Cheap Toyota 4Runner Car Insurance in 2026 (Save With These 10 Companies)

Progressive, USAA, and American Family are top choices for cheap Toyota 4Runner car insurance. Progressive stands out with the best overall and most affordable rates, starting as low as $65 per month. These providers offer affordable, comprehensive coverage for budget-conscious Toyota 4Runner drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated January 2025

Company Facts

Min. Coverage for Toyota 4Runner

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota 4Runner

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota 4Runner

A.M. Best Rating

Complaint Level

Pros & Cons

Our Top 10 Company Picks: Cheap Toyota 4Runner Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

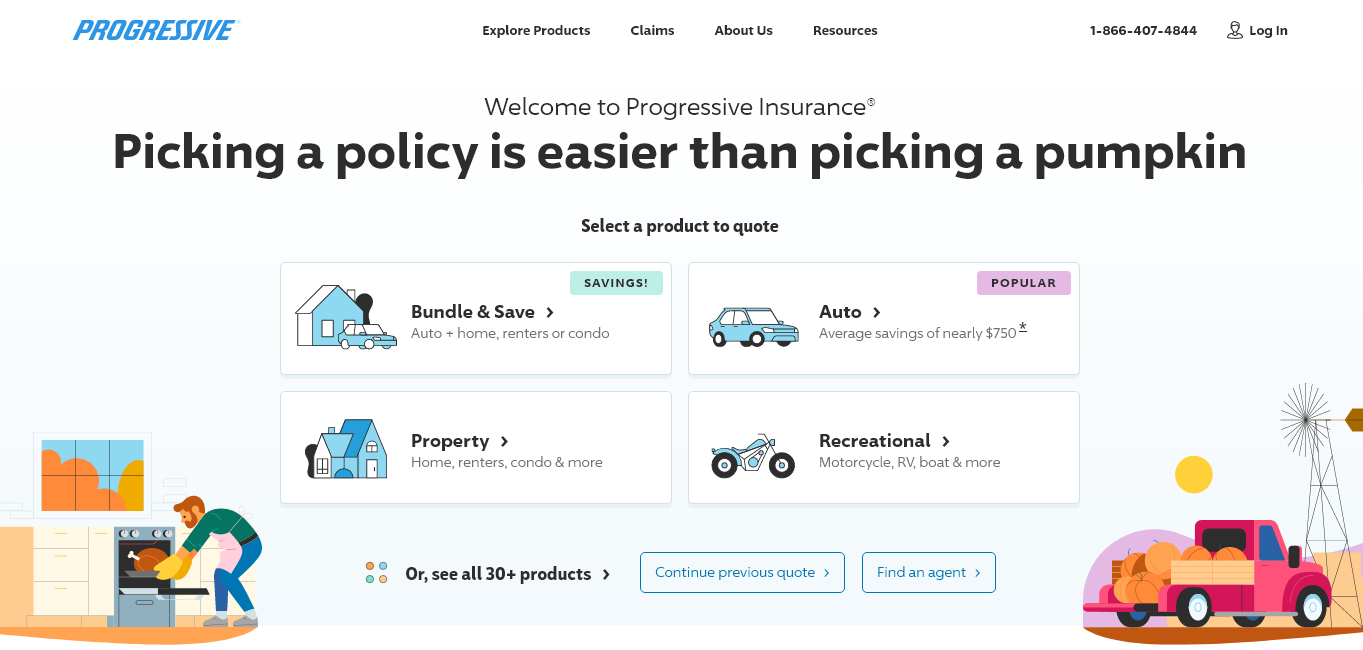

#1 $65 A+ Competitive Rates Progressive

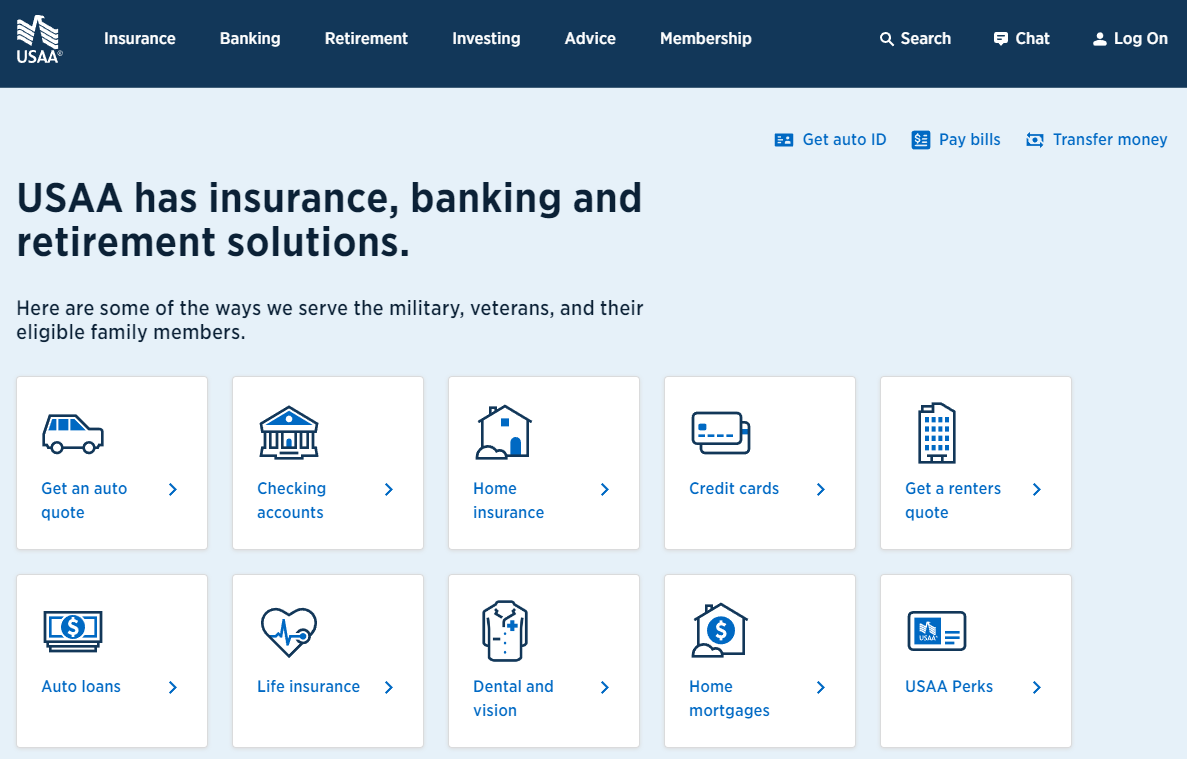

#2 $67 A++ Military Families USAA

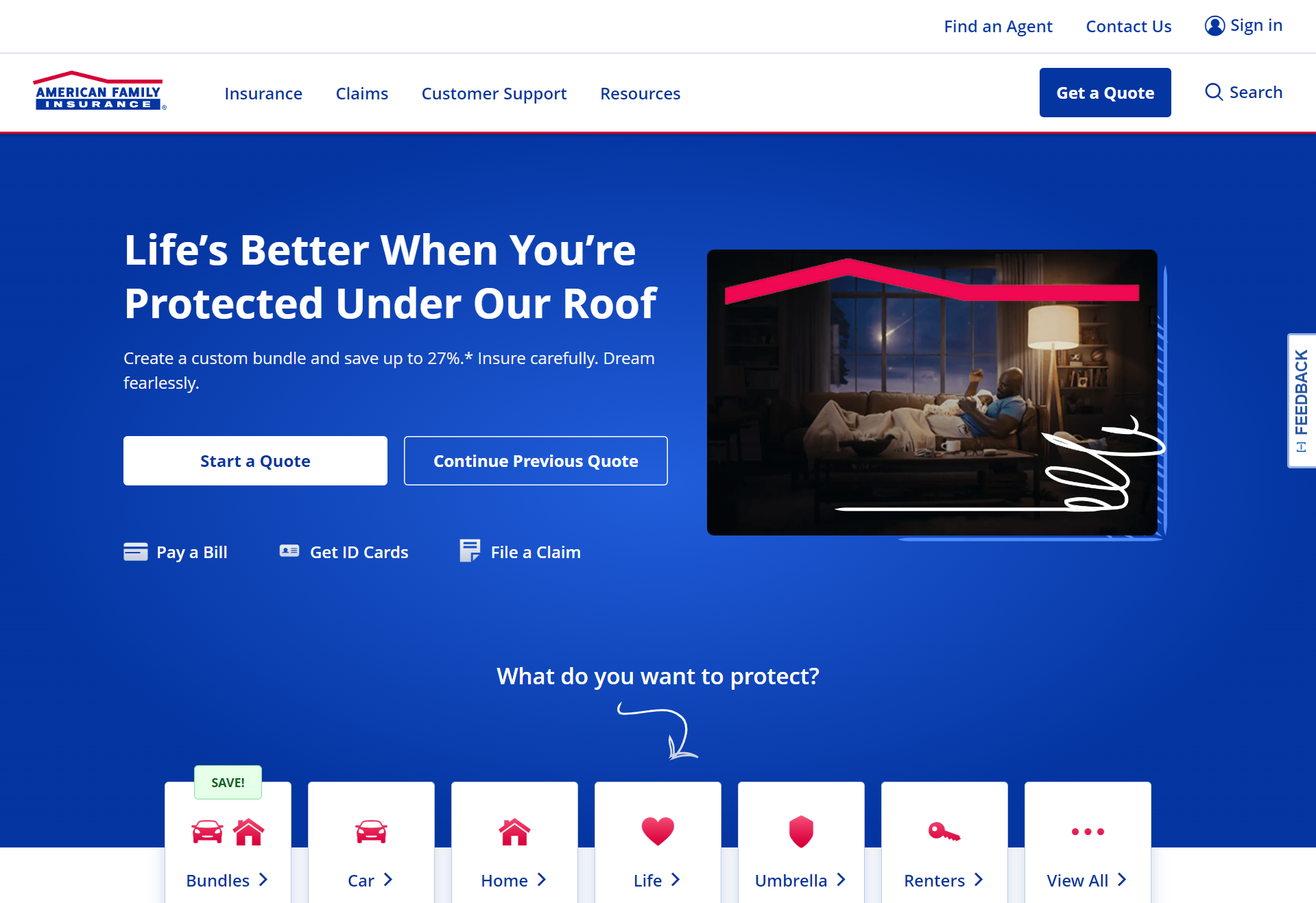

#3 $70 A Loyalty Rewards American Family

#4 $72 B Customer Service State Farm

#5 $73 A++ Hybrid Discount Travelers

#6 $75 A+ Safe Driver Allstate

#7 $77 A+ Senior Benefits The Hartford

#8 $78 A+ Roadside Assistance Nationwide

#9 $80 A Personalized Plans Farmers

#10 $85 A Custom Coverage Liberty Mutual

Additionally, we explore coverage options, discounts, and strategies to secure affordable premiums, ensuring you make informed decisions for your Toyota 4Runner. Compare quotes from these leading providers to find the best insurance solution tailored to your needs.

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive consistently offers some of the most affordable insurance rates for the Toyota 4Runner. This is due to their competitive pricing strategies and use of advanced algorithms to assess risk, which helps lower premiums for many drivers, according to Progressive insurance review & ratings.

- Wide Range of Discounts: Progressive provides numerous discount opportunities for Toyota 4Runner owners. These include discounts for having multiple policies with Progressive, maintaining a clean driving record, installing anti-theft devices, and even for safe driving habits.

- User-Friendly Online Tools: Progressive offers an easy-to-navigate website and mobile app for managing your Toyota 4Runner policy, getting quotes, and filing claims. Their online tools are designed to simplify the process for users.

Cons

- Higher Deductibles for Some Policies: While Progressive offers competitive rates for Toyota 4Runner owners, some of their lower-cost policies come with higher deductibles, which can be a drawback if you need to make a claim.

- Mixed Customer Service Experiences: Although Progressive generally has good ratings, there are mixed reviews regarding customer service and claims handling for Toyota 4Runner owners. Some customers report delays or difficulties during the claims process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Affordable Rates for Military Families

Pros

- Affordable Rates for Military Families: USAA is renowned for offering some of the lowest insurance rates for Toyota 4Runner owners, especially for active military members, veterans, and their families.

- Comprehensive Coverage Options: USAA offers a range of coverage options for the Toyota 4Runner, including liability, collision, comprehensive, and specialized coverage such as gap insurance and rental reimbursement, as mentioned in the USAA insurance review & ratings.

- Discounts and Savings: USAA provides various discounts for Toyota 4Runner owners, such as multi-policy discounts, safe driving discounts, and discounts for having a vehicle with safety features.

Cons

- Eligibility Restrictions: USAA’s services are only available to active military members, veterans, and their families, which limits their availability to a broader audience, including many Toyota 4Runner owners.

- Limited Availability: USAA insurance is not available in all states, which may be a problem for Toyota 4Runner owners moving or traveling frequently.

#3 – American Family: Best for Good Coverage Options for Toyota 4Runner

Pros

- Good Coverage Options for Toyota 4Runner: American Family provides comprehensive coverage options tailored for the Toyota 4Runner, including liability, collision, comprehensive coverage, and various add-ons.

- Attractive Discounts: American Family offers several discounts that can reduce your Toyota 4Runner insurance premiums, such as discounts for safe driving, bundling multiple policies, and having safety features installed.

- Flexible Deductibles: They provide options for adjusting your deductibles for your Toyota 4Runner to fit your budget, which can help you manage your insurance costs.

Cons

- Potentially Higher Premiums: American Family’s rates for Toyota 4Runner owners can sometimes be higher compared to other insurance providers, especially for drivers with less favorable profiles, as noted in the American Family insurance review & ratings.

- Limited Availability in Some Regions: While American Family is available in many states, there are some areas where they do not offer coverage for Toyota 4Runner owners.

#4 – State Farm: Best for Customizable Insurance Policies

Pros

- Customizable Insurance Policies: State Farm provides a range of coverage options and add-ons for Toyota 4Runner owners to tailor your policy to your specific needs, as highlighted in the State Farm insurance review & ratings.

- Wide Availability: State Farm is one of the largest insurance providers in the U.S., with coverage for Toyota 4Runner owners available in all states and a broad network of local agents.

- Discount Opportunities: State Farm offers a variety of discounts for Toyota 4Runner owners, including discounts for safe driving, multi-policy bundles, and having anti-theft devices.

Cons

- Higher Premiums for Some Drivers: State Farm’s rates for Toyota 4Runner owners can be higher for drivers with poor credit or a history of accidents compared to some competitors.

- Complex Discount Structure: The discount structure at State Farm can be complex for Toyota 4Runner owners, making it difficult for customers to understand which discounts they qualify for.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Affordable Rates

Pros

- Affordable Rates: Travelers offers competitive insurance rates for the Toyota 4Runner, making it a good option for cost-conscious consumers, as mentioned in the Travelers insurance review & ratings.

- Diverse Discounts: Travelers provides a variety of discounts that can help lower your Toyota 4Runner insurance costs, including discounts for safe driving, multi-policy, and anti-theft devices.

- Comprehensive Coverage Options: They offer a wide range of coverage options and add-ons for Toyota 4Runner owners.

Cons

- Mixed Customer Reviews: While generally positive, there are mixed reviews about Travelers’ customer service and claims processing for Toyota 4Runner owners.

- Higher Rates for High-Risk Drivers: Travelers may have higher premiums for Toyota 4Runner owners with a history of accidents or poor credit.

#6 – Allstate: Best for Good Coverage Options

Pros

- Good Coverage Options: Allstate offers a comprehensive range of coverage options for the Toyota 4Runner, including liability, collision, comprehensive coverage, and specialized add-ons.

- Discount Opportunities: Allstate provides various discounts for Toyota 4Runner owners, including safe driving discounts, multi-vehicle discounts, and discounts for having advanced safety features.

- Customizable Insurance Policies: Allstate allows Toyota 4Runner owners to customize their insurance policy with a variety of add-ons and coverage options.

Cons

- Higher Premiums for Some Drivers: Allstate’s premiums for the Toyota 4Runner can be higher for drivers with less favorable profiles, such as those with poor credit or a history of accidents.

- Complex Claims Process: The claims process at Allstate can be complex and slow for Toyota 4Runner owners, according to Allstate insurance review & ratings.

#7 – The Hartford: Best for Affordable Rates for Seniors

Pros

- Affordable Rates for Seniors: The Hartford offers attractive rates for senior drivers, which can be beneficial for older Toyota 4Runner owners.

- Comprehensive Coverage Options: The Hartford provides a range of coverage options for Toyota 4Runner owners, including liability, collision, comprehensive coverage, and additional features.

- Discounts for Safe Driving and AARP Members: The Hartford offers various discounts for Toyota 4Runner owners, including those for safe driving and AARP members, as highlighted in the The Hartford insurance review & ratings.

Cons

- Limited Discounts for New Drivers: The Hartford may offer fewer discounts for new or younger Toyota 4Runner drivers.

- Higher Premiums for Younger Drivers: The Hartford may charge higher premiums for younger or less experienced Toyota 4Runner drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Competitive Rates

Pros

- Competitive Rates: Nationwide offers competitive insurance rates for Toyota 4Runner owners, which can help you find affordable coverage, as highlighted in the Nationwide insurance review & ratings.

- Discounts for Safe Driving and Multiple Policies: Nationwide provides discounts for Toyota 4Runner owners with good driving records, bundling multiple policies, and having anti-theft devices.

- Comprehensive Coverage Options: Nationwide offers a broad range of coverage options for the Toyota 4Runner, including collision, comprehensive, liability, and more.

Cons

- Higher Premiums for High-Risk Drivers: Nationwide’s premiums for Toyota 4Runner owners can be higher for drivers with poor credit or a history of accidents.

- Less Flexibility in Policy Options: Some Toyota 4Runner owners find that Nationwide’s policy options are less flexible compared to other insurance providers.

#9 – Farmers: Best for Customizable Insurance Policies

Pros

- Customizable Insurance Policies: Farmers offers a wide range of insurance products and add-ons, allowing you to create a policy that meets your specific needs for the Toyota 4Runner.

- Discount Opportunities: Farmers provides multiple discounts for Toyota 4Runner owners, including those for safe driving, multi-policy bundles, and advanced safety features.

- Varied Coverage Options: Farmers offers a variety of coverage options tailored for different needs, including basic and comprehensive insurance for the Toyota 4Runner.

Cons

- Higher Premiums for High-Risk Drivers: Farmers’ rates for Toyota 4Runner owners can be higher for drivers with a history of accidents or poor credit, as highlighted in the Farmers insurance review & ratings.

- Complex Policy Terms: Farmers’ insurance policies and discount structures for Toyota 4Runner owners can be complex, which might be confusing for some customers.

#10 – Liberty Mutual: Best for Affordable Rates

Pros

- Affordable Rates: Liberty Mutual offers competitive rates for Toyota 4Runner insurance, which can help you find affordable coverage.

- Discounts Available: Liberty Mutual provides several discount opportunities for Toyota 4Runner owners, including discounts for safe driving, bundling policies, and having advanced safety features.

- Good Coverage Options: Liberty Mutual offers a variety of coverage options and add-ons for the Toyota 4Runner, as highlighted in the Liberty Mutual Review & Ratings.

Cons

- Mixed Customer Reviews: Liberty Mutual has a range of customer reviews from Toyota 4Runner owners, with some reports of issues with customer service and claims handling.

- Higher Rates for Some Drivers: Liberty Mutual’s rates for Toyota 4Runner owners can be higher for drivers with poor credit or a history of accidents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect Toyota 4Runner Car Insurance Rates

The cost of insuring a Toyota 4Runner can be influenced by several factors. One significant factor is the model year and age of the vehicle. Typically, newer models of the 4Runner tend to have higher insurance rates due to their higher market value and the cost of repair or replacement.

Toyota 4Runner Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $75 $150

American Family $70 $140

Farmers $80 $160

Liberty Mutual $85 $170

Nationwide $78 $155

Progressive $65 $135

State Farm $72 $145

The Hartford $77 $152

Travelers $73 $148

USAA $67 $138

Additionally, the age of the driver plays a role in determining the insurance premiums. Younger drivers, especially those with limited driving experience, usually attract higher rates due to their perceived higher risk of accidents. Another factor that affects insurance rates is the location where the vehicle is primarily parked or stored. Urban areas with higher rates of theft and accidents may result in higher insurance costs.

Another factor that can affect the insurance rates for a Toyota 4Runner is the driver’s driving record. Drivers with a history of accidents or traffic violations may be considered higher risk by insurance companies, leading to higher premiums. On the other hand, drivers with a clean driving record and no claims history may be eligible for lower insurance rates.

Insurance Coverage Options for Your Toyota 4Runner

Before diving into the details of insurance costs, it is crucial to understand the different coverage options available for your Toyota 4Runner. The most common types of coverage include liability insurance, which covers damages caused to other people or their property in an accident you are found responsible for.

Chris Abrams Licensed Insurance Agent

Collision coverage covers damages to your own vehicle in the event of a collision, while comprehensive coverage protects against non-collision related damages such as theft, vandalism, or natural disasters. Additionally, there are other coverage options that you may want to consider for your Toyota 4Runner.

One such option is uninsured/underinsured motorist coverage, which provides protection in the event that you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

Another option is medical payments coverage, which helps pay for medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. It is important to carefully review and understand all of your insurance coverage options to ensure that you have the appropriate level of protection for your Toyota 4Runner.

Comparing Car Insurance Quotes for Toyota 4Runner

When shopping for car insurance for your Toyota 4Runner, it is highly recommended to obtain multiple quotes from different insurance providers. This allows you to compare the coverage options, deductibles, and premiums offered by various companies. Online comparison tools can be particularly useful in this regard, as they provide a convenient way to obtain multiple quotes in a short amount of time.

One important factor to consider when comparing car insurance quotes for your Toyota 4Runner is the level of coverage provided. Different insurance providers may offer varying levels of coverage, such as liability coverage, collision coverage, and comprehensive coverage. It is important to carefully review the coverage options and determine which ones are most suitable for your needs and budget.

In addition to coverage options, it is also important to consider the deductibles and premiums associated with each car insurance quote. A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in.

Higher deductibles typically result in lower premiums, but it is important to consider whether you can afford to pay the deductible in the event of an accident. Comparing deductibles and premiums can help you find a balance between affordability and adequate coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Get Affordable Car Insurance for Your Toyota 4Runner

Securing affordable car insurance for your Toyota 4Runner is possible with some smart strategies. One tip is to maintain a clean driving record by avoiding accidents and traffic violations. Insurance companies tend to offer lower rates to drivers who exhibit responsible driving behavior. Additionally, raising your deductible, the amount you pay out of pocket in the event of a claim, can lower your premium.

However, it is important to ensure that you can comfortably afford the deductible amount should an incident occur. Another strategy to get affordable car insurance for your Toyota 4Runner is to take advantage of discounts offered by insurance companies. Explore our detailed analysis on “Lesser Known Car Insurance Discounts for” for additional information.

Many insurers offer discounts for various reasons, such as having multiple policies with the same company, being a safe driver, or having certain safety features installed in your vehicle. It’s worth exploring these discounts and seeing if you qualify for any of them.

Furthermore, comparing quotes from different insurance providers can help you find the most affordable option for your Toyota 4Runner. Each insurance company has its own pricing structure and factors that determine premiums, so it’s important to shop around and compare rates. Online comparison tools can make this process easier by allowing you to quickly compare quotes from multiple insurers.

The Average Cost Of Insuring A Toyota 4Runner

The Average Cost Of Insuring A Toyota 4Runner can vary depending on your specific circumstances and location. According to recent data, the average monthly premium for full coverage insurance for a Toyota 4Runner is around $120. However, it is crucial to note that this is just an average, and your individual premiums may be higher or lower based on various factors.

Factors that can affect the cost of insuring a Toyota 4Runner include your age, driving record, credit score, and the level of coverage you choose. Additionally, the location where you live can also impact your insurance rates. For example, if you reside in an area with high crime rates or a high number of accidents, you may have to pay higher premiums.

On the other hand, if you live in a safe neighborhood with low crime rates, you may be eligible for lower insurance rates. It is important to shop around and compare quotes from different insurance providers to find the best coverage at the most affordable price for your Toyota 4Runner. For further details, check out our in-depth “What is comprehensive coverage?” article.

Choosing Car Insurance for Your Toyota 4Runner

When selecting car insurance for your Toyota 4Runner, it is important to consider several factors. Firstly, evaluate the level of coverage you need based on your budget and risk tolerance. Consider the value of your vehicle and the potential cost of repairs or replacement. Get more insights by reading our expert “Insurance Quotes Online” advice.

Secondly, review the reputation and financial stability of the insurance company to ensure they will be able to fulfill their obligations in the event of a claim. Lastly, carefully read and understand the policy terms and conditions, including any exclusions or limitations that may affect your coverage.

Additionally, it is important to consider the specific needs and usage of your Toyota 4Runner when choosing car insurance. If you frequently use your vehicle for off-road adventures or towing, you may want to look for insurance policies that offer coverage for these activities.

Furthermore, if you have installed any aftermarket modifications or accessories on your 4Runner, make sure to inform the insurance company and inquire about coverage for these additions. By considering these factors, you can ensure that your car insurance provides comprehensive protection for your Toyota 4Runner.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mistakes to Avoid When Buying Toyota 4Runner Insurance

When purchasing car insurance for your Toyota 4Runner, it is essential to avoid common mistakes that could result in inadequate coverage or excessive costs. One common mistake is solely focusing on the price and neglecting the coverage and policy terms. While affordability is important, it should not come at the expense of comprehensive protection.

Another mistake is failing to disclose accurate information to the insurance company, such as the primary usage of the vehicle or the driving history of all drivers who will be operating the car. Providing inaccurate or incomplete information can lead to claim denials or even policy cancellations. Continue reading our full “Commonly Misunderstood Insurance Concepts” guide for extra tips.

Types of Car Insurance for Your Toyota 4Runner

When choosing car insurance for your Toyota 4Runner, you will encounter different types of policies. The most common types include standard policies, which offer coverage for a specific period and can be renewed annually, and usage-based policies, which track your driving habits and set premiums accordingly.

Usage-based policies can provide more personalized rates for safe drivers or those who drive less frequently. For more information, explore our informative “Types of Car Insurance Coverage” page.

How Age and Model Year Affect Toyota 4Runner Insurance Rates

The age and model year of a Toyota 4Runner have a direct impact on insurance rates. Newer models are generally associated with higher insurance premiums due to higher replacement costs and repair expenses. On the other hand, older models may have lower premiums but could also result in reduced coverage options.

Additionally, younger drivers typically face higher rates regardless of the vehicle’s age, as they are considered more prone to accidents and other driving-related risks. Expand your understanding with our thorough “What age do you get cheap car insurance?” overview.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Lower Your Toyota 4Runner Insurance Premiums

If you are looking to lower your car insurance premiums for your Toyota 4Runner, consider implementing several effective strategies. Maintaining a clean driving record, completing a defensive driving course, bundling your car insurance with other policies such as homeowners or renters insurance, and installing safety devices or anti-theft systems in your vehicle are all potential avenues for savings.

Additionally, discussing potential discounts or savings opportunities with your insurance provider can potentially lower your premiums. Discover our comprehensive guide to “What are some ways to lower my car insurance premiums?” for additional insights.

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. When insuring a Toyota 4Runner, it is important to understand the deductible options available to you.

A higher deductible can lead to lower premiums since you are taking on more financial responsibility in the event of a claim. However, it is crucial to consider your ability to meet the deductible at any given time and ensure it aligns with your financial situation. For further details, check out our in-depth “What is the difference between a deductible and a premium in car insurance?” article.

How Location Affects Toyota 4Runner Insurance Rates

Your location can have a significant impact on the insurance rates for your Toyota 4Runner. Insurance companies take into account the risk factors associated with the area where the vehicle is primarily located.

Urban areas with higher rates of theft, vandalism, or accidents often attract higher insurance premiums. On the other hand, rural areas or neighborhoods with lower crime rates and less traffic congestion may result in lower insurance costs. Learn more by visiting our detailed “How much is car insurance?” section.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Your Driving Record Affects Toyota 4Runner Insurance

Your driving record is a crucial factor that insurance companies consider when determining the cost of insuring your Toyota 4Runner. A clean driving record, with no or minimal accidents or traffic violations, demonstrates responsible driving behavior and can lead to lower insurance rates.

On the other hand, a history of accidents, tickets, or DUI convictions may result in higher premiums as it indicates a higher risk of future claims. Dive deeper into “How to Get Free Insurance Quotes Online” with our complete resource.

Comprehensive vs. Collision Coverage for Toyota 4Runner

When considering insurance coverage for your Toyota 4Runner, it is important to understand the differences between comprehensive and collision coverage. Comprehensive coverage protects against non-collision-related damages, such as theft, vandalism, or natural disasters.

Collision coverage, on the other hand, covers damages to your vehicle in the event of a collision, regardless of fault. Evaluating your specific needs and budget can help you decide which type of coverage is most suitable for you. Read our extensive guide on “Collision vs. Comprehensive Car Insurance” for more knowledge.

Exploring Discounts Available for Insuring a Toyota 4Runner

Insurance companies often offer various discounts that can help reduce the cost of insuring your Toyota 4Runner. Common discounts include multi-policy discounts for bundling multiple policies with the same insurer, safe driver discounts for maintaining a clean driving record, and anti-theft device discounts for installing security systems in your vehicle.

Jimmy McMillan Licensed Insurance Agent

It is worth exploring the available discounts with your insurance provider to potentially lower your insurance premiums. In conclusion, the cost of car insurance for a Toyota 4Runner can vary based on factors such as the vehicle’s age, driving record, location, and coverage options. For more information, explore our informative “Can I bundle my car insurance with other policies?” page.

By understanding these factors and following the tips provided, you can navigate the car insurance market and secure affordable coverage for your beloved Toyota 4Runner.

Remember to compare quotes from different insurance providers and consider your unique needs when selecting the most suitable coverage options. By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Frequently Asked Questions

Are Toyota 4Runners expensive to insure?

The insurance cost for Toyota 4Runners can vary depending on the factors mentioned earlier. Generally, SUVs like the Toyota 4Runner tend to have higher insurance rates compared to smaller vehicles due to their size and potential for causing more damage in accidents.

Does the trim level of the Toyota 4Runner affect insurance rates?

The trim level of a Toyota 4Runner can impact insurance rates to some extent. Higher trim levels often have more advanced safety features, which can potentially lead to lower insurance premiums. However, the cost difference may not be significant, and other factors play a larger role in determining insurance rates.

Is it more expensive to insure a new Toyota 4Runner?

In general, insuring a new Toyota 4Runner may be slightly more expensive compared to an older model. This is because new vehicles have a higher market value, which means higher repair or replacement costs for the insurance company in case of an accident or theft.

Explore our detailed analysis on “How to Get Free Insurance Quotes Online” for additional information.

Is a Toyota 4Runner cheap to insure?

The Toyota 4Runner is not the cheapest to insure compared to other vehicles, but it offers moderate rates due to its safety features and reliability.

What factors contribute to the higher insurance premiums for the Toyota 4Runner?

Higher insurance premiums for the Toyota 4Runner are due to its larger size, higher repair costs, and its popularity among off-road enthusiasts, which increases the likelihood of claims.

What are some ways to lower the cost of Toyota 4Runner car insurance?

There are several strategies to potentially reduce the cost of Toyota 4Runner car insurance. These include maintaining a clean driving record, opting for higher deductibles, bundling insurance policies, taking advantage of available discounts.

Get more insights by reading our expert “Car Insurance Discounts by Age” advice.

Which insurance providers are considered the best for Toyota 4Runner owners?

Progressive, USAA, and American Family are considered some of the best insurance providers for Toyota 4Runner owners due to their competitive rates and comprehensive coverage options.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Which company typically offers the lowest insurance rates for the Toyota 4Runner?

Progressive is typically the company that offers the lowest insurance rates for the Toyota 4Runner.

Are there specific reasons why insurance might be more affordable for the Toyota 4Runner?

Insurance might be more affordable for the Toyota 4Runner due to its strong safety ratings and lower risk of theft compared to other vehicles in its class.

Continue reading our full “Safety Car Insurance Discounts” guide for extra tips.

Among different Toyota 4Runner models, which one is the least expensive to insure?

The base model Toyota 4Runner tends to be the least expensive to insure due to its lower cost and fewer high-end features.

Is it common for insurance premiums to be higher for the Toyota 4Runner compared to other SUVs?

Which insurance company is the most reliable and trusted for insuring a Toyota 4Runner?

What type of insurance coverage for a Toyota 4Runner tends to be the most costly?

When insuring a Toyota 4Runner, which company, Geico or Progressive, offers lower rates?

Is it possible to negotiate insurance premiums for a Toyota 4Runner with insurers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.