Liberty Mutual Car Insurance Review & Ratings (2024)

Find affordable Liberty Mutual car insurance coverage for your vehicle. With Liberty Mutual, you can protect your car and enjoy peace of mind on the road. Explore a range of coverage options tailored to your needs and budget. Whether you're looking for basic liability coverage or comprehensive protection, Liberty Mutual has you covered.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Peyton Leonard

Published Author & Insurance Expert

Peyton Leonard is an insurance and finance writer living in Colorado Springs, CO. She is currently obtaining her Bachelor’s in English at Thomas Edison State University. Peyton is the author of “Lyme & Not the Fruit.” She also has experience writing for the business magazine, Productivity Intelligence Institute.

Published Author & Insurance Expert

UPDATED: Jan 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance company and cannot guarantee quotes from any single insurance company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Jan 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance company and cannot guarantee quotes from any single insurance company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Welcome to our comprehensive guide on Liberty Mutual car insurance. If you’re looking for reliable and affordable coverage for your vehicle, you’ve come to the right place. In this article, we will delve into the key topics related to Liberty Mutual car insurance, including coverage options, pricing, customer reviews, and more.

Whether you’re interested in understanding the different types of coverage available, comparing prices and discounts, or hearing from other customers about their experiences with Liberty Mutual, we’ve got you covered. To ensure you find the best rates from the top insurance providers in your area, simply enter your zip code in the form provided and get ready to save on your car insurance today.

Liberty Mutual’s Rating Agency

Bringing in tons of revenue a year says a lot about a company’s potential and power. Just in 2018 alone, Liberty Mutual racked up $39.4 billion in sales. Incredible, right?

While that says a lot about the powerhouse company, there are also other ways to tell if they’re doing well.

That’s why we’ll be talking about ratings.

Ratings can be measured in a different number of ways–by letter or number–and can help consumers determine an organization’s financial strength and esteem, as well as providing an easier way for consumers to compare the performance of various organizations.

Let’s take a look at the chart below and see how Liberty Mutual has been graded as an organization by some of the best risk-assessing organizations in the business.

| Agency | Rating |

|---|---|

| A.M. Best | A (Excellent) |

| Better Business Bureau | A |

| Consumer Affairs | 1.25 |

| Consumer Reports | 88 |

| J.D. Power | 3-About Average |

| Moody's Rating | A2 |

| NAIC Complaint Index | 1.80 (2018) |

| S&P Rating | BBB |

A.M. Best

A.M. Best, a global credit rating agency, measures a company’s financial strength and creditworthiness, as well as accountability to policyholders and is among the best at it.

Liberty Mutual received an “A” from A.M. Best. In other words, this company is considered as “excellent” in meeting their insurance obligations.

In fact, the press release on Liberty Mutual from A.M. Best provides insight upon this rating.

AM Best views Liberty Mutual’s operating performance as adequate, characterized by relatively strong investment income and generally solid underwriting performance…The group has a strong, diversified business profile that serves to protect its earnings stream.

Getting such a high-level rating attests to Liberty Mutual being a strong organization overall.

Better Business Bureau

The Better Business Bureau is an organization dedicated to helping individuals “find businesses they can trust”.

Operating mainly in Mexico, Canada, and the United States, the BBB rates organizations based on information that it is able to obtain about the business–this includes complaints from the public.

BBB has its highest rating at “A+” and it’s the lowest rating as “F”. In some cases organizations may receive an “NR” or no rating based on several factors, including not having enough information about the business and when the business is being updated.

As it relates to Liberty Mutual, their grade “A” signifies that they are among the highest performing organizations rated by the Better Business Bureau. Grade A represents the range “94-96.99”, with 100 being the highest.

Moody’s Rating

Moody’s is a bond credit rating business that aims to evaluate the future creditworthiness of securities.

Banks rated “A” posses superior intrinsic financial strength. Moody also assigns numerals–1,2, and 3–to indicate the categories’ rank; a 3, for example, indicates the lowest grade in its class.

From December 2002 to December 2016, Liberty Mutual has managed to maintain an A2 rating from Moody’s. This makes Liberty Mutual a company that is valuable, predictable, and strong.

S&P Rating

With over 150 years of experience, S&P Rating is the world’s leading provider of credit ratings. Ratings range from “AAA”, that is, highly likely that the borrower will repay its debt, and “D”, which means that the insurer is already at default.

Understanding the likelihood of an organization paying back its debts says a lot about it as a whole, so these ratings are extremely telling.

Liberty Mutual has been rated “BBB” from S&P. This means that:

An obligation rated ‘BBB’ exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to weaken the obligor’s capacity to meet its financial commitments on the obligation.

When looking at investing in this company, for example, there is a potentially high likelihood that this organization is able to pay its debt, despite the external factors that may pose a threat to its organization.

NAIC Complaint Index

Knowing the financial and institutional strength of an organization is one thing, knowing what your fellow peers have said about their personal experience is also important.

Every year the National Association of Insurance Commissioners (NAIC) publishes this complaint data.

Let’s take a closer look.

| Private Passenger Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 173 | 129 | 141 |

| Complaint Index (Better or Worse than National Index) | 0.95 (better) | 1.26 (worse) | 1.80 (worse) |

| National Complaint Index | 1 | 1 | 1 |

| US Market Share | 0.72% | 0.60% | 0.51% |

| Total Premiums | $1,534,264,837 | $1,396,322,288 | $1,249,166,622 |

Looking at the data, we see that the total number of complaints decreased in 2017 after 2016, then slightly increased in 2018.

JD Power

J.D. Power is a worldwide pioneer in consumer insights, advisory services, and information and investigation.

In 2019, J.D. Power conducted a survey based on “responses from 11,186 auto insurance customers who settled a claim within the past six months”.

In that study, Liberty Mutual, the insurance giant, scored a three out of five for overall customer satisfaction (customer claims, a subsidiary of the overall score also received a three out of five).

What this means is that customers found Liberty Mutual to be “about average” for handling its claims.

Consumer Reports

Liberty Mutual received a score of 88 from Consumer Reports, who factors in satisfaction with price of premiums and also satisfaction with handling claims.

A score of 100 means all respondents were completely satisfied; 80 would mean very satisfied, on average; 60, somewhat satisfied; 40, somewhat dissatisfied.

This means that most individuals, according to Consumer Reports, were a little more than “very satisfied” on average about the company.

Consumer Affairs

Consumer Affairs prides itself on helping individuals make big purchases through utilizing their company reviews.

Take Liberty Mutual, for example. Liberty Mutual received 1.25 stars out of five from Consumer Affairs. While this isn’t impressive, to say the least, it is also helpful to know that this rating was created from 150 customer reviews.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

Liberty Mutual History

Liberty Mutual has been in the business for the past 100 years. This is incredibly noteworthy, to say the least. Here are a few historic milestones about the company.

- Established in July 1, 1912, providing workers compensation insurance.

- Expanded into its first auto policy in 1918.

- Built home office in Boston in 1937.

- Grew outside North America to the United Kingdom in 1973.

- Grew in the 1990s through the acquisition of prominent commercial and risk carriers.

- Gained Seattle-based Safeco Corporation as a part of Liberty Mutual enterprise in 2008.

- Created Solaria Labs’ in 2016, a commitment to customer-focused innovation today.

Read more: Safeco Car Insurance Discounts

Liberty Mutual Market Share

A market share is the percentage of an industry that an organization makes up. One would take an organization’s total sales and divide that over the total sales of the insurance industry, for example, to get one’s market share.

Depending on how high (or low) one’s market share is determines its prominence in that particular industry.

Let’s take a look at the four-year market share period for Liberty Mutual.

| Year | Market Share |

|---|---|

| 2015 | 4.99% |

| 2016 | 5.01% |

| 2017 | 5.01% |

| 2018 | 4.77% |

Looking at the chart we find that Liberty Mutual’s share of the U.S. insurance market increased in 2016 from 2015, remained consistent in 2017, and decreased slightly in 2018.

Liberty Mutual’s Position for the Future

Looking at Liberty Mutual’s company reviews and market share we discover several things.

First, we discover that the organization is more than just a household name, but displays strength and promise as a financial institution.

Through rating-organizations like A.M. Best, BBB, and Moody’s, for example, we see that Liberty Mutual is strong from the inside out.

Financial strength and solid core, Liberty Mutual is known as an organization that can fulfill its business obligations, even if it faces a few environmental threats.

Furthermore, Liberty Mutual’s market share has been somewhat consistent, though it faced a drop in 2018, proving that this organization is holding its own in the insurance industry.

Liberty Mutual does have competition in this area, however, as State Farm, Geico, and Allstate, for example, own a greater market share and have shown growth in recent years.

So overall, Liberty Mutual is in a great position for the future.

On the other hand, we learn that Liberty Mutual can improve in the customer service department. Perhaps, the company would benefit from more customer incentives or strengthening its customer service core base overall.

Nevertheless, Liberty Mutual is a company of great position and is in a great place to compete with its competitors in the future.

Liberty Mutual’s Online Presence

With the rise of virtual communication, companies all around have utilized their online presence to reach their customers.

With Liberty Mutual, you are invited to get a quote online. You can also get a quote by calling the number listed: 1-800-295-2723 (sales).

You are also able to reach a local agent with your ZIP code or agent name.

There is also an option to log in and file a claim. Furthermore, the claims department can be reached at 1-833-218-0219.

If you need any additional help, you can contact Customer Service at 1-844-629-8984. There is also a digital insurance provider who can help guide you to certain resources, one being the FAQs page, as well as insurance agents available for live chat.

Liberty Mutual’s Commercials

If you’ve watched a Liberty Mutual commercial lately, you might have noticed quite an odd pairing. That’s because in recent years Liberty Mutual has been using an emu “LiMu Emu” or Liberty Mutual emu in its commercials as a sidekick to a character named “Doug”.

But what can an emu and Doug tell us about car insurance? Well, looking at Liberty Mutual’s slogan “only pay for what you need,” it is inferred that there are some companies out there who are charging individuals more than warranted for their car insurance.

That’s where these two detectives come in. They are on a mission to inform as many people as possible that being ripped off is at large and they have the only solution–join Liberty Mutual and save.

While the two have been rewarded for their great work, even Doug reminds the people in this commercial that the mission isn’t over yet and that there’s no time to waste because there are more people to save from being ripped off.

https://www.youtube.com/watch?v=5ugLWL3G9iQ

In recent months, along with the LiMu Emu series, Liberty Mutual has also added to its “Truth Teller” series. You know, the scenic Statue of Liberty view in the background of various different characters from bad actors to newscasters.

https://www.youtube.com/watch?v=Rcz0eRwox6k

What do they all have in common? They all need Liberty Mutual insurance to enhance their life despite their various circumstances.

Liberty Mutual in the Community

Liberty Mutual does more than just provide thousands of individuals with insurance. Their programs aim to strengthen ecosystems in various groups.

Here are the four programs that Liberty Mutual buckets into their giving stream:

- Empowering individuals experiencing homelessness

- Advancing access for people with disabilities

- Expanding education opportunities for underserved students

- Supporting Liberty Torchbearers (employees who give back)

In fact, Liberty Mutual’s employees are active and awarded for their impact in the community.

Last year, employee giving was an astounding $10,604,090 alone. Coupled with corporate, total giving rose to $44,547,518 in 2018 alone, all with efforts to improve communities and lives.

Liberty Mutual’s Employees

While taking an in-depth look at Liberty Mutual, it’d also be beneficial to look at their employees, as this also provides a view into a company’s reputation.

Liberty Mutual employs a large number of employees; 45 percent are Millenials born between 1981 and 1997. Second, you have Generation X, 36 percent, born between 1965 and 1980. Lastly, at Liberty Mutual, you have the Baby Boomers at 18 percent, born between 1945-1964.

Most individuals stay at Liberty Mutual two to five years (roughly 27 percent). The second tenure happens to be less than two years at roughly 20 percent. While this may seem like a lot of turnovers, you have 35 percent who stay over 10 years at the company.

83 percent of employees say Liberty Mutual is a great place to work.

Let’s break that down a bit:

- 91 percent — I feel good about the ways we contribute to the community.

- 91 percent — When you join the company, you are made to feel welcome.

- 89 percent — I am able to take time off from work when I think it’s necessary.

- 88 percent — People here are given a lot of responsibility.

- 86 percent — Management is honest and ethical in its business practices.

That’s pretty good, right?

Furthermore, individuals at the company have said that balance is good, as well as flexibility. Also, it was noted that benefits and people make employees feel like Liberty Mutual is a great place to work.

Liberty Mutual has also won several awards for their workplace.

- #27 in PEOPLE 2019 Companies that Care — Forbes 2019

- #73 in Best Workplaces for Diversity 2019 — Fortune Profile

- #80 in Best Workplaces for Diversity 2017

- Digital Workplace of the Year (2018)

This speaks volumes and shows that Liberty Mutual is more than just an insurance giant, but an established place of business for many individuals.

Liberty Mutual has over 4,000 employee reviews on glassdoor.com, and this site reports that claims adjusters’ average annual salary can range from $35,556-$82,519, an average of $56,317 from the 169 salaries posted.

Cheap Car Insurance Rates

Now that we’ve looked at ratings and the esteem of Liberty Mutual based on its employees and external parties of high caliber, it’s time to get down to business to see just how Liberty Mutual stacks up against its competitors.

Because let’s face it, paying high rates for car insurance is nobody’s dream.

Liberty Mutual Availability and Rates by State

Below is a data table for the average Liberty Mutual rate in each state.

Read more: Utah Car Insurance Discounts

| State | Annual Premium | Higher/Lower Than State Average | Higher/Lower Percent Than State Average |

|---|---|---|---|

| Alabama | $4,005.48 | $438.52 | 12.29% |

| Alaska | $5,295.55 | $1,874.04 | 54.77% |

| Arizona | Data Not Available | Data Not Available | Data Not Available |

| Arkansas | Data Not Available | Data Not Available | Data Not Available |

| California | $3,034.42 | -$654.51 | -17.74% |

| Colorado | $2,797.74 | -$1,078.65 | -27.83% |

| Connecticut | $7,282.87 | $2,663.95 | 57.67% |

| Delaware | $18,360.02 | $12,373.69 | 206.70% |

| District of Columbia | Data Not Available | Data Not Available | Data Not Available |

| Florida | $5,368.15 | $687.69 | 14.69% |

| Georgia | $10,053.44 | $5,086.61 | 102.41% |

| Hawaii | $3,189.55 | $633.91 | 24.80% |

| Idaho | $2,301.51 | -$677.58 | -22.74% |

| Illinois | $2,277.65 | -$1,027.83 | -31.09% |

| Indiana | $5,781.35 | $2,366.38 | 69.29% |

| Iowa | $4,415.28 | $1,434.00 | 48.10% |

| Kansas | $4,784.42 | $1,504.80 | 45.88% |

| Kentucky | $5,930.97 | $735.57 | 14.16% |

| Louisiana | Data Not Available | Data Not Available | Data Not Available |

| Maine | $4,331.39 | $1,378.12 | 46.66% |

| Maryland | $9,297.55 | $4,714.85 | 102.88% |

| Massachusetts | $4,339.35 | $1,660.50 | 61.99% |

| Michigan | $20,000.04 | $9,501.40 | 90.50% |

| Minnesota | $13,563.61 | $9,160.36 | 208.04% |

| Mississippi | $4,455.94 | $791.37 | 21.60% |

| Missouri | $4,518.67 | $1,189.74 | 35.74% |

| Montana | $1,326.11 | -$1,894.73 | -58.83% |

| Nebraska | $6,241.52 | $2,957.84 | 90.08% |

| Nevada | $6,201.55 | $1,339.85 | 27.56% |

| New Hampshire | $8,444.41 | $5,292.64 | 167.93% |

| New Jersey | $6,766.62 | $1,251.40 | 22.69% |

| New Mexico | Data Not Available | Data Not Available | Data Not Available |

| New York | $6,540.73 | $2,250.85 | 52.47% |

| North Carolina | $2,182.71 | -$1,210.40 | -35.67% |

| North Dakota | $12,852.83 | $8,686.99 | 208.53% |

| Ohio | $4,429.74 | $1,720.03 | 63.48% |

| Oklahoma | $6,874.62 | $2,732.30 | 65.96% |

| Oregon | $4,334.55 | $866.78 | 25.00% |

| Pennsylvania | $6,055.20 | $2,020.70 | 50.09% |

| Rhode Island | $6,184.12 | $1,180.76 | 23.60% |

| South Carolina | Data Not Available | Data Not Available | Data Not Available |

| South Dakota | $7,515.99 | $3,533.72 | 88.74% |

| Tennessee | $6,206.69 | $2,545.80 | 69.54% |

| Texas | Data Not Available | Data Not Available | Data Not Available |

| Utah | $4,327.76 | $715.87 | 19.82% |

| Vermont | $3,621.08 | $386.95 | 11.96% |

| Virginia | Data Not Available | Data Not Available | Data Not Available |

| Washington | $3,994.73 | $935.41 | 30.58% |

| West Virginia | $2,924.39 | $329.03 | 12.68% |

| Wisconsin | $6,758.85 | $3,152.79 | 87.43% |

| Wyoming | $1,989.36 | -$1,210.72 | -37.83% |

Read more: Connecticut State Employees Car Insurance Discount

Drivers paying the highest average premium live in Michigan at $20,000.04 annually. Delaware and Minnesota proceed with annual premiums of $18,360.02 and $13,563.61 respectively.

On the other hand, however, residents in Montana pay the cheapest at $1,326.11 annually. This was followed by Wyoming and North Carolina, $1,989.36 and $2,182.71 respectively.

Read more: Penn State Car Insurance Discount

Comparing the Top 10 Companies by Market Share

How do Liberty Mutual’s rates compare to other providers?

| Insurer | Average Premium |

|---|---|

| Allstate | $4,532.96 |

| American | $3,698.77 |

| Farmers | $3,907.99 |

| Geico | $3,073.66 |

| Liberty Mutual | $5,295.55 |

| Nationwide | $3,187.20 |

| Progressive | $3,935.36 |

| State Farm | $2,731.48 |

| Travelers | $3,729.32 |

| USAA | $2,489.49 |

Unfortunately, Liberty Mutual comes in as having the most expensive rates on average.

The cheapest? USAA, Statefarm, and Geico, respectively.

Average Liberty Mutual Male vs Female Car Insurance Rates

| Group | Married 35-year-old Female | Married 35-year-old Male | Married 60-year-old Female | Married 60-year-old Male | Single 17-year-old Female | Single 17-year-old Male | Single 25-year-old Female | Single 25-year-old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,156.09 | $3,123.01 | $2,913.37 | $2,990.64 | $9,282.19 | $10,642.53 | $3,424.87 | $3,570.93 |

| American Family | $2,202.70 | $2,224.31 | $1,992.92 | $2,014.38 | $5,996.50 | $8,130.50 | $2,288.65 | $2,694.72 |

| Farmers | $2,556.98 | $2,557.75 | $2,336.80 | $2,448.39 | $8,521.97 | $9,144.04 | $2,946.80 | $3,041.44 |

| Geico | $2,302.89 | $2,312.38 | $2,240.60 | $2,283.45 | $5,653.55 | $6,278.96 | $2,378.89 | $2,262.87 |

| Liberty Mutual | $3,802.77 | $3,856.84 | $3,445.00 | $3,680.53 | $11,621.01 | $13,718.69 | $3,959.67 | $4,503.13 |

| Nationwide | $2,360.49 | $2,387.43 | $2,130.26 | $2,214.62 | $5,756.37 | $7,175.31 | $2,686.48 | $2,889.04 |

| Progressive | $2,296.90 | $2,175.27 | $1,991.49 | $2,048.63 | $8,689.95 | $9,625.49 | $2,697.73 | $2,758.66 |

| State Farm | $2,081.72 | $2,081.72 | $1,873.89 | $1,873.89 | $5,953.88 | $7,324.34 | $2,335.96 | $2,554.56 |

| Travelers | $2,178.66 | $2,199.51 | $2,051.98 | $2,074.41 | $9,307.32 | $12,850.91 | $2,325.25 | $2,491.21 |

| USAA | $1,551.43 | $1,540.32 | $1,449.85 | $1,448.98 | $4,807.54 | $5,385.61 | $1,988.52 | $2,126.14 |

Unfortunately, compared to other major companies nationally, Liberty Mutual has the highest rates for all demographics of age, gender, and marital status.

Just for male 17-year-olds, for instance, Liberty Mutual charges $13,718.69. And while their lowest prices are for married 60-year-old females at $3,4445, it still wasn’t low enough the beat the rest of the bunch (for that same demographic USAA charged $1,449.85).

Average Liberty Mutual Rates by Make and Model

It is a known fact that the car you drive could enhance your annual premium costs.

Let’s take a look at the chart below to see Liberty Mutual’s rates by make and model.

Average Annual Car Insurance Rates by Make and Model by Company

| Group | 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 Average Annual Rates | 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT Average Annual Rates | 2015 Toyota RAV4 XLE Average Annual Rates | 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 Average Annual Rates | 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT Average Annual Rates | 2018 Toyota RAV4 XLE Average Annual Rates |

|---|---|---|---|---|---|---|

| Allstate | $4,429.74 | $4,753.69 | $4,324.99 | $5,491.12 | $5,380.28 | $4,947.90 |

| American | $3,447.30 | $3,178.82 | $3,326.18 | $3,487.91 | $3,721.32 | $3,496.99 |

| Farmers | $4,093.50 | $4,405.21 | $3,728.22 | $4,390.19 | $4,779.51 | $3,769.00 |

| Geico | $3,092.11 | $3,092.58 | $3,090.89 | $3,338.40 | $3,338.87 | $3,337.18 |

| Liberty Mutual | $5,830.16 | $5,869.32 | $5,825.33 | $5,988.85 | $6,682.63 | $6,244.44 |

| Nationwide | $3,571.01 | $3,547.84 | $3,517.03 | $3,373.64 | $3,361.93 | $3,328.57 |

| Progressive | $3,914.05 | $4,429.56 | $3,647.22 | $3,962.58 | $4,528.90 | $3,730.78 |

| State Farm | $3,204.23 | $3,024.24 | $3,226.02 | $3,497.17 | $3,189.99 | $3,418.33 |

| Travelers | $4,023.47 | $4,420.37 | $4,383.78 | $4,412.42 | $4,661.22 | $4,708.19 |

| USAA | $2,551.56 | $2,409.67 | $2,454.58 | $2,855.69 | $2,422.66 | $2,529.63 |

Read more: Ford Car Insurance Discount

Again we see that Liberty Mutual charges more than its competitors for all makes and model.

While this doesn’t necessarily make Liberty Mutual a bad company, it is something to consider when shopping around for insurance.

Read more: Toyota Car Insurance Discount

Average Liberty Mutual Commute Rates

When it comes to commuter rates, just how does Liberty Mutual perform alongside its competitors?

Let’s take a look.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $4,841.71 | $4,934.20 |

| American Family | $3,401.30 | $3,484.88 |

| Farmers | $4,179.32 | $4,209.22 |

| Geico | $3,162.64 | $3,267.37 |

| Liberty Mutual | $5,995.27 | $6,151.63 |

| Nationwide | $3,437.33 | $3,462.67 |

| Progressive | $4,030.02 | $4,041.01 |

| State Farm | $3,175.98 | $3,344.01 |

| Travelers | $4,399.85 | $4,469.96 |

| USAA | $2,482.69 | $2,591.91 |

Once again we find that Liberty Mutual offers the highest average for commuter rates for both categories, while USAA, Geico, and State Farm offer the lowest rates respectively.

Average Liberty Mutual Coverage Level Rates

Changing coverage levels can leave a dent in your wallet. While expanding your coverage level is wise in certain circumstances, it may come at a cost.

Focusing on Liberty Mutual, let’s take a look at how coverage level rates are impacted by these major companies.

| Group | Low | Medium | High |

|---|---|---|---|

| Allstate | $4,628.03 | $4,896.81 | $5,139.02 |

| American | $3,368.49 | $3,544.37 | $3,416.40 |

| Farmers | $3,922.47 | $4,166.22 | $4,494.13 |

| Geico | $3,001.91 | $3,213.97 | $3,429.14 |

| Liberty Mutual | $5,805.75 | $6,058.57 | $6,356.04 |

| Nationwide | $3,394.83 | $3,449.80 | $3,505.37 |

| Progressive | $3,737.13 | $4,018.46 | $4,350.96 |

| State Farm | $3,055.40 | $3,269.80 | $3,454.80 |

| Travelers | $4,223.63 | $4,462.02 | $4,619.07 |

| USAA | $2,404.11 | $2,539.87 | $2,667.92 |

So, who penalizes you less for beefing up your plan? That would be American and Nationwide with a rate change of 1.42 percent and 3.26 percent, respectively.

Liberty Mutual comes in at fourth with 9.48 percent.

Who charges the highest? That would be Progressive with a rate change of 16.43 percent.

So while Liberty Mutual may have the highest rates overall, they are a tad bit more forgiving when you decide to ensure yourself more.

Average Liberty Mutual Credit History Rates

Your credit history is one of the commonly known factors that companies utilize when establishing your rates. Who offers the lowest change for good to poor credit? Who offers the highest?

| Group | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $3,859.66 | $4,581.16 | $6,490.65 |

| American | $2,691.74 | $3,169.53 | $4,467.98 |

| Farmers | $3,677.12 | $3,899.41 | $4,864.14 |

| Geico | $2,434.82 | $2,986.79 | $4,259.50 |

| Liberty Mutual | $4,388.18 | $5,604.24 | $8,802.22 |

| Nationwide | $2,925.94 | $3,254.83 | $4,083.29 |

| Progressive | $3,628.85 | $3,956.31 | $4,737.64 |

| State Farm | $2,174.26 | $2,853.00 | $4,951.20 |

| Travelers | $4,058.97 | $4,344.10 | $5,160.22 |

| USAA | $1,821.20 | $2,219.83 | $3,690.73 |

Looking at the data table, while Liberty Mutual has the highest figures all around, they are third to last (at 100.59 percent) in rate change when going from good to poor credit.

State Farm and USAA are first and second highest at 127.72 percent and 102.65 respectively.

The cheapest? Travelers (27.13 percent), followed by Progressive (30.55 percent).

Average Liberty Mutual Driving Record Rates

Keeping a clean driving record pays off in the long run, as insurance companies look at your record when setting rates. But what if you, in the worst-case scenario, get a DUI? How do companies change their rates, if at all?

Let’s take a quick peek.

| Group | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $3,819.90 | $4,483.51 | $4,987.68 | $6,260.73 |

| American Family | $2,693.61 | $3,025.74 | $3,722.75 | $4,330.24 |

| Farmers | $3,460.60 | $4,079.01 | $4,518.73 | $4,718.75 |

| Geico | $2,145.96 | $2,645.43 | $3,192.77 | $4,875.87 |

| Liberty Mutual | $4,774.30 | $5,701.26 | $6,204.78 | $7,613.48 |

| Nationwide | $2,746.18 | $3,113.68 | $3,396.95 | $4,543.20 |

| Progressive | $3,393.09 | $4,002.28 | $4,777.04 | $3,969.65 |

| State Farm | $2,821.18 | $3,186.01 | $3,396.01 | $3,636.80 |

| Travelers | $3,447.69 | $4,260.80 | $4,289.74 | $5,741.40 |

| USAA | $1,933.68 | $2,193.25 | $2,516.24 | $3,506.03 |

While some may get turned off at Liberty Mutual’s seemingly higher rates in general, they actually come in fourth in rate change when one goes from a clean record to a DUI–59.47 percent to be exact.

Progressive and State Farm come in at first and second–roughly 16.99 percent and 28.91.

Who offers the highest? Geico (127.21 percent), followed by USAA (81.31 percent).

Coverages Offered

Since learning that Liberty Mutual, on average, can be a bit higher than most of its competitors, it’ll be a good thing to talk about coverage next.

Is it worth it to purchase Liberty Mutual insurance? What types of add-ons and discounts do they offer besides standard auto insurance?

Read more: Liberty Mutual Right Track Car Insurance Discount

You’ll want to stay tuned as we’ll cover that next.

Let’s get to it.

Types of Coverages Offered

Liberty Mutual offers a variety of options when it comes to protecting you, others, and your vehicle.

Below is a list of coverage types. There are also additional add-ons that you can use to bulk up your policy for more protection than the standard auto insurance policy.

Read on.

- For you

- Medical Payments (standard)

- Uninsured Motorist (add-on)

- Personal Injury Protection (add-on)

- For others

- Bodily Injury Liability (standard)

- Property Damage (standard)

- Medical Payments (standard)

- For your automobile

- Collison (add-on)

- Comprehensive (add-on)

- Liberty Mutual Deductible Fund (add-on)

- Accident Forgiveness (add-on)

- Lifetime Repair Guarantee (add-on)

- New Car Replacement (add-on)

- Better Car Replacement (add-on)

- Rental Car Reimbursement (add-on)

- Towing and Labor (add-on)

- Auto loan/lease gap (add-on)

- Original Parts Replacement (add-on)

- Teachers Car Insurance (add-on)

- Mexico Car Insurance (add-on)

In addition to this, Liberty Mutual offers vehicle protection for the following:

- Motorcycle

- Boat and Watercraft

- Antique and Classic Car

- ATV and Off-Road Vehicle

- Recreational Vehicle (RV)

- Umbrella

Types Besides Car Insurance/Bundling

Here are additional types of coverage individuals can purchase through Liberty Mutual.

Property:

- Homeowners

- Renters

- Condo

- Landlord

- Mobile Home Insurance

- Flood

- Umbrella

Other insurance:

- Life

- Accident Insurance

- Critical Illness

- Identity Theft

- Pet Insurance

- Tuition Insurance

- Small Business

Liberty Mutual also gives you the option of bundling your auto insurance policy with either “home”, “renters”, or “condo”. Simply make a selection and enter your ZIP code to get started.

Discounts

The good thing is that Liberty Mutual offers an array of discounts that could reduce the amount of money you pay for your annual premium.

| Discount Offered | Notes |

|---|---|

| Adaptive Cruise Control | - |

| Adaptive Headlights | - |

| Anti-lock Brakes | - |

| Anti-Theft | - |

| Claim Free | - |

| Daytime Running Lights | - |

| Defensive Driver | - |

| Driver's Ed | Class costs $69.95 Called teenSMART Offered by ADEPT driver |

| Driving Device/App | - |

| Electronic Stability Control | - |

| Federal Employee | - |

| Forward Collision Warning | - |

| Full Payment | - |

| Further Education | - |

| Good Student | - |

| Green Vehicle | - |

| Homeowner | - |

| Lane Departure Warning | - |

| Low Mileage | typically <5,000 CA plans focus more on miles than those in other states |

| Married | - |

| Membership/Group | "Affinity Program" 14,000+ employers, groups, credit unions & associations |

| Military | must be active duty |

| Multiple Policies | - |

| Multiple Vehicles | - |

| New Address | - |

| New Customer/New Plan | - |

| New Graduate | - |

| Newly Licensed | - |

| Newlyweds | - |

| Occupation | - |

| Paperless/Auto Billing | - |

| Passive Restraint | - |

| Recent Retirees | - |

| Students & Alumni | - |

| Switching Provider | - |

| Vehicle Recovery | - |

| VIN Etching | - |

| Young Driver | - |

What Stands Out, What’s Missing

What Liberty Mutual lacks in rates, it makes up for in customer programs and discounts. Bundling could also reduce your costs, which is a great compensation for less than appealing starter rates.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

Canceling Your Policy

Some companies make canceling your policy a complete hassle. No one wants the run-around when it comes to switching or canceling a provider.

Next, we’ll look at how to do this with Liberty Mutual.

Cancellation Fee

Is there a cancellation fee when canceling with Liberty Mutual?

The short answer is “yes”.

How much that fee is, however, is unknown until you contact customer service.

The process and possible fees for policy cancellation varies according to the insurance regulations in your state.

Be sure, then, to have some money set aside for possible fees in the event you end up canceling with Liberty Mutual.

How to Cancel (Step-by-Step Guide)

According to the website, you can cancel your Liberty Mutual insurance by calling 1-800-658-9857.

When can I cancel?

You can cancel your policy with Liberty Mutual at any time.

Premiums Written and Loss Ratios

A great way to measure the commitment of a company to fulfilling claims is to examine the consistency of total premiums written and loss ratios.

A loss ratio under 40 percent is probably too low, and a loss ratio over 75 percent is too high.

If a loss ratio is too low then the company is collecting more premium than it needs for the number of claims it is getting.

If a loss ratio is too high, the carrier is not collecting enough premium for the claims it is receiving and is a sign that a rate might increase.

A high loss ratio doesn’t mean an insurance company is facing bankruptcy unless the loss ratio is high for several years in a row. More than likely, a high loss ratio means the company is going to have a rate increase in the relatively near future.

With this in mind, let’s look at Liberty Mutual’s loss ratios and written premiums for Liberty Mutual.

| Year | Direct Premiums Written | Loss Ratio |

|---|---|---|

| 2015 | $9,499,538,000 | 62.75 |

| 2016 | $10,756,228,000 | 67.35 |

| 2017 | $11,585,976,000 | 67.16 |

| 2018 | $11,776,654,000 | 62 |

According to the data, Liberty Mutual, over the years, has been doing a great job of fulfilling its obligations; even with the dip in 2018, Liberty Mutual is considered to be in a safe zone of sorts.

How to Get a Quote Online

Getting a quote online at Liberty Mutual is easy.

Simply follow the outlined steps below.

Step #1 — Select Product

In order to get a quote online, you must first select a product: auto, home, renters, or condo.

Step #2 — Enter your ZIP code

Simply enter your ZIP code to get a quote (to bundle and save see “step 3”).

Step #3 — Bundle and Save

Next, you’ll have the option of bundling your auto insurance with either home, renters, or condo to get discounts.

Step #4 — Basic Information

- Address

- Full name

- Birthdate

- Email address

Step #5 — Vehicle Information

- Choose vehicle

- Year purchased

- Own/finance/lease

- Use: personal or business

- Average mileage

Step #6 — Driver Information

- Phone number

- Age first licensed

- Residence and ownership

- Highest level of education

- Occupation

- Accidents

Step #7 — Current Insurance

- Other policies with Liberty Mutual?

- Start date for new policy

- Current company

- Years with the current company?

- Coverage with the current company?

Step #8 — Get Quote

After you’re done entering the information above, you will receive your quote with eligible discounts.

Here’s a recap:

| Information | Required? |

|---|---|

| Social Security Number | No |

| Driver's License | No |

| Vehicle Identification Number | No |

| Contact Information (email, address, phone, etc.) | Yes |

| Driver's History | Yes |

| Vehicle Information | Yes |

Design of Website and App

Being online is far from simply being tech-savvy, but rather, making it easier and more efficient for customers to get where they need to go–and fast.

Let’s take a look into Liberty Mutual’s website and design to see if they accomplish this.

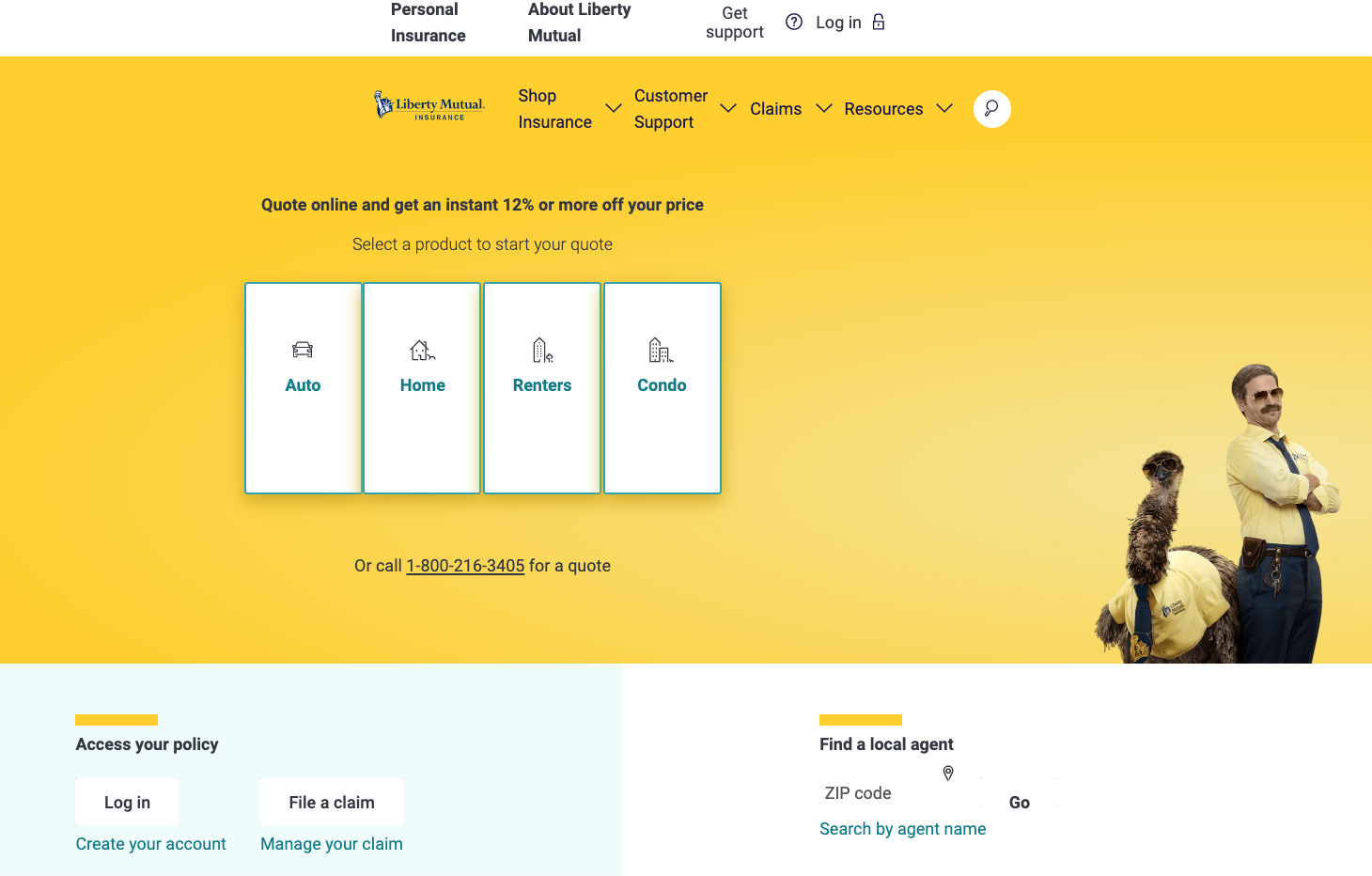

Website

Liberty Mutual outlines both its products and features on its main homepage to give users easy access to their interests.

You can select a product to start your quote, access your policy (for members), find a local agent, among others such as customer support, claims, and resources.

And if that isn’t enough, there is a search bar at the right-hand corner of the website where one could expand their search by entering keywords.

How easily can you find answers?

Finding answers on Liberty Mutual’s website is simple. Not only do they have a customer support page in case you need to speak to an individual, but they also have a resource page where you can find useful information.

Lastly, there is a search bar that links you to informational pages on Liberty Mutual’s site as well as documents which contain more detailed information.

Is the design a plus or minus?

The design is simple yet effective, with a minimalistic style. Liberty Mutual steers away from cluttering its homepage with graphics and heavy text.

The simple yellow color grabs your attention, allowing the simplicity of the text to stand out in a strong manner, emphasizing the highlights on key commands.

Mobile App

The Liberty Mutual App tries, at best, to garner the simplicity as the website. And while it offers some of the same features as the website–resources for its members and filing a claim, for example–it can be hard to navigate unless you’re acquainted with where resources are located.

Nevertheless, Liberty Mutual does have a mobile presence, extremely important when combatting the competition.

How easily can you manage your account using just the app?

Out of 28,000 ratings, Liberty Mutual received a 4.8 out of five stars. Reviews stemmed from how convenient the app was all the way down to the chat feature that was removed from the app that customers found extremely helpful.

Nevertheless, Liberty Mutual makes signing in and conducting business for its members extremely useful with having a one-stop place to all functions.

Is the design a plus or minus?

At best, the online mobile app design is subpar. While individuals find it convenient to conduct business on the app, it’s text-heavy, consists of long drop-down features and various commands on a single page, which are not consistent with the simplicity and functionality of its online website. Too much information is clustered into one space.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

Pros and Cons

| Pros | Cons |

|---|---|

| Excellent ratings from top industry leaders displaying financial and sustainable strength | Led with highest rates from top companies when looking at various factors such as credit history, driving records, and age/gender/marital demographics |

| Premiums written and loss ratios display consistent health and demands met from organization | While market share is somewhat stable, it is still lower than competitors like State Farm, Geico, and Allstate. |

| Has a variety of add-ons and discounts, providing excellent coverage and acknowledging the various circumstances and needs of its customers | You can't cancel your policy online. You must call a number and speak with a representative. |

Liberty Mutual Car Insurance Claims Innovation

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Liberty Mutual Insurance boasts an efficient and user-friendly claims process, offering policyholders multiple avenues to report their claims. Whether you prefer the convenience of filing online, the personal touch of speaking to a claims representative over the phone, or the mobility of using their mobile app, Liberty Mutual caters to your preferences.

This flexibility ensures that customers can report claims in a way that suits their needs and busy lifestyles.

Average Claim Processing Time

One crucial aspect of any insurance company’s performance is the speed at which they process claims. Liberty Mutual has consistently demonstrated a commitment to timely claim settlements. While specific processing times can vary depending on the complexity of the claim, customers generally appreciate the company’s efforts to expedite the process, helping them get back on track swiftly after an unfortunate event.

Customer Feedback on Claim Resolutions and Payouts

Customer satisfaction is a critical measure of any insurer’s claims process, and Liberty Mutual stands out in this regard. Feedback from policyholders indicates a high level of satisfaction with the company’s claim resolutions and payouts.

With an emphasis on fairness and reliability, Liberty Mutual ensures that their customers feel supported during challenging times, reinforcing their reputation as a dependable insurance provider.

Empowering You With Liberty Mutual Car Insurance Digital Tools

Mobile App Features and Functionality

Liberty Mutual’s mobile app is a valuable tool for policyholders. It goes beyond the basics, offering a range of features and functionalities that enhance the insurance experience. From accessing policy information to filing claims, tracking the claims process, and even receiving real-time updates on policy status, the mobile app provides customers with a seamless and convenient way to manage their insurance needs on the go.

Online Account Management Capabilities

The ability to manage insurance policies online is a must in today’s digital age, and Liberty Mutual excels in this aspect. Policyholders can effortlessly access and update their policy information, make payments, and view important documents through the company’s online portal. This digital convenience empowers customers to have more control over their insurance affairs and simplifies the management of policies.

Digital Tools and Resources

Liberty Mutual doesn’t stop at basic online account management; they offer a wealth of digital tools and resources to assist policyholders in making informed decisions.

From educational resources about insurance coverage options to tools for estimating premiums and coverage needs, Liberty Mutual leverages technology to empower its customers with knowledge and self-service capabilities, ultimately improving the overall customer experience.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

The Bottom Line

Liberty Mutual promises that they’ll only charge you for what you need–the only problem with that is there are others who will charge you cheaper rates. Despite numerous discounts and coverage types, Liberty Mutual rates will still have you wondering why you should pay more.

On the contrary, if you’re looking to go with a company with financially strong backing, it might put you at ease knowing that this company is stable and meets its obligations.

Furthermore, if you’re looking for an upright company, you’ve also met your match. The company invests millions of dollars into charity and invests in their employees all the same.

So the bottom line is this–if you have the extra bucks to spend, it might bring you peace at night knowing that your insurance company is stable and improving the lives of individuals inside and outside the company.

Frequently Asked Questions

Who is the Liberty Mutual actor?

Tanner Novlan plays the bad actor in the Liberty Mutual “Truth Teller” series.

Another infamous Liberty Mutual actor is David Hoffman, who plays the character “Doug”, in the LiMu (Liberty Mutual) Emu series.

What is Liberty Mutual’s Right Track program?

The Right Track program is a telematics program, that is, a small device in-car that tracks one’s driving habits.

Right Track is used jointly by Liberty Mutual and Safeco and includes four key elements:

- Hard breaking

- Rapid acceleration

- Time of Day

- Miles Driven

Liberty Mutual desires to reward good drivers through the Right Track Program and carves out discounts to lower your annual premium.

How much is it lowered?

Five percent for signing up and a permanent 30 percent discount for those who track their driving after a 90-day period.

How do you cancel your Liberty Mutual policy?

You can cancel your insurance by calling 1-800-658-9857. Fees may be applicable, depending on insurance regulations in your state.

How can I find a Liberty Mutual near me?

You can find a local insurance agent by location (search city or ZIP code) or by agent name (first and last name required).

Where are Liberty Mutual Operations?

Liberty Mutual is available in all 50 states in the United States. They also have international operations in Latin America, Canada, Europe, the Asia Pacific.

How can I find local agents for auto insurance from Liberty Mutual?

To find local agents for auto insurance from Liberty Mutual, you can visit their website and use the “Find an Agent” tool, or call their customer service hotline for assistance.

What is the process for adding a new driver to my auto insurance policy with Liberty Mutual?

To add a new driver to your auto insurance policy with Liberty Mutual, simply contact your agent or call their customer service hotline, provide the necessary information about the new driver, and complete any required forms or documentation as per their instructions.

What is the process for filing a claim with Liberty Mutual for auto insurance?

To file a claim with Liberty Mutual for auto insurance, you can do so online through their website or mobile app, or call their claims hotline to report the incident, provide relevant details, and follow their instructions for further steps in the claims process.

Does Liberty Mutual offer accident forgiveness for auto insurance?

Yes, Liberty Mutual does offer accident forgiveness as an optional add-on to their auto insurance policies.

What types of car insurance coverage does Liberty Mutual offer?

Liberty Mutual offers various types of car insurance coverage, including liability coverage, collision coverage, comprehensive coverage, personal injury protection, medical payments coverage, and uninsured/underinsured motorist coverage.

How do I get a quote for car insurance from Liberty Mutual?

You can get a quote for car insurance from Liberty Mutual by visiting their website or calling their customer service line. You will need to provide some basic information, such as your name, address, and driving history.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

Peyton Leonard

Published Author & Insurance Expert

Peyton Leonard is an insurance and finance writer living in Colorado Springs, CO. She is currently obtaining her Bachelor’s in English at Thomas Edison State University. Peyton is the author of “Lyme & Not the Fruit.” She also has experience writing for the business magazine, Productivity Intelligence Institute.

Published Author & Insurance Expert

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.