurance needs of your business may vary based on factors such as the nature of your products or services, the size of your operation, and your individual risk profile.

Consulting with an insurance professional can help you assess your business’s unique requirements and determine the most suitable coverage options.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unraveling Insurance Expenses for Etsy Businesses

Determining the cost of insurance for your Etsy entrepreneur business involves several factors. Insurance providers take into account various aspects of your business to calculate premiums. Here are the key factors that can influence the cost of insurance:

- Business Size and Revenue: The size of your business, including its annual revenue and number of employees, can impact insurance costs. Larger businesses with higher revenue and more employees typically have higher insurance premiums due to increased exposure to risks.

- Industry or Type of Products Sold: The industry in which your Etsy business operates and the specific products you sell can affect insurance costs. Certain industries, such as high-risk or specialized sectors, may require more coverage, resulting in higher premiums.

- Coverage Limits and Deductibles: The coverage limits you choose and the deductibles you agree to can impact the cost of insurance. Higher coverage limits and lower deductibles generally lead to higher premiums because they provide greater financial protection in the event of a claim.

- Claims History: Your business’s claims history plays a role in determining insurance costs. If your business has a history of frequent or significant claims, insurance providers may consider it higher risk and charge higher premiums. Find additional information in “How does the insurance company determine my premium?“

- Location of the Business: The geographical location of your business can influence insurance costs. Factors such as local regulations, crime rates, and natural disaster risks can impact premiums. For example, if your business is located in an area prone to hurricanes or earthquakes, you may need additional coverage, which can increase costs.

- Risk Assessment: Insurance providers assess the level of risk associated with your specific business activities. This evaluation considers factors such as the nature of your products or services, the safety measures you have in place, and any potential hazards. Higher-risk activities or businesses may result in higher premiums.

The cost of insurance can vary significantly based on these factors and the specific insurance provider you choose. It’s advisable to obtain multiple quotes from different insurers to compare prices and coverage options. Additionally, bundling multiple insurance policies, such as purchasing a business owner’s policy (BOP), may offer cost savings compared to buying individual policies separately.

To get an accurate estimate of insurance costs for your Etsy business, it’s recommended to consult with insurance professionals or use online tools that provide customized quotes based on your business information.

Business Insurance Monthly Rates for Etsy Businesses by Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $40 $135

American Family $50 $155

Chubb $65 $175

Farmers Insurance $45 $145

Liberty Mutual $50 $150

Nationwide $55 $160

Progressive $50 $150

State Farm $40 $130

The Hartford $60 $170

Travelers $45 $140

Based on the business insurance rates provided, State Farm offers the best combination of low rates for both minimum coverage ($40) and full coverage ($130). This makes State Farm the most cost-effective option for your business needs. Allstate also provides a low monthly rate for minimum coverage at $40, though its rate for full coverage is slightly higher at $135.

Other companies, such as Chubb and The Hartford, have significantly higher rates, making them less appealing options if you’re looking for affordability. Ultimately, State Farm stands out as the best option for a balance between coverage and cost.

Business Insurance Discounts for Etsy Businesses

Many insurance companies offer a range of discounts to business clients, aimed at helping them reduce their insurance costs. These discounts can be based on factors such as holding multiple policies with the same insurer, maintaining a safe and claims-free business, and utilizing risk management or safety programs.

Business insurance companies for Esty ventures offer a variety of discounts to help businesses save on costs. By bundling policies, practicing safe operations, and showing loyalty, businesses can take advantage of these savings. Exploring available discounts can help businesses maximize their insurance investment.

Taking Extra Measures: Safeguarding Your Etsy Entrepreneur Business

In addition to obtaining the right insurance coverage, here are some other three steps you can take to protect your Etsy business:

- Get the best rate on insurance. Explore different insurance providers and compare quotes to find the most affordable and suitable coverage for your business.

- Maintain good business practices. Follow ethical standards, maintain quality control, and provide excellent customer service to minimize the risk of disputes and claims. Take a closer look at “Your Insurance Agent’s Role in the Claims Process” to gain further insights.

- Keep accurate records. Maintain detailed records of transactions, agreements, and any interactions with customers or suppliers. These records can be crucial in case of a dispute or legal proceedings.

Remember, while insurance provides financial protection, it’s important to implement preventive measures and good business practices to minimize risks and protect your Etsy business in the long run.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: The Importance of Business Insurance for Etsy Sellers

These case studies showcase how having the right insurance coverage can protect Etsy business owners from various unexpected events.

- Case Study #1– Quick Claims Processing:Sarah, an Etsy business owner, faced legal action over a customer’s allergic reaction to her product. She reported the incident to Progressive, who provided quick legal support. The case was efficiently settled, protecting her business from financial loss. Consider reading “Commercial General Liability (CGL) Insurance: A Complete Guide” for more.

- Case Study #2– Tailor Your Protection: David, an Etsy business owner, faced a significant fire in his studio, threatening his customized art business. Fortunately, his Travelers insurance promptly assessed and covered the damage. This support enabled him to resume operations without major financial setbacks.

- Case Study #3– Your Shield Against Uncertainty: Lisa, who runs an Etsy business from home, faced a challenge when a customer damaged several pottery pieces during a workshop visit. Luckily, her comprehensive coverage from State Farm allowed her to file a claim and get reimbursed for the damages. This protection helped her maintain her business without a significant financial setback.

These case studies illustrate the importance of having the right insurance coverage for Etsy business owners, as it can provide essential protection against unforeseen events and potential financial losses.

From quick claims processing and legal support to tailored coverage for property damage and liability, insurance plays a critical role in helping Etsy entrepreneurs navigate challenges and maintain their business continuity.

Brief Recap: Business Insurance for Etsy Businesses

Obtaining comprehensive insurance coverage is vital for the success and protection of your Etsy entrepreneur business. The diverse risks faced by Etsy businesses require tailored solutions to mitigate potential liabilities. Throughout this article, we have explored key points regarding business insurance and the significance of different types of coverage.

General liability insurance emerges as a fundamental policy, offering financial protection against contract breaches, trademark infringement claims, and other risks. Product liability insurance is essential for Etsy sellers who offer physical products.

Commercial property insurance is crucial for safeguarding business-related property, including inventory, equipment, and supplies. Lastly, home-based business insurance protects Etsy businesses operating from residential premises. Explore the articles below for more information.

- Best Business Insurance for Furniture Stores

- Best Business Insurance for Graphic Designers

- Best Business Insurance for Jewelry Stores

- Best Business Insurance for Advertising Firms

By securing the right insurance coverage for your Etsy entrepreneur business, you can mitigate financial risks, safeguard assets, and maintain long-term sustainability. Consider factors such as cost, coverage limits, and deductibles when selecting policies tailored to your specific business needs. Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

Frequently Asked Questions

How much is insurance on Etsy?

The cost of insurance for Etsy sellers varies depending on the type of coverage, the size and nature of the business, and other factors.

Find affordable options for commercial insurance by entering your ZIP code below into our free comparison tool.

What does Etsy insurance cover?

Etsy insurance typically covers potential risks like general liability, product liability, and property damage.

Who provides the cheapest business insurance?

The cheapest business insurance provider varies depending on individual business needs. Compare quotes from top companies like Progressive, Travelers, and State Farm to find the most affordable option.

Consider reading “22 Tips for How to Get Cheap Home Insurance” for more.

What is the best liability protection your business can have?

General Etsy liability insurance is often considered the best protection for a business, covering third-party injuries, property damage, and legal costs.

What does general insurance cover?

General insurance covers a range of risks, including bodily injury, property damage, personal and advertising injury, and legal defense costs.

Does Etsy insure packages?

Etsy does not directly insure packages, but sellers can purchase shipping insurance separately or include it as part of their Etsy business insurance coverage to protect against package loss or damage.

How to claim insurance on Etsy?

To claim insurance, Etsy sellers should contact their insurance provider, provide necessary documentation, and follow the claims process outlined in their policy.

Find out more about “How to File a Car Insurance Claim” to enhance your understanding.

What is the difference between insurance and general insurance?

Insurance is a broad term encompassing various types of coverage. General insurance covers risks such as third-party injury and property damage.

What risks does general insurance cover?

General insurance for Etsy businesses covers risks such as bodily injury, property damage, personal and advertising injury claims, and legal defense costs.

Do Etsy sellers need insurance?

Yes, Etsy sellers need insurance to protect their business from potential risks and liabilities, including product liability insurance etsy, property damage, and legal defense costs.

What percentage does Etsy take?

How does Etsy insurance work?

Does Etsy have any buyer protection?

Do I need an Etsy privacy policy?

What is the best insurance for a business owner?

What should I include in my Etsy shop policies?

How do I protect my digital products on Etsy?

Will Etsy refund me if I get scammed?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.