Farmers Car Insurance Review & Ratings (2024)

Farmers car insurance reviews find the company with an A rating from A.M. Best and an A+ with the Better Business Bureau. Strong financial and customer service ratings make Farmers a strong choice for coverage, but you may want to compare Farmers auto insurance policies against other local companies to make sure they’re the best for you. Start here with our free online comparison tool below.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristine Lee

Licensed Insurance Agent

Kristine Lee is a licensed insurance agent and one of The Zebra’s in-house content strategists. With a background in copywriting, she covers the ins and outs of the home and car insurance industries. She has been a contributor to numerous publications focused on the nuances of insurance, including on The Points Guy.

Licensed Insurance Agent

UPDATED: Dec 29, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance company and cannot guarantee quotes from any single insurance company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 29, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance company and cannot guarantee quotes from any single insurance company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Farmers Auto Insurance Overview | Info |

|---|---|

| Year Founded | 1928 |

| Current Executives | Jeffrey Dailey, Chief Executive Officer Deborah Aldredge, Chief Administrative Officer |

| Number of Employees | 21,000 |

| Total Sales/Assets | 16.06 billion |

| HQ Address | 6301 Owensmouth Avenue Woodland Hills, CA 91367 |

| Phone Number | 1-888-327-6335 |

| Company Website | https://www.farmers.com |

| Premiums Written (Total Private Passenger Auto) | 10,496,476 |

| Loss Ratio | 61.05 % |

| Best For | Drivers with clean records Drivers with poor credit |

Looking for a new car insurance provider? It can be tough to find an insurer you trust, and that has good rates.

Picking an insurer is one of the more critical decisions you’ll make in your life, as insurers pick up the bill after your life goes wrong. If you don’t have a good insurer, most of that accident bill will be dumped on your doorstep.

So if you’re looking for peace of mind that Farmers is the right insurer, this guide is for you. Our car insurance review"}” data-sheets-userformat=”{"2":4995,"3":{"1":0},"4":[null,2,13689059],"10":1,"11":4,"12":0,"15":"Arial"}”>Farmers Car Insurance Review covers the company;s ratings, prices, coverages, and more.

Keep reading to get a complete picture of Farmers as an insurer, so you can see if Farmers is worth your time and money.

Ready to compare rates now? Enter your zip code above for FREE.

Rating Agency

We don’t just want to tell you what we think of Farmers. This section covers important ratings from important independent reviewers.

Their ratings range from financial reviews to customer satisfaction studies. These categories are important. Financial stability tells us if a company is stable enough to pay out claims without going bankrupt.

Customer satisfaction tells us if a company is good at dealing with claims and customer complaints. The last thing you want is to sign up with a company that ignores your calls and places you on hold for hours.

To see if Farmers rated well, keep reading.

AM Best

Let’s start with a financial rating. AM Best is a global agency that rates the creditworthiness of multiple companies. The rating scale ranges from A++ to D.

Farmers has an A rating from AM Best.

This rating means that AM Best believes Farmers has an “excellent ability to meet their ongoing insurance obligations.” Since part of these insurance obligations is paying out claims, an A rating is good news.

Better Business Bureau

Rather than dealing with finances, the Better Business Bureau (BBB) looks at the ethics of a company’s business dealings. The final rating is calculated off of several factors.

- Business type

- Company’s complaint history

- Time in business

- Failure to honor commitments to BBB

- Transparency of business practices

- Advertising issues

- Licensing or government actions against the company

The final score is out of 100 and follows a letter grade scale.

However, the BBB doesn’t have an overall score for the company as a whole. Instead, the BBB rates the companies by area.

So Farmers’ service in one state may receive a different rating than its service in other states. We chose to look at Farmers’ rating in California, where its headquarters are located.

The BBB gave Farmers’ California location an A+ rating, meaning Farmers scored at least a 97 out of 100.

This is a great rating. If you would like to search for Farmers’ rating in your area, though, you can visit BBB’s site and search by the company’s name and your location.

Moody’s Rating

Moody’s is another financial rating company. Like AM Best, Moody’s looks at the creditworthiness of a company.

In 2018, Moody’s gave Farmers an A2 rating, which means a company has low credit risk. While not the highest rating, it is a decent rating.

However, Moody’s also determined that Farmers’ outlook is negative. This means that Farmers’ good credit score is predicted to drop in the future.

Because of this, it is worth keeping an eye on Farmers’ credit ratings to make sure they don’t drastically drop.

S&P Rating

Standard and Poor (S&P) also rate companies’ creditworthiness.

Farmers has an A rating (AAA is the highest rating), which means that it has a strong ability to pay off debts.

However, an A rating does mean Farmers are more at risk during poor economic conditions. This is similar to Moody’s assessment, which labeled Farmers’ outlook as negative.

So if the economic conditions change, Farmers could struggle to keep its decent credit score rating.

NAIC Complaint Index

Now that we covered financial ratings, we want to dive into customer satisfaction. The first reviewer we want to look at is the National Association of Insurance Commissioner’s (NAIC) data on Farmers’ complaint index.

What is a complaint index? It’s the comparison of total complaints to a company’s total customers.

A company could have over 1,000 complaints, but if a company has 1 million customers, the complaint index is still going to rate as low. So let’s take a look at Farmers’ complaint index.

| Private Passenger Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 162 | 166 | 145 |

| Complaint Index (Better or Worse than National Index) | 0.69 (Better) | 1.01 (Worse) | 0.97 (Better) |

| National Complaint Index | 1.0 | 1.0 | 1.0 |

Farmers’ complaint index in 2017 was higher than the national average. However, the complaint index was lower than average in 2016 and 2018, which is good.

Still, Farmers’ complaint index is a little higher than normal.

JD Power

Another well-known customer satisfaction reviewer, JD Power surveyed over 42,700 car insurance customers in 2019.

JD Power rated companies on a 1,000 point scale and assigned each company a JD Power circle rating.

- Five power circles mean a company is “among the best.”

- Four power circles mean a company is “better than most.”

- Three power circles mean a company is “about average.

- Two power circles mean a company is among “the rest.”

Points and power circles vary by region, as companies perform differently in various areas. Below is a complete list of Farmers’ ratings in the regions it’s available in.

| Region | Consumer Satisfaction (Out of 1,000) | Power Circle Rating |

|---|---|---|

| California | 805 | 3 |

| Central | 817 | 2 |

| Mid-Atlantic | 826 | 2 |

| North Central | 818 | 3 |

| Northwest | 818 | 3 |

| Southwest | 812 | 3 |

| Texas | 834 | 3 |

Farmers’ ratings are rather poor. When it didn’t score “about average,” it scored as “the rest.”

These ratings suggest that customers are just lukewarm about Farmers’ service, and other companies have much better levels of customer satisfaction.

Consumer Reports

Because Farmers’ rating was average at JD Power, we want to see what Consumer Reports found out about customer satisfaction with Farmers’ claim process.

| Claims Process | Rating |

|---|---|

| Ease of Reaching an Agent | Excellent |

| Simplicity of the Process | Very Good |

| Promptness of Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Very Good |

| Timely Payment | Very Good |

| Freedom to Select Repair Shop | Very Good |

| Being Kept Informed of Claim Status | Very Good |

Unfortunately, Farmers’ also scored about average in most of the categories. The only category that earned the highest score of excellent was the ease of reaching an agent.

While very good is the second-highest rating, we would like to see more excellent ratings sprinkled in.

Consumer Affairs

Unlike JD Power and Consumer Reports, which are survey-based, Consumer Affairs is a platform where customers can post a review at any time.

Currently, there are less than 100 reviews, and the average rating is only 2.1 stars out of five.

This rating is poor, but it is not surprising. Consumer Affairs is the perfect platform for disgruntled customers to post reviews of their experiences. As well, this rating is only based on a small selection of reviews.

Surveys that question thousands of customers, like JD Power, will provide a more accurate representation of customers’ thoughts on Farmers. Still, Consumer Reports is a great place to find out what negatives consumers have found with the company.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

Farmers’ Company History

Farmers have been around since 1928 when John C. Tyler and Thomas E. Leavey founded the company from a one-room office in Los Angeles.

When the Great Depression hit in the 30s, the company was “one of the few companies able to pay customers’ claims in cash instead of IOUs.”

Farmers continued to serve customers with service that went above the norm, such as offering customers an interest-free monthly payment plan in the 1960s.

Today, Farmers provides insurance in almost all 50 states and is a major competitor in auto, home, and business insurance.

Now that we know how Farmers came about, we want to see how it’s recent growth, current advertising, community involvement, and more predict Farmers’ future.

Let’s dive right in.

Farmers’ Market Share

A market share is a good indicator of a company’s growth. If a company is working hard at staying competitive in the market, it will see a slight growth in its market share.

Below, you can see the NAIC’s data on Farmers’ market share over a four-year period.

| Year | Market Share |

|---|---|

| 2015 | 5.09% |

| 2016 | 4.8% |

| 2017 | 4.48% |

| 2018 | 4.26% |

Unfortunately, Farmers’ market share has decreased by almost one percent from 2015 to 2018. Since Farmers only had 5 percent to start with, this is a significant decline in market share.

If Farmers’ market share keeps dropping, this is cause for concern.

Farmers’ Position for the Future

We’ve looked at a lot of reviews and ratings, which have given us a good indication of how Farmers are positioned for the future.

While Farmers are currently financially stable, there a few warning signs. Its market share has declined, and Moody’s listed Farmers’ outlook as negative.

However, other sites gave Farmers a good financial rating, so these signs aren’t necessarily a cause for alarm, but it is a good idea to keep an eye on Farmers’ ratings in the future.

As well, Farmers’ customer satisfaction ratings were just average. While there are no major warning signs that pop up because of this, improvement in customer satisfaction will help stabilize Farmers’ future.

All in all, though, Farmers has a decent future ahead of it. It is deemed financially stable by multiple reviewers, so it shouldn’t be folding under any time soon.

Farmers’ Online Presence

Farmers have a strong online presence, as it maintains an official website that allows customers to find information and sign into accounts.

The website also allows site visitors to message customer service online, which is a nice feature. If customers would rather visit an agent in-person to talk over information, you can search for an agent on Farmers’ website.

Farmers also maintains its online presence through various social media handles.

These social media handles, combined with Farmers’ website, are important in maintaining a strong online presence.

Farmers’ Commercials

Farmers’ depends on humor to make its’ commercials stand out, as its slogan is, “At Farmers®, we’ve seen almost everything, so we know how to cover almost anything®.”

You may also recognize the face in Farmers commercials as the actor J.K. Simmons.

An Academy Award winner for the 2014 movie Whiplash, J.K. Simmons is now the official spokesperson for Farmers.

You will also see appearances by famous guests like the Muppets. If Farmers’ commercials stick in your mind, Farmers’ advertising is doing a good job.

After all, the commercials you see will help you remember who the major insurers are when you sit down to research a new car insurance company.

Farmers in the Community

Every company should have some form of community involvement. It shows a company cares and is using its resources to benefit the community around it.

Farmers, like most corporate companies, is involved in a few outreach programs.

- Farmers® Cares is a program that focuses on disaster resilience, education, and civic engagement.

- Farmers is also partnered with Team Rubicon Disaster Response, Operation BBQ Relief, and the American Red Cross.

As the Farmers founder John C. Tyler said, “The measure of our worth is not what we have done for ourselves, but what we have done for others.

Based on Farmers’ involvement in the community, it is doing a good job helping others in the surrounding communities.

Farmers’ Employees

We know what customers think of Farmers, but what about Farmers’ employees?

A company’s employees can give valuable insight into a company’s workings, such as its ethics and service. To start our evaluation of employees’ satisfaction, we want to look at a Great Place to Work’s review of Farmers.

Eighty-one percent of Farmers’ employees rated the company as a Great Place to work.

This is a good rating. We want to dig a little deeper, though, and see what demographics create Farmers’ workforce, as well as the average tenure.

| Age | Percentage |

|---|---|

| Millennials (born between 1981 and 1997) | 42% |

| Gen X (born between 1965 and 1980) | 40% |

| Baby Boomers (born between 1945 and 1964) | 18% |

Farmers’ workforce is predominately made up of millennials and Generation X. Now let’s take a look at how long these millennials, Generation X, and baby boomers stay at Farmers.

| Tenure | Percentage |

|---|---|

| <2 years | 18% |

| 2 to 5 years | 22% |

| 6 to 10 years | 16% |

| 11 to 15 years | 19% |

| 16 to 20 years | 10% |

| Over 20 years | 14% |

An impressive 14 percent of employees have been at Farmers for over 20 years. While 18 percent stay less than two years, this is a normal turnover rate for a major company.

Now that we know who the employees are and how long they stay, let’s see how many agreed with the following statements:

- 91 percent say that when you join the company, you are made to feel welcome.

- 88 percent say that people at the company are given a lot of responsibility.

- 88 percent say that they feel good about the ways the company contributes to the community.

- 87 percent say that they are given the resources and equipment needed to do their job.

- 86 percent say that management is honest and ethical in its business practices.

The high agreement rates for each category are good indicators that employees approve of Farmers.

https://youtu.be/bQJ8v1c1XAQ

However, we would like to look at a few more employee review sites to make sure we are getting a complete picture of Farmers’ work environment.

On Glassdoor, Farmers has 3.4 stars out of five, based on 3,200 reviews.

Common complaints with the company?

- Poor work-life balance

- Long hours

- Management lacking in experience

One review also said the following, “They promote great customer service at the customer front, but behind the scenes its everything they can do to not pay out in claims.”

This is common, though. Insurers must make sure claims are legitimate before they are willing to pay for them.

So what is Farmers doing right? Other employees mention great pay, great pay, and great benefits.

As well, 72 percent of employees on Glassdoor say they approve of the CEO. However, only 54 percent said they would recommend Farmers to a friend.

Let’s take a look at one more employee review site — Payscale.

Farmers has 3.3 stars out of five on Payscale.

The company scored worst in the categories of fair pay, pay transparency, and pay policy. However, Farmers scored well in the categories of manager communication and manager relationship.

Since Farmers’ employees are disgruntled over salaries, though, let’s take a look at the average salaries listed on Payscale.

- Insurance Producer — $27,894

- Customer Service Representative —$33,216

- Insurance Sales Agent —$32,185

- Insurance Claims Adjuster — $55,423

- Senior Claims Adjuster — $69,328

- Claims Adjuster —$51,314

- Insurance Agent — $36,439

- Office Manager — $40,237

- Claims Supervisor — $74,308

- Insurance Claims Representative — $64,529

- Business Consultant — $55,235

Farmers’ salaries are about average.

Farmers’ Awards and Accolades

Before we end this section on Farmers’ history, we want to see what awards and accolades Farmers has won.

- 2019 Award for Fortune 100 Best Companies to Work For (#91)

- 2019 Award for Best Workplaces in Financial Services and Insurance (#26)

- 2018 Award Best Workplaces for Diversity (#55)

Farmers has won some impressive awards for its workplace environment, which is an encouraging sign.

Cheap Car Insurance Rates

Now that we know what people think of Farmers’ ethics, financial standing, and customer service, we want to jump into studying Farmers’ rates.

After all, a company’s customer service doesn’t matter if you can’t afford its rates. However, it’s also important to make sure that cheap rates don’t mean cheap coverages.

Before we get into coverages, though, we want to look at Farmers’ rates. To provide the most accurate data possible, we’ve partnered with Quadrant to bring you the following rates.

We will cover the basic rate changes for multiple factors, such as a driver’s record or credit score.

So keep reading to see if Farmers’ rates will meet your budget.

Farmers’ Availability and Rates by State

Farmers has been around for a while, which means it’s been able to expand into all 50 U.S. states.

This is good news, as it means you can keep Farmers as a provider if you move to a new state. However, how much you pay for a Farmers’ policy can change drastically after a move.

| State | Farmers' Annual Premium | Higher/Lower Than State Average | Higher/Lower Percentage Than State Average |

|---|---|---|---|

| Alabama | $4,185.80 | $618.84 | 17.35% |

| Alaska | Data Not Available | Data Not Available | Data Not Available |

| Arizona | $5,000.08 | $1,229.11 | 32.59% |

| Arkansas | $4,257.87 | $132.89 | 3.22% |

| California | $4,998.78 | $1,309.85 | 35.51% |

| Colorado | $5,290.24 | $1,413.85 | 36.47% |

| Connecticut | Data Not Available | Data Not Available | Data Not Available |

| Delaware | Data Not Available | Data Not Available | Data Not Available |

| District of Columbia | Data Not Available | Data Not Available | Data Not Available |

| Florida | Data Not Available | Data Not Available | Data Not Available |

| Georgia | Data Not Available | Data Not Available | Data Not Available |

| Hawaii | $4,763.82 | $2,208.18 | 86.40% |

| Idaho | $3,168.28 | $189.19 | 6.35% |

| Illinois | $4,605.20 | $1,299.72 | 39.32% |

| Indiana | $3,437.55 | $22.58 | 0.66% |

| Iowa | $2,435.72 | -$545.56 | -18.30% |

| Kansas | $3,703.77 | $424.15 | 12.93% |

| Kentucky | Data Not Available | Data Not Available | Data Not Available |

| Louisiana | Data Not Available | Data Not Available | Data Not Available |

| Maine | $2,770.15 | -$183.13 | -6.20% |

| Maryland | Data Not Available | Data Not Available | Data Not Available |

| Massachusetts | Data Not Available | Data Not Available | Data Not Available |

| Median | $3,907.99 | $247.10 | 6.75% |

| Michigan | $8,503.60 | -$1,995.04 | -19.00% |

| Minnesota | $3,137.45 | -$1,265.80 | -28.75% |

| Mississippi | Data Not Available | Data Not Available | Data Not Available |

| Missouri | $4,312.19 | $983.26 | 29.54% |

| Montana | $3,907.55 | $686.71 | 21.32% |

| Nebraska | $3,997.29 | $713.61 | 21.73% |

| Nevada | $5,595.56 | $733.86 | 15.09% |

| New Hampshire | Data Not Available | Data Not Available | Data Not Available |

| New Jersey | $7,617.00 | $2,101.79 | 38.11% |

| New Mexico | $4,315.53 | $851.89 | 24.60% |

| New York | Data Not Available | Data Not Available | Data Not Available |

| North Carolina | Data Not Available | Data Not Available | Data Not Available |

| North Dakota | $3,092.49 | -$1,073.35 | -25.77% |

| Ohio | $3,423.01 | $713.30 | 26.32% |

| Oklahoma | $4,142.40 | $0.08 | 0.00% |

| Oregon | $3,753.52 | $285.75 | 8.24% |

| Pennsylvania | Data Not Available | Data Not Available | Data Not Available |

| Rhode Island | Data Not Available | Data Not Available | Data Not Available |

| South Carolina | $4,691.85 | $910.71 | 24.09% |

| South Dakota | $3,768.80 | -$213.47 | -5.36% |

| Tennessee | $3,430.07 | -$230.82 | -6.30% |

| Texas | Data Not Available | Data Not Available | Data Not Available |

| Utah | $3,907.99 | $296.10 | 8.20% |

| Vermont | Data Not Available | Data Not Available | Data Not Available |

| Virginia | Data Not Available | Data Not Available | Data Not Available |

| Washington | $2,962.00 | -$97.32 | -3.18% |

| West Virginia | Data Not Available | Data Not Available | Data Not Available |

| Wisconsin | $3,777.49 | $171.43 | 4.75% |

| Wyoming | $3,069.35 | -$130.73 | -4.09% |

Farmers tends to be more expensive than the state average in the majority of states. For example, Farmers costs 86 percent more than Hawaii’s state average.

However, Farmers can be cheaper than the state average. It is cheapest in Minnesota, where the average cost of policy is 28 percent cheaper than the state average.

So if you are planning a move to a new state, make sure that Farmers’ rates don’t increase too much. Otherwise, it may be time to look for a new insurer.

Comparing the Top 10 Companies by Market Share

If you move to a new state and are looking for cheaper rates than those offered by Farmers, take a look at the table below.

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

Farmers is sometimes on the higher end of costs. In California, it has the most expensive rate out of the top 10 providers. In Colorado, Farmers has the second-most expensive rates.

If you look at the median rates at the bottom of the table, you’ll see that Farmers’ average is the third-highest.

So if you pick Farmers, you can expect to pay more than you would at other providers.

Average Farmers’ Male vs Female Car Insurance Rates

Now that we’ve tackled Farmers’ rates by state, we want to start looking into rate change factors beyond location. One of the first factors that insurers use to calculate rates is demographics — age and gender.

However, using gender as a demographic factor has been banned in Massachusetts, North Carolina, Montana, Hawaii, Pennsylvania, and parts of Michigan.

If you don’t live in one of those states, though, Farmers will still use your gender to determine rates.

| Demographic | Average Annual Rate |

|---|---|

| Married 60-year old female | $2,336.80 |

| Married 60-year old male | $2,448.39 |

| Married 35-year old female | $2,556.98 |

| Married 35-year old male | $2,557.75 |

| Single 25-year old female | $2,946.80 |

| Single 25-year old male | $3,041.44 |

| Single 17-year old female | $8,521.97 |

| Single 17-year old male | $9,144.04 |

You may have noticed that males pay more on average than females, even if it’s only a dollar more (35-year-olds). Insurers have found that males engage in riskier driving habits, leading to more crashes.

More important than gender, though, is age. The younger a driver is, the more they will pay. This is common sense, as younger drivers have less experience and are more likely to crash.

Average Farmers’ Rates by Make and Model Last Five-Year Average

The make and model of the car you drive also changes your car insurance rates. Insurers care about the safety rating of your vehicle and how expensive replacement parts are.

If your car tests poorly in crash ratings or needs imported parts, Farmers will charge more.

| Make and Model | Farmers |

|---|---|

| 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $4,093.50 |

| 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $4,390.19 |

| 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $4,405.21 |

| 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $4,779.51 |

| 2015 Toyota RAV4 XLE | $3,728.22 |

| 2018 Toyota RAV4 XLE | $3,769.00 |

Read more: Toyota Car Insurance Discount

There is a $1,000 difference between the most expensive vehicle and the least expensive vehicle at Farmers. This is on the higher end of price increases.

So next time you shop for a car, consider how it will change your insurance rates.

Average Farmers’ Commute Rates

Farmers also change rates based on how far drivers commute each year. This is because drivers are more likely to get into an accident the more they are on the road.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Farmers | $4,179.32 | $4,209.22 |

Farmers only charge an average of $30 for a longer commute. This is on the lower end of price increases.

Remember, though, that Farmers’ overall rate is more expensive than the average provider, which is probably why Farmers charge less for a long commute.

Average Company Coverage Level Rates

We know that Farmers’ rates are more expensive than other providers, which is why we want to know how much it costs for low, medium, and high coverage.

Since high coverage is best, we want to make sure Farmers’ rate for high coverage is affordable.

| Group | Low | Medium | High |

|---|---|---|---|

| Farmers | $3,922.47 | $4,166.22 | $4,494.13 |

To upgrade from low to high coverage will cost an average of $570. This is actually a good rate increase — most upgrades from low to high coverage clock in at around $1,000.

Still, remember that Farmers’ rates are more expensive. If it charged an average of $1,000 to upgrade, the rates would be too expensive for most customers.

Average Farmers Credit History Rates

If drivers have a poor credit score, they will find that their insurer charges more.

The average credit score in the U.S. is 675.

A score of 675 is considered a good credit score by most insurers. So if your score is lower, you may face higher car insurance rates.

| Group | Good | Fair | Poor |

|---|---|---|---|

| Farmers | $3,677.12 | $3,899.41 | $4,864.14 |

If a driver’s credit score drops from good to poor, rates will increase an average of $1,000.

This $1,000 increase is fairly normal at most insurers. The result is that Farmers’ rate for poor credit is about average.

Average Farmers Driving Record Rates

It’s not surprising to learn that your driving record is a factor in determining rates, but it may surprise you to learn just how much your rates increase.

| Group | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Farmers | $3,460.60 | $4,079.01 | $4,518.73 | $4,718.75 |

A speeding violation will raise your rate the least, increasing your costs by about $619. However, remember that this is in addition to the cost of your speeding ticket.

As for a DUI, this will raise your rates the most ($1,260). This is usually the offense that raises rates the most, although sometimes an accident will cost more than a DUI.

Coverages Offered

It’s important to know what coverages a company offers. If a company has a decent selection of coverages plus extra add-ons and bonus programs, you can rest assured that you’ll be decently covered.

However, sometimes you aren’t getting your money’s worth of coverages from a company. To make sure Farmers don’t skimp out on coverages, we are going to go through Farmers’ coverage options.

We will also cover discounts and programs, so you can start working on bringing your costs down.

Let’s get started.

Read more: Farmers Car Insurance Discounts

Types of Coverages Offered

Take a look at the table below to see what coverages Farmers’ offers.

| Coverage | What it Covers | Situation |

|---|---|---|

| Accident Forgiveness | Forgives one at-fault accident for every three years accident-free. | You get into your first accident in three years. |

| Collision | Pays to help cover the costs of repairs to your vehicle if it's damaged or to compensate you for your vehicle if it is totaled. | You dent your car running into a mailbox. |

| Comprehensive | Pays to help cover the costs of damage to your vehicle caused by something other than a crash (natural disasters, theft, vandalism, animal collisions). | A hailstorm shatters the windshield of your car. |

| Customized Equipment | Pays for the cost to replace aftermarket parts, such as custom stereo. | Your new set of custom wheels are ruined after a crash. |

| Glass Deductible Buyback or Full Glass/Windshield Coverage | Pays for glass/windshield repair or replacement. $100 deductible with buyback coverage and $0 deductible with full coverage. | Your windshield is cracked after an incident with a rock. |

| Guaranteed Value | Pays for the agreed upon value of your car if it's a total loss. | Your classic car is totaled after your garage collapses. |

| Liability | Pays for others' bodily injury and/or property damage caused by a covered loss that you are responsible for | You run into another car, giving the other driver a concussion and a broken taillight. |

| Loss of Use | Provides a flat sum for transportation (public, rideshare, rentals, etc.) | You don't want to just use a rental car, as you normally take public transportation. |

| Medical Payments | Pays for medical expenses from from an accident, no matter which driver was at fault. | You break your arm in a crash and your passenger has a concussion. |

| New Car Replacement Coverage | Covers cost of a new car if it's totaled (within first two model years) | You're driving your brand new car off the lot when a car runs into you, totaling your new car. |

| Original Equipment Manufacturer (OEM) | Covers cost of OEM parts in repairs. | You need a new OEM part after an accident. |

| Personal Injury Protection (PIP) | Pays for rehabilitation, medical expenses, and lost wages. | You need a month to recover from your injuries after an accident and can't work. |

| Personal Umbrella | Provides extra liability coverage. | You are sued after an accident. |

| Rental Car Reimbursement | Pays for a rental car while your car is in the shop after a covered accident. | Your car is in the shop for a week and you need a way to get to work. |

| Rideshare | Protects rideshare drivers when they aren't driving on their personal insurance. | You took a job for Uber and need rideshare insurance. |

| Spare Parts Coverage | Covers costs to replace spare parts you have, up to $750. | You keep special parts for your classic car. |

| Towing and Roadside Assistance | Helps with common breakdown situations: locked out of car, no gas, flat tire, or dead battery. | Your tire blows out on the highway and you're stranded. |

| Uninsured/Underinsured Motorist | The at-fault driver has little or no insurance and can't pay your damage or injury costs. | A driver runs into you and drives off without stopping (a hit and run). |

Farmers actually have an impressive range of coverages. It offers all the basics that states usually require, such as PIP and liability, as well as the basic coverages all drivers should have: collision, comprehensive, and underinsured/uninsured coverages.

There are also a number of great add-on coverages. Farmers offer a few add-ons that aren’t typically offered, such as glass deductibles and spare part coverages.

So even though Farmers’ prices are higher than average, the range of coverages helps make up for it.

Factors that Affect Your Rates

A number of factors that affect your rates we’ve already covered, such as:

- Commute distance

- Coverage level

- Credit history

- Demographic

- Driving record

- Vehicle type

However, there is another factor that can help lower your rates — discounts. Taking advantage of discounts helps bring the costs down, which is why it’s important to be aware of what your company offers.

The last thing you want is to miss out on an important discount.

One discount you should be aware of is bundling discounts. If you have an auto policy at Farmers, having a home or life policy at Farmers too will earn you a discount.

This also makes it easier to manage your insurance, as all your policies are at the same provider.

Getting the Best Rate at Farmers

A bundling discount is one way to get the best rate at Farmers, but there are multiple other discounts that you can get at Farmers. Let’s take a look.

| Available Discounts | |

|---|---|

| Adaptive Headlights | Green Vehicle |

| Anti-lock Brakes | Homeowner |

| Anti-theft | Low Mileage |

| Claim Free | Military |

| Continuous Coverage | Multiple Policies |

| Daytime Running Lights | Multiple Vehicles |

| Defensive Driver | Newer Vehicle |

| Distant Student | Occupation |

| Driver's Ed | Paperless Documents |

| Early Signing | Paperless/Auto Billing |

| Electronic Stability Control | Passive Restraint |

| Family Plan | Safe Driver |

| Farm Vehicle | Senior Driver |

| Federal Employee | Switching Provider |

| Full Payment | Utility Vehicle |

| Garaging/Storing | Vehicle Recovery |

| Good Student | VIN Etching |

Farmers has a total of 34 discounts, which is one of the highest amount of discounts offered at providers (the highest number is 38).

Read more: Farmers Insurance Signal Car Insurance Discount

So make sure to familiarize yourself with the list, as a little saved here and there can add up into a significant amount.

Farmer’s Programs

Farmers have two programs that are designed to save customers money.

- Accident Forgiveness — Farmers won’t raise a driver’s premiums after an at-fault accident if the driver has been accident-free for three years.

- Signal® Usage-Based App — Drivers can earn five percent off their premium for safe driving and 15 percent off their next renewal.

Accident forgiveness is a significant discount. Remember, an accident can cost a driver around $1,000 in increased premiums.

However, Farmers is lacking money-saving programs like disappearing deductibles.

What Stands Out and What’s Missing

Now that we’ve covered rates and coverages, let’s take a moment to see what stands out and what’s missing at Farmers.

- What Stands Out — Farmers has a great selection of coverages and add-ons. It also has a higher than average number of discounts.

- What’s Missing — Even with Farmers’ discounts, the cost is going to be a little higher than average.

However, Farmers’ higher cost is matched with great coverages and multiple discounts, which can help balance out the negatives of the higher cost.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

Canceling Your Policy

To avoid stress in the cancellation process, it’s vital to be prepared beforehand. You’ll need to know what fees are charged, what information is needed, and when you can cancel.

Luckily, we’ve created this section to help make the process go as smoothly as possible for you. Keep reading to learn all about Farmers’ cancellation process.

Let’s get started.

Cancellation Fee

Farmers’ has limited cancellation information on their website, which is typical. Because of this, they don’t mention a cancellation fee.

However, former customers have said they had to pay a $50 cancellation fee.

To make sure, call your Farmers’ agent and ask about cancellation fees. Sometimes insurers will only charge a fee if you cancel before the end of a renewal cycle.

Is there a refund?

If you cancel before the end of a renewal cycle and already paid in full, insurers should refund you the unused portion.

Let’s say you prepaid for 12 months of coverage but cancel in the eighth month. Farmers needs to refund you for the unused portion, as you paid for coverage you’re not going to use.

How to Cancel

Now that we’ve covered fees, let’s look at the process of how to cancel a Farmers’ policy. Keep reading for a step by step guide on how to cancel.

Step One: Have a new insurer

Before you call to cancel, you need to have a new insurer. Farmers will ask for the name of your new insurer and the start date of your new policy.

Why?

Because insurers want to make sure that you won’t have a lapse in coverage. Your new insurer will also ask for the name of your old insurer and the end date of your old policy.

If your insurer finds a gap period, it will raise your rates for having a lapse in coverage. So make sure to have a new insurer and your policy information ready beforehand.

However, if you are canceling because you no longer need insurance, you will need proof of that. Farmers will ask for a bill of sale (if you sold your vehicle) or proof you gave up your license plates.

To avoid scrambling for this documentation or having to call back, make sure you have all the necessary information ready beforehand.

Step Two: Contact Farmers to Cancel

There are two ways to cancel your policy at Farmers.

- Contact your agent directly.

- Call customer service.

Customer service can be reached at 1-888-327-6335. It is available during the following days and hours:

- Monday through Friday from 7 a.m. to 11 p.m. CST.

- Saturday to Sunday from 8 a.m. to 8 p.m. CST.

When you call Farmers to cancel, make sure you have a reason to cancel. Farmers will probably try to convince you to stay by going through ways to lower your rates.

Step Three: Confirm Cancellation

You may have heard stories of people who canceled their policies only to find out they were still paying premiums months later. Make sure your cancellation went into effect by checking your Farmers’ account and your bank account.

As well, you can also call Farmers again to double-check. It’s important that you just don’t stop paying and expect Farmers to cancel your policy.

This is not an official cancellation, and Farmers can take you to court to pay the premium. So make sure to cancel your policy officially — don’t just ghost Farmers.

When can I cancel?

You can cancel your Farmers’ policy at any time you want. However, it is best to cancel at the end of a renewal cycle to avoid the hassle of refunds and fees.

Your cancellation will go into effect immediately or at your desired end date. Just make sure to double-check your cancellation went through.

How to Get a Quote Online

A great way to decide if a company is right for you is getting a free quote. If you get a free quote, you can see if the price fits into your budget.

It will also help you see which companies have the best prices and discounts, as you can easily compare quotes from multiple companies.

Keep scrolling to follow our step by step guide to getting a free quote from Farmers.

Step One: Visit Farmers’ Website

The first step is to visit the website. Right away, you will see an option on the left side of the screen to select a product and get a free quote.

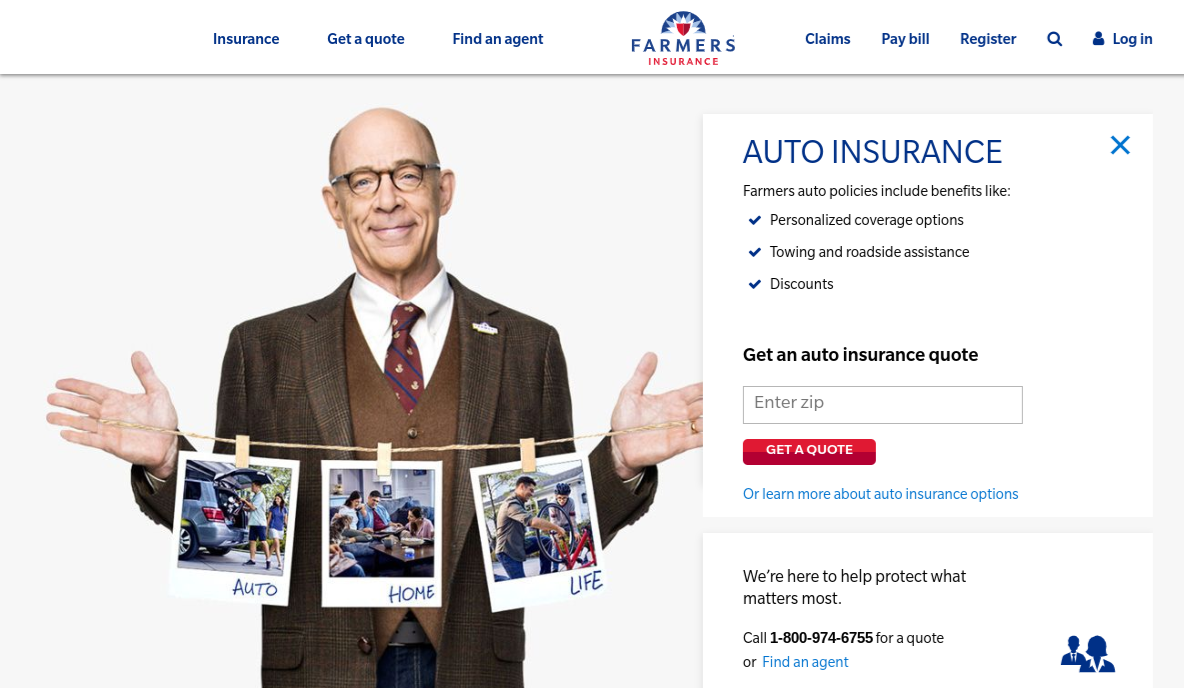

Step Two: Select Auto and Enter Zip Code

When you click auto under products, you will see the following screen.

Enter your zip code and click get a quote.

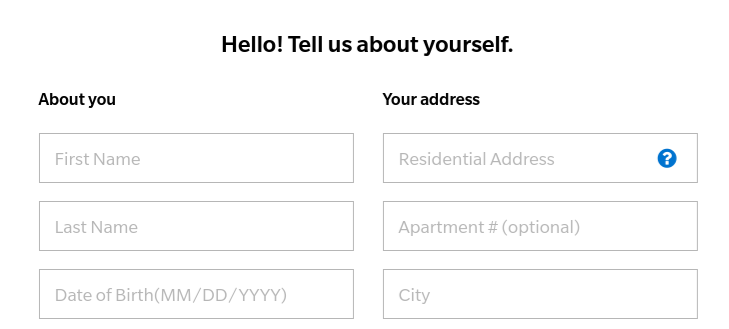

Step Three: Enter Basic Contact Information

Farmers will ask first for basic information, such as your name, address, and date of birth.

Farmers will also ask what your gender is on this page.

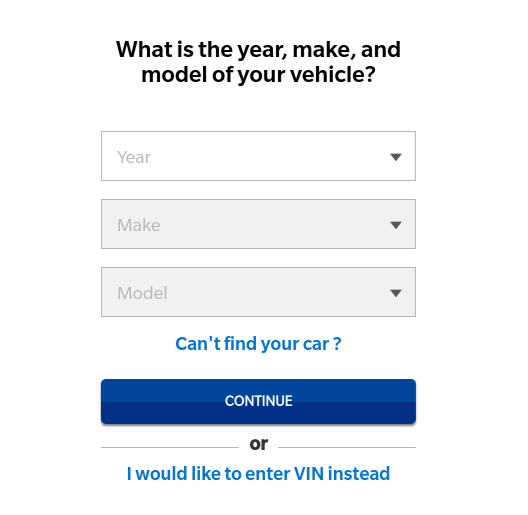

Step Four: Enter Vehicle Information

Next, Farmers will ask for information on your vehicles.

If you know your Vehicle Identification Number (VIN), you can enter it here.

Step Five: Enter Driver Information

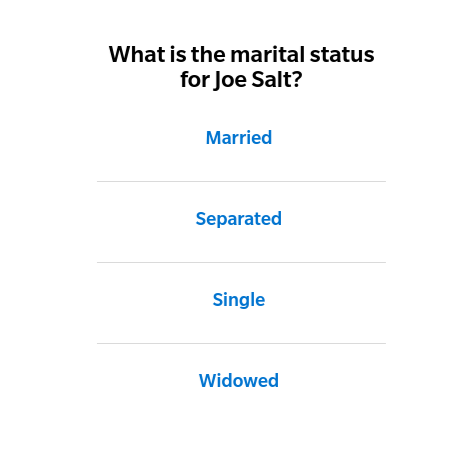

Farmers will then ask for additional driver information.

You will have to fill out a complete driver profile, asking about all of the following:

- Marital status

- Occupation

- Current insurance information (length of continuous coverage, policy limits, policy expiration date, etc.)

- Age at which you were first licensed

- Whether you require proof of financial responsibility (such as an SR-22)

- Phone number

- Social security number (optional)

- Completed driver safety courses in the past three years

- Accident history

Farmers’ driver section is more extensive than other quote forms, but this means you’ll get a more accurate quote. For example, occupation allows Farmers to add any discounts like the military or federal employee discounts.

Red more: Government Employee Car Insurance Discount

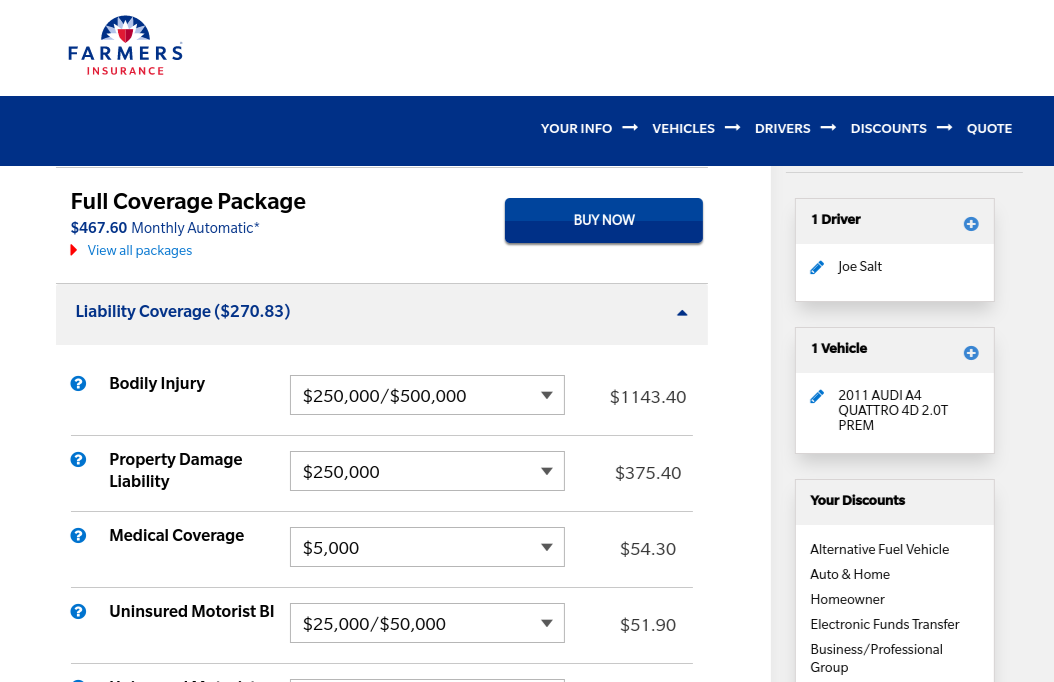

Step Six: Check Discounts, Bundling, and Access Quote

Farmers will ask a few questions to see if there are any more discounts you want to add, such as paperless billing or a bundling quote. Once you select what you want, Farmers will show you your quote.

That’s it! You have your free quote from Farmers. Remember, you need the following information to apply.

| Information | Needed? |

|---|---|

| Contact information | Yes |

| Driver history | Yes |

| Drivers license | No |

| Social Security Number | Optional |

| Vehicle information | Yes |

Design of Website and Apps

The technical design of a company’s website and app matter. Appearance, ease of navigation, loading time — these can serve to attract or dissuade customers from getting a Farmers’ policy.

Since you’ll be using Farmers’ technology, if you sign up with Farmers, keep reading to see how its website and apps rated.

Let’s jump right in.

Design of Website

Farmers have a functional website. When you take a look at the homepage, you’ll see that there is a menu listed across the top.

Below is what happens when you click on insurance on the far left side of the screen.

The graphics Farmers places above each option on the drop-down menu make it easy to locate your information. Clicking on any of the options will lead you to more information about coverages, claims, and more.

This great layout design makes it easy to find information on the website. There is also a search bar on the upper right corner. Below is a picture of what appears when you click the search bar.

Below the search bar is also a list of quick-service links. Scrolling down to the bottom of any page on Farmers’ website will result in this list of links.

As you can see, there are plenty of ways to find information on Farmers’ website. The only thing you won’t be able to find is information on canceling a policy, as most insurers don’t provide ready information on this.

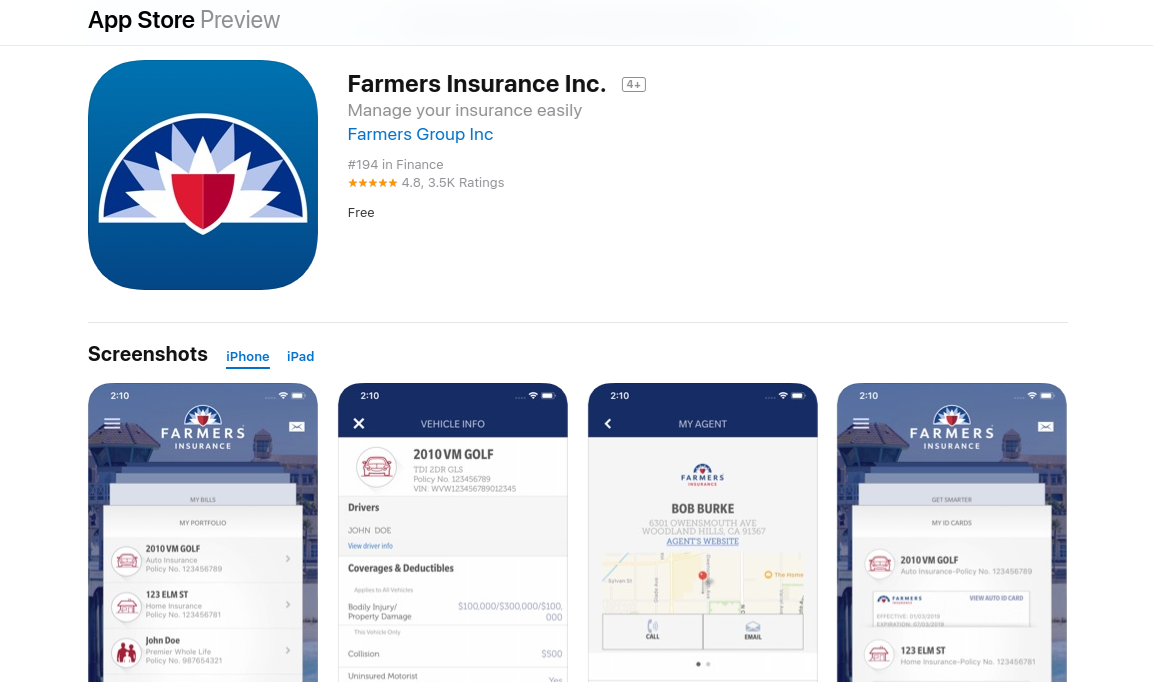

Design of Apps

Let’s start with Farmers’ mobile app. On the app, you can do all of the following:

- Review bills, make payments, and manage payment methods.

- Access insurance ID cards.

- View policy documents.

- File a claim and track your claim status.

- Request roadside assistance.

- Get a quote.

- Find agent contact information.

The app also has Touch and Face ID, so you don’t have to remember a password.

So what did customers think of Farmers’ app?

On Apple, the app rated 4.8 stars out five.

Customers like the user-friendly design of the app, which is great. There aren’t any complaints about major issues with the app, such as trouble signing in, so Farmers is doing a good job of keeping the app updated and free of bugs.

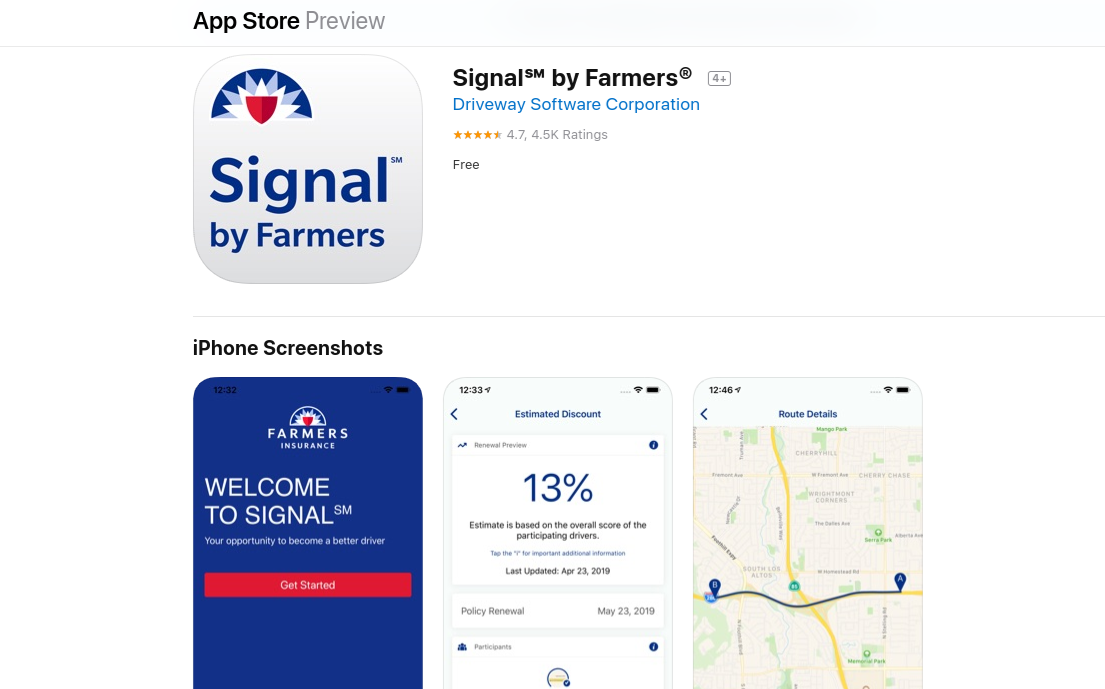

As for Farmers’ other app, Signal®, it also has excellent ratings on Apple. The app has 4.8 stars out of five, which is very high for a usage-based app.

There were more complaints with Farmers’ driving app, which isn’t unusual. Customers complained of low scores for factors outside of their control, such as driving early in the morning or late at night.

Braking is also an issue, as the app can’t recognize when hard braking isn’t the driver’s fault, such as another car swerving in front of the driver.

However, the app rated well overall, which is a good sign.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

Pros and Cons

Now that we are nearing the end of our guide on Farmers, let’s take a look at its pros and cons.

| Pros | Cons |

|---|---|

| Strong financial ratings | A decline in market share in recent years |

| Good coverage options | Fewer programs than some other insurers |

| Nice selection of discounts | Discounts aren't always available in all states |

It’s up to you if Farmers’ pros or cons outweigh the other.

Effortless Claims Handling With Farmers Car Insurance

Ease of Filing a Claim

Farmers car insurance offers multiple convenient options for filing claims. Policyholders can file claims online through the company’s official website, over the phone by contacting their customer service, or even using the mobile app provided by Farmers. This flexibility ensures that customers can choose the method that suits them best, making the claims process more accessible and user-friendly.

Average Claim Processing Time

One crucial aspect of evaluating an insurance company is the efficiency of its claims processing. While specific claim processing times can vary depending on the complexity of the claim, Farmers aims to expedite the process as much as possible. Policyholders should contact the company directly for information on average claim processing times for their particular case.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback on the resolution of claims and the timeliness of payouts is invaluable for potential policyholders. Farmers has garnered mixed reviews in this regard.

While some customers have reported satisfactory experiences with their claims being processed and resolved promptly, others have expressed dissatisfaction. To gain a comprehensive understanding of Farmers’ performance in this area, it’s advisable to research and read customer reviews specific to your region and circumstances.

Exploring Farmers Car Insurance Digital and Technological Innovations

Mobile App Features and Functionality

Farmers offers a dedicated mobile app that provides policyholders with various features and functionalities. The app allows users to manage their policies, file claims, access digital ID cards, and even contact customer support. Farmers’ mobile app is designed to streamline the insurance experience, offering convenience and accessibility at the touch of a button.

Online Account Management Capabilities

Policyholders can easily manage their insurance policies and accounts through Farmers’ online portal. This portal provides users with the ability to view policy details, make payments, update personal information, and track the progress of their claims. The online account management system enhances transparency and empowers customers to have greater control over their insurance-related activities.

Digital Tools and Resources

In addition to the mobile app and online account management, Farmers provides policyholders with a range of digital tools and resources. These tools may include educational materials, calculators, and guides to help customers make informed decisions about their insurance needs. By offering these digital resources, Farmers aims to empower its customers with knowledge and support throughout their insurance journey.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

The Bottom Line

Farmers serves all 50 states, which is great. It means that you can keep Farmers as an insurer no matter where you go. Farmers have also managed to grow their number of written premiums and have decent financial strength and creditworthiness.

While customer satisfaction is only average, Farmers is still a decent option. While its rates can be higher than average, the rates are not drastically high in every state, and the coverages offered are excellent.

The higher number of discounts offered also means that you can lower costs on your policy. So while Farmers isn’t the best of the best, it is still a decent option worth consideration.

Frequently Asked Questions

Will Farmers cover me if I rent a car?

If you rent a car, you need to ask Farmers’ if your coverage covers rental car insurance. Often, you will just end up paying the rental car company for car insurance.

This is a good option if you are prone to accidents. If you get into a car accident, you won’t file through Farmers, which means Farmers won’t raise your rates.

Does Farmers have accident forgiveness?

You can qualify for accident forgiveness at Farmers if you’ve been accident-free for at least three years.

If you qualify, Farmers will forgive your first at-fault accident and won’t raise your rates

How do I pay my Farmers’ bill?

You can pay online through your account at Farmers’ website or Farmers’ mobile app.

If you’d rather talk to someone, you can call Customer Service at 1-888-327-6335 to pay your bill.

Does Farmers cover windshield repairs?

Farmers offer glass deductible buyback and full windshield and glass coverage. Either of these coverages will cover windshield repairs and replacements.

Does Farmers cover flood damage?

Farmers will cover flood damage if you have comprehensive coverage. This coverage will also protect from damages from other natural disasters, theft, vandalism, and animal collisions.

Ready to compare rates now? Enter your zip code above for FREE.

How can I add roadside assistance to my auto insurance policy with Farmers?

To add roadside assistance to your auto insurance policy with Farmers, you can contact your Farmers agent or log in to your online account and add the service through the “Manage Your Policy” section.

How can I file an auto insurance claim with Farmers?

To file an auto insurance claim with Farmers, you can call the Farmers Claims Contact Center at 1-800-435-7764, file online through your Farmers account, or contact your Farmers agent for assistance.

How can I find a local agent for auto insurance from Farmers?

To find a local agent for auto insurance from Farmers, you can use the “Find an Agent” tool on the Farmers website, or call the Farmers customer service hotline at 1-888-327-6335 for assistance.

What is the process for renewing my auto insurance policy with Farmers?

The process for renewing your auto insurance policy with Farmers may vary depending on your specific policy and state. Typically, you will receive a renewal notice from Farmers prior to your policy expiration date, and you can either renew your policy online through your Farmers account, by contacting your Farmers agent, or by calling the Farmers customer service hotline at 1-888-327-6335.

Compare The Best Insurance Quotes In The Country

Compare quotes from the top insurance companies and save!

Secured with SHA-256 Encryption

Kristine Lee

Licensed Insurance Agent

Kristine Lee is a licensed insurance agent and one of The Zebra’s in-house content strategists. With a background in copywriting, she covers the ins and outs of the home and car insurance industries. She has been a contributor to numerous publications focused on the nuances of insurance, including on The Points Guy.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.