Best Life Insurance for a Child’s Father in 2026 (Top 10 Companies)

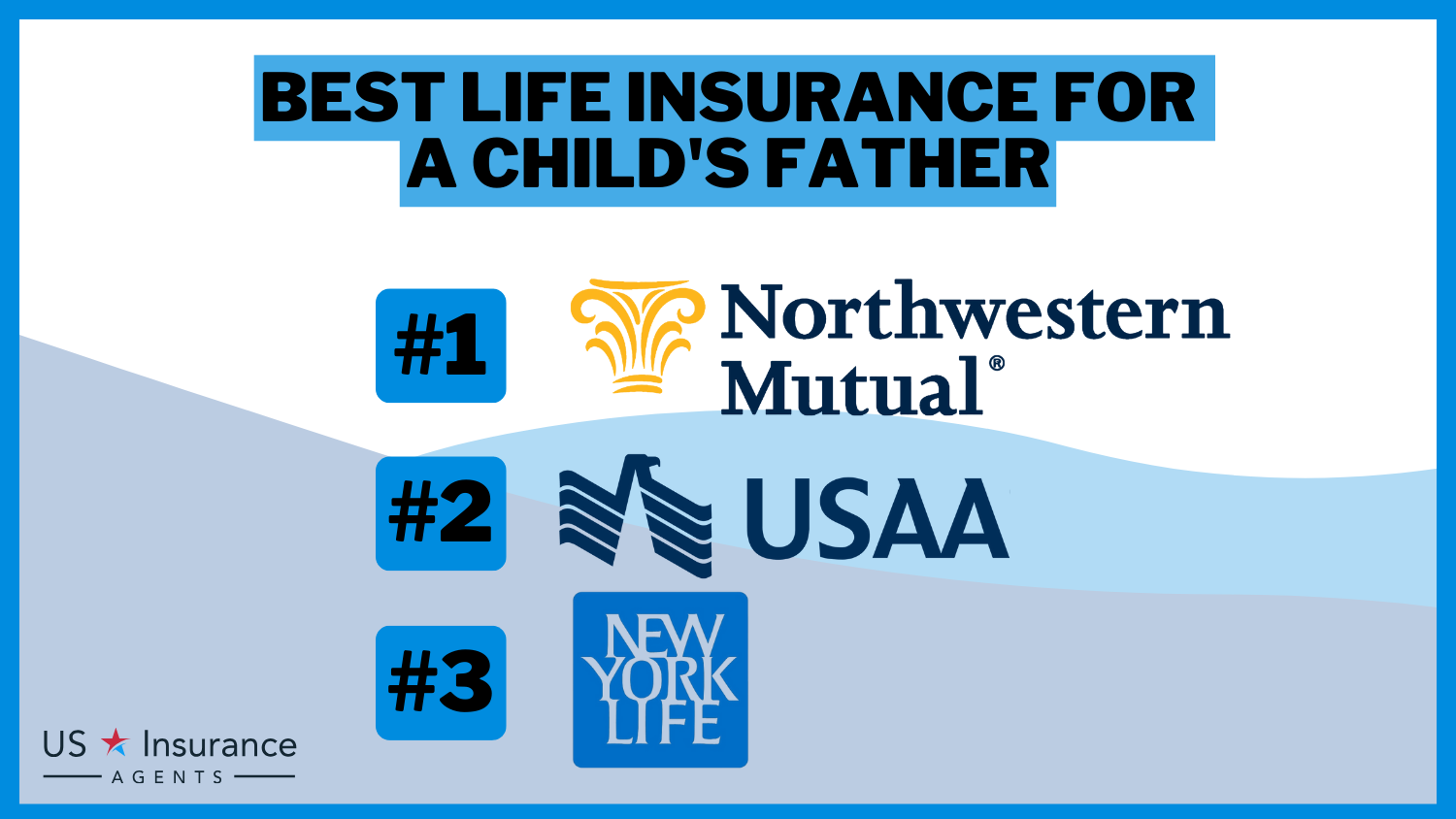

Secure the best life insurance for a child's father with Northwestern Mutual, USAA, and New York Life, where discounts of up to 15% are available. Enjoy monthly rates as low as $42, ensuring financial stability for your loved ones. Explore personalized policies and secure your family's future today.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2025

Company Facts

Full Coverage for a Child’s Father

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for a Child’s Father

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for a Child’s Father

A.M. Best Rating

Complaint Level

Pros & Cons

You can get free quotes for life insurance and secure financial protection for your loved ones by entering your ZIP code into our tool above.

- Northwestern Mutual as the top pick, with discounts up to 15%

- Rates as low as $42/month ensure affordability for comprehensive coverage

- Choose customizable policies for your family’s secure financial future

#1 – Northwestern Mutual: Top Overall Pick

Pros

- Exceptional Financial Stability: Explore the Northwestern Mutual insurance review & ratings, showcasing an impressive financial strength rating, ensuring policyholders that their investments are secure.

- Customizable Policies: The company offers a range of policy options, allowing flexibility in tailoring coverage to meet the unique needs of the insured.

- Dividend Payouts: Northwestern Mutual is known for its consistent dividend payouts, providing additional financial benefits to policyholders.

Cons

- Potentially Higher Premiums: While offering robust coverage, Northwestern Mutual’s premium rates may be relatively higher compared to some competitors.

- Strict Underwriting: The company’s stringent underwriting process could lead to more rigorous eligibility requirements for some individuals.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Exemplary Customer Service Standards

Pros

- Top-Notch Customer Service: USAA is renowned for its exceptional customer service, consistently receiving high ratings for its responsiveness and support.

- Exclusive Membership Benefits: The company’s membership model, exemplified in the USAA insurance review & ratings, allows for exclusive benefits, fostering a strong sense of community among policyholders.

- Digital Tools and Resources: USAA provides user-friendly online tools, making it convenient for customers to manage policies and access information.

Cons

- Limited Eligibility: USAA is primarily available to military members and their families, potentially excluding individuals who don’t meet these criteria.

- Fewer Physical Locations: The company has a limited number of physical branches, which may pose challenges for customers who prefer in-person interactions.

#3 – New York Life: Best for Nurturing Longevity in the Industry

Pros

- Long-Standing Industry Presence: With a history spanning over a century, New York Life insurance review & ratings brings a wealth of experience and reliability to policyholders.

- Diverse Policy Offerings: The company provides a wide array of life insurance products, catering to various needs and preferences.

- Strong Financial Ratings: New York Life consistently receives high financial strength ratings, indicating stability and trustworthiness.

Cons

- Possibly Higher Premiums: Similar to Northwestern Mutual, New York Life’s premiums may be on the higher side, potentially impacting affordability.

- Complex Policy Structure: Some customers may find the company’s extensive policy options and riders a bit overwhelming.

#4 – State Farm: Best for Crafting Policies

Pros

- Tailored Coverage Options: State Farm excels in offering customizable policies, allowing individuals to tailor coverage according to their specific needs.

- Extensive Agent Network: With a vast network of agents, policyholders can benefit from personalized guidance and support.

- Additional Insurance Products: State Farm’s comprehensive range of insurance products, highlighted in the State Farm Insurance review & ratings, allows customers to bundle policies for potential discounts.

Cons

- Possibly Higher Premiums: While offering customization, the flexibility in policies may come with relatively higher premium rates.

- Limited Online Presence: State Farm’s online tools and digital services may be less advanced compared to some competitors.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Prudential: Best for Versatile Policy Options

Pros

- Versatile Policy Riders: Prudential stands out for its diverse range of policy riders, enabling customers to enhance and customize their coverage.

- Financial Strength: The company maintains strong financial stability, as evidenced by the Prudential insurance review & ratings, providing confidence to policyholders in the longevity of their investments.

- Innovative Underwriting: Prudential’s innovative underwriting practices may offer more flexible options for individuals with specific health conditions.

Cons

- Complex Policy Options: The abundance of policy riders and options may be overwhelming for customers looking for a more straightforward selection.

- Potentially Stringent Underwriting: Some individuals may face more rigorous underwriting processes, impacting eligibility for certain policies.

#6 – MassMutual: Best for Financial Growth Through Dividends

Pros

- Consistent Dividend Payments: MassMutual policyholders often benefit from consistent and attractive dividend payouts, providing additional financial value.

- Customer-Owned Company: As a mutual company, MassMutual insurance review & ratings is owned by its policyholders, aligning interests with customers’ long-term financial well-being.

- Strong Financial Ratings: The company maintains strong financial ratings, reflecting stability and reliability.

Cons

- Possibly Complex Policies: MassMutual’s policies, while beneficial, may have a more intricate structure that requires careful consideration.

- Potential Higher Premiums: The emphasis on dividends may come with slightly higher premium costs compared to companies with different structures.

#7 – Guardian Life:Best for Diverse Policy Options

Pros

- Diverse Policy Options: Guardian Life offers a variety of life insurance policies, catering to different needs and preferences.

- Flexible Underwriting: The company may provide more flexibility in underwriting, accommodating a broader range of applicants.

- Strong Customer Service: Guardian Life is known for its strong customer service, ensuring a positive experience for policyholders.

Cons

- Policy Complexity: The array of policy options might be intricate for some customers, requiring careful consideration, including Guardian Life insurance review & ratings.

- Possibly Higher Costs: While offering variety, certain policy options from Guardian Life may come with higher premium costs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Transamerica: Best for Cutting-Edge Online Tools

Pros

- Advanced Online Tools: Transamerica insurance review & ratings reveals how Transamerica excels in providing user-friendly online tools, offering convenient policy management and information access.

- Tech-Savvy Approach: The company embraces technology to enhance the customer experience, reflecting a modern and efficient approach.

- Accessible Resources: Customers can access a wealth of online resources, making it easier to understand policies and make informed decisions.

Cons

- Varied Customer Service: While online tools are advanced, some customers may find that the in-person or phone customer service experience varies.

- Product Limitations: Transamerica’s focus on online tools may lead to fewer face-to-face interactions, which could be a drawback for those who prefer a more personal touch.

#9 – AIG: Best for Unmatched Global Presence

Pros

- Worldwide Reach: AIG’s global presence allows customers to access life insurance solutions with international coverage, suitable for those with global lifestyles.

- Diverse Product Portfolio: The company offers a diverse range of insurance products beyond life insurance, including AIG insurance review & ratings, providing comprehensive coverage options.

- Financial Strength: AIG maintains strong financial stability, instilling confidence in policyholders regarding the security of their investments.

Cons

- Potentially Higher Premiums: AIG’s global reach and extensive coverage options may come with higher premium costs compared to more localized competitors.

- Varied Customer Service: The customer service experience may vary based on geographic location, potentially impacting the overall customer satisfaction.

#10 – MetLife: Best for Employee Benefits

Pros

- Comprehensive Employee Benefits: MetLife excels in providing life insurance as part of comprehensive employee benefits packages, attracting businesses seeking robust coverage for their workforce.

- Group Insurance Options: The company offers group life insurance options, making it an attractive choice for employers looking to provide coverage for multiple employees, including MetLife insurance review & ratings.

- Global Presence: MetLife’s international presence allows businesses with global operations to offer consistent employee benefits across various regions.

Cons

- Limited Individual Focus: MetLife’s primary focus on group insurance may result in fewer individualized options for customers seeking standalone life insurance.

- Complex Group Policies: The intricacies of group insurance policies may be challenging for individuals to navigate compared to more straightforward individual policies.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Analyzing Coverage Dynamics: Life Insurance Cost Insights for a Child’s Father

When considering life insurance for a child’s father, it’s crucial to delve into the specific coverage rates offered by different insurance companies. The coverage rates, represented by both the minimum and full coverage amounts, vary across renowned insurance providers.

Life Insurance Monthly Rates for a Child's Father by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $47 | $133 |

| Guardian Life | $49 | $138 |

| MassMutual | $43 | $122 |

| Metlife | $49 | $140 |

| New York Life | $50 | $140 |

| Northwestern Mutual | $42 | $120 |

| Prudential | $48 | $135 |

| State Farm | $44 | $125 |

| Transamerica | $45 | $127 |

| USAA | $46 | $130 |

Examining the data reveals that Northwestern Mutual boasts the lowest minimum coverage rate at $42, while New York Life presents the highest minimum coverage at $50. Similarly, in terms of full coverage, Northwestern Mutual remains on the more affordable side with a rate of $120, whereas New York Life and MetLife tie for the highest full coverage rate at $140.

USAA, State Farm, Prudential, MassMutual, Guardian Life, Transamerica, and AIG fall in between these extremes, offering varying degrees of coverage at different price points. This diversity in rates provides potential policyholders with the opportunity to align their preferences and financial capacities with the insurance provider that best suits their needs.

Understanding the specific coverage rates offered by each company is instrumental in making an informed decision when selecting a life insurance policy for a child’s father. Consider reading “Best Final Expense Insurance Life Insurance Policies” for more.

Choosing the Type of Life Insurance

Once you have displayed insurable interest and have secured consent, you can take out a life insurance policy on your child’s father. You can typically choose between a whole life insurance policy or term life insurance coverage for life insurance on the child’s father.

Whole life policies also accrue cash value, while term life policies have no value unless the insured person dies. You also need to figure out who is going to pay the bill for life insurance on the child’s father. If you don’t have a particularly good relationship with the father, you may have to pay for the insurance yourself or get a court order requiring him to pay the bill for life insurance policy on child’s father.

Jeff Root Licensed Life Insurance Agent

This allows you to ensure that the payments take place on time so the policy remains in force. If you’ll be the responsible party, you’ll need to declare your annual income and expenses so the insurance company can confirm you will be able to afford the payments for life insurance for my father.

Once you’ve decided who is going to pay, the insurance underwriters will look at the father’s general health, medical history, and lifestyle records. They’ll also consider any current life insurance when they come up with a proposal for life insurance on child’s father.

If you’re happy with the details and the father is willing to sign the documentation, you can take out this life insurance to give you an additional layer of protection for life insurance policy on child’s father.

Getting Life Insurance on a Child’s Father

Securing life insurance on the father of your child is a significant decision that requires careful consideration and understanding of the process involved. Here’s a detailed look at how to navigate this process effectively:

- Displaying Insurable Interest: Before obtaining life insurance on the child’s father, it’s essential to establish insurable interest. Insurable interest refers to the financial loss you could experience if the insured person were to pass away. For example, if you rely on the father’s financial support, such as through a divorce settlement or shared expenses, you likely have insurable interest.

- Obtaining Consent: Life insurance companies require the explicit consent of the insured individual to proceed with the policy. This step ensures transparency and prevents unauthorized policies. Therefore, it’s crucial to obtain the father’s consent before moving forward with the application process.

- Ownership and Premium Payment: While it’s possible for the child’s father to own the life insurance policy and pay the premiums, it may be more practical and advantageous for you to take ownership of the policy and manage premium payments. By owning the policy, you retain control over its management and ensure that the policy remains in force.

- Ensuring Policy Continuity: By owning the life insurance policy and managing premium payments, you can proactively ensure that the policy remains active and provides continuous coverage. This is particularly important for maintaining financial security for your family in the long term.

- Legal Considerations: Depending on your circumstances and relationship with the child ‘s father, there may be legal considerations to address when obtaining life insurance. If your relationship is amicable and cooperative, obtaining consent and managing the policy may proceed smoothly.

Securing life insurance on the father of your child involves several crucial steps, including establishing insurable interest, obtaining consent, and managing ownership and premium payments. By proactively addressing legal considerations and navigating the process with care, you can ensure that your family’s financial future is protected effectively.

Justin Wright Licensed Insurance Agent

Remember to seek legal guidance if needed and prioritize open communication throughout the process. With careful planning and understanding, you can make informed decisions to safeguard your loved ones’ well-being.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Best Life Insurance for a Child’s Father

Explore real-life examples of securing a child’s father’s future through comprehensive life insurance.

- Case Study #1 – John’s Story: John, a 35-year-old father of two, chose Northwestern Mutual for its financial stability, customizable policies, and consistent dividends. Opting for an affordable term life policy, he ensured substantial coverage tailored to his family’s needs. With Northwestern Mutual’s strength, John secured his children’s future.

- Case Study #2 – Sarah’s Experience: Single mom Sarah secures her child’s future with New York Life’s whole life plan. Its industry presence, diverse policies, and strong ratings aligned perfectly with her goal.

- Case Study #3 – David’s Decision: David, a new father in his late 20s, used online research to choose USAA. With its exemplary service and customizable policies, USAA met his evolving family needs. Its modern approach resonated with David, ensuring a reliable solution.

- Case Study #4 – Emily’s Choice: Emily, a working mother, sought life insurance for her child’s father to secure their family’s future. After careful consideration, she chose Northwestern Mutual for its comprehensive coverage and financial stability, ensuring protection for her family’s well-being.

- Case Study #5 – Mark’s Dilemma: Self-employed father Mark sought life insurance as a primary caregiver, opting for a blend of term and permanent coverage from USAA. Known for exceptional service, USAA’s plan met Mark’s need for flexibility, ensuring comprehensive protection.

These case studies highlight the importance of selecting the right life insurance provider tailored to individual needs. Find additional information in “Northwestern Mutual vs. New York Life Life Insurance: Which is better?“.

Whether it’s Northwestern Mutual, New York Life, USAA, or another provider, securing your child’s father’s future is paramount for ensuring peace of mind and financial stability for your family.

Conclusion: Securing Your Family’s Future With Father’s Life Insurance

Selecting an appropriate life insurance policy for the father of your child is an essential step towards securing your family’s financial stability. Renowned companies like Northwestern Mutual, USAA, and New York Life are prominent choices due to their competitive rates, extensive coverage options, and unwavering dedication to customer satisfaction.

By delving into customized policy offerings and capitalizing on available discounts, you can guarantee tranquility, knowing that your loved ones will be safeguarded in times of unforeseen events. Remember to conduct thorough comparisons of quotes from diverse insurers to pinpoint the optimal solution tailored to your unique requirements and financial constraints.

With the right coverage in place, you can confidently assert that your family’s future is protected against uncertainties. Whether you’re considering dads insurance, a father of insurance policy, or life insurance for my dad, prioritizing comprehensive coverage for the father of your child ensures a solid financial foundation for your family’s well-being.

Expand your knowledge with “Can I get a preferred plus rates on my life insurance policy?” Safeguard your family’s future while saving on coverage — enter your ZIP code below to compare life insurance quotes with our free tool today.

Frequently Asked Questions

Can I get life insurance for the father of my child without his consent?

No, you cannot obtain life insurance for the child’s father without his explicit consent. Life insurance companies require the insured person’s permission to avoid unauthorized policies and ensure transparency. Consent is a crucial step in the process.

What is insurable interest, and how does it affect life insurance on the child’s father?

Insurable interest refers to the financial loss an individual could suffer if the insured person passes away. In the context of life insurance for the child’s father, having insurable interest is essential. For example, if you rely on the father’s financial support, such as negotiated during a divorce settlement, you have insurable interest.

What type of life insurance is suitable for the child’s father, and how do I choose?

You can choose between term life insurance, which remains in effect for a specific number of years, or whole life insurance, which lasts until the insured person’s death. The choice depends on your specific needs. Term life is often more affordable, while whole life accrues cash value over time.

Find additional information in “Best 5-Year Term Life Insurance Policies“

Can I own the life insurance policy on the child’s father, and who pays the premiums?

Yes, you can own the policy and pay the premiums. It may be better for you to have control, especially if you have concerns about the father’s responsibility. If the father is responsible for payments, a court order may be necessary to ensure timely payments.

Find cheap life insurance quotes by entering your ZIP code into our free quote comparison tool below.

What factors do life insurance underwriters consider when evaluating the child’s father for coverage?

Underwriters assess the father’s general health, medical history, lifestyle, and any existing life insurance. The proposal they provide takes these factors into account. If you, as the policyholder, are responsible for payments, your financial stability may also be considered.

What do the insurance underwriters consider when I apply for life insurance on my child’s father?

The insurance underwriters will look at the father’s general health, medical history, and lifestyle records. They’ll also consider any current life insurance when they come up with a proposal.

Explore “Can I get a health and wellness programs on my life insurance policy?” to learn more.

Can I own the life insurance policy on my child’s father?

Yes, it may be better for you to own the policy and pay the premiums so that you have control and can keep the policy in force.

Can I get life insurance on my child’s father?

This is the fundamental question, and the short answer is yes, you can get life insurance for the parent of your child. If your child’s father will not go through the process himself, you can shop around and find a policy to help protect your child’s interests, especially if your child is the beneficiary of the life insurance.

However, you will need to get the father’s permission first. You also need to be able to answer some questions before you can qualify and choose the right type of insurance.

Do I need consent to take out insurance on my child’s father?

You will need to get his permission before proceeding, as you cannot buy a life insurance policy on him without his consent. This type of permission is in place to avoid somebody taking out a policy on a wealthy and aged person without their knowledge.

In insurance terms, you can only take out a policy without express consent if the insured party is your minor child. As a parent, you would have the legal right to give the child’s consent on their behalf. This would not apply in the case of getting a life policy for a child’s parent.

How do I get my dad’s life insurance?

To obtain dads life insurance for your father, you typically need his consent. You can start by researching insurance providers, comparing quotes, and discussing options with your father. Once you’ve selected a suitable policy, your father will likely need to undergo a medical evaluation, and you’ll need to complete the application process together.

Can I take a life cover for my father?

Does insurable interest affect any insurance on my child’s father?

Did dad have life insurance?

What is the best age to get life insurance?

What is the age limit for life insurance?

Can I name a parent as a beneficiary of life insurance?

What is the best life insurance for parents?

Can I get a life insurance policy on my child’s father?

How to claim life insurance after death?

Which life cover is the best for life insurance on a child’s father?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.