Cheap Chevrolet SS Car Insurance in 2026 (Save With These 10 Companies!)

USAA, State Farm, and Progressive offer the best rates for cheap Chevrolet SS car insurance, starting as low as $45 per month. These companies lead due to their competitive pricing, comprehensive coverage options, and excellent customer service, making them top choices for Chevrolet owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated November 2024

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Chevrolet SS

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Chevrolet SS

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Chevrolet SS

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top picks for cheap Chevrolet SS car insurance are USAA, State Farm, and Progressive, renowned for their affordability and reliable coverage.

These companies excel by offering competitive premiums, exceptional customer support, and a range of comprehensive policy options tailored for Chevrolet owners. Learn more in our “Chevrolet Car Insurance Discount.”

Our Top 10 Company Picks: Cheap Chevrolet SS Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $45 A++ Local Agents USAA

#2 $48 B Industry Experience State Farm

#3 $52 A+ Military Savings Progressive

#4 $63 A++ Mobile App Chubb

#5 $65 A+ Organization Discount The Hartford

#6 $67 A Roadside Assistance AAA

#7 $75 A Small Businesses Farmers

#8 $83 A++ Multi-Policy Savings Travelers

#9 $90 A+ Family Plans Nationwide

#10 $106 A+ Infrequent Drivers Allstate

Their strong reputation in the industry ensures that drivers receive excellent value, backed by robust financial stability. For Chevrolet SS owners looking to balance cost and quality, these insurers provide the best options in the market.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- USAA is the top pick for cheap Chevrolet SS car insurance

- Tailored insurance options meet the unique needs of Chevrolet owners

- Specialized coverage ensures Chevrolet SS drivers are comprehensively protected

#1 – USAA: Top Overall Pick

Pros

- Competitive Rates: USAA offers some of the lowest monthly rates at just $45. See more details on our USAA insurance review & ratings.

- Top-Rated Customer Service: Highly rated for customer support through local agents.

- Strong Financial Rating: USAA holds an A++ rating from A.M. Best, indicating superior financial health.

Cons

- Limited Availability: USAA services are available only to military members, veterans, and their families.

- Fewer Physical Locations: Compared to some competitors, USAA has fewer local offices.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Industry Experience

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored for different business needs. More information is available about this provider in our State Farm car insurance review & ratings.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

#3 – Progressive: Best for Military Savings

Pros

- Tailored Discounts for Military: Progressive offers specific savings for military personnel.

- Flexible Payment Options: Allows customers to tailor payment schedules. Read up on the “Progressive Car Insurance Review & Ratings” for more information.

- Broad Acceptance: Welcomes a wide range of drivers, including those with less than perfect driving records.

Cons

- Variable Customer Service: Customer service quality may vary significantly by region.

- Higher Rates for Riskier Drivers: Riskier drivers might face significantly higher rates.

#4 – Chubb: Best for Mobile App

Pros

- Advanced Mobile App: Chubb offers a state-of-the-art mobile app for easy management of policies.

- High Coverage Limits: Known for offering high coverage limits ideal for valuable assets. Check out insurance savings in our complete Chubb insurance review & ratings.

- Global Coverage: Provides insurance coverage internationally, which is beneficial for travelers.

Cons

- Higher Premiums: Generally, Chubb has higher premiums compared to other insurers.

- Selective Policy Acceptance: Chubb tends to insure only higher-value properties and clients.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Organization Discount

Pros

- Exclusive Organization Discounts: Offers discounts to members of affiliated organizations.

- Specialized Coverage for Seniors: Tailors products like car insurance to suit senior citizens.

- Strong Business Coverage: Offers robust business insurance options. Discover more about offerings in our The Hartford insurance review & ratings.

Cons

- Complex Claims Process: Some users report a more complex claims process.

- Limited Appeal for Younger Drivers: Coverage options and discounts may not appeal as much to younger drivers.

#6 – AAA: Best for Roadside Assistance

Pros

- Superior Roadside Assistance: Renowned for offering comprehensive roadside help. Access comprehensive insights into our AAA insurance review & ratings.

- Multiple Membership Benefits: Provides additional benefits and discounts to AAA members.

- Wide Range of Insurance Products: Offers a diverse selection of insurance options beyond vehicles.

Cons

- Membership Required: Must purchase a membership to access insurance products.

- Inconsistent Service Levels: Service quality can vary greatly between regions.

#7 – Farmers: Best for Small Business

Pros

- Tailored Small Business Insurance: Offers specific products catering to small business needs.

- Diverse Policy Options: Wide array of policy options allowing for highly customized coverage.

- Proactive Claims Service: Known for a proactive and helpful claims process. Delve into our evaluation of Farmers car insurance review & ratings.

Cons

- Higher Premiums for Certain Policies: Some policies come with higher than average premiums.

- Less Competitive for Personal Insurance: More competitive in business insurance than personal lines.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Multi-Policy Savings

Pros

- Excellent Multi-Policy Discounts: Attractive discounts when bundling different insurance types.

- Extensive Coverage Options: Provides a broad range of insurance products.

- Efficient Claim Handling: Known for efficient and fair claim processing. Unlock details in our Travelers insurance review & ratings.

Cons

- Pricier Options: Can be expensive if not bundling policies.

- Average Customer Satisfaction: Customer satisfaction rates are good but not top-tier.

#9 – Nationwide: Best for Family Plans

Pros

- Specialized Family Plans: Offers tailored plans that are ideal for family use. Discover insights in our Nationwide insurance review & ratings.

- Flexible Policy Options: Wide range of policy options to meet various needs.

- Strong Financial Stability: Maintains a solid financial rating with A.M. Best.

Cons

- Mixed Customer Reviews: Customer experiences can vary widely.

- Higher Rates Without Bundling: More competitive rates available only with bundled services.

#10 – Allstate: Best for Infrequent Drivers

Pros

- Discounts for Low Mileage: Offers discounts specifically for infrequent drivers.

- Robust Accident Forgiveness: Policies include accident forgiveness elements. If you want to learn more about the company, head to our Allstate insurance review & ratings.

- Wide Agent Network: Extensive network of agents available for personalized service.

Cons

- Higher Base Premiums: Generally higher premiums compared to some competitors.

- Variable Discounts by State: Discounts and services can vary significantly by state.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

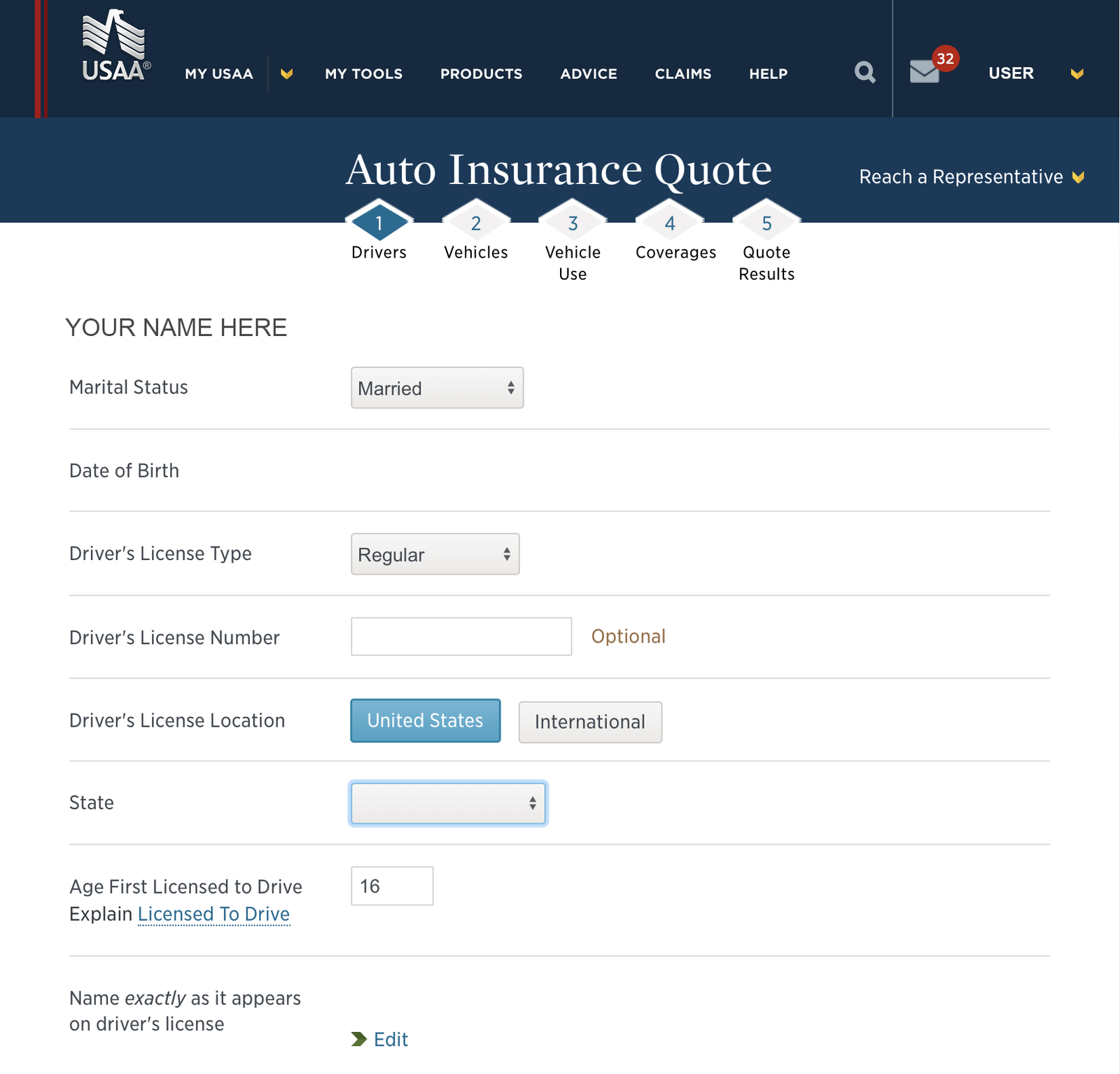

Monthly Car Insurance Rates for Chevrolet SS: Minimum vs. Full Coverage

When considering insurance for a Chevrolet SS, it’s important to understand how monthly rates can vary significantly between minimum and full coverage options across different providers. This knowledge assists in making an informed decision tailored to your coverage needs and budget. See more details on our “Full Coverage Car Insurance: A Complete Guide.”

Chevrolet SS Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $67 $156

Allstate $106 $182

Chubb $63 $152

Farmers $75 $164

Nationwide $90 $173

Progressive $52 $140

State Farm $48 $112

The Hartford $65 $149

Travelers $83 $169

USAA $45 $108

Monthly rates for the Chevrolet SS start as low as $45 for minimum coverage with USAA, which is the most affordable option. On the other hand, State Farm offers the lowest full coverage rate at $112 per month. At the higher end, Allstate charges $106 for minimum and $182 for full coverage, making it one of the pricier choices.

Progressive also stands out with a relatively low rate of $52 for minimum and $140 for full coverage, highlighting a balance between affordability and comprehensive protection. Each company offers a range of rates, reflecting different levels of coverage and benefits, allowing Chevrolet SS owners to choose a policy that best suits their driving needs and financial circumstances.

Factors That Affect the Cost of Chevrolet SS Car Insurance

When determining the cost of insurance for a Chevrolet SS, providers assess various influencing factors, which can differ from one company to another.

Key factors include the driver’s age and driving history, where young or historically reckless drivers often face steeper premiums. The location of the vehicle plays a significant role, as regions prone to accidents or theft can increase costs. The model year also affects rates, with newer models generally carrying higher premiums due to more expensive parts and repairs.

Insurance costs are further impacted by the chosen coverage levels and deductibles—higher coverage and lower deductibles typically elevate the price. Additionally, the driver’s credit score and the vehicle’s primary use, such as for business purposes or lengthy commutes, are also considered.

Notably, while some insurers may factor in the driver’s gender, recognizing variations in accident rates or claims among genders, this practice is not universally applied and is restricted in some areas. Read up on the “Best Car Insurance Discounts for Women Over 50” for more information.

Understanding the Insurance Rates for the Chevrolet SS

Insurance rates for the Chevrolet SS can vary significantly among different providers. It’s essential to gather quotes from multiple insurance companies to compare premiums, coverage options, and available discounts.

Keep in mind that while cost is an important factor, it’s not the only one to consider when choosing car insurance for your Chevrolet SS. Coverage levels, customer service, and the provider’s financial stability are also crucial factors to evaluate.

One factor that can affect insurance rates for the Chevrolet SS is the driver’s age and driving history. Younger drivers or those with a history of accidents or traffic violations may face higher premiums due to the increased risk they pose to insurance companies. On the other hand, older drivers with a clean driving record may be eligible for lower rates.

Another factor that can impact insurance rates is the location where the Chevrolet SS will be primarily driven and parked. Urban areas with higher rates of accidents, theft, and vandalism may result in higher insurance premiums compared to rural or suburban areas with lower risk factors. Check out insurance savings in our complete “Is car theft covered by car insurance?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Insurance Quotes for the Chevrolet SS

When comparing insurance quotes for your Chevrolet SS, it’s important to understand the specific coverage options provided by each insurer. Some policies may offer basic liability coverage only, while others may include comprehensive and collision coverage, which are essential for protecting your investment.

Comprehensive coverage typically protects against incidents like theft, vandalism, and natural disasters, while collision coverage covers damages resulting from accidents with other vehicles or objects. It’s important to evaluate your needs and preferences to select the coverage options that best suit your situation.

Kristine Lee Licensed Insurance Agent

Additionally, it’s worth considering the deductible amount when comparing insurance quotes. The deductible is the amount you’ll have to pay out of pocket before your insurance coverage kicks in. A higher deductible can lower your premium, but it also means you’ll have to pay more in the event of a claim.

On the other hand, a lower deductible may result in a higher premium, but it can provide more financial protection if you need to make a claim. Discover more about offerings in our “What is the difference between a deductible and a premium in car insurance?”

Furthermore, it’s important to review the insurer’s reputation and customer service when comparing insurance quotes. Look for reviews and ratings from other policyholders to get an idea of how satisfied they are with the company’s claims process and overall customer experience. A reputable insurer with good customer service can provide peace of mind and a smoother claims process in the event of an accident or other covered incident.

Tips for Finding Affordable Car Insurance for Your Chevrolet SS

Finding affordable car insurance for a Chevrolet SS, while managing not to compromise on coverage, can be challenging due to its higher cost, but there are effective strategies to help reduce your premiums. To secure the best rates, it’s essential to shop around and compare quotes from various insurers, as each offers unique discounts and pricing models.

Increasing your deductibles is another viable option that can significantly lower your monthly payments. Moreover, make sure to explore all available discounts, which could be for safe driving, bundled policies, or having anti-theft devices installed. Access comprehensive insights into our “Anti Theft System Car Insurance Discount.”

Taking a defensive driving course or opting for a usage-based insurance program can further reduce costs by demonstrating safe driving habits through monitored data.

It’s also wise to periodically review and adjust your insurance policy to align better with your current needs and the aging of your Chevrolet SS. For instance, if your vehicle is older, consider whether maintaining collision and comprehensive coverage is cost-effective relative to the car’s value. Always weigh the potential risks and benefits carefully when altering your coverage to ensure it still meets your needs without unnecessary expense.

The Average Cost of Insuring a Chevrolet SS in Specific Location

The average cost of insuring a Chevrolet SS can vary depending on your location. Insurance rates are influenced by factors such as local accident rates, crime rates, and the cost of living. Delve into our evaluation of “Determining Fault in a Multiple Car Accident.”

To get an accurate estimate of the average insurance cost for your Chevrolet SS in a specific location, it’s recommended to obtain quotes from insurance providers in that area.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Insurance Options for Your Chevrolet SS

When exploring insurance options for your Chevrolet SS, it’s crucial to understand the different types of coverage available. Liability coverage is typically required by law and covers damages to other parties if you are found at fault in an accident. Comprehensive and collision coverage, as mentioned earlier, protect against damages to your own vehicle.

Additionally, uninsured/underinsured motorist coverage can provide protection if you’re involved in an accident with a driver who doesn’t have sufficient insurance.

Medical payments coverage can help cover medical expenses resulting from an accident, while personal injury protection provides coverage for medical expenses, lost wages, and other related costs. Unlock details in our “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

Factors That Increase or Decrease the Insurance Premiums for a Chevrolet SS

Several factors can increase or decrease the insurance premiums for a Chevrolet SS. Factors that may increase premiums include:

- The Driver’s Age and Driving History

- A High Incidence of Accidents or Theft in the Vehicle’s Location

- A Newer Model Year With Higher Repair Costs

- A Low Credit Score

- High Coverage Limits and Low Deductibles

- Extra Usage, Such as Business or Long Commuting Distances

On the other hand, factors that may decrease insurance premiums include having a clean driving record, installing anti-theft devices, and being eligible for specific discounts offered by insurance providers. Discover insights in our “Car Driving Safety Guide for Teens and Parents.”

Understanding the myriad factors that influence Chevrolet SS insurance premiums is crucial for securing a cost-effective policy. By maintaining a clean driving record, installing anti-theft devices, and maximizing eligible discounts, you can effectively counteract factors that typically drive up rates, such as age, location risks, or vehicle specifics.

How the Model Year Affects the Cost of Insuring a Chevrolet SS

The model year of the Chevrolet SS can impact the cost of insurance coverage. Generally, insuring a newer model year may result in higher premiums compared to insuring an older model. Newer models tend to have higher repair costs and a higher market value, leading insurance providers to charge higher premiums.

Ty Stewart Licensed Insurance Agent

However, discounts and other factors can also affect the insurance rates, so it’s always advisable to seek quotes from multiple insurers to get an accurate understanding of the cost. Learn more in our “Lesser Known Car Insurance Discounts.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Analyzing the Safety Features of the Chevrolet SS and Its Impact on Insurance Rates

The safety features of the Chevrolet SS can have a positive impact on insurance rates. Insurance providers often consider the presence of safety features when determining premiums. The Chevrolet SS typically comes equipped with advanced safety technologies like traction control, stability control, anti-lock brakes, and airbags.

These safety features may help reduce the risk of accidents or injuries, leading to potential savings on insurance premiums. It’s important to inform your insurance provider about these safety features to explore possible discounts or reductions in your premiums. See more details on our “Best Safety Features Car Insurance Discounts.”

The Importance of Maintaining a Clean Driving Record When Insuring a Chevrolet SS

Maintaining a clean driving record is paramount when insuring a Chevrolet SS. Insurance providers consider a driver’s history of accidents, moving violations, and claims when determining premiums. A clean driving record demonstrates responsible and safe driving behavior, which can result in lower insurance rates.

On the other hand, a history of accidents or violations may lead to increased premiums. Defensive driving, obeying traffic laws, and avoiding distractions while driving can help maintain a clean driving record and potentially reduce insurance costs. Check out insurance savings in our complete “Traffic School Can Lower Your Car Insurance Rates.”

Tips for Reducing Your Car Insurance Costs for a Chevrolet SS

Aside from maintaining a clean driving record, there are several other tips you can follow to reduce car insurance costs for your Chevrolet SS:

- Consider increasing your deductibles, but ensure you can afford to pay the deductibles in the event of a claim.

- Take precautions against theft, such as parking in secure areas and installing anti-theft devices.

- Bundle your car insurance with other insurance policies, such as home or life insurance, for potential multi-policy discounts.

- Ask your insurance provider about available discounts, including safe driver discounts, low mileage discounts, and discounts for membership in certain organizations.

- Regularly review your coverage and adjust it as needed, ensuring you have adequate protection without overpaying for unnecessary coverage.

To effectively lower car insurance costs for your Chevrolet SS, it’s crucial to balance strategic adjustments with practical affordability.

By increasing deductibles sensibly, securing multi-policy discounts, and regularly updating your coverage to match your changing needs, you can maintain optimal protection without overspending, ensuring your Chevrolet remains both well-protected and economically insured. Discover more about offerings in our “How much insurance coverage do I need?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Comprehensive and Collision Coverage Options for Your Chevrolet SS

Comprehensive and collision coverage are two essential options to consider when insuring your Chevrolet SS. Comprehensive coverage protects against incidents like theft, vandalism, natural disasters, and certain other non-collision incidents. Collision coverage, on the other hand, covers damages resulting from accidents with other vehicles or objects. Unlock details in our “Collision vs. Comprehensive Car Insurance.”

Melanie Musson Published Insurance Expert

Both coverages can help protect your investment in a Chevrolet SS, but they may significantly affect insurance premiums. It’s important to evaluate your needs and budget to determine the right level of coverage for your specific situation.

Exploring Discounts and Savings Opportunities When Insuring a Chevrolet SS

When insuring a Chevrolet SS, there may be various discounts and savings opportunities available to help reduce your premiums. Some common discounts offered by insurance providers include:

- Safe driver discounts for a clean driving record.

- Multi-policy discounts are available for bundling car insurance with other policies.

- Good student discounts for high-achieving students.

- Affinity discounts for members of specific organizations or professional groups.

- Discounts for installing approved anti-theft systems.

- Discounts for low annual mileage.

It’s always wise to inquire about available discounts with your insurance provider and explore every opportunity to reduce your Chevrolet SS insurance premiums. Delve into our evaluation of “Best Car Insurance Discounts to Ask for.”

Common Misconceptions About Insuring a High-Performance Car Like the Chevrolet SS

There are several misconceptions when it comes to insuring high-performance cars like the Chevrolet SS. One common misconception is that insurance for these vehicles is always exorbitantly expensive.

While it’s true that insurance rates for high-performance cars can be higher due to factors such as increased repair costs and higher risks associated with powerful engines, the actual cost will depend on a range of factors discussed earlier, as well as the specific insurance provider.

Another misconception is that owning a high-performance car automatically translates to expensive insurance. While the cost of insurance may be higher, it’s essential to shop around, compare quotes, and explore available discounts to find the most affordable coverage that meets your needs.

In conclusion, when considering how much Chevrolet SS car insurance costs, it’s crucial to understand the various factors that insurers evaluate, including driver-related factors, the car’s location, model year, and desired coverage options. Discover insights in our “Best Safe Driver Car Insurance Discounts.”

By exploring insurance options, taking advantage of discounts, and maintaining a clean driving record, it’s possible to find affordable car insurance for your Chevrolet SS without compromising on necessary coverage.

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of Chevrolet SS car insurance?

Several factors can influence the cost of Chevrolet SS car insurance, including the driver’s age, driving history, location, coverage options, deductible amount, and the insurance provider’s policies.

For additional details, explore our comprehensive resource titled “Best Car Insurance for 21-Year-Old Drivers.”

Are Chevrolet SS cars expensive to insure?

The cost of insuring a Chevrolet SS car can vary depending on multiple factors. Generally, sports cars like the Chevrolet SS tend to have higher insurance rates due to their higher performance capabilities and potential for increased risk.

Can I get discounts on Chevrolet SS car insurance?

Yes, it is possible to obtain discounts on Chevrolet SS car insurance. Insurance providers often offer various discounts such as multi-policy discounts, safe driver discounts, good student discounts, and more. It is advisable to check with different insurance companies to explore available discounts.

Is it cheaper to insure an older Chevrolet SS model?

Insuring an older Chevrolet SS model might result in slightly lower insurance costs compared to a brand new model. This is because older cars generally have lower market values, which can affect insurance premiums. However, other factors such as the car’s condition, safety features, and the driver’s profile will still play a significant role in determining the final insurance cost.

What are some tips for reducing Chevrolet SS car insurance premiums?

To potentially lower your Chevrolet SS car insurance premiums, consider maintaining a clean driving record, opting for a higher deductible if financially feasible, bundling your car insurance with other policies, inquiring about available discounts, and comparing quotes from multiple insurance providers to find the best rate.

To find out more, explore our guide titled “Best Multi Policy Car Insurance Discounts.”

Is the Chevy SS a rare car?

This car is uncommon, but unlike the VehiCROSS, its rarity isn’t due to inherently limited production. Rather, there are only 12,924 Chevrolet SS models, with just 2,645 featuring a manual transmission. The Chevy SS serves almost as a unique example in automotive analysis.

Is a Camaro SS expensive to maintain?

Over the first 10 years, maintaining and repairing a Chevrolet Camaro is estimated to cost approximately $7,015, which is $408 less than the average for similar popular coupe models. Additionally, there’s a 20% likelihood that the Camaro will need a major repair during this period, translating to an average monthly maintenance cost of about $58.

What is the cheapest Chevy to insure?

The Chevrolet Aveo 1.2 S 3d has the lowest monthly insurance rate. The Chevrolet Aveo 1.4 LT 5d and 1.4 LT 5d (Auto), with their slightly larger engine sizes, carry the highest monthly insurance costs.

What are the cons of Chevy cars?

Before purchasing a Chevrolet, be informed of some common issues reported in recent models. These include transmission troubles, leaks, and problems with brakes, electrical systems, steering, and high oil consumption.

To learn more, explore our comprehensive resource on “Does my car insurance cover damage caused by a brake failure?”

Why is my car insurance so expensive?

Your car insurance costs might be higher due to factors like your driving record, where you live, the type of vehicle you drive, or your credit history. Recent claims or traffic violations can elevate your monthly rates for a period of three to five years. Alternatively, you might simply be with an insurer that generally charges more for their coverage.

Are smaller cars cheaper to insure?

Are Chevy SS illegal in the US?

Is the Chevy SS a good car?

Is a Chevy SS a sports car?

How fast is a Chevy SS?

How much is an oil change for a Camaro SS?

What car has the cheapest insurance?

What Chevy engine lasts the longest?

Does credit score affect car insurance?

Is it cheaper to insure an old or new car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.