Northwestern Mutual vs. New York Life Life Insurance: Which is better?

Embark on the pivotal decision between Northwestern Mutual and New York Life for life insurance, exploring their histories, offerings, and reputations to secure the financial well-being of your loved ones.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

Embarking on the crucial decision between Northwestern Mutual and New York Life for life insurance requires a thorough examination of key factors like coverage rates, options, discounts, and customer reviews. In this comprehensive guide, we delve into the histories, offerings, and reputations of these insurance giants, guiding you to secure the financial well-being of your loved ones.

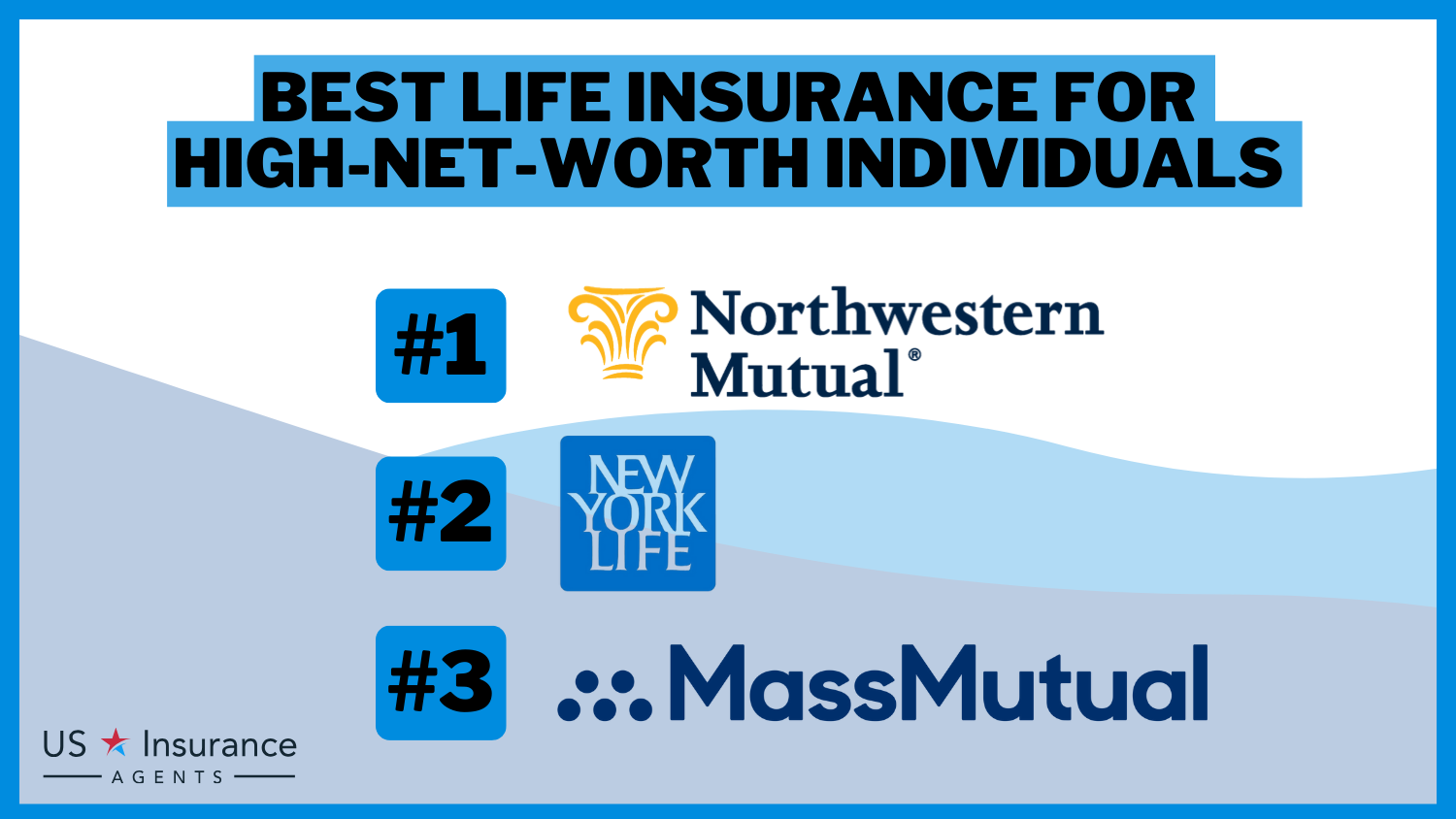

Our in-depth analysis reveals that Northwestern Mutual stands out as the superior choice, boasting unmatched financial strength, a diverse portfolio of life insurance products, and a tradition of consistent dividend payouts.

Join us as we explore how these factors influence insurance rates across different customer profiles, providing you with a quick, informative snapshot to make an informed decision on your life insurance provider.

Northwestern Mutual

Pros:

- Established Reputation: With over 160 years of history, Northwestern Mutual is a well-established and trusted life insurance provider.

- Financial Strength: The company consistently receives high ratings for its financial stability, offering policyholders confidence in its ability to fulfill long-term commitments.

- Dividend Payouts: Northwestern Mutual is known for its consistent payment of dividends, providing additional value to policyholders.

- Diverse Product Portfolio: Offering a range of life insurance products, including term, whole, universal, and variable life insurance, Northwestern Mutual caters to various needs.

Cons:

- Potentially Higher Premiums: While offering financial strength, the reputation and stability of Northwestern Mutual may come with slightly higher premium costs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New York Life Insurance

Pros:

- Longevity and Trust: Founded in 1845, New York Life is one of the oldest mutual life insurance companies, known for its commitment to policyholder interests.

- Comprehensive Product Range: New York Life provides a diverse array of life insurance products, allowing customers to choose coverage that aligns with their unique needs.

- Strong Customer Service: The company is recognized for its exceptional customer service, ensuring policyholders receive personalized attention and support.

- Potential Dividends: Like Northwestern Mutual, New York Life offers participating policies that may be eligible for dividends based on company performance.

Cons:

- Potentially Higher Premiums: Similar to Northwestern Mutual, the reputation and longevity of New York Life may result in slightly higher premium costs.

Choosing the Best: Northwestern Mutual vs. New York Life

When weighing the merits of Northwestern Mutual and New York Life, one company emerges as the superior choice overall: Northwestern Mutual.

- Unmatched Financial Strength: Northwestern Mutual’s consistent high ratings for financial stability instill unparalleled confidence in its ability to fulfill long-term commitments, providing policyholders with a reliable foundation for their financial security.

- Longevity and Versatility: With a history spanning over 160 years, Northwestern Mutual offers a diverse range of life insurance products, including term, whole, universal, and variable life insurance. This extensive portfolio provides customers with the flexibility to tailor their coverage to meet individual needs.

- Consistent Dividend Payouts: Northwestern Mutual’s tradition of paying dividends adds substantial value to policyholders, enhancing the overall return on investment and solidifying its reputation as a reliable and beneficial choice.

- Superior Overall Returns: The combination of financial stability, diverse product offerings, and consistent dividend payments positions Northwestern Mutual as the superior choice when considering both potential returns and long-term financial security.

Northwestern Mutual outshines New York Life in key aspects, making it the best overall choice for individuals seeking a life insurance provider that prioritizes reliability, versatility, and financial strength.

Understanding Life Insurance

Life insurance is a topic that holds great importance in today’s world. It serves as a financial safety net, providing individuals with peace of mind knowing that their loved ones will be taken care of in the event of their demise. Before delving into the specifics of Northwestern Mutual and New York Life Insurance, it is essential to have a comprehensive understanding of what life insurance entails.

At its core, life insurance is a contractual agreement between an individual and an insurance company. The individual pays regular premiums, and in return, the insurance company promises to pay a sum of money, known as the death benefit, to the beneficiaries named in the policy upon the insured’s death. This financial protection can be a lifeline for families, helping them navigate the challenging aftermath of losing a loved one.

Moreover, understanding life insurance involves comparing providers like AIG insurance and Chubb insurance to find the best coverage. AIG insurance is known for comprehensive policies and a global reach, catering to individuals and businesses. Chubb insurance offers customized coverage with a focus on high-net-worth clients and exceptional service. Both companies are key players in the life insurance market, helping secure financial futures.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Basics of Life Insurance

Life insurance policies can be broadly categorized into two types: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. During this period, if the insured passes away, the death benefit is paid out to the beneficiaries. However, if the insured outlives the term, the policy expires, and no benefits are paid.

This type of insurance is often chosen to provide coverage during specific stages of life when financial obligations are high, such as when raising children or paying off a mortgage. On the other hand, permanent life insurance offers coverage for the entire lifetime of the insured individual. Unlike term life insurance, permanent life insurance does not have an expiration date.

It combines a death benefit with a savings or investment component, allowing policyholders to accumulate cash value over time. This cash value can be accessed during the policyholder’s lifetime, providing flexibility and potential financial growth.

When considering life insurance, it is crucial to assess your financial needs and goals. Various factors should be taken into account, such as dependents, outstanding debts, and future financial obligations. By carefully evaluating these aspects, you can determine the appropriate coverage amount and policy type that aligns with your unique circumstances.

Importance of Life Insurance

The importance of life insurance cannot be overstated. It serves as a crucial tool in providing financial protection to your loved ones, ensuring their well-being even when you are no longer there to provide for them. In the unfortunate event of your demise, life insurance can help cover funeral expenses, outstanding debts, and mortgage payments.

It can also provide income replacement, ensuring that your family can maintain their standard of living and meet their financial obligations. Moreover, life insurance extends beyond immediate financial needs. It can also be utilized as an effective estate planning tool.

By having a life insurance policy, you can create liquidity to pay estate taxes, preventing the need to sell valuable assets or burdening your beneficiaries with tax liabilities. This ensures a smooth transition of assets to your loved ones, allowing them to inherit and enjoy the fruits of your labor without unnecessary financial strain.

Ultimately, life insurance is a powerful financial instrument that offers peace of mind and protection to individuals and their families. It provides a safety net during challenging times, allowing your loved ones to focus on healing and rebuilding their lives without the added stress of financial uncertainty.

Understanding the intricacies of life insurance is the first step towards making informed decisions that can safeguard the financial future of those you hold dear.

An Overview of Northwestern Mutual Life Insurance

United States. Established in 1857, the company has a long-standing history and a strong financial foundation. A significant aspect of their offerings includes the Northwestern Mutual cash value life insurance, which provides policyholders with a death benefit along with a cash value component that grows over time.

This makes it an attractive option for those looking for both protection and a means of building financial security. Many people seeking comprehensive coverage often compare options and wonder, “Is Northwestern Mutual the best life insurance company?” Given their robust reputation and extensive range of products, they certainly stand out in the industry.

When considering other options, it’s common to evaluate similar companies to Northwestern Mutual. For instance, potential policyholders often look at Mass Mutual vs Northwestern Mutual to determine which insurer better meets their needs.

Companies like Northwestern Mutual, such as Mass Mutual, offer comparable life insurance products and strong financial ratings, making the decision challenging for consumers.

Additionally, prospective clients may explore companies like Northwestern Mutual to see what unique benefits or services they might provide. Insightful feedback can be gathered from resources like Northwestern Mutual financial advisor review, which sheds light on customer experiences and satisfaction with the company’s advisory services.

Understanding these perspectives can help individuals make informed decisions about their life insurance and financial planning needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

History and Background of Northwestern Mutual

Northwestern Mutual has a rich history dating back over 160 years, founded by John C. Johnston and Samuel Daggett as the Mutual Life Insurance Company of the State of Wisconsin. Initially serving only Wisconsin, the company expanded and is now headquartered in Milwaukee, Wisconsin, with a nationwide presence renowned for its financial strength and stability.

A significant aspect of their offerings includes the Northwestern Mutual cash value life insurance, which provides policyholders with a death benefit and a cash value component that grows over time. This feature makes Northwestern Mutual an attractive option for those seeking both protection and financial growth.

When evaluating life insurance options, many consider similar companies to Northwestern Mutual. For instance, potential policyholders often compare Mass Mutual vs Northwestern Mutual to determine the better fit. Companies like Northwestern Mutual, such as Mass Mutual, offer similar products and strong financial ratings.

Additionally, feedback from Northwestern Mutual financial advisor review can provide insights into customer experiences. Understanding the Northwestern Mutual background and their offerings, such as Northwestern Mutual term life insurance, helps individuals make informed decisions about their life insurance and financial planning needs.

Reviewing the Northwestern Mutual dividend history also provides valuable information on the company’s financial performance and reliability.

Life Insurance Products Offered by Northwestern Mutual

Northwestern Mutual offers a wide range of life insurance products to cater to different needs and budgets. Its product portfolio includes term life insurance, whole life insurance, universal life insurance, and variable life insurance.

Term life insurance policies provided by Northwestern Mutual offer affordable coverage for a specific period. They can be a suitable option for individuals looking for temporary coverage, such as young families with children or individuals with outstanding debts.

Whole life insurance policies offered by Northwestern Mutual provide lifelong coverage and accumulate cash value over time. These policies can serve as a long-term investment and estate planning tool.

Universal life insurance and variable life insurance policies offered by Northwestern Mutual provide flexibility and the potential for higher returns. These policies allow policyholders to allocate their premiums towards different investment options, potentially leading to greater cash accumulation.

In addition, life Insurance Products Offered by Northwestern Mutual encompass a wide range tailored to diverse needs. Northwestern Mutual renters insurance provides coverage specifically designed for tenants, protecting their belongings and liability in rental properties.

Meanwhile, Northwestern Mutual cash value life insurance combines a death benefit with a savings component that grows over time, offering policyholders both financial security and investment potential. These products highlight Northwestern Mutual’s commitment to delivering comprehensive solutions that meet the financial protection requirements of individuals and families.

Customer Service and Reputation of Northwestern Mutual

Northwestern Mutual is widely regarded for its exceptional customer service and strong reputation in the industry. The company has consistently received high ratings and accolades for its financial strength, customer satisfaction, and claims-paying ability.

With a commitment to serving its policyholders, Northwestern Mutual provides personalized financial planning and advisory services to help clients make informed decisions about their life insurance and financial well-being.

Subsequently, Customer Service and Reputation of Northwestern Life Insurance customer service are crucial aspects that contribute to its standing in the insurance industry. Northwestern Mutual business insurance offerings cater to a wide range of businesses, providing tailored solutions to meet their specific needs.

The Northwestern Mutual dividend payout date is eagerly anticipated by policyholders, reflecting the company’s financial stability and commitment to returning value to its customers.

These factors underscore Northwestern Mutual’s reputation for reliability and customer satisfaction, making it a preferred choice for individuals and businesses alike seeking dependable insurance coverage and financial security. Understanding these aspects helps potential customers make informed decisions about their insurance needs with Northwestern Mutual.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

An Overview of New York Life Insurance

Established in 1845, New York Life Insurance has built a strong reputation rooted in its history and commitment to innovation. New York Life custom whole life insurance reviews highlight its specific benefits and drawbacks, providing insights into its effectiveness in meeting individual financial goals and long-term planning needs.

Additionally, New York Life pros and cons are evaluated based on factors such as coverage guarantees, cash value accumulation, premium costs, and flexibility compared to other insurance options.

The company’s ongoing New York Life insurance company expansion initiatives and the opening of New York Life insurance company new store locations reflect its dedication to enhancing accessibility and customer engagement nationwide.

Understanding these elements helps potential customers make informed decisions about selecting New York Life for their insurance and financial planning needs, leveraging its established reputation and strategic growth efforts.

History and Background of New York Life

New York Life insurance history has rooted in supporting individuals and families in times of need. The company was founded by a group of prominent businessmen and now has a nationwide presence.

Throughout its long history, New York Life has focused on providing financial security and peace of mind to its policyholders. The company has built a reputation for its steadfast commitment to policyholder interests and financial strength.

Additionally, founded in 1845, the history of New York Life insurance is extensive, cementing its reputation as one of the oldest and most esteemed insurers in the United States. The history of New York Life Insurance Company underscores its enduring stability and reliability across nearly two centuries.

This legacy extends to its national presence, including New York Life insurance in Jacksonville, FL and New York Life insurance in Johnston, RI, ensuring residents in these areas have access to its renowned insurance products.

When considering similar companies to New York Life , individuals can compare insurers offering similar products and services, leveraging New York Life’s rich history and background to make informed decisions about their insurance needs. Understanding these aspects helps individuals secure their financial futures with a trusted and long-standing insurer like New York Life.

Life Insurance Products Offered by New York Life

New York Life offers a comprehensive range of life insurance products to cater to diverse customer needs. Its product lineup includes term life insurance, whole life insurance, universal life insurance, and variable life insurance.

New York Life’s term life insurance policies offer affordable coverage for a specified period. These policies can be an excellent choice for individuals seeking temporary protection, such as young families or individuals with outstanding debts.

Whole life insurance policies provided by New York Life offer lifetime coverage and feature guaranteed cash value accumulation. These policies provide security and can serve as a valuable component of an individual’s long-term financial strategy.

Universal life insurance and variable life insurance products offered by New York Life provide policyholders with flexibility and the opportunity for cash value growth. These policies allow individuals to allocate their premiums towards different investment options, potentially leading to higher cash accumulation.

Moreover, New York Life offers a diverse range of life insurance products, tailored to meet various needs and preferences. New York Life insurance agents play a crucial role in guiding customers through the selection process, offering personalized advice and expertise.

Looking forward, New York Life insurance upcoming products represent the company’s commitment to innovation and meeting evolving market demands. Understanding the breadth of New York Life insurance products ensures individuals can choose options that align with their financial goals and future planning needs, supported by the expertise of dedicated New York Life insurance agents.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Customer Service and Reputation of New York Life

New York Life has a strong reputation for providing exceptional customer service and being a reliable partner to its policyholders. The company has consistently received high ratings for its financial strength, claims-paying ability, and commitment to policyholder satisfaction.

With a deep understanding of the importance of life insurance, New York Life places great emphasis on providing personalized service and customizing policies to meet individual needs. The company’s dedicated network of financial professionals offers expert guidance and support to policyholders.

Also, customer Service and Reputation of New York Life are reinforced by New York Life financial advisor reviews and New York Life financial professional review. These evaluations provide valuable insights into the quality and effectiveness of the company’s advisory services.

Similarly, New York Life insurance review offers perspectives on customer experiences with the company’s insurance products, shedding light on satisfaction levels and areas for improvement. Understanding these reviews aids potential customers in assessing New York Life’s dedication to excellence in financial planning and insurance services, enabling informed decisions aligned with their long-term financial goals.

Comparing Northwestern Mutual and New York Life Insurance

Now that we have explored the backgrounds and offerings of both Northwestern Mutual and New York Life Insurance, let’s compare them across different aspects to help you make a well-informed decision.

By comparing Mass Mutual vs New York Life insurance and MetLife vs New York Life allows potential policyholders to evaluate key differences and similarities in insurance offerings. Each company brings unique strengths to the table: New York Life insurance is renowned for its long-standing history and comprehensive product range, emphasizing stability and reliability.

On the other hand, Mass Mutual and MetLife offer competitive alternatives with distinct features tailored to diverse financial needs and preferences. When considering New York Life insurance vs Northwestern Mutual, individuals can weigh factors such as coverage options, customer service reputation, and financial strength to determine which insurer best aligns with their long-term financial goals and insurance requirements.

Understanding these comparisons empowers consumers to make informed decisions that effectively secure their financial future.

Comparison of Life Insurance Products

When it comes to life insurance products, both Northwestern Mutual and New York Life offer a comprehensive range of options. Both companies provide term life insurance, whole life insurance, universal life insurance, and variable life insurance policies.

However, it is important to note that there may be slight variations in the specific features, pricing, and policy terms between the two companies. To determine the most suitable product for your needs, it is recommended to carefully review the details and consult with a financial professional.

To simplify the process, you can leverage online tools that allow you to compare insurance quotes from different companies. This way, you can review rates and coverage options to find the best policy that aligns with your requirements and budget.

Additionally, insurance comparison platforms can help you find the most competitive rates and potentially save money on your life insurance premiums. By reviewing rates online, you can ensure that you are getting the best value for your money.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparison of Customer Service

Both Northwestern Mutual and New York Life are known for their excellent customer service and commitment to policyholder satisfaction. Both companies have well-trained financial professionals who can guide you through the policy selection process and provide ongoing support.

When choosing a life insurance provider, it is essential to assess the level of customer service offered. Consider factors such as availability, responsiveness, and the ability to address your specific needs and concerns. This will ensure a seamless experience and a reliable relationship with your insurance provider.

It is also worth mentioning that Northwestern Mutual and New York Life have mobile apps and online portals that allow policyholders to manage their policies, make changes, and access important information easily. These digital offerings can enhance convenience and accessibility.

When it comes to managing your life insurance policy, having the right tools and resources can make a significant difference. If you are a gym owner, personal trainer, or fitness professional, consider using Exercise.com. It is the best software platform that can help you sell workout plans, run fitness challenges, schedule gym and personal training sessions.

Run referral campaigns, form workout groups, and message clients and leads with SMS, email, and in-app messaging. It also allows you to sell fitness memberships and much more, all from custom branded fitness apps. With Exercise.com, you can ensure a streamlined and efficient approach to managing your fitness business.

Comparison of Financial Strength and Stability

Assessing the financial strength and stability of an insurance company is crucial as it directly impacts the company’s ability to fulfill its obligations to policyholders. Both Northwestern Mutual and New York Life have established themselves as financially secure and stable institutions.

Northwestern Mutual Life Insurance Company and Northwestern Mutual ratings are critical considerations when choosing a life insurance provider. These companies regularly receive high ratings and accolades from independent rating agencies that evaluate the financial health of insurance companies.

It is recommended to review these ratings when considering a life insurance provider, as they provide insights into the company’s ability to meet its long-term financial commitments. Evaluating Northwestern Mutual ratings ensures policyholders can make informed decisions based on the company’s financial strength and stability, essential for long-term financial planning and security.

By conducting thorough research and review, you can gain confidence in the financial strength and stability of both Northwestern Mutual and New York Life. This will help you choose an insurance provider that can offer you peace of mind and financial security.

In Conclusion

Choosing the right life insurance company is a critical decision that requires careful consideration of various factors. Both Northwestern Mutual and New York Life Insurance are well-established companies with strong reputations and a wide range of life insurance products.

To make a decision, assess your specific needs, consider the features and benefits of each company’s offerings, compare insurance quotes online, and review the financial strength of the insurers. By evaluating these factors, you can make an informed decision about the best life insurance company for you.

Remember, life insurance is a long-term commitment, and it plays a significant role in safeguarding the financial well-being of your loved ones. Take the time to thoroughly research and explore your options, and leverage the available resources to make the best choice for your future. Compare insurance quotes with our free tool and review insurance rates from different companies online to save money and find the best rates.

Frequently Asked Questions

What is the difference between Northwestern Mutual and New York Life life insurance?

Northwestern Mutual and New York Life are both reputable life insurance companies, but they differ in several aspects. Northwestern Mutual is known for its strong financial stability and dividends, while New York Life offers a wide range of policy options and a long history of serving policyholders. The best choice between the two depends on individual preferences and needs.

Which company has better financial stability, Northwestern Mutual or New York Life?

Northwestern Mutual is renowned for its exceptional financial strength and stability. It consistently receives high ratings from independent rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s. New York Life also has a strong financial position, but Northwestern Mutual is often considered one of the most financially secure companies in the industry.

What types of life insurance policies do Northwestern Mutual and New York Life offer?

Both Northwestern Mutual and New York Life offer a variety of life insurance policies to cater to different needs. They provide term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each policy type has its own features and benefits, so it’s important to evaluate your specific requirements before choosing.

Can I receive dividends with Northwestern Mutual and New York Life life insurance?

Yes, both Northwestern Mutual and New York Life policyholders have the potential to receive dividends. Northwestern Mutual is particularly known for its long history of paying dividends to its policyholders, which can provide additional value and financial growth. New York Life also offers participating policies that may be eligible for dividends based on the company’s performance.

How do I decide which life insurance company is better for me?

Choosing between Northwestern Mutual and New York Life depends on your individual circumstances and priorities. Consider factors such as financial stability, policy options, premium costs, customer service, and any specific requirements you have for your life insurance coverage. It’s recommended to research and compare quotes from both companies to make an informed decision.

Are there any specific advantages of Northwestern Mutual or New York Life life insurance?

Both Northwestern Mutual and New York Life have their unique advantages. Northwestern Mutual’s strength lies in its financial stability, long-standing reputation, and consistent dividend payments. New York Life offers a wide range of policy options, excellent customer service, and a strong commitment to policyholder satisfaction. Assessing your priorities will help determine which advantages align better with your needs.

Does New York Life have an app?

Yes, New York Life offers a mobile app called “New York Life Mobile.” This app is designed for policyholders to conveniently manage their insurance policies on the go. Users can view policy details, make payments, access digital ID cards, file claims, contact customer service, and receive updates on their policy status. The app is available for download on both iOS and Android devices through the respective app stores.

Does Northwestern Mutual sell health insurance?

Northwestern Mutual primarily focuses on life insurance, disability income insurance, and long-term care insurance. While they do not sell traditional health insurance plans (like medical or dental insurance), their products can provide financial protection in the event of illness or disability.

How to cancel a Northwestern Mutual policy?

To cancel a Northwestern Mutual policy, policyholders should contact their financial advisor directly or reach out to the customer service department. A financial advisor can guide you through the cancellation process, explain any surrender charges or potential impacts on benefits, and assist with the necessary paperwork.

Is Northwestern Mutual a good life insurance company?

Yes, Northwestern Mutual is widely recognized as a top-rated life insurance company. It consistently receives high ratings for financial strength and stability from independent rating agencies like A.M. Best, Moody’s, and Standard & Poor’s. Additionally, Northwestern Mutual is known for its strong customer service, comprehensive insurance products, and long-term commitment to policyholder benefits.

Is New York Life a mutual company?

What is the New York Life app used for?

What is the background of New York Life?

Does New York Life offer car insurance?

What do people say in career reviews about New York Life?

How can I access the New York Life insurance mobile app?

What are the reviews for Northwestern Life Insurance?

Does Northwestern Mutual offer auto insurance?

Where can I find New York Life insurance agents?

What is Northwestern Mutual known for?

When does Northwestern Mutual pay dividends?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.