Best Car Insurance for Federal Employees in 2026 (Top 10 Companies)

Discover the best car insurance for Federal Employees with USAA, Progressive, and Allstate as top providers. Enjoy competitive rates from $22 monthly for minimum coverage, plus significant discounts. Explore custom coverage for government employees.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Chris Tepedino is a feature writer that has written extensively about home, life, and car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. ...

Chris Tepedino

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated January 2025

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Federal Employees

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Federal Employees

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Federal Employees

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

USAA stands out as the top pick overall, with rates starting as low as $59 per month for full coverage and $22 per month for minimum coverage, along with up to 25% discounts, ensuring both affordability and quality protection for federal employees.

Our Top 10 Company Picks: Best Car Insurance for Federal Employees

| Company Logo | Rank | Safe Driver Discount | Federal Employee Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 18% | Military Savings | USAA | |

| #2 | 11% | 17% | Comprehensive Coverage | Progressive | |

| #3 | 9% | 15% | Safe-Driving Discounts | Allstate | |

| #4 | 10% | 16% | Online Convenience | Geico | |

| #5 | 10% | 16% | Local Agents | State Farm | |

| #6 | 8% | 14% | Bundling Policies | Farmers | |

| #7 | 9% | 15% | Vanishing Deductibles | Nationwide |

| #8 | 8% | 14% | Customizable Coverage | Liberty Mutual |

| #9 | 10% | 16% | Multi-Policy Discounts | Travelers | |

| #10 | 7% | 13% | Loyalty Rewards | American Family |

With a variety of coverage options to choose from, federal employees can strike the ideal balance between affordability and security for their unique needs.

Enter your ZIP code above to ensure you get competitive rates and personalized coverage tailored to your needs and take the first steps to secure the ideal car insurance for you and your family. Drive confidently, knowing you have the coverage to protect your loved ones on the road.

- Tailored coverage options for federal employees’ specific needs

- Competitive rates and discounts for government workers

- USAA recognized as the top pick for federal employee car insurance

#1 – USAA: Top Overall Pick

Pros

- 12% Safe Driver Discount: USAA offers a significant safe driver discount, rewarding policyholders with a history of responsible driving.

- 18% Federal Employee Discount: Federal employees can benefit from a substantial discount on their auto insurance premiums with USAA.

- Military Savings: USAA insurance review & ratings highlight the company’s reputation for offering specialized services and discounts to military members and their families.

Cons

- Limited Eligibility: USAA membership is restricted to military members, veterans, and their families, limiting accessibility for the general public.

- Not the Cheapest for All: While USAA often provides competitive rates, it may not always be the absolute cheapest option for every individual.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Comprehensive Coverage

Pros

- 11% Safe Driver Discount: The “Progressive Insurance Review & Ratings” showcase how the company incentivizes safe driving habits with substantial discounts on auto insurance premiums.

- 17% Federal Employee Discount: Federal employees may receive a substantial discount on their insurance with Progressive.

- Comprehensive Coverage: Progressive offers a range of coverage options, including comprehensive policies for various needs.

Cons

- Not the Cheapest for All: Progressive’s rates may vary, and it may not always be the most affordable option for every driver.

- Average Customer Service: Some customers have reported average experiences with Progressive’s customer service, citing delays and difficulties in claims processing.

#3 – Allstate: Best for Safe-Driving Discounts

Pros

- 9% Safe Driver Discount: Allstate provides a safe driver discount, encouraging and rewarding responsible driving behavior.

- 15% Federal Employee Discount: Federal employees may benefit from a discount on their auto insurance premiums with Allstate.

- Safe-Driving Discounts: Highlighted in the Allstate insurance review & ratings is the array of safe-driving discounts available to policyholders.

Cons

- Relatively Higher Premiums: Some customers find Allstate’s premiums to be on the higher side compared to other insurers.

- May Penalize Accident Forgiveness Users: While Allstate offers accident forgiveness, some customers have reported premium increases after using this feature.

#4 – Geico: Best for Online Convenience

Pros

- 10% Safe Driver Discount: Geico provides a safe driver discount for policyholders with good driving records.

- 16% Federal Employee Discount: Federal employees can enjoy a discount on their auto insurance premiums with Geico.

- Online Convenience: Geico is known for its user-friendly online platform, providing convenience in managing policies.

Cons

- May Not Offer the Most Personalized Service: Geico’s focus on online convenience may result in a less personalized experience compared to companies with extensive local agent networks.

- Limited Policy Customization: As outlined in the “Geico Insurance Review & Ratings“, the focus on simplicity might constrain policy customization options for certain customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Local Agents

Pros

- 10% Safe Driver Discount: State Farm offers a safe driver discount, rewarding policyholders with good driving records.

- 16% Federal Employee Discount: Federal employees can benefit from a discount on their auto insurance premiums with State Farm.

- Local Agents: State Farm has an extensive network of local agents, providing personalized service and assistance.

Cons

- May Not be the Cheapest for Everyone: Referencing the “State Farm Insurance Review & Ratings“, although the company delivers commendable service, it may not consistently provide the most competitive premiums.

- Limited Online Presence: For those who prefer managing policies online, State Farm’s online platform may not be as robust as some competitors.

#6 – Farmers: Best for Bundling Policies

Pros

- 8% Safe Driver Discount: Farmers offers a safe driver discount, encouraging and rewarding responsible driving.

- 14% Federal Employee Discount: Federal employees may receive a discount on their auto insurance premiums with Farmers.

- Bundling Policies: According to the Farmers Insurance Review & Ratings, Farmers offers discounts for bundling auto insurance with other policies.

Cons

- Potentially Higher Premiums for Some: Some customers report higher premiums compared to other insurers, especially for certain coverage types.

- Limited Online Tools: Farmers’ online tools and mobile app may not be as advanced as those of some competitors.

#7 – Nationwide: Best for Vanishing Deductibles

Pros

- 9% Safe Driver Discount: Nationwide offers a discount for safe driving records, encouraging and rewarding responsible behavior.

- 15% Federal Employee Discount: Federal employees can benefit from a discount on their auto insurance premiums with Nationwide.

- Vanishing Deductibles: Nationwide’s Vanishing Deductible program allows customers to reduce their deductible over time for safe driving.

Cons

- Not Always the Cheapest: Similar to other larger insurers, Nationwide may not always provide the lowest premiums for every individual.

- Mixed Customer Service Reviews: Nationwide insurance review & ratings indicate a mixed reception regarding customer service feedback.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Coverage

Pros

- 8% Safe Driver Discount: Based on “Liberty Mutual Insurance Review & Ratings“, policyholders with safe driving records receive a discount.

- 14% Federal Employee Discount: Federal employees may receive a discount on their auto insurance premiums with Liberty Mutual.

- Customizable Coverage: Liberty Mutual offers a range of coverage options, allowing customers to tailor their policies to their specific needs.

Cons

- Mixed Customer Reviews: Customer reviews for Liberty Mutual vary, with some praising its service and others expressing dissatisfaction.

- May Have Higher Premiums for Some Drivers: Some customers may find Liberty Mutual’s premiums to be higher compared to other options, especially for certain demographics.

#9 – Travelers: Best for Multi-Policy Discounts

Pros

- 10% Safe Driver Discount: Travelers offers a safe driver discount, encouraging and rewarding responsible driving.

- 16% Federal Employee Discount: Federal employees may enjoy a discount on their auto insurance premiums with Travelers.

- Multi-Policy Discounts: Travelers insurance review & ratings indicate that policyholders can receive discounts for insuring multiple cars on one policy.

Cons

- Potentially Higher Premiums for Some Drivers: Travelers’ premiums may be higher for certain drivers, especially those with less-than-perfect driving records.

- Limited Local Agents: While Travelers offers online and phone support, it may not have as many local agents as some other companies.

#10 – American Family: Best for Loyalty Rewards

Pros

- 7% Safe Driver Discount: The “American Family Insurance Review & Ratings” show that policyholders with good driving records can benefit from discounts offered by the company.

- 13% Federal Employee Discount: Federal employees may receive a discount on their auto insurance premiums with American Family.

- Loyalty Rewards: American Family provides rewards for customer loyalty, offering additional benefits for long-term policyholders.

Cons

- May Not be Available Nationwide: American Family operates in a limited number of states, limiting accessibility for some customers.

- Mixed Customer Reviews: Customer reviews vary, with some praising the company’s service and others expressing dissatisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Deep Dive Into Exclusive Coverage Rates Among Top Providers for Federal Employees

Examining the table, USAA stands out with competitive $59 full coverage and affordable $22 minimum coverage, offering federal employees flexible options. Progressive presents balanced $105 full coverage and $39 minimum coverage rates. Allstate provides comprehensive protection at $160 full coverage and $61 minimum coverage.

Car Insurance Monthly Rates for Federal Employees

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $44 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

Geico emphasizes affordability with $80 full coverage and $30 minimum coverage rates. State Farm maintains balance with $86 full coverage and $33 minimum coverage rates, ensuring quality and cost-effectiveness. Farmers caters to diverse needs, offering $139 full coverage and $44 minimum coverage rates.

Nationwide strikes a balance between flexibility and protection, offering $115 full coverage and $44 minimum coverage rates. Liberty Mutual provides extensive coverage at $174 full coverage and $68 minimum coverage. Travelers balances affordability and protection with $99 full coverage and $37 minimum coverage rates.

American Family concludes the list with $117 full coverage and $44 minimum coverage rates, offering federal employees a range of choices based on their preferences and budget, including exclusive federal employee car discounts. By comparing rates and features, federal employees can find the coverage that best fits their needs and budget, ensuring peace of mind on the road.

The Importance of Comprehensive Coverage for Federal Employee Car Insurance

Comprehensive coverage is vital for federal employees to protect both personal and government-owned vehicles. This type of coverage extends beyond basic liability insurance and covers damages incurred due to incidents other than collision, including theft, vandalism, natural disasters, and animal collisions.

Jeff Root Licensed Life Insurance Agent

Comprehensive coverage provides peace of mind to federal employees, knowing that they are protected from unforeseen incidents that may result in significant financial burdens. It’s crucial to carefully review the specifics of comprehensive coverage offered by different insurance providers to ensure they meet your needs.

Learn More: Best Government Employee Car Insurance Discounts

Comparing Different Car Insurance Options for Federal Employees

When comparing car insurance options for federal employees, it’s essential to obtain quotes from multiple insurers to ensure you’re getting the best coverage at the most competitive rates. Evaluating the policy features, coverage limits, and deductibles side by side can help you make an informed decision.

Car Insurance Monthly Rates for Federal Employees by Age & Gender

| Insurance Company | 25-Year-Old Female | 25-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male |

|---|---|---|---|---|---|---|

| Allstate | $181 | $190 | $168 | $176 | $162 | $160 |

| Farmers | $172 | $180 | $160 | $167 | $139 | $139 |

| Hiscox | $150 | $161 | $138 | $141 | $127 | $127 |

| Liberty Mutual | $187 | $215 | $174 | $200 | $171 | $174 |

| Nationwide | $136 | $150 | $124 | $136 | $113 | $115 |

| Progressive | $141 | $146 | $131 | $136 | $112 | $105 |

| State Farm | $101 | $111 | $103 | $94 | $86 | $86 |

| The Hartford | $135 | $143 | $126 | $133 | $115 | $113 |

| Travelers | $107 | $116 | $99 | $108 | $98 | $99 |

| USAA | $80 | $85 | $74 | $79 | $59 | $59 |

It’s also worth considering any additional discounts that may be available based on your status as a federal employee. Many insurance companies offer special discounts or benefits exclusively to federal employees, so it’s crucial to inquire about these options when obtaining quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

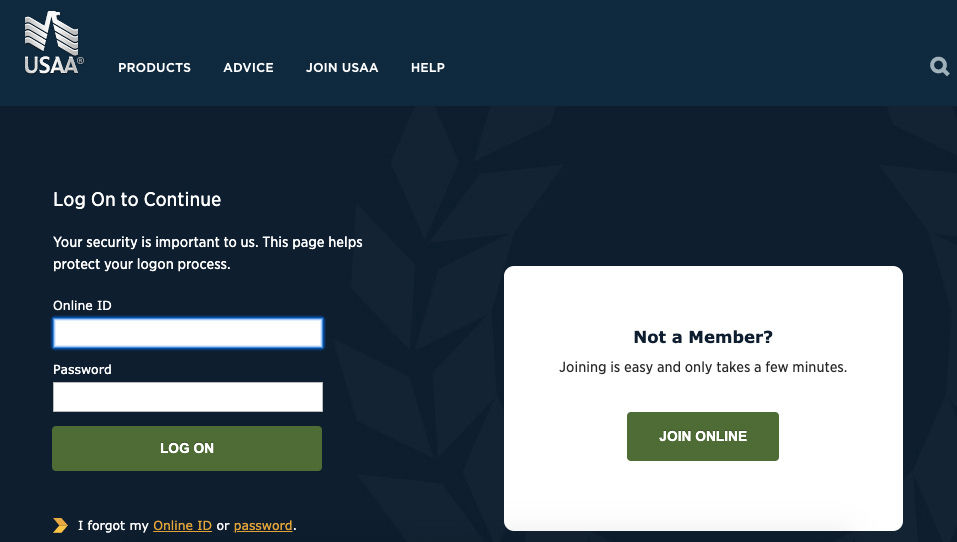

Navigating Car Insurance Quotes as a Federal Employee

As a federal employee, obtaining car insurance is essential to ensure protection on the road. Here’s a concise guide on how to file a quote for car insurance, tailored to meet the specific needs of federal employees.

Firstly, research insurance companies known for offering competitive rates and excellent service. Next, gather necessary information like personal details, vehicle information, and coverage preferences. Then, request quotes from multiple insurers, specifying any discounts or options you’re interested in. Review the quotes carefully, comparing rates, coverage options, and benefits.

Once you’ve selected the best option, follow the insurer’s instructions to purchase the policy. Keep a copy of the quote and policy documents for your records, and provide details to your employer if needed.

By following these streamlined steps, federal employees can efficiently navigate the process of obtaining car insurance quotes, ultimately securing the coverage necessary to safeguard themselves and their vehicles.

Exploring the Benefits of Car Insurance for Federal Employees

Factors to Consider When Choosing Car Insurance for Federal Employees

When selecting an car insurance provider, federal employees should consider several factors to ensure they are getting the best coverage. One crucial factor is the financial stability and reputation of the insurance company. It’s essential to choose a reputable insurer with a solid track record of customer satisfaction and prompt claims handling.

- Coverage Options: Evaluate the range of coverage options offered by insurance providers to ensure they meet your specific needs, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Cost: Compare premium rates and deductibles from multiple insurers to find affordable options that fit within your budget while providing adequate coverage.

- Discounts: Inquire about discounts available to federal employees, such as group discounts or special rates, which can help lower insurance premiums.

- Customer Service: Research the reputation of insurance companies for customer service and claims handling to ensure a smooth experience in the event of an accident or claim.

- Financial Stability: Choose insurers with a strong financial standing and positive ratings from agencies like A.M. Best to ensure they can fulfill their obligations in the event of a claim.

- Policy Features: Consider additional features and benefits offered by insurance policies, such as roadside assistance, rental car coverage, or accident forgiveness, to enhance your coverage.

- Ease of Access: Assess the convenience of accessing insurance services, including online account management, mobile apps, and local agent availability, to meet your preferences and needs.

- Specialized Coverage: Determine if specialized coverage options are available for federal employees, such as coverage for government-owned vehicles or work-related travel, to ensure comprehensive protection.

- Claims Process: Understand the claims process of insurance companies, including how claims are filed, processed, and resolved, to make an informed decision about the insurer’s reliability and efficiency.

- Reviews and Recommendations: Seek feedback from other federal employees or read online reviews to gauge the experiences of policyholders with different insurance providers before making a decision.

In conclusion, federal employees should carefully consider these factors when choosing car insurance to ensure they find the coverage that best meets their needs. By evaluating coverage options, cost, discounts, customer service, and other key factors, federal employees can secure reliable insurance protection while navigating the roads with confidence.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Claims Process for Federal Employee Car Insurance Policies

In the unfortunate event of an accident, federal employees need to understand the claims process for their car insurance policies. Firstly, it’s crucial to report the incident promptly to the insurance company. Most insurers have a specific window within which to report claims.

In addition to reporting the incident, gather all necessary documentation, including police reports, photographs, and witness statements. Providing detailed information to the insurance company is essential in expediting the claims process and ensuring a fair outcome.

Finally, communicate regularly with the insurance company throughout the claims process and follow any instructions provided. Understanding the claims process and cooperating with the insurer can help federal employees navigate the often complex and time-consuming claims process more effectively.

Read More:

- How to Document Damage for Car Insurance Claims

- Why You Should Always Take Pictures After a Car Accident

Examining the Pros and Cons of Bundling Home and Car Insurance for Federal Employees

Explore the numerous advantages awaiting federal employees when bundling their home and car insurance policies. From cost savings to simplified management and enhanced coverage options, discover how this strategic decision can elevate their insurance experience.

- Cost Savings: Bundling home and car insurance policies often results in discounted rates, leading to overall cost savings for federal employees.

- Convenience: Managing both policies with a single insurer simplifies administrative tasks such as billing, policy renewal, and claims filing.

- Enhanced Coverage Options: Some insurers offer additional benefits or discounts for bundling policies, such as increased coverage limits or access to additional policy features.

- Loyalty Rewards: Bundling insurance policies with the same insurer may qualify federal employees for loyalty rewards or discounts over time, rewarding long-term policyholders for their continued business.

Bundling home and car insurance offers benefits for federal employees, but it’s important to consider potential drawbacks. Explore the nuances of bundling and its impact on insurance choices and financial security.

- Limited Flexibility: Bundling may limit federal employees’ ability to choose different insurers for each type of coverage, potentially restricting their ability to find the best rates or coverage options.

- Risk Concentration: Concentrating all policies with a single insurer increases the risk of financial loss in the event of insurer insolvency or a catastrophic event.

- Policy Changes Impact Both Policies: Changes to one bundled policy may affect both home and car insurance policies, potentially causing unintended consequences or disruptions in coverage.

- Potential for Higher Premiums: While bundling can lead to cost savings, it’s essential to compare bundled rates with standalone policies to ensure the best overall value, as bundling isn’t always the most cost-effective option.

Cost savings, convenience, and enhanced coverage are benefits of bundling, but federal employees must carefully consider limitations like flexibility and risk concentration. Understanding these nuances empowers informed decisions about insurance and financial security.

Essential Coverage Options to Include in Your Federal Employee Car Insurance Policy

When selecting car insurance as a federal employee, there are several essential coverage options to consider. By understanding these options, federal employees can ensure they have comprehensive coverage that addresses potential risks and suits their individual needs.

Firstly, liability coverage is crucial. This coverage protects federal employees from financial liabilities arising from bodily injury or property damage that they may cause in an accident. It is legally required in most states.

In addition to liability coverage, collision coverage is important. This coverage pays for repair or replacement costs when federal employees’ vehicles are damaged in a collision, regardless of fault. Comprehensive coverage, as discussed earlier, is also vital. It provides protection against damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

The Federal Employee Perspective

In conclusion, finding the best car insurance for federal employees requires careful consideration of their unique needs, coverage options, and insurance providers. By understanding the different factors involved and comparing multiple options, federal employees can secure the coverage they need at the most competitive rates.

Remember to evaluate various policy features, explore potential discounts, and consider the specific risks and responsibilities associated with being a federal employee. With comprehensive coverage in place, federal employees can drive with confidence, knowing they are protected should an unfortunate incident occur.

Compare quotes now by entering your ZIP code below. Secure the best coverage for your needs and drive with confidence knowing you have the right protection in place.

Frequently Asked Questions

What types of discounts are available to federal employees for car insurance?

Federal employees may qualify for various discounts on car insurance, including federal employee auto insurance discounts and car insurance discounts specifically tailored for government employees. These discounts can result in significant savings on premiums and may include safe-driving discounts, multi-policy discounts, or loyalty rewards.

Are there specific discounts available for federal employees when purchasing car insurance?

Yes, some car insurance companies offer exclusive discounts or benefits specifically for federal employees. It is advisable to inquire with insurers about these options to maximize potential savings.

To unlock these savings, inquire with insurers, enter your ZIP code below for relevant local offers.

How does being a federal employee affect car insurance rates?

Being a federal employee itself does not directly impact car insurance rates. However, certain organizations or associations related to federal employment may have partnerships with insurers that offer discounted rates or special benefits.

Do insurance companies offer federal employee home insurance discount?

Yes, some insurance companies offer federal employee home insurance discount. These discounts are often part of bundled insurance packages that combine home and auto insurance policies. Federal employees should inquire with insurers about available discounts on home insurance to maximize savings.

What distinguishes government employee car insurance from standard auto insurance policies?

Government employee car insurance may offer specialized coverage options and discounts tailored specifically for employees of government agencies. These policies often provide unique benefits and features designed to meet the needs of government employees, such as flexible coverage options and enhanced customer service.

What is the best car insurance for government employees?

The best car insurance for government employees often depends on individual needs and preferences. However, providers like USAA, Progressive, and Allstate are known for offering tailored coverage and discounts specifically for government employees.

Are there specific discounts available on car insurance for government employees?

Yes, many insurance companies offer exclusive discounts for government employees. These discounts can vary but may include special rates, safe-driving discounts, or multi-policy discounts for federal employee auto insurance.

How can federal employees secure the best car insurance rates in Federal Way?

To secure the best car insurance rates in Federal Way, federal employees should compare quotes from multiple insurance providers. Additionally, taking advantage of any available discounts for government employees can help lower premiums.

What factors should federal employees consider when purchasing car insurance?

Federal employees should consider factors such as coverage options, cost, customer service reputation, available discounts, and the insurer’s financial stability when purchasing car insurance for government employees.

Do federal employees qualify for specific auto insurance discounts?

Yes, federal employees may qualify for specific auto insurance discounts offered by insurance companies. These discounts are often tailored to government employees and can result in significant savings on premiums.

What coverage options are essential for federal employees when selecting car insurance policies?

How can federal employees maximize discounts on their car insurance policies?

Can federal employee auto insurance discounts be combined with other offers?

Are there specialized insurance plans designed specifically for auto insurance for government employees?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.