Best Whole Life Insurance in 2026 (Your Guide to the Top 10 Companies)

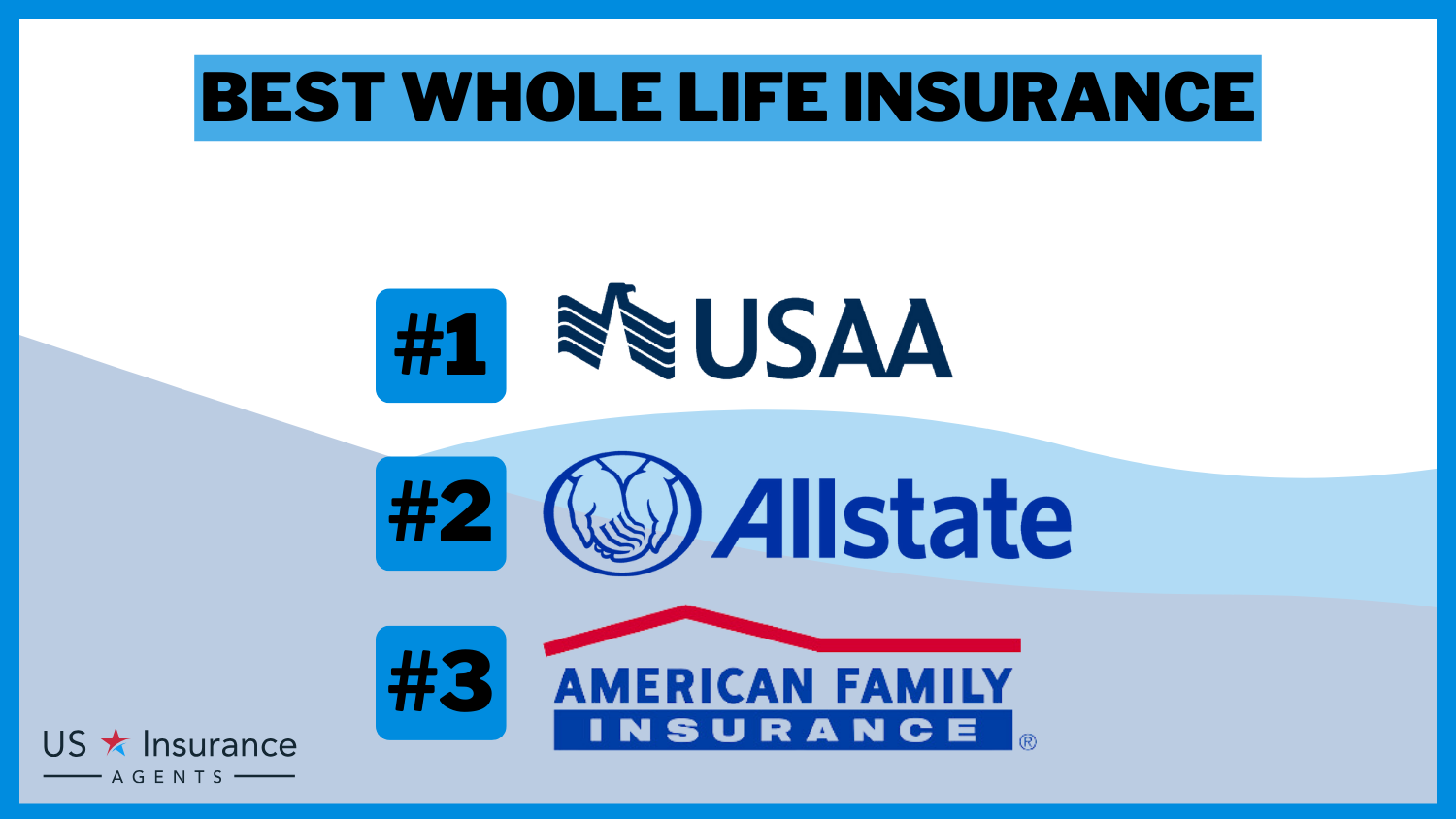

USAA, Allstate, and American Family stand out as top picks for best whole life insurance companies with rates starting at $90 per month. These companies stand out for their commitment to providing reliable coverage that offers peace of mind for policyholders, financial stability to secure your investment.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated November 2024

Company Facts

Full Coverage Whole Life Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Whole Life Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Whole Life Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

The top pick overall for the best whole life insurance providers, considering multiple factors such as affordability, coverage options, and financial stability, is highlighted in this comprehensive guide.

With a focus on securing the best coverage for your needs, we delve into the benefits, cost factors, and policy features of whole life insurance. Discover the top 10 whole life insurance providers. This guide evaluates affordability, coverage, and financial stability for your needs.

Our Top 10 Company Picks: Best Whole Life Insurance

| Company | Rank | Loyalty Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 8% - 11% | A++ | Military Members | USAA | |

| #2 | 5% - 8% | A+ | Full Coverage | Allstate | |

| #3 | 6% - 13% | A | Loyalty Rewards | American Family | |

| #4 | 3% - 6% | A | Insurance Discounts | Farmers | |

| #5 | 4% - 8% | A+ | Usage-Based Discount | Amica | |

| #6 | 4% - 7% | A | Teens | AAA |

| #7 | 5% - 7% | A+ | Filing Claims | Erie |

| #8 | 2% - 5% | A+ | Customer Service | Country Financial |

| #9 | 8% - 9% | NR | Mobile App | MetroMile |

| #10 | 5% - 7% | A+ | NY and NJ Drivers | NJM |

Whether you’re seeking lifelong protection, retirement planning, or estate preservation, compare quotes from top companies to find the most competitive rates tailored to your specific location and preferences.

Enter your ZIP code to compare quotes instantly and find the cheapest insurance available

#1 – USAA: Top Overall Pick

Pros

- Excellent Customer Service: USAA is known for its exceptional customer service, consistently ranking high in satisfaction surveys. They offer personalized support and competitive rates across various insurance types.

- Competitive Pricing: USAA provides competitive rates for auto, home, and life insurance, with discounts available for members. Learn more in our USAA car insurance review.

- Membership Benefits: USAA offers exclusive benefits such as financial planning services and discounts on products and services.

Cons

- Limited Eligibility: Membership is restricted to military personnel and eligible family members.

- Availability Restrictions: Not all insurance products may be available in every location served by USAA.

#2 – Allstate: Best for Full Coverage

#3 – American Family: Best for Loyalty Rewards

#4 – Farmers: Best for Insurance Discounts

Pros

- Versatile Coverage: Farmers offers diverse options, including whole life insurance, ensuring tailored protection for customers’ needs. Check out our online Farmers review for more information.

- Personalized Service: Through a wide agent network, Farmers provides personalized guidance, aiding customers in selecting suitable whole life insurance policies.

- Financial Stability: Farmers Insurance’s solid financial reputation assures policyholders of its ability to meet obligations, including whole life insurance payouts.

Cons

- Limited Online Tools: While offering online services, Farmers’ digital tools may be less advanced, affecting the convenience of managing policies and claims online.

- Cost Consideration: Farmers’ premiums, particularly for whole life insurance, may be perceived as relatively higher, prompting cost-conscious individuals to explore other options.

#5 – Amica: Best for Usage Based Discount

Pros

- Financial Stability: Amica is financially secure, ensuring it can fulfill long-term obligations such as policy payouts.

- Customizable Policies: Amica offers flexible whole life insurance policies, allowing policyholders to tailor coverage to their specific needs. Explore more coverage options in our Amica auto insurance review.

- Superior Customer Service: Amica consistently provides excellent customer service, which is crucial for navigating whole life insurance policies effectively.

Cons

- Possibly Higher Premiums: Amica’s whole life insurance may come with relatively higher premiums compared to other options.

- Limited Availability: Amica’s whole life insurance may not be universally available, potentially limiting access for some demographics.

#6 – AAA: Best for Teens

Pros

- Extensive Coverage Options: AAA insurance provides diverse coverage options, including whole life insurance, ensuring customers can find the optimal policy. Learn more: AAA Auto Insurance Company Review

- Simple Application Process: Through user-friendly online tools and agent assistance, AAA Life Insurance simplifies the application process for customers.

- Membership Benefits: While membership isn’t mandatory, AAA offers additional perks, potentially enhancing the value of their whole life insurance policies.

Cons

- Limited Availability: AAA Life Insurance may not operate in all states, restricting access to their policies.

- Nicotine Usage Impact: Premiums may be higher for nicotine users, potentially affecting individuals seeking the best whole life insurance.

#7 – Erie: Best for Filing Claims

#8 – Country Financial: Best for Customer Service

#9 – MetroMile: Best for Mobile App

Pros

- Affordable Rates: Metromile insurance offers potential annual savings of up to $947 compared to traditional auto insurance, making it a cost-effective choice. Get more info in our detailed report: Metromile Car Insurance Review

- Tailored Coverage: The insurance policy can be customized to suit individual needs, ensuring customers receive the specific coverage they require.

- Convenient App Features: The Metromile app provides various functionalities like trip monitoring, car health diagnostics, and street sweeping alerts, enhancing user convenience and control over their insurance experience.

Cons

- Mileage Restrictions: Metromile imposes a daily mileage limit of 250 miles (150 miles for New Jersey drivers), potentially inconveniencing users with higher mileage requirements.

- Limited Availability: Metromile’s services are currently limited to select states, restricting access for drivers outside these areas and potentially excluding them from its benefits.

#10 – NJM: Best for NY and NJ Drivers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $125 | $135 |

| Allstate | $100 | $110 |

| American Family | $110 | $120 |

| Amica | $120 | $130 |

| Country Financial | $135 | $145 |

| Erie | $130 | $140 |

| Farmers | $115 | $125 |

| MetroMile | $140 | $150 |

| NJM | $145 | $155 |

| USAA | $90 | $100 |

Explore the monthly rates for whole life insurance coverage across various providers and coverage levels. From AAA to USAA, compare minimum and full coverage costs, empowering you to make informed decisions about your insurance needs and budget.

Whether you’re seeking affordable rates or comprehensive coverage, this comprehensive overview helps you find the perfect fit for your financial security. Check out special discounts from the top 10 best whole life insurance providers. Save on premiums with personalized offers ensuring enduring financial stability.

From military discounts and loyalty rewards to homeowner discounts and membership benefits, companies like AAA, Allstate, Amica, and more provide opportunities for policyholders to enjoy savings tailored to their needs. Whether you’re bundling policies, securing your home, or maintaining long-term loyalty, these discounts ensure comprehensive coverage at affordable rates.

Understanding Whole Life Insurance

Whole life insurance covers you for your entire life, provided you actively pay your premiums. A whole life insurance policy includes a guaranteed death benefit and a savings component to accumulate interest.

With whole life insurance, your death benefit will pay for your funeral costs, unpaid debts, and living expenses for your beneficiaries. The savings portion, or accumulated cash value, is a living benefit. You can withdraw or borrow from the cash value portion tax-free before your death.

Heidi Mertlich Licensed Insurance Agent

Traditional whole life insurance has fixed premiums, meaning you’ll pay the same amount each month for your policy forever. Modified whole life insurance policies may allow you to begin smaller payments for a set term.

Mechanics of Whole Life Insurance

With both a death benefit and cash value in play, understanding how whole life insurance works can get complicated. Add in tax-free withdrawals or borrowing against your cash value, and things get even more complicated. There are also different subclass categories of whole life insurance to consider.

We’ll explain how whole life insurance works step-by-step, from understanding premiums and benefits to guaranteeing a payout upon your death. Insurers carefully calculate these amounts so that your cash value equals your policy’s face value as you reach a specific age.

For most, that age is 100 or 121. If your insurance hasn’t paid out the death benefit by then, they’ll offer a policy extension or its cash value. Essentially, your accumulated cash value offsets the cost of paying your death benefit to the insurance company. Once you have “paid back” your death benefit, they return the payout to you.

Using Your Accumulated Cash Value

Your whole life insurance policy’s cash value isn’t static; it’s a resource you can utilize. Whether for major expenses or investment, you can withdraw or borrow from it, potentially enhancing its worth. However, as cash value typically takes years to accumulate significantly, viewing it as a long-term investment strategy is prudent.

You can use it to cover your premiums, easing your financial burden. Secondly, you can make tax-free withdrawals, capped at the amount you’ve paid in premiums, offering a flexible financial resource. Borrowing against the cash value is an option, with no usage restrictions but subject to interest charges. Surrendering the policy for its current cash value is another alternative.

Jimmy McMillan Licensed Insurance Agent

Determining the Cost of Whole Life Insurance

We’ll be upfront: you’ll pay more for whole life insurance than any other type of life insurance. There are ways to save money on life insurance, but you’re not likely to save money with a whole life insurance plan. That’s because you’re paying for the guarantee of your death benefit, monthly premiums, and cash value accumulation. With such a big payout, you’ll have to pay big premiums.

Your whole life insurance costs will depend on your age, health status, where you live, and whether you participate in risky work or activities.

The Pros and Cons of Whole Life Insurance

Whole life insurance is a nuanced policy that can be a huge asset to you and your family in some circumstances. Typically, it’s a good fit for high-net-worth individuals who can afford the higher premiums. Take a look at the pros and cons of whole life insurance to get a sense of whether it might be a good fit for you:

Pros and Cons of Whole Life Insurance

| Pros | Cons |

|---|---|

| Includes cash value component | Slow gains on cash value |

| Fixed, predictable premiums | High monthly premiums |

| Low risk | No say in investments |

| Guaranteed death benefit if conditions are met | Cash value doesn’t pay out upon death |

Discussing your circumstances with your insurance provider can shed light on whether whole life insurance aligns with your needs. It may be a suitable option if you possess a substantial net worth and require estate planning, anticipate lifelong financial dependents, seek diversification in your investment portfolio, or can comfortably manage higher premiums.

However, if whole life insurance doesn’t suit your requirements, the flexibility offered by permanent life insurance policies might better accommodate your financial and familial circumstances.

Case Studies: Analyzing the Benefits and Considerations of Whole Life Insurance

Join us as we examine real-life scenarios where whole life insurance plays a pivotal role in providing financial security, retirement planning, legacy preservation, estate planning, and supplemental income generation.

- Case Study #1 – John’s Financial Security with Whole Life Insurance: John, a 35-year-old husband and father of two, sought to protect his family financially. After thorough research, he chose a whole life insurance policy, ensuring a death benefit for his loved ones in case of his untimely passing. The policy also accrued cash value over time, providing him with financial security and peace of mind

- Case Study #2 – Sarah’s Retirement Planning with Whole Life Insurance: Sarah, 50, focused on retirement. Opting for a whole life insurance policy, she built cash value steadily. Its guaranteed growth and tax benefits made it her reliable retirement plan, boosting her financial security.

- Case Study #3 – Mark’s Legacy Planning with Whole Life Insurance: Mark, a prosperous business owner in his late 40s, aimed to secure his legacy for his children and future generations. Choosing a whole life insurance policy, he ensured his children would inherit a substantial death benefit.

- Case Study #4 – Lisa’s Estate Planning with Whole Life Insurance: At 65, Lisa, a retiree, worried about estate taxes for her heirs. To safeguard assets and ease wealth transfer, she integrated whole life insurance into her estate plan. By funding a trust with a policy, she secured a tax-free death benefit for beneficiaries, covering potential estate taxes.

- Case Study #5 – Michael’s Supplemental Income with Whole Life Insurance: Michael, 45, sought extra retirement income. He saw the tax advantages of a whole life insurance policy, so he bought one and built its cash value over time. He intended to use policy loans for tax-free income in retirement.

From safeguarding loved ones’ financial future to bolstering retirement savings and preserving legacies, whole life insurance emerges as a versatile instrument in comprehensive financial planning.

Chris Abrams Licensed Insurance Agent

We hope these case studies have provided valuable insights into the potential of whole life insurance to address various financial objectives effectively. Thank you for joining us, and until next time, may your financial journey be guided by informed decisions and sound strategies.

Buy the Best Whole Life Insurance to Secure Your Family’s Future

Whole life insurance can be a great investment for high net worth individuals and others with certain financial situations. You’ll get a guaranteed death benefit payout and predictable premium payments, meaning you can carefully plan your finances throughout your life.

If managed well, you can maximize the investment of your whole life insurance policy by borrowing or withdrawing against your accumulated cash value. Talk with your insurance company and your financial advisor to see if whole life insurance is good for you and your family.

Shop around for personalized life insurance quotes that fit your needs and budget by entering your ZIP code.

Frequently Asked Questions

How does whole life insurance work?

Whole life insurance is a type of life insurance policy that remains in effect for as long as you live, provided the premiums are kept up to date. It includes a payout value as well as a cash value account that can be used by the policyholder while the insured person is still living.

To gain further insights, consult our comprehensive guide titled “Types of Life Insurance.”

How is whole life insurance different from term life insurance?

Whole life insurance lasts for as long as you live, while term life insurance only lasts for a specific period of time. This is why whole life insurance typically costs more than term life insurance.

Don’t settle for high life insurance rates. Shop for low rates and ensure your loved ones are protected by entering your ZIP code below.

What are the advantages of whole life insurance?

Whole life insurance offers a guaranteed payout regardless of how long the insured person lives, and the cash value account can be used by the policyholder even while the insured person is still living. It can be used for a variety of purposes, including leaving an inheritance for children, paying for final expenses, or leaving money for bills and household upkeep after the policyholder has passed away.

How do I know if whole life insurance companies are financially stable?

You can check the financial stability of an insurance company by looking at the ratings from a financial watchdog company such as the A.M. Best Company.

What happens if I stop paying my whole life insurance premiums?

If the policyholder stops paying their premiums, the policy will lapse, and they will lose coverage. However, they may be able to reinstate the policy by paying the outstanding premiums and any interest or fees.

For additional details, explore our comprehensive resource titled “What does health insurance cover?”

Can I cancel a whole life insurance policy?

Yes, policyholders can cancel a whole life insurance policy at any time, but they may incur fees or penalties for early cancellation.

What factors should I consider when looking for the best permanent life insurance?

When searching for the best permanent life insurance policy, consider factors such as your financial goals, coverage needs, budget, the financial strength and reputation of the insurance company, policy features, customer service, and the flexibility of the policy.

To learn more, explore our comprehensive resource on insurance titled “Best Permanent Life Insurance: A Complete Guide.”

What is the best whole insurance?

The “best” whole life insurance varies depending on individual needs and preferences. It’s essential to consider factors like coverage amount, premium affordability, company reputation, and policy features to determine the best option for you.

How do I choose the best whole life insurance for adults?

When selecting the best whole life insurance for adults, consider factors such as the financial stability of the insurance company, the policy’s premiums and benefits, the flexibility of premium payments, and the potential for cash value growth. It’s essential to compare quotes and policies from multiple insurers to find the most suitable coverage for your needs.

What are whole life insurance plans?

Whole life insurance plans are permanent life insurance policies that provide coverage for the entirety of the insured’s life as long as premiums are paid. They typically include a death benefit and a cash value component that grows over time.

To delve deeper, refer to our in-depth report titled “How does the insurance company determine my premium?”

Which insurance companies offer the best whole life insurance policies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.