Cheap Rolls-Royce Wraith Car Insurance in 2026 (Save Money With These 10 Companies)

Explore the top picks for cheap Rolls-Royce Wraith car insurance, featuring rates as low as $55 per month. Progressive, The General, and State Farm excel with competitive pricing and tailored coverage options for Rolls-Royce Wraith owners, ensuring comprehensive protection at affordable rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2025

Company Facts

Min. Coverage for Rolls-Royce Wraith

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Rolls-Royce Wraith

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Rolls-Royce Wraith

A.M. Best Rating

Complaint Level

Pros & Cons

Explore the best options for cheap Rolls-Royce Wraith car insurance with a focus on top providers like Progressive, The General, and State Farm.

This article delves into their competitive offerings, tailored specifically for Rolls-Royce Wraith owners seeking comprehensive coverage at affordable rates. Learn more in our article called “What is Premium?”

Our Top 10 Company Picks: Cheap Rolls-Royce Wraith Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $55 A++ Low-Mileage Drivers Progressive

#2 $58 A+ High-Risk Drivers The General

#3 $60 B Young Drivers State Farm

#4 $62 A+ Safe Drivers Geico

#5 $65 A+ Full Coverage Allstate

#6 $67 A++ Multi-Policy Holders Farmers

#7 $70 A High-Value Cars Liberty Mutual

#8 $72 A+ Comprehensive Coverage Nationwide

#9 $75 A++ Families American Family

#10 $78 A++ Military Families USAA

Discover how these insurers stand out with their extensive policies designed to meet the unique needs of luxury car owners, ensuring peace of mind on the road without compromising on quality or service.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

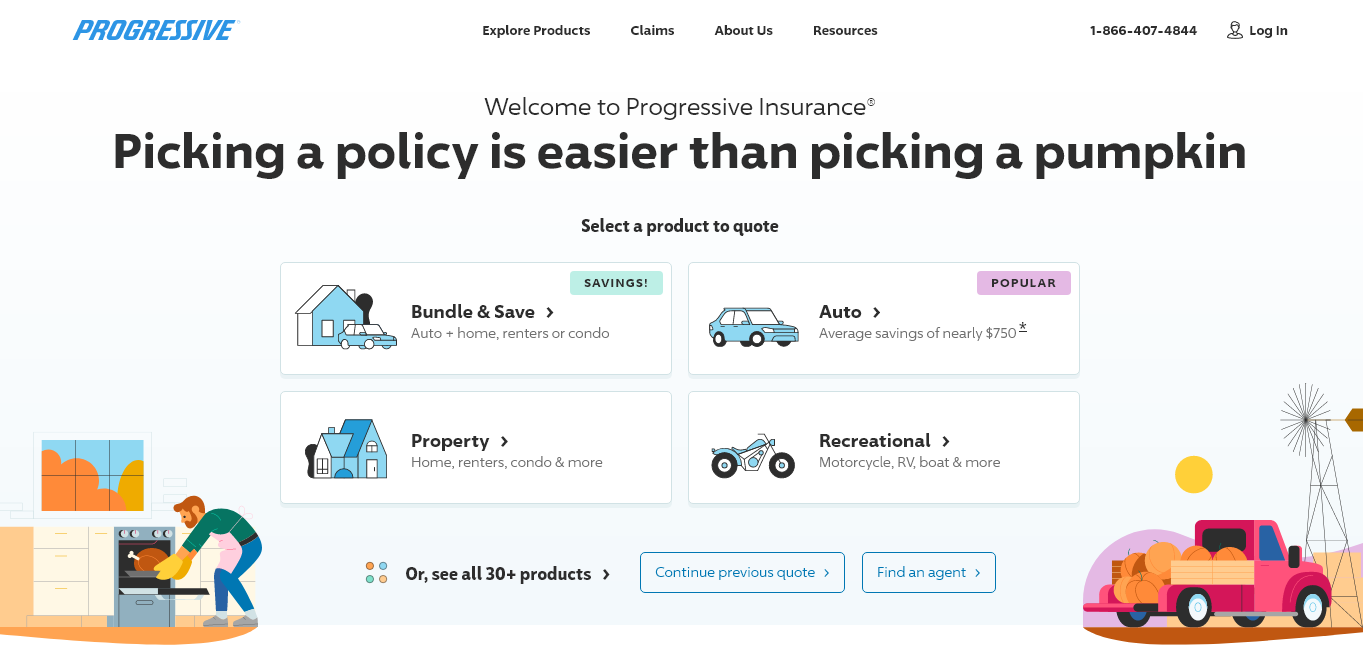

#1 – Progressive: Top Overall Pick

Pros

- Low Rates: Progressive offers the lowest monthly rate starting at $55 for Rolls-Royce Wraith owners.

- A++ Rating: With an A++ rating from A.M. Best, Progressive assures financial stability. See more details on our guide “Progressive Insurance Review & Ratings.”

- Discounts: Progressive provides significant discounts tailored for Rolls-Royce Wraith drivers.

Cons

- Limited Coverage Options: Some niche coverage options may be less comprehensive for Rolls-Royce Wraith owners.

- Claims Process: Claim processing times might be longer during peak seasons, affecting Rolls-Royce Wraith owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – The General: Best for High-risk Drivers

Pros

- Competitive Rates: The General offers affordable premiums, starting at $58, beneficial for Rolls-Royce Wraith owners.

- A+ Rating: A solid A+ rating from A.M. Best assures financial stability and reliability. Access comprehensive insights into our article called “The General Car Insurance Review & Ratings.”

- SR-22 Insurance: Specializes in SR-22 insurance, crucial for high-risk Rolls-Royce Wraith drivers.

Cons

- Limited Coverage Options: May not offer as many specialized coverage options for Rolls-Royce Wraith owners.

- Customer Service: Some customers report issues with customer service responsiveness, impacting Rolls-Royce Wraith owners.

#3 – State Farm: Best for Young Drivers

Pros

- Versatile Coverage: State Farm provides diverse coverage options suitable for Rolls-Royce Wraith owners.

- Discounts: Offers a range of discounts that can significantly benefit Rolls-Royce Wraith owners. See more details on our article called “State Farm Insurance Review & Ratings.”

- Reputation: Well-regarded for customer service and claims handling, reassuring for Rolls-Royce Wraith owners.

Cons

- Higher Premiums: Premiums may be relatively higher compared to competitors, even with discounts for Rolls-Royce Wraith owners.

- Online Tools: Online and mobile tools might be less intuitive, affecting Rolls-Royce Wraith owners user experience.

#4 – Geico: Best for Safe Drivers

Pros

- Competitive Rates: Geico offers affordable premiums starting at $62, beneficial for Rolls-Royce Wraith owners.

- A+ Rating: An A+ rating from A.M. Best indicates strong financial stability and reliability. Unlock details in our article called “Do Geico employees get car insurance discounts?“

- Discounts: Geico provides a range of discounts that can lower costs for Rolls-Royce Wraith owners.

Cons

- Claims Process: Some customers report delays in the claims process, impacting Rolls-Royce Wraith owners.

- Limited Local Agents: Geico’s reliance on direct sales may not appeal to Rolls-Royce Wraith owners seeking personalized service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Full Coverage

Pros

- Comprehensive Coverage: Allstate offers extensive coverage options suitable for Rolls-Royce Wraith owners.

- A+ Rating: An A+ rating from A.M. Best guarantees robust financial stability assurance. Delve into our evaluation of “Allstate Insurance Review & Ratings.”

- Customer Satisfaction: Known for strong customer satisfaction, reassuring for Rolls-Royce Wraith owners.

Cons

- Higher Premiums: Premiums may be on the higher side, impacting Rolls-Royce Wraith owners budgets.

- Policy Complexity: Policies may be complex, requiring thorough review by Rolls-Royce Wraith owners.

#6 – Farmers: Best for Multi-Policy Holders

Pros

- Discounts: Farmers offers significant discounts for bundling policies, beneficial for Rolls-Royce Wraith owners.

- A++ Rating: A++ rating from A.M. Best signifies exceptionally strong financial stability and reliability. Discover more about offerings in our article called “Farmers Insurance Review & Ratings.”

- Customizable Coverage: Provides customizable coverage options tailored to Rolls-Royce Wraith owners needs.

Cons

- Cost: Premiums may still be higher for certain coverage levels, affecting Rolls-Royce Wraith owners.

- Claims Process: Some customers report issues with the claims process, impacting Rolls-Royce Wraith owners experience.

#7 – Liberty Mutual: Best for High-value Cars

Pros

- Specialized Coverage: Liberty Mutual offers specialized coverage for high-value cars like the Rolls-Royce Wraith.

- A Rating:A solid A rating from A.M. Best underscores their financial stability and reliability. Discover more about offerings in our article titled “Liberty Mutual Review & Ratings.”

- Personalized Service: Provides personalized service options tailored specifically for Rolls-Royce Wraith owners needs.

Cons

- Premiums: Premiums may be higher due to the specialized nature of coverage for Rolls-Royce Wraith.

- Coverage Options: Limited flexibility in coverage options may not meet all needs of Rolls-Royce Wraith owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

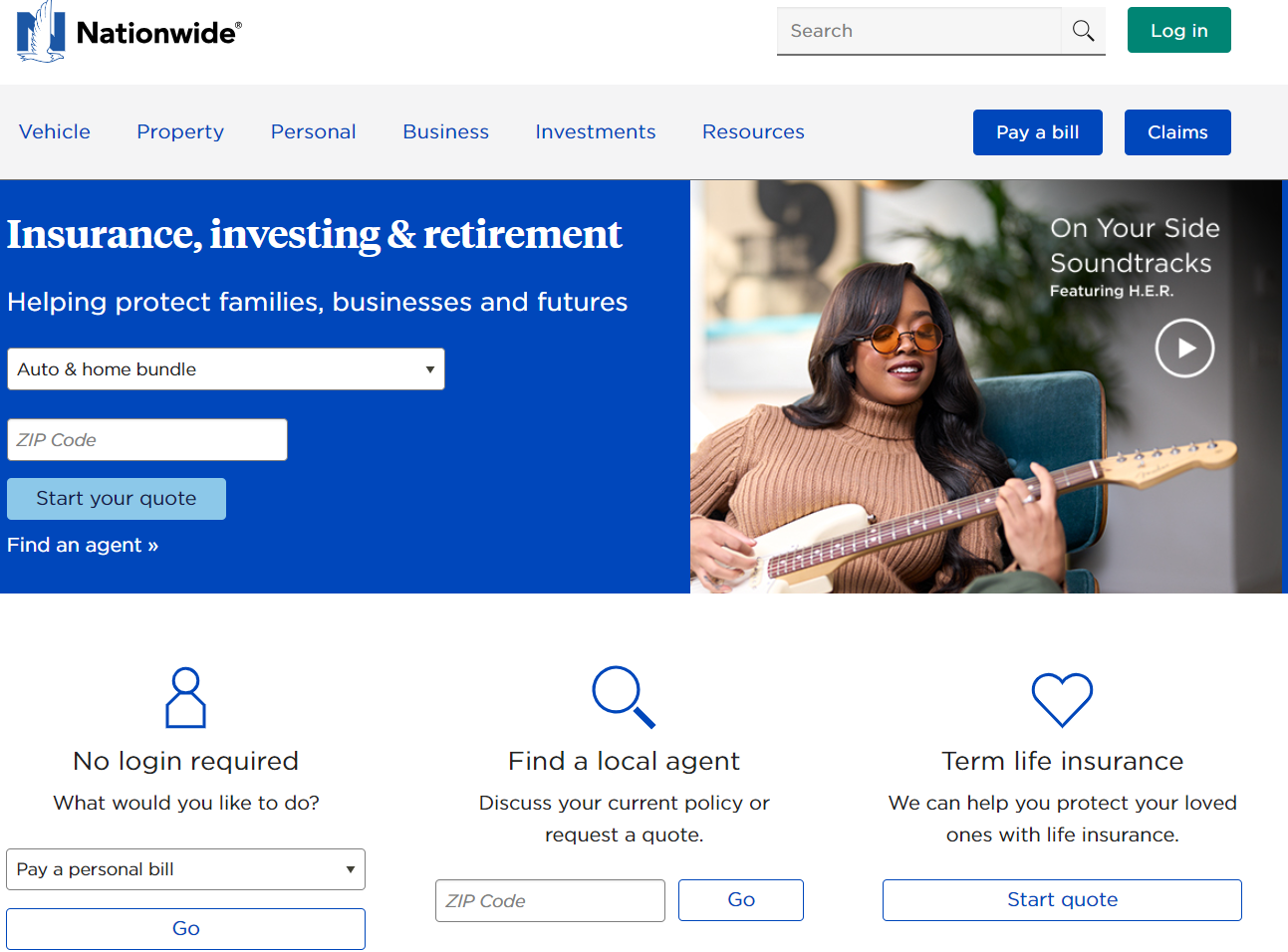

#8 – Nationwide: Best for Comprehensive Coverage

Pros

- Comprehensive Options: Nationwide offers comprehensive coverage options suitable for Rolls-Royce Wraith owners.

- A+ Rating: A+ rating from A.M. Best indicates strong financial stability and reliability.

- Discounts: Provides various discounts that can benefit Rolls-Royce Wraith owners. Learn more in our guide titled “Nationwide Insurance Review & Ratings.”

Cons

- Customer Service: Some customers report issues with customer service responsiveness, affecting Rolls-Royce Wraith owners.

- Premiums: Premiums may be higher compared to competitors, impacting Rolls-Royce Wraith owners budget.

#9 – American Family: Best for Families

Pros

- Family Discounts: American Family offers discounts tailored for families, including those owning a Rolls-Royce Wraith. Check out insurance savings in our complete article called “American Family Insurance Review & Ratings.”

- A++ Rating: A++ rating from A.M. Best indicates exceptionally strong financial stability and reliability

- Customer Service: Known for excellent customer service, reassuring for Rolls-Royce Wraith owners.

Cons

- Limited Coverage Options: May not offer as many specialized coverage options for Rolls-Royce Wraith owners.

- Premiums: Premiums may be higher depending on the coverage selected by Rolls-Royce Wraith owners.

#10 – USAA: Best for Military Families

Pros

- Military Focus: USAA caters specifically to military families, offering unique benefits for Rolls-Royce Wraith owners.

- A++ Rating:A++ rating from A.M. Best ensures exemplary financial stability for peace of mind.

- Discounts: Provides various discounts that can lower costs for Rolls-Royce Wraith owners. Discover insights in our guide titled “USAA Insurance Review & Ratings.”

Cons

- Membership Limitation: Only available to military personnel and their families, excluding others from Rolls-Royce Wraith owner eligibility.

- Customer Service: Limited availability of local agents may impact Rolls-Royce Wraith owners seeking personalized service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rolls-Royce Wraith Car Insurance Monthly Rates Overview

The table below outlines the monthly insurance rates for Rolls-Royce Wraith across various coverage levels offered by leading providers. These rates reflect both minimum and full coverage options, providing a comprehensive view of insurance affordability and options tailored to different needs.

Rolls-Royce Wraith Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $65 $150

American Family $75 $180

Farmers $67 $160

Geico $62 $140

Liberty Mutual $70 $170

Nationwide $72 $175

Progressive $55 $130

State Farm $60 $135

The General $58 $132

USAA $78 $185

When considering insurance for a Rolls-Royce Wraith, the rates vary significantly among providers and coverage levels. Progressive offers the lowest monthly rate for full coverage at $130, making it ideal for budget-conscious owners seeking comprehensive protection. To learn more, explore our comprehensive resource on “How much insurance coverage do I need?”

State Farm follows closely with a competitive rate of $135, ensuring quality coverage at an affordable price point. For minimum coverage, Progressive remains the most cost-effective at $55, while The General and State Farm provide options at $58 and $60 respectively.

These rates reflect each insurer’s approach to balancing cost with the level of protection offered, catering to diverse needs and preferences in car insurance coverage for the Rolls-Royce Wraith.

Factors That Affect the Cost of Rolls-Royce Wraith Car Insurance

When it comes to insuring a luxury car like the Rolls-Royce Wraith, the cost of car insurance can be significantly higher compared to a standard vehicle. This is primarily due to several factors that insurance companies take into consideration when determining insurance rates. Understanding these factors can help you make an informed decision about the cost of insuring your Rolls-Royce Wraith.

One of the major factors that affect the cost of insurance is the value of the vehicle. The Rolls-Royce Wraith is a high-end luxury car with a hefty price tag, so it’s no surprise that the insurance premiums for such a vehicle would be higher. Insurers consider the value of the car when calculating your rates, as a more expensive car would require greater coverage in case of damage or theft.

Another factor that impacts insurance rates for the Rolls-Royce Wraith is the car’s performance capabilities. With a powerful engine and top-of-the-line features, the Wraith is considered a high-performance vehicle. These types of cars are often associated with higher risks on the road, leading insurance companies to charge higher premiums to cover potential accidents or damages that may result from the vehicle’s capabilities.

The location in which you live also plays a role in determining the cost of car insurance for your Rolls-Royce Wraith. Areas with higher crime rates or a greater likelihood of accidents may result in higher insurance premiums. Insurance companies assess the risk associated with specific locations, taking into account factors such as theft rates and the frequency of accidents.

Additionally, your personal driving history and experience can impact the cost of insuring a Rolls-Royce Wraith. Insurance companies will consider your age, driving record, and the number of years you have held a valid driver’s license. If you have a clean driving record and a long history of safe driving, you will generally be eligible for lower insurance rates.

Read up on the “Defensive Driving Courses Can Lower Your Car Insurance Rates” for more information.

Other factors that may influence the cost of insurance for your Rolls-Royce Wraith include your credit score, annual mileage, and the level of coverage you choose. All these factors are taken into account by insurance companies when determining the premiums you will pay for your luxury car.

It is important to note that the cost of Rolls-Royce Wraith car insurance can also be affected by the insurance company you choose. Different insurance providers may have varying rates and policies for luxury vehicles. It is recommended to shop around and compare quotes from multiple insurers to ensure you are getting the best coverage at the most competitive price for your Rolls-Royce Wraith.

Understanding the Insurance Coverage for Rolls-Royce Wraith

Before delving into the specifics of the cost of insurance for a Rolls-Royce Wraith, it’s essential to understand the different types of insurance coverage options available for this luxury vehicle.

The primary coverage that every Rolls-Royce Wraith owner should have is liability insurance. This coverage is mandatory in most states and covers the costs associated with bodily injury or property damage to others if you are at fault in an accident.

Another essential coverage option is collision insurance, which covers damages to your Rolls-Royce Wraith in the event of a collision with another vehicle or object. This coverage is particularly crucial for luxury cars like the Wraith, as the cost of repairs can be exorbitant.

Kristine Lee Licensed Insurance Agent

Comprehensive insurance is also highly recommended for your Rolls-Royce Wraith. This coverage protects your vehicle against non-collision-related damages, such as theft, vandalism, fire, or natural disasters. Given the high value of a luxury car, having comprehensive coverage ensures that you are protected from various risks that may arise. Discover more about offerings in our article called “Collision Car Insurance: A Complete Guide.”

Finally, uninsured/underinsured motorist coverage is another important consideration. This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It helps cover your medical expenses and repairs to your Rolls-Royce Wraith if the at-fault driver cannot pay for them.

When it comes to optional coverage, Rolls-Royce Wraith owners may also consider specialized coverage options such as roadside assistance, rental car reimbursement, and OEM parts replacement coverage. These additional coverage options can provide added peace of mind and protection for your luxury vehicle.

Understanding the different insurance coverage options available for your Rolls-Royce Wraith is crucial in determining the appropriate level of protection you need and ultimately, the cost of insuring your luxury car.

It’s important to note that the cost of insurance for a Rolls-Royce Wraith can vary significantly depending on several factors. These factors include your driving record, location, age, and the level of coverage you choose. Additionally, insurance companies may also consider the value of the vehicle, its safety features, and the cost of repairs when determining the premium for your Rolls-Royce Wraith insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding the Best Insurance Rates for a Rolls-Royce Wraith

Now that we have covered the factors influencing Rolls-Royce Wraith car insurance costs and the available coverage options, let’s explore practical tips to find the best rates. First, shop around and compare quotes from various insurers to secure competitive pricing.

Maintain a clean driving record to qualify for lower premiums, and consider opting for a higher deductible to reduce costs, ensuring you can afford it in case of a claim. Bundling policies with the same insurer can also unlock discounts, while installing anti-theft devices can enhance security and lower rates.

Additionally, usage-based insurance and loyalty discounts offer further opportunities to save on insurance premiums. By applying these strategies, you can effectively manage insurance costs without compromising coverage quality. Discover more about offerings in our article called “Types of Car Insurance Coverage.”

Comparing Insurance Quotes for a Rolls-Royce Wraith

One of the most effective ways to find the best insurance rates for a Rolls-Royce Wraith is by comparing insurance quotes from different providers. This allows you to assess the coverage options and premium rates offered by each insurance company, enabling you to make an informed decision.

To begin, compile a list of reputable insurance companies that offer coverage for luxury vehicles like the Rolls-Royce Wraith. You can start by researching online or asking for recommendations from other luxury car owners or car enthusiasts.

Once you have your list of potential insurance providers, visit their websites or contact their representatives to request insurance quotes specifically tailored to your Rolls-Royce Wraith. Provide accurate and detailed information about your car, driving history, and desired coverage so that the quotes are as accurate as possible.

When comparing insurance quotes, pay attention to the coverage limits and deductibles offered by each company. It’s essential to ensure that the coverage provided adequately protects your Rolls-Royce Wraith and suits your individual needs. Look for any additional benefits or discounts that may be available, such as a safe driver discount or multi-policy discount.

Unlock details in our article called “Best Safe Driver Car Insurance Discounts.”

It’s also a good practice to read customer reviews and check the reputation and financial stability of the insurance companies you are considering. A reliable insurance company with excellent customer service can make a significant difference in your overall insurance experience.

Additionally, consider reaching out to local Rolls-Royce dealerships or luxury car clubs for recommendations on insurance providers. They may have insights into which companies specialize in insuring high-end vehicles like the Rolls-Royce Wraith and can provide valuable recommendations based on their experience and expertise.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

What factors affect the cost of Rolls-Royce Wraith car insurance?

The cost of Rolls-Royce Wraith car insurance is influenced by various factors, including the driver’s age, location, driving record, coverage options, deductibles, and the insurance provider’s policies.

To learn more, explore our comprehensive resource on Commercial Auto Insurance titled “Lesser Known Car Insurance Discounts.”

Are Rolls-Royce Wraith car insurance rates higher than average?

Yes, insurance rates for luxury vehicles like the Rolls-Royce Wraith are generally higher than average due to their high value and expensive repair costs.

Can I get discounts on Rolls-Royce Wraith car insurance?

Insurance providers may offer discounts for the Rolls-Royce Wraith based on factors such as the driver’s safe driving history, installation of anti-theft devices, bundling multiple policies, or being a member of certain professional organizations.

Is comprehensive coverage necessary for Rolls-Royce Wraith car insurance?

While comprehensive coverage is not legally required, it is highly recommended for Rolls-Royce Wraith owners due to the vehicle’s high value. Comprehensive coverage protects against damage caused by theft, vandalism, natural disasters, and other non-collision incidents.

Are there any specific insurance requirements for Rolls-Royce Wraith car owners?

Insurance requirements may vary by state or country, but typically Rolls-Royce Wraith owners must carry at least the minimum liability coverage mandated by their jurisdiction. Additional coverage options can be added based on personal preferences and needs.

Access comprehensive insights in our review of “How does the insurance company determine my premium?“

How reliable is the Rolls-Royce Wraith in terms of car insurance?

Recent Rolls-Royce models, including the Wraith under BMW’s management, have proven to be dependable. The Rolls-Royce Wraith has had no recalls in the past three years, which may positively impact your car insurance rates.

What is the cost of Rolls-Royce Wraith car insurance?

The 2021 Rolls-Royce Wraith starts at $343,350. Insurance costs can vary based on factors like coverage options, your driving history, and location. It’s advisable to get quotes from multiple providers to find the best rate.

Has Rolls-Royce discontinued the Wraith?

Yes, Rolls-Royce has announced the discontinuation of its two-door models, including the Rolls-Royce Wraith and the Rolls-Royce Dawn. This may affect availability and pricing for car insurance policies.

Can a Rolls-Royce Wraith be used for daily driving?

Rolls-Royce cars are built to endure, often lasting 70 years or more. You can drive your Rolls-Royce Wraith daily, but higher mileage may impact your insurance premiums.

Discover more about offerings in our “Best Low Mileage Car Insurance Discounts.”

Which is better for insurance: Rolls-Royce Wraith or Ghost?

The Rolls-Royce Ghost has a classic profile, while the Wraith offers a sportier design. Insurance costs can vary, so it’s beneficial to compare quotes for both models based on your coverage needs.

What are the downsides of owning a Rolls-Royce Wraith for car insurance?

Does Rolls-Royce provide a lifetime warranty, and does it affect insurance?

Is it safe to drive a Rolls-Royce Wraith, and does it impact insurance rates?

Is the Rolls-Royce Wraith considered a supercar for insurance purposes?

Is the Rolls-Royce Wraith a two-seater, and how does this affect insurance?

What will replace the Rolls-Royce Wraith, and how does this affect insurance?

Are Rolls-Royce cars a good investment in terms of insurance?

What are the benefits of owning a Rolls-Royce Wraith in terms of insurance?

Do Rolls-Royce cars consume a lot of fuel, and how does this impact insurance?

What factors should I consider when comparing insurance quotes for my Rolls-Royce Wraith?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.